Calculation of the number of months worked

Vacation is calculated in proportion to the number of months worked (not calendar) after the previous vacation period. In this case, rounding is performed to the full number according to the rules of arithmetic

: the number of days less than 15 is discarded, and those greater than 15 are rounded up.

According to Article 121 of the Labor Code of the Russian Federation

, when calculating months worked, you need to pay attention to several points.

Days are not taken into account when the worker or employee:

- did not come to work without a good reason

; - was on leave to care for a child up to 1.5 or up to 3 years old.

The periods taken into account are when:

- was not actually at work, but his place and position were retained

(for example, while on sick leave, on holidays and on weekends); - was absent due to forced absenteeism;

- was on vacation, including without pay

(up to 14 days per working year is allowed).

https://youtu.be/gXAUMelo9as

How to calculate the number of days?

Knowing the length of vacation entitled to an employee and his vacation period, which is taken into account when calculating compensation, it is not difficult to calculate the number of days not used for rest.

Calculator for calculating days of unused vacation.

Step-by-step algorithm for calculating days of unused vacation for compensation upon dismissal:

- The vacation period is calculated in months.

- The required number of days per month is determined.

- The total number of vacation days due over the entire length of service is calculated.

- The number of days of rest previously used is summed up.

- The number of unused days on the day of dismissal is calculated by subtracting from the total duration of the period already used.

Based on the obtained value, you can calculate the amount of compensation - step-by-step calculation with examples.

Vacation experience

To calculate how many days of unused vacation the employee must be compensated upon dismissal, the vacation period must be calculated.

Vacation experience is the period of work in a given organization that allows you to count on annual vacation.

The length of service for annual rest includes the following periods:

- study leave;

- main and additional leaves;

- absence due to advanced training;

- just me;

- absence from work in connection with the performance of one’s duties to the state or society;

- forced absenteeism due to illegal dismissal;

- rest without income for less than 2 weeks;

- disability (including pregnancy and childbirth).

Please note that maternity leave is included in a woman’s vacation period. It is necessary to understand that this concept includes the period from 140 to 194 days indicated on the certificate of incapacity for work.

IMPORTANT! Leave to care for a child under 3 years of age, starting after maternity leave, is not taken into account when calculating unused days.

The following will not be taken into account when calculating vacation time for compensation:

- weekends without saving income if their duration exceeds two weeks;

- absenteeism;

- periods for which the employee was suspended from work without maintaining average earnings;

- child care up to 3 years old.

To calculate vacation time, you need to convert the entire period of work into full months.

In practice, length of service calculated in whole months is extremely rare. Almost always, it includes incompletely worked months (hiring, dismissal).

When calculating compensation, it is customary to use the following rule: if an incomplete month includes less than 15 days actually worked, then it is not taken into account; more than 15 are considered full.

Example 1

The employee worked for the company for 6 months and 11 days. When calculating compensation, six months of service will be taken into account, 11 days will not be taken into account.

Example 2

The employee worked for the organization for 2 months and 21 days. In this case, the length of service will be rounded up to 3 months.

Useful video

For information on the procedure and rules for calculating length of service giving the right to annual paid rest, watch the video:

In 1 month

The second step for calculation is to calculate the number of days per 1 month of experience:

Formula:

Number of days in 1 month = Total duration / 12 months.

Thus, with a vacation of 28 calendar days, one month will account for 2.33.

About calculating the amount of vacation time for 1 month

Determining the duration of the required vacation

The number of unused vacation days (D) can be calculated using the formula:

where O

– duration of annual leave (28 days or more);

M

– number of full months worked (rounded).

One month adds 2.33 days to the standard vacation. This figure is obtained by dividing 28 days by 12 months. For example, for 7 months worked, an employee is entitled to 16.31 days of vacation. The law does not stipulate how the resulting figure should be rounded. However, the employer is not allowed to infringe on the interests of the worker. That is, he must round 16.31 to 17 days.

The calculation can and should take into account all unused vacations over the past years of work

regardless of the reasons why the employee did not give them the day off.

Contrary to popular belief, vacation days do not expire

after any period of time.

The collective agreement and other local documents may establish an additional vacation period. For example, 3-4 days for length of service or position held. They also need to be taken into account when finding the duration of unused vacation.

Examples of dismissal

Example 1. Annual leave with a duration of 28 days.

Conditions:

Ivanov K.S. carried out labor activities at Tekhinvest LLC from 08/07/2013.

Date of dismissal: 02/11/2019. There were no periods excluded from the length of service.

During all this time, the employee was on vacation for 133 days. The duration of Ivanov’s annual main rest is 4 weeks.

Calculation of compensated days for this employee:

First you need to calculate Ivanov’s working time:

Vacation experience for the period from 08/07/2013 to 02/11/2019 = 5 years. 6 months 5 days = 5*12 + 6 = 66 months. (5 days are not included)

Next, the total duration of Ivanov’s well-deserved rest is calculated for the entire period of his work at Techinvest LLC:

Vacation = 66 * 2.33 = 153.78 days.

