# When do you have to pay tax on card-to-card transfers in 2020

Officials promised that they would not withhold personal income tax from all receipts to the accounts of individuals (letter of the Ministry of Finance dated 06/07/2019 No. 03-04-05/41947, letter of the Federal Tax Service dated 06/27/2018 No. BS-3-11 / [email protected] ). Moreover, they assured that they do not plan to make changes to the Tax Code that would allow this to be done (letter of the Federal Tax Service dated June 25, 2018 No. 03-02-08/43217).

The Federal Tax Service and the Ministry of Finance agreed that not all the money that came into a person’s account is his income. If one citizen transfers money from his account to another person’s account free of charge, such transfers are not subject to personal income tax. Indeed, in this case, the transfer is a monetary gift. And cash income that an individual received as a gift is not taxed. Moreover, it does not matter how much the person transferred and to whom he transferred the money - a spouse, a child, another relative or a stranger.

But if the inspectors decide that the transfer to the card is payment for work, goods or services, remuneration for labor duties or under civil contracts, they will charge additional personal income tax. But in order to charge additional tax on a transfer from card to card in 2020, tax officials must prove that the person received the money for a reason. Extracts alone are not enough for this.

What transfers between individuals are taxable?

Those who believe that a tax will be charged for transferring money from card to card should carefully read the text of the code regarding the content of tax fees. Ordinary money transfers are not of interest to Federal Tax Service employees and are not taxable.

The tax service is interested only in the income of citizens received without paying the required contributions. As a rule, this applies to temporary part-time jobs, seasonal work and other similar types of income that were left without declaration.

That is, you only need to pay taxes on income, not transfers. At the same time, no one will check all deposit holders and bank card holders.

# Which card-to-card transfers will attract the attention of tax authorities

Officials say investigators only request account information from individuals who appear suspicious. For example, a person bought an apartment, came to the inspectorate with a deduction, and the income according to 2-NDFL certificates is small. The Federal Tax Service will be interested in where the funds for the purchase are coming from and will ask for information about the movement of money.

During the inspection, the attention of inspectors will be drawn to a situation when money comes to a person’s card from different people. The inspectors will decide that the person receives income for his work or services. For example, provides hairdressing or cosmetic services without registering as an entrepreneur.

Transfers from card to card, which a person consistently receives from the same source, are regarded by tax authorities as payment for work or rental property. For example, one person transfers 30,000 rubles to another monthly. Inspectors will try to find a source of income. They will check what property the recipient himself and his family members own to see if it is rented out.

Inspectors will not require personal income tax on each transfer between individuals, the Ministry of Finance promised. However, there are situations where tax will still have to be paid.

Debit cards for transfers

The fastest way to send funds to another person is to transfer to a card. Let's consider special bank offers for the transaction. Let's determine which debit card for transfers within Russia provides the most favorable conditions.

| Card name | Percentage of overpayment upon enrollment, % | Commission for sending funds, % | Payment amount, rub. (min) | Distinctive features |

| LOCKO-Bank "Maximum Income" | In the company’s network – 0 | Between organization cards–0 | No limits | Possibility of connecting additional cards; interest is charged on the balance |

| Renaissance Credit "Debit" | Free replenishment with other banks in the amount of up to 150 thousand rubles. | 0 | Instant execution of the operation; bonus reward for purchases | |

| Citibank "Citi Priority"» | 0; Failure to comply with tariffs entails a commission of 250 rubles. when replenishing up to 45 thousand rubles. | 0 – subject to service conditions, otherwise – 1% | Instant conversion of finances into one of 10 world currencies; accumulative interest is calculated on the balance | |

| Tinkoff Bank "Tinkoff Black" | 0 – when conducting a non-cash transaction in the currency of the card account (internal transfer or from another bank), using ATMs. Cash deposits through partner services up to 300 thousand rubles. (10 thousand dollars/euro) – free. For cash top-ups of a larger amount, a commission is charged - 2% | Transfers to cards of other companies - 0, subject to the limit - 20 thousand rubles / billing period. Exceeding the mark entails a commission fee of 1.5% (min. 30 rubles) | (issued at the request of the client) – guarantees coverage of financial losses within 24 hours, up to 100 thousand rubles, caused by third parties. The program operates 24/7 throughout the world | |

| ROSBANK “#EVERYTHING IS POSSIBLE” | 0 – when replenishing the card through the company’s self-service machines; 0 – for transferring an amount of at least 30 thousand rubles to an internal card at bank cash desks, otherwise the commission will be 100 for each transaction | Interbank non-cash ruble transfer of funds through the cash desk – 1.5% (min 100 rubles, max 1.5 thousand rubles), foreign currency – 1.3% (min 600 rubles, max 3 thousand rubles) Intra-bank non-cash transactions between individuals are not subject to fees | Interest-free withdrawal of funds in self-service devices around the world |

