General provisions

Accounting is mandatory for almost all Russian organizations.

Even small businesses are no exception. Although simplified accounting and financial report forms are provided for them. Thus, companies annually send completed forms (both balance sheet and F-2) to the Federal Tax Service. Please note that for some categories of entities there are obligations to submit interim reports. For example, public sector employees and some insurers are required to submit accounting reports monthly and quarterly. Also, interim financial statements are required to be prepared by accountants of those companies in which such a decision was made by management.

The main composition of financial statements is a balance sheet, a statement of financial results, as well as appendices to them (financial statements: Form 1, Form 2). Let us note that the structure, composition and procedure for filling out accounting reports are regulated by Order of the Ministry of Finance No. 66n dated 07/02/2010.

What changes in financial reporting forms for 2020?

All organizations must submit their financial statements by April 1 inclusive. In 2020, there were changes to reporting forms and accounting rules. Below, the review provides recommendations. What new things to consider when you prepare reports.

Submit your reports for 2020 using the forms from the Order of the Ministry of Finance dated July 2, 2010 No. 66n. In 2020, the Ministry of Finance made changes to the forms (Order of the Ministry of Finance dated March 6, 2018 No. 41n). The amendments were minor. But check that the reporting form is in the current edition.

There are also new forms with a line about mandatory audit and indicators. Which take into account amendments to PBU 18/02. But they cannot be used when submitting reports for 2020. The Ministry of Finance has not yet approved the forms. It will be necessary to report on them for 2020.

Let us remind you that organizations submit financial statements for 2020 only to the tax authority; there is no need to submit financial statements for 2020 to statistical authorities. An exception is organizations whose financial statements contain state secrets, as well as organizations in cases established for them by the Government of the Russian Federation; they continue to submit reports to the statistical authorities at the place of registration (see clause 3, clause 7 of Article 18 of Law No. 402 - Federal Law “On Accounting”).

The general rule is that starting from 2020, a legal copy of the reporting and the auditor’s report on it is submitted to the tax authority via TCS channels in the form of an electronic document. At the same time, paragraph 2 of Art. 4 of Law No. 444-FZ of November 28, 2018 allows small businesses to choose the form of presentation of financial statements for 2020 - on paper or in the form of an electronic document.

As the Ministry of Finance of the Russian Federation explains in Information Message No. IS-Accounting-18 dated May 28, 2019, changes in reporting forms are associated with the introduction of a state information resource for the accounting statements of organizations. This resource is formed and maintained by the federal executive body authorized for control and supervision in the field of taxes and fees (clause 2 of Art.

In the header part of the financial reporting forms there are codes of reporting forms in accordance with the All-Russian Classifier of Management Documentation OK 011-93 (as amended by Rosstandart Order N676-st dated June 25, 2014).

| Name of the reporting form | OKUD form code (new) | OKUD form code (former) |

| Statement of changes in equity | 0710004 | 0710003 |

| Cash flow statement | 0710005 | 0710004 |

| Report on the intended use of funds | 0710003 | 0710006 |

The type of activity of the organization should be indicated in accordance with the All-Russian Classifier of Types of Economic Activities OKVED 2; earlier the OKVED classifier was mentioned in the forms.

2. Units of measurement of reporting indicators

Previously, when filling out financial reporting forms, organizations had a choice of units of measurement for indicators - thousands of rubles (code 374 according to OKEI) or millions of rubles (code 375 according to OKEI). According to the new rules, there is no such choice: starting from the financial statements for 2020, indicators must be presented only in thousands of rubles (code 374 according to OKEI).

3. Mandatory disclosure of information about the audit organization that conducted the audit of the statements has been introduced

When the financial statements of an organization are subject to mandatory audit, the heading part of the balance sheet discloses: the name of the auditing organization, its Taxpayer Identification Number (TIN) and OGRN. If the audit was carried out by an auditor - an individual entrepreneur, his full name, INN, and OGRNIP are disclosed.