The final step is to calculate the number of unused days:

Non-working days for compensation upon dismissal = 153.78 – 133 = 20.78 days.

Example 2. Annual leave consists of basic and additional.

Conditions:

Petrova A.S. worked at ZAO Kholod for 2 years, 7 months and 18 days.

As a disabled person of group 2, she is entitled to basic annual leave of 30 days, in addition, on the basis of local acts of the company, Petrova is entitled to 3 additional paid days.

During the entire period of work, the resigning employee rested for 56 days.

How will the unused days of additional leave upon dismissal be calculated for this employee?

Calculation:

Vacation experience = 2 * 12 + 7 + 1 = 32 m. (18 days are also rounded to a full month).

Petrova is entitled to rest for a year, lasting 33 days, and one calendar month accounts for 2.75 (33/12).

For the entire period of work, Petrova is entitled to 88 days (2.75 * 32 months worked).

Compensation upon dismissal for A.S. will be calculated based on 32 unused days (88 - 56).

Calculation of average daily earnings

In the problem of how to calculate vacation pay upon dismissal, average earnings per day are of great importance. The average daily earnings (AD) of an employee at an enterprise can be found from this relationship established by Article 139 of the Labor Code of the Russian Federation

:

where is the salary

– actual salary for the billing period;

12

– number of months in a year;

29.3

– the average number of calendar days in a month (

Parts 3, 4 of Article 139 of the Labor Code of the Russian Federation

).

Let's calculate compensation for missed vacation

The size of the compensation payment will primarily depend on the number of unused vacation days and the average daily salary. But the reason for dismissal and the duration of work in the organization also influences.

How are vacation pay paid upon voluntary dismissal and in the event of liquidation of the organization? From a legal point of view, these are different situations. In the first case, the employee is entitled to partial or full compensation, in the second - always full. But let's look at it in order.

In most cases, the employee should expect partial compensation

based on the number of days actually worked. The payment is calculated using the formula:

where K

– amount of compensation;

NW and D

– the already familiar average daily earnings and the number of vacation days not taken off.

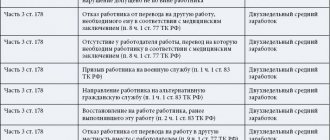

In certain situations, the payment amount does not need to be calculated, since the employee’s vacation must be fully compensated. It is understood that the quitter will receive compensation in the amount of average monthly earnings. These are the cases (according to clause 28 of the “Rules on Vacations”

):

- The employee has worked for the company for at least 11 months

. - The employee worked in the organization for 5.5-11 months.

and was dismissed for the following reasons: liquidation or reorganization of the company; - staff reduction;

- entry into military service;

- revealed professional unsuitability for this type of work.

How are non-vacations paid upon dismissal if a person has worked in the organization for only a short time? Even if he was hired for temporary work lasting up to two months (under a fixed-term employment contract), he is accrued two days for each month worked

(remember, they are rounded according to the rules of arithmetic). The amount is calculated in proportion to the days counted.

This is important to know: Vacation after a long sick leave

In some cases, you should not expect any monetary compensation for your vacation at all. This is possible in two situations:.

- When concluding a civil contract

. - If the employee was registered in the organization for less than 15 days

.

How to count vacation days for which compensation is due upon dismissal?

Ponomareva Tatyana, economist, chief editor of the magazine “Personnel Business”

Magazine "Personnel Affairs" No. 6 June 2010

When terminating an employment contract, the HR manager faces many difficult questions. Perhaps the most controversial of them concerns the calculation of the employee’s unused vacation days for which he is entitled to monetary compensation. How to correctly determine the number of vacation days in proportion to the months worked? Why did different calculation methods arise and which one should be used? In what cases is it necessary to round the result of calculations? Let's clarify the situation.

Let's decide on the problem

The Labor Code does not provide recommendations on how to calculate vacation days in order to pay monetary compensation to an employee upon dismissal. But there is a normative act that is applied to the extent that does not contradict the Code - the Rules on regular and additional leaves adopted in 1930 (approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169) (hereinafter referred to as the Rules). They contain several important provisions.

Let's say an employee quits. In the current working year, he did not use the annual basic paid leave - 28 calendar days, for which he is entitled to compensation upon termination of the employment contract (Articles 126, 127 of the Labor Code of the Russian Federation). To determine the amount of this compensation, the personnel officer needs to know:

- how many full months in the current working year the employee worked in the organization before dismissal;

- how many days of vacation out of its total duration (28 days) proportionally fall on the time worked.

The procedure for proportional calculation of vacation days is provided only for employees who have entered into an employment contract for a period of up to two months (two working days per month of work) (Article 291 of the Labor Code of the Russian Federation).

When counting months, problems usually do not arise, since paragraph 35 of the Rules clearly states: surpluses amounting to less than half a month are excluded from the calculation, and those amounting to half a month or more are rounded up to the whole month. For example, if 5 months and 5 days have passed from the beginning of the working year to dismissal, the employee is considered to have worked 5 full months. At the same time, 5 months and 15 days are rounded up to 6 months. But the proportional calculation of vacation days based on months worked has become a real stumbling block: neither personnel officers nor lawyers have a common position on the calculation methodology.

