Quite often there is a need to transfer the balance sheet and profit and loss account from the old form (which was valid until 2011 inclusive) to the new form.

Unfortunately, it was not possible to find a convenient way to transfer old statements to new ones and vice versa, so you will have to manually remake the balance sheet and profit and loss account into a modern form.

To do this, you can use the following tables of correspondence between the line codes of the accounting reporting forms, compiled in accordance with the requirements of Order of the Ministry of Finance No. 67n, with the line codes designated by Order of the Ministry of Finance dated 07/02/2010 No. 66n

How to use it?

If you have a new balance sheet and income statement, and you need to convert them to the old form, then you need:

- Open this page - ;

- Copy tables to excel;

- Open your balance sheet and income statement and, using the pictures in this article, fill out the old balance sheet and income statement.

If you have an old balance sheet and profit and loss account, and you need to convert them to a new form, do this:

- Open the page ;

- Copy the tables into excel;

- Open your old report and, using the pictures from the article, fill out the new report

I found the tables themselves here: https://www.twirpx.com/file/808002/

The financial analysis:

- Some computers have problems both with saving data from tables and with sending them by email. The algorithm for solving this issue is quite simple: you need...

- An aggregated balance sheet is a way to simplify the appearance of the balance sheet, make it more compact, a form of balance sheet intended for management analysis For ease of reading data and conducting…

- This online calculator is designed to quickly determine trends in the financial results, assets and liabilities of a commercial enterprise. This can be useful, for example, when justifying...

- This post contains a unique free generator of financial accounting statements for three years. If you need a balance sheet and income statement for your work and...

- This page contains the forms of the balance sheet and profit and loss account that were in effect until 2011. If you need new forms of balance and...

- The statement of financial results (profit and loss) (form 2) for conducting a financial analysis of the enterprise for three years is as follows: Indicator Indicator code 2011 2012...

- When preparing dissertations, coursework, master's and other educational works on financial analysis, very often there is a need to conduct an analysis, having data for three years only at the end...

Line 1230 of the balance sheet - deciphering

it helps to understand the size of receivables at the time of drawing up the document. Other balance lines are filled in using the same principle. Our article will discuss what information should be contained in the balance sheet line by line.

Line 1230 of the balance sheet (230, 240): decoding, principles of structure of line codes

Each line of the balance sheet

corresponds to a code that allows you to identify the data contained in it. The main consumers of these codes are statistical and regulatory authorities, which can carry out analytical work on them.

Currently the codes are 4 digits long. For example, line 1230 of the balance sheet

, former line 240, contains accounts receivable in the transcript. This line shows the amount of debt that its partners, counterparties and other persons interacting with it have to the company in a certain period of time.

Line 230 also belonged to this category and reflected debts that could be repaid in no earlier than 12 months.

Balance sheet line codes

contain very specific information:

- The first digit is that it belongs specifically to the balance sheet and not to another document.

- The second digit indicates belonging to a specific section of the asset.

- The third number shows the place of this asset in the liquid ranking. The higher the liquidity, the higher the number.

- The fourth digit is required for line detail. Thus, the requirements contained in PBU 4/99 are met.

Using a similar principle, we will selectively describe which codes correspond to the strings and provide a brief explanation of them. We will separately indicate in the table the new and old codes, since the balance must be drawn up for 3 years, and 2 years ago the previous code values were still in effect.

Fixed assets. Line 1150

This line of the Balance Sheet reflects information about fixed assets (fixed assets) recorded in accounting on account 01 “Fixed Assets”. On the issue of reflecting in the Balance Sheet unfinished capital investments accounted for in account 08 “Investments in non-current assets” (except for subaccounts 08-5 and 08-8), there are currently two positions.

The first position is that the amount of unfinished capital investments in objects that will subsequently be accepted for accounting on account 01 is included in the indicator of line 1150 and is reflected separately on one of the lines deciphering the indicator of this line. This position is based on the fact that in the form of the Balance Sheet approved by Order No. 66n, there is no separate line “Construction in progress”. At the same time, according to paragraph 20 of PBU 4/99, the article “Construction in progress” is included in the group of articles “Fixed assets”, and paragraph 3 of Order of the Ministry of Finance of Russia N 66n allows organizations to independently determine the detail of indicators for reporting items. In addition, Appendix No. 3 to Order No. 66n provides an example of the preparation of Explanations to the Balance Sheet and the Financial Results Report. In this Example, Sect. 2 “Fixed assets” includes table 2.2 “Unfinished capital investments”.