Thus, for an LLC, the appointment of an audit, approval of the auditor and determination of the amount of payment for his services falls within the competence of the General Meeting of Participants. The company's charter may refer this issue to the competence of the company's board of directors (clause 2.1, article 32, clause 10, clause 2, article 33 of Law No. 14-FZ “On LLC”).

If, at the time of submission of the statutory copy of the reporting to the tax authority, the audit has not yet been carried out and the reporting is presented without an audit report, the audit report can be submitted later within 10 working days from the day following the date of the audit report, but no later than December 31 of the year following the reporting year. year, i.e.

no later than December 31, 2020. However, the submitted reports must indicate that the reports are subject to mandatory audit (see example below). According to the Draft Order of the Federal Tax Service “On approval of formats...”, an audit report in PDF format, submitted after submitting financial statements to the tax authority, is submitted using the document format necessary to ensure electronic document flow with the tax authority, approved by Order of the Federal Tax Service of Russia dated January 18, 2017 No. MMV -7-6/ [email protected]

An example of a block of information about the auditor in the header section of the organization's annual balance sheet.

In order to bring the forms of financial statements into compliance with the new edition of PBU 18/02 “Accounting for calculations of income tax of organizations”, the composition and name of the indicators disclosing the amount of income tax in the Statement of Financial Results (OFR) were clarified.

| OFR lines in reporting for 2020 | OFR lines in reporting for 2019 | ||

| Line name OFR | Line code | Line name OFR | Line code |

| Income tax, incl. | 2410 | This line was missing | |

| Current income tax | 2411 | Current income tax, incl. | 2410 |

| Permanent tax liabilities (assets) | 2421 | ||

| Deferred income tax | 2412 | Change in deferred tax liabilities | 2430 |

| Change in deferred tax assets | 2450 | ||

| Tax on profits from transactions the result of which is not included in the net profit (loss) of the period | 2530 | This line was missing | |

Changes regarding the procedure for reflecting income tax information in the FMR will come into force starting with the financial statements for 2020, i.e. simultaneously with the corresponding changes to PBU 18/02. The organization has the right to decide to apply such changes before the specified period, including when the head compiles reports for 2020.

According to the general rules, the balance sheet - Form 1 must be submitted as part of the reporting for the past year no later than March 31 of the following year. This deadline must be observed when submitting balance sheets and other forms to the Federal Tax Service and statistics.

In addition, under certain conditions, an audit report must be sent to Rosstat as an attachment. The deadline is set for ten days, but no later than December 31 of the following year.

Some organizations need to submit financial statements and publish them due to the type of activity they carry out, or according to other criteria defined by law. For example, tour operators must send their reports to Rostrud within three months from the date of their approval.

The legislation provides for separate deadlines for organizations that registered after September 30 of the reporting year. Due to the fact that their calendar year may be determined differently in this case, the due date may be set by such organizations on March 31 of the second year after the current one. For example, Rebus LLC received an extract from the Unified State Register of Legal Entities on October 25, 2017; the accounting report must be submitted for the first time on March 31, 2020.

Attention! Accounting statements are usually submitted based on the total for the year. However, it is possible to present it quarterly. In this case it is called intermediate. Such documentation is very often needed when applying for loans from banks, company owners, etc.

https://youtu.be/XU_CzO2XusA

Required Forms

The reports that all companies without exception are required to submit include a balance sheet and an income statement: Form 1 and Form 2.

Balance sheet 2020 - form 1 and 2 - this is directly a statement of financial results. Let us recall that earlier f. No. 2 had a different name: “Profit and Loss Statement.” Officials also excluded the numbering of reporting forms. Previously, all forms were identified by their number. Currently, the use of numbering for accounting records is not provided for at the legislative level. However, accountants continue to name forms the old fashioned way.

We described in detail the general composition of financial statements in the article “Forms of financial statements”. Unified forms for small businesses: “Simplified accounting financial statements for 2020.”

