Details for paying insurance premiums for compulsory social insurance against industrial accidents and occupational diseases

Recipient: UFK for Moscow (Governmental institution - Moscow regional branch of the Social Insurance Fund of the Russian Federation)

INN 7710030933 Checkpoint 770701001

BIC of the recipient's Bank

Department 1 Moscow, Moscow 705

Main Directorate of the Bank of Russia for the Central Federal District, Moscow

(Abbreviated name - State Bank of Russia for the Central Federal District)

Recipient's ACCOUNT NUMBER

KBK 393 1 0200 160 – insurance premiums

KBK 393 1 0200 160 — fine

KBK 393 1 020 2050 07 3000 160 — fines

For policyholders who voluntarily entered into legal relations under compulsory social insurance in case of temporary disability and in connection with maternity:

KBK 393 11700 180 – voluntary insurance contributions

Monetary penalties (fines) for violation of the law (for example, failure to submit a report or late submission of a report, failure to provide information about opening an account, etc.)

KBK 393 1 1600 140 – fine

Other proceeds from monetary penalties (fines) and other amounts for damages

KBK 393 1 1600 140 – administrative fine

1. For current payments, field 22 (“Code” in the payment order) is entered as 0.

2. From the requirement to pay taxes and contributions.

If an enterprise has arrears on taxes or fees, it will be presented with demands for payment of taxes and fees, which will indicate the required UIN.

The procedure for paying insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity from 01/01/2017.

Transferred to the Federal Tax Service

1.BCC for contributions for reporting periods before 01/01/2017:

INSURANCE PREMIUMS FOR COMPULSORY SOCIAL INSURANCE IN CASE OF TEMPORARY DISABILITY AND MATERNITY (recipient of the Federal Tax Service)

The procedure for paying insurance premiums has been changed

Since January 2020, the algorithm for transferring payments for compulsory insurance to working citizens has changed dramatically. Now, for a number of payments for compulsory insurance, the recipient is not only the Social Insurance Fund (in terms of compulsory insurance against accidents at work and occupational diseases, or, as they often say, “for injuries”), but also the Federal Tax Service, and the Pension Fund completely transferred the powers of the administrator to the Federal Tax Service. Now mandatory insurance payments are regulated by the Tax Code and Law dated July 24, 1998 No. 125-FZ.

The Social Insurance Fund retains the rights to administer payments for injuries. FSS details for payment of insurance premiums 2020 regarding FSS NS and PZ remained unchanged. Fill out the payment order in the same way as last year, 2016.

The powers of Social Insurance as a regulatory body have not changed: employees also conduct desk and on-site inspections, monitoring the reimbursement of funds for insurance coverage and the correct calculation of payments.

https://youtu.be/Hfu1QGfkJN0

For another company

In 2020, changes affected the procedure for making:

- tax fees;

- other payments;

- insurance premiums.

Now third parties can make contributions for the organization.

Russian business practice provides for mutual and mutual settlement relationships. This is possible if one organization has debt obligations to another. In order not to simply transfer funds from the current account of the first company to another, you can send the payment to the state treasury. Therefore, the debtor is allowed to pay insurance premiums for the creditor.

Even if the company carries out the transfer not independently, but through an intermediary, it is necessary to fill out a payment order. It provides some features.

Previously, it was prohibited to transfer funds for another company, even if the debt was particularly large. The bans were lifted at the legislative level. Therefore, the payment can be made by another organization or individual entrepreneur.

There is also another option for paying insurance premiums. Deductions can be made by the director of the institution using personal funds.

Such measures are very convenient. If the organization does not currently have funds, debts will not accumulate through the transfer of contributions by another company. Then the company will be able to avoid fines and penalties for late transfers of funds to the state budget.

Details for transferring contributions in 2020

In the current financial year, Social Insurance Fund details may be required in the following cases:

- Payment details for “injuries” have not changed in 2020.

- Calculations for 2020, if the organization has a debt for the previous period (identified during a desk audit, an error in the payment), we pay using the old details.

- Submission of reports submitted to Social Security.

- Receive reimbursement of insurance costs if your region is not included in the pilot project to directly finance these costs.

- Appeals to the Fund (complaints, clarifications, disagreements, etc.).

Until 2020, policyholders could transfer payments for compulsory social insurance in case of temporary disability and in connection with maternity (hereinafter referred to as VNIM) in the amount of the difference in calculated contributions and expenses incurred (benefits, sick leave).

