Compensation for unused vacation

In Russia, according to the law, every officially working citizen is entitled to paid rest in the form of vacation - at least 28 days, not including weekends and holidays.

An employee receives the right to it within six months after taking up his official duties. Also, each person can claim vacation pay. Vacation pay is an amount separate from earnings, issued during vacation, which is also reflected in the 2-NDFL certificate, only it has a different code so that it can be distinguished from other income. Vacation pay must be reflected in this reporting in the month in which it is accrued.

Upon dismissal, if all or part of the vacation was never used, then the allocated funds for it do not burn, but must be given to the dismissed employee as compensation. It, in turn, like other income, is subject to personal income tax deduction at a standard rate of 13% in accordance with Article 217 of the Tax Code of the Russian Federation (clause 3). Compensation for unused vacation upon dismissal is accrued along with the calculation, and personal income tax is withheld from it on the same day. The tax must be transferred to the budget within 24 hours.

Information on all income of individuals is reflected in 2-NDFL:

- the form and requirements for completion are regulated by the order of the Federal Tax Service of Russia dated October 30, 2015;

- lists of income and deduction codes are in the order of the Federal Tax Service of Russia dated September 10, 2015.

Performing the calculation

At the request of the employee, the employer will replace days of rest with vacation payments, but this is done only in relation to days exceeding the established norm.

For example, an additional three days of rest due to employees with irregular working hours is replaced by a cash payment. Teachers who are entitled to a 45-day vacation can also replace part of their vacation (up to 17 days). For “harmful” people, vacation is replaced with money only if it exceeds the minimum norm - 7 days. For example, for working in hazardous conditions, an employee is entitled to an additional 10 days, seven of them are issued, and the remaining three are replaced with compensation.

Also, you cannot replace rest with money for the following categories of workers:

- Pregnant employees;

- minor workers.

The income code in 2nd personal income tax is the same as compensation upon dismissal - 2013.

In most cases, compensation payments to an employee upon dismissal are related to payment for vacation days that he did not use. To calculate the amount, it is absolutely unimportant for what reason the employment contract between the employer and employee is terminated.

Despite the fact that the state has established the total duration of vacation for an employee at 28 calendar days, based on working conditions and taxpayer categories, this period can be increased. When calculating compensation, it is necessary to take into account the duration of vacation for each specific employee of the company.

Compensation for unused vacation is calculated based on two indicators: the employee’s average daily earnings and the number of unused vacation days.

In order to calculate the average daily earnings, it is necessary to take into account the employee’s wages for the 12 months preceding the month of dismissal.

For what reason is the indicator 29.3 used for calculation? This is the average number of days contained in one calendar month.

The number of vacation days for calculating and paying compensation to an employee is calculated on the basis that each employee must be provided with 28 calendar days of vacation for a full year worked.

Accordingly, for each fully worked month, an employee has the right to claim 2.33 days of vacation (28 days / 12 months). As mentioned above, the basis for calculating the number of unused vacation days is the duration of vacation for a specific employee.

According to the latest news in the field of legislation, the calculation of compensation for unused vacation depends on the number of days worked. However, they are rounded up to the nearest month. For example, 7 months and 3 weeks will be rounded up to eight months. To receive a full payment, you must work a full 11 months.

Important! Calculation is made only for unused days. Standard vacation is 28 days. If a person took part of the vacation, then recalculation is done for unused days.

In order to protect your labor rights, it is necessary to conclude contracts: labor and collective, which detail all the rights and obligations of the employee.

The dismissal of an employee is certainly accompanied by the issuance of all necessary documents, as well as full financial settlement up to and including the last working day. This also applies to unused vacation or part of it, for which compensation is provided. This point is regulated by the labor code, namely Article 127. It clearly states the terms of payments and the necessary actions of the manager.

The Labor Code strictly regulates the procedure for paying compensation for unused vacation, in particular, this should occur directly on the day of dismissal or the next day, which corresponds to the working period and organization (provided that the employee has a shift schedule and the last working day is a day off, then the calculation is provided for the next working period of the organization upon direct application by the dismissed person).

