A person can get a serious illness or injury both at work and away from the place where they perform their work duties. In any case, there are two options for further action:

- Resign and be at home in retirement;

- Do not interrupt your working relationship with the employer if, due to minor health problems, he is assigned a disability group with the ability to work.

In the first case, he is calculated and paid severance pay upon dismissal due to disability, in accordance with the norm of the Labor Code (Labor Code of Russia) - Article 83.

Which disabled person is entitled to severance pay?

Compensation benefits are due to all disabled people with group 1 who are paid from the workplace due to medical contraindications and limited physical capabilities (clause 5, part 1, article 83 of the Labor Code of Russia).

Disabled people of the 2nd and 3rd groups are able-bodied (or partially able-bodied) members of society, but their physical capabilities are incomparable with the abilities of a healthy person.

Such people often remain to work, but in easier conditions (Article 20 of Federal Law No. 181, dated November 24, 1995). Others quit at their own request, or (in special cases) at the will of the employer.

It is not permitted by law to dismiss an able-bodied disabled person on one’s own initiative and without any justification (with the exception of some options provided for by the Labor Code).

If the standards are not followed, the employer faces a fine, and the employee is reinstated at work (Labor Code of the Russian Federation, Art. 77).

The decision to transfer a disabled person to a new place with more comfortable conditions for him is made by two parties.

Termination of an employment contract sometimes occurs for reasons beyond the control of the parties:

- Lack of a place in the company that would be optimal for the employee according to medical indications;

- Unfavorable working conditions for the health of a disabled person;

- A written refusal by the employee of the administration’s proposals to transfer him to a new position.

In all circumstances from this list, when a disabled person is dismissed, he is given a compensation benefit.

When the severance of the labor relationship with the employer is initiated by an employee of his own free will, he is not entitled to a benefit.

In order for payment to be made to a disabled person, the expression “due to health reasons” or “due to illness” must be used in the application.

Payments upon dismissal due to disability

Work activity is often accompanied by various stresses and risks of loss of health. A person can become disabled not only because of certain work situations, but also for other reasons not related to work. In any case, when an employee is dismissed due to disability, he is entitled to severance pay.

In what cases is the benefit entitled?

As a rule, after receiving disability, an employee cannot work as before. The employer is obliged to find him a vacancy with more lenient conditions that will suit the employee’s health condition. If such a vacancy is not found or the employee refuses to move to a new job, the employment contract with him is terminated.

When an employee is dismissed due to disability, he is entitled to the following payments:

- average monthly salary if there is a reduction in employees or liquidation of the enterprise;

- average salary for two working weeks, if the employee is fired due to incapacity for work;

- separate payments stipulated in the contract, which are supported by local regulations;

In addition to these payments, the employee must be paid the remaining wages, as well as payments for all unused vacations, regardless of their duration.

Severance pay is paid only if the employee is fired. But when an employee decides to resign on his own, he is not provided with severance pay. This is confirmed by Article 178 of the Labor Code of the Russian Federation.

When should you apply for legal compensation?

If an employee was fired by his employer due to disability and cannot find a new job within 2 months, he has every right to apply for benefits to his former employer. Proof of lack of work will be a work book without a note about the new position.

If an employee is employed by an employment center, but they cannot find a suitable vacancy for him within 3 months, then, together with a certificate confirming this from this organization, he must contact his former employer, and he must pay him money.

Taxation of severance pay upon dismissal due to disability

Disability payments are not subject to taxation, which is prescribed in Article 217 of the Tax Code of the Russian Federation. However, there is one nuance here.

If the amount of severance pay is 3 times the average monthly salary, then tax will be charged on the amount of the excess.

Is there a relationship between benefit accruals and the reason for dismissal?

There is a relationship between benefit accruals and the reason for dismissal.

An employment agreement may be terminated:

- if the organization does not have available places that are suitable for employees with disabilities;

- the employee independently refuses these places;

- working conditions cause a negative impact on the health of the disabled person, etc.

In these cases, severance pay for disability is mandatory.

But if an employee who is disabled writes a letter of resignation of his own free will, then he is not provided with severance pay for disability. He can only receive wages and compensation for all unused vacations.