Why are 28 days of vacation compensation paid for both 11 and 12 months?

The right to vacation accrues to an employee every working year. A working year is a period consisting of 12 calendar months during which the employee actually performed his labor functions or retained his place of work in accordance with labor legislation (Article 121 of the Labor Code of the Russian Federation). According to Article 121 of the Labor Code, the vacation period includes the vacation itself. And its duration is almost a month – 28 days. Thus, full compensation is paid to an employee who has worked in the organization for 12 months, including a month of vacation. The same idea is expressed in the Rules, only in different words: full compensation is paid to an employee who has worked in the organization for at least 11 months, which are subject to credit towards the period of work giving the right to leave (clause 28). This means 11 months excluding the month of vacation. This is a kind of guarantee, a bonus for an employee who is just a little short of a full working year.

When determining compensation for unused vacation, average daily earnings are considered for the last 12 calendar months (Article 139 of the Labor Code of the Russian Federation).

The unclear wording of paragraph 28 of the Rules leads to discrepancies. For example, there is an opinion that full compensation is due only for the whole year worked, and for 11 months it is necessary to carry out a proportional calculation by month. But with this approach, the employee will receive an amount less than 28 days of vacation, which conflicts with paragraph 28 of the Rules. Therefore, 11 full months worked must be rounded to the nearest year. In this case, there will be no claims against the organization, since the employee’s position improves (Article 8 of the Labor Code of the Russian Federation).

If the first and last month of work in the organization were incomplete, the total number of days in these months should be taken into account (clause 35 of the Rules).

Methods for calculating vacation days

There are several methods for calculating days of annual paid leave in proportion to the months worked. Special mention should be made about the two most common ones*.

The first is considered generally accepted. It is based on this formula:

In accordance with it, 2.33 days of basic paid leave (28 days / 12 months = 2.33) are multiplied by the number of months worked. The results of calculations using this method are given in the table.

Calculation using the formula 2.33 days x number of months worked

| Number of months worked | Number of allotted vacation days | Number of months worked | Number of allotted vacation days |

| 1 month | 2,33 | 7 months | 16,31 |

| 2 months | 4,66 | 8 months | 18,64 |

| 3 months | 6,99 | 9 months | 20,97 |

| 4 months | 9,32 | 10 months | 23,30 |

| 5 months | 11,65 | 11 months | |

| 6 months | 13,98 | 12 months |

The second seems more profitable for the employee, since the calculation results for it are slightly greater than for the first. Here is its formula:

The number of vacation days in one month, calculated using this method, is 2.33, as in the first case. However, further calculation results diverge due to the difference in mathematical operations in the first and second formulas. You can see the results of calculations using the second method in the table on page 24.

Calculation using the formula 28 days x number of months worked: 12 months

| Number of months worked | Number of allotted vacation days | Number of months worked | Number of allotted vacation days |

| 1 month | 2,33 | 7 months | 16,33 |

| 2 months | 4,67 | 8 months | 18,67 |

| 3 months | 7,00 | 9 months | 21,00 |

| 4 months | 9,33 | 10 months | 23,33 |

| 5 months | 11,67 | 11 months | |

| 6 months | 14,00 | 12 months |

Note that both formulas count vacation days only up to 10 months worked, inclusive, because with 11 and 12 months, as we said above, the employee is entitled to full compensation for 28 days.

Commentary from an accounting and tax specialist

Sergey SHIKIN, leading expert of the Glavbukh magazine:

– The provision of paragraph 28 of the Rules should be interpreted as follows: if 11 to 12 months inclusive are worked in a year, compensation is due for a full working year. To make it clear what we are talking about, let’s look at a specific situation: an employee has worked for the company for exactly 11 months and is leaving. He was not on vacation. If you pay him proportional compensation, he will receive it for exactly 11 months worked. But if he takes a vacation with subsequent dismissal, it will turn out that he will work a full 12 months, since the time of this vacation will be included in the vacation period and accordingly will increase the period of his work in the organization to a full year (Article 121 of the Labor Code of the Russian Federation). Then he will be entitled to all 28 days of vacation. In both cases, the employee actually quits on the same day. This means that in the first case he also has the right to full vacation compensation.

It should be noted that paying compensation for 12 months, if only 11 have actually been worked, will not lead to any tax risks. Yes, the company will thereby reduce its income tax, since the amount of compensation will increase. But, firstly, tax inspectors do not have the right to interpret labor legislation. And secondly, an increase in the amount of compensation will also lead to an increase in “salary” tax payments on it. So in the end the budget will not suffer tax losses.

What technique should I use?

Since none of the methods is officially accepted as the main one, you can use any of them - both are legal and reasonable, since they comply with paragraph 29 of the Rules**. If we analyze the algorithm for calculating vacation days given in this paragraph, it turns out that the employee is entitled to compensation in the amount of 1/12 of the full vacation.