In 2020, the authority to consider applications for refund of VNiM expenses was retained by the Social Insurance Fund, but the administrator of income for contributions to VNiM has changed. To pay only the difference, you must confirm the expenses with the Social Insurance Fund by filling out a refund application with supporting documents.

Important! In 2020, to offset expenses incurred, confirmation from the Social Insurance Fund is required. Representatives of the Fund will independently notify the Federal Tax Service of the decision of offset (confirmation) or refusal of offset (clause 9 of Article 431 of the Tax Code of the Russian Federation).

Reporting via the Internet. Contour.Extern

Federal Tax Service, Pension Fund of Russia, Social Insurance Fund, Rosstat, RAR, RPN. The service does not require installation or updating - reporting forms are always up to date, and the built-in check will ensure that the report is submitted the first time. Send reports to the Federal Tax Service directly from 1C!

ADDITIONAL LINKS on the topic

- A link is provided to download the new form for 2020 for free. Excel format - Excel. Policyholder code. You can rewrite the old form 4-FSS

- EXAMPLE OF COMPLETING the new 4-FSS form for 2020 The new 4-FSS report form for the quarter was approved by FSS Order 381, and the procedure for filling out the calculation for “injuries” is given. An example of filling and a sample is provided.

- INFORMING POLICIES ABOUT THE PROJECT

- Survey about the project

- General information about the introduction of ELN

- Information about the Fund's public services

- Information materials

- Benefits paid by the Foundation

- Insured event and insurance coverage

- Registration and deregistration

- Registration and deregistration of policyholders - individuals

- Procedure and terms for payment of insurance premiums

- The procedure for providing technical means of rehabilitation

- The procedure for providing sanatorium-resort treatment

- About the program

Where to find current details for paying insurance premiums in 2018

To avoid errors in payment orders, it is necessary to clarify information about the recipient of funds:

- Name,

- information about the recipient's bank details: personal account, bank name and other data.

You can obtain such information about the Social Insurance Fund in several ways:

- contact Social Insurance (in person, by phone or in writing), employees will definitely provide you with the current details for paying contributions in 2020,

- obtain information through the “State Services” portal, to do this, send a request through your personal account on the website, information will be provided within 24 hours,

- check on the official website of the FSS on the Internet.

KBK codes in the FSS injuries, NS and PZ, penalties, fines, arrears in 2017

Have the BCCs changed for contributions to the Social Insurance Fund in 2020? No, there were no changes to the social insurance codes, it remains the same as in 2020. Below is the List of income classification codes (KBK FSS), also reserved by the Ministry of Finance of the Russian Federation to reflect payments to the FSS of the Russian Federation for organizations and individual entrepreneurs.

| KBK number | Purpose of transfer |

Insurance against injuries at work and occupational diseases | |

| 393 1 0200 160 | Insurance premiums for employees for “injuries” |

| 393 1 0200 160 | KBC for paying penalties to the FSS from the National Tax Service in 2020 |

| 393 1 0200 160 | Fines - amounts of monetary penalties |

KBC voluntary contributions to the Social Insurance Fund in 2020 for individual entrepreneurs for themselves | |

| 393 11700 180 | voluntary contributions from the entrepreneur |

| 393 1 1600 140 | Fines for violation of the established deadline for submitting reports to the Social Insurance Fund or failure to submit them, late registration) |

Note: If, due to an error in the KBK FSS details, the money does not go to the correct account, the policyholder will be charged a penalty.

to menu

Transfer of insurance premiums in 2020, details for the Federal Tax Service and the Social Insurance Fund

Let’s look at the payment of insurance premiums “for injuries” and VNIM using examples.

Example 1. An organization transfers VNiM contributions administered by the Federal Tax Service for January 2020 in the amount of 150,000.09 rubles. We issue a payment order, focusing on the following fields of the payment order:

Field 4. Date of payment. The tax must be paid within the established deadlines: no later than the 15th day of the month following the month in which contributions were calculated.

Cells 6 and 7 - fill in the amounts with kopecks in words and numbers = 150,000.09 rubles (one hundred fifty thousand rubles 09 kopecks).

In field 22 enter 0.

In field 101 (payer status), enter code “01” for the organization, since it is a direct payer of the contribution (tax, fee).

