How and why to use it

This process must be reflected in the accounting journal. Customer-supplied materials and raw materials will be accounted for as fixed assets. Upon transfer, a report is drawn up that includes the main data on the materials. The serial code of raw materials, grade and brand is indicated. It is necessary to indicate which part is suitable for further work. You can use the M-15 waybill form, which is only recommended. To get a good filling result, you can use books and articles on accounting. It is recommended to familiarize yourself with the sample.

Appendix No. __ to the Contract Agreement dated “__” ________ 20__ No. _______

REPORT on the use of materials

| No. | Name of type of work | Name of materials used | Material unit | Price per unit of measurement, rub. | Materials transferred by the customer | Materials actually used by the contractor |

| Quantity (volume) | Amount, rub. | Quantity (volume) | Amount, rub. |

| On behalf of the Contractor | On behalf of the Customer | ||

| (signature) | (FULL NAME.) | (signature) | (FULL NAME.) |

https://youtu.be/lXol_qHcb-Y

Tax accounting of operations for processing customer-supplied materials

Ermoshina E. L., expert of the information and reference system “Ayudar Info”

The definition of “consignment materials” is enshrined in the accounting legislation. Thus, paragraph 156 of Methodological Instructions No. 119n states that these are materials accepted by the organization from the customer for processing (processing), performing other work or manufacturing products without paying the cost of the accepted materials and with the obligation to fully return the processed (processed) materials, delivery of completed works and manufactured products.

In Chapter 25 of the Tax Code of the Russian Federation there is no definition of customer-supplied materials or anything similar, while their accounting has its own characteristics, due primarily to the fact that the ownership of these materials does not pass to the processor (performer).

What essential conditions must be reflected in the contract for materials processing? What are the features of accounting for income and expenses among the parties to such an agreement? What primary documents should be used to document operations related to the transfer of materials and the return of finished products to the customer?

Contract for processing of raw materials supplied by customer, sample and appendix 2020

Basic concepts. If you look at the NKU, then in accordance with its paragraph.

There is a special clause in the definition of this term: operations with customer-supplied raw materials include! Customer-supplied raw materials are considered to be raw materials, materials, semi-finished products, components, energy resources that are the property of one business entity of the customer and are transferred to another business entity - the manufacturer for the production of finished products.

VIDEO ON THE TOPIC: Raw materials supplied by customers

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

- Sample contract for processing of customer-supplied raw materials

- Agreement for processing of customer-supplied raw materials

- Contract for processing of customer-supplied raw materials: important points

- We draw up a toll agreement

- Agreement for processing of customer-supplied raw materials (potatoes and starch) (filling sample)

- Act of transfer of customer-supplied materials

Sample contract for processing of customer-supplied raw materials

Agreements for the processing of raw materials supplied by customers are very convenient for the parties. The customer gets the opportunity to manufacture products without having production capacity, and the processor gets the opportunity to use free production capacity. In this article we will look at the legal basis for concluding such agreements.

At the moment, operations with customer-supplied raw materials are defined only in paragraphs.

According to this standard, an operation with customer-supplied raw materials is an operation for the processing, enrichment or use of customer-supplied raw materials, regardless of the number of customers and performers, as well as the stages of operations in order to obtain finished products for an appropriate fee.

In this case, customer-supplied raw materials are considered to be raw materials, materials, semi-finished products, components, energy carriers, which are the property of one business entity of the customer and are transferred to another business entity - the manufacturer for the production of finished products, with further transfer or return of such products or part thereof to their owner or on his instructions to another person pp.

However, the corresponding amendments to the Tax Code were never made, in particular with regard to the reference to the twenty percent criterion for the cost of finished products.

This definition with a twenty percent criterion should be used solely for tax purposes.

Moreover, it is necessary to focus on it only in cases where the NKU provides for special standards specifically for operations with customer-supplied raw materials.

XX NKU. Let us remind you that the zero rate cannot be applied by business entities producing products using raw materials supplied by customer; In the Civil Code of Ukraine, contracts for toll processing are not separately identified and are regulated by the general provisions of Chapter 61 “Contracting”.

Such agreements refer to contract agreements involving the performance of work from the customer’s material, Art. The contractor, the processor, under a contract for the processing of customer-supplied raw materials, performs work and does not provide services.

This affects the specifics of currency regulation of these operations. For more details, see

The key point when concluding contracts for the processing of raw materials supplied by customer is that the ownership of the materials and manufactured products transferred to the processor belongs to the customer.

At the same time, it is important to indicate this separately in the contract. In accordance with Part. That is, by default it is considered that the waste belongs to the customer. If waste is not returned to the customer, the contract should indicate the following conditions:

In the first option, disposal on behalf of the customer without transfer of ownership of the waste to the recycler, disposal actions are carried out on the basis of a commission agreement or mandate with the customer, which stipulates the terms of disposal, including:.

In the second option, the conditions for the transfer of ownership are also fixed in the contract.

Waste that has economic value can be transferred to the recycler under a purchase and sale agreement for a fee or free of charge, while “non-economic” waste is usually transferred to the recycler free of charge.

Relationships under contracts with non-resident customers are usually drawn up in a similar manner. Thus, if the parties do not indicate in the contract which country’s law is subject to the application of legal relations, the following rules will apply:

In addition to cash, the customer can pay the processor with raw materials or finished products. The following options are possible: In this case, a barter agreement takes place.

Such an agreement is not considered barter, since obligations are offset under different agreements.

The receipt of customer-supplied raw materials for processing from the customer is documented with the usual documents: invoice, delivery note, etc.

In addition, such a transfer can be formalized by an act of acceptance and transfer of customer-supplied raw materials. In these documents, it is advisable to indicate the collateral value of the transferred materials.

The processor formalizes raw material processing operations with documents used at the enterprise in accordance with the adopted accounting policies.

Thus, the transfer of raw materials from a warehouse to production can be documented with documents approved by the order of the Ministry of Statistics of Ukraine. The processor keeps records of expenses incurred for processing customer-supplied raw materials in a register, the form of which can be developed independently, taking into account the specifics of a particular production.

After completing the work, the processor is obliged to provide the customer with a report on the use of the material and return the rest of it. In addition, it is advisable to issue an acceptance certificate for the products of processing of customer-supplied raw materials and a certificate of work performed.

Since the mentioned documents correspond to the characteristics of the primary document, they must contain all the details provided for in Part.

From the above definition of customer-supplied raw materials, it follows that the manufacturer is considered to be the processor of customer-provided products.

And here the question arises: can the customer be considered a manufacturer? It is important, in particular, for the purposes of the need to use registrars of settlement transactions when selling products.

So, according to Part. There is reason to believe that the customer is also a manufacturer. This follows, in particular, from the norms of paragraphs. Tax officials also classify products manufactured on tolling terms as finished products of agricultural producers, see According to paragraph.

Nevertheless, there are clarifications in which tax authorities came to the conclusion that products manufactured for the customer are not considered their own products, a letter from the State Tax Administration from And besides, controllers believe that products of their own production for the purposes of using settlement transaction registrars include products that are produced and sold by the enterprise itself in a single technological process using its own or hired labor, an explanation from the section In the letter of the Ministry of Justice dated According to Art.