In both cases this proportion is respected. But the first method allows you not to calculate this proportion anew each time, but to use the already calculated indicator of the number of days of unused vacation per month worked - 2.33.

In addition, the first method is supported by the position of Rostrud. For example, letter No. 944-6*** states that if the working year is not fully worked, vacation days for which compensation is due are calculated in proportion to the months worked. Compensation is determined at the rate of 2.33 days of vacation per month of work. The same opinion is given in a later letter of Rostrud No. 1920-6.

Recently, a similar position was expressed by the Russian Ministry of Health and Social Development in an explanation published on the website of this department ****. Officials of this department state that at present the only legal act establishing the principle of proportionality in the payment of compensation for unused vacation remains the Rules. And from them it follows that with a vacation duration of 28 calendar days, for each month of the working year there are 2.33 calendar days of vacation.

Is it possible to round up the number of vacation days obtained after calculations?

When calculating days of unused vacation using any of the formulas, whole numbers are rarely obtained. But since we are talking about the payment of funds, and not about providing the employee with real days of rest, “ugly” numbers, as a rule, are not rounded, but are used in the same form in further calculations of the amounts to be paid.

In the next issue we will tell you how tax inspectors calculate compensation for vacations, as well as what compensation is due for long vacations (36, 42, 56 days, etc.).

However, employers still have questions about the possibility of rounding. For example, for ease of calculation, is it possible to convert a number to an integer if the nearest integer is a smaller one? The answer is given in the letter of the Ministry of Health and Social Development of Russia No. 4334-17*****: when determining the number of calendar days of unused vacation to be paid when calculating compensation, rounding them is not provided for by law. But this does not mean that you cannot round. The letter goes on to say that if an organization decides to round, for example, to whole days, this should be done not according to the rules of arithmetic, but in favor of the employee. For example, if an employer must pay an employee compensation for unused vacation of 20.4 calendar days, this value can be rounded not to 20 days, but only to 21.

Such a decision can be enshrined in a local act of the organization, for example in the Regulations on Leave, Regulations on Wages or in a collective agreement.

Example

Maxim A. was hired at Alpha LLC on January 12, 2010, and left on June 30, 2010. He did not use his vacation for 2010. The organization's collective agreement provides for rounding when calculating days for calculating compensation for unused vacation. Let's calculate the vacation days for which the employee is entitled to compensation upon dismissal. For calculations we will use the first method:

2.33 days x total months worked.

First, let’s determine how many months Maxim is entitled to compensation upon dismissal. More than half of the month was worked in January, which means we count it as a full month. The month of dismissal - June - was fully worked out. From January to June it is 6 months. Now let's determine the number of vacation days:

2.33 days x 6 months = 13.98 days.

So, Maxim is entitled to monetary compensation for 13.98 days. For ease of calculation, this result was rounded to 14 days.

When should the calculated amount be paid to the employee?

The requirements in this regard are clearly stated in Article 140 of the Labor Code of the Russian Federation

:

“When an employment contract is terminated, payment of all amounts due to the employee from the employer is made on the day the employee is dismissed. If the employee did not work on the day of dismissal, then the corresponding amounts must be paid no later than the next day after the dismissed employee submits a request for payment. In the event of a dispute about the amount of amounts due to the employee upon dismissal, the employer is obliged to pay the amount not disputed by him within the period specified in this article.”

To receive payment, the quitter must contact the employer with an application. When working part-time, part-time, as well as for foreign citizens, the calculation is carried out in the same way.

Calculating vacation pay using a calculator

In order to use an online calculator for calculating vacation days upon dismissal, you need to be armed with initial data. They are the same as for calculations using the above formulas. You will need:

- employment date

; - data on the number of days excluded from the billing period

; - stubs or statements

of actual salary received; - you will have to remember the number of vacation days used

.

The vacation pay calculator has several fields that need to be filled out.

After clicking the "Calculate"

We receive statistics for the entire period of work at the enterprise.

It shows that for the time worked, 364

days of vacation are due, of which

336

.

For the remaining 28 days

with an average daily salary of

690 rubles.

the person resigning will receive compensation in the amount of

19,320 rubles.

The given calculator for calculating non-vacation leave upon dismissal in 2020 is not the only one existing on the network. There are other types too.

Transfer of a part-time worker to the main place of work

Situation: how to determine the number of unused vacation days when calculating compensation for unused vacation associated with dismissal? The employee was first a part-time worker, and then transferred to his main place of work.

When calculating the number of unused vacation days, take into account the time that the employee worked part-time before being transferred to the main place of work.

After all, part-time workers are granted leave on the same basis as other employees (Part 2 of Article 287 of the Labor Code of the Russian Federation). And upon dismissal, the organization must pay compensation to the employee for all unused vacations, including those due to a part-time worker (Article 127 of the Labor Code of the Russian Federation).

An example of determining the number of unused vacation days when calculating compensation for unused vacation associated with dismissal. The employee was first a part-time worker, and then transferred to his main place of work

A.I. Ivanov has been working part-time in the organization since April 22, 2014. On July 1, he was transferred to his main place of work. He is entitled to annual leave of 28 calendar days.

