What actions need to be taken before signing the deed?

Immediately before transferring affairs to the new chief accountant, the director of the organization must sign a special order, which, as a rule, should indicate:

- people who are responsible for receiving and transmitting accounting matters;

- the period of time during which the documents will be transferred;

- if for some time the former and new chief accountant will have to work together, then the order will have to indicate the division of responsibilities between them;

- the date before which all accounting operations must be completed by the chief accountant leaving the company;

- procedure, timing of inventory;

- the procedure for processing documents such as the acceptance and transfer of cases.

Inventory is mandatory only when there is a change of financially responsible officials (it must be carried out if the employment contract with the chief accountant contains a condition regarding full financial responsibility).

Features and nuances of dismissal of the chief accountant

It should be said right away that the dismissal of the chief accountant is a process that has many differences from the dismissal of an ordinary employee, since it is the accountant who deals with financial issues, is responsible for taxes, and accompanies the receipt of funds and their expenditure.

Chief accountant at work

It is the chief accountant who knows all the intricacies of accounting and conducting business in the company - even the head of the company is not familiar with such nuances. Therefore, when resigning, an accountant must report all the data about his work and submit reports either to the director or to a new specialist - this process is called “transfer of affairs.” At the same time, all accountants must transfer their affairs, since the work of the entire enterprise depends on this. You also need to remember that the chief accountant is responsible for all decisions he makes.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how to solve your specific problem

— contact a consultant:

There are only four reasons for dismissal. Let's take a closer look at them.

In the remaining free time, the accountant needs to concentrate on fulfilling his duties, completing all the work he has started, and putting the documents in order so that the next employee can quickly get used to the work when taking over the work. No other work is provided, that is, the manager does not have the right to force a specialist to complete reports or complete any other tasks - only at the request of the accountant himself. When paying compensation, payment for unused vacation plus severance pay is taken into account.

This happens if an employee has violated discipline, causing damage to the enterprise through his actions, for example, when writing off valuable property that was useful.

In addition, a specialist can be fired if there is a change of owner - if the new manager decides to hire another chief accountant. He will be paid severance pay in the amount of three months' earnings. Similar compensation is required to be issued in the event of dismissal due to staff reduction, for example, if the head of the company, wanting to save money, intends to perform the functions of the chief accountant.

The occurrence of circumstances beyond the control of the parties

This includes the death of an employee or worker, which automatically terminates the employment contract.

At the same time, it does not matter in which organization - public or private - the specialist works - all cases of dismissal are regulated by the Labor Code of the Russian Federation and are similar to each other

Professional experience, innovative thinking and passion for professional development

Most employers need accounting practitioners who can quickly adapt to dynamically changing market conditions and legislative innovations. The cost of a candidate increases if he previously worked in the field of external or internal audit. But this factor is seen as an advantage, not a necessity.

Of course, work experience is important. However, today employers have slightly changed their tactics for selecting candidates for financial positions. Many of them can overlook the lack of professional experience of an accountant if he has a sparkle in his eyes and a desire to immerse himself in the work right at the interview. Today, an ambitious innovative accountant with sparkling eyes, fresh ideas and a desire for professional development is 2 times more likely to get a prestigious, highly paid job than an uninitiated conservative candidate, albeit with many years of experience.

Professional experience, as understood by management, is closely intertwined with continuous professional development. An advantage in interviews is given to those specialists who have diplomas, certificates, certificates confirming the relevance of their knowledge in the field of accounting, tax and management accounting, financial management, internal audit, etc.

Instructions for drawing up a document

The order is drawn up in the generally accepted form, but there are some differences from other documents for the enterprise.

Form

The legislation has not developed a special form for such a document, which means freestyle.

Like any other, such an order is printed with the company details and address at the top of the sheet. Below in the center is the name - the order, on the next line on the left indicate the point where the change of chief accountant takes place and the company is located, and on the right - the date.

On the left, a short column describes the topic of the document, in this case it looks like this: “Concerns the transfer of affairs by the chief accountant.” Below, with a paragraph, the text part of the document begins.

Contents of the paper

As the first point, the head of the company, on whose behalf and signature the order will be issued, must state the reason for the transfer of financial papers, for example: “In connection with the dismissal of the chief accountant, I order:”, and then place the points one after another. When obliging to provide folders, papers, and information on a computer, it is imperative to set a deadline during which the orders must be completed.