The full technological production cycle is a set of premises, technological and other equipment, relevant technological processes that ensure the processing of raw materials into products ready for sale to the final consumer, as well as laboratories accredited by executive authorities authorized in accordance with the law.

https://youtu.be/UlujCzjy6I0

In this regard, when selling finished products made from customer-supplied raw materials for cash, in cases provided for by law, it is better for the customer to use a payment transaction registrar, without relying on the norms of Part.

GKU - Civil Code of Ukraine from NKU - Tax Code of Ukraine from Methodological foundations and explanations of KVED, approved by order of the State Statistics Committee of Ukraine from

Contract for processing of customer-supplied raw materials: important points

Today, individual entrepreneurs make up a significant part of the entrepreneurial community. At the same time, they successfully compete in the market with commercial organizations not only in the field of trade, consumer services or public catering, but also in the production of finished products.

Moreover, the lack of necessary equipment and personnel with appropriate qualifications for a businessman is not an obstacle to organizing a full-fledged production process. After all, you can make products not only on your own, but also by the processor by concluding an agreement with him on toll processing of raw materials.

We will talk about such an agreement concluded by individual entrepreneurs for the purpose of production in this article.

As is known, in accordance with the article of the Civil Code of the Russian Federation, hereinafter referred to as the Civil Code of the Russian Federation, a contract is an agreement between two or more persons on the establishment, modification or termination of civil rights and obligations.

However, among the contracts provided for by the Civil Code of the Russian Federation, the agreement for the processing of customer-supplied raw materials is not distinguished as an independent type of civil law contract. However, this does not prevent business entities from concluding such agreements in practice.

Firstly, by virtue of paragraph 2 of Article of the Civil Code of the Russian Federation, the parties can enter into an agreement either provided for or not provided for by law or other legal acts. From this we can conclude that, in general, a toll processing agreement is an agreement in which one party receives raw materials or materials from the other, processes them, and transfers the finished product to the counterparty.

We draw up a toll agreement

Products - finished food products, non-alcoholic, highly carbonated drinks, the quality of which complies with technical regulations, state standards, technical conditions, technological instructions, other regulatory and technical documentation provided for by the legislation of the Russian Federation and applicable to this type of product. The result of the work is products that meet the requirements of the current legislation of the Russian Federation and the terms of the Agreement, ensuring the safety of life and health of consumers. Packaging is the outer shell of the Product, protecting the Product from damage and loss, facilitating the rational organization of the process of storage, sale and transportation of the Product, supporting and strengthening the market position of the Product. According to the terms of the Agreement - individual packaging, group packaging, transport packaging.

The customer transfers raw materials or materials to the contractor for processing according to the invoice or act.

Download all automated templates with automatic document creation programs. Subject of the agreement. The Contractor undertakes to provide, with his own resources and resources, services for processing customer-supplied raw materials and manufacturing finished products, and the Customer undertakes to accept the results of processing and make payment for the work performed in accordance with the terms of this agreement.

Agreement for processing of customer-supplied raw materials (potatoes and starch) (filling sample)

Agreements for the processing of raw materials supplied by customers are very convenient for the parties. The customer gets the opportunity to manufacture products without having production capacity, and the processor gets the opportunity to use free production capacity. In this article we will look at the legal basis for concluding such agreements.

The act of transferring tolling materials is an important document in the scheme of documenting the interaction of contractors as a tolling organization and a processor.

The degree of interest of tax services in conducting audits in a particular organization will depend on how correctly it is drawn up. Open and download online. A contract agreement is concluded between the organization that uses the materials and their supplier.

This agreement must take into account the interests of both parties. The following fundamentally important points are usually stated:.

Agreement for the provision of services for the processing of customer-supplied raw materials

If the Customer, despite a timely and reasonable warning from the Contractor about these circumstances, does not eliminate them within a reasonable time, the Contractor has the right to withdraw from this agreement and demand compensation for losses caused by its termination. 3.2. The customer is obliged to: 3.2.1. Provide raw materials in full required for the Contractor to complete the tasks. 3.2.2. 3.3.2.

Legal regulation

It should be noted that the Civil Code of the Russian Federation also does not have a definition of “consignment materials”, but there is Art. 220 of the Civil Code of the Russian Federation, regulating the relations of the parties under a processing agreement. Paragraphs 1 and 2 of this article provide the following.

The right of ownership to a new movable thing manufactured by a person by processing materials that do not belong to him is acquired by the owner of the materials, who is obliged to reimburse the cost of processing. In this case, a reservation is given - unless otherwise provided by the contract.

However, if the cost of processing significantly exceeds the cost of materials, then the ownership of the new item is acquired by the person who, acting in good faith, carried out the processing for himself. This person is obliged to reimburse the owner of the materials for their cost.

An agreement for the processing of customer-supplied raw materials is not provided for as an independent type of agreement in the Civil Code of the Russian Federation. Only in ch. 37 “Contract” of the Civil Code of the Russian Federation there is Art. 713, which regulates the procedure for performing work using customer material.

So, under an agreement for the processing of customer-supplied materials, one party (the contractor) undertakes to manufacture from materials belonging to the other party (the customer) products in the quantity and according to the characteristics specified in the agreement, and the latter undertakes to pay for processing services.

Based on the above norms, it is advisable to fix the following provisions in the contract:

- the provision of materials is carried out by the customer on a toll basis;

- ownership of the materials remains with the customer;

- the contractor uses materials economically and prudently and only for the purposes for which they were provided to him;

- the contractor is obliged to provide the customer with a report on the materials used, as well as return the remainder of the material.

In addition, it is necessary to stipulate such conditions as the nature of the processing work performed, technological requirements for them; name and quantity of transferred materials; deadlines for fulfilling obligations; name and technical characteristics of the finished product.

The parties must foresee where the unused material will go – return to the customer or remain with the contractor. In the latter case, ownership of the materials passes to the performer. He should pay them or reduce the price of the work by the cost of the remainder.

Tolling contract. Sample form and download form for 2020

A tolling agreement (also known as a tolling agreement) refers to types of agreements not mentioned in the legislation. The regulation of a toll agreement is carried out by analogy with its related work contract.

Files in .DOC: Form of toll agreement Sample of toll agreement

Subject of the agreement

Like a contract, tolling implies an agreement by which the performer (contractor) undertakes to perform a certain type of work on behalf of the customer.

The peculiarity of a toll agreement is not the subject itself, but the method and conditions of its execution. Thus, due to contractual circumstances, the contractor not only undertakes to fulfill the order, but also to produce products from raw materials or materials provided by the customer. In turn, the customer receives the additional function of a supplier, that is, a “giver” in a toll contract.

Regulation

By its legal nature, a tolling agreement can be classified as an unnamed agreement, since not a single regulatory act contains a listing of the conditions and features of tolling.

Any lacuna (gap) in the legislation is subject to regulation by analogy. The closest type of agreement (similar) to tolling is a work contract, although it does not cover all of its individual characteristics.

To a certain extent, a tolling agreement is legal nonsense, due to which judicial practice operates with definitions not contained in the Civil Code of the Russian Federation, such as “toller” in relation to the customer and “processor” in relation to the contractor.