104 (KBK): 182 1 0210 160 (VNiM).

105 (OKTMO) - we check with the tax office or in a special reference book - the All-Russian Classifier of Municipal Territories (each federal district has its own volume approved).

106 (basis of payment): indicate the code “TP” (current period).

Field 107 (tax period) is coded in a special way: “MS.01.2018”.

In fields 108–110 we indicate “0”, since there is no data to fill in, 110 is empty.

Filling sample (VNIM)

Example 2. An organization transfers a payment “for injuries” to the Social Insurance Fund for January 2020 in the amount of 1,309.42 rubles.

The fields are filled in the same way as in the example above, except for fields 101 and 104.

Important! In field 101 (payer status), enter code “08” (payer making payments to the budget system of the Russian Federation, with the exception of taxes, fees, insurance premiums and other payments administered by tax authorities).

Important! KBK "injury": 393 1 0200 160 (FSS NS and PZ).

Where there is no change

Deductions for insurance against accidents and occupational illnesses (they are also contributions for injuries) remain under the jurisdiction of the FSS.

Let us remind the BCC of this contribution: 393 1 0200 160.

There are currently no changes to these contributions in the plans of officials and legislators. So you need to keep a report on their accrual to the Social Insurance Fund. Please note that the rates of these contributions and benefits have not changed either. On the contrary, there is talk to maintain the status quo on injuries until 2020.

For more information, see “2020 Personal Injury Premiums: An Up-to-Date Review.”

Sample payment form for contributions for injuries to the Social Insurance Fund in 2019

If an organization has arrears in contributions (fines, penalties), then the Social Insurance Fund can provide a deferment (installment plan) (subclause 2, clause 1, article 18 of Law No. 125-FZ of July 24, 1998). Deferment implies the establishment of a one-time payment period for the entire debt. Installment plan – repayment of debt in installments according to the schedule.

A deferment (installment plan) can be obtained if an organization is temporarily unable to pay contributions for one of the reasons:

- damage resulting from a natural disaster, technological disaster or other force majeure circumstances,

- seasonal nature of production or sales.

- lack of budget funding,

The application form for granting a deferment (installment plan) was approved by Order No. 196 of the Social Insurance Fund dated April 25, 2017.

6 issues of “Salary” as a gift!

Details of the Social Insurance Fund and the Federal Tax Service for paying insurance premiums in 2019

To pay only the difference, you must confirm the expenses with the Social Insurance Fund by filling out a refund application with supporting documents. 9 ). To avoid errors in payment orders, it is necessary to clarify information about the recipient of funds:

- information about the recipient's bank details: personal account, bank name and other data.

- Name,

You can obtain such information about the Social Insurance Fund in several ways:

- obtain information through the “State Services” portal, to do this, send a request through your personal account on the website, information will be provided within 24 hours,

- contact Social Insurance (in person, by phone or in writing), employees will definitely provide you with the current details for paying contributions in 2020,

- check on the official website of the FSS on the Internet.

Let’s look at the payment of insurance premiums “for injuries” and VNIM using examples.

KBK FSS against accidents in 2020 for legal entities

The KBK for payment of contributions from accidents and occupational diseases in 2019 for employees is 393 1 0200 16. The numbers “393” at the beginning of the code mean that the company transfers contributions to the Social Insurance Fund. Pension, medical and social contributions in case of maternity illness are transferred to the Federal Tax Service. .

The KBK of penalties in the Social Insurance Fund for accidents in 2020 and fines differs from the code for “accident” contributions in numbers in 14 – 17 digits. Instead of 1000, you should write 2100 and 3000, respectively. Let's remember... Enter the budget classification code in field 104 of the payment order.

We fill out payments for insurance premiums

Step 1. At the top of the document, the status of the payer of the payment document is indicated.

Filling out 101 fields is defined by adj.

5 Order 107n. for insurance premiums 2020:

- organizations indicate code 01,

- individual entrepreneurs - 09.

The number and date are also indicated. The transfer amount is indicated without rounding.

Step 2. Information about the payer and recipient, as well as the bank details of the parties, are filled out in the same way as for regular payments with counterparties. Payer's details: Recipient's details: Step 3. In sector 21 (“Priority”), the values 3 or 5 are indicated, depending on the order of the transfer by the bank: 3 - priority, 5 - in calendar order.

Step 4. Specify the values determined by the payment and payment procedure. This table will be useful for filling out.

