Business lawyer > Accounting > Accounting and reporting > Line 2350 of the Financial Results Report: essence and rules for filling out

One of the most important indicators for assessing the performance of a business is its costs. They have a direct impact on the results of the work. In addition to production costs and commercial expenses, the Financial Results Report contains a separate line for expenses called “other”. The procedure for their calculation and inclusion in a financial document is regulated by accounting legislation.

General provisions about the Report

The financial results statement is one of the fundamental final accounting documents. Until 2013, it bore a name that reflected only the final indicator of business activity: profit or loss. Now it is clear from it that the content of the reporting document includes, in addition to the level of profit achieved or loss incurred, other indicators.

Financial statements

Based on the information presented in the final financial statements, an assessment is made of the financial and economic position of the company, the level of its profitability and liquidity, and operational stability. It is necessary to predict the future performance of a business, therefore it is used by almost all counterparties: government agencies, banking institutions, partners, investors.

The form for drawing up a financial report was approved by the Ministry of Finance by order No. 66 n of 2010 and is presented in the first appendix to it under the previously existing name “Profit and Loss Statement”. Information from this document supplements the information included in the main body of the company - the balance sheet.

If the balance sheet shows that a business entity has active funds and liabilities at the end of the reporting year, then from the report you can find out about the amount of income it has achieved over the past period of time and the expenses it has incurred in the course of business, the receipt of net profit or loss, i.e. about business performance over the past year.

Conventionally, the structure of the report under consideration is represented by four large sections:

- Company income and costs by main types of business activity.

- Amounts of income and expenses that differ from the main expenses and benefits - other.

- The financial result of doing business for the past annual period.

- Reference information.

The report is compiled for the entire enterprise, regardless of the tax regime used, under which it operates and whether it has independent structural divisions.

Annual data

In addition to the indicators of the reporting year, for example, for 2020, the document provides information for the same previous period, i.e. for 2020. As follows from the rule established by clause 10 of PBU 4/99, if the information for two adjacent years turns out to be incomparable, it must be brought to a comparable form by adjusting it.

PBU 9/99, dedicated to the profitability of companies, PBU 10/99, regulating expenses, classify all income and expenses of business entities into two groups:

- from normal (main) activities

- other

Each organization itself decides the issue of assigning certain costs to the first or second group, reflecting the accepted principles of separation in its internal accounting policy. This right is clarified by the Ministry of Finance in letter No. 07-02-06/203.

What company costs are included in other expenses?

Expenses classified by the company as other are shown in the report under consideration on line 2350. Interest payable should be excluded from them.

Other costs include:

- costs incurred as a result of the company's participation in the charter of third-party business entities

- expenses caused by the write-off or sale of manufactured products, goods, fixed assets

- interest paid by an enterprise on credit and other similar obligations

- service costs in organizations lending business

- debt of counterparties with an expired statute of limitations

- expenses for issuing property for rent, including objects related to the company’s intellectual property

Expense items - allocations to reserve funds, which are formed in accordance with accounting rules (for depreciation of investments in the Central Bank, for problematic debt, etc.)

- allocations to own reserves, organized in cases of recognition of conditional facts of business affairs

- penalties, compensation, penalties, fines for violations of contractual discipline

- compensation for losses of other persons resulting from the actions of the company

- last year's losses recognized in the current period

- other debts that are not possible to collect

- difference in payment amounts or revenue resulting from changes in exchange rates

- markdown of owned resources

- donations to charity

- expenses for organizing cultural, entertainment, sports and other similar events

- expenses resulting from force majeure in business activities

Line 2400 of the income statement

Yurkov Enterprise Economics

Electronic textbook

MODULE 7.2. TYPES OF PROFIT

A distinction is made between accounting profit and net economic profit. As a rule, under economic profit

– refers to the difference between total revenue and external and internal costs.

The internal costs also include the normal profit of the entrepreneur. (An entrepreneur's normal profit is the minimum fee required to retain entrepreneurial talent.)

Profit determined on the basis of accounting

, represents the difference between income from various activities and external costs.

Currently, there are five types (stages) of profit in accounting: gross profit, profit (loss) from sales, profit (loss) before tax, profit (loss) from ordinary activities, net profit (retained profit (loss) of the reporting period) .

Gross profit

is defined as the difference between the proceeds from the sale of goods, products, works, services (minus VAT, excise taxes and similar mandatory payments) and the cost of goods, products, works and services sold.

Revenue from the sale of goods, products, works and services is called income from ordinary activities.

Costs for the production of goods, products, works and services are considered

expenses for ordinary activities.

Gross profit is calculated using the formula

where VR

- revenues from sales;

C

– cost of goods, products, works and services sold.

Profit (loss) from sales

represents gross profit less administrative and selling expenses:

where is Ru

– management costs;

Rk

– commercial expenses.

Profit (loss) before tax

– this is profit from sales taking into account other income and expenses, which are divided into operating and non-operating:

where Sodr –

operating income and expenses;

Svdr –

non-operating income and expenses.

Operating income includes income related to the provision of the organization's assets for temporary use for a fee; receipts related to the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property; proceeds related to participation in the authorized capitals of other organizations (including interest and other income on securities); proceeds from the sale of fixed assets and other assets other than cash (except foreign currency), products, goods; interest received for the provision of an organization's funds for use, as well as interest for the bank's use of funds held in the organization's account with this bank.

