It is important not only for the employees themselves to improve their qualifications and professionalism, but also for the company in which they work. Personnel are the face of the organization, and the quality of their work largely determines the success of the business. Investing money in training, education and retraining of personnel is beneficial in the long term if this money is managed wisely. To do this, you need to understand what the costs of employee training and how to account for them correctly.

What is included in employee training costs?

The most common expenses for training company employees are:

- Payment to employees for training in other professional skills.

- Learning foreign languages by employees.

- Reimbursement of training costs for employees in higher education institutions, including postgraduate and doctoral studies.

- Spending on periodic events to improve the skills of employees, which in some professions is a mandatory condition of work.

- Retraining of personnel, training of new employees within the organization or in special educational institutions.

In Art. 196 of the Labor Code of the Russian Federation states that the need for training - within the framework of both vocational education and additional education - is determined by the employer based on his business objectives and the specifics of the organization’s activities. The procedure and conditions for such training should be reflected in the collective agreement, employment contracts with employees and other agreements relating to the implementation of labor activities in the company.

However, when determining the necessary professions, specialties and methods of training personnel, the employer must not only rely on the needs of the business at the moment, but also take into account the opinion of the organization representing the interests of workers.

Federal laws and some other regulations oblige employers in a number of cases to provide training and provide the opportunity for employees to receive additional professional education (including compensating them for training costs), if without this training it is impossible for them to perform certain types of work activities.

In particular, Russian companies and individual entrepreneurs, whose activities include the operation of vehicles, must provide conditions for improving the qualifications of employees working on city or ground electric transport as drivers, or engaged in traffic regulation (Clause 1, Article 20 of the Federal Law “On Safety”) road traffic" No. 196-FZ dated December 10, 1995).

In addition to transport workers, medical workers have guarantees for training at the expense of the employer (vocational training, advanced training, retraining). This is reflected in Part 1 of Art. 72 of the Federal Law “On the Fundamentals of Protecting the Health of Citizens in the Russian Federation” No. 323-FZ of November 21, 2011. Training activities for doctors and medical staff must be provided by their medical institution, therefore for healthcare enterprises the costs of training employees are inevitable.

In addition to paying for professional training and education, the employer’s responsibilities include providing all other guarantees established by the Labor Code and internal regulations of the company, as well as creating conditions so that the employee can combine the performance of his work tasks with training.

The right of workers to receive additional professional education and training is also enshrined in Art. 197 Labor Code of the Russian Federation. To exercise this right, an employee can enter into an agreement with the employer, which will spell out all the conditions of training and the procedure for reimbursement of expenses.

Read the material on the topic: Payment for study leave

How to organize employee training at the employer's expense

Attention

Employees sent for vocational training or additional vocational education away from work to another location are paid for travel expenses in the manner and amount that are provided for persons sent on business trips. Is it legal to conclude an agreement with an employer on advanced training? Relations between the parties in connection with sending employees for advanced training may be formalized by additional contracts (agreements) with employees (Article 197 of the Labor Code of the Russian Federation). When concluding such a contract (agreement), the parties can provide for a condition regarding the period during which the employee undertakes to work in the organization, as well as a condition for the employee to compensate the employer for training expenses in the event of early termination of the employment contract at the initiative of the employee.

How to track employee training costs

Accounting Regulations “Organization Expenses” PBU 10/99, approved by order of the Ministry of Finance of the Russian Federation No. 33n. dated May 6, 1999 (specifically clauses 5, 6, 6.1, 7), classifies the enterprise’s expenses for employee training (in any form) as expenses for ordinary activities. Their amount must be reflected in the training contract.

Clause 16 of PBU 10/99 lists the following criteria under which a company’s expenses, including employee training costs, can be recognized in accounting:

- The basis for the expense is a contract, legal act or business customs.

- The amount is clearly defined.

- An expense is part of a transaction that clearly results in a reduction in the economic benefits of the enterprise (this is typical in cases where the company actually transfers its asset to someone or there is complete certainty that the asset will be transferred).

Expenses associated with training and retraining of company employees meet all these conditions and therefore can be counted in the period corresponding to the provision of educational services, namely, the date of signing the act of completion of work (regardless of when the payment for training was actually transferred) – see clause 18 of PBU 10/99.

The company's expenses for employee training are reflected in accounting:

- In the debit of account 60 (“Settlements with suppliers and contractors”).

- In the correspondence for account 50 (“Cashier”).

- On account 51 (“Current Account”), if the company pays for employee training by bank transfer.

- On account 71 (“Settlements with accountable persons”), if the payment was made in cash.

These costs are reflected in the form of accounts receivable if an advance payment was transferred to an educational institution for an employee’s training (see paragraphs 3, 16 of PBU 10/99). But this is no longer an expense, unlike the above cases. Data on prepayment must be present in the credit of account 50 (“Cash”), 51 or 71 (depending on whether the prepayment is made by cash or non-cash payment), as well as in the debit of account 60 (“Settlements with suppliers and contractors”) and analytical account 60-va (“Calculations for issued advances and prepayments”).

As soon as the document of acceptance and transfer of educational services has been received, expenses for employee training should be reflected in the debit of expense accounts 20, 25, 26, 44, in the credit of account 60 and, at the same time, offset the amount of the prepayment in the invoice for the provision of services, making an internal entry in analytical accounting on account 60 (debit 60, credit 60).