Question answer

Answer: From January 1, 2020, the minimum wage is 9,489 rubles per month (Article 3 of Federal Law No. 421-FZ dated December 28, 2017

“On amendments to Article 1 of the Federal Law of June 19, 2000 No. 82-FZ “On the minimum wage”

) From May 1, 2020, the minimum wage is 11,163 rubles per month (Art.

2 of Federal Law dated 03/07/2019 No. 41-FZ

“On amendments to Article 1 of the Federal Law of June 19, 2000 No. 82-FZ “On the minimum wage”

) Answer: Registration of legal entities, non-profit and public organizations is carried out within 3 working days.

Details for contributions from accidents and injuries 2020, KBK FSS payment for employees

Moscow (Abbreviated name - State Bank of Russia for the Central Federal District) Recipient's ACCOUNT NUMBER: 40101810045250010041KBK 393 11700 180 - voluntary contributions of the entrepreneur KBK 393 1 1600 140 - fine KBK 393 1 1600 140 - administrative fine Social insurance website : https://r77.fss.ru/Branches: https://r77.fss.ru/ab.shtmlIf the payment order for the transfer of insurance contributions contains incorrect payment parameters: Federal Treasury account, KBK FSS contributions 2020, name of the recipient bank of the regional branch of the social insurance fund.

then the obligation to pay contributions is considered not fulfilled.

The remaining errors do not prevent the transfer of money to the budget or the payment of contributions, which means they will not lead to.

State Institution - Volgograd regional branch of the Social Insurance Fund of the Russian Federation

Moscow (Government institution - Moscow regional branch of the Social Insurance Fund of the Russian Federation) TIN 7710030933 KPP 770701001

| Bank details | UNTIL 02/06/2017 | NEW from 02/06/2017 |

| BIC of the recipient's Bank | 044583001 | 044525000 |

| Payee's bank | Department 1 Moscow, Moscow 705 | Main Directorate of the Bank of Russia for the Central Federal District of Moscow (Abbreviated name - GU of the Bank of Russia for the Central Federal District) |

| Recipient's ACCOUNT NUMBER | 40101810800000010041 | 40101810045250010041 |

- KBK 393 1 0200 160 – insurance premiums

- KBK 393 1 0200 160 — fine

- KBK 393 1 020 2050 07 3000 160 — fines

For policyholders who voluntarily entered into legal relations under compulsory social insurance in case of temporary disability and in connection with maternity:

- KBK 393 11700 180 – voluntary insurance contributions

Monetary penalties (fines) for violation of the law (for example, failure to submit a report or late submission of a report, failure to provide information about opening an account, etc.)

- KBK 393 1 1600 140 – fine

Other proceeds from monetary penalties (fines) and other amounts for damages

- KBK 393 1 1600 140 – administrative fine

How to find out UIN

- For current payments, field 22 (“Code” in the payment order) is entered as 0.

- From the requirement to pay taxes and contributions.

If an enterprise has arrears on taxes or fees, it will be presented with demands for payment of taxes and fees, which will indicate the required UIN.

The procedure for paying insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity from 01/01/2017.

Transferred to the Federal Tax Service

- BCC for contributions for reporting periods before 01/01/2017:

Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (recipient of the Federal Tax Service)

| KBK | Name |

| 182 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) (for billing periods expired before January 1, 2020) |

| 182 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (penalties on the corresponding payment) (for billing periods expired before January 1, 2020) |

| 182 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (interest on the corresponding payment) (for billing periods expired before January 1, 2020) |

| 182 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) (for billing periods expired before January 1, 2020) |

- BCC for contributions for reporting periods starting from 01/01/2017:

Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (recipient of the Federal Tax Service)

| KBK | Name |

| 182 1 0210 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled payments) (for billing periods starting from January 1, 2020) |

| 182 1 0210 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (penalties on the corresponding payment) (for billing periods starting from January 1, 2020) |

| 182 1 0210 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (interest on the corresponding payment) (for billing periods starting from January 1, 2020) |

| 182 1 0210 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) (for billing periods starting from January 1, 2020) |

You might be interested...

TRANSFER OF POLICY HOLDERS REGISTERED WITH BRANCH No. 35 OF THE FUND BRANCH TO BRANCH No. 27 OF THE FUND BRANCH. Dear policyholders!