The second position is that information about unfinished capital investments is not reflected in line 1150 “Fixed assets”. This conclusion follows from the norms of PBU 6/01 (later than the above-mentioned PBU 4/99). In particular, the requirements for the disclosure of information about fixed assets in the financial statements are established by clause 32 of PBU 6/01, which does not contain any mention of unfinished capital investments or unfinished construction. In addition, PBU 6/01 “Fixed assets” itself does not apply to capital investments, since they do not meet the conditions for acceptance for accounting as part of fixed assets (clauses 3, 4 of PBU 6/01). An additional argument in favor of this position is that in the Regulations on Accounting and Financial Reporting in the Russian Federation, in the section “Rules for the evaluation of items in financial statements”, the subsection “Unfinished capital investments” is present along with the subsection “Fixed assets”.

Thus, organizations will have to independently, taking into account the above arguments, decide whether to include the amount of unfinished capital investments in the indicator of line 1150 “Fixed assets” or not. In the latter case, the amount of unfinished capital investments can be reflected in Section. I “Non-current assets” according to a separate line “Unfinished capital investments” independently entered by the organization, and if the indicator is not significant - according to line 1190 “Other non-current assets” (on the issue of disclosing data on in-progress capital investments, see also Letter of the Ministry of Finance of Russia dated January 27, 2012 N 07-02-18/01).

Let us note that when deciding on the reflection of incomplete capital investments in the Balance Sheet, it is advisable to apply a unified approach to reflecting all types of investments in non-current assets.

OS objects are tangible assets used as means of labor in the production of products, performance of work or provision of services, or for the management of an organization (clause 46 of the Regulations on Accounting and Financial Reporting).

OS objects include buildings and structures, machinery and equipment, computer technology, vehicles, working, productive and breeding livestock, perennial plantings, on-farm roads and other objects.

As part of fixed assets accepted for accounting on account 01, the following are also taken into account:

— capital investments for radical improvement of land (drainage, irrigation and other reclamation works);

— capital investments in leased fixed assets;

— land plots, environmental management objects (water, subsoil and other natural resources) (clause 5 of PBU 6/01);

- special tools, special devices, special equipment, special clothing (if provided for by the organization’s accounting policy) (clause 9 of the Guidelines for accounting of special tools, special devices, special equipment and special clothing, approved by Order of the Ministry of Finance of Russia dated December 26, 2002 N 135n, Letter of the Ministry of Finance of Russia dated May 12, 2003 N 16-00-14/159);

- leased property, accounted for by agreement of the parties on the balance sheet of the lessee (clause 8 of the Instructions on the reflection in accounting of transactions under a leasing agreement, approved by Order of the Ministry of Finance of Russia dated February 17, 1997 N 15);

- fixed assets of a leased enterprise (when leasing an enterprise as a property complex) (Letters of the Ministry of Finance of Russia dated 06/21/2002 N 04-02-06/3/41, dated 02/20/2007 N 03-03-06/1/101).

The specified assets are accepted by the organization for accounting as fixed assets if the following conditions are simultaneously met:

a) the object is intended for use in the production of products, when performing work or providing services, for the management needs of the organization <*>;

b) the object is intended to be used for a long time, i.e. a period exceeding 12 months or the normal operating cycle if it exceeds 12 months;

c) the organization does not intend the subsequent resale of this object;

d) the object is capable of bringing economic benefits (income) to the organization in the future.

In addition, the organization has the right to establish in its accounting policy a cost criterion for accepting for accounting an asset that satisfies the above conditions as an asset (clauses 4, 5 of PBU 6/01). If the value of such an asset does not exceed 40,000 rubles. (or other limit established by the organization), it can be taken into account as part of inventories.

Attention!

Real estate objects subject to state registration, for which capital investments have been completed, are accepted for accounting as fixed assets in a separate subaccount to account 01, regardless of whether the documents have been submitted for state registration or not (clause 52 of the Guidelines for accounting of fixed assets, approved Order of the Ministry of Finance of Russia dated October 13, 2003 N 91n).

Fixed assets transferred for rent or free use, as well as those transferred to conservation, those in the process of restoration, completion or additional equipment are not written off from account 01. We also note that the accrual of depreciation on an asset in the amount of 100% of the original (replacement) cost is not a basis for writing off this asset from accounting.

An asset is subject to write-off from accounting if it is recognized in accordance with the established procedure by the organization as unsuitable for further use or sale and, in connection with this, this object is not capable of generating economic benefits (income) in the future. The residual value of such an asset is written off as other expenses of the organization (clause 29 of PBU 6/01, Appendix to the Letter of the Ministry of Finance of Russia dated January 29, 2014 N 07-04-18/01).

Attention!

Agricultural organizations take into account on account 01, subaccount 01-5 “Perennial Plantings” (analytical account “Young Plantings”), the cost of perennial plantings that have not reached operational age, defined as the amount of costs incurred for their planting and the amount of costs for them added annually cultivation (clause 7 of section 2 of the Methodological recommendations for accounting of fixed assets of agricultural organizations, approved by Order of the Ministry of Agriculture of Russia dated June 19, 2002 N 559, Methodological recommendations for the application of the Chart of Accounts for the accounting of financial and economic activities of enterprises and organizations of the agro-industrial complex, approved by the Order of the Ministry of Agriculture Russia dated June 13, 2001 N 654, Methodological recommendations for correspondence of accounting accounts of financial and economic activities of agricultural organizations, approved by Order of the Ministry of Agriculture of Russia dated January 29, 2002 N 68).