Disability benefits

An illness or accident can turn a healthy, strong person into a disabled person. In this case, the employee may become completely disabled and the employer is forced to fire him. Let's look at how to correctly formalize a dismissal due to disability, how to calculate severance pay and other payments, as well as the specifics of taxation.

Payment of benefits upon dismissal of a disabled person

Before receiving disability, a citizen who has received an injury, mutilation, or illness undergoes treatment in a medical institution, where he is issued a certificate of incapacity for work.

After discharge, he is sent to a specialized institution to undergo a medical and social examination.

A special medical commission, consisting of specialists in the profile of the disease, evaluates the physical and psychological condition of the patient.

Upon inspection, a report of the established form is drawn up. The citizen receives an ITU certificate and an individual rehabilitation program. He presents the entire set of documents to the human resources department of the employer organization.

The HR department official studies the submitted documents, evaluates the working conditions and the ability of the disabled person to perform professional duties in the position in which he worked. If a citizen needs to be transferred to another workplace, and the enterprise has corresponding vacancies, the disabled person’s written consent to the transfer is taken.

To establish the suitability of an employee to perform certain job functions, all significant circumstances are taken into account: the state of his physical and mental health, the complexity of the work, the compliance of the employee’s qualifications and experience with the level of work performed.

Payment terms

A citizen can be dismissed on the basis of disability in the following cases:

- complete loss of ability to work;

- The employer does not have any vacancies for which the citizen is able to apply due to health reasons.

In this case, dismissal is formalized due to circumstances beyond the control of the parties.

The employer is obliged to accrue and pay:

- sick leave benefits during inpatient and outpatient treatment;

- compensation for vacation days not used by the employee;

- two weeks allowance.

Amount of severance pay upon dismissal due to disability

Let's look at the calculation procedure using a specific example.

Employee of the oil and gas enterprise Yakovlev V.Ya. became a group 1 disabled person as a result of an ischemic stroke. He was in the hospital from November 4 to November 30, 2020. Then he underwent outpatient treatment from December 1, 2020 to May 23, 2020.

The medical commission of the ITU establishment established for Yakovlev V.Ya. 1st disability group.

On June 5, the documents were transferred to the employer through relatives, since the disabled person himself could not do this due to paralysis. An employee of the HR department drew up an act of acceptance and transfer of the following documents:

- certificate of incapacity for work, closed on May 23, 2019;

Source: https://45jurist.ru/trudovoe-pravo/vyplaty-pri-uvolnenii-po-invalidnosti.html

Calculation of the benefit amount in 2020. Taxation features

The algorithm for calculating the amount of severance pay is simple and can be carried out independently by each resigning disabled person. But this will be an approximate figure. Specialists from the relevant service will calculate the payment more accurately.

The calculation takes place in several steps:

1. Calculation of the amount of income earned by a disabled person for the year that elapsed before dismissal. From the amounts actually received by him (before the day of dismissal - April 24, 2019), it is necessary to exclude:

- Material assistance;

- Payment for temporary disability (staying on sick leave);

- Money issued for travel expenses.

Let’s say that a company employee was paid 204 thousand rubles for the year (from 04/23/2018 to 04/23/2019), of which: 4 thousand rubles. amounted to financial assistance, travel allowances - 13 thousand rubles. He was not on sick leave for a year. Based on these data, the employee received the following annual salary:

Zg = 204000 – (4000 + 13000) = 187000 rub.

2. Calculation of working hours (days) worked over 12 months. In our case, the person worked 217 working days (Kr), while vacation and vacation pay are not included in the calculation.

3. Calculation of average earnings for 1 working day (Zs) - the basis for calculating the amount of benefits. To do this, divide the annual salary by the total number of days worked in the previous year before dismissal:

Zs = Zg : Kr = 187000 : 217 = 861.75 rubles.

4. Determining the amount of the benefit, taking into account that this amount is equal to two weeks’ earnings:

861.75 x 10 = 8617.5 rubles, where:

10 – working days within a two-week period.

Taxes are not supposed to be collected from this amount, according to Art. 217 Tax Code (Tax Code). If the severance pay for dismissal due to disability was more than three times the monthly salary, taxes would be calculated.