The Fund Branch informs that in order to improve the quality and accessibility of the provision of public services, the Fund Branch is taking measures to redistribute policyholders between branches of the Fund Branch, thus policyholders registered in branch No. 35 of the Fund Branch are transferred to branch No. 27 of the Fund Branch (order Branch of the Fund dated September 28, 2017 No. 272).

You can find out your new branch by dialing the FSS registration number or TIN and going to the main page of the official website (https://r77.fss.ru/). In the upper left corner, under the Ticker, there is a search box FIND YOUR BRANCH.

FROM 12/13/2017 BRANCH No. 35 OF THE FUND BRANCH IS LOCATED AT A NEW ADDRESS: 111024, MOSCOW, ENTHUSIASTOV HIGHWAY, 21, Bldg. 1,2, M. AVIAMOTORNAYA

Dear citizens and policyholders!

From December 13, 2017, Branch No. 35 of the Foundation Branch will be located at a new address: 111024, Moscow, Entuziastov Highway, 21, building 1, 2, Aviamotornaya metro station.

Payment details for paying “unfortunate” social taxes to the Social Insurance Fund

Since 2020, employers will transfer only “unfortunate” contributions directly to the Social Insurance Fund, using the following details:

Payment line name

Name of the regional social insurance authority at the place of registration of the policyholder

Details of the treasury where the money is transferred

Recipient's TIN and checkpoint

Data from the regional social insurance office at the place of registration of the policyholder

The payer chooses according to his geographical location

Fixed in field 22 only if there is a request for payment of arrears

Lines 106–110 of the payment slip do not need to be filled out.

A sample payment form for paying contributions for injuries to the Social Insurance Fund can be downloaded from the link.

Read about the rules for calculating “accident” premiums in the material “Insurance premiums for injuries in 2020 - rate and BCC.”

KBK

One of the important details in payment and banking documents is KBK. It is presented as a digital value and reflects the budget classification code.

In accordance with the BCC, funds that were transferred by the taxpayer are directed and distributed. If the code is written with errors, the contribution will be considered paid. But due to incorrect information, the distribution will not be completed. Therefore, the organization begins to accrue arrears.

Previously, companies from the Pension Fund and the Social Insurance Fund were recommended to pay contributions for 2020 before its end. This would allow the payment to be made using the previous details. Next, it was necessary to reconcile the paid contributions to avoid overpayments or underpayments. If there are any inaccuracies, the difference is returned or entered into the Federal Tax Service.

Corrective accounting statements are needed in order to change data about the company or its employees in which errors were discovered as a result of a desk or field audit. Find out about insurance premiums for injuries in 2020 from our article.

A directory where you can view the current BCC for 2020 is contained in Order of the Ministry of Finance of the Russian Federation No. 65n, which was issued on July 1, 2013, as amended on December 7, 2020. According to the document, various codes have been adjusted.

Transfer of VNIM contributions to the Federal Tax Service

Since 2020, the functions of monitoring insurance premiums (except for “accidents”) have been transferred to the tax department, including social fees for temporary disability and maternity (VNiM) (Chapter 34 of the Tax Code of the Russian Federation).

In this regard, the payment details for paying VNIM contributions have changed and are as follows:

- TIN and KPP of the recipient - TIN and KPP of the Federal Tax Service at the place of registration of the contribution payer (at the location of the separate legal entity or at the place of registration of the individual entrepreneur),

- recipient - the name of the treasury and in brackets the abbreviated designation of the Federal Tax Service,

- KBK - since the payment administrator is the Federal Tax Service, the numbers with which the code begins are 182.

When filling out the remaining details for insurance premiums, tax officials recommend following the rules applied for tax payments (Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n).

Find samples of payment orders for insurance premiums filled out according to the updated rules in this article.

KBK FSS against accidents for 2020

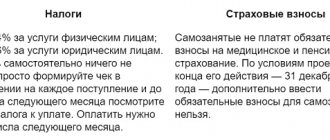

Due to changes made to tax legislation, from 2020 payments for temporary disability and maternity insurance are administered by the Federal Tax Service. Therefore, the administrator code in the KBK will be 182. Contributions from accidents are controlled by the FSS. That is, in the budget classification code the administrator will be the Social Insurance Fund, whose code is 393.

