What is a security deposit

A security deposit is a fairly effective tool. Until 2020, the use of this tool was not regulated in the Civil Code of the Russian Federation. But now the situation has changed. A security payment is a powerful instrument intended for the fulfillment of undertaken obligations, which is used in various areas. An example is a situation in which transactions are carried out with a guarantee fee in the form of shares and bonds. It occurs within the framework of the concepts of conditional transactions. For example, if circumstances specified in the contract come into force, the security payment is included in the invoice in order to pay off the debt (

Connection with VAT

When drawing up the contract, the seller does not know whether the security deposit will be returned to the buyer after all obligations are fulfilled. Therefore, the amount of the fee is included in the VAT base. According to the Ministry of Finance, the security payment is subject to VAT , since it is associated with payment for work performed, services or goods.

In case of early termination of the contract, the amount of payment that the seller received for services, work or goods not provided will not be included in the VAT base. Upon his return, updated information .

If, upon expiration of the contract, a new agreement is concluded between the parties and payments under the previous contract are charged against the new one, then the VAT calculated upon receipt of the guarantee will not be deducted. The security payment will not be returned to the tenant, and there will be no need to re-assess the tax on the amount of the payment taken into account in the new agreement.

https://youtu.be/RgH7soU6bw8

Features of applying a security deposit

The security payment has certain properties. If we turn to the Civil Code of the Russian Federation, then this method is not considered as a fine, the amount of which the debtor must pay in case of violation of the terms of the contract. The use of this method is intended to repay property losses, as well as debts. These circumstances are given in Art. 381.1 Civil Code of the Russian Federation.

A security deposit represents a kind of guarantee that the conditions listed in the contract will be met. It is included in the account in order to pay off the debt (the amount should not exceed the established one). That is, it is one of the types of liability measures. Due to the specifics of the security payment, it cannot be used for the purpose of enrichment, since its main purpose is to restore the creditor’s condition in accordance with the terms of the agreement.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Regulations under the Civil Code of the Russian Federation

In ch.

23 of the Civil Code of the Russian Federation, clause 8 was added on payment with security, which includes parts 381.1 and 381.2, which began on June 1, 2015. The essence of the standards specified in the document comes down to the transfer by one party of a certain amount to another person under the main obligation, in the absence of implementation of which the payment remains with the holder. Securities (bonds, shares), cash or items defined by generic characteristics can be transferred as payment.

The legislation provides for the following cases for the return of a security deposit:

- if circumstances have not occurred as a result of which the amount will be accrued;

- the secured obligation has been terminated.

This is not a measure of responsibility for the violation committed.

The amount received will cover property losses within the limits of losses or debt. However, the tenant will not be able to satisfy the size of the payment with security requirements that exceed its own costs and debts. Upon proper performance of official obligations, the debtor receives his payment back.

In accordance with Art. 317.1 of the Civil Code of the Russian Federation, interest is not accrued .

The legislative framework

The provisions governing the use of this method are prescribed in the Civil Code of the Russian Federation. The legislation also provides for the definition and main features of a security deposit. This type of payment assumes that one of the parties to the contract deposits an agreed amount into the account of the other party. This payment obliges you to adhere to the terms of the contract, or to compensate for losses in case of violation of these terms.

Important! If ultimately all obligations are fulfilled by the debtor properly, the security payment is returned to him.

The main function of a security payment is to cover possible losses of the creditor. It does not represent one of the ways to punish a violator, and this is where payment differs from a deposit.

Advantages and disadvantages, as well as nuances of these legal relations

Considering the advantages of this form of security, we can highlight the opportunity for the injured party to fully compensate for losses incurred in the event of dishonest behavior of the culprit. The party accepting such collateral does not actually risk anything.

On the other hand, the person who transfers the money only risks if he does not fulfill the agreement. Based on this, such a payment is not only a guarantee, but also a catalyst for a conscientious attitude towards the undertaken obligations.

The only negative is that the party that transferred the money, receiving it back, loses part of its purchasing power.

The only nuance of a security deposit is that if the contract is drawn up incorrectly, it may begin to mask another transaction (for example, a deposit or an advance). And, accordingly, it may be declared invalid by the court, which will lead to the loss of compensatory functions, since the money will have to be returned back to the owner.

A security payment is an obligation that provides for the ability of a bona fide participant in a transaction to protect possible losses, and not to force another participant to fully fulfill it.

You can learn more about the security deposit from the video:

See also Phone numbers for consultation January 10, 2020 kasjanenko 341

Share this post

Discussion: 2 comments

- bor123vip says:

06/30/2017 at 05:30Great innovation! I've been waiting for it for a long time, now I should try to use it. The only bad thing is that the law does not clearly indicate how to formalize this security. Well, I think that a separate clause in the text of the contract will do. The British call this a Security Deposit, and as a rule, it is not refundable. In principle, I agree with such an interim measure, but non-refund is too much. Therefore, since 2010, I have been demanding that foreign partners either remove the security deposit altogether or prescribe a condition for its return.

Answer

- Ivan says:

06/07/2019 at 21:31

Is there any way to get the security deposit back if the deal falls through due to circumstances allegedly intentionally created by the other party?