But in essence, perennial plantings that have not reached operational age are not fixed assets, but investments in non-current assets (clause 4, 13 PBU 6/01, clause 34 of the Methodological Guidelines for Accounting for Fixed Assets, clause 7, Section. 2 Methodological recommendations for accounting of fixed assets of agricultural organizations, Letters of the Ministry of Finance of Russia dated 08/14/2006 N 03-06-01-02/33, dated 07/20/2006 N 07-05-08/279).

Fixed assets are accepted for accounting under account 01 at their original cost, which is determined in accordance with the requirements of paragraphs 8 - 13 of PBU 6/01.

Attention!

The initial cost of fixed assets includes the amount of estimated liabilities for their dismantling and disposal, as well as for environmental restoration, if the occurrence of such obligations is directly related to the acquisition, construction and manufacture of these fixed assets. If the occurrence of an estimated liability is associated with the creation (acquisition) of several fixed assets at the same time, the amount of such liability is distributed among these objects in proportion to the justified base chosen by the organization (clause 8 of the Accounting Regulations “Estimated Liabilities, Contingent Liabilities and Contingent Assets” PBU 8 /2010, approved by Order of the Ministry of Finance of Russia dated December 13, 2010 N 167n, Letter of the Ministry of Finance of Russia dated January 9, 2013 N 07-02-18/01).

The initial cost of fixed assets is repaid by depreciation. The amounts of depreciation accrued on fixed assets are reflected in account 02 “Depreciation of fixed assets”. During the useful life, depreciation on fixed assets is not suspended, with the exception of cases of transfer to conservation for a period of more than three months, as well as during the restoration period of the object, the duration of which exceeds 12 months (clauses 17, 23 of PBU 6/01) .

There are categories of fixed assets that are not depreciated (clause 17 of PBU 6/01). These include: used for the implementation of the legislation of the Russian Federation on mobilization preparation and mobilization, OS objects that are mothballed and not used in the production of products, when performing work or providing services, for the management needs of the organization or for provision by the organization for a fee for temporary possession and use or for temporary use; land; environmental management facilities; objects classified as museum objects and museum collections.

An organization may decide to annually revalue fixed assets at current (replacement) cost (clause 15 of PBU 6/01). Revaluation of fixed assets is carried out by recalculating their original cost or current (replacement) cost and depreciation amounts accrued for the entire period of use of the objects. Revalued fixed assets are reflected in accounting at their replacement cost. Revaluation of fixed assets is carried out at the end of the reporting year. The amount of additional valuation of an asset as a result of revaluation is credited to the additional capital of the organization. Moreover, if in previous reporting periods the fixed asset was discounted and the amount of the markdown was charged to the financial result as other expenses (until 01/01/2012 - to the account of retained earnings), the amount of additional valuation of the fixed asset, equal to the amount of its markdown, is credited to the financial result in as other income.

The amount of depreciation of an asset as a result of revaluation is included in the financial result as other expenses. If in previous reporting periods the fixed asset was overvalued and the amount of the revaluation was included in the organization's additional capital, then the amount of the writedown of the fixed asset is included in the reduction of additional capital, and the excess of the amount of the writedown of the fixed asset over the amount of its revaluation credited to the additional capital is credited to the financial result in as other expenses.

Attention!

If during the reporting period the organization assessed fixed assets for the purpose of transferring them as collateral (or for other purposes), then such an assessment is not taken into account when preparing reports. Only revaluation made according to the rules of clause 15 of PBU 6/01 is taken into account.

The initial cost of fixed assets at which they are accepted for accounting may also change in cases of their retrofitting, modernization, reconstruction and partial liquidation (clause 14 of PBU 6/01, clause 41 of the Methodological Guidelines for Accounting of Fixed Assets).

ADDITIONALLY on this issue, see the section “Accounting for fixed assets and construction in progress (accounts 01, 02, 07, 08)” of the Guide to Information Security “Correspondence of Accounts”.

This line of the Balance Sheet indicates the residual value of the organization's fixed assets as of the reporting date, as of December 31 of the previous year and as of December 31 of the year preceding the previous one (clause 35 of PBU 4/99, clause 49 of the Regulations on Accounting and Financial Reporting, Letter of the Ministry of Finance Russia dated January 30, 2006 N 07-05-06/16) <*> <**>. The residual value of fixed assets as of the reporting date is determined as the difference between the balance of accounts 01 and 02 (taking into account revaluation, if any). Fixed assets not subject to depreciation are shown in the Balance Sheet at their original (replacement) cost.