Operating expenses are expenses associated with the provision for a fee for temporary use (temporary possession and use) of the organization’s assets; costs associated with the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property; expenses associated with participation in the authorized capitals of other organizations; interest paid by an organization for providing it with funds (credits, borrowings) for use; expenses associated with the sale, disposal and other write-off of fixed assets and other assets other than cash (except foreign currency), goods, products; expenses related to payment for services provided by credit institutions.

Non-operating income includes fines, penalties, penalties for violation of contract terms; assets received free of charge, including under a gift agreement; proceeds to compensate for losses caused to the organization; profit of previous years identified in the reporting year; amounts of accounts payable and depositors for which the statute of limitations has expired; exchange differences; the amount of revaluation of assets (except for non-current assets).

Non-operating expenses include fines, penalties, penalties for violation of contract terms; compensation for losses caused by the organization; losses of previous years recognized in the reporting year; amounts of receivables for which the statute of limitations has expired, and other debts that are unrealistic for collection; exchange differences; the amount of depreciation of assets (except for non-current assets).

Rice. 20 Relationship between profit indicators

Profit (loss) from ordinary activities

can be obtained by subtracting from profit before tax the amount of income tax and other similar mandatory payments (the amount of penalties payable to the budget and state extra-budgetary funds):

where N

– amount of taxes.

Net profit

is profit from ordinary activities taking into account extraordinary income and expenses (Fig. 20):

where Chdr –

extraordinary income and expenses.

Extraordinary income is considered to be income arising as a consequence of extraordinary circumstances of economic activity (natural disaster, fire, accident, nationalization, etc.). These include insurance compensation, the cost of material assets remaining from the write-off of assets unfit for restoration and further use, etc. Extraordinary expenses include expenses that arise as a consequence of emergency circumstances of economic activity (natural disaster, fire, accident, nationalization of property and so on.).

Information used to fill out line "2350"?

The information base for line 2350 of the financial document under consideration is the final turnover indicator. In this case, the following are not taken into account:

- accounts on which interest is payable

- value added tax invoices

- excise taxes

- other similar obligatory financial resources that the company receives from contractors and citizens

Data Search

The indicator for Dt 91-2 corresponds with the credit of various accounts: account. 01, count. 02, count. 10, count. 50, count. 52, count. 60, count. 62, count. 76.

In the financial report it is allowed not to make a detailed reflection of other expenses:

- If the accounting rules provide for or do not prohibit their reflection in this form.

- If the company’s income and the costs associated with them arose from one identical fact of entrepreneurial actions and are not particularly significant in the final parameter of the financial condition of the enterprise.

Income statement

From which reserve funds are created and funds for circulating production are increased.

Net profit is calculated as follows:

Income Tax Expense – Income Tax Recovered + Extraordinary Expenses – Extraordinary Revenues + Interest Paid – Interest Received. The result is an amount equal to EBIT, which stands for “earnings before interest and taxes.”

If you add depreciation deductions to the resulting amount and subtract the revaluation of assets, you get the EBITDA value. This indicator is used to level out the impact of income tax payments, borrowed funds and non-current assets.

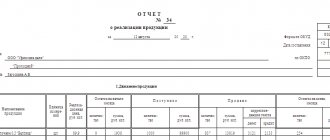

Line 2350: examples of data entry

The indicator entered in line 2350 of the report under consideration is the sum of other company expenses without the total value of line 2330. For clarity, the formula for its calculation can be as follows:

Page 2350 = TO count. 91/2 – page 2330,

where DO count. 91/2 – the amount of annual turnover in the debit of subaccount 91-2.

Attention! When preparing a simplified reporting document, nothing is deducted from the total amount of the company's other expenses.

Let's look at a practical example of the calculation procedure and rules for filling out line 2350.

First option: the company shows the amounts in detail.

In this case, the volume of other expenses is simply equal to the final debit to subaccount 91-2:

Page 2350 = TO count. 91/2

This excludes excise taxes, VAT, interest payable and similar payments that the company receives from third-party business entities and citizens, reflected in account 91-2.

Second method: collapsed presentation of indicators.

Page 2350 = TO count. 91/2 for unbalanced other costs + (KO account 91/1 - DO 91/2) for balanced income and spent funds,

where KO count. 91/1 – total turnover according to Kt 91-1.

For example:

TO count. 91-2 equals 9870 thousand rubles.

KO account 91/1 is 7890 thousand rubles.

Then page 2350 = 9870 + (7890 – 9870) = 9870 – 1980 = 7890

The amount of costs related to other expenses of the organization is entered in parentheses (round brackets) in the document on the company's performance results. So, the result from the above example should be reflected in line 2350 in the following form: (7890).

So, in the course of business activities, in addition to the main costs, firms incur costs called other. Due to the fact that their number constitutes a significant share of the total expenses, the legislation distinguishes them into a separate group and requires them to be included in a special line of the annual financial report with code “2350”. The legislator provided business entities with freedom to classify their own expenses and consolidate it in their accounting policies.

Filling out line 2350 is based on the resulting accounting data, namely the final debit of subaccount 91-2 in correspondence with various accounts. The calculation of the amount depends on the option chosen by the company for reflecting the result: collapsed or expanded. The total value is indicated in the reporting document enclosed in parentheses.

Top

Write your question in the form below