Compensation for unused vacation is paid in any case, regardless of the reason for dismissal - at will, for violation of labor discipline, contract or for other reasons. The only point that does not imply payment of compensation for vacation not taken is its full use during the past working period.

In 2020, the calculation and payment for unused vacation assumes the same procedure as before. Payment is made based on the employee’s application and, if possible, the organization. Upon dismissal, unused vacation is paid in any case. The calculation is based on the number of days that the employee was entitled to as rest and was not used by him for any reason.

The final calculation is based on the employee’s average earnings. This also applies if a person’s salary is floating and depends on output. In this case, all payments for the past period are summed up and the average is found.

The main point when calculating compensation for unused vacation is length of service. That is why, first of all, it is necessary to determine the time worked by the employee, and then calculate the total number of days that are not spent on vacation.

If a person has worked for less than 11 months, then the following formula applies:

- Divide the “number of allotted vacation days” by 12 months;

- multiply the figure by the number of months worked in the organization;

- From the received amount, subtract the number of days that have already been used as vacation.

There is some amendment, namely, if a person worked for more than 2 weeks, then it is counted as a whole month. If less than 2 weeks, then the month is not considered at all and no compensation is due.

The result is a number that indicates the number of days to be compensated. It is calculated using a simpler formula - unused days are multiplied by a person’s average earnings over the past year.

Upon dismissal

If an employee resigns, he is also provided with compensation payments for unused vacation.

Full financial compensation in this regard is received by employees who have worked in the organization from 5.5 to 11 months and were dismissed for the following reasons:

- liquidation of an organization or its branch;

- military conscription into the armed forces of the Russian Federation;

- students serving in educational institutions under current legislation;

- inability to hold a position due to health reasons.

All other categories of citizens who resign receive compensation based on standard calculations, based on the number of days of unused vacation.

Calculation of compensation for unused vacation

No dismissal

If an employee has a sufficient number of accumulated vacation days that he cannot take off, then a standard application is written to the manager for compensation.

In most cases, if the boss cannot release the employee for such a long period, then material resources are paid without problems. Otherwise, if necessary, require the provision of legal rest.

We invite you to read: Leave without pay for a working pensioner

There is no other option, since the employer cannot leave a person without leave and compensation at the same time.

Based on the fact that the average duration of additional vacation is 7 days, compensation for this period is not provided, and the vacation itself is intended exclusively for the citizens themselves. If the number of days of additional leave is exceeded, the employee has the right to demand compensation for the period that he was at work (all days exceeding 7 days).

2-NDFL in 2020: form and new codes

On January 1, 2020, amendments to the law regulating work with 2-NDFL came into effect. In 2020, this certificate must be issued for each employee, coding his income, before April 1.

The form that underwent the most changes in 2020 was:

- In Section 1, new lines have appeared about the “Reorganization Form” and TIN/KPP of this organization.

- You need to enter the OKTMO code at the location of the company or its branch.

- There are new rules for filling out the “Tax Agent” field.

- In “Data about the recipient of income” the address is no longer needed.

- Section 4 no longer takes into account investment tax deductions, etc.

No less serious changes have affected the coding used to record the income of each individual employee. Previously, one of the following codes was selected to compensate for unused vacation:

- 2000 - remuneration for performing labor and other duties.

- 2012 - vacation pay.

- 4800 is a universal code designated as “Other income”. Its use was considered the most justified.

But, in order to no longer take these payments into account among those hiding under code 4800, among others, code 2013 was added, which precisely means “Amount of compensation for unused vacation.”

Responsibility

If any details in certificates of income of individuals are indicated incorrectly, then by law this is recognized as unreliable information. However, this does not affect the interests of the employee and will not lead to the fact that funds will not be transferred to the budget, so you just need to submit updated information to the Federal Tax Service.

But if an employee who quit does not receive his compensation, this is already a serious offense, which, when filing a complaint with the labor inspectorate, is punishable by a fine of up to:

- 50,000 rubles from the employer.