The contractor’s obligation under the toll agreement, by analogy with Article 703 of the Civil Code of the Russian Federation, which regulates the contract, will be to perform work as directed by the customer. The direction of work can be varied, and the general condition will be the transfer of the results of the work to the customer.

However, under a standard contract, the work must be performed by the contractor using his own materials and means of production.

Based on the above, we can assume that tolling is fully regulated by Chapter 37 of the Civil Code of the Russian Federation.

Benefits of the agreement

By concluding a tolling agreement, the customer gets rid of the need to maintain or support his own raw materials processing plant, thus excluding production from the raw materials-production-sales chain. He transfers the produced or purchased raw materials to the contractor who has the production capacity, pays him a remuneration, receives the finished product and sells it.

The contractor, in turn, receives a scope of work for its production facilities, without spending money and time on searching for suppliers of raw materials and subsequent distributors of finished products.

The tolling agreement must contain not only an indication of the subject of the agreement, but also the relationship of the parties regarding the transfer and use of tolling material.

Moreover, since the material belongs to the category of things that have only generic characteristics, the contract itself must contain notifications regarding:

- type of material or raw material;

- technical characteristics, for example labeling of raw materials;

- quantity determined by weight, meters (linear, square or cubic), liters, etc.

The terms of the contract are determined by the actual capabilities of the contractor to produce finished products from the received materials.

The material received by the contractor is ultimately returned back to the customer, but in a processed form; the performer does not become the owner of the material. Therefore, a tolling agreement may contain a condition for the return to the customer of the unused part of the materials or waste material.

We invite you to familiarize yourself with a sample application from your place of work for housing.

If the customer leaves leftovers or waste to the contractor, then, as a rule, he uses this to offset the remaining balances in the cost of payment for the contractor’s work.

As mentioned above, customer-supplied materials transferred to the contractor remain the property of the customer. Therefore, materials (raw materials) cannot be subject to any debt obligations of the contractor.

Accordingly, they cannot be seized in enforcement proceedings, and they cannot be included in the bankruptcy estate during bankruptcy proceedings.

For these reasons, tolling agreements become ways to avoid fulfilling debt obligations. To achieve these goals, by mutual agreement of the counterparties, fictitious tolling agreements are concluded, removing part of the debtor’s property from the bankruptcy estate.

As a rule, such agreements differ from ordinary ones in that the ownership of the toll material under them belongs to third-party companies.

A similar feature was noticed and appreciated by the courts.

Due to this assessment, there are already cases in judicial practice when customer-supplied raw materials included in the bankruptcy estate were not excluded from it upon applications of third parties to release property from seizure.

The issues of the contractor's responsibility for the safety of the customer's materials and the distribution of the risks of damage or destruction of materials among the contracting parties require separate consideration.

By virtue of Article 714 of the Civil Code, the contractor is responsible for the safety of raw materials received from the customer. The risk of accidental loss or damage to materials lies with the customer.

Due to the specificity of the tolling agreement, the penalty cannot be calculated based on the cost of materials or the cost of work. In accordance with the Resolution of the Federal Antimonopoly Service for the Moscow Region dated March 18, 2014 (n/a A40-51605/11-23-418), the amount of the penalty can be calculated as an agreed percentage based on the total cost of work under the contract.

When notifying the conditions for accrual of a penalty in a tolling agreement, you should carefully consider determining the timing of its accrual. That is, the absence of a notification regulating the accrual of a penalty for a day of delay (for example, 0.1 percent per day of delay) will lead to the fact that the penalty will be paid one-time for the entire period in the amount of 0.1%.

Under a tolling agreement (for processing customer-supplied raw materials), the contractor undertakes to manufacture specific products for a fee from raw materials that belong to the other party (customer). The customer becomes the owner of the manufactured product, and the contractor only processes the raw materials.

In the Civil Code of the Russian Federation, the contract for the processing of customer-supplied raw materials is not distinguished as an independent type of contract. The essential features of this agreement make it possible to consider it as a type of contract. Therefore, in relation to the relations of economic entities that are based on a tolling agreement, the regulatory provisions regarding the contract are used.

– the presence of two subjects of relations: the owner of the raw materials (customer) and the processor of the raw materials (contractor);

– the customer transfers raw materials to the contractor for the next production and processing of a certain type of product;

– the contractor, after processing the raw materials, transfers the finished product to the customer in the specified quantity;

– for the work performed, the customer pays the contractor the amount of money stipulated by the contract or transfers to him a certain number of manufactured products.

2. All tolling operations must be divided into four types, which differ from each other in legal form. These are operations in relation to the processing of the counterparty's raw materials:

- on a contract basis according to the “work-product” scheme;

- on a contract basis according to the “work-money” scheme;

- on a contract basis according to the “materials-labor-money” scheme.

- on a contract basis according to the “work-raw materials” scheme;

Accordingly, with this type of tolling transaction, the contractor must, at his own risk, perform certain work for the order using the customer's raw materials, and the customer must provide the raw materials and pay in cash for the contractor's work.

In general, this operation is no different from ordinary work execution operations, according to which the contractor performs work from the customer’s materials. It is possible to identify the characteristic features of this type of operation.

Firstly, the subject of the contract is a certain result of the work performed - products that are received after performing certain work by the contractor for processing the customer's raw materials.

Thirdly, after completing the work, the contractor transfers the acquired result (products obtained as a result of processing) to the customer, and the customer pays for the work performed in cash, in accordance with the terms of the contract.

This agreement does not contain any specific differences or features from a simple work contract.

Accordingly, with this type of tolling operation, the contractor accepts the obligation, at his own risk, to perform certain work on an order using the customer’s raw materials, and the customer must provide the raw materials and pay for the services of the processor in the form of transferring to the latter a certain number of products manufactured by him.

Since with this type of tolling the parties enter into (both legally and actually) a mixed agreement, which contains elements of contracting and delivery (purchase and sale), it is necessary to be guided by the regulations on contracting and purchase and sale or supply (in the relevant part ).

Different points of view have been expressed on this matter at different times. For example, it was proposed to consider this agreement as an exchange agreement according to the “work-goods” scheme.

However, the execution of work (as well as the provision of services) is not actually the subject of an exchange agreement. Therefore, the transfer of products and the performance of work in the structure of this agreement are separate elements.

Primary documents drawn up by the parties to the agreement

As you know, an organization can use unified forms of primary documents or independently develop these forms.

The customer (vendor) draws up an invoice for the transfer of raw materials and supplies (standard form No. M-15 can be taken as a basis).

The contractor (processor), having received the materials to be supplied, draws up a receipt order (you can use form No. M-4), where it should be indicated that the materials were received on toll terms.

After execution of the contract, the processor draws up a report on the use of the received raw materials or materials, which must reflect:

- name and quantity of materials received and used;

- name and quantity of finished products;

- name and quantity of residual materials and waste from their use.

After completing the processing work, the parties draw up and sign an acceptance certificate for the work performed, which indicates the monetary value of the work.

The customer, upon receiving finished products, issues a receipt order No. M-4 or an invoice for finished products according to f. No. MX-18 (approved by Rosstat Resolution No. 66 dated 08/09/1999).

What is toll processing?

This definition of customer-supplied raw materials is given in paragraphs.