Next, let's look at how financial statements are filled out: sample forms 1 and 2 will show the key points of filling out.

Form (form) and procedure for drawing up the liquidation balance sheet

Preliminary preparation of data and the preparation of the liquidation balance sheet itself, due to its certain specifics, usually falls on the shoulders of accounting workers. Although, formally, according to the law, this procedure must be carried out by the liquidation commission.

For 2020, there is no established form of the final liquidation balance sheet for commercial organizations (except for banks and budgetary institutions).

At the same time, in October 2020, the tax office officially explained that the liquidation balance sheet can be prepared in the form of a balance sheet, approved by the founders (participants) of the LLC or the person who made the decision to liquidate it.

Form No. 1 “Balance Sheet”, recommended in such cases, is usually taken as a basis.

Balance sheet: briefly about the main thing

F. No. 1 is the main financial report on the current state of the company’s economic activities. The balance sheet consists of two equal parts or sides: an asset and a liability. In turn, each part is structured and contains generalized indicators about property, valuables, reserves, liabilities, capital, reserves and others.

Accounting data is presented over the past few years. That is, the financial report allows you to compare similar indicators in relation to the same period of previous years.

Unified form

In f. No. 1, you should enter accounting data generated as of the reporting date. If errors from previous years were identified during the reporting financial year, the information must be corrected. Information about discrepancies must be disclosed in detail in an explanatory note in the balance sheet.

Report on financial results of activities - form No. 2

The current form is OKUD 0710002, the tabular part reveals indicators of income, expenses from business or other activities, as well as the results of the financial activities of the institution.

NPOs are required to submit this report if:

- During the reporting period, the organization received its own income from the sale of work and services, and the sale of goods.

- The amount of income received from business activities is significant in relation to total income.

- Reflection of income in the report on the intended use of funds is not enough to fully disclose information about the implementation of activities.

- The lack of information prevents a real assessment of the organization's financial condition.

Accounting according to f. No. 2 consists of the title part, which indicates the details of the economic entity: name of the non-profit organization, type of activity, legal form of ownership, TIN. The tabular part of the document contains:

- name of the indicator;

- line code for each item;

- numerical expression of the indicator for the reporting period;

- the same figure for the previous period.

Some lines of the tabular section are subject to additional decoding in the explanatory note to the report. Due to the disclosure of information for the reporting and previous periods, inconsistencies may arise that need to be corrected.

| Form 2 financial statements |

| Form 2 financial statements |

Financial results report

The old profit and loss reporting form has been adjusted, but only slightly. The form must also indicate information about income received during the reporting period. And also provide information about all expenses that the company incurred in the calendar year.

Accounting data is indicated over time, that is, for the reporting and previous years. This structure allows you to immediately identify significant deviations and analyze them. Let us remind you that a detailed and thorough analysis of reporting indicators is the key to a successful business. It is the analysis that makes it possible to timely identify weaknesses in activities and make the right management decisions.

Current report form

Note that the unified financial reporting form itself contains the basic rules for filling it out. So, for example, the amount of revenue should be indicated minus value added tax and excise taxes (line 2110).

If necessary, the report data will have to be detailed in the explanatory note to the balance sheet.

Form 1 (sample)

All organizations are required to prepare financial statements, which include, among other things, a balance sheet and a statement of financial results.

How is Form 2 compiled?

- Revenue data is indicated in line 2110. It is necessary to show all income data that relates to the usual activities of the enterprise.

