Often, in order to take a business to the next level, it may require a radical reorganization. However, under the terms of the current legislation, all reorganization measures must be documented, and the tax service must be notified of their implementation.

In this review, we will look at the procedure for notifying the Federal Tax Service about upcoming changes, how and within what time frame an official notification of reorganization should be made, and also consider the features of filling out form P12003 “Notification of the start of the reorganization procedure.”

Reorganization of a legal entity - concept

Reorganization is a set of actions by the owner (legal entity) related to the termination of one legal entity, as a result of which rights, financial and contractual obligations are transferred to the successor, while new legal entities may be created, as well as one or more previous legal entities may be terminated. Reorganization can be carried out in different forms - accession, division, separation, merger, transformation.

This is one of the most constructive forms of getting a business out of difficult economic situations. To carry out this procedure, the state establishes a number of requirements, including the need to send to the fiscal authorities a document filled out on a standardized form, Form 12003 “Notification of the start of the reorganization procedure.”

Form P12003 was introduced by order of the Federal Tax Service of Russia No. MMV-7-6 / [email protected] dated January 25, 2012, as amended. dated 05/25/2016 (Appendix No. 3 to the order)

Submission of notification is mandatory. The requirements for filling it out are established by Section IV of the Order.

Form P12003 provides the following nuances:

- Business entities are given the opportunity to cancel the reorganization procedure by their own decision by submitting a corresponding notice of cancellation of the reorganization. To do this, it is enough to send a notice of reorganization to the tax authority (form P12003), indicating the cancellation code, and provide it with the owner’s decision to cancel the procedure.

- It is not required to indicate the successor legal entity created as a result of reorganization measures and its registration data.

How to send a letter

Since details are the most important part of official documentation, it is advisable to send letters about all changes associated with them in “natural” form. This makes it possible to reliably bring information about new details to the attention of counterparties, especially if you send these messages by registered mail with return receipt requested.

As a last resort, you can combine different sending options: for example, combine an email or fax message with sending via Russian Post. On the one hand, this will allow partners to be notified of changes as quickly as possible, and on the other hand, it will provide the sender with evidence that the corresponding letter was sent to them in a timely manner and received by the addressee.

Deadlines for filing P12003

Notification P12003 is a document through which a business entity (owner) notifies the relevant tax office of the decision made and the start of reorganization measures.

According to paragraph 1 of Art. 13.1 of Federal Law No. 129-FZ of 08.08.2001 (as amended on 27.12.2018), “Notification of the start of the reorganization procedure” with the attachment of the Decision on reorganization, the legal entity is obliged to send to the Federal Tax Service inspectorate with which it is registered no later than three workers days from the date of the decision.

Based on the data specified in the Notification, the fiscal services, within 3 working days, make the necessary notes about the beginning of the reorganization in the Unified State Register of Legal Entities.

You can submit Form P12003 Notification:

- during a personal visit to the Federal Tax Service;

- through a unified electronic document management system (a verified signature will be required);

- through the MFC;

- through the postal operator.

To whom is a letter about a change of legal address sent?

The law recommends notifying your counterparties and creditors of a change of legal address in advance. We are talking about all business partners with whom the organization maintains business relationships: banks, suppliers, clients, legal consultants, etc. This need is dictated by the importance of details in office work: not a single contract is concluded, not a single service is provided without indicating the legal address of the LLC. Responsibility for untimely notification of partners and, as a result, errors in documents falls on the organization that changed the address.

Form P12003: sample and features of filling out the form

When filling out the notice of the beginning of the reorganization procedure (Form P12003), you must comply with the established requirements regulated by the Requirements for the execution of the notice (Section IV of the Order). In particular:

- form P12003 can be filled out electronically using computer technology, or by hand

- when filling out using a PC, columns and lines are filled in with 18 point size, “CourierNew” font,

- When entering data manually, use a pen with black ink;

- The form must be filled out in capital letters only;

- The notification is filled out by the applicant - it is formed on behalf of the manager, or a person authorized to act without a power of attorney on behalf of the company;

- The applicant's signature is certified by a notary.

When preparing the Notice of Reorganization, you should take into account some features of its completion.

The title page (page 001) states:

- the reason for filing the Notification (section 1). For this, codes “1” (a decision on reorganization was made) and “2” (cancellation of a decision on reorganization) are used; if code “1” is selected, fill out sections 2 and 3;

- form of the upcoming reorganization (section 2) - indicate the corresponding code (from 1 to 9) of its type - transformation, merger, etc.;

- the number of legal entities created after reorganization (section 3) is not indicated during transformation and merger.

On sheet “A” of the form the entire list of registration data of the reorganized business entity is indicated, as well as its status at the end of the procedure (sections 1 and 2). Section 3 is filled in when the decision on reorganization is canceled. The number of sheets “A” is filled in according to the number of reorganized entities.