14.1.41 NKU. Let’s say right away: these special terms are important for the purposes of “identifying” tolling operations and reflecting them in tax accounting. And the main feature of such operations is this: the right of ownership to customer-supplied raw materials at each stage of its processing, as well as to the finished products made from it, belongs to the customer and does not pass to the contractor.

So, for tax and accounting purposes, the process of interaction between the parties in transactions with customer-supplied raw materials can be outlined as follows: 1) the customer transfers his raw materials to the contractor for processing; 2) the contractor processes these raw materials into finished products and transfers them to the customer; 3) the customer accepts the finished product and pays for the contractor’s work on processing the raw materials.

Sample contract for processing raw materials supplied by customer Attention

5. Procedure for delivery and acceptance of products 5.1.

Handover and acceptance of completed work is carried out by the parties according to the act within _____________________________________ from the moment the customer is notified of the readiness of the processed raw materials.

A selection of the most important documents upon request (regulatory acts, forms, articles, expert consultations and much more).

The main disadvantage of this method is that companies implement it using a simplified system. This means that their partners cannot deduct “input” VAT.

The document is available: in the commercial version of ConsultantPlus In connection with the above, it is hardly possible to agree with the position of M.I. Braginsky that relations for the processing of raw materials supplied by customers are a mixed agreement containing both elements of contracting and supply.

As for tolling (processing of raw materials provided by another party so that payment for the work is made with manufactured products), due to the fact that the technology for processing alumina into aluminum has already been developed and the customer is simply deprived of the opportunity to give any instructions on the processing of raw materials, this relationship is a supply.

When carrying out tolling operations, the supplier (customer) transfers inventories to the processor (performer). This is done in order to carry out certain work on the conversion of raw materials. Upon completion of the work, the customer receives the finished product.

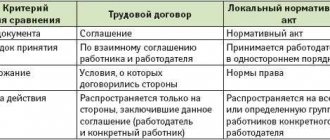

| Provider (customer) | Processor (performer) |

| Owns raw materials or has available funds to purchase them | Possesses the necessary production capacity |

| Has its own trademark, patented technologies, etc. | Processes raw materials |

| Has its own sales channels for finished products | Returns processed products to the seller |

| Pays for processing services | |

| Has ownership rights to raw materials and waste | |

| Possesses processed products |

To carry out operations for processing raw materials, two organizations enter into an agreement with each other for the processing of customer-supplied products. Such contractual relations between the parties are carried out on the basis of Chapter 37 “Contracting” of the Civil Code of the Russian Federation.

2.2. The Customer undertakes: 2.2.1. No later than from the moment the Parties sign this Agreement, provide the Contractor with the Customer’s assignment.

2.2.3. No later than upon receipt from the Contractor of the calculation of the quantity of raw materials, provide the Contractor with the corresponding quantity of raw materials according to the TORG-12 invoice.

In all other cases, the Processor does not have the right to independently sell products made from the raw materials of the recipient Supplier.

The parties undertake to monthly summarize the results of work under this agreement, which are recorded in the relevant protocols. Payments for containers are made in the following order: ______________________________. 8.

Responsibility of the Parties: For under-delivery, delivery of products of inadequate quality, late payment and sampling of manufactured products, the Supplier-recipient shall pay a fine in the amount of __________% of the cost of under-delivered, low-quality, unselected or untimely paid products, but not more than __________ rubles.

According to the concluded agreement, the contractor carries out the task of processing the customer’s products and transfers the final result to him. The provider is obliged to pay for the services of the performer (Article 702 of the Civil Code of the Russian Federation). The ownership of finished products (Article 703 of the Civil Code of the Russian Federation) belongs to the enterprise that ordered the processing.

In paragraph 1 of Art. 705 of the Civil Code states that the supplier is responsible for accidental loss or damage to customer-supplied materials. The contractor is responsible for accidental damage or destruction of finished products. The contract may specify other rules for risk distribution.

The agreement provides for a clear distribution of responsibilities between the parties. Thus, it is reflected that the finished products are produced from the customer’s products, and the supply of individual auxiliary resources is carried out by the contractor.

If such distribution of responsibilities is not specified in the agreement, during an audit by the tax inspectorate, doubts may arise about the validity and economic feasibility of the costs of each party to the agreement.

Find out what: How to revoke a power of attorney for a lawyer

The contract stipulates:

- Subject of the agreement;

- Deadlines for completion of work;

- A clear description of the materials being transferred, indicating quantity, cost and quality;

- The procedure for transferring and receiving raw materials;

- The procedure for transferring and receiving finished products;

- Assortment and name of finished products;

- Delivery deadlines for inventories and liability for failure to meet them;

- Remodeling service price;

- Payment procedure;

- Waste accounting procedure.

Shipment of resources for rework is carried out according to the invoice. It is filled out in duplicate. The invoice form number is M-15. The document must make a note about the transfer of products on a toll basis. It is also necessary to indicate the details of the contract.

One copy of the invoice is the basis for the release of raw materials from the warehouse and is stored in the warehouse of the supplier. The second copy of the invoice remains with the contractor.

The document for the transfer of raw materials indicates the name, quantity, and cost of the transferred material reserves. In trading enterprises, an invoice No. TORG-12 is issued. Just as in manufacturing enterprises, the invoice is drawn up in two copies: one remains with the seller, the second with the processor.

Upon completion of the work performed, the customer must request the following documents from the contractor:

- Report on materials consumed. It indicates information on the amount of inventories consumed, the amount of products produced, as well as the amount of waste generated as a result of production.

- The act of acceptance and transfer. Information about the cost and list of work performed is displayed.

An enterprise can make the receipt of received inventories in several ways.

- Registration of a receipt order (form No. M-4). Definitely do o. In the unified form, an additional column “Base” should be made. The absence of such a record may be regarded by tax authorities as receipt of materials free of charge.

- By placing a stamp on the customer's accompanying documents. The stamp is evidence that you certify the quality and quantity of the inventory received. The stamp must contain a note indicating that materials were received on a toll basis under the contract.

Acceptance of customer-supplied raw materials by the contractor is carried out by a primary document - an invoice. It indicates the cost and physical assessment of processed products. In this case, no invoice is issued.

We invite you to read: When will the queue for municipal housing be eliminated?

The transfer of finished products from the contractor to the customer does not provide for a unified primary accounting document. Its enterprises develop and approve independently. The basis for this document can be taken as the Invoice for the transfer of finished products to storage locations (f. MX-18).

The processing company draws up a report on the amount of raw materials consumed. The contractor transfers the returnable waste to the customer using an M-15 invoice, on which the note “Return of customer-supplied unconsumed materials” is made.

- The cost of manufactured products is distorted.

- The result of the economic activity of the enterprise is distorted.

- The fact of free receipt (transfer) of raw materials arises.

As a result, regulatory authorities may impose additional income taxes, as well as penalties.

The parties to the transaction decide what conditions the agreement on processing of raw materials will contain. But according to our legislation, there are essential conditions that must be included in the contract. These include:

- the subject of this agreement;

- the time frame within which work on processing customer-supplied raw materials must be completed;

- a detailed description of the characteristics of the transferred materials;

- conditions for the transfer and acceptance of the subject of the contract;

- a detailed description of the finished work from the contractor;

- liability of the contractor and vendor;

- terms of payment;

- procedure and grounds for making changes and terminating the contract.