- 20,000 - from the responsible person.

- 5,000 - with individual entrepreneur.

The employee will also have to pay a fine if compensation for vacation is delayed.

All citizens of the Russian Federation who are officially employed have the right to payment for both their activities and annual vacation. And if they do not exercise their right, this does not mean that they are deprived of it. Therefore, compensation of vacation funds to a resigning employee upon dismissal is a mandatory rule for all legal entities and individual entrepreneurs. And in order for the tax service to be able to track the timing of the compensation payment, it must be correctly noted in 2-NDFL, which is easy from 2020 using the 2013 code.

Vacation compensation upon dismissal in 1s 8.3 accounting

Next, in the “Reflection in accounting” part of the window, indicate:

- Method: the one that suits you for attributing costs.

- If you are a UTII payer, also select the option you need.

Click the “record” button. This is what should happen: Get 267 video lessons on 1C for free: Accrual and calculation of vacation in 1C 8.3 upon dismissal Now let’s move on to the document for calculating vacation pay in 1C Accounting. As I said earlier, you must calculate the amount of compensation manually.

Let's create a new document. Since the employee is resigning, the final payment can also be made in this document. But I still advise you to make separate documents, there will be less confusion.

How to reflect

Each employee is entitled to a rest period of at least 28 days annually. This right appears after 6 months of work in a new place. Vacation pay is not wages and is reflected in 2nd personal income tax according to code 2012, according to the month the money is transferred to the employee, even if the vacation period falls on different months.

Sometimes employees are unable to rest on time; many, when changing jobs, have leftover vacation leaves, then they are replaced with a cash payment (subject to personal income tax). The tax rate is 13%, transferred on the last working day along with the calculation. If a person took a vacation in advance, upon dismissal, the “extra” days are withheld from the final calculation.

The certificate will reflect the amount of money based on the month in which the person left work. Personal income tax is withheld on the day of transfer, upon dismissal of an employee. Money is transferred to the budget no later than the next day.

Previously, there was no separate code for compensation for unused vacation. The accountants reflected the amount of compensation primarily as “other income” - 4800 (the Federal Tax Service Inspectorate recommended reflecting it in the same way). But some experts used the designations 2000 and 2012. Since 2020, a special code has appeared - 2013.

Attention! When filling out the certificate, the accountant must indicate the correct code, otherwise the inspectorate will have questions during the tax audit.

Features of payment in 2017

In 2020, the rules for calculating compensation for unused vacation remained unchanged. The calculation is made based on the same calculation formulas.

In case of reduction

Ivanov A.E. in September 2020, they announced a reduction due to the difficult economic situation in the company. Monthly earnings were 35,000 rubles. He was not given any leave this year. In October 2020, Ivanov A.E. quit and took a similar position in another organization.

If an employee is laid off, in accordance with the law, he must be paid compensation at the rate of 28 calendar days if he worked this year for more than 5 months and 15 calendar days.

The employee worked more than five and a half months in 2020; accordingly, compensation will be calculated based on 28 calendar days.

The employee needs to transfer compensation in the amount of 33,447.12 rubles.

However, due to the fact that compensation for unused vacation is not included in the list of tax-free types of compensation for staff reductions, income tax must be calculated and paid to the budget on this amount.

Dismissal by agreement of the parties is carried out according to the same rules, except that the duration of unused vacation is calculated based on 2.33 days of vacation for each month fully worked by the employee.

Sergeev P.V. On March 30, 2020, he decided to resign from the company where he worked for four years. Earnings of Sergeev P.V. was 23,000 rubles per month. The employee did not go on vacation this year.

Tax benefits

Since personal income tax is withheld from such income, tax deductions also apply to these amounts. The tax refund deduction is provided in the same way as for other rewards. If they are provided for children, then the tax base is reduced when calculating personal income tax.

Today the following benefits are provided:

- 1400 rubles – for the first and second child;

- 3000 rubles – for the third and subsequent children.