In more complex situations, when the company incurs the costs of training citizens with whom an employment contract has not been signed - children of full-time employees, etc. - these amounts are classified as other expenses (which is regulated by clauses 2, 11 of PBU 10/99 ). They must be entered in the debit of account 91 (“Other income and expenses”), subaccount 91.2 (“Other expenses”), as well as in correspondence with the credit of account 60.

Read the material on the topic: How to hire an employee

Who will pay for employee training?

The guarantees provided to a student employee are listed in Articles 173-176, 187 of the Labor Code of the Russian Federation:

- Payment for additional leave provided during training.

- Reimbursement of transportation costs associated with travel to an educational institution.

- The employee retains his average salary.

Each operation related to registration and payment of training must be confirmed by primary documentation (Part 1 of Article 9 of Federal Law No. 402). It is also necessary to confirm the fact that the educational service was received. An act signed by the employer and a representative of the educational institution is suitable for this.

The main requirement for a supporting document is the presence of all details. Education documents are proof of the provision of services. For example, a diploma. Rules and features of work for training Payment for training is a kind of investment by the employer.

How to record employee training expenses in tax accounting

Expenses for employee training can reduce the income tax of an organization or individual entrepreneur, since they reduce the amount of taxable profit of the enterprise (as reflected in Chapter 25 of the Tax Code of the Russian Federation). The main thing is that the mandatory conditions are met:

- These employee training costs make sense from an economic point of view.

- All payments have documentary evidence.

- The purpose of training events is to increase the company’s profits (see paragraph 1 of Article 252 of the Tax Code of the Russian Federation).

The taxpayer can attribute his costs for education and training of employees to expenses associated with production and sales (see paragraph 23, paragraph 1, article 264 of the Tax Code of the Russian Federation). To do this, it is necessary that the training meets the requirements established by Letter of the Ministry of Finance of the Russian Federation No. 03-04-06/48063 dated November 11, 2013 and clause 3 of Art. 264 Tax Code of the Russian Federation:

- whether the institution where the company's employees will study has a license to provide educational services (or the necessary status from a foreign educational institution);

- an employment contract has been signed between the employee and the taxpayer company or a training contract between the company and the citizen, obliging him to work for one year after graduation (starting his career in the company within three months from the date of completion of the training course) under the newly concluded employment contract.

If at least one of these requirements is not met, the taxpayer has no reason to consider employee training expenses as production costs and thereby reduce his taxable profit (see Letter of the Ministry of Finance of the Russian Federation No. 03-03-07/41000 dated July 16, 2015).

Tax Code of the Russian Federation in Ch. 25 does not provide for accounting for expenses such as payment for education or maintenance in preschool institutions for the children of company employees as production costs deducted from profit.

Read the material on the topic: How to save on payroll taxes so that everyone is happy

We train employees

General rules

Other production costs include, among other things, the costs of training employees in basic and additional professional educational programs, as well as vocational training and retraining (subclause 23 and 1 of Article 264 of the Tax Code of the Russian Federation). The list of professional educational programs is given in the Federal Law of December 29, 2012 No. 273-FZ “On Education in the Russian Federation”, therefore, if some educational services are not included in the specified list, the costs of paying for them cannot be taken into account when taxing profits (letter from the Ministry of Finance Russia dated July 16, 2015 No. 03-03-07/41000).

In addition, the following conditions must be met simultaneously:

1. An educational institution must have the appropriate license or status if it is a foreign educational company (subclause 1, clause 3, article 264 of the Tax Code of the Russian Federation and letters of the Ministry of Finance of Russia dated September 23, 2013 No. 03-03-06/1/39249, dated March 12. 2010 No. 03-03-06/2/42).

2. The training is carried out by employees or persons who have entered into an apprenticeship agreement with the organization and who undertake, no later than three months after completion of training, to enter into an employment relationship with the company and work for at least one year (subclause 2, clause 3, article 264 of the Tax Code of the Russian Federation, letter from the Ministry of Finance of Russia dated September 23, 2013 No. 03-03-06/1/39249). If such an employee left the organization before this period or such a potential employee did not enter into an employment contract with the organization, the cost of training must be restored in income (letter of the Ministry of Finance of Russia dated September 10, 2009 No. 03-04-06-02/67, dated September 8, 2009 No. 03-03-06/1/575).

Practical situations

A stipend for potential employees based on the results of academic semesters upon successful completion of the sessions cannot be included in the reduction of the tax base for income tax (letter of the Ministry of Finance of Russia dated April 17, 2009 No. 03-03-06/1/257).

The paid scholarship can be taken into account in tax expenses only after the scholarship recipient is employed (subclause 49, paragraph 1, article 264 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated 06/08/2012 No. 03-03-06/1/297, dated 06/08/2011 No. 03- 03-06/1/336). If, after training, a citizen is still not hired, the scholarship paid to him cannot be written off from tax expenses (letters from the Ministry of Finance of Russia dated July 3, 2014 No. 03-03-06/1/32275, dated March 26, 2015 No. 03-03-06 /1/16621, dated 06/08/2011 No. 03-03-06/1/336, Article 255 of the Tax Code of the Russian Federation).

If training is carried out by employees of the organization itself, payments to mentors are taken into account as part of labor costs (letter of the Ministry of Finance of Russia dated May 14, 2015 No. 03-03-06/1/27734).