The operating principle of such a scheme is simple and recognized as beneficial for each party to the contract. Toll processing is the processing of material that the customer company transfers to the performing company in order to obtain a product ready for sale or an intermediate product for use in production.

Common examples:

- Processing of crude oil in the manufacture of fuel or lubricants.

- Processing of agricultural products for the production of canned food and semi-finished products.

- Recycling to obtain industrial raw materials.

The employer transfers the raw materials without charging a fee for it. The Contractor is obliged to hand over the manufactured products in full after completing the work.

Accounting with the customer (vendor)

Accounting

An organization that has transferred its materials to another organization for processing (processing, performing work, manufacturing products) as toll, does not write off the cost of such materials from the balance sheet, but continues to record them in the account of the relevant materials (in a separate sub-account) (clause 157 of Methodological Instructions No. 119n ).

The transfer is reflected in internal records on account 10:

Debit 10-7 “Materials transferred for processing to third parties” Credit 10-1 “Raw materials and materials”.

The cost of services provided by the contractor for processing materials (excluding VAT) will be the organization’s expense for ordinary activities, on the basis of which the cost of production is formed (clauses 5 and 9 of PBU 10/99 “Organization expenses”). On the date of signing the acceptance certificate for completed work, the following entry is made: Debit 20 Credit 60.

If, as a result of processing materials, returnable waste is generated, which, by agreement of the parties, is returned to the customer (vendor), accounting for this waste is carried out based on the provisions of clause 111 of Methodological Instructions No. 119n. Waste is delivered to warehouses using delivery notes indicating their name and quantity. The cost of waste is determined by the organization based on the prevailing prices for scrap, waste, rags, etc. (that is, at the price of possible use or sale).

On the date of approval of the report, the customer accepts returnable waste, making an accounting entry: Debit 10-6 “Other materials” Credit 20.

The cost of recorded waste is included in the reduction of the cost of materials released into production.

Ultimately, the actual cost of materials will be the sum paid to the supplier, plus processing costs, minus returnable waste (if any).

The actual cost is written off by posting: Debit 20 Credit 10-7.

Finished products accepted for accounting are reflected by the posting: Debit 43 Credit 20.

Tax accounting

Material costs.

As a general rule, the costs of organizations for the purchase of materials are considered material expenses and, when calculating income tax, are taken into account on the date of their transfer to production (clause 1, clause 1, article 254, clause 2, article 272 of the Tax Code of the Russian Federation). As for the supplier, at the time he transfers the materials supplied to the processor to the processor, their actual transfer into production has not yet been confirmed. Expenses can be recognized only on the date of approval of the contractor’s report on the use of materials.

Costs for the acquisition of work and services of a production nature, performed by third parties, are recognized as material expenses on the basis of paragraphs. 6 clause 1 art. 254 Tax Code of the Russian Federation.

The question arises: what costs (direct or indirect) are processing costs related to? On the one hand, according to paragraph 1 of Art. 318 of the Tax Code of the Russian Federation, direct costs can include, in particular, material costs determined in accordance with paragraphs. 1 and 4 paragraphs 1 art. 254 Tax Code of the Russian Federation. On the other hand, in accounting, the cost of materials consists of costs in the form of the amount paid to the supplier and the cost of processing. If some are taken into account as direct and others as indirect, this will significantly increase the complexity of calculations and will lead to the formation of differences and the application of PBU 18/02 “Accounting for calculations of corporate income tax.”

We believe that in this situation you can use the recommendations of the Ministry of Finance, which are given in Letter No. 03-03-06/1/214 dated 05/02/2012: when forming the composition of direct expenses in tax accounting, the taxpayer can take into account the list of direct expenses associated with production and sales goods (performance of work, provision of services), used for accounting purposes. Thus, the costs of processing materials can be taken into account as direct.

Return of leftover materials.

If the balance of supplied materials is not returned by the contractor and is counted towards payment for the work performed by him, the contractor must include in income the proceeds from their sale as of the date of approval of the report on the use of materials on the basis of clause 1 of Art. 249, paragraph 1, art. 248 Tax Code of the Russian Federation.

Return of waste.

According to paragraph 6 of Art. 254 of the Tax Code of the Russian Federation, the amount of material costs is reduced by the cost of returnable waste. For the purposes of applying Sec. 25 of the Tax Code of the Russian Federation, returnable waste refers to the remains of raw materials (materials) formed during the production of goods (performance of work, provision of services), which have partially lost the consumer qualities of the original resources (chemical or physical properties) and are therefore used at increased costs (reduced product yield ) or not used for its intended purpose.

Returnable waste is assessed in the following order:

1) at a reduced price of the initial material resource (at the price of possible use), if this waste can be used for main or auxiliary production, but with increased costs (reduced yield of finished products);

2) at the selling price, if this waste is sold externally.

In the latter case, returnable waste should be assessed based on market prices determined in the manner provided for in paragraph 1 of Art. 105.3 of the Tax Code of the Russian Federation (see Letter of the Ministry of Finance of Russia dated April 26, 2010 No. 03-03-06/4/49).

Example 1.

The organization purchased materials whose cost is 354,000 rubles. (including VAT - 54,000 rubles).

The materials were transferred on a toll basis to the processor, the cost of whose services amounted to 94,400 rubles. (including VAT – 14,400 rubles).

As a result of processing, finished products and returnable waste were obtained, which are planned to be sold. The cost of returnable waste is estimated at RUB 30,000.

The following entries were made in the customer’s accounting records:

| Debit | Credit | Amount, rub. |

| Materials received from supplier | 300 000 | |

| “Input” VAT reflected | 54 000 | |

| Accepted for deduction of VAT presented by the supplier | 54 000 | |

| Materials sent for recycling | 300 000 | |

| The cost of processing is reflected (94,400 – 14,400) rubles. | 80 000 | |

| “Input” VAT reflected | 14 400 | |

| Accepted for deduction of VAT presented by the processor | 14 400 | |

| Cost of recycled materials written off | 300 000 | |

| Returnable waste received | 30 000 | |

| Finished products (300,000 + 80,000 – 30,000) rubles were accepted for accounting. | 350 000 | |

| Funds transferred for processing services | 94 400 |

In tax accounting, the cost of materials is also 350,000 rubles. (300,000 + 80,000 – 30,000) and included in direct expenses.

Contract for the manufacture of products from customer-supplied raw materials

date and place of signing

SUBJECT OF THE AGREEMENT

1.1. The Contractor undertakes to manufacture the following products according to the Customer’s instructions: _____________ (hereinafter referred to as finished products), transfer them to the Customer, and the Customer undertakes to accept the finished products and pay for them.

1.2. The Contractor performs the work under this Agreement on its own using its own equipment from the Customer’s raw materials.

1.2.1. Requirements for the quality of raw materials: ___________________________.

1.2.2. Requirements for the quality of finished products: _______________.

2.1.1. No later than _______ from the moment of receipt of the assignment from the Customer, draw up a work estimate and work schedule and send it to the Customer for approval, accompanied by a calculation of the amount of raw materials required to complete the work.