The organization may decide to include the value of unfinished capital investments in the indicator of line 1150 “Fixed assets” with a separate reflection of this value in the line “Unfinished capital investments” (or “Construction in progress”), detailing the indicator of line 1150. In this case, in addition to the residual value OS indicator line 1150 forms debit balances on accounts 08 “Investments in non-current assets” and 07 “Equipment for installation”. In this case, debit balances on accounts 07 and 08 are taken into account in the part related to capital investments in fixed assets, which will subsequently be accepted for accounting on account 01 “Fixed Assets”.

Attention!

An object subject to accounting is classified at the time of its recognition based on compliance with established criteria for asset types. Therefore, information about fixed assets whose remaining useful life at the reporting date is 12 months or less cannot be disclosed in Section. II “Current assets” and should be included in section. I Balance Sheet (Letter of the Ministry of Finance of Russia dated December 19, 2006 N 07-05-06/302).

Attention!

If the organization also has fixed assets accounted for as part of profitable investments in tangible assets on account 03 “Income-generating investments in tangible assets,” then from the balance of account 02 it is necessary to exclude the amounts of depreciation accrued on these objects (for more details, see Section 3.1.1.6 .1 “Which fixed assets are taken into account on account 03”).

Line 1150 “OS” = Debit balance on account 01 (excluding the analytical account “Young plantings” - Credit balance on account 02 (excluding depreciation on fixed assets, accounted for on account 03)

Organizations independently determine the detail of the indicator on line 1150 “Fixed assets”. For example, the balance sheet may contain separate information on the cost of buildings, machinery and equipment, vehicles, etc., if such information is recognized by the organization as significant (paragraph 2, paragraph 11 of PBU 4/99, paragraph 3 of the Order of the Ministry of Finance of Russia N 66n).

In general, the indicators in line 1150 “Fixed assets” as of December 31 of the previous year and as of December 31 of the year preceding the previous year are transferred from the Balance Sheet for the previous year. Comparative indicators are subject to adjustment if, in the reporting year, the organization corrected significant errors in accounting for fixed assets made in previous years and identified after the approval of the financial statements for the previous reporting year, as well as if in the reporting year there was a change in the organization’s accounting policy in relation to fixed assets ( clause 2, clause 9 of PBU 22/2010, clause 15 of PBU 1/2008). In the event of revaluations, comparative data for the period (periods) preceding the reporting period do not change (Appendix to Letter of the Ministry of Finance of Russia dated January 29, 2014 N 07-04-18/01).

The “Explanations” column provides an indication of the disclosure of this indicator (paragraph 2 of clause 28 of PBU 4/99).

Example of filling out line 1150 “Fixed assets”

The organization decided to separately reflect unfinished capital investments on a separate, independently entered line in section. I “Non-current assets”, and in case of insignificance of the indicator - on line 1190.

Indicators for accounts 01 and 02 in accounting:

rub.

| Index | As of the reporting date (December 31, 2014) |

| 1 | 2 |

| 1. On the debit of account 01, including: | 12 358 000 |

| 1.1. Replacement cost of buildings | 5 180 000 |

| 1.2. Replacement cost of machinery and equipment | 5 920 960 |

| 1.3. Initial cost of vehicles | 937 040 |

| 1.4. Initial cost of office equipment | 320 000 |

| 2. On the credit of account 02, analytical account for depreciation of fixed assets recorded on account 01, including: | 1 561 464 |

| 2.1. Depreciation of buildings | 841 750 |

| 2.2. Depreciation of machinery and equipment | 510 016 |

| 2.3. Vehicle depreciation | 139 799 |

| 2.4. Depreciation of office equipment | 69 899 |

Fragment of the Balance Sheet for 2013

| Explanations | Indicator name | Code | As of December 31, 2013 | As of December 31, 2012 | As of December 31, 2011 |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 2.1, 2.3, 2.4 | Fixed assets | 1150 | 11 905 | 11 963 | 10 511 |

| including: | |||||

| building | 1151 | 4403 | 4590 | 4216 | |

| cars and equipment | 1152 | 6027 | 5202 | 4816 |

Solution

The residual value of the operating system is:

as of December 31, 2014 - RUB 10,797 thousand. (RUB 12,358,000 - RUB 1,561,464);

as of December 31, 2013 - RUB 11,905 thousand;

as of December 31, 2012 - RUB 11,963 thousand.

Including:

residual value of buildings:

as of December 31, 2014 - 4338 thousand rubles. (RUB 5,180,000 – RUB 841,750);

as of December 31, 2013 - 4,403 thousand rubles;

as of December 31, 2012 - 4590 thousand rubles;

residual value of machinery and equipment:

as of December 31, 2014 - RUB 5,411 thousand. (RUB 5,920,960 - RUB 510,016);

as of December 31, 2013 - 6027 thousand rubles;

as of December 31, 2012 - 5202 thousand rubles.