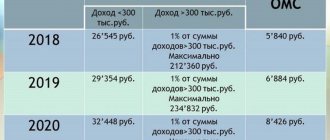

KBK FSS in case of temporary disability 2018

Contributions for temporary disability (illness) and maternity are paid by legal entities and entrepreneurs who use hired labor or make voluntary payments “for themselves.” There may be exceptions to this rule. Reduced insurance premium rates are applied to taxpayers under special tax conditions. In some cases, the payment amount is reduced to zero.

KBK insurance premiums in case of temporary disability 2018: fines and penalties

Budget classification codes, which are used to pay fines and penalties for late or incorrect transfers of insurance premiums, differ when paying for different periods.

| Purpose of payment | |

| Fines for contributions to compulsory social insurance for temporary disability and maternity in 2020 | 182 1 0210 160 |

| Fines for contributions to compulsory social insurance for temporary disability and maternity for the period until January 2017 | 182 1 0200 160 |

| Penalties on contributions to compulsory social insurance for temporary disability and maternity in 2020 | 182 1 0210 160 |

| Penalties on contributions to compulsory social insurance for temporary disability and maternity for the period until January 2017 | 182 1 0200 160 |

KBK FSS against accidents 2020

These contributions are also called injury contributions. These include not only accidents, but also occupational diseases. They are transferred to the territorial branch of the Social Insurance Fund where the legal entity or individual entrepreneur is registered.

KBK FSS NS and PZ 2020: 393 1 0200 160

The same budget classification code is used to transfer payments for periods before January 2020.

KBC of the FSS fine for 2020 for injuries: 393 1 02 02050 07 3000 160

KBC penalties for injuries 2020: 393 1 0200 160

These codes are used when calculating penalties and interest for late or incorrect payment of insurance premiums. They are indicated in field 104 of the payment order.

Budget classification codes in order to correctly transfer contributions electronically for the payment of insurance contributions for compulsory social insurance, NS and PZ to the Social Insurance Fund of the Russian Federation, and for government services. Otherwise, fines and penalties are also possible.

Payment of insurance premiums for periods preceding 2017

Starting from January 2020, transfers of social taxes (except for “unfortunate” contributions) for periods preceding this year should no longer be made according to the details of the funds, but to the appropriate tax office. Especially for this purpose, separate KBKs were opened in the Treasury:

The Federal Tax Service details depend on the location of the legal entity or the registration of the individual entrepreneur. If a separate division has the right to pay employees wages, then payments for social insurance of employees are transferred to the tax office at the location of this division.

ATTENTION! If, by mistake or ignorance, you sent a payment to the details of the Federal Tax Service or the Pension Fund of the Russian Federation indicating the previous BCC, the Federal Tax Service will automatically recode the information and include the payment in the card corresponding to the contribution (letter of the Federal Tax Service dated January 17, 2017 No. 3N-4-1/). But we still recommend that if you find errors in your payments, you check with the tax authorities and find out whether all your payments have reached them.

The KBK for “unfortunate” transfers did not undergo changes in connection with the changes in 2020, and policyholders, when generating payment documents for these accruals, still indicate in them the details of the Social Insurance Fund and KBK 39310202050071000160.

How can the policyholder figure out which government agency is responsible for which social contributions? Here is a brief reminder of the interaction between the policyholder, the Social Insurance Fund and the Federal Tax Service:

- For all questions to the Social Insurance Fund regarding situations that arose before 01/01/2017: reporting, arrears, overpayments, reimbursement of expenses for VNIM, chamber chambers, including appealing their results, as well as complaints against employees, the policyholder should contact social insurance.

- The fund sent the balance of settlements with the policyholder as of 01/01/2017 to the Federal Tax Service - if there are debts, then the tax authorities will collect them from 2020.

- The FSS informs tax inspectors about the refusal to reimburse insurance expenses incurred before 2020, as well as about additional charges and the results of on-site audits for 2020 and earlier.

- Since 01/01/2017, tax officials have been collecting contributions for VNiM, checking with policyholders on social contributions accrued and paid in 2020 and beyond, conducting off-site calculations and conducting on-site inspections, reimbursement of expenses for social payments, but on the basis of social insurance information about the acceptance of these expenses.

Regarding contributions for injuries and occupational diseases, the policyholder still interacts with the Social Insurance Fund.