2.1.2. No later than _______ from the moment of receipt of raw materials from the Customer according to the raw material acceptance and transfer certificate (Appendix No. _____), issue a receipt order in Form No. M-4 indicating that the raw materials were received on a toll basis, begin manufacturing the products and complete production no later than _______ from the moment it began.

2.1.3. Upon completion of the work, notify the Customer about this and agree with him on the date of acceptance and delivery of the finished product, prepare the following documents by the agreed date: certificate of completion, invoice, invoice, report on the consumption of raw materials, certificate of quality of the finished product.

2.1.5. Warn the Customer within ________ and before receiving instructions from him to suspend work if the following is discovered: – unsuitability or non-compliance of the raw materials provided by the Customer with the terms of this Quality Agreement;

– circumstances beyond the Contractor’s control that threaten the suitability or strength of the products or make it impossible to complete the work on time.

2.1.6. If there is a need to carry out additional work and increase the cost of work, the Contractor is obliged to notify the Customer about this within __________.

2.2.1. No later than _______ from the moment the Parties sign this Agreement, provide the Contractor with the Customer’s assignment.

2.2.3. No later than _______ from the moment of receipt from the Contractor of the calculation of the quantity of raw materials, provide the Contractor with the corresponding quantity of raw materials according to the TORG-12 invoice.

2.2.4. Pay for the work performed in the manner and on the terms provided for in this Agreement.

2.2.5. Upon receipt of the Contractor's notification of completion of work, agree with the Contractor on the date of acceptance and delivery of finished products.

2.2.6. Accept finished products no later than the date agreed upon by the Parties.

2.2.8. If you receive the Contractor's notification provided for in clause 2.1.5 of this Agreement, send your instructions to the Contractor no later than _______ from the date of receipt of the notification.

CONTRACT PRICE

3.1. The cost of work under this Agreement is determined in the work estimate agreed upon by the Parties (Appendix No. _____ to this Agreement).

3.2. The customer undertakes to pay the cost of work in the following order: _________________ within the following terms: ________________.

TERM OF THE AGREEMENT

4.1. The validity period of this Agreement: from the moment it is signed by the Parties until the Parties fulfill their obligations.

4.2. This Agreement may be amended or terminated early by written agreement of the Parties.

4.3. This Agreement may be terminated unilaterally in the cases provided for in paragraph 5 of Art. 709, paragraphs 2 – 3 art. 715, paragraph 3 of Art. 716, Art. 717, paragraph 2 of Art. 719, paragraph 3 of Art. 723 of the Civil Code of the Russian Federation, subject to written notification to the counterparty of termination no less than __________ before the date of proposed termination.

5.1. If a dispute arises between the Parties regarding any defects in the finished product, at the request of either Party, an examination is appointed. The costs of the examination are borne by the Contractor (option: Parties in equal shares). If the examination establishes that the Contractor is not at fault, the Contractor has the right to demand reimbursement from the Customer for its expenses incurred for the examination.

6.1. The warranty period under this Agreement is established within _______ from the date the Customer signs the certificate of completion of work.

6.2. During the warranty period, the Contractor undertakes to eliminate at his own expense any problems that arise through his fault.

7.1. The Contractor is responsible for loss/damage to the raw materials provided by the Customer from the moment the raw materials acceptance certificate is signed (Appendix N _____).

In cases where the work was performed by the Contractor with deviations from the terms of this Agreement and the Customer’s assignment, which worsened the result of the work, or with other shortcomings that make the result of the work unsuitable for use for the purposes of this Agreement, the Customer has the right, at his choice, to demand from the Contractor: a) free of charge eliminate deficiencies within a reasonable time; b) a proportionate reduction in the price established for the work;

c) reimbursement of their expenses for eliminating deficiencies.

The Contractor has the right, instead of eliminating the deficiencies for which he is responsible, to perform the task again free of charge with compensation to the Customer for losses caused by the delay in performance.

If the defects in the work have not been eliminated within a reasonable period of time established by the Customer or are irreparable, the Customer has the right to refuse to perform the task or to fulfill the Contract and demand compensation for losses caused.

7.4. If the Customer violates the deadline for payment for work performed, the Contractor has the right to demand that the Customer pay a penalty in the amount provided for by the current legislation of the Russian Federation.

8.1. In the event of force majeure circumstances, which include: _________________, the Parties are not responsible for non-fulfillment or improper fulfillment of obligations under this Agreement.

We invite you to read the Contract for the work of an electrician

8.2. The Party for which it is impossible to fulfill its obligations under this Agreement is obliged to notify the other Party of the occurrence of force majeure circumstances within ______.

8.3. If these circumstances continue for more than _________________, then each of the Parties will have the right to refuse further fulfillment of obligations under this Agreement.

9.1. Disputes that may arise from this Agreement shall be resolved by the Parties through negotiations.

9.2. If the Parties do not reach an agreement, the dispute shall be resolved in ____________ court in accordance with the current legislation of the Russian Federation.

10.1. The Agreement is drawn up in two copies in Russian, having equal legal force, one for each of the Parties.

10.2.1. Customer's assignment (Appendix N _____).

10.2.2. Copies of powers of attorney of authorized representatives of the Customer (Appendix N _____).

10.2.3. Certificate of acceptance and transfer of raw materials and containers (Appendix N _____).

10.2.4. Copies of quality certificates: a) raw materials, b) finished products (Appendix N _____).

10.2.5. Receipt order in form N M-4 (Appendix N _____).

10.2.6. Invoice in form N MX-18 (Appendix N _____).

10.2.7. Certificate of completed work (Appendix N _____).

10.2.8. Report on consumption of raw materials (Appendix N _____).

10.2.9. Work estimate (Appendix N _____).

10.2.10. Work schedule (Appendix N _____).

Accounting with the contractor (processor)

Since when raw materials are transferred for processing, ownership of the materials remains with the customer, the processor cannot reflect them on its balance sheet.

Customer-supplied raw materials are accounted for by the processor on off-balance sheet account 003 “Materials accepted for processing” in the assessment either provided for in the contract or agreed with their owner (clause 14 PBU 5/01 “Accounting for inventories” and clause 156 of the Methodological Instructions No. 119n).

If the ownership of manufactured products does not belong to the organization, you should use off-balance sheet account 002 “Inventory assets accepted for safekeeping.” In this case, products are accounted for at a cost consisting of the cost of customer-supplied raw materials and actual processing costs (clauses 10, 18 of Guidelines No. 119n).

On off-balance sheet account 002, waste returned to the supplier under the terms of the contract is also taken into account in the conditional valuation (until the moment of return) (clauses 155, 156 of Methodological Instructions No. 119n).

The processor's expenses for the manufacture of products from customer-supplied raw materials (the cost of the processor's own auxiliary materials, wages with accrued insurance premiums, general business expenses, etc.) are expenses for ordinary activities (clauses 5 and 9 of PBU 10/99 “Organization expenses” ).

Revenue from the performance of work (provision of services) for processing raw materials is recognized by the processor as part of income from ordinary activities on the date the parties sign the acceptance certificate for the work performed and services provided (clauses 5, 6, 12 of PBU 9/99 “Organizational Income”) .

The raw materials and materials received from the supplier are not included in the processor's income or expenses, since they remain the property of the supplier.

