The MP (micro) form for 2020 is one of the few forms of statistical reporting that has not yet changed and is submitted on the usual form. Who are the respondents to this form? What should be included in it and when should it be submitted? Instructions for compiling the MP (micro) statistical form are in our article.

Also see:

- New form 1-IP for 2020

- STD-PFR form: who submits it (issues it) and when

MP respondents (micro). Who are they?

The obligation to prepare statistical reporting forms depends on the size of the enterprise and the type of activity performed. Even if the organization is one of those who are required to submit one form or another, it is not at all necessary that there is an obligation to submit it. For an obligation to arise, an organization must be included in the sample of statistical bodies. You can find out which reports should be submitted to statistics for the year on the official website of Rosstat.

Let's look at the MP (micro) form for 2020 in our article. It should not be confused with the MP (micro) form - in kind for 2020: these are two completely different statistical reports.

Respondents to the SE (micro) form are microenterprises. Individual entrepreneurs are not classified as such, so they do not have to submit the form.

The criteria by which a company can be classified as a micro-enterprise are specified in the law “On the development of small and medium-sized enterprises in the Russian Federation” dated July 24, 2007 No. 209-FZ.

What conditions must be met for a company to be classified as a micro-enterprise:

All micro-enterprises must be in a special register of small businesses. You can view the register on the official website of the tax office. If you meet all the criteria for the concept of a micro-enterprise, but you are not in the register, this is a reason to concern yourself with this issue and send a request to clarify the information in the register. This can also be done on the official website of the tax office.

Who's under the gun?

TZV-MP is a report that, although many, but not all business participants must submit. For example, the following are exempt from this requirement:

- microorganizations;

- large, medium-sized companies;

- individual entrepreneurs.

But representatives of the small sector of the economy, including farms, are required to provide this report.

How can you determine if a company is one of those that should report? It’s quite simple - a company is part of a Russian small business if:

- the number of hired personnel (average parameter) ranges from 15-100 people;

- annual income ranges from 120 to 800 million rubles;

- the share of participation in LLCs of various funds, municipalities, etc. is no more than 25%, and that of other companies (including foreign ones) is no more than 49%.

It should be remembered that if any of these values are exceeded for three years in a row, the small enterprise ceases to be such.

On what form do we submit the MP (micro) for 2019?

As already mentioned, the form has not changed over the past year. It was approved in Appendix 13 of Rosstat Order No. 461 dated July 27, 2018.

Fill out the form in accordance with the instructions approved by Rosstat Order No. 654 dated November 2, 2018.

How to fill out the document?

When entering information, you must adhere to certain instructions:

- sheets must not be connected with paper clips, staplers or clamps;

- You need to enter data in sections specially designated for them;

- correct all errors using the sample document;

- It is unacceptable to use a proofreader and cover up erroneous data with parts of the paper.

On the first sheet of the report, before the section on general information, you need to enter the details of the organization: full name and postal address.

Here you can find a free example of filling out a report.

All questions of the form are combined into 4 sections and occupy the same number of sheets.

If you are interested in how to get statistics codes, read this material. You will find information about consolidated reporting and the features of its preparation here.

Section 1. General information about the enterprise

Enter here:

- legal and actual address of the company;

- the date when the company began to engage in economic activity;

- the exact number of working months over the past year (for non-permanent organizations);

- information on possible structural changes in joint stock companies in previous years;

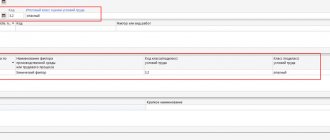

- taxation systems used by the company in the reporting period.

If it is necessary to select from the proposed items, the correct answers are indicated in the provided columns with an “X”.

Section 2. Main performance indicators of a legal entity

- 2.1. The total number of employees of the company and the accrued salary is included here: the average number of working people per year, including payroll employees, external part-time workers, employees hired under civil contracts;

- only the number of workers on the payroll;

- the total amount of accrued staff salaries;

- only the monetary volume of salaries of employees on the payroll and external part-time workers;

- the average number of all people working in the company in 2014.

