Is the bonus part of income always related to salary or not?

Answers to the questions of whether a bonus is subject to taxes and contributions and what taxes are paid on bonuses to employees can be obtained by understanding what a bonus is.

A bonus is an incentive or incentive payment to an employee assigned for the successful performance of job duties. The bonus can also be paid for a specific event.

What kind of awards there are, read here.

The inclusion of bonuses in salary is not mandatory. But this can be done (Articles 129, 191 of the Labor Code of the Russian Federation), and employers quite often allocate a bonus part in the remuneration system they have developed. This allows them to solve two problems:

- influence on the employee’s interest in the results of his work;

- the possibility of regulation due to the bonus part of the amount of labor costs attributed to expenses.

Under what conditions does the employer have the right not to award a bonus or reduce its size? Is it possible to deprive an employee as a disciplinary sanction? You will find answers to these and other questions in the Guide from ConsultantPlus. Get free access to the system and go to the material.

For the procedure for paying bonuses under labor laws, see here.

The bonus can have two sources of payment:

- costs - for bonuses accrued in connection with labor achievements;

- net profit - for bonuses paid on the occasion of events not related to work.

Regardless of the source of payment, bonuses may be included in the wage system. But even if the bonus is not included in the incentive part of the salary, if it is one-time and paid out of profit, it still remains the employee’s income. And this determines the mandatory taxation of premiums.

For more information about the document establishing the remuneration system, read the article “Regulations on remuneration of employees - sample - 2020 - 2020” .

Let's consider what tax is imposed on bonuses to employees, as well as what insurance contributions need to be paid to the budget.

Compensation for training costs at the expense of the employer upon dismissal of an employee

The employee is obliged to reimburse the costs of your organization for his training in the event of dismissal without good reason before the expiration of the period established by the student or employment contract. Calculate the amount of compensation by the employee for training costs in proportion to the time actually not worked after completion of training, unless otherwise provided by the employment contract or training agreement, and reflect the employee’s debt in accounting as of the date of dismissal.

Include the amount reimbursed by the employee as part of other income (clause 7 of PBU 9/99 “Income of the organization”). Such income must be reflected in accounting in the reporting period, obtaining the employee’s written consent for partial reimbursement of training costs (clause 10.2, 16 PBU 9/99).

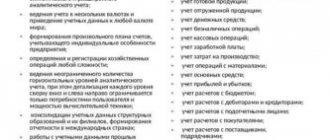

To account for settlements with employees for transactions not related to wages, including reimbursement of training costs upon dismissal, account 73 “Settlements with personnel for other transactions” is intended.

An employee can repay the debt by depositing cash into the cash register or transferring it to the organization’s current account.

He can also submit an application to the accounting department with a request to withhold the existing debt to the employer or part of it from wages. Such an operation will not constitute forced retention within the meaning of Art. 137 Labor Code of the Russian Federation. Therefore, the norms provided for by the provisions of Art. Art. 137, 138 of the Labor Code of the Russian Federation, on limiting the types and amount of deductions from wages. A similar point of view regarding the possibility of repaying the amount of the loan provided at the expense of wages at the request of an employee is expressed in the Letter of Rostrud dated September 26, 2012 N PG/7156-6-1.

The entries for recording employee compensation for training expenses are as follows:

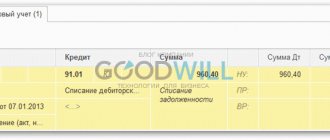

Debit 73 Credit 91-1 - Reflects the debt recognized by the employee for partial reimbursement of expenses for his training;

Debit 70 Credit 73 - The amount of partial reimbursement of training expenses was withheld from wages;

Debit 50 (51) Credit 73 - The employee’s debt was repaid by depositing cash into the organization’s cash desk (by transferring money to the current account).

If you receive compensation for training costs after the dismissal of an employee, then settlements with him should be carried out on account 76 “Settlements with various debtors and creditors”. In this case, on the date of dismissal of the employee, transfer the amount of debt from account 73 to the debit of account 76.

What insurance premiums are charged on the premium and is personal income tax paid on it?

So, what is the taxation of bonuses to employees in 2019-2020, is income tax levied on the bonus?

Since the incentive payment is part of the salary, there is no need to wonder whether bonuses are subject to income tax and insurance premiums. Of course they are taxable! A bonus is part of an employee’s income, and on it, as well as on other components of remuneration, it is necessary to accrue all insurance contributions for compulsory pension, social and medical insurance and withhold personal income tax.

Taxation of bonuses to employees with income tax is carried out taking into account the norms of Chapter. 23 Tax Code of the Russian Federation.

NOTE! Prizes for achievements in the field of education, literature and art, science and technology, and the media according to the list of awards approved by the Government of the Russian Federation (clause 7 of Article 217 of the Tax Code of the Russian Federation) are not subject to personal income tax.

Taxation of 2019-2020 premiums by insurance premiums is subject to the provisions of Sec. 34 of the Tax Code of the Russian Federation and the law “On compulsory social insurance against accidents...” dated July 24, 1998 No. 125-FZ.

According to what rules are bonuses paid to an employee after dismissal taxed, ConsultantPlus experts told:

Get free access to K+ and learn all the nuances.