A fragment of the Balance Sheet in Example 1.5 will look like this.

| Explanations | Indicator name | Code | As of December 31, 2014 | As of December 31, 2013 | As of December 31, 2012 |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 2.1, 2.3, 2.4 | Fixed assets | 1150 | 10 797 | 11 905 | 11 963 |

| including: | |||||

| building | 1151 | 4338 | 4403 | 4590 | |

| cars and equipment | 1152 | 5411 | 6027 | 5202 |

Lines 1100 (190), 1150 (120), 1160, 1170 (140), 1180, 1190

Line 1100 contains information about the full amount of non-current assets of the enterprise. Before the order was changed, this was line 190. The next 6 lines are elements that add up to the value of this line.

Line 1150

corresponds to the previous line 120. Data on fixed assets of the enterprise available at the time of the report is entered into it.

Line 1160 reflects information about the amount of material assets available at the enterprise, as well as investments that generate income. All data is recorded on account 03.

Line 1170, former 140, contains data on the enterprise’s investments if they are made for more than 12 months. Accounting is maintained by the debit of accounts 58 and 55, the subaccount is called “Deposits”.

Line 1180 contains the allocated tax assets. The balance of account 09 is indicated here. Line 1190 includes all non-current assets that were not mentioned above.

How are fixed assets depreciated on the company's balance sheet?

An item of fixed assets is depreciated from the 1st day of the month following the month in which the property was accepted for accounting. Depreciation is accrued until the property is written off or until its cost is fully repaid (depreciation stops on the 1st of the month following the month in which one of the above 2 events occurred).

Important! The depreciation method chosen by the company for a group of fixed assets characterized by homogeneity must be applied throughout the entire useful life of the property included in this group.

In total, there are 4 methods of calculating depreciation available when paying off the cost of fixed assets:

Whatever depreciation method is chosen by the enterprise, depreciation charges are accrued in the amount of 1/12 of the annual amount during the reporting year. Depreciation is carried out in compliance with the following rules:

| Controversial issue regarding depreciation of fixed assets | Solution |

| Suspension of depreciation charges for fixed assets | Depreciation continues throughout its useful life. Exception: – OS recovery time is more than 1 year, – conservation of the object for more than 3 months by order of the authorities. |

| Dependence of depreciation charges on fixed assets on the results of the company’s work in the reporting period | Depreciation is reflected in the accounting of the period to which it relates and does not depend on the results of the enterprise for the reporting year. |

| Displaying summary information about asset depreciation | Generalized data on deductions accumulated over the period of use of the operating system are reflected in account 02. |

| Reflection of fixed assets depreciation amounts in correspondence with various accounting accounts | Accrued depreciation payments are indicated according to Kt. 02 in correspondence with production (sales) expense accounts. |

| Depreciation of retired and damaged fixed assets | Written off in CT account. 01 subaccount “Disposal of fixed assets”. Likewise for: – completely worn out OS, – lost OS, – realized objects, – decommissioned OS, – donated free of charge, – partially liquidated. |

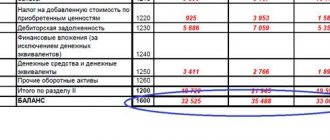

Lines 1210 (210), 1220 (220), 1240 (250), 1250, 1260 and 1200 (290)

The previous line 210 corresponds to the current line 1210 of the balance sheet; the accounting department enters data on the remaining inventories into it.

Line 1220 of the balance sheet as before —

line 220. It must contain data on VAT, which was issued by the supplier, but was not accepted for deduction until the report was drawn up. This is essentially the debit balance of account 19.

Line 1240

of the balance sheet with a breakdown

was previously line 250. It reflects investments whose maturity does not reach a year.

Line 1250 is the company’s monetary assets in national and foreign currencies, as well as other resources. This refers to accounts 50, 51, 52 and 55.

Line 1260 contains all other assets that did not find a place in the above section lines.

Line 1200 in the previous version of the form was line 290

of the balance sheet.

The final results for section 2 are reflected here.

Section I. Non-current assets

Intangible assets.

The residual value of intangible assets is reflected on line 1110. Clause 3 of PBU 14/2007 “Accounting for intangible assets”, approved by Order of the Ministry of Finance of Russia dated December 27, 2007 N 153n, allows you to find out what belongs to this group. Thus, in order to accept an object for accounting as an intangible asset, it is necessary that the following conditions be simultaneously met:

The object is capable of generating economic benefits in the future, and the organization has the right to receive them;

An object can be separated or separated (identified) from other assets;

The object is intended to be used for a long time, that is, it exceeds 12 months;

It is possible to reliably determine the actual (initial) cost of the object;

The object has no material form.

For example, if the specified conditions are met, intangible assets include works of science, literature and art, programs for electronic computers, inventions, utility models, selection achievements, production secrets (know-how), trademarks and service marks. Intangible assets also take into account business reputation arising in connection with the purchase of an enterprise as a property complex (in whole or part thereof).

