Transport tax rates in the Moscow region

For a year

| Name of taxable object | Rate (RUB) for 2020 |

| Passenger cars | |

| up to 100 hp (up to 73.55 kW) inclusive | 10 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 34 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 49 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 75 |

| over 250 hp (over 183.9 kW) | 150 |

| Motorcycles and scooters | |

| up to 20 hp (up to 14.7 kW) inclusive | 9 |

| over 20 hp up to 35 hp (over 14.7 kW to 25.74 kW) inclusive | 16 |

| over 35 hp (over 25.74 kW) | 50 |

| Buses with the number of years that have passed since the year of manufacture, up to 5 years inclusive | |

| up to 200 hp (up to 147.1 kW) inclusive | 27 |

| over 200 hp (over 147.1 kW) | 56 |

| Buses with the number of years that have passed since the year of manufacture exceeding 5 years | |

| up to 200 hp (up to 147.1 kW) inclusive | 50 |

| over 200 hp (over 147.1 kW) | 100 |

| Trucks with the number of years that have passed since the year of manufacture, up to 5 years inclusive | |

| up to 100 hp (up to 73.55 kW) inclusive | 20 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 25 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 33 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 45 |

| over 250 hp (over 183.9 kW) | 58 |

| Trucks with a number of years that have passed since the year of manufacture exceeding 5 years | |

| up to 100 hp (up to 73.55 kW) inclusive | 25 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 40 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 50 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 65 |

| over 250 hp (over 183.9 kW) | 85 |

| Other self-propelled vehicles, pneumatic and tracked machines and mechanisms | 25 |

| Snowmobiles, motor sleighs | |

| up to 50 hp (up to 36.77 kW) inclusive | 25 |

| over 50 hp (over 36.77 kW) | 50 |

| Boats, motor boats and other water vehicles | |

| up to 100 hp (up to 73.55 kW) inclusive | 100 |

| over 100 hp (over 73.55 kW) | 200 |

| Yachts and other motor-sailing vessels | |

| up to 100 hp (up to 73.55 kW) inclusive | 200 |

| over 100 hp (over 73.55 kW) | 400 |

| Jet skis | |

| up to 100 hp (up to 73.55 kW) inclusive | 250 |

| over 100 hp (over 73.55 kW) | 500 |

| Non-self-propelled (towed) ships for which gross tonnage is determined (from each registered ton of gross tonnage) | 200 |

| Airplanes, helicopters and other aircraft with engines (per horsepower) | 250 |

| Airplanes with jet engines (per kilogram of thrust) | 200 |

| Other water and air vehicles without engines (per vehicle unit) | 2000 |

FILES

Note to the table: the values are given in the Moscow region for 2020, 2020, 2020, 2020, 2020. To select rates for a specific year, use the selector. These rates are applied in the cities: Aprelevka, Balashikha, Bronnitsy, Vidnoye, Volokolamsk, Voskresensk, Golitsyno, Dzerzhinsky, Dmitrov, Dolgoprudny, Domodedovo, Dubna, Yegoryevsk, Zheleznodorozhny, Zhukovsky, Ivanteevka, Istra, Kashira, Klimovsk, Klin, Kolomna, Korolev, Kotelniki, Krasnoarmeysk, Krasnogorsk, Krasnozavodsk, Lobnya, Losino-Petrovsky, Lukhovitsy, Lytkarino, Lyubertsy, Mozhaisk, Mytishchi, Naro-Fominsk, Noginsk, Odintsovo, Lakes, Orekhovo-Zuevo, Pavlovsky Posad, Podolsk, Pushkino, Pushchino, Ramenskoye, Reutov , Sergiev Posad, Serpukhov, Solnechnogorsk, Stupino, Troitsk, Fryazino, Khimki, Chernogolovka, Chekhov, Shatura, Shcherbinka, Shchelkovo, Elektrogorsk, Elektrostal, Yakhroma and other settlements of the Moscow region.

In the Moscow region there are fewer registered transport tax payers than in Moscow. However, more than in other regions of the country - 2 million 150 thousand citizens and legal entities. All of them make payments to the budget, guided by the requirements of Law No. 33 of July 9, 2008.