The information lines of the pages of sheet “B” are filled with information about the legal entity that submitted the application, the applicant, and documents proving his identity. If the reorganization affects several companies, one of them will apply.

The last page of Sheet “B” of the Notification is the official receipt-order of the applicant, certified by a notary. FULL NAME. the applicant is entered manually, his signature is affixed and the code for the method of receiving documents on amendments to the Unified State Register of Legal Entities (in person or by mail) is indicated.

All pages of the completed “Notification of the commencement of the reorganization procedure” (form P12003) are numbered sequentially.

Read also: Separation balance sheet during reorganization

An example of writing a letter about changing the details of an organization

Filling out the header of the letter

- At the top of the message, the sender is first indicated, that is, it is entered

- full name of the organization (in accordance with registration papers),

- address and telephone number for contact.

- Then enter information about the recipient:

- its name

- and a specific person to whom the address is directly made (position, surname, first name and patronymic).

- After this, the date of drawing up the letter and its number according to internal document flow are indicated.

- Below in the middle of the line is written the name of the document.

Filling out the body of the letter about changing details

The following is an information section.

- First, the recipient is informed of the fact that the details have changed and it is indicated which data has been changed. The date from which the previous details lost their meaning is also entered here.

- Then, you should indicate all the requests the sender has regarding past and future documents regarding the changed data.

- At the end, the letter must be signed, with a transcript of the signature and an indication of the position of the signatory.

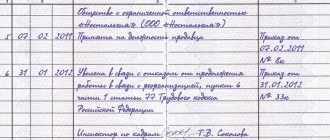

Features of personnel changes during the separation process

The heads of companies created during the separation process need to issue an order on personnel changes in connection with the reorganization.

This document should contain a list only of those employees of the reorganized company who are going to work for a specific successor, that is, in the company created during the division process.

Go How to repay a debt without a receipt or witnesses? Is it possible? || Is correspondence enough to prove the fact of borrowing money?

The successor receives and stores personnel documents relating only to these employees (and not all employees of the reorganized entity).

How to correctly write a notification to counterparties about a change of legal address?

There is no single sample notification provided. The letter is drawn up within the framework of the accepted rules of business correspondence, in free form, on company letterhead. An official letter always indicates the full name of the institution to which the notification is sent, the full name and position of the person who is the contactee, as well as the legal and postal addresses of your LLC - old and new. The text of the letter itself contains information about the change in your company details and the reasons why this is happening. The date when the partners will be sent an additional agreement to the current partnership agreement is also indicated. The letter contains the current date and the signature of the manager, certified by the company seal.

If you are late with notification

Let's say the payment information has changed, but the prepared sample notification about the change in bank details has not been sent to the organization. What will happen in this situation:

- Funds under an agreement with incorrect information may be seized by the bank until clarification. The clarification period is 5 days or more. Consequently, the institution will not receive payment on time.

- The money will be returned to the sender, and the blame for the delay in the debt will lie with the organization with incorrect data in the agreement. In this case, it is impossible to impose penalties or fines.

- Such problems with settlements under agreements and contracts have a negative impact on the business image of the company as a whole, therefore, counterparties may refuse further cooperation.

| General Director of BANYA MP LLC BPH CHAIKA I.M. Sidorenko |

When do you need to notify about a change in bank details?

When concluding any agreement, regardless of its content, companies are required to indicate their data: full name, legal and actual addresses, registration information (TIN, KPP, OKTMO, OGRN), for making payments, also payment information (name of bank, settlement and personal accounts, BIC and correspondent account).

In what cases is a sample information letter about changing details drawn up:

- If an error has crept into this information, for example, a typo in the current account number or TIN.

- During the validity period of the agreement, changes occurred in the registration data of the enterprise.

- Payment information has been adjusted, for example, a government agency has changed its credit and banking company or the bank has changed its name.

Notify counterparties, business partners and clients about these changes.

Compose a letter correctly

We are preparing an up-to-date sample notification of changes in the organization’s bank details. The company's lawyers or an accounting employee should be responsible for preparing such a letter if there is no legal department on staff. The notification is prepared in any form, but the following mandatory data must be indicated:

- The name of the sending company, its address and telephone number.

- Similar information about the recipient company.

- Information about the place and time of drawing up the document.

- Written explanations of the current situation. Describe why the company's payment details were adjusted. For example, the reason may be the conclusion of a new agreement with a bank, a change of credit and banking company, a change in the current account number (a foreign currency or special account was specified).

- New data and the date from which they become effective. For example, if the company switched to servicing a new credit company (or the bank changed its name), then provide new details.

- Signatures of the responsible person and the head of the company, certified by a seal (if available). The chief accountant is not required to sign the letter, but the presence of the chief accountant’s mark will increase confidence in the information.