The organization's expenses for paying for practical classes to students incurred during the training period in accordance with paragraph. 2 tbsp. 204 of the Labor Code of the Russian Federation and on the basis of apprenticeship agreements, reduce the tax base for corporate income tax in the period of occurrence in cases where they satisfy the requirements of Art. 252, 264 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated March 26, 2015 No. 03-03-06/1/16621).

When additionally paying a student's salary up to the average earnings, these expenses can be taken into account when taxing profits, if this is stated in the employment or collective agreement (letter of the Ministry of Finance of Russia dated 06/03/2013 No. 03-03-06/1/20155). If the employee independently decided to undergo training, then the average earnings for the period of additional leave to undergo intermediate certification for an employee who independently decided to study in a master’s program and already has the qualification “certified specialist” in the same specialty cannot be taken into account by the employer when taxing profits (letter from the Ministry of Finance Russia dated August 31, 2012 No. 03-03-06/1/454). Personal income tax is, of course, withheld from such amounts (letter of the Ministry of Finance of Russia dated April 22, 2014 No. 03-04-05/18603).

If, after training, an employee moves to work in another organization and the new employer reimburses the previous employer for the cost of training such an employee, then this amount is the economic benefit of the latter, accordingly, the new employer must withhold personal income tax from the individual. If the specified amount is paid through deductions from the employee’s salary, tax income does not arise (letter of the Ministry of Finance of Russia dated October 28, 2013 No. 03-04-06/45690).

When paying for training at once for the entire period of training (in advance), the company must take into account training costs throughout the entire period of training (clause 14 of Article 270 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated March 16, 2015 No. 03-03-06/13706).

VAT on tuition fees

If a non-profit organization providing services in the field of education has an appropriate license, then it does not pay VAT on the cost of training (subclause 14, clause 2, article 149 of the Tax Code of the Russian Federation), which means that the organization that sent the employee for training has nothing to deduct.

In a situation where an employee is undergoing training in a company that does not have a license to carry out educational activities, the service provider is not entitled to a benefit under Art. 149 of the Tax Code of the Russian Federation. This means that the VAT presented as part of the cost of training will be deducted by the customer company, even if, as a result of the training, the employee does not receive a certificate, diploma, certificate or certificate (letter of the Ministry of Finance of Russia dated November 1, 2012 No. 03-07-07/112, dated June 21, 2012 No. 03-07-07/59, dated December 5, 2012 No. 03-07-07/127 and dated April 28, 2012 No. 03-07-07/47).

Documentary evidence for tax accounting

In order to confirm training and take into account training costs in tax expenses, the following documents are needed (letters from the Ministry of Finance of Russia dated November 9, 2012 No. 03-03-06/2/121, dated April 21, 2010 No. 03-03-06/2/77 ):

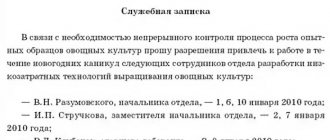

1) order from the head of the organization to send an employee for training;

2) agreement on the provision of paid educational services (letter of the Ministry of Finance of Russia dated February 17, 2012 No. 03-03-06/1/90);

3) certificate of provision of services or other document confirming that the employee:

— or completed a stage of study, for example a semester (certificate issued by an educational organization);

— or completed training (copy of diploma, certificate, certificate, etc.).

Personal income tax

The cost of any employee training is not subject to personal income tax if it is conducted by a Russian organization that has a license for educational activities, or a foreign educational organization with the appropriate status (clause 21 of article 217 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated November 11, 2013 No. 03-04-06 /48063).

The cost of employee training is not subject to insurance premiums (including insurance against industrial accidents) if it is carried out within the framework of basic professional educational programs or additional professional programs (clause 12, part 1, article 9 of Law No. 212-FZ, sub-clause 13, clause 1, article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases” (hereinafter referred to as Law No. 125-FZ), letter of the FSS of Russia dated November 17, 2011 No. 14-03-11/08-13985).

Study leave

When training an employee, the organization is obliged to provide him with study leave (paid or unpaid) if the following conditions are met:

1) the organization is the main place of work for the employee (Article 287 of the Labor Code of the Russian Federation);

2) the employee presented a summons certificate issued by the educational organization in the approved form (Article 177 of the Labor Code of the Russian Federation). Leave is granted for the number of days specified in the certificate or less, but at the request of the employee. If the total number of days of educational leave for which there are certificates of summons for the current academic year exceeds the duration established by the Labor Code, then the organization must provide the employee with paid educational leave for the number of days that fits into the standard, and unpaid educational leave for the number of days which exceeds the standard;

3) the employee studies (enters training) in a program that has state accreditation (information about state accreditation is indicated in the summons certificate):

— basic general or secondary education (school, gymnasium, etc.);

— secondary vocational education (technical school, college, school, etc.);

— higher professional education (bachelor’s, master’s, specialty, postgraduate, residency, assistantship-internship);

4) the employee receives (is going to receive) education of this level for the first time (Article 177 of the Labor Code of the Russian Federation).

If an employee simultaneously studies in two educational organizations, then you are obliged to provide him with study leave for only one of them. For which one, the employee himself decides. Cases when an employee is entitled to paid and unpaid study leave are given in table. 1 and 2 respectively.