The period for which the documentation is transferred should also be specified (usually 3 years).

If the chief accountant tries to hide information, does not disclose all the nuances of the actual situation of finances or taxes, the availability of materials, etc., or openly ignores this document, then it turns out that the order is not being executed, and it is possible that the employee who has access to the company’s finances , intends to hide the abuse.

In this case, completely different disciplinary measures may be taken, taken into account by the Labor Code of the Russian Federation, and the cases will be entrusted to a commission, the competence of which will make it possible to clarify the situation and identify shortages of funds or materials.

The order must specifically indicate the full name and position of the person submitting the case, as well as the details of his successor. The person accepting the papers may be the new chief accountant, and if the candidacy has not yet been approved, then there is an option to entrust the acceptance of the documentation to a deputy or other official.

It is important that the host has sufficient competence in financial matters and the nuances of tax policy. After the handing over person leaves, all responsibility is assumed by the one who accepted the case and signed it. Other persons may also be involved in the procedure for handing over cases - the financial director, a representative of the company’s own security service, etc.

During the period allotted for acceptance from the outgoing chief accountant, an inventory of the material base is usually also carried out.

Other persons may also be involved in the transfer of cases - the financial director, a representative of the company's own security service, etc. During the period allocated for acceptance from the outgoing chief accountant, an inventory of the material base is usually also carried out.

The date of issue of the order must correspond to the one that coincides with the registration log, and at the same time precede the acceptance process by 1-2 days: the persons involved in this action must be familiar with the document for signature.

The document also stipulates the powers and responsibilities of those who participate in the delivery and acceptance of cases from the chief accountant. For example, you can indicate that if any shortages or discrepancies are identified, an audit firm should be involved. Based on the results of acceptance, an act must be drawn up, specifically specifying what the order should specify in the order and indicating the person responsible for this.

The manager usually retains control over the execution of this document. Under the text, indicate the full position of the manager and his full name, and after signing, list the positions and full names of everyone who should be familiar with the document.

Everyone who is in one way or another involved in the transfer of cases and is mentioned in the order should be familiarized with its contents under the signature on the first copy. It is this order that is drawn up in 1 copy, which is necessary for office work, and for everyone mentioned, the secretary will prepare copies.

The chief accountant has no right to leave without transferring the case, and to control this process an order must be issued for the enterprise. This is a simple document for the internal circulation of the company, but when drawing up the paper you need to know what exactly such a document should contain.

Responsibility of the chief accountant after dismissal 2020

It should be taken into account that if there is a refusal to initiate a criminal case or a criminal case is terminated, but there are signs of an administrative offense, then the above periods are calculated from the moment the decision is made to refuse to initiate a criminal case or terminate the case.

In each specific case, it is determined which area is affected by the offense committed by the accountant. For example, Art. 15.1 of the Code of Administrative Offenses of the Russian Federation, describes an administrative offense in the financial sector. It follows from this that under this article an accountant can be brought to administrative liability within two months from the date of the offense.

Criminal liability: statute of limitations Article 78 of the Criminal Code of the Russian Federation establishes the statute of limitations for bringing to criminal liability.

Responsibility of the chief accountant from 2017-2018

This is possible in the following situations:

- distortion of financial statements;

- non-payment of taxes;

- incorrect payroll.

The procedure for holding people accountable is standard. The tax inspector draws up a special protocol.

Attention After this, a statement of claim is filed in court to bring the chief accountant to criminal liability. The punishment depends on the severity of the offense committed

Important Material Based on the Labor Code of the Russian Federation, the employer has the right to recover damages from the accountant, the amount of which does not exceed his monthly salary. This point is regulated by Article No. 238 and Article No. 241 of the Labor Code of the Russian Federation

It is also possible to recover damages in full.

But this point must be specified in the employment contract. Otherwise, the employer simply will not have the right to recover damages in full.

What responsibilities does the chief accountant have?

- enter the amount of salary that was earned in 365–730 days;

- sentenced to forced labor for two years;

- arrested for six months;

- imprisoned for two years.

If qualifying signs are identified, the punishment is increased:

- the fine is increased by 100 or 200 thousand, and the salary is taken for 12–36 months;

- forced labor is extended to 60 months;

- imprisonment for six months.