Property tax rate table

In accordance with Article 406 of the Tax Code of the Russian Federation, tax rates are established by regulatory legal acts of municipalities. Thus, in the Moscow region, each municipal entity operates in accordance with independently adopted regulations.

But, having analyzed the Decisions of the Council of Deputies of various municipalities located in the Moscow region, we can conclude that in almost all municipalities the rates are the same and do not contradict tax legislation:

| Object of taxation | Tax rate, % of cadastral value |

| Objects whose cadastral value does not exceed 300 million rubles | |

| Apartments, rooms | 0,1% |

| Residential buildings | 0,3% |

| Unfinished construction projects (residential building) | 0,3% |

| A real estate complex that includes residential premises | 0,3% |

| Garage, parking place | 0,3% |

| Outbuildings and structures, the area of which does not exceed 50 sq.m., located on land plots provided for the conduct of personal subsidiary plots, dacha farming, vegetable gardening, horticulture or individual housing construction | 0,3% |

The size of property tax rates for legal entities is determined by the regulatory act of the municipality, but generally the interest rates are as follows:

| Object of taxation | Interest rate |

| · main pipelines; · power lines; · structures that are an integral technological part of these facilities | 2016 – 1.3% 2017 – 1.6% 2020 – 1.9% |

| · public railway tracks; · structures that are their integral technological part. | 2017 – 1% 2020 – 1.3% 2020 – 1.3% 2020 – 1.6% |

| Objects subject to taxation based on cadastral value: | |

| · administrative, business, shopping centers and premises located in them · non-residential premises providing for the placement of offices, retail facilities, public catering facilities and consumer services; · real estate of foreign companies that do not operate in the Russian Federation through permanent representative offices; · real estate of foreign companies not related to the activities of these companies in the Russian Federation through permanent representative offices; · residential assets not accounted for as fixed assets. | 2% |

| Objects of taxation, the cadastral value of which exceeds 300 million rubles | 2% |

| Other objects of taxation | 0,5% |

| Average annual value of a property | 2,2% |

Tax calculation and payment deadlines for organizations

Unlike the vast majority of regions, the Moscow Region exempts taxpayers from among legal entities from making advance payments. The tax is paid in full at the end of the year. The payment deadline is March 28. When calculating, the amount is rounded to the nearest ruble according to mathematical rules: if there are more than 50 kopecks in the amount, they are paid as one ruble, less - kopecks are not taken into account.

Deadline for payment of transport tax for legal entities in 2020:

- for 2020 - no later than March 28, 2019

- for the 1st quarter of 2020 - no later than April 30, 2019

- for the 2nd quarter of 2020 (6 months) - no later than July 31, 2020

- for the 3rd quarter of 2020 (9 months) - no later than October 31, 2020

- for the 4th quarter and the whole of 2020 - no later than March 28, 2020

Rules and deadlines for paying taxes for individuals

Citizens also do not make advance payments, but they do not need to make payments themselves. All the necessary information for paying taxes for the past year is received by residents of the region in the form of notifications from the territorial divisions of the Federal Tax Service. Letters are sent to the place of registration of the individual. If the place of residence has been changed, and due to circumstances the tax authority has not been notified about this, you can use the taxpayer’s Personal Account on the tax service website.

Individuals are required to pay invoices no later than December 1 of the same year in which the notification is received. Failure to pay taxes on time will result in a fine.

Deadline for payment of transport tax for individuals in 2020:

- for 2020 - no later than December 1, 2019

- for 2020 - no later than December 1, 2020

Please take into account: in accordance with paragraph 7 of Art. 6.1. Tax Code of the Russian Federation, if the last day of the period falls on a weekend, then the day of expiration of the period is considered to be the next working day following it.

When to pay

By virtue of paragraph 1 of Article 363 of the Tax Code of the Russian Federation, the Moscow Region law establishes for legal entities:

- tax deduction procedure;

- payment terms;

- resolves the issue of advance payments (there may not be any).

Article 2 of the Moscow Region Law No. 129/2002-OZ dated November 16, 2002 says that the deadline for paying transport tax in the Moscow region for 2016 is March 28, 2020 (this is a month more than in Moscow).

According to the calendar, it will be Tuesday - a regular working day. Therefore there should be no transfers.

Do not confuse the deadline for transferring transport tax in the Moscow region with the deadline for submitting a declaration for it. The last one ends on February 1, 2020 (inclusive).