On February 27, 2020, Ivanov resigned. During the entire period of his work in the organization, he was not on vacation.

Ivanov worked in the organization for less than 11 months, so he is entitled to proportional compensation for unused vacation. To calculate the number of unused vacation days, the accountant determined that the number of full (working) months of an employee’s work in the organization is 10 (from April 22, 2014 to February 21, 2015).

The remaining number of days before the employee’s dismissal is six (from February 22 to February 27, 2020), which is less than half of the working month (28 days: 2). Therefore, they are not taken into account when calculating compensation.

That turned out to be 10 full months (including the employee’s part-time work).

The number of unused vacation days for which compensation must be paid to Ivanov was: 28 days. : 12 months × 10 months = 23.3333 days.

Leave upon dismissal until the end of the working year for which the leave has already been spent

In practice, it happens that an employee leaves the organization before the end of the working year, for which he was already granted leave. In this case, funds are withheld for vacation days used in advance. From an accounting perspective, this process is usually not a problem. At the final settlement, the required amount is simply withheld from the salary. To do this, you need an order from the head of the enterprise. The employee's consent is not required by law.

However, there are two small limitations.

- The deduction for unworked vacation days upon dismissal cannot be more than 20% of the amount

issued in hand. - When calculating the number of unworked days, rounding is done in favor of the employee

. That is, if it turned out to be 2.33 days, then he will have to make a refund in 2 days.

If 20% is not enough to reimburse for days used, the employer has several options:

- Try to negotiate

with the former employee so that he will return the rest of the amount voluntarily. However, the person who quits, by law, in this case is not obliged to the employer. - If the amount is significant, sue

. - If the amount is small, it will be much easier to forget about it and write it off as a bad debt in three years.

Usually, when calculating compensation and deductions, questions arise if there was an increase in salary during the vacation. In case of these and other difficulties, it is better to contact a labor law specialist. A qualified legal consultant will help protect the interests of the employee or employer, while being guided by the letter of the law.

Calculation of compensation for unused vacation

The employer’s obligation to pay compensation to the employee upon dismissal for all unused vacations is enshrined in the Labor Code, but neither the Labor Code nor other regulations contain precise instructions on how to calculate the number of days. Obviously, the number of days of unused vacation is determined as the difference between the number of vacation days “earned” by the employee and the number of days of vacation actually granted to him. The number of days of vacation actually granted is not difficult to determine, but the algorithm for calculating the number of vacation days “earned” by an employee is not so simple and unambiguous.

First, this requires determining the employee’s length of service. This point does not raise questions, since the procedure for determining length of service is prescribed in the Labor Code.

According to Article 121 of the Labor Code of the Russian Federation, the length of service that gives the right to annual paid leave includes:

- actual work time;

- the time when the employee did not actually work, but in accordance with labor legislation and other regulatory legal acts containing labor law norms, a collective agreement, agreements, local regulations, an employment contract, he retained his place of work (position), incl. time of annual paid leave, non-working holidays, weekends and other rest days provided to the employee;

- time of forced absence due to illegal dismissal or suspension from work and subsequent reinstatement to the previous job;

- the period of suspension from work of an employee who has not undergone a mandatory medical examination (examination) through no fault of his own;

- the time of unpaid leave provided at the request of the employee, not exceeding 14 calendar days during the working year.

The length of service that gives the right to annual basic paid leave does not include:

- the time the employee is absent from work without good reason;

- time of parental leave until the child reaches the legal age.

Next, it is necessary, based on the length of service received, to calculate the number of vacation days due to the employee. In general, the duration of annual leave is 28 calendar days (Article 115 of the Labor Code of the Russian Federation). That is, for each full year of service, or working year, the employee should “accrue” 28 calendar days of vacation. The Labor Code does not contain explanations on how to calculate the number of vacation days for an incompletely worked working year. The only regulatory document regulating this issue is the Rules on regular and additional leaves, approved. NKT of the USSR 04/30/1930 No. 169 (hereinafter referred to as the Rules), which are still applied to the extent that does not contradict the Labor Code of the Russian Federation.

According to paragraph 28 of the Rules, employees who have worked in the organization for at least 11 months, included in the length of service giving the right to leave, receive full compensation; in other cases, employees receive proportional compensation. Based on the calculation examples presented in the Rules, we can conclude that in order to calculate proportional compensation, the number of vacation days due to an employee should be determined by dividing the established duration of vacation (generally 28 calendar days) by 12 months and multiplying by the number of months of the employee’s vacation period . Moreover, in order to calculate proportional compensation, the employee’s vacation period, which, as a rule, at the time of dismissal of the employee is an incomplete number of months, should be rounded to whole months. The rules for rounding service are set out in paragraph 35 of the Rules: surpluses amounting to less than half a month will be excluded from the calculation, and surpluses amounting to at least half a month are rounded up to a full month.

It is important to know: From what funds (money) are vacation pay paid?

In practice, this procedure for calculating unused vacation days can be interpreted differently.