In case of failure to fulfill the duties of a tax agent (Article 199.1), the following is provided:

- fine from one hundred to 300 thousand rubles;

- deduction of earnings for 24 months;

- forced labor for 24 months;

- arrest for six months;

- imprisonment for 24 months.

In accordance with Article 199.2 of the Criminal Code of the Russian Federation, when concealment of money or property is noted, arrears are collected.

Responsibility of the chief accountant from 2020

They include:

- For crimes of minor gravity - two years;

- For crimes of medium gravity, the term is six years;

- For serious crimes - six years;

- For especially serious crimes the term is fifteen years;

For all crimes, the statute of limitations is calculated independently. When deciding on the statute of limitations for bringing an accountant to criminal liability, it is necessary to refer directly to the article and its sanctions for which there is suspicion of a crime.

This includes evasion of payment of required taxes or other fees from the enterprise, associated with the failure to submit tax returns or other documents that must be submitted in accordance with the legislation of the Russian Federation on taxes and fees.

When does the chief accountant become criminally liable?

It contains the following information:

- for what reason are cases transferred;

- start and end date of the procedure;

- FULL NAME. retiring accountant and employee responsible for receiving cases;

- the composition of the commission is indicated;

- deadlines for drawing up an act of acceptance and transfer of cases.

After this, the procedure for accepting and transferring cases is carried out. The director of the company or the commission can accept cases.

The procedure consists of the following steps:

- issuance of an order on the acceptance and transfer of cases;

- inventory of property and liabilities;

- checking the status of accounting and reporting, the availability of accounting and tax documents;

- acceptance and transfer of cases with the preparation of an inventory;

- drawing up an inventory of accepted cases and an acceptance certificate.

If the chief accountant resigns, the transfer of affairs must be carried out before his last working day at the enterprise.

The extent of any punishment directly depends on the severity of the act committed.

A specific individual is responsible for his actions in the post of chief accountant even after dismissal or transfer to another position. This point is reflected in legislative norms.

The accountant's responsibility after dismissal lasts for a limited period of time. This point is also reflected in legislative norms.

Responsibility of the chief accountant after dismissal at his own request

Even after the termination of the employment relationship, the accountant-manager can be held accountable by both the former employer and government regulators. In this case, the chief accountant may incur both material, administrative, and even criminal liability.

Monetary sanctions for an accountant can be applied within one year after his dismissal and discovery of damage to the company, as stated in Article 392 of the Labor Code of the Russian Federation. Financial liability for the chief accountant may arise if:

- the financially responsible person committed an illegal act or inaction, which led to material damage to the enterprise, if during the period of management he suffered monetary damage, loss of property or corporate assets (clause 2 of Article 243 of the Labor Code of the Russian Federation);

- The chief accountant was found guilty of committing a violation under Article 233 of the Labor Code of the Russian Federation.

Administrative liability can be imposed on an official within two months from the date of disclosure of the offense (Article 4.5 of the Code of Administrative Offenses of the Russian Federation). This includes gross violations of accounting and management accounting rules:

- Article 15.11 of the Code of Administrative Offenses of the Russian Federation states that an administrative fine in the amount of 5,000 to 10,000 rubles may be imposed on a retired chief accountant if the processes of conducting cash transactions and working with cash are violated;

- if the deadline for submitting tax reports is missed, Articles 15.1–15.9 of the Tax Code are applied;

- fines are possible if there is a deliberate distortion of indicators in accounting records, understatement of tax collections, etc.

Note that criminal liability provided for in Article 78 of the Criminal Code of the Russian Federation is applied to chief accountants extremely rarely. Nevertheless, there are certain articles for this - numbered 199, 199.1, 199.2 of the Criminal Code of the Russian Federation. Difficulties in applying these standards arise, as a rule, due to the fact that responsibility for them must be assigned to a specific official, and the employee who left the company is not actually one. But this is possible on the basis of an act of acceptance and transfer of affairs, which delineates the responsibility of the departed and newly hired manager.

And the last thing I would like to note on this issue: it is impossible to collect a fine from the chief accountant for lost (lost) profits on the basis of labor law norms.