The processor's income will be the cost of the work performed, agreed upon by the parties to the contract. It is recognized in the reporting (tax) period when these works are completed (clause 1, clause 1, article 248, clause 1, article 249, clause 1, article 271 of the Tax Code of the Russian Federation).

The contractor's expenses for processing customer-supplied materials are taken into account for tax purposes and can be (depending on the accounting policy) direct or indirect.

If, according to the contract, the balance of unused materials remains with the contractor, he becomes the owner of these materials and can reflect the costs of their purchase when calculating income tax.

Example 2.

Let's use the data from example 1.

The following entries were made in the contractor's accounting records:

Some companies, in order to optimize production processes, transfer their own materials to other companies for further processing. Accounting for these operations has its own characteristics both for the enterprise transferring raw materials and for the institution that takes on the processing function. In this case, a special agreement is concluded and the concept of raw materials supplied by customers is mentioned. The relations between the participants here are regulated by the Civil Code of Russia.

Answer:

In this case, the customer transfers his materials to the contractor as toll for carrying out repair work. At the time of transfer of materials, the following posting is made:

In the 1C:Enterprise 8.2 system. Accounting of a government agency" the document "Internal movement of materials" is intended for this operation. The document has a tab “Transfer of raw materials supplied by customer”, which indicates the counterparty to whom the raw materials/materials and the contract are transferred. Based on this operation, an M-15 invoice is printed.

The use of internal movement is justified in 1C by Chapter 37 of the Civil Code of the Russian Federation (see below Recommendation No. 1)

The cost of materials used by the contractor during repairs is written off upon receipt of a report on the consumption of materials:

In the 1C:Enterprise 8.2 system. Accounting of a government institution" the document "Write-off of materials" is intended for this operation.

2) upon completion of the repair work, a certificate of acceptance and delivery of repaired fixed assets is drawn up in form No. OS-3.

Repair costs are taken into account during the period of receipt of the act in form No. OS-3;

3) the first step - the customer receives the materials purchased for repairs;

the second step - the customer transfers the materials to the contractor by issuing an invoice in form No. M-15;

third step - the contractor submits a report on the consumption of materials to the customer, and a certificate of acceptance and delivery of repaired fixed assets is drawn up in form No. OS-3.

The rationale for this position is given below in the materials of the Glavbukh System.

1. Recommendation: How to formalize and reflect in accounting the transfer of materials for processing (supplied raw materials)

An organization may engage third parties to process materials. This operation is called transfer of raw materials for processing. In this case, the organization that owns the materials will be the customer, and the processing organization will be the performer of the work. Relations between the customer and the contractor are regulated by Chapter 37 of the Civil Code of the Russian Federation.

After processing, the performing organization is obliged to transfer the result to the customer (Clause 1, Article 703 of the Civil Code of the Russian Federation). At the same time, the remaining unused materials are transferred (Clause 1, Article 713 of the Civil Code of the Russian Federation).

When transferring materials for processing to the contractor, issue an invoice in form No. M-15. In the documents, indicate that the materials were transferred for processing on a toll basis.

After processing the materials, the implementing organization must submit the following documents:*

invoice in form No. M-15;

report on the consumption of materials (clause 1 of article 713 of the Civil Code of the Russian Federation). This document must contain information about materials received and not used for production, the quantity and range of materials (products) received. It also indicates how much waste was received, including returnable waste. The surplus must be returned to the seller, unless otherwise provided by the contract;

This is interesting: Letter of participation in the tender sample

act of acceptance and transfer of work for the cost of processing work (Article 720 of the Civil Code of the Russian Federation).

When receiving materials from processing, the customer must issue a receipt order (Form No. M-4). If finished products are obtained as a result of processing materials, issue an invoice for the transfer of finished products to storage locations (Form No. MX-18).

Accounting: transfer and processing results

Further accounting of materials sent for processing depends on the result of processing. Accounting rules vary depending on the following cases:

the result of processing is a finished product;

recycling only prepares the material for use;

recycled materials are used in the manufacture (creation) of fixed assets.

In your case, if the result of processing is a repaired vehicle:

Accounting: settlements between the contractor and the customer

Payments between the contractor and the customer for processing materials on a toll basis can be carried out in several ways:

raw materials transferred for processing;

other inventory items (services, works).

In your case, payment in cash is reflected in the customer’s accounting with the following entries:

The specified operations are not subject to VAT according to KFO 4, but if it is necessary to carry out according to KFO 2 with VAT, then make the following entries:

2. Recommendation: How to carry out and reflect in accounting the repair of fixed assets

Confirm the need for repair work with documents (Article 9 of the Law of December 6, 2011 No. 402-FZ). Such a document may be an act on identified malfunctions (defects) of a fixed asset (defect sheet). For some industries, standardized forms of such documents are provided. For example, to document identified defects in the handling and transport equipment of sea trade ports, a defect sheet is used, approved by Decree of the Ministry of Transport of Russia dated January 9, 2004 No. 2. Defects in the main elements of pipelines of thermal power plants are reflected in the sheet of pipeline defects (approved by Decree of the Gosgortekhnadzor of Russia dated June 18, 2003 city No. 94).

If a unified form of document confirming detected defects is not established, use a self-developed form, for example, a report on identified faults (defects) of a fixed asset item. The main thing is that your own form contains all the mandatory details listed in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. The report must indicate the faults of the fixed asset and proposals for their elimination.

The number of copies of the report on identified faults (defects) of the fixed asset (defect sheet) will depend on who owns the property and who will do the repairs. If an organization decides to repair fixed assets on its own, one copy is sufficient. If the work will be performed by a third-party organization, it is better to fill out the report (defect sheet) in several copies according to the number of companies involved in the repair. In this case, the documents must be signed by representatives of all parties involved.

When transferring a fixed asset for repair to a special division of the organization (for example, a repair service), you should draw up an invoice for internal movement in form No. OS-2. If the location of the fixed asset does not change during repairs, there is no need to prepare an invoice. This procedure follows from the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

If an organization does not carry out repair work on its own, a contract agreement must be concluded with the performers (Article 702 of the Civil Code of the Russian Federation).

Recommendation: if a fixed asset is transferred to a contractor for long-term repairs, draw up an act of acceptance and transfer of the fixed asset for repair. In the event of loss (damage) of a fixed asset, the signed act will allow the organization to demand compensation from the contractor for the losses caused (Articles 714 and 15 of the Civil Code of the Russian Federation). In the absence of such an act, it will be difficult to prove the transfer of fixed assets to the contractor.

Upon completion of the repair work, a certificate of acceptance and delivery of repaired fixed assets is drawn up in form No. OS-3. It is filled out regardless of whether the repairs were carried out internally or by contract. Only in the first case, the organization draws up the form in one copy, and in the second - in two (for itself and for contractors). The act is signed:

the acceptance committee created in the organization;

the employee responsible for the repair of the fixed asset (or the contractor’s representative);

an employee responsible for the safety of the fixed asset after repair.