Table 1. When an employee is entitled to paid study leave

| Type of education | Form of study | Reason for leave and its duration (in calendar days) |

| Professional higher education (bachelor's, master's, specialist's) | Part-time or part-time | 1. Interim certification (Article 173 of the Labor Code of the Russian Federation): — in the 1st and 2nd courses — 40 days per academic year; - in subsequent courses - 50 days per academic year. 2. State final certification - no more than four months (Article 173 of the Labor Code of the Russian Federation) |

| Professional higher education (graduate study, residency, assistantship, internship) | Correspondence | 1. 30 days during the calendar year plus the time spent traveling from the place of work to the place of training and back (Article 173.1 of the Labor Code of the Russian Federation). 2. Admission to defend a dissertation for an academic degree (Article 173.1 of the Labor Code of the Russian Federation, clause 2 of the Rules for granting leave): – Candidate of Sciences – three months; – Doctor of Science – six months |

| Professional secondary | Part-time or part-time | 1. Interim certification (Article 174 of the Labor Code of the Russian Federation): — in the 1st and 2nd courses — 30 days per academic year; - in subsequent courses - 40 days per academic year. 2. State final certification - no more than two months (Article 174 of the Labor Code of the Russian Federation) |

| General basic | Part-time | State final certification - nine days (Article 176 of the Labor Code of the Russian Federation) |

| Overall average | State final certification - 22 days (Article 176 of the Labor Code of the Russian Federation) |

Table 2. When an employee is granted unpaid study leave

| Type of education | Form of study | Reason for leave and its duration (in calendar days) |

| Professional higher education (bachelor's, master's, specialist's) | Any | Final certification after training at the preparatory department - 15 days (Article 173 of the Labor Code of the Russian Federation) |

| Entrance tests - 15 days (Article 173 of the Labor Code of the Russian Federation) | ||

| Full-time | 1. Interim certification - 15 days per academic year (Article 173 of the Labor Code of the Russian Federation). 2. Delivery (Article 173 of the Labor Code of the Russian Federation): — final state exams — a month; – final state exams and defense of final qualifying work – four months | |

| Professional secondary | Any | Entrance tests - ten days (Article 174 of the Labor Code of the Russian Federation) |

| Full-time | 1. Interim certification - ten days per academic year (Article 174 of the Labor Code of the Russian Federation). 2. State final certification - no more than two months (Article 174 of the Labor Code of the Russian Federation) |

You can also take into account expenses for paying for educational leave to an employee when he receives education in a specialty not related to his job responsibilities (letter of the Ministry of Finance of Russia dated April 24, 2006 No. 03-03-04/1/389), as well as expenses for paying for vacation employees receiving a second education, stipulating this in the employment contract with the employee (clause 25 of article 255 of the Tax Code of the Russian Federation, article 177 of the Labor Code of the Russian Federation).

Payment by an organization for educational leave when training an employee in an educational institution that does not have state accreditation (Part 6 of Article 173, Part 6 of Article 174 and Part 3 of Article 176 of the Labor Code of the Russian Federation) is risky to recognize as an expense, since the provision of educational leave not provided for by law.

Travel expenses to the place of study

If an organization compensates an employee for travel expenses to the university and back, such compensation is exempt from personal income tax and insurance contributions, but only once per academic year (Part 3, Article 173 and Part 3, Article 174 of the Labor Code of the Russian Federation).

The organization includes the amount of compensation in tax expenses (clause 3 of Article 217, clause 13 of Article 255 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated April 24, 2006 No. 03-03-04/1/389, dated September 1, 2015 No. 03-04 -06/50182, dated July 24, 2007 No. 03-04-06-01/260, subparagraph “e”, paragraph 2, part 1, article 9 of Law No. 212-FZ, subparagraph 2, paragraph 1, article 20.2 of the Law No. 125-FZ, letters of the FSS of Russia dated November 17, 2011 No. 14-03-11/08-13985, Ministry of Health and Social Development of Russia dated April 20, 2010 No. 939-19). Travel costs are subject to compensation, even if the employee has added annual paid leave to the study leave (Part 2 of Article 177 of the Labor Code of the Russian Federation, letter of the Ministry of Finance of Russia dated 02/06/2006 No. 03-03-04/4/24).

Guarantees and compensation for those who combine work and study

Reducing working hours (by the number of hours specified in Parts 4, 5 of Article 173, Parts 4, 5 of Article 174, Part 2 of Article 176, Part 1 of Article 173.1, Article 72, Part 5 Article 173, Part 5, Article 174, Part 2, Article 176 of the Labor Code of the Russian Federation).

Payment for time off from work (in accordance with the amounts specified in Part 4 of Article 173, Part 4 of Article 174, Part 2 of Article 176, Part 1 of Article 173.1 of the Labor Code of the Russian Federation).

Payment for travel to and from the place of study when studying in an accredited educational program in absentia and once a year (Part 3 of Article 173, Part 1 of Article 173.1, Part 3 of Article 174 of the Labor Code of the Russian Federation).

Practical situations

If an employee concealed from the employer that he was receiving education at the appropriate level again, and he was granted and paid for study leave, the amount of paid vacation pay can be recovered from the employee only by a court decision. Grounds - Part 1 of Art. 177, para. 4 hours 4 tbsp. 137 of the Labor Code of the Russian Federation.

The organization's expenses for paying for the training of foreign workers for profit tax purposes for educational programs specified in the List of basic and additional professional educational programs (Article 12 of the Federal Law of December 29, 2012 No. 273-FZ “On Education in the Russian Federation”) can be taken into account when taxing profits. This is stated in the letter of the Ministry of Finance of Russia dated July 16, 2015 No. 03-03-07/41000.