Dismissal of the chief accountant (including at his own request) is a special task. But if you have basic knowledge of personnel issues, document management and legislation, you can cope with it. We recommend that you take a responsible approach to the procedure for transferring cases and documentation, since the stable and competent accounting of the company, as well as the consequences of tax audits, depend on their complete and clear transmission to the successor.

What must be included in a resume for an accountant?

The accounting profession is very common; no enterprise can do without it. It is better for the applicant to understand that competition in this area is quite large, and the manager will choose the best specialist who can complete the work in the shortest possible time and without errors. To interest an employer, you need to create a resume that demonstrates the positive aspects of your professional activities.

Exact job title

It is important to clearly write the position for which the specialist is applying. This will make it clear to the employer that the person evaluates himself objectively and thoughtfully approaches the issue of job search.

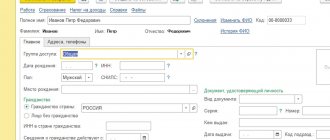

Candidate information

Your resume must include your full name, age, registration/residence address, contact information, and educational information. List all educational institutions in chronological order, indicating department name and graduation date. The list also includes courses and trainings. If there are quite a lot of them, don’t write about them all, choose the most suitable ones.

Desired salary level

The specific figure should be indicated taking into account offers for such positions on the labor market.

experience

In this section, it is worth listing only the most significant jobs and positions that you have held for 5-10 years, if during this time you worked for several companies. Or your last 2-3 jobs, where you worked full-time and held a good position.

Be sure to indicate the direction of the company’s activities, positions held, job responsibilities, and period of work.

Special skills in a resume (examples for an accountant)

The content of an accountant's work depends on the area in which he works. Here you should indicate what you can do and what you can offer the employer. Evaluate the opportunities objectively, since during the interview the level of your knowledge will become clear to the employer one way or another. Also try to avoid common phrases. For example, you should not write that you are familiar with all accounting programs. Indicate specifically which of them you have mastered at a high level. Examples of key skills in an accountant's resume are as follows:

- cash management skills;

- Experience in submitting reports to funds and tax authorities;

- knowledge of the rules and experience in maintaining tax and accounting records in a specific area (indicate which one);

- skills in preparing primary documents;

- ability to work with large volumes of data;

- knowledge of civil, labor and tax legislation.

It is worth listing not only the key accountant skills in your resume, but also additional information. For example, if a candidate has knowledge that is currently not mandatory, but will be useful in his professional activities, this will be a plus for him.

List of achievements

Professional achievements in an accountant's resume are results of work that demonstrate the successful completion of professional tasks and reflect the economic benefits received by the company where you once worked. A phrase about achievements may sound like this: “During the time I worked at the company, I passed ten tax audits without a single comment.” This information will allow a potential employer to judge you as a valuable specialist.

Personal qualities

A sample resume for an accountant based on primary documentation should contain references to personal qualities that will be especially valuable when performing professional duties. For example, these are analytical skills, organization and the ability to work with information.

Photo

You should attach a high-quality photo to your resume. Many applicants neglect this, believing that the employer should select candidates based on professional qualities, and not on appearance. We agree. But practice shows that resumes with photos are opened 80% more often than those without them. The resume photo should be in a discreet business style. It's best if the photo was taken at your workplace.

It is important that the entire resume has a clear structure and is compiled accurately, without errors. Write briefly and concisely. There is a high probability that the employer will not even be interested in the large text.

Private

If the accountant’s work book does not include the entry “chief”, this does not mean that questions cannot arise to him after signing the dismissal order. For example, if the only accountant at an enterprise is responsible for all accounting at the enterprise, then in this regard it is not much different from the chief accountant.

For an accountant responsible for a particular area, only violations directly related to his functions “for the area” can pose a danger. Typically, job responsibilities are specified either in the personal instructions or in the employment contract. If the incident is not related to the accountant’s work functions or did not result from his work, then he will not be responsible for them.

Does it carry it?

Any employee should understand that poorly performed work can lead to problems, even if he has not been in an employment relationship with the organization for quite some time. This is true for both chief accountants and ordinary employees.

- If the organization does not have a chief accountant. If there is only one accountant at an enterprise, this does not always mean that he should be equally responsible as the head of the service. Here, a lot depends on the accounting policy of the organization and the job description of the accounting employee.