- In line 2120 you will need to indicate the cost of sales. In fact, the amount of expenses for all types of activities of the enterprise is indicated. For example, expenses that are formed on the basis of production of products, purchase of raw materials, performance of certain works;

- In line 2100 you will need to indicate the gross result. This is ordinary profit data excluding all administrative and selling expenses. To calculate this indicator, you need to deduct the cost of sales from the amount of revenue. If a negative indicator is formed, it is indicated in brackets (round brackets are used);

- All commercial expenses that are generated at the enterprise are entered in line 2210, and administrative expenses are indicated in line 2220;

- Line 2200 contains an indication of data in the form of profit or loss of the enterprise. The calculation is carried out by deducting commercial and administrative expenses from the amount of gross profit;

- All income that is received indirectly is reflected in line 2310, for example, indicating dividends or the value of property. Income received from participation in other organizations is indicated in line 2310, and the interest that the enterprise receives on loans and securities is indicated in line 2320;

- The interest that the company will pay itself is indicated in line 2330, and other expenses in the next two lines;

- Line 2300 indicates tax profit. This line shows the accounting profit or loss from the activities of the enterprise, but the current tax indicators should be reflected in line 2410.

Net profit should be reflected in line 2400. After compiling this table, reference information is provided. The results of the revaluation of non-current assets are indicated, without taking into account net profit. It is imperative to indicate the results of all transactions that did not include net profit. Data on the overall financial result, etc. is provided.

This form must be signed by the supervisor. Previously, the document was necessarily signed by the chief accountant; today, the document should not contain this detail, but at the same time, the legislator does not prohibit the accountant’s signature on the document.

Form 1 and Form 2 of financial statements

Forms 1 and 2 of financial statements are the main reporting forms - these are the balance sheet and the income statement. Not a single set of reporting documentation for any company can do without them.

- A balance sheet is a set of indicators of a company’s performance as of the reporting date (about the residual value of fixed assets, cash balances in accounts and in cash, accounts payable and receivable, etc.);

- An income statement is data about revenues, expenses and profits for a reporting period of time.

These forms are supplemented by other related reports (capital flow, cash flow, etc.). The information contained in them explains and details the data reflected in Form 1 and Form 2 of financial statements.

Forms 1 and 2 are present in accounting reports compiled for any period (month, quarter, year). For example, the minimum set of financial statements for the 1st quarter of 2020 (if the company prepares interim accounting statements by decision of the owners or for other reasons) must necessarily include both forms. At the same time, such a reporting set can be supplemented with detailed explanations (if there is a need for them).

Both reports have a unified form approved by order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n.

Basic requirements for preparing financial statements

With the exception of cases specified in the Law “On Accounting” dated November 6, 2011 No. 402-FZ, financial statements consist of a balance sheet and a statement of financial results. They are often called forms 1 and 2 (forms 1 and 2 of the balance sheet).

Accounting statements are submitted by all organizations maintaining accounting records in accordance with Art. 6 of Law 402-FZ. It can be intermediate and final.

Final reporting is prepared at the end of the reporting period, which lasts from January 1 to December 31, interim reporting - based on the results of the month and quarter (clause 36 of the Accounting Regulations No. 34n).

Data from previous reporting periods that turn out to be incomparable with data from the current period are subject to adjustment in accordance with the current reporting procedure. If the adjustment turns out to be significant, then its reasons and consequences are reflected in the explanatory note. The procedure for classifying deviations as significant is determined by the company independently and is fixed by it in its accounting policies (clause 3 of PBU 22/2010).

Accounting statements are compiled on an accrual basis from the beginning of the year. It should give an objective picture of the organization's assets and liabilities, its income, costs and revenue.

Form 1: balance sheet

The balance is a table divided into 2 parts:

- Part 1. Balance sheet assets are the assets and liabilities of a company that are used in its activities and can bring benefits to it in the future.

- Part 2. Balance sheet liability - reflects the sources of formation of the balance sheet asset.

In a correctly drawn up balance sheet, the equality is satisfied:

balance sheet asset items = balance sheet liability items

In more detail, this equality for Form 1 of the financial statements looks like this:

Section 1 + Section 2 = Section 3 + Section 4 + Section 5,

- Section 1 - the value of non-current assets (long-term used property, the cost of which is repaid in installments).

- Section 2 - the cost of current assets (quickly turnover and quickly redeemed assets: materials, inventories, etc.).