Amount and calculation of payments

The amount of compensation payments depends on two factors:

- the reason for dismissal;

- from the official salary of the employee for the past year.

If an enterprise is closed or staff is reduced, compensation will be equal to the average monthly salary. If the dismissed person was unable to find a job within the next month after the layoff, then he is additionally paid the average monthly salary for the second month.

If the employee did not find a job during this period, but submitted documents to the regional employment center, then he is paid the average monthly salary for the third month. To do this, you must provide an extract from the employment service stating that the person registered within two weeks after the termination of the employment contract.

In other situations in which severance pay is due, its amount will be two average weekly earnings.

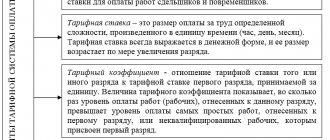

Calculation using formulas

The calculations do not take into account the disability group. The amount of severance pay is calculated using the following formula:

Allowance = SrDZ * DV

In this formula:

- Average daily earnings are the average daily earnings calculated for the previous calendar year;

- DV – the number of working days for which payment is due; holidays and weekends are not taken into account.

SrDZ = GD / KRD

In this formula:

- GD – annual income;

- KRD – the number of working days for the past billing period.

When calculating annual income, the following social benefits are not taken into account:

- vacation pay;

- payment of sick leave;

- business trips;

- social cash assistance.

However, when calculating the total annual income, bonuses and allowances are taken into account.

These calculations are valid for any form of remuneration:

- monthly salary according to the staff schedule;

- hourly payment;

- payment for production.

To calculate severance pay for disability, the CRD is 2 weeks.

Note! In the era of coronavirus, everyone is looking for additional opportunities to earn money. It’s surprising that you can earn much more using alternative methods, up to millions of rubles a month. One of our best authors wrote an excellent article about making money on games with reviews from people.

Calculation example

The employee was dismissed due to disability on March 15, 2020. His monthly salary, according to the staffing table, was 25,000 rubles without bonuses and bonuses. The vacation was used in full, there were no sick days or days off.

The employer cannot offer him another position suitable for his health condition, and therefore must pay the dismissed person two weeks' severance pay.

First, you need to calculate your total income for the past year. If we assume that in 2020 there were 247 working days and no additional payments were accrued, then the average daily earnings are: 25,000 rubles * 12 months / 247 days = 1,214 rubles per day.

Severance pay for dismissal for 2 weeks, that is, 10 working days, will be equal to:

1214 rubles * 10 days = 12140 rubles.

What to do if severance pay is not paid upon dismissal

If the payment is not made, the disabled person must perform certain actions in the following sequence:

- Contact your employer, and in writing. The document must reflect aspects of the violation. The application must be submitted in 2 copies, one of which (with a secretary’s note on receipt) must be kept for yourself. A written appeal to the employer makes it possible to confirm an attempt at pre-trial settlement in the event that a lawsuit has to be filed;

- Request help from the trade union organization at your former place of work;

- Failure to satisfy legal requirements is a reason to contact the labor inspectorate located at the location of the enterprise. Employees of the institution are given a month to review and verify the violation;

- Contacting the prosecutor's office in the event of a superficial and incompetent consideration of the complaint by the inspectorate;

- It is necessary to submit a statement of claim to the court if justice has not been restored as a result of the previous actions of the dismissed person. The following documents must be attached to the application:

- Concerning the justification for the plaintiff’s employment in the organization, his dismissal;

- A copy of the payslip;

- Copies of appeals and responses during pre-trial attempts to receive payment.

If the outcome of the case is positive for the disabled person, both the employer, the workers of the trade union committee, and the inspection staff will be punished.

Correctly formalizing the severance of an employment relationship with a disabled person is a guarantee that there will be no problems for the employer in the future. If the rules for maintaining labor documentation are not followed, the former employee will challenge the illegality of the dismissal, demand (and receive) from the employer payment of wages for forced absence, moral compensation and severance pay. He will definitely be reinstated at work.

Free legal advice for people with disabilities: +7 ext. 945 (MSK) +7 ext. 599 (St. Petersburg) 8 ext. 584 (RF)

Required documents

If the medical commission, based on the results of the examination, recognizes the employee as disabled, then he must provide the corresponding certificate to his employer. It must indicate the disability group, as well as the restrictions that are imposed on the performance of certain works.