- the cost of products at which they were purchased for subsequent resale in the reporting period, while the year of purchase is not important;

Section 3. Fixed assets and investments in fixed capital

- 3.1. The paragraph explains which fixed assets are not indicated in the report lines. Tangible fixed assets include buildings, tools, transmission devices, livestock, computer equipment, transportation, and so on. Intangible ones are developments, computer software, copyrights, monetary costs for the exploration of valuable minerals, high-tech industrial technologies, and others. The section includes: information on the availability of fixed assets on the company’s balance sheet at their original book value at the beginning of 2020;

- fixed assets of the company that are on the balance sheet at the initial and residual prices at the end of the reporting period;

- information on investments in fixed capital concerning the costs of creating and purchasing fixed assets.

Rules for filling out the MP (micro) form

This form should be presented as a whole for the organization, without breaking down the data into separate divisions, if any.

In addition to entering digital data, when filling out the form, it is necessary to note the presence or absence of the phenomenon in question. In column 3, you must circle “is” if the phenomenon is present, and circle “no” if it is absent.

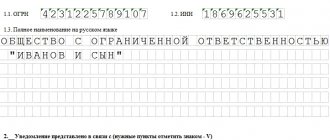

Title page

The title contains general information about the organization, according to which the territorial statistical body must identify it and assign it to one or another group by type of activity. Here you should reflect the name of the organization (full and short), postal address, OKPO and OKVED2 codes. If an organization declares several types of activities, then it is necessary to indicate the OKVED type of activity that has the largest share in the turnover volume.

Place and due date

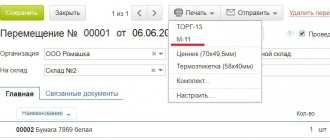

The completed document is submitted to the regional department of Rosstat at the location of the reporting company in paper or electronic form.

Since the form is a one-time document, it has a strict deadline: until 04/01/2016 . In case of failure to comply with established standards and entering incorrect information, the law provides for fines:

- per company - from 20 to 70 thousand rubles;

- for responsible persons - from 10 to 20 thousand;

- in case of repeated violation: for a company - from 100 to 150 thousand, for officials - from 30 to 50 thousand.

How to fill out the form

The procedure for filling out the MP-micro form was approved by Rosstat order No. 704 dated November 2, 2016.

The federal statistical observation form No. MP (micro) “Information on the main indicators of micro-enterprise activity” is provided by commercial organizations, consumer cooperatives that are micro-enterprises in accordance with Article 4 of the Federal Law of July 24, 2007 No. 209-FZ “On the development of small and medium-sized enterprises in the Russian Federation” Federation.”Individuals carrying out entrepreneurial activities without forming a legal entity do not provide form No. MP (micro).

Micro-enterprises using a simplified taxation system

when providing primary statistical data in the federal statistical observation form No. MP (micro), they are guided by these Instructions.

The form includes information for the legal entity as a whole, that is, for all branches and structural divisions of a given micro-enterprise, regardless of their location. The head of the legal entity appoints officials authorized to provide statistical information on behalf of the legal entity.

See the line-by-line procedure for filling out the form on our website: “ Line-by-line filling out the IP-Micro form in 2020

«.

An example of filling out the MP-micro annual form for 2020

LLC "Tour" - a travel agency on the simplified tax system, is a micro-enterprise. For 2016, the organization must submit the MP-micro form to “statistics”. We will show you how a company accountant will fill out a report.

The data is like this. In 2020, Tour LLC had 5 payroll employees, no one quit or joined. The amount of accrued wages for the year is RUB 2,790,500. There were no social benefits. The number of man-hours worked is 9870.

Revenue from the sale of tourism services for 2020, according to accounting data, amounted to 8,900,400 rubles. During this period, the company acquired one fixed asset - a passenger car worth 570,000 rubles. The organization does not have any freight vehicles on its balance sheet.

The accountant will put all the necessary codes in the header of the report. Section 1 will indicate that the company applies the simplified tax system. Section 2 will reflect the average number of employees, accrued wages and man-hours worked. In section 3, he will record the amount of revenue and the cost of the purchased car. I will put dashes in section 4, since Tour LLC did not trade in 2020. But the accountant will not fill out section 5, since the company does not have freight transport.

In 2020, companies will have to submit statistical reporting on new deadlines and using new forms. Rosstat has updated forms on key performance indicators of companies. In addition, the department no longer sends out a list of reports that companies need to submit. In this article we will tell you when and to whom you need to submit reports to statistics.