If an employee leaves before the deadline established by the employment contract, he is obliged to reimburse the employer only the amount of costs directly for training, based on the time not worked after completion of training, regardless of the fact that the training agreement provides for reimbursement of all costs associated with training (tuition fees, travel, accommodation; daily allowance, average earnings). This position is supported by judicial practice. The main argument used by the courts: in accordance with Art. 9, 232 of the Labor Code of the Russian Federation, employment contracts cannot contain conditions that limit the rights or reduce the level of guarantees of employees compared to those established by labor legislation.

As an example, we can cite the ruling of the Supreme Court of the Russian Federation dated September 28, 2012 No. 56-KG12-7, the Supreme Court of the Udmurt Republic dated September 1, 2010 No. 33-2849, the resolution of the Federal Antimonopoly Service of the West Siberian District dated February 24, 2012 in case No. A81-1294/2011 , Central District dated October 23, 2013 in case No. A54-5835/2012, rulings of the Moscow City Court dated September 4, 2013 in case No. 11-25893/2013, Supreme Court of the Komi Republic dated June 27, 2013 in case No. 33-3414/2013 .

Expenses for employee training and personal income tax

Expenses of enterprises on employee training are not subject to personal income tax. It does not matter whether the company pays the price for training directly to the educational institution or compensates the costs of training to the employee himself, as well as who initiated the training - the employee or his management. Also, personal income tax is not withheld from the costs of educational literature and materials, examination fees.

However, all of the above is irrelevant for freelancers or job seekers with whom employment contracts have not yet been concluded.

Deduction upon dismissal for training

Thus, if an employee worked for 2.5 years and quit, for example, of his own free will without a good reason, then he will be required to reimburse the employer for 50% of the costs incurred for his training. IN THE SAME TIME…

Important: We are not talking about cases where the employer is obliged to pay for advanced training of employees, which is provided for by law (for example, once every 5 years for medical workers). In cases where the employer wants to recover funds from the employee, the court will side with the employee, since advanced training of employees in this case is one of the conditions for the validity of the license, if for its implementation it is necessary to obtain a special document. In other words - no advanced training - no license.

- Only those expenses that the employer actually incurred for training are subject to reimbursement.

At the same time, the legislator does not determine which expenses are classified as such. We believe that this includes not only payment for courses at an educational institution, but also the purchase of tickets, payment for accommodation, payment of travel expenses, etc. Info 2 years before this, she was sent to advanced training courses in London at the expense of her employer. According to the apprenticeship agreement concluded between them, she was obliged to work for 3 years in the company. The court sided with the employee, since she did not terminate the contract of her own free will. received a higher education in the specialty “Engineer” at the expense of the employer. According to the terms of the additional agreement to the contract, he had to work for at least 4 years. However, after 2 years, the employee writes a letter of resignation of his own free will, arguing that he has decided to retire. The court sided with the employer, since the citizen’s right to a long-service pension arose back in 2004, but he continued to work.

Qualified employees with the most up-to-date knowledge in their industry are the company’s asset, its most valuable resource. That is why enterprise management must regularly send its employees to training. Let us consider the taxation problems associated with paying for training and retraining of specialists.

Personnel training, professional training and retraining of workers, and improvement of their qualifications are very relevant for many organizations. As well as issues of taxation of expenses associated with these processes.

In the provisions of the Labor Code of the Russian Federation (LC RF), in particular, in Art. 196 provides that the employer has the right to determine the need for professional training and retraining of personnel for its own needs. At the same time, he can conduct professional training, retraining, advanced training of employees, training them in second professions, etc. In cases provided for by law, the employer is obliged to provide advanced training to employees if this is a condition for them to perform certain types of activities.

The forms of professional training, retraining and advanced training, and the list of required professions are determined by the employer, taking into account the opinion of the representative body of employees. The presentation procedure is established in Art. 372 Labor Code of the Russian Federation.

The workers, in turn, according to Art. 197 of the Labor Code of the Russian Federation have the right to professional training, retraining and advanced training, including training in new specialties.

This right is exercised by concluding an additional agreement between the employee and the employer.

Are employee training costs subject to insurance premiums?

Expenses for employee training (this includes training, retraining, and completion of basic and additional educational programs) are also not subject to insurance contributions. The key requirement for the main or additional programs in which an employee is trained is their compliance with federal requirements and standards in the field of education.

If employee training (in any form) is initiated by the employer to improve the quality and efficiency of work at the enterprise, then, according to statements of the Ministry of Health and Social Development of the Russian Federation (see Letters dated August 5, 2010 No. 2519-19, dated August 6, 2010 No. 2538-19), insurance premiums cannot be collected from educational expenses - this would violate Art. 9 of the Law on Insurance Contributions.

Compensation to employees for expenses on advanced training, professional training and retraining are also non-taxable payments (see paragraph “e”, paragraph 2, part 1, article 9 of the Law on Insurance Contributions). All types of guarantees and compensation that employees who have completed training in these forms can claim are recorded in Chapter. 23 Labor Code of the Russian Federation. And Federal Law No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases” (clause 2, clause 1, article 20.2) directly states that any expenses of companies for education, training, advanced training and retraining of employees are not subject to contributions to insurance funds.

Personal income tax and insurance premiums

Situation: is it necessary to withhold personal income tax from the cost of training for an employee (employee’s children)? The training is carried out in the interests of the employee (his children), but at the expense of the organization.