If the order establishing accounting rules states that accounting and tax decisions are approved by the manager, then such wording completely whitewashes the accountant’s actions. If the organization has a chief accountant. When an accountant is part of an entire financial service, his responsibilities must be clearly stated in an employment contract or job description, and the accuracy and completeness of their implementation is controlled by the chief accountant.

If a violation is recorded “in the area” of a specific accountant, then he may also be subject to compensation for material damage or administrative liability. He need not worry about all other issues. A simple rule applies here: if the document does not have the signature of the accountant-executor, then it will be very difficult to prove his guilt and involvement in the violation.

For what violations?

A modest place in the management structure of an enterprise does not guarantee an ordinary accountant exemption from liability. An ordinary accounting employee also faces:

- financial liability if he intentionally or negligently caused damage to the property of the enterprise (himself or as part of a group);

- criminal if he acted secretly or in collusion with his superiors.

Administrative liability is provided for the officials of the enterprise, and the ordinary employee is usually not included in their list. But the fine paid by the employer, if there is evidence of the guilt of the former employee and compliance with the deadlines under Art. 392 of the Labor Code, can be classified as material damage and try to recover it through the court.

Authorization

Requirements for an accountant when hiring

An accountant is a versatile profession, it’s not just dry numbers and reports, it’s solid knowledge in many areas, including economics, law, informatization and other areas of activity of any organization.

In a large organization, there may be several accountants, and each is assigned their own functions: a chief accountant, who, for example, manages the financial and economic division of the organization, a finance and credit accountant, specialists specializing in accounting operations and involved in accounting, accountants involved in calculation of the personnel of the organization (issuing wages), etc.

The general requirements for an accountant when hiring are the necessary knowledge in the field of bookkeeping and accounting, because Receiving a diploma of higher education in this field does not yet indicate the employee’s qualifications and the ability to apply the knowledge acquired at a university or secondary specialized educational institution in practice. Despite the fact that the person being hired is not a lawyer, the applicant must know the basics of legislation on accounting, document management, as well as archival activities in this area, in addition to being familiar with tax legislation, as well as laws on social and health insurance, as well as other legislation ( depending on the specifications of the organization for which the applicant is applying for the position of accountant).

An accountant must be savvy in the basics of computer science and also be good at working on a computer. Knowledge is nothing without practice, so an accountant must be able to apply his knowledge in practice, which is easily verified during an interview.

The accountant must also have basic knowledge of verifying primary documents, including those on electronic media. You should not hire an applicant who does not know how to use various computer accounting programs, and you should not limit yourself to checking only your knowledge of the 1C: Accounting program. A trained applicant must also be able to use information, legal and reference search engines in his work, and skillfully use office equipment (printer, scanner, etc.).

The requirements for hiring a chief accountant are, of course, broader.

Firstly, this is a work experience of at least 5 years (if you have a specialized secondary education), 3 years (if you have a higher education). A plus will be the completion of professional retraining programs for accountants, as well as advanced training courses.

It is worth noting that various economic entities have the right to demand other additional requirements for chief accountants, as well as the presence of other skills necessary in a particular organization.

When choosing a chief accountant, it is certainly more difficult for a manager than when choosing an ordinary accountant, because the manager can entrust the selection of an ordinary staff accountant to an experienced chief accountant.

In order to have at least some idea of the requirements for a chief accountant, the manager needs to familiarize himself with the Professional Standard “Accountant”, approved by Order of the Ministry of Labor and Employment of the Russian Federation dated December 22, 2014 No. 1061n.

In addition, it is recommended to invite a specialist from another, preferably a large organization, to participate in the interviews of applicants for the position of chief accountant. Perhaps the chief accountant, who will play the role of an expert during the interview, will ask for payment for the specified work. But, in this case, it is better to pay once when choosing the right candidate than to pay three times later, constantly remembering the proverb that the miser pays twice.

An interview with a future accountant is clearly different from interviewing other applicants for other positions. Instead of regular testing, it is most likely necessary to use specific accounting tests; questions for applicants for the position of accountant are fundamentally different from questions for candidates for other positions, because have special specificity.