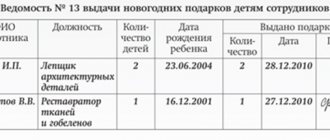

Documenting

The basis for calculating a bonus is an order from the head of the organization to reward an employee (Form No. T-11) or a group of employees (Form No. T-11a). The employee (employees) must be familiarized with the order against signature (Section 1 of the instructions approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1).

Instead of standard forms of bonus orders, you can use independently developed forms of such documents (provided that they contain all the necessary details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

This procedure follows from Part 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ and is confirmed by the letter of Rostrud of February 14, 2013 No. PG/1487-6-1.

Payment of bonuses from the cash register can be made:

- according to payroll or payroll (according to forms No. T‑49 or No. T‑53);

- according to an expense cash order (according to form No. KO-2).

This is stated in paragraph 6 of Bank of Russia Directive No. 3210-U dated March 11, 2014.

Are there any specifics to taxes on bonuses that are paid from net profit?

Is a 2019–2020 bonus paid to an employee out of net profit, for example, on a holiday, taxable or not?

As income received by the employee, any bonuses are subject to personal income tax, and this tax must be withheld from the employee’s bonus. The source of the premium payment in this case does not matter.

Are premiums subject to insurance premiums when paid out of net profit?

Here the emphasis should be placed not on the source of funding for the bonus, but on its connection with wages. If the bonus is a labor bonus, then there can be no questions: the contributions are paid. If not, there are two possible points of view.

Officials believe that contributions for such a bonus should also be calculated (clause 1 of Article 420 of the Tax Code of the Russian Federation and clause 1 of Article 20.1 of Law No. 125-FZ dated July 24, 1998, letter of the Ministry of Finance dated October 25, 2018 No. 03-15-06/ 76608). For income tax purposes, these contributions can be taken into account in full as expenses that reduce the profit base (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated April 2, 2010 No. 03-03-06/1/220 ).

The courts are against contributions from bonuses that are not of a labor nature.

Read more about this here.

Accounting for vacation pay accruals

Accounting for vacation pay accruals in accounting is carried out on the same accounts where the employee’s wages are accrued. The exception is cases when vacation is accrued “in advance”, that is, for example, vacation pay is accrued in June, and the vacation period also includes the days of July. In such cases, the amount of accruals is calculated for each period separately and accrued in two transactions:

Debit 20 Credit 70 - accrued vacation pay for March;

Debit 97 Credit 70 - accrued amount of vacation pay for April.

In the future, at the end of April, deferred expenses will be classified as current expenses. This will be reflected in the accounting by the following entry:

Debit 20 Credit 97 - the amount of vacation pay for April is taken into account in the current expenses of the enterprise.

Is it possible to reduce the amount of personal income tax and premium contributions in 2019-2020

The Tax Code does not contain provisions allowing employee bonuses and contributions to be tax-free. But if a company employee is awarded a bonus for a significant event or holiday, such as the New Year, then you can arrange it as a gift from the employer. According to paragraph 28 of Art. 217 of the Tax Code of the Russian Federation, gifts totaling 4,000 rubles. per year, are not subject to personal income tax.

In order not to calculate insurance premiums on gifts, they need to be formalized in the form of civil law relations. According to paragraph 4 of Article 420 of the Tax Code, income received by the insured person under a GPC agreement, the subject of which is the transfer of ownership of property, is not subject to insurance premiums. To do this, you must conclude a written donation agreement with the employee in accordance with the provisions of Art. 574 Civil Code of the Russian Federation.

Results

Is the salary bonus taxable in 2019-2020? Yes, it is taxable! And as part of the remuneration, it is subject not only to personal income tax, but also to all insurance contributions. The source from which the premium is calculated does not matter in this case. If the bonus is unearned, payment of contributions can be avoided.

Sources:

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

- Civil Code of the Russian Federation

- Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

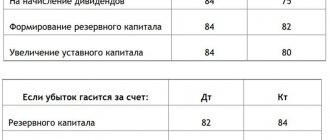

Decision on payment of bonuses

To pay bonuses from retained earnings, the consent of the owners of the organization (founders, shareholders) to such expenditure of profits is required. This rule applies to both LLCs and joint stock companies (clause 2 of Article 67.1 of the Civil Code of the Russian Federation).

The decision to spend retained earnings in an LLC is documented in the minutes of the general meeting of founders. There are no mandatory requirements for the minutes of the general meeting of an LLC in the legislation. But there are details that are better to indicate. This is the number and date of the minutes, place and date of the meeting, agenda items, signatures of the founders.

In a joint stock company, minutes of the general meeting of shareholders are drawn up. The minutes of a joint stock company differ from the minutes of an LLC in that they are drawn up in two copies and have mandatory details. They are listed in paragraph 2 of Article 63 of the Law of December 26, 1995 No. 208-FZ and paragraph 4.29 of the Regulations approved by order of the Federal Financial Markets Service of Russia dated February 2, 2012 No. 12-6/pz-n.

In an LLC (consisting of one participant) and in a joint stock company (where all voting shares belong to one shareholder), the protocol is not drawn up (Article 39 of the Law of February 8, 1998 No. 14-FZ, paragraph 3 of Article 47 of the Law of December 26 1995 No. 208-FZ). In this case, the participant (shareholder) draws up a written decision to allocate net profit to pay bonuses.