Intangible assets do not include expenses associated with the formation of a legal entity (organizational expenses), intellectual and business qualities of the organization’s personnel, their qualifications and ability to work (clause 4 of PBU 14/2007).

Results of research and development.

Research and development expenses recorded on account 04 “Intangible assets” are reflected on line 1120.

Intangible and tangible search assets.

These two indicators are given in lines numbered 1130 and 1140. They are intended for organizations - users of subsoil to reflect information on the costs of developing natural resources (PBU 24/2011 “Accounting for the costs of developing natural resources”, approved by Order of the Ministry of Finance of Russia dated 10/06/2011 N 125n).

Fixed assets.

For depreciable objects, the residual value of fixed assets is recorded in line 1150. If we are talking about non-depreciable property, then the line indicates its original cost.

Assets classified as fixed assets must comply with the conditions of clause 4 of PBU 6/01 “Accounting for fixed assets”, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n.

Objects must be owned by the organization or have the right of operational management or economic management. It is also allowed to include property received under a leasing agreement as fixed assets if it is taken into account on the balance sheet of the lessee.

Objects subject to mandatory state registration of property rights are considered fixed assets from the moment they are registered, that is, like all other objects. The fact that documents are submitted to the appropriate authority does not matter.

In Sect. Form I of the balance sheet does not have the line “Construction in progress”. The question arises: under what balance sheet item should expenses for the construction of real estate be reflected? The answer is on line 1150 “Fixed assets”. This is stated in paragraph 20 of PBU 4/99, approved by Order of the Ministry of Finance of Russia dated July 6, 1999 N 43n. It’s best to add the decoding line “Unfinished construction” to line 1150, according to which you can record the named expenses.

Profitable investments in material assets.

Data on profitable investments in material assets corresponds to line indicator 1160. This is the residual value of property intended for rent (leasing) and accounted for in the account. If the property was first used for production and management needs, but was later leased out, it must be reflected in a separate subaccount of the account as part of fixed assets. This is due to the fact that the transfer of the value of fixed assets into profitable investments and back is not provided for in accounting (Letter of the Federal Tax Service of Russia dated May 19, 2005 N GV-6-21/).

Financial investments.

For long-term financial investments, that is, with a circulation period of more than a year, line 1170 is allocated (for short-term ones - line 1240 of section II “Current assets”). Investments in subsidiaries, affiliates and other companies are also shown here. Financial investments are taken into account in the amount spent on their acquisition.

The cost of own shares purchased from shareholders for resale or cancellation, and interest-free loans issued to employees are not considered financial investments (clause 3 of PBU 19/02 “Accounting for financial investments”, approved by Order of the Ministry of Finance of Russia dated December 10, 2002 N 126n). For the first indicator, line 1320 is provided. The second indicator is reflected as part of accounts receivable, namely, long-term loans are shown on line 1190, short-term loans - on line 1230.

Deferred tax assets.

Line 1180 “Deferred tax assets” is filled in by income tax payers. Since “simplified people” are not included in their number, it must be marked with a dash.

Other noncurrent assets.

Here (line 1190) shows data on non-current assets that are not reflected in other lines of section. I balance sheet.

Lines 1510 (610), 1520 (620), 1530, 1540, 1550 and 1500 with decryption

In the previous edition of the form, line 1510

of the balance sheet with a breakdown

was

line 610 of the balance sheet.

It contains information about short-term borrowed funds (accounts 66 and 67).

Line 1520

of the balance sheet with decoding

before 2020 was line 620. It reflects short-term debt to partners, staff, etc. Line 1530 contains account balance 98.

Line 1540 is liabilities reflected on the credit of account 96, the maturity of which is less than 12 months.

Line 1550 is all other obligations that are not reflected in the previous lines.

Line 1500 contains the final result for section 4.

Balance sheet lines 2020: decoding liability items

The passive part of the report contains three groups of item-by-item decoding of accounting data based on the results of work for the last year. The first block of information shows the value of capital in its various forms (lines 1310-1360). The composition of capital takes into account profits or losses that were not distributed on the last day of the reporting period - line 1370 of the balance sheet.

These indicators are presented in more detail in the statement of changes in equity. Profit amounts are reflected in an additional form - a statement of financial results. Line 1370 of the balance sheet - the decoding focuses on the value of profit in monetary terms, which is subject to distribution. Its payment can be initiated in the new year by the decision of the founders.

What does line 1370 of the balance sheet consist of:

- account balance 84;

- the value of the balance formed on account 99 (if an intermediate reporting type is generated).