According to personnel officers, a future accountant does not have to undergo such currently popular psychological tests, including intellectual ones, because The special makeup of an accounting employee is quite difficult to assess from the point of view of psychology, and IQ is determined in accounting tests imbued with logic. The testing can include both theoretical and practical situational questions.

Primary testing can also be carried out by personnel workers, but in the future you will need a specialist who knows the intricacies of accounting in order to clarify not only narrow issues in the field of accounting, but also to determine whether the applicant is a responsible person, because It is the accountant who is responsible for providing primary documents.

Probably, as in any profession, it is impossible to know everything from memory. And an accountant also cannot keep all the information in his head, but, nevertheless, a competent specialist always knows where to find the necessary information and what to do with it.

Punctuality is also an essential quality of an accountant, because... Together with responsibility, this quality helps to comply with all deadlines for accounting and tax reporting.

One of the golden qualities of a competent accountant is communication skills, because... Due to their work, they have to negotiate and work with various regulatory authorities. And sometimes polite and friendly communication can solve many unpleasant issues for an enterprise.

Oddly enough, the appearance of the applicant is also of no small importance for choosing an applicant for the position. Despite an impressive resume and extensive work experience, employers may be put off by an applicant’s unkempt appearance. All this inspires hostility towards the candidate, and this can decide the issue in favor of a less experienced colleague, who is externally and visually more pleasant.

During the interview, the HR employee needs to pay attention to the behavior of the applicant and his manner of communication. If an applicant for the position of chief accountant is lost in the answers, blaming it on excitement and embarrassment, then the big question is how he is going to manage a department with great financial responsibility.

If he is too rude and arrogant, then work in a team will be in constant tension, which is also undesirable for the team.

The chief accountant must have organizational skills so that the manager, having entrusted him with one of the most difficult areas of work, can be calm about the financial well-being of his organization.

The hiring process for a chief accountant is approximately the same. First, the personnel department studies the application forms when hiring an accountant, then from the selected application forms, applicants are invited for an interview.

After all these procedures are over, and the candidacy of the accountant is approved by the management of the organization, the personnel service will have to register the new employee in strict accordance with the legislation of the Russian Federation.

A feature of the registration process for hiring a chief accountant, enshrined in the Law “On Accounting,” is that only the first person of the organization (director, general director, etc.) has the right to appoint and dismiss from this position.

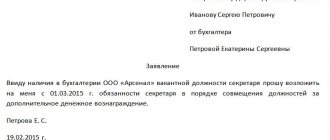

To begin with, the applicant writes a job application, which is typical and addressed to the head of the organization. After this, the head of the organization puts a resolution on the application to conclude an employment contract and prepare an order for hiring an accountant.

The employment contract specifies all the nuances of the accountant’s work in the organization: his job responsibilities and rights. The basic salary for the job, bonuses and other payments are also indicated.

Since the accountant is a financially responsible person, it is necessary to conclude an agreement on financial responsibility with him (especially if he is an accountant-cashier).

Bringing full financial responsibility to the chief accountant is possible if the condition for this responsibility is specified in the employment contract, or if an agreement on full individual financial responsibility has been concluded with him.

There is no universal agreement on the full financial responsibility of an accountant, but it can state something like the following: the accountant’s full name, as well as the sanctions that the accountant undertakes in connection with the lack of property (material assets) entrusted to him.

The agreement on full liability is also recommended to reflect the accountant’s responsibilities, which include keeping records of the movement of material assets, as well as by any legal means ensuring the safety of the organization’s material assets and notifying the organization’s management or other designated persons of any encroachment on them. The said agreement should also stipulate the responsibilities of the head of the organization in the form of ensuring normal conditions for the safety of the valuables entrusted to the accountant. Such a contract is always fixed-term, and if it expires, it is extended or a new contract is drawn up.

After the employment contract is signed, in accordance with Art. 68 of the Labor Code of the Russian Federation, an accountant must be familiar with the order for his employment. At the employee's request, he must be given a certified copy of such an order.

How to leave work before two weeks

Here you need to come to an agreement in any case. A good relationship with the boss (as well as the absence of complaints in terms of work discipline) will play a major role. In this case, there will be a termination of cooperation by agreement of the parties - because only this option implies voluntary departure from the organization without the notorious two-week work. For example, you need to go to a seriously ill relative, your husband is sent to a new duty station.