The answer to this question depends on whether the conditions listed in paragraph 21 of Article 217 of the Tax Code of the Russian Federation are met.

Namely, the educational institution (organization carrying out educational activities) in which the employee (his children) studied has a license for educational activities or the corresponding status for a foreign educational institution. If these conditions are met, do not withhold personal income tax (clause 21, article 217 of the Tax Code of the Russian Federation). Moreover, the fact that the training was in the interests of the employee (his children) does not matter. It also does not matter who pays for the studies (the organization itself or the employee, and the organization reimburses him for the costs). Please note that the organization must have documents confirming the expenses incurred (training agreement, which indicates the license number or status of the educational institution, type of study and payment procedure, payment documents).

If the conditions established in paragraph 21 of Article 217 of the Tax Code of the Russian Federation are not met, study in the interests of the employee (his children) refers to income in kind, which is subject to personal income tax (subclause 1, paragraph 2, Article 211 of the Tax Code of the Russian Federation).

Similar conclusions follow from letters of the Ministry of Finance of Russia dated October 4, 2012 No. 03-04-06/6-295, dated April 2, 2012 No. 03-04-06/6-88.

Regardless of the taxation system applied, contributions to compulsory pension (social, medical) insurance, as well as contributions to insurance against accidents and occupational diseases, must be assessed on the cost of training in the interests of the employee.

This is explained by the fact that this payment is considered as payment for employee services. The employer makes such payments within the framework of the employment contract; in addition, they are not included in the closed list of amounts not subject to insurance premiums (including for accidents and occupational diseases). This conclusion can be drawn from Part 1 of Article 7 and Article 9 of the Law of July 24, 2009 No. 212-FZ, as well as Part 1 of Article 20.1 and Part 1 of Article 20.2 of the Law of July 24, 1998 No. 125-FZ.

The procedure for calculating other taxes depends on what taxation system the organization uses.

How are employee training expenses reimbursed?

Before sending an employee to study at the company’s expense, it is necessary to conclude an additional agreement with him (separate from the standard labor agreement), according to which the employee, having completed courses or an educational program, will have to work for some time in a company that compensated his training costs.

In such cases, a trained employee is immediately hired and does not need to undergo a probationary period. By paying for someone's training, the company hopes to get a trained and qualified specialist and make full use of his knowledge and skills. But the employee himself is not always interested in this. If he refuses to work for the company for a specified period, the employer has the right to demand that he reimburse training costs in proportion to the length of time that the employee had to work (this provision can be found in detail in Article 207 of the Labor Code of the Russian Federation). The procedure for making calculations is described in Art. 249 Labor Code of the Russian Federation.

Therefore, in the additional agreement containing all the conditions for paying the employee’s training costs, all the main points that may cause disputes between the employee and the employer must be clearly formulated:

- the duration of the period of compulsory service upon completion of training;

- educational institution where the employee will be trained;

- the amount of company expenses associated with his training;

- terms and procedure for reimbursement of funds spent in the event of an employee’s refusal to work or dismissal without good reason.

The legislation of the Russian Federation allows in such situations to recover only the cost of training from a failed employee. All associated expenses - travel expenses, expenses for study leave, etc. - which other employers also try to demand from the applicant, he is not obliged to pay.

When an employee has already left the organization, it is no longer useful to demand that he pay any money (including reimbursement of the company’s expenses for his education and training). This is obvious from a practical point of view and is reflected in the Labor Code, Art. 258. However, as long as the citizen continues to work in the organization, it is quite possible to recover a sum of money from him, provided that it falls within the amount of his monthly salary.

Before signing a collection order, the employer must obtain written consent from the employee to deduct from his salary when the final calculation of training expenses is made. This will give the accountant the right to deduct the required amount.

If the training costs of an employee who decides to suddenly quit without working work turn out to be more than his monthly earnings, then the required amount can only be recovered through the court (otherwise, the former student himself can sue and accuse the employer of violating the law). By agreement of the parties, large sums spent by the company on training an employee can be paid in installments. It is advisable that all such situations be taken into account in the training contract.

Read the material on the topic: Private accountant services

An employee whose employer paid for training quits...

As we said earlier, the apprenticeship contract stipulates the terms of service, that is, the minimum period during which the employee, after completing training, must work for the employer who paid for the training is stipulated.

But it happens that an employee does not fulfill this condition and quits without good reason, so to speak, ahead of schedule. In such a situation, the employee must reimburse the employer for the training costs incurred by the latter. The amount of compensation is calculated in proportion to the time actually not worked after completion of training (Article 207 of the Labor Code of the Russian Federation). However, the contract may provide for other conditions.

Here is an example of calculating the amount of compensation. Let’s say 100 thousand rubles are spent on training an employee. According to the terms of the contract, the employee must work in the organization for at least 2 years after completing training. However, he resigned of his own free will a year after completing the training. Thus, the employee must reimburse the organization 50 thousand rubles. (100 thousand rubles x 12 months / 24 months).

What are the features of employee training costs under the simplified tax system?

and as an object of taxation, having a difference in income and expenses, can safely include the costs of training their employees (starting with basic and additional professional education and ending with retraining and advanced training) in expenses - see paragraphs. 33 clause 1 art. 346.16 of the Tax Code of the Russian Federation. But in this case it is necessary to follow the procedure described in Chapter. 25 “Income tax”.