Attention! When determining the size of the tax-free base, all children are taken into account, regardless of age, but the benefit is provided only for children under 18 years of age, or up to 23 years of age if they are studying full-time.

Each spouse receives benefits; if only one parent is raising children, deductions are doubled. A maximum limit has been established - 350 thousand rubles; if a person’s income exceeds this amount, deductions are not applied from the month in which the limit was reached.

Therefore, in order to correctly calculate deductions at a new place of work, the resigning person must be given 2 personal income taxes, which contain information about the income received from the beginning of the year until the dismissal.

When an employee is dismissed, vacation days not taken are replaced by a cash payment. Such amounts are reflected in the certificate, since personal income tax is withheld from them, code - 2013. In a normal situation, vacation is replaced with a cash payment only if it exceeds the established 28 days. And even then, only days exceeding the norm are replaced with money.

How are deduction data reflected in the declaration?

To correctly enter data using deduction code 620 in the reporting document in Form 3-NDFL, you first need to determine what kind of transactions are reflected under this item:

- If code 620 reflects additional total contributions to the pension in its funded part, then the data is entered in the “Social fiscal deductions” section in the tab on voluntary life insurance documents and pensions.

- If code 620 reflects the total expenses for transactions with financial transaction instruments not used in the securities market, or a negative result from economic activity with securities traded on the organized stock market, then the information in the tax return under code 4800 is reflected minus these amounts . The explanatory letters of the Federal Tax Service of Russia indicate that non-taxable income is not subject to declaration.

Legal entities and individual entrepreneurs are required to provide c.

Profit and loss statements reflect the financial results of an organization.

The procedure and deadlines for filing tax returns are subject to regular changes.

The current account is blocked.

An individual entrepreneur on the simplified tax system of 6% (income) switched to UTII from the beginning of the year with a refusal.

How can an individual entrepreneur submit a zero VAT return on OSNO if it is missing?

I have an apartment. Belongs only to me, there are corresponding documents. I am renting this apartment. Designed with.

A few years ago I bought an apartment with a mortgage. No documents to obtain.

When selling securities, the tax base for personal income tax is determined from them.

At the beginning of October last year, an individual entrepreneur was opened, there were no activities, a current account.

I bought an apartment a long time ago, more than 10 years have already passed. Earlier declarations to the tax office for refund.

I received a fine for not submitting a declaration on time. Why are penalties charged? For late delivery.

My husband and I bought an apartment under a shared construction agreement. This was done the year before last. At the end.

I recently bought myself an apartment. The transaction was completed on credit.

Where to include this or that deduction in the personal income tax return is a question that often arises.

The organization must submit one more report - a profit and loss report. Recommended

Compensation code for unused vacation in certificate 2-NDFL in 2020

Previously, code 4800 was used to indicate the income of an individual when he received vacation pay compensation upon dismissal.

Such clarifications were given by the Federal Tax Service in its letters dated 08.08.2008 No. 3-5-04/ [email protected] and dated 16.08.2017 No. ZN-4-11/ [email protected]

The Federal Tax Service issued an order dated October 24, 2017 No. ММВ-7-11/ [email protected] , on the basis of which changes are made to Appendix No. 1 of the order dated September 10, 2015 No. ММВ-7-11/ [email protected] From the moment of entry into force By virtue of this order, income code 2013 is used to compensate for unused vacation.

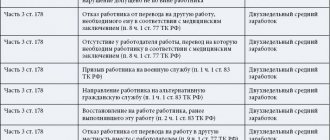

| Before the changes come into force | After the changes come into force (in 2020) |

| Income code for compensation for unused vacation |

Is it necessary to retroactively allocate vacation compensation upon dismissal to a separate income code for personal income tax in 2020?

There is no need to apply the new code retroactively. At the same time, it should be borne in mind that for each certificate with incorrect codes, the tax agent may be fined 500 rubles. This amount of sanctions is established in Art. 126.1 Tax Code of the Russian Federation.

Where is the income code indicated for compensation upon dismissal in the 2-NDFL certificate in 2020?