In addition, the listed banking organizations have other features. For example, Renaissance Credit does not impose a commission on transfers from cards of other banks if the total amount of transfers per month does not exceed 150 thousand rubles. Transactions in excess of the established limit require an additional tax payment of 0.95% (min 45 rubles). Renaissance Credit Bank instantly makes transfers using the Debit card. This factor will be especially appreciated by clients who need to urgently transfer money.

It is appropriate to recall that issuing banks have the right to charge additional fees for making a transfer. Conditions, restrictions and tariffs should be obtained from representatives of the financial company involved in the transaction.

# Which transactions are suspicious for the bank

Blocking the card by the bank is more likely than claims from the inspectorate. Banks, within the framework of anti-money laundering legislation, constantly monitor the movement of money on individuals’ cards.

In particular, the following operations may come under suspicion:

- large purchases with little official income;

- a sharp increase in the receipt and expenditure of money;

- atypical transactions for the cardholder;

- receipt of funds from a legal entity and prompt cashing;

- receipt of funds from various geographically distant sources.

These transactions may serve as grounds for blocking the card by the bank. The bank may also request information from the individual about the transaction completed. The bank should respond to the request as soon as possible, while it is safer not to connect the purpose of the operation with business activities.

How can the tax office find out about the income received and is it possible not to pay taxes?

There may be several options:

- From the bank, if you request an account statement. This is only possible if there is significant evidence - information that you purchased or sold real estate or a car, but did not declare income.

- From buyers who also provided data to the tax office. For example, you sold a laptop for 50,000 rubles, but did not declare income. A year later, your buyer sells the same laptop for the same 50,000 rubles, but goes to the tax office and declares income, attaching a receipt or receipt stating that he bought it from you a year ago. And then the tax office sees that you didn’t pay anything from this income a year ago.

- From neighbors, if you are engaged in renting out real estate, and the tenants you come across are noisy or do not get along with their neighbors. They can go to the tax office and say that you are hiding the fact of renting out the apartment and not paying taxes.

- From other tax agents. In some cases, tax agents cannot withhold personal income tax, then they send this data to the tax office, where everything is calculated, and you receive a notification about the debt.

Some more important facts about bank transfers, taxes and the tax office:

- Banks do not transmit any information about the movement of funds in your account to the tax office. It will be possible to obtain this data only during a tax audit, if there are grounds for it.

- The tax office has information that you have an account, but does not have information about what amounts are received and what amounts you spend.

- The Federal Tax Service had plans to gain access to transfers, but for several years they have remained plans.

- Tax representatives, not you, must prove the fact that the transfer is a gift and not income received.

- No taxes are automatically charged on transfers.

- There is no cost control in Russia. Even if you do not have an official income, but you purchased an apartment, this is not a reason to charge taxes.

- To eliminate all questions from the tax office when transferring money to a card to another person, you can write “gift” in the justification for the transfer.

In general, if you have any doubts about whether you need to pay tax in a particular case, you can send a corresponding request to the tax office and receive an accurate answer. As for transfers, there is no need to pay taxes on them, except in situations where the receipt of money is income.

# Five new rules for bank cards 2020

Plastic is steadily pushing cash out of our wallets. It is difficult to find a person who does not have a single payment card. This means that it will be interesting to learn about the new rules that are being introduced for bank card holders in 2020.

#1. You will have to pay for fast payments.

Starting this year, you can transfer money to the right person instantly and without much hassle - using the Fast Payment System. Just go to the bank’s mobile application, enter the recipient’s phone number and the transfer amount. But if in 2020 they didn’t charge a penny of commission for the transfer, then from 2020 you will have to pay for this convenience.

Will Russians be charged additional personal income tax and VAT for card transfers?

Author Editorial staff of the “Economics” column

Updated: 11/10/2019 00:50 Published: 06/14/2019 09:03

Economics » Rules of the game

“Letter of the Federal Tax Service of Russia dated May 7, 2019 No. SA-4-7/8614” appeared on social networks, the essence of which allegedly boils down to the fact that private individuals who are engaged in commercial activities in one form or another, without appropriate registration of this activity, will still be subject to VAT and personal income tax.