Firstly, the question raises the question of rounding the employee’s length of service to a whole number of months: what is considered “surplus amounting to less than half a month” and “surplus amounting to at least half a month”. The number of days in different months is different: will 14 calendar days of service in February be considered half a month, like 15 days of service in March?

We also note that some experts are of the opinion that compensation should be calculated based on the monthly number of vacation days rounded to two decimal places, i.e. take into account 2.33 days for each month of vacation experience. That is, if an employee worked for 2 months, then he is entitled to compensation for 2.33 x 2 = 4.66 days of vacation. The result obtained, however, will differ from that calculated and rounded according to the rules of mathematics: 28 / 12 x 2 = 4.67 days. Which calculation option should be used?

These methodological issues are resolved in the 1C: Salary and Personnel Management 8 program as follows: the algorithm for calculating days of compensation for unused vacation is implemented in maximum compliance with regulatory documents, and controversial and ambiguous issues are resolved in favor of employees:

1) When calculating vacation experience, the number of full months is calculated from the date of admission according to the calendar principle, i.e. for example, if an employee was hired on January 17, then on February 16 his experience will be exactly one month, on March 16 exactly two months, etc. Accordingly, on the date of dismissal, the employee’s length of service entitling him to annual leave will be a number of full months and a number of days. This number of days is considered “surplus”.

For example, if an employee hired on January 17, 2013, quits on March 3, 2013, then his vacation period will be exactly 1 month (from January 17 to February 16) and an excess of 15 days (12 days - from February 17 to 28 and 3 days from March 1 to March 3).

To determine whether the surplus is less than half of the month or at least half, you need to select a month and divide the number of days in that month in half. In the 1C program, the calendar month that contains the largest number of days in the employee’s last working month is selected for analysis. In the example under consideration, this is March. The employee's last working month is the period from February 17 to March 16 (if he had completed it completely, he would have earned a full month of experience). In this period, 12 days fall in February and 16 days in March, hence March is selected for analysis. There are 31 calendar days in March, which means that the excess of 15 days is less than half the month (31:2 = 15.5). Thus, this excess is discarded and the employee’s length of service is considered to be 1 month.

Note that if the employee quit on March 4, then his length of service would be 1 month and 16 days, 16 days is an excess amounting to more than half a month, therefore, to calculate days of vacation compensation, the employee’s length of service would be rounded to 2 whole months.

If the employee’s dismissal date fell after March 17, then April would have been selected for calculating half of the month, because The last working month would be considered the period from March 17 to April 16. Let, for example, the employee’s dismissal date be March 31, 2013, then the employee’s length of service is 2 full months (from January 17 to March 16) and 15 days (from March 17 to March 31). In this example, the excess of 15 days is already exactly half of the month of April (30 calendar days: 2), therefore, it is rounded up to a full month, and the calculation of vacation compensation days is based on 3 months of vacation experience.

2) For 11 full months worked, full compensation is calculated, i.e. as if the employee had worked a full working year (however, if the employee worked for less than 11 months, for example, 10 months and 20 days, then the number of days of compensation is calculated proportionally - for 11 months of vacation experience).

3) When calculating proportionally, the number of days of vacation compensation is calculated without intermediate rounding, and the final result obtained using the formula is rounded:

Thus, if an employee quits after working for 2 months, then the program will offer him compensation for 28 / 12 x 2 = 4.67 days of vacation, and not 4.66 days. This approach, firstly, does not infringe on the rights of employees (compensation for 4.67 days will be greater than for 4.66), and secondly, it allows you to accurately calculate compensation for 3, 6 or 9 months of work. The number of compensated vacation days in this case will be 7, 14 and 21 vacation days, respectively. When applying the calculation, based on 2.33 days of vacation per month of service, the number of days of compensation will be 6.99 days for 3 months of work, 13.98 for six months, 20.97 days for 9 months, which is clearly not expected the result of the calculation, first of all, for the employee himself.

In addition, the program implements the ability to calculate days of vacation compensation, rounded to whole days. This feature is enabled in the accounting settings. Due to the low prevalence of this technique, by default the option Round off vacation compensation days upon dismissal is disabled in the program.

H2 Rounding days in “odd” months

The length of service giving the right to annual paid leave is counted from the date of commencement of work. So, if an employee goes to work on the 8th, then each of his working months begins on the 8th of each month and ends on the 7th of each subsequent month.

If a person’s last month of work has 30 or 28 days (for example, from April 8 to May 7, 2020), then determining half of the month is easy. These are 15 and 14 days respectively.

But what should you do if the last month of work has 31 days or 29 days (for example, from February 5 to March 4, 2020)?

Parts of months that have 31 or 29 days must be rounded according to the rules of arithmetic. If there are 29 days in the employee’s last working month, then 15 days worked are taken into account for a full month (half a month is 14.5 days, rounded up to 15 days). If there are 31 days, then 16 days are taken into account (half a month is 15, 5 days).