The procedure for filling out the 2-NDFL certificate, as well as the form itself, has changed since January 1, 2020. The Simplified 24/7 program has a current form where you can see a sample of filling out the income code for compensation.

Income code for compensation in 2-NDFL

To compensate for unused vacation upon dismissal in 2019, at what point is the personal income tax code set according to the new rules?

Order No. ММВ-7-11/ [email protected] came into force. New codes are valid when indicated in 2-NDFL certificates for 2020 and beyond.

Filling out 2-personal income tax upon dismissal of an employee 2020 (severance pay) – Employee Rights

2-NDFL is a document that describes all information about taxes on personal income. These funds are sent by the employer to the budget, since it is he who is responsible for paying the taxes of his employees. The certificate is filled out in accordance with the established form; the company’s seal must be located in the appropriate place.

How to draw up and indicate severance pay in papers, code in 2-NDFL - is regulated by the tax legislation of the Russian Federation. The accounting department is responsible for issuing such documents, and their production time is up to 3 days.

Severance pay upon dismissal and staff reduction

During the period of activity of the enterprise, the company management has the right to regulate the number of employees, but without violating the Labor Code of the Russian Federation. Employees, trade union organizations and the Employment Center at the place of registration of the office should be notified in advance about upcoming changes in the staff.

When staffing is reduced

Termination of activities of laid-off personnel is carried out within 2 months from the date of notification of this procedure. In case of staff reduction, the entrepreneur is obliged to pay compensation to the former employee. The salary is paid for another 2 months (in some situations - three) and is calculated based on the average annual income of the citizen.

By agreement of the parties

Severance pay upon dismissal is not paid by agreement of the parties, and the contract itself is concluded if it is necessary to optimize the number of staff without a reduction procedure. In this case, the employer becomes the initiator.

You need to understand that if an employee has a disability, it will not be possible to make him redundant. Dismissal is only possible with the consent of the employee.

The payment includes:

The last point concerns additional compensation for the dismissal of an employee, and therefore should be discussed by both parties especially carefully.

The tax deduction on income during layoff is not withheld for the first two to three months from the date of dismissal.

Is it necessary to reflect personal income tax-2 on the certificate?

The form of the 2-NDFL certificate is specified in the Order of the Federal Tax Service of Russia, and those incomes that should be taxed are also determined.

The report will not include:

- benefits that are paid under the state program to support laid-off workers - but not more than three times the amount;

- payment for employees who have entered into a dismissal agreement by agreement of the parties;

- compensation payments to the head of the enterprise, his deputies and the chief accountant.

If an employee worked in the Far North (and equivalent regions), then he has the right to six times the amount of benefits, which will not be taxed.

Revenue code

To maintain accounting, you need to understand and correctly draw up reporting documentation, fill out the appropriate declarations, and deal with the posting of company funds. It should be understood that the severance pay income code in the 2-NDFL certificate for redundancy is 2014.

Only reliable data must be provided to the tax office. For errors and inaccuracies, a fine of 500 rubles may be imposed for each submitted paper.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

- If you want to find out how to solve your particular problem, please use the online consultant form on the right or call:

- +7;8

- It's fast and free!

What expense type code and KOSGU should be used to make payments upon layoff?

Keeping records of expenses during organization should be in accordance with the orders of the Ministry of Finance of the Russian Federation - No. 65н.

Accounting documents include expenses for severance payments in case of layoffs:

Insurance contributions are also not paid from severance pay. It is important that upon dismissal the documents are completed properly. The number of employees should be reduced in accordance with the legislation of the Russian Federation. In this case, it is necessary to prepare a calculation and make all due compensation payments.

Source:

Compensation for unused vacation - income code

Subordinates who cause conflict in the team are often fired, which leads to regular disruption of the work process. There can be many reasons for drawing up a dismissal order.

Upon termination of the employment contract, the subordinate must be paid all compensation amounts. In this article you can find out what the income code “compensation for unused vacation 2-NDFL” is and why it is needed.

Is 2-NDFL reflected in the certificate?