17 shared

These norms, by the way, came into force on January 1, 2019. However, in practice and everywhere, due to total verification and monitoring of all money transfers, they will start working in 2020 - this is exactly what insiders promise.

At the same time, the letter from the Federal Tax Service is characteristic in that it prescribes the signs of “secret commercial activity.” At the same time, factors are additionally spelled out that allow tax authorities to qualify a particular private transaction as commercial - these include “testimonies of persons who paid for goods, work, bank account statements of a person held administratively liable” and even the placement of advertising on the Internet.

By the way, as emphasized in the letter from the Federal Tax Service, “the lack of profit itself does not affect the qualification of this offense, since making a profit is the goal of entrepreneurial activity, and not its obligatory result.”

The only way for such “freelancers from small businesses” not to be subject to personal income tax and VAT with penalties, fines and other unpleasant deductions to the state is to register themselves as an individual entrepreneur and work “white” under a simplified taxation system at 6%.

As for specific examples of such commercial activities, a number of lawyers and consultants explain that taxation, based on a study of transfers to a card, includes, for example, trading via the Internet, leasing personal cars, leasing real estate, especially if we are talking about commercial real estate. The service sector will also be subject to personal income tax and VAT. Well, and understandably, small-scale, “everyday” trade in a stall at the market.

As the authors of the “Sofa Analyst” channel note, “Congratulations to sofa wrestlers and mother’s tax evaders - in 2020, additional personal income tax and VAT will be charged for transfers to the card. Do you use Momentum (the QIWI provider will hand over a special transit account), write for a fee, sell advertising in public pages, do design, nails or cakes, code freelancing, rent out an apartment or car, drive a taxi, sell fruits and cosmetics, do renovations? If a person received money on a card for this, then hello, VAT and (if not exempt under Article 145 of the Tax Code of the Russian Federation) personal income tax.

The Tax Department promises that the checks will be total and all transactions on cards of all banks will be analyzed for “systematic recovery of profits.” The state needs your money, cats."

However, they are already writing on social networks that “Gifts are not income (regardless of the amount). There is no need to indicate it anywhere. There will be no trouble." Experts explain that “Article 217 of the Tax Code lists the income of individuals that is not subject to taxation. Paragraph 18.1 of this article states that income in cash and in kind received from individuals as a gift is not taxed (with the exception of cases of donation of real estate, vehicles, shares, interests, shares).”

“Transfer and receive any amounts on cards - if it’s a gift, you don’t need to pay tax,” they advise. However, earlier representatives of Russian banks have already stated that their special IT systems analyze transfers from card to card and massively “search” for those in which the purpose of the transfer is constantly indicated - “debt” or “gift”.

It is clear that, on the one hand, this is an attempt by the state to reduce the gray economic zone in which several trillion rubles circulate throughout the country. On the other hand, in the context of the pension reform, the increase in VAT to 20% and, in general, a certain economic recession, the presence of social discontent is not difficult to predict.

However, it seems that the state system has set a course towards tightening and systematizing economic policy, and this will last for a long time.

Discuss

Topics: Federal tax service debt taxes transfer tax transfer to card bank cards tax for the self-employed

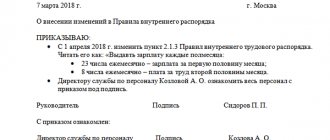

How to avoid fines for receiving money on a bank card

In order for an individual to avoid fines, penalties and taxes in connection with receipts on a bank card, you must remember the following:

- If an individual receives regular income on his card, then it would be better to register him as an individual entrepreneur and choose, for example, the simplified tax system as a tax regime. In this case, he will not have to pay 13% on income, but declare only 6%.

- Banks have the right to report account transactions that, in their opinion, are suspicious. Therefore, care should be taken to have supporting documents indicating that the proceeds should not be subject to tax.

- Care should be taken to ensure that the persons sending the transfer to the card complete the transfer correctly. That is, you need to make sure that they indicate the purpose, for example, a gift or repayment of a debt.

- For large sums, it is worth drawing up a gift or loan agreement in writing. In addition, it would be useful to keep receipts and other documents that can confirm that receipts on cards are not taxable income.

It should also be remembered that an individual must file a 3-NDFL declaration for all income received. It is submitted to the tax authority no later than April 30 of the year following the year in which the income was received.