Simply writing a statement “on your own” will not work, because Article 80 of the Labor Code obliges a person in this case to still write a petition, taking into account the mentioned two weeks, that is, after the words “I ask you to dismiss me from ...”, he puts a date that must occur after fourteen days after submission of the application.

To resign under Article 77 of the Labor Code (agreement of the parties), you must first write a memo to the employer and discuss the terms.

For example:

General Director of Prima-standard LLC

Ivanov I. I.

from the chief accountant Fedorova T.P.

SERVICE NOTE No. 2

I would like to bring to your attention that my husband received a long-term contract to work in Berlin and in connection with this I cannot continue to work at Prima-Standard LLC from July 1, 2020, nor do I have two weeks to work.

I ask you to dismiss me by agreement of the parties.

Sincerely

Fedorova Tatyana Petrovna (signature)

July 30, 2020.

memo about the impossibility of working for two weeks upon dismissal

After this, the said agreement is drawn up. It needs to be studied with all care - it may well turn out that the employer promised one thing, but in reality something else will turn out. If you find it (especially with regard to the date of dismissal, you don’t want to be fired for absenteeism and have your work book decorated with the corresponding note), demand that the text of the document be rewritten.

dismissal agreements by agreement of the parties without working off

True, as practice shows, bosses usually agree to this option and accommodate employees halfway. After this, the employer issues an appropriate order to terminate cooperation. The reason will not be indicated (it should be indicated in the memo or at least stated in words). At the same time, the boss transmits an order to the personnel service to prepare documentation for dismissal, that is, enter information into the employee’s personal card (T-2) and make an entry in the document on seniority. On the last day, in addition to the settlement, the financier is given a 2-NDFL certificate and a work book with the corresponding entry and a link to Article 77 of the Labor Code.

filling out a personal T-2 card upon dismissal of the chief accountant

So in a general sense, the dismissal of the chief accountant is no different. Unless he has more responsibility than an ordinary specialist who has nothing to do with the financial turnover of the company, which means there may be more reasons for terminating cooperation.

Personal qualities are important for an accountant

The chief accountant works closely with the company's chief executive or, at a minimum, with the financial director, so it is extremely important that the interview is conducted by an employee with whom further direct interaction will take place. The director must also talk to the potential employee, because This meeting will make it clear whether it is possible to find a common language with this person or not.

Gender and age

Quite often, when managers are looking for a chief accountant, they choose young specialists, but the optimal age for a chief accountant is at least 35 years old. It is at this age that a person is already fully formed as a person, and he can be called a professional with the necessary work experience. At this age, people quickly find a way out of crisis situations, so such a candidate will be quite effective in completing assigned tasks.

It is preferable if the accountant is a woman (this is more common and inspires trust), and she should have a well-groomed and neat appearance, because there will be a need to present financial reports quite often to influential people, for example, investors.

Direction of the organization's activities

When you choose a chief accountant, a fairly important factor is the direction of the company. It should be noted that when choosing a candidate, it is advisable to choose a person who has already worked in the field you need. This is due to the fact that the reporting and accounting system in different areas differs significantly in level of complexity. If the service sector is the simplest, then not every accountant can cope with the construction sector. It may be difficult for the selected specialist to start working in a completely unfamiliar field.

What is the ideal candidate?

To summarize: if you want to find the ideal chief accountant, pay attention to women or men over 30-35 years old, with a higher financial or accounting education and with at least 5 years of experience in the desired field. As for personal qualities, what is important here is the ability to find a common language with people, goodwill, the ability to defend one’s position, organize the work of oneself and the team, because The chief accountant may have a whole enterprise accounting staff subordinate to him. It is also important to focus on professional and career growth.

You can try to find such specialists yourself. And if you want to save your own time and be sure of a positive result, then contact the TOTAL recruitment agency. Our specialists will select a chief accountant who will fully meet your criteria. Literally a few days after filling out the application, you will have a professional chief accountant on your staff.

How to correctly transfer and accept affairs when changing the chief accountant

A change of chief accountant is always stressful for an organization. The new accountant must have time to get comfortable and take over the business from his predecessor. How to do this so as not to disrupt the usual rhythm of the company’s activities and minimize negative consequences in further work?