- Section 3 - the value of capital and reserves (sources of the company's own funds).

- Section 4 and Section 5 are long-term and short-term liabilities expressed in monetary terms, respectively (the company's obligations to pay loans, loans, taxes, wages, etc.).

Cash flow statement - form No. 4

Most non-profit organizations have the right to conduct accounting in a simplified way. The issue of the procedure and composition of simplified reporting is discussed in the topic: “We submit reports according to a simplified scheme.” In case of insignificant cash flows or their complete absence, the organization has the right not to provide document OKUD 0710004.

The report contains information on the annual movement of financial flows in terms of receipts, expenditures, lending, invested activities and other areas of the company. Disclosure of indicators should be carried out taking into account balances at the beginning and end of the calendar year in the currency of the Russian Federation (rubles). If a non-profit enterprise makes payments in foreign currency, then the report indicators are subject to conversion (recalculation) into rubles at the exchange rate on the date of preparation of the financial statements.

The report does not include the following types of cash flow amounts:

- investments of funds related to investing in government securities, bills, shares and other cash equivalents;

- cash receipts from the repayment of cash equivalents excluding interest and payments accrued during the period of use;

- currency exchange transactions without taking into account exchange rate differences (profit or loss);

- transactions for the exchange of cash equivalents without taking into account gains and losses during the exchange;

- transfer of funds of the organization between its current accounts;

- write-off operations to receive cash from the company’s current account;

- other similar cash flows.

A detailed filling algorithm is presented in the Regulations on BU 23/2011 (Order of the Ministry of Finance of the Russian Federation dated 02.02.2011 No. 11n). The text is posted on the official website of the Ministry of Finance.

| Form 4 financial statements |

| forms 4 |

Filling out the form

Form 2 of the financial statements shows the income and expenses that form the profit/loss of the enterprise in the reporting year. The form also provides data for the same period of the previous reporting year.

The “header” indicates for what period the report was compiled; company name, INN, OKPO; Next, the numerical indicators are filled in.

Expenses on separate lines, as well as losses, are indicated in parentheses, since they are deducted from income amounts. Units of measurement are thousands (code 384) or millions (code 385) rubles.

For filling out, accounting registers and analytics for cost accounts, accounts 90, 91, 84, 99, etc. are used.

The manager signs the report and sets a date for completion.

Enterprises that have the right to submit simplified reporting (Clause 4, Article 6 of Law No. 402-FZ) use the usual form with aggregated indicators, or its simplified version.

How to fill out Form 2 of financial statements is described in detail here.

How to fill out the form

The finished form can be downloaded from the Internet. It is filled out in the form of a table. Before entering information at the top of the form you must enter information about:

- company details, including TIN, OKVED, OKOPF, OKPO, OKFS codes;

- reporting period and date;

- units of measurement (usually in thousands of rubles).

The financial performance report and its preparation is the topic of this video:

https://youtu.be/__8u4j_pFhA

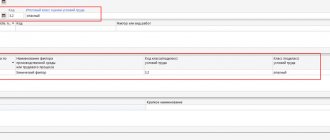

Table

The table itself has 4 columns:

- Explanation of the report (number).

- Index.

- Line code (Appendix 4 Ex. No. 66n).

- The size of the indicator for the current period and for the corresponding period in the previous year (it is taken from column 3 of the Report for the previous year).

Explanations for filling out the table

If the data for the previous and current year is not comparable, the information for the previous year must be adjusted, depending on changes in the accounting policies of the enterprise, legislative and other regulations.

The distribution of expenses in the financial statements is made in the following form:

| Name | Line code | Explanation |

| Revenue | 2110 | Receipts from the main activities of the enterprise: sales, provision of services, works. |

| Cost of sales | 2120 | Expenses related to revenue, that is, income from the company's core activities, funds spent on the purchase of raw materials, supplies, goods, production costs, receipt or sale of work and services. |