The next block of information concerns the long-term type of liabilities of the company. It consists of lines 1410-1450. The data must correspond to the information provided in Form 5. Short-term loans and borrowings in the balance sheet - line 1500. Liabilities are detailed by the following groups:

- in the column with code 1510, the credit balance of account 66 is indicated;

- line 1520 of the balance sheet - decoding involves displaying the sum of values from the balances of accounts 69, 68, 62, 60, 76, 75, 73, 71, 70;

- in the cell next to code 1550 they show those amounts of the company’s short-term liabilities that, for objective reasons, were not included in other lines for recording borrowed resources with a maturity of less than a year.

When line 1520 of the balance sheet is filled out, the entered data must be checked against the information detailed in Form 5. The column is intended for entering information about the current state of settlements with counterparties and accountable persons, employees of the company in the context of debts to them under existing contractual relationships. The results of the liability are summarized in line 1700. The performance indicators of the asset and liability in the report must be equal. If they do not agree, then the balance sheet is drawn up incorrectly.

We also discussed the requirements for it in our consultations. You can read more about the content and structure of the balance sheet. How is line 1150 of the balance sheet filled out?

Page 2110 and other balance sheet forms 2

Lines starting with number 2, in particular 2110 “Revenue”, refer to Form 2 of the balance sheet. It was previously known as the income statement.

Hi all!

I found a good job where each item in the accounting statements is briefly described. Maybe someone will be interested)

Section I “Non-current assets”

Section I

“Non-current assets”

of the balance sheet reflects information about the organization’s assets that are used to make a profit over a long period of time. These are intangible assets, fixed assets, profitable investments in tangible assets, financial investments, deferred tax assets and other non-current assets of the organization.

Formation of indicators for Section I “Non-current assets”

In Section II “Current assets”

The balance sheet provides information on the value and composition of the organization's current assets as of the reporting date. Current assets are assets that relatively quickly transfer their value to costs. Current assets include property

Formation of indicators of section II “Current assets”

____________________________________________________________ In Section III "Capital and Reserves"

The balance sheet reflects the amount of the organization's equity capital. These are authorized, additional and reserve capital, retained earnings and other capitalized reserves

Formation of indicators for Section III “Capital and Reserves”

____________________________________________________________ In Section IV “Long-term liabilities”

the amounts of loans, credits, etc. received by the organization for a period of more than a year and not repaid as of the reporting date are reflected. It also reflects the amount of the organization's deferred tax liabilities and reserves for contingent liabilities. All other amounts of long-term accounts payable are reflected in a separate line. The organization can add decoding lines to section IV if it considers it necessary to highlight any other indicators. For example, in an additional line you can show the amount of long-term accounts payable to subsidiaries or to the founders.

Formation of indicators of section IV “Long-term liabilities”

____________________________________________________________ In Section V “Short-term liabilities”

The balance sheet reflects the amounts of accounts payable, the repayment period of which, according to the terms of the agreement, does not exceed 12 months. This section reflects the amount of short-term accounts payable of the organization to suppliers (for goods supplied, work performed and services rendered for the organization), buyers (for advances received from them), founders and employees, to the budget and extra-budgetary funds, lenders and other creditors. In addition, reserves for future expenses are reflected as part of the organization's short-term liabilities.

Formation of indicators for Section V “Short-term liabilities”

____________________________________________________________

The balance sheet has a certain structure, which is based on filling out individual lines. To be able to “read” financial statements, you should have an idea of what data is entered into the report lines. We will decipher the most important indicators and lines of the balance sheet.

Explanatory note plan

The general outline of the document looks like this:

- Enterprise data. All information about the location of the organization, its divisions and branches, information about the managers, founders and affiliates of the enterprise, types of permitted activities, average annual number of employees and other similar information.

- General information about accounting policies. Includes information on the methods used for assessing finished products, inventories, depreciation, determining financial results and other items.

- Main current financial indicators for the reporting period. The amounts of revenue and expenses by type of activity, the amount of public funds received are explained, and a breakdown of major expenditure or income transactions carried out in the current year is provided.

- Explanations for individual items of the balance sheet or other reports. In this section, it is recommended to reflect information on changes in the organization’s capital by their types (authorized, reserve, additional and others). Assess the composition and movement of the enterprise's reserves, the structure and volume of fixed assets and intangible assets. Explain information about leased property and financial investments. Decipher the composition of costs for production and product development. Analyze the dependence of the volume of sales of goods and services by type of activity and sales markets.

Each organization has the right to exclude unused parameters and supplement the explanations with information that takes into account its individual characteristics and field of activity.

Balance sheet lines approved for 2016-2017 with their decoding codes

Each line is a value that characterizes the operation of the enterprise and its availability:

- Money;

- material reserves;

- current and non-current assets:

For each line of the report, an individual code is provided, which will allow you to further systematize the information contained in the company’s balance sheet and draw up a general forecast. The codes for each line were approved within the framework of Appendix No. 4 of Order No. 66n of the Ministry of Finance of the Russian Federation dated July 2, 2010, which amended the list of codes and now modern codes have four characters, while outdated ones consisted of only three digits.