The legislation of the Russian Federation does not provide for regulations for the reception and transfer of cases when changing the chief accountant in a company. However, it is in the interests of the organization itself, especially a large one (with large turnover and various types of activities), to carry out and formalize this procedure properly.

What to consider when accepting business from a departing chief accountant

When changing the chief accountant, it is necessary to develop a clear scheme for the transfer of cases to the departing and the acceptance of cases by the new employee. It stipulates the procedure and timing for the acceptance and transfer of cases, the period during which each of the chief accountants will conduct current affairs, manage the work of the accounting department, and also sign documents. The developed scheme is approved by order of the head of the organization. It also indicates the persons responsible for the implementation of this order.

The procedure for transferring affairs to the new chief accountant consists in particular of the following steps:

issuing an order from the head of the organization on the acceptance and transfer of cases;

conducting an inventory of the organization’s property and liabilities;

familiarization with internal documents of the company;

direct transfer of cases, including transfer of primary documentation, accounting and tax registers, accounting and tax reporting;

checking the status of accounting and reporting;

execution and approval by the manager of the act of acceptance and transfer of cases.

So, on the date approved by the order, all accounting processes for the past period must be completed and all necessary accounting entries must be generated, registers must be printed and reports submitted to the tax authorities, and primary documentation for this period must be filed in folders. Moreover, this must be a date determined based on the deadlines for submitting accounting and tax reporting. So, if the chief accountant resigns in February 2012, then the order for the acceptance and transfer of affairs may indicate that he is responsible for submitting accounting and tax reports for 2011, and the new chief accountant is responsible for submitting reports starting in January 2012 . Read about the procedure for changing the chief accountant in the box below.

When the new chief accountant accepts cases, it is necessary to conduct an inventory of the organization’s obligations and property, and transfer all documents, the preparation of which is within the competence of the chief accountant, according to the inventory. The organization's seal, the keys to the safe, if there is one in the department, and the client-bank system must also be transferred. If the chief accountant is assigned the duties of a cashier, then the former accountant is obliged to transfer to him all cash, bank check books, forms of strict reporting documents and keys to the cash register.

It is important for the new chief accountant to find out whether the organization is in arrears in paying taxes and insurance premiums. This can be determined by the balances on the relevant accounting accounts

In addition, it should be clarified whether the organization is in the process of litigation with contractors, employees or regulatory authorities.

It is advisable if the previous and new chief accountants, as well as the financial director or head of the company, participate in this transfer of affairs and inventory. In some cases, auditors may be involved in the audit to help conduct an independent examination of the state of accounting and reporting.

Inventory as a component of the case transfer procedure

When and who is obliged to apply the professional standard

Compliance with the professional standard approved by Order of the Ministry of Labor of Russia dated December 22, 2014 No. 1061n and registered with the Ministry of Justice of Russia on January 23, 2015 under No. 35697 is necessary for the chief accountant or for those responsible for accounting in the following companies and institutions:

- open joint stock companies, excluding credit companies;

- NPF;

- companies engaged in insurance activities;

- AIF and management mutual fund;

- other entities that have securities admitted to trading, with the exception of credit structures;

- governing bodies of government and extra-budgetary territorial funds.

It is important to note that the application of professional standards is necessary for employees occupying positions in which their qualification level is established by law or regulations.

And also if for the performance of labor functions a number of benefits, compensations are provided, or, conversely, some restrictions are imposed. Read more: sample job description for an accountant

Read more: labor safety instructions for accountants

Question

I will tell you the situation as it is. In another organization, the chief accountant fell ill. It's reporting period now. And she says that she won’t do anything. I was asked to look at the documents, and there is this picture: a complete mess, there are not even payroll records, no calculation of sick leave, no refund from the Social Insurance Fund for 2 years, PU-5 in the computer only for the 1st quarter of 2014, no invoices and invoices . Maybe somewhere there is something, but the entire document flow at the enterprise needs to be restored. Therefore, my question is: is she responsible for the above and for the accuracy of tax returns after dismissal, because. she says that she will not work anymore, and is now on sick leave. With respect and gratitude A.A.

List of sources

- ipshnik.com

- kleotur.info

- www.26-2.ru

- www.glavbukh.ru

- lawgurufaq.com

- AstroKamen.ru

- moyafirma.com

- ipinform.ru

- IDeiforbiz.ru