The income code for compensation for vacation that was not used when leaving a permanent job in the current year is used to receive payments for unused vacation.

In 2020, there is a new income code, which should not be forgotten.

Not long ago, in order to indicate the income of an individual when he received a certain amount of compensation payments (vacation pay) upon termination of an employment contract, code 4800 was used.

Previously, the Federal Tax Service issued an order on the basis of which a new code is used to receive all compensation payments for vacation that was never used. Let's figure out what Form 2-NDFL is. This is a certificate indicating the income and tax amounts of an individual.

Starting from the new year, there are two forms of a citizen’s income certificate. A certificate in form 2-NDFL on the income of a subordinate must be submitted by the employer to the tax office every year. He needs to contact the service at his place of registration.

This certificate must be drawn up based on the results of the expired tax period (calendar year) in relation to the calculated, withheld and transferred personal income tax on income that was paid in this period. This document must also be drawn up in cases where it is impossible to withhold tax from the income of a particular citizen due to his dismissal.

When preparing this document, it is strictly prohibited to correct errors using a correction or any other similar means. Do not use double-sided printing or join sheets in any way that could damage their integrity. Negative numeric values cannot be entered.

The paper must be filled with ink of the following colors: blue, purple and black. It is prohibited to use pens of bright colors and shades (red, pink, green) when drawing up documents.

As for the correct entry of numeric, text values and code indicators, this should be done from left to right, starting from the first (left) familiarity. In areas of the sheet where no entries need to be made, a dash is placed.

If the certificate is not filled out manually, but is typed on a computer, then the values of the numerical indicators must be aligned to the right (last) familiarity.

When printing, it is permissible not to frame familiar spaces and dashes in places that have not been filled in.

The head of the organization who is preparing the certificate must fill out all text fields only in capital block letters.

If there is no total value, then you need to enter a zero (number). The income code for compensation for unused vacation must be indicated in the 2-NDFL certificate.

In the table of section number three, in the corresponding column “Income Code”, the income code must be indicated next to the month in which certain payments were made.

Opposite compensation for vacation that was not used by the employee upon dismissal, a new code must be written on all lines.

What is the income code?

It must be remembered that during an audit, the tax service may discover an inaccuracy, and if a certificate is submitted with incorrect codes, the tax agent may receive a fine of 500 rubles. What code should I indicate if compensation for unused vacation is paid without dismissal?

A subordinate can ask his superiors to return at least part of his vacation pay without actually terminating the employment contract. The manager may, but is not obligated to, grant such a request. It is worth noting that money can be returned for vacation days only when the number of days involved is more than the standard 28.

This could be some kind of additional vacation. For example, one that is associated with special working conditions. Often subordinates receive extended basic leave. Additional days, at the request of the employee, can be replaced by cash payments. For example, if a subordinate does not want to rest for several days, and instead decides to go to work.

In this case, the new 2013 code “compensation payments for unused vacation upon dismissal” is not applied by the employer. In this case, you should select the value 4800. There is no special code for such payments.

It must be remembered that when returning vacation pay, the corresponding certificate for 2020 and beyond must indicate the previous code - 2013.

Upon dismissal, in order to receive compensation payments for unused vacation, in addition to the code, the full amount of income must be written down in the certificate. It is indicated without tax deductions according to the appropriate code.

If any professional deductions are provided for cash receipts, or the subordinate’s income is not subject to personal income tax in full, then the corresponding deduction code must be indicated opposite the income.

We replace vacation with compensation

Employees are provided with annual leave while maintaining their place of work (position) and average earnings.

In exceptional cases, with the consent of the employee, it is allowed to transfer vacation to the next working year if the vacation was not used by him in the current year (Part 3 of Article 124 of the Labor Code of the Russian Federation). According to Part 4 of Art.

124 of the Labor Code of the Russian Federation, failure to provide annual paid leave for two years in a row is prohibited.

The employer is obliged to take into account unused days of annual paid leave when drawing up a vacation schedule. At the same time, it is mandatory for both the employer and the employee (Part.