Let's look at what codes are provided for Assets and Liabilities in financial statements:

| Assets | Passive |

| 1100, 1150, 1160, 1170, 1180, 1190, 1200, 1210, 1220, 1230, 1240, 1250, 1260, 1600 | 1300, 1360, 1370, 1410, 1420, 1500, 1510, 1520, 1530, 1540, 1550, 1700 |

| The basic order of the lines in this section is the principle of increasing liquidity. At the top is the property, which remains in its original form until the very end. | The information in these lines allows you to study the dynamics of changes in the balance sheet structure. Here you can see when the funds were received by the organization and when the company must return them. Get 267 video lessons on 1C for free: |

Changes in the balance sheet since 2020

Since 06/01/2019, an updated version of accounting reporting has been in effect, approved by order of the Ministry of Finance dated 04/19/2019 No. 61n.

The following adjustments have been made to the balance sheet:

- “Header” of the document - a line has been added in which it is necessary to indicate information about whether the company is subject to mandatory audit, and information about the audit company (IP) that conducted the audit.

- The unit of measurement million rubles has been excluded. — all indicators in the updated form are entered in thousands of rubles.

- OKVED has been replaced by OKVED 2.

- OKEI code 385 has been abolished.

Read about how other forms of accounting reporting have changed here.

You can download the updated balance sheet below.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

ATTENTION! Accounting statements no longer need to be submitted to statistics. For details, see the material “Changes in reporting in 2020”.

Let's take a closer look at what the new balance sheet looks like with line codes for all its sections.

The first is about non-current assets.

Decoding individual lines of the balance sheet

Let's look at the most significant lines of the balance sheet and give their explanation. Each code contains certain information:

- the first digit explains what type of documentation the indicator belongs to, in this case 1 is the balance sheet;

- the second digit indicates the Asset section, for example, 1 - non-current assets;

- the third figure is assets that increase in order of liquidity;

- the last sign is used to carry out line-by-line detailing of indicators that are the most significant.

Based on this decoding rule, let’s consider several balance sheet items at once:

- line 1150 – “Fixed assets”. This line indicates information regarding the company’s assets, which are fixed assets and which were formed during the registration of the enterprise. The information is presented at the time of preparation of the report;

- line 1210 – “Inventories”. This line indicates the total balance of inventories, data for which are stored in accounts 10, 11, 15, 16, 20, 21, 23, 28, 29, 41, 43, 44, 45, 97. The credit balance of accounts 14 and 42;

- line 1230 - “Accounts receivable”. This indicator is formed in the form of a total balance of indicators from the accounting accounts, which characterize the debt to the company in various sectors of its activity. The main accounts used are: 60, 62, 68, 69, 70, 71, 73, 75, 76. The exception is account 63. The balance on this account is not taken into account;

- line 1240 – “Financial investments”. The total amount of data from accounts 55, 58, 73 is entered in the line, except for account 59. The indicators of financial investments for a period of over 12 months are noted here;

- line 1250 - “Cash and cash equivalents” - data on the availability of funds in various accounts is indicated. The total indicator is entered into the line, which is formed from the accounts: 50, 51, 52, 55, 58, 76;

- line 1300 – “Capital totals”. This line is final and it contains the total sum of all lines relating to information about the movement of capital of the company as of a specific reporting date;

- line 1370 - “Retained earnings (uncovered loss).” Lines 1300-1370 detail data on changes in capital and information about the financial result of the company. The company determines the level of clarification independently;

- line 1520 – “Short-term accounts payable.” The total sum of indicators from the accounts is reflected here: 60, 62, 68, 69, 70, 71, 73, 75, 76. Additionally, the resulting total is deciphered in form No. 5:

Deciphering individual balance lines is necessary so that users can understand what is being discussed when drawing up documentation. In addition, it allows you to get the most complete explanation of a particular figure indicated in the balance sheet.

Form 5 financial statements

If an organization accounts for goods on account 41 at sales prices with a reflection of the trade margin on account 42 “Trade margin”, then when calculating the indicators of lines 5670 and 5680, the debit balance on account 41 at the beginning and end of the reporting year is reduced by the credit balance on account 42 by these dates.

The positive difference obtained from the above formula means an increase in balances, i.e. represents the amount that must be subtracted from the amount of expenses incurred in the reporting year to determine the cost of sales. Therefore, a positive difference is indicated in parentheses. In this case, the line is assigned code 5670.

If the resulting difference is negative, i.e. the balances of work in progress and finished products have decreased, which means the resulting difference is added to the amount of expenses incurred in the reporting year to determine the cost of sales. Therefore, the negative difference is given without parentheses, and the line is given code 5680.

The indicator in the column “For the previous year” is generally transferred from the column “For the reporting year” in line 5670 or 5680 of Table 6 of the Explanations for this previous year.