Also see “When to submit a transport tax return for 2016.”

As for non-legal entities - ordinary citizens and individual entrepreneurs - for them the deadline for deducting tax for their transport is clearly regulated by the Tax Code of the Russian Federation: for 2020 - until December 1, 2020 (clause 1 of Article 363 of the Tax Code of the Russian Federation).

Benefits for individuals

A number of residents of the region may qualify for transport tax benefits:

- heroes of the USSR, Russian Federation, as well as full holders of the Order of Glory;

- veterans and disabled combat veterans, incl. WWII;

- disabled people (disability group 1, 2);

- citizens who were captured by the Nazis as minors during WWII;

- victims of radiation as a result of the Chernobyl accident;

- guardian of a disabled child, one of the parents in a large family;

- victims of radiation during the accident at Mayak, as well as those exposed to radiation during testing at the Semipalatinsk test site;

- citizens who were at risk during nuclear weapons testing, as well as those who suffered from radiation sickness during such tests;

- guardian of an incapacitated citizen;

- owners of vehicles with engines less than 70 hp.

FILESOpen table of transport tax benefits in the Moscow region

Who can apply for benefits and when?

The land tax benefit is of a declarative nature. To apply for it, a pensioner should:

- Prepare documents confirming rights to benefits.

- Submit the documents to the regional tax office at your place of residence.

An applicant for a fiscal preference must prepare the following documents:

- civil passport of the Russian Federation;

- pensioner's ID;

- income certificate;

- certificate of ownership of real estate;

- cadastral passport of the object;

- additionally:

- birth certificates of all children;

- certificate of family composition;

- conclusion of a medical and social examination on the assignment of disability to a citizen;

- a copy of the serviceman's death certificate;

- documents confirming receipt of state awards;

- receipt for payment of land tax for the previous year.

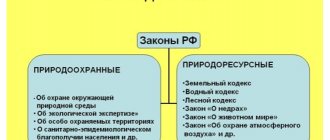

According to federal and local legislation, some categories of citizens are completely exempt from paying land tax in 2017:

- veterans of the Great Patriotic War;

- participants in hostilities in peacetime;

- liquidators of the accident at the Chernobyl nuclear power plant;

- parents and widows of deceased employees;

- disabled people of groups 1 and 2, disabled since childhood.

For pensioners there is a 20% discount. The tax amount is reduced by 50% if:

- the total income of a family of pensioners does not exceed 2 minimums established for the region;

- if there are 3 or more children, and the average per capita income is below the subsistence level;

- This is a single citizen living alone, or a family whose average monthly income is below the 1st minimum accepted for this category of citizens.

In order to take advantage of the benefit, you need to submit supporting documents to the tax office and write an application. It is filled out on site according to the prescribed form. Payment of tax at a reduced rate is possible only for one plot. If, for example, the pensioner owns two of them, then it is necessary to indicate in the application in respect of which of them the benefit should be provided.

Land tax, like other contributions of citizens of the Russian Federation, has clearly defined preferential categories that allow some groups of people to make payments at lower rates.

If we talk about individuals, the benefits are:

- disabled children, as well as I-II groups;

- disabled people and war veterans;

- heroes of the Russian Federation and the USSR;

- participants in the liquidation of the Chernobyl accident;

- pensioners.

As for land tax benefits for organizations, they are spelled out in Article No. 395 of the Tax Code of the Russian Federation.

In the Tax Code of the Russian Federation, each benefit is assigned an individual code to simplify filling out the tax return.

What is the essence of the benefits? Citizens are allowed not to pay tax if the area of the land is 6 acres or less. If it is more than 6, then 6 acres are deducted from the total area, and tax is paid only for the area of land that remains.

To do this, you need to submit the relevant documents, which will confirm the citizen’s right to receive benefits.

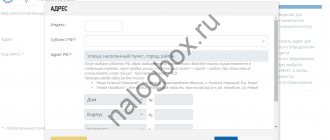

To receive the discounts due from the state, you need to write an application for land tax benefits, where you indicate the following information:

- code of the tax office to which the taxpayer's land plot belongs;

- owner details;

- information about the land plot;

- TIN;

- disability group (additionally provide documents confirming it);

- the text of the application itself clearly stating the request and reasons for providing the benefit.