Example. How to correctly round days in odd months Employee Popov was hired at Polet LLC on April 8. If he quits on October 23, then to calculate compensation for vacation one must take into account:

- 6 full months from April 8 to October 7;

- 16 days worked from October 8 to October 23. The last month, not fully worked, has 31 days (from October 8 to November 7). This means we round 16 days to a full month.

Thus, to calculate compensation, you need to take into account 7 months of work.

But if the employee quit on October 22, then only 6 months of work (from April 8 to October 7) would be included in the calculation of compensation. And 15 days from October 8 to October 22 would be excluded from the calculation.

Calculation of unused vacation days in the program

The number of days of unused vacation for which an employee should be paid monetary compensation upon dismissal is calculated automatically in the program.

When registering a dismissal (entering a document Dismissal from organizations), the employee’s length of service and information about the vacations actually granted to him are analyzed. Based on these data, the vacation balance is calculated.

This is important to know: Sample application for early leave to care for a child under 3 years old

An employee’s length of service, which gives the right to annual paid leave, includes all time worked under an employment contract (i.e., from the date of hiring to the day of dismissal), with the exception of: periods of parental leave until the age of three years, periods leaves without pay exceeding 14 calendar days during the working year. To determine periods not included in the length of service, the program analyzes data from the subsystem of personnel records of absenteeism - the information register State of Employees of Organizations.

Accounting for vacations actually used by employees is kept in the accumulation register Actual vacations of organizations.

The program implements two options for recording data on the actual use of vacations: personnel records of absenteeism or documents of the payroll calculation subsystem. The accounting option is selected in the accounting parameters settings.

It should be noted: since the personnel accounting subsystem does not have documents that register vacation compensation, compensation is always written off using settlement documents, regardless of the configured write-off order.

If the calculated vacation balance turns out to be positive, then unused vacation days are offered to be compensated.

In the document Dismissal from organizations, the Compensation column indicates the value Compensation.

When you subsequently enter the document Calculation upon dismissal of an employee of an organization, the employee will be accrued monetary compensation for unused vacation. If the balance turns out to be negative, that is, the employee used more vacations than he “earned,” then it is proposed to make a deduction for the unworked vacation days (the Deduction value in the Compensation column).

In this case, in the document Calculation upon dismissal of an employee of the organization, the amount to be deducted from the employee’s earnings will be calculated.

Calculation examples

In certain cases, when an employee has worked at the company for less than the established period, he also has a chance to receive full vacation compensation. In other conditions, compensation payments are provided commensurate with the number of months of experience giving the right to annual paid leave in a part-time working year.

The quantitative relationship in this situation should be presented as follows:

Mo:12 = Ku: Ko, where:

- Mo - number of months worked

- 12 - number of months of the year;

- Ku - the amount of compensated days at the time of dismissal;

- Ko - volume of the vacation period.

Therefore, the vacation period is expressed by the following formula:

Ku = (Mo x Ko):12

For example, an employee terminates an employment relationship on his own initiative. The worked period of the current working year was 7 months, and the vacation period was 28 days. The number of paid vacation days is 28 days. x 7 months: 12 months = 16.33 days.

https://youtu.be/EdKgyxMWq3Q

Calculation of compensation for unused vacation upon dismissal

To correctly calculate compensation for unused vacation, the first thing you need to do is determine the number of days for which money should be paid. In the article you will find an example of calculating compensation upon dismissal.

When dismissing an employee, the employer must pay him compensation for all unused vacations. To calculate compensation, it is important to know the employee’s salary and the number of vacation days to which he was entitled at the time of dismissal. The procedure for payment of compensation is established by paragraph 28 of the Rules on regular and additional leaves, approved by the People's Commissariat of Labor of the USSR dated 04/30/30 No. 169.

If, shortly before dismissal, an employee used vacation for an unfulfilled working year, then upon dismissal, overpaid vacation pay must be withheld from his salary. In some cases, such deduction is not made, for example, during the liquidation of an organization (Part 2 of Article 137 of the Labor Code of the Russian Federation).

To fully understand how to correctly calculate and pay wages, average earnings, benefits, travel allowances, etc., sign up for the Kontur.School online course “Settlements with personnel for wages.” Upon completion of the training, you will receive a certificate of advanced training.

Duration of vacation

To find out how much compensation a resigning employee is entitled to, you need to know how much vacation the employee is entitled to per year. But there is a separate category of citizens who can count on a longer guaranteed vacation. This category includes:

- minor workers: 31 k.d.;

- employees with disabilities: 30 k.d.;

- education workers: from 42 to 56 k.d.;

- doctors and candidates of science: from 36 to 48 kd.;

- representatives of emergency services: from 30 to 40 k.d.;

- health workers whose activities involve a risk of contracting HIV infection: 36 k.d.;

- civil servants: 30 k.d.;

- representatives of the Investigative Committee at the Prosecutor's Office of the Russian Federation: 30 k.d.

Compensation payments are subject to personal income tax and insurance premiums are charged. Employees who have not worked for two weeks at the time of termination may be limited in receiving compensation.

You should not think about whether you need to round up compensation days for unused vacation. In case of evasion of payment, you may incur criminal, administrative and financial penalties.