According to paragraph 3 of Art. 264 of the Tax Code of the Russian Federation, a company operating under the simplified tax system can write off the costs of training its employees subject to the following conditions:

- An employment contract has been concluded with the employee, whose training costs are covered by the company.

- Training is carried out in Russian educational institutions that have a license, or in foreign educational institutions with the appropriate status.

- An agreement is also concluded between the educational institution and the company.

- If we are talking about an applicant whom the company plans to train at its own expense before adding it to the staff, an employment contract with him must be signed within three months from the end of the training. This employee must work for the company for at least one year.

If the employment contract was not concluded within the specified period or the employee did not work for the company for the required year, then the company includes the costs of his training in its simplified tax system income. However, there are exceptions to this rule (see Article 83 of the Labor Code of the Russian Federation) - situations of termination of an employment contract due to insurmountable external circumstances, namely:

- The employee was called up for military service in the Armed Forces of the Russian Federation.

- The person who previously occupied it was restored to his position by order of the state labor inspectorate or a court decision.

- The employee was not elected to the position.

- He was convicted and sentenced to a prison sentence that prevented him from continuing to work for the company.

- The employee was declared incapable of performing work activities due to disability, etc., and there is a medical certificate confirming his condition.

We send an employee to a seminar

As a general rule, costs for seminars can be included in the costs of training for basic and additional professional educational programs, professional training and retraining of workers (subclause 23, clause 1, article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated February 28, 2007 No. 03-03 -06/1/137), while expenses can only be taken into account if the conditions listed in clause 3 of Art. 264 of the Tax Code of the Russian Federation, namely:

— training must take place on the basis of an agreement with a Russian educational institution that has the appropriate license, or a foreign educational institution that has the appropriate status;

— employees who have entered into an employment contract with the company must undergo training;

— if the student is not on the company’s staff, then an agreement must be concluded with him, which stipulates that the employee must, no later than three months after training, enter into an employment contract with the company and work under it for at least one year.

In the absence of a license for educational activities, costs can be taken into account as expenses for consulting services (subclause 15, clause 1, article 264 of the Tax Code of the Russian Federation, resolution of the Federal Antimonopoly Service of the Moscow District dated September 23, 2009 No. KA-A40/9373-09-2). In this case, an agreement with the organizer of the seminar, a plan for the seminar and an act of services rendered are sufficient (letter of the Federal Tax Service of Russia for Moscow dated June 28, 2007 No. 20-12/060987, resolution of the Federal Antimonopoly Service of the Moscow District dated July 15, 2011 No. KA-A40/7114-11 ), although the issuance by the organizer of the seminar of any certificates and the availability of training programs are not required (Resolution of the Federal Antimonopoly Service of the Moscow District dated October 21, 2010 No. KA-A40/12309-10).

In addition, an order to send an employee to a seminar would not hurt (see sample).

Seminar abroad

When participating in a seminar abroad, costs can be included in expenses, even if it is conducted by a foreign educational institution (letter of the Federal Tax Service of Russia for Moscow dated February 17, 2006 No. 20-12/12674). Supporting documents may be (clause 3 of Article 264 of the Tax Code of the Russian Federation):

— agreement on holding a seminar;

— a document confirming the educational status of the organization conducting the seminar;

— seminar program;

— an order from the company to send an employee to a seminar;

— a certificate issued to the employee based on the results of the seminar;

- act of services rendered.

Documentation: official explanations and judicial practice

The fact of provision of services must be confirmed in any case, otherwise the tax authorities will not recognize the expenses. Such a document can be either a bilateral act drawn up in accordance with the terms of the agreement (letter of the Federal Tax Service of Russia for Moscow dated February 18, 2010 No. 16-15/017646) and in compliance with the requirements of Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, or a document drawn up in accordance with the business customs of the foreign state in whose territory the services were provided and reflecting their essence (letter of the Ministry of Finance of Russia dated October 10, 2011 No. 03 -03-06/1/645, resolution of the Federal Antimonopoly Service of the Moscow District dated October 19, 2010 No. KA-A40/12291-10-P in case No. A40-35277/09-35-189).

In this case, documents drawn up in a foreign language must have a line-by-line translation into Russian (clause 1 of article 9 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n, as well as 3, Article 284, Article 312 of the Tax Code of the Russian Federation). Such a translation can be done either by a professional translator or by a specialist from the organization itself (letters from the Ministry of Finance of Russia dated 04/20/2012 No. 03-03-06/1/202, dated 03/26/2010 No. 03-08-05/1, dated 11/03/2009 No. 03-03-06/1/725, Federal Tax Service of Russia for Moscow dated May 26, 2008 No. 20-12/050126, resolution of the Moscow District Federal Antimonopoly Service dated April 21, 2011 No. KA-A40/2152-11). The costs of translating documents by a third-party specialist can be classified as information services on the basis of subclause. 14 clause 1 art. 264 of the Tax Code of the Russian Federation (letter of the Federal Tax Service of Russia for Moscow dated May 26, 2008 No. 20-12/050126). The Russian Ministry of Finance insists on notarization of such a translation (letter dated December 17, 2009 No. 03-08-05), however, Chapter 25 of the Tax Code of the Russian Federation does not establish such an obligation for the taxpayer.

If the organization has not received a document confirming the status of a foreign educational institution, it can do without it (Resolution of the Federal Antimonopoly Service of the Moscow District dated October 19, 2006 No. KA-A40/9887-06).