After this, the act is approved by the head of the organization and transferred to the accountant. Upon receipt of the report, information about the repairs performed must be reflected in the fixed asset inventory card in form No. OS-6 (OS-6a) or in the inventory book in form No. OS-6b (intended for small enterprises). This is stated in the instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

Situation:

Is it necessary to indicate in the act in form No. OS-3 the cost of materials used by the contractor to repair the fixed asset. The organization handed over spare parts to the contractor for repairs.

Form No. OS-3 is used for the acceptance and delivery of fixed assets from repair (instructions approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7).

Processing agreement

There are two main parties here - the supplier of raw materials and the processor. The first retains the role of owner. The contractor undertakes an obligation to complete certain work and timely delivery to the customer. In exchange for his help, he receives a certain amount.

Toll raw materials are materials transferred for processing to another enterprise in order to impart certain properties to it. Once it has been properly processed, the organization that submitted the material for processing receives a corresponding report.

This document indicates the amount of materials that were consumed, data on the products produced and waste generated during the activities of the processor.

It is also mandatory to hand over the acceptance certificate for completed work. Here you can find information about the list of manipulations performed and the final cost of the work. When receiving finished products, a special invoice is issued. The cost of such products is formed on the basis of the price of materials and the cost of work. It also includes payment costs:

- intermediary;

- transportation of material;

- business trips;

- general and general production expenses.

https://youtu.be/RQSfd4DHyK0

The procedure for forming the cost price must be indicated in the relevant documentation.

Waste control

This point also plays an important role. If waste is transferred to a recycler, this is reflected in the documentation as a gratuitous transfer. According to current legislation, such manipulation is equivalent to implementation. This means that VAT is charged on such transfer. If the donor organization retains the right to continue to use the waste, the processing costs must be adjusted.

Control transfer of raw materials and receipt of final results may involve their modification and production of the finished product. The first point is that the supplier transfers the material to another company for revision. That is, it must provide raw materials in a state that allows them to be used for the further production of certain goods. In fact, the processor is not engaged in the manufacture of goods, but merely brings them to a certain state.

Separate accounting

All aspects related to the production process are recorded by the organization processing the materials. If this company, among other things, produces goods from its own raw materials, it should maintain separate accounting for different types of financial costs. This need is explained by the fact that it is necessary to keep records of operations for the production of products from customer-supplied raw materials and one’s own.

When materials are transferred for recycling, ownership of them will remain with the company that ordered the relevant services. It turns out that the processor does not have the right to indicate the property transferred for disposal on its own balance sheet. The financial costs borne by the processor are recorded in the production cost accounts. First of all this:

- price of own materials;

- general production and general business expenses;

- workers' salaries.

Tax accounting

Tax accounting for transactions that occur between two organizations can be accompanied by a number of difficulties. They concern costs - direct and indirect. Difficulties are also possible with regard to production balances and the procedure for their assessment.

The method for allocating different types of expenses must be determined by companies initially. This point is regulated by Article 318 of the Tax Code of the Russian Federation. Direct costs must be distributed in accordance with the accounting policies of the company, which in this case plays the role of the taxpayer. Indirect expenses are considered in the current period and are classified as a cost type for tax accounting purposes. They are recorded in full.

When planning and selling finished products in a warehouse, the processing organization must distribute direct costs of general purpose between types of activities. VAT is 18%. The law does not look at either the manufactured products or the processed raw materials. The object of taxation is the work performed by the processor, and not the moment relating to the sale of products.

You can deduct VAT if it was paid at the time of purchasing raw materials for production. The same applies to the tax at the time of payment for services, work of employees, and other items on which the processor had to spend money.

Report on the use of customer-supplied materials

Customer-supplied materials are understood as materials that are accepted by the organization from the customer for processing (processing), performing other work or manufacturing products without paying the cost of the accepted materials and with the obligation to fully return the processed (processed) materials, delivery of completed work and manufactured products (paragraph 2 p. 156 Methodological guidelines, approved by Order of the Ministry of Finance dated December 28, 2001 No. 119n). We explained in our consultation how accounting for customer-supplied raw materials is kept.

What is meant by a report on the customer’s materials consumed (consignment materials)? We will talk about this in our consultation and provide a sample of how to fill it out for the report on the consumption of customer-supplied materials.

Sample download report on the consumption of customer-supplied materials

A report in form N M-29 is drawn up on the basis of: 1. Data on the completed volumes of construction and installation work in physical terms, taken from the primary accounting form for capital construction N KS-6 “Recording log of completed work”.

2. Approved production standards for the consumption of materials per unit of measurement of the volume of a structural element or type of work, divided into:

This section is filled out by the employee directly responsible for the work and consumption of materials at the site (site manager or senior foreman). Filling out the second section of the report on form M-29 Overexpenditure must be indicated with a “minus” sign, and savings with a “plus” sign.

If there is an overrun in the future, the site foreman must write an explanatory note (also according to a special sample).

A report in form N M-29 is drawn up on the basis of: 1. Data on the completed volumes of construction and installation work in physical terms, taken from the primary accounting form for capital construction N KS-6 “Recording log of completed work”. 2.

Is a report on toll materials required?

When it comes to customer-supplied materials, it is understood that a contract has been concluded between the parties (Article 702 of the Civil Code of the Russian Federation). Accordingly, the party who received the materials supplied for the work is called the contractor.

Civil law requires that the contractor use the materials provided by the customer economically and prudently, and after completing the work, submit a report on the materials used. The remainder of the supplied raw materials must be returned to the customer. By agreement of the parties, the cost of the contractor’s work may be reduced by the cost of materials remaining with the contractor (clause 1 of Article 713 of the Civil Code of the Russian Federation).

Obviously, a report on toll materials is one of the most important documents that are drawn up when executing a contract with toll raw materials. The report will ensure reliable accounting and control of raw materials supplied by the contractor and the customer, and determine the cost of work under the contract. In addition, the amount of materials consumed by the contractor from the customer will be included in the cost of work performed or manufactured products, and therefore, without drawing up reports, it will not be possible to correctly determine, for example, the cost of construction.

At the same time, there is no single form for reporting on the use of customer-supplied materials (sample). How to draw up such a report is up to the parties to decide for themselves. In this case, the form of the report on tolling materials (sample) is fixed in the contract.

The report should clearly indicate how much and what kind of material was consumed during the reporting period and how much was left.

Below is an example of a report on the use of supplied materials in construction.

Prev. / Next a report on the consumption of customer-supplied materials can be found here. Only subscribers of the Main Ledger magazine can download document forms.

- I am a subscriber: electronic magazine printed magazine

- I'm not a subscriber, but I want to become one

- I want to download document forms for free and try all the features of a subscriber

Yes that's right. The materials were moved to the account 10.07. Now all that remains is to physically ship the materials and wait for the contractor to make finished products from them.

Receipt from processing

We will issue a document in 1C 8.3 for the return of materials from recycling. This document is similar, at first glance, to the goods receipt document, but it performs several more functions:

- firstly, we must write off the materials from which the contractor made our products;

- secondly, we may incur additional costs associated with, for example, the delivery of materials. These costs should be reflected in the cost of finished products;

- thirdly, there may be leftover materials that the contractor returns to us, and we must capitalize them;

- Well, in the end, as a result of all these operations, we should have finished products in the warehouse.

Let's start drawing up the document. Similar to the first one, we will fill in the organization, warehouse and counterparty with the contract.