The medical report should be prepared in federal institutions that are authorized to conduct such examinations.

Nuance! If a worker is given group I disability, then he must be dismissed with compensation, since he cannot perform any more work.

When assigned to group II or III, the employer is obliged to offer the disabled person another vacancy suitable for his state of health or dismiss him with payment of severance pay.

No additional documents other than a medical report are required. Calculations are carried out according to the data specified in the dismissal order.

If an employee believes that he was fired illegally, in violation of his rights, then he can go to court to appeal the employer’s decision, and the amount of benefits can be changed upward due to compensation.

Exit compensation amount

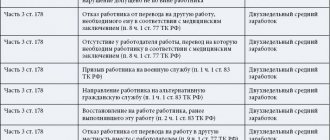

In accordance with Article 178 of the Labor Code of the Russian Federation, who has every right to receive severance compensation? These include:

- disabled people of group 1;

- employees of 2-3 disability groups who were fired;

- the same employees if they refuse a new position offered;

- employees to whom the company cannot offer a new position.

The amount of severance compensation for each employee resigning due to disability is different. It directly depends on the degree of disability, as well as on average daily earnings. There may also be other payments that the employee and employer agreed upon in advance.

conclusions

Let us highlight the main points on the topic studied:

- A two-week severance pay is paid upon dismissal for reasons: inadequacy of the position due to health reasons, complete disability, relocation of the employer, conscription into the army, change in working conditions.

- Payments in a larger amount are permitted if this is stipulated by the company’s local documents and employment contracts.

- The biweekly payment is calculated based on the average daily earnings for the year. Only days actually worked and income as remuneration are taken into account. Compensations and other payments are not taken to calculate average earnings.

- Only working days of the pay period are included. The compensation is equal to the average daily earnings multiplied by the number of working days.

- The payment is not subject to income tax. The remaining amounts due upon dismissal are subject to income tax in the usual manner - thirteen percent.

- Two weeks' severance pay is paid on the day of dismissal along with other due payments.

Illegal dismissal of a disabled person and liability measures

If a contract with a person with limited ability to work is terminated, the company is subject to additional regulations, the violation of which entails administrative and civil liability. You can appeal the actions of management through the court or the state labor inspectorate.

The law provides for penalties for employers - individuals - with a fine of up to 5,000 rubles, legal entities - up to 50,000 rubles. Also, as a preventive measure, it is possible to suspend business activities for 3 months.

The period for resolving disputes with the employer is 1 month from the date of loss of employment. It concerns the time to go to court. You can file a complaint with the labor inspectorate at any time, even several years after your dismissal. This government agency will still accept the application and organize an appropriate inspection.

https://youtu.be/5EKTdDDrjgo

Based on the results of the investigation, the State Labor Inspectorate has the right to issue an order canceling the unlawful order to remove a disabled person from office. The manager will have to fulfill it and restore the person. In the case when an employee has already been hired, he is dismissed under Article 83 of the Labor Code of the Russian Federation, or is transferred to another place. In addition, the company can be punished by imposing a fine on a legal entity or its individual employee who made a mistake in the procedure for dismissing a disabled person.

Subtleties of design

There is a certain design algorithm that it is advisable to adhere to.

4 steps to correctly terminate an employment relationship:

- Offer the person possible vacancies.

- Obtain a resolution from the employee on whether he agrees or not with the proposed option.

- Receive an application to terminate the contract at your own request if the person does not agree with the proposed vacancies.

- Prepare a dismissal order.

In what cases is the benefit provided?

All norms of the legislation of the Russian Federation on dismissal due to employee illness and transition to disability are set out in the Labor Code of the Russian Federation, for example, in Article 83.

It refers exclusively to dismissal due to disability of group 1, and not group 2, which is assigned in the event of complete loss of ability to work.

The situation is different with workers who have been given 2 or 3 disability groups. They are not prohibited from working, since their health condition still allows it.

However, practice shows that such a person simply needs softer working conditions, since he is not able to work as before (on a par with healthy employees).