Attendance by the same employee of several seminars on similar topics should not cause claims from inspectors, since they should assess the validity of expenses only from the point of view of circumstances indicating the company’s intentions to obtain an economic effect (letter of the Ministry of Finance of Russia dated January 20, 2011 No. 03-03- 06/1/18).

Practical situations

If after the seminar the employee quits, there is no need to exclude such expenses from the tax base, since when calculating income tax, the possibility of taking into account expenses for the seminar does not depend on the period during which the employee worked in the company after the end of the seminar (resolution of the Federal Antimonopoly Service of the Ural District dated 11.05. 2010 No. Ф09-3203/10-С3).

The organization's expenses for paying for the participation of an employee working part-time on the basis of an employment contract in a seminar, the attendance of which helps to improve his professional level, are also included in expenses for ordinary activities (Articles 196, 287 of the Labor Code of the Russian Federation).

The cost of the seminar is not subject to personal income tax and insurance contributions to extra-budgetary funds in accordance with clause 3 of Art. 217 Tax Code of the Russian Federation.

If during the seminars meals are provided for participants, their entertainment, treatment or other services and the cost of such services is not separately allocated in the contract, then the subject of personal income tax and insurance contributions also does not arise (Articles 7, 9 of the Federal Law of July 24, 2009 No. 212- Federal Law (hereinafter referred to as Law No. 212-FZ), letters of the Ministry of Health and Social Development of Russia dated 08/06/2010 No. 2538-19, dated 08/05/2010 No. 2519-19, FSS of Russia dated 11/17/2011 No. 14-03-11/08-13985 “On payment of contributions"), since the organization does not have the opportunity to personify and evaluate the economic benefits received by the employee who took part in the seminar. Such expenses (as well as expenses for accommodation, provision of equipment, a conference room, transportation services) are taken into account when determining the tax base for income tax (letter of the Ministry of Finance of Russia dated January 20, 2011 No. 03-03-06/1/18, resolution of the Ninth Arbitration Court of Appeal dated 02.02.2011 No. 09AP-32031/2010-AK in case No. A40-31488/10-142-189).

If the cost of the above services is allocated and it is possible to reliably determine its size, it is included in the employee’s income. At the same time, the specified expenses in accordance with clause 43 of Art. 270 of the Tax Code of the Russian Federation are not taken into account when determining the tax base for income tax (letter of the Ministry of Finance of Russia dated May 13, 2011 No. 03-04-06/6-107).

Accounting

In general, when recording training costs, the following entries must be made:

Debit 60, 76 Credit 51

— tuition fees are transferred;

Debit 20, 23, 25, 26, 44, 91 Credit 60, 76

— the cost of employee training services is included in expenses (clauses 5, 6.1, 7, 16 of the Accounting Regulations “Organization Expenses” PBU 10/99, approved by order of the Ministry of Finance of Russia dated 05/06/99 No. 33n).

VAT on vocational training

Educational services of commercial educational institutions are subject to VAT at a rate of 18%. The organization can claim “input” VAT paid to a Russian educational institution for deduction if certain conditions are met (Article 171 of the Tax Code of the Russian Federation): an act on the provision of the relevant services must be signed and a correctly executed invoice indicating the amount of VAT must be received.

The services of non-profit educational organizations (NPOs) located on the territory of Russia for conducting the educational and production process, with the exception of consulting services (clause 14, clause 2, article 149 of the Tax Code of the Russian Federation), are not subject to VAT.

Operations for the sale of non-licensable services for conducting non-profit educational and production process in the form of one-time lectures, internships, seminars and other types of training, not accompanied by final certification and issuance of educational documents, are subject to VAT in the general manner (letters from the Ministry of Finance of Russia dated August 27, 2008 No. 03–07–07/81, dated July 20, 2007, No. 03–07–07/24).

If educational services are provided by a foreign organization outside the territory of Russia, they are not subject to VAT (clause 3, clause 1, article 148 of the Tax Code of the Russian Federation). To confirm the fact that a service is provided abroad, it is necessary to have documents confirming the place of provision of the service, a program, charter or other documents (letter of the Ministry of Finance of Russia dated August 5, 2010 No. 03–04–06/6–163).

...if a foreign organization provides services on the territory of Russia, then our country is recognized as the place of their implementation. Then the services are subject to VAT...

A foreign organization may not operate through a permanent representative office and may not be registered as a taxpayer with the Russian tax authorities. In this case, a Russian organization paying for training services for its employee will be a tax agent obligated to calculate, withhold and pay the corresponding amount of VAT in full to the budget.

This is done at the expense of funds to be transferred to a foreign organization or other persons at its direction, at a rate of 18/118 of the payment amount. VAT is paid simultaneously with the transfer of funds to a foreign educational institution. A Russian company as a tax agent has the right to deduct the amount of VAT withheld from the income of a foreign organization and transferred to the budget in the manner established in clause 3 of Art. 171 Tax Code of the Russian Federation.

If services are provided by a foreign organization on the territory of Russia, then our country is recognized as the place of their implementation. Then the services are subject to VAT.

And a final example. The territory of the Russian Federation is not recognized as the place where services for training foreign specialists are sold abroad by a domestic organization, including under an agreement with another Russian organization. Accordingly, such services are not subject to taxation in the Russian Federation on the basis of paragraphs. 3 clause 1.1 art. 148 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated August 8, 2007 No. 03-07-08/230).

Ekaterina Shmeleva, auditor

« Previous :: Next »