The details for paying insurance premiums in 2020 have changed due to the fact that social contributions, except for “unfortunate” ones, must be paid to the Federal Tax Service starting this year. The payment for injuries is still transferred to social insurance in accordance with the details of your territorial branch of the fund and the KBK, which have remained unchanged since 2016.

Changes to the BCC for insurance contributions to the Pension Fund for employees for 2020

For organizations and individual entrepreneurs that are employers of individuals and pay contributions to compulsory pension insurance, the following BCCs apply in 2020:

| Payment type | KBK | |

| For payments accrued after 2020 | For payments accrued before 2020 | |

| Contribution to compulsory pension insurance | 18210202010061010160 | 18210202010061000160 |

| Penalty | 18210202010062110160 | 18210202010062100160 |

| Fines | 18210202010063010160 | 18210202010063000160 |

For organizations and individual entrepreneurs that are employers of individuals and pay contributions for compulsory health insurance, the following BCCs are valid in 2020:

| Payment type | KBK | |

| For payments accrued after 2020 | For payments accrued before 2020 | |

| Compulsory health insurance contribution | 18210202101081013160 | 18210202101081011160 |

| Penalty | 18210202101082013160 | 18210202101082011160 |

| Fines | 18210202101083013160 | 18210202101083011160 |

ERRORS in the PAYMENT ORDER (payment) in the FSS of the Russian Federation and PENALTY, liability

If the payment order for the transfer of insurance premiums contains incorrect payment parameters:

- Federal Treasury account,

- KBK FSS contributions 2020,

- name of the beneficiary bank of the regional branch of the social insurance fund.

then the obligation to pay contributions is considered not fulfilled.

Other errors do not prevent the transfer of money to the budget or the payment of contributions, which means they will not lead to the accrual of penalties. Such shortcomings include: incorrect TIN or checkpoint of the recipient.

Procedure for filling out a payment order

In accordance with the fact that insurance premiums have become regulated by the Federal Tax Service since 2020, the old details for the Pension Fund and Social Insurance Fund are no longer used.

Innovations have been made in sections about:

- recipient;

- taxpayer identification number;

- code reflecting the reason for registration;

- budget classification code.

Based on this, there is a special procedure for filling out a payment order:

| "Recipient" | You must indicate the name of the body of the Federal Treasury of the Russian Federation. Information about the Federal Tax Service is written next to it in brackets. |

| "INN" | You must enter the number assigned to the territorial branch of the Federal Tax Service. |

| "Checkpoint" | Contains information about the checkpoint inspection. |

| "KBK" | Information about the KBK is displayed. |

In 2020, it was established that for insurance premiums the KBK will begin with the number 182. The value is the code of the payment administrator - the tax office.

There is no need to enter information about your insurance number in the “Purpose of payment” column. This rule applies to all contributions to the tax service.

There are other changes that you need to remember when filling out a payment order:

- Field 101, containing the payer status, previously contained code 08. New codes are now being provided.

- A new BCC is entered in line 104.

- The OKTMO code has now become eight-digit.

- The basis for the payment is reflected in field 106.

- To indicate the tax period for which payment is made, field 107 is provided.

The date and number of the document that is the basis for the contribution are entered after the organization makes the payment as a payment, penalty or fine. It is determined in accordance with the requirements of the Federal Tax Service, which are written in fields 108 and 109.

https://youtu.be/-Fn3zhPxbjY

FSS NS and PZ payment, sample filling in 2020, where to pay

How to correctly fill out a payment order to the Federal Social Insurance Fund of the Russian Federation in 2020 in case of an accident? This is a very important question, because if the money goes “by”, then the organization or individual entrepreneur will face penalties and fines.

Below is a form, a sample of filling out a payment order and a collection order in social insurance upon request to the Tax Service.

Sample payment form to the Federal CC of the Russian Federation for “injuries”

So we looked at the FSS KBK for injuries, NS and PZ, penalties for insurance premiums

to the Social Insurance Fund to correctly draw up instructions for contributions.

KBK for insurance contributions to the Social Insurance Fund from NS and PZ in 2020: where and when to pay

Each employer is required to regularly pay accident insurance premiums (abbreviated as “NS and PZ contributions” or “injury contributions”) for its employees. These payments relate to mandatory non-tax deductions, the procedure for their payment is regulated by Law No. 125 Federal Law of July 24, 1998. Deductions are used to generate one-time payments from the Social Insurance Fund, which are due to the employee if an accident occurs to him while performing his duties.