Answer

Security payment as a method of fulfilling obligations

The most popular options for using the payment in question include:

| Use Cases | Example |

| Preliminary agreement | The moment of making the security payment can be used as a starting point for starting to fulfill the terms of the contract. That is, with the payment being made, the deadline for the fulfillment of obligations by the second party begins. Until the payment is received, accordingly, the party does not begin to execute the contract. |

| Lease contract | The lease may provide that the security deposit will be offset against the last rent not paid by the tenant |

| Supply contract | The supply agreement, for example, may include a condition that if payment for the goods is delayed, the payment amount will increase. In this regard, the buyer will endeavor to properly fulfill its payment obligations. A condition may also apply when, in case of timely payment for the goods, the creditor returns part of the security payment. |

Basic Concepts

A monetary obligation, which one party undertakes to provide to the other party as security for obligations assumed, can be provided even for those obligations that arise only in the future.

This definition is enshrined in Article 381.1 of the Civil Code of the Russian Federation, answering the question of what a security deposit is. If certain circumstances occur, the party who received the security payment (SP) has the right to offset the funds against the fulfillment of the obligations for which the funds were received. Consequently, such a tranche acts as a deposit made to the creditor’s current account, from which funds can be withdrawn in favor of fulfilling accepted obligations.

A security deposit as a way to ensure the fulfillment of obligations is often used when concluding lease agreements. For example, the tenant agrees to pay monthly rent to the owner of the property. If the monthly tranche is not received on time, the lessor has the right to write off unpaid obligations from the deposit. The lessor also has the right to write off the cost of damaged property, if such was provided for in the lease agreement.

How an agreement is drawn up

Current legislation does not establish specific requirements for the form in which the agreement on making the payment in question must be drawn up. But this does not mean that you should rely only on the norms established by the Civil Code of the Russian Federation. Since the code does not have enough specific data.

Particular attention should be paid to additional specification of the terms of the contract, such as:

- primary obligation;

- specific conditions under which crediting to the main obligation occurs;

- return conditions;

- accrual of interest for the use of funds.

Funds are transferred in the form of a fixed amount to the creditor’s account in accordance with the stated obligations. There is no legislation prohibiting the use of these means. For example, if the obligations are established for a long period and the payment amount is quite large, then the creditor is not prohibited from receiving additional profit from the use of these funds in the company’s turnover. Thus, the contract can include a clause according to which the debtor will receive interest on his money.

Positive and negative sides

Payment of the security deposit may be made in foreign currency. At the same time, you should pay attention that in case of fulfillment of obligations, it is also returned in foreign currency. If the agreement is concluded for a short period or is envisaged for its annual renewal, then it is necessary to pay attention to the fact that the security agreement is transferred from one agreement to another. If you make a mistake, the counterparty can appropriate this money for himself and it will be very difficult to prove this in court. If you provide for this nuance in the contract, then disputes may be avoided. It would be better if the contract excludes the possibility of using this payment as repayment of a fine. Sanctions may be excessively high and it will be very problematic to obtain any excess in the future.

Important! A security payment allows you to receive guaranteed funds in accordance with the contract before breach of obligations.

The legislation does not establish the procedure for using these funds. That is, the creditor has the right to put this money into circulation in order to increase profits. Then the contract must provide for a clause on the payment of interest.

Accounting for security deposit

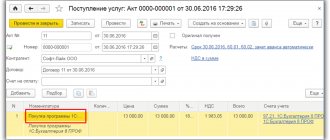

If there is an appropriate agreement, then the transfer of the security payment should be reflected in the company's accounting. Funds received are reflected as accounts payable - D51 K76. In addition, the guarantee transfer is also reflected by debit to account 008 (off-balance sheet account). When a refund occurs, the following entry is drawn up - D76 K51, and this amount is reflected in the credit of account 008.

If the terms of the contract were violated, as a result of which the counterparty suffered losses, then the funds are used to pay off the debt. In this case, the operation has the following form - D76 K 89. The amount of VAT withheld is reflected by posting D90.3 K68 (Read also the article ⇒ Security payment: postings).

Return of security deposit

Important! If the obligations under the contract provide for a long period and a large amount, then the creditor has the right to receive additional profit from the use of the security payment in the company’s turnover.

In the event of termination of the contract, the counterparty's obligation is to return the security deposit. This procedure is carried out in accordance with the conditions stipulated by the contract. If these conditions are not specified, then the interested party submits a letter of claim to the counterparty, according to which the latter is obliged to return the money.

Transfer of collateral

It is not uncommon for concluded contracts to be fully executed, their validity periods have passed, and payment remains unclaimed. What to do with funds? Everything depends on further circumstances.

If the parties have fulfilled the accepted conditions and do not plan to enter into new contracts, then the guarantee amount must be returned to the debtor. Moreover, the volume of the return is determined on an individual basis, taking into account the agreements specified in the contract. Let us remind you that in certain cases the creditor has the right not to return the money at all.

The repayment period must be specified in the contract, as well as the amount and rules for writing off the security amount. If such conditions are not fixed in the text of the agreement, then the refund must be made no later than 7 days from the date of receipt of the request for the return of the security.

If the parties decide to extend cooperation, then the security payment can be transferred to a new agreement. But only if such a condition is enshrined in the original contract. If there are no agreements, then it is best to return the money, and then enter into a new agreement and re-transfer the security. The second option is to decide the fate of the security deposit by agreement of the parties. For example, by concluding an agreement that the security will be transferred to a new contract.