In addition, Article 83 of the Labor Code of the Russian Federation stipulates that the employer does not have the right to dismiss such an employee immediately - the following procedures must be followed:

- The medical commission must make a written opinion regarding the employee’s incapacity, as well as determine the group of his disability. Why is this so important? The thing is that if the employer begins the process of dismissal in the absence of such a medical report on the employee’s state of health, then an administrative measure (fine) will be applied to him.

- Before dismissing an employee who has become disabled, the employer must offer him an alternative place of work whose conditions are quite acceptable for citizens with disabilities (with the exception of complete loss of ability to work).

A logical question arises: then, in what case can the working relationship between an employee with a disability group and the employer be terminated?

Consider the following situations:

- If the employee wrote a letter of resignation of his own free will or entered into an agreement with the employer to terminate the employment contract.

- The employer has the right to initiate the process of dismissal of an employee if the position he holds does not correspond to his current capabilities due to loss of ability to work, and there is no other position that would be suitable for this employee and would not harm his health.

- If an employee refuses the proposed alternative workplace, then the employment contract is immediately terminated.

At the same time, the employer must take into account that the reason for dismissal has a direct impact on the possible payment of severance pay.

That is why he should be interested in studying the documentation that he must provide him about the established degree of the employee’s ability to work.

It is important to pay attention to the disability group assigned to the employee.

The exact date of establishment of disability, noted in the conclusion of the medical commission, also plays a key role, since it is from this date that the process of dismissing the employee or transferring him to another place of work will begin.

Practice shows that in some cases it is not worth dismissing an employee for health reasons if he has group 3 disability, since proper treatment can improve his well-being.

Thus, the employer must transfer such an employee to a position with less difficult work, and after some time (no more than 4 months) he can return him to his previous workplace if his health has noticeably improved.

If an employee with a disability group has any disagreement with the dismissal order, he can appeal this decision through the court.

The HR department must make an appropriate entry in the work book of the dismissed employee, and the severance pay must be calculated by the accounting department.

The procedure for registering dismissal due to disability and the algorithm for calculating severance pay

You can independently determine the amount of transfers. You need to know exactly the average salary for calculations. It is specified how much the remuneration is for one day. You can use a sample for calculations.

If all of the above conditions are met, the organization issues benefits. On the contrary, an entry in the work book about voluntary dismissal means that the person is deprived of the right to receive payments. Only compensation is made for unused rest days.

Summary

If a person loses his health while at work, then you cannot just fire the employee.

- The procedure established by labor legislation must be followed.

- Termination of the contract is allowed if a person does not agree with the proposed vacancies.

- The dismissed employee is paid a farewell allowance in the amount of two weeks' pay.

- Local acts may adjust the size of transfers.

- Deductions are made from both wages and severance pay. Therefore, the accounting department withholds alimony from parting compensation.

The procedure for dismissing a person with the first group of disabilities

Dismissal of a group 1 disabled person implies that benefits will be paid in any case.

A medical certificate is required to receive benefits due. 2 documents to receive benefits:

- certificate establishing the degree of disability;

- a medical specialist’s opinion on what work the employee can perform.

Termination of labor relations is confirmed by order. The form includes the grounds for termination of the employment contract and the decision to pay a sum of money to the dismissed specialist.

Design nuances

- At his request, a disabled person can be given 4 months of recovery, after which he will return to work. In this case, his position is retained; no one can occupy it on a permanent basis, unless temporarily. During this recovery period, no wages are accrued.

- After 4 months, the employee must again undergo a medical examination and check his health. If it improves, then you can return to duty.

- If a disabled person is offered a new duty station, he must check the box next to the positions - “agree” or “disagree.”

- If an employee no longer wants to continue working in the organization, he must write a letter of resignation and indicate that the reason is “health status.” But for disabled people who resign of their own free will, severance pay is not provided.

When will benefits be denied?

Payment of two weeks of financial compensation will be suspended if the employee is transferred to another position. Payment may be refused in the following situations:

- The employee was repeatedly brought to disciplinary liability for violating labor discipline.

- The dismissal occurred during the trial period.

- The contract that was concluded for a short period (less than 2 months) is terminated.

- The person leaves by agreement of the parties, of his own free will.

- There is no medical certificate confirming disability.

Attention! For calculating benefits without the applicant providing a medical certificate, the employer faces a fine.