How to calculate compensation for unused vacation?

If an employee has worked in an organization for 12 months, which includes the vacation itself (Article 121 of the Labor Code of the Russian Federation), then he is entitled to an annual vacation of 28 calendar days. In other words, full compensation is paid to an employee who has worked for the employer for at least 11 months (clause 28 of the Rules on regular and additional leaves). If the resigning employee has not worked the period that entitles him to full compensation for unused vacation, compensation is paid in proportion to the days of vacation for the months worked (clause 29 of the Rules).

When calculating the periods of work that give the right to compensation upon dismissal, surpluses amounting to less than half a month are excluded from the calculation, and surpluses amounting to more than half a month are rounded up to a full month. Compensation is paid in the amount of average earnings for 2.33 days (28 days / 12 months) for each month of work.

Example of compensation calculation

The annual basic paid leave is 28 calendar days.

Solution:

- The employee has worked for more than half a month; accordingly, he can count on compensation for unused vacation.

- Compensation must be paid for one month. We determine the days for which compensation should be calculated: 28 days / 12 months = 2.33 days.

- We determine compensation for unused vacation. 917.11 * 2.33 = 2,136.87 rubles.

Determination of length of service

Before accruing compensation payments to the employee, the number of days allotted for vacation is determined . To do this, calculate the total time worked. The starting point is the day the employee joins the enterprise. An employee has the right to apply for annual paid leave of 28 calendar days.

This right is granted to each employee after 11 months worked at the enterprise. You are allowed to take a vacation after 6 months, but the rest period will be shorter.

It should be noted that the Labor Code does not determine the procedure for establishing the number of rest days accumulated by an employee at the time of dismissal.

For these purposes, one should resort to the clauses of the Rules on regular and additional leaves in an article consistent with Labor legislation. Thus, a resigning employee who has worked at a certain enterprise for at least 11 months and has not exercised his right to leave is entitled to full compensation.

Compensation for unused vacation: personal income tax and contributions

Alexey Bondarenko, lawyer, tax consultant : “Regardless of the tax system that the organization uses, withhold personal income tax from compensation for unused vacation associated with dismissal (paragraph 6, clause 3, article 217 of the Tax Code of the Russian Federation). Since compensation is not payment for completed work duties, the date the employee receives income will not be the last day of the month or the last day of the employee’s work (as in the case of remuneration, clause 2 of Article 223 of the Tax Code of the Russian Federation), but the moment of actual payment of income (clause 1 Article 223 of the Tax Code of the Russian Federation). Also, do not forget that from compensation for unused vacation associated with dismissal, you need to accrue contributions to compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases in contributions in the usual manner.”

Rounding of leave upon dismissal of more than 14 days

Return to Compensation for unused vacationAccording to Article 127 of the Labor Code of the Russian Federation, upon dismissal, an employee is paid monetary compensation for unused vacation. In the 1C: Payroll and Personnel Management 8 program, the number of days of unused vacation for which compensation should be paid upon dismissal is determined automatically. Calculation of compensation for unused vacation The employer’s obligation to pay compensation to the employee upon dismissal for all unused vacation is enshrined in the Labor Code, but neither the Labor Code nor other regulations contain precise instructions on how to calculate the number of days. Obviously, the number of days of unused vacation is determined as the difference between the number of vacation days “earned” by the employee and the number of days of vacation actually granted to him.

Compensation for unused part of vacation while working

Sometimes an employer can pay compensation to an employee without waiting for dismissal. In this case, we will talk about additional paid leave, part of which, upon the written application of the employee, can be replaced by monetary compensation while working for a specific employer. However, it is not allowed to replace annual additional paid leave with monetary compensation for pregnant women and employees under the age of 18, as well as employees engaged in work with harmful and (or) dangerous working conditions, for work in appropriate conditions (except for the payment of monetary compensation for unused leave upon dismissal).

There are vacations exceeding 28 days, but not subject to compensation during the period of work, the so-called extended vacations.

Another calculation option

Along with this, there is a slightly different position in relation to the algorithm for establishing the number of days of rest due to an employee at the time of dismissal. This approach is based on the explanations of the Federal Service for Labor and Employment of the Russian Federation, according to which each month worked by an employee will be equivalent to 2.33 days of vacation.

This coefficient is obtained by dividing the duration of vacation by the number of months in a year. The final number of vacation days is determined by multiplying this number by the vacation period.

Thus, the Federal Service for Labor and Employment recommends dividing the specified formula into two separate arithmetic operations: divide the number of rest days by the number of months in the year; multiply the resulting value by the number of months worked.

The Labor Code does not say anything about the need to round compensation for unused vacation upon dismissal, so the employer is given this right to choose.

It is allowed to round off vacation days upon dismissal with a positive result for the employee. For example, the index 5.45 should be rounded to 6, ignoring arithmetic rules. To apply rounding in the accounting of an enterprise, it is necessary to indicate this item in the local regulatory act.

If you round days according to arithmetic rules, the manager risks being fined a significant amount.

https://youtu.be/ar5p_sDMLSA