Why explain the balance?

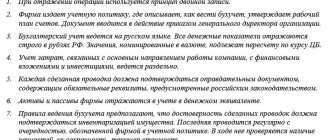

Reporting must be reliable and complete and provide the user with a clear picture of the financial position of the organization. In the balance sheet and Form 2 we present generalized indicators, from which, as a rule, it is difficult to draw comprehensive conclusions. This means that they need to be explained.

IMPORTANT! Accounting statements for 2020 must be prepared using updated forms, and submitted according to new rules. Due to the coronavirus, the deadline has been extended.

Let’s take the line “Accounts receivable” as an example. To put this figure in the report, you need not only to collect the balances of all settlement accounts, but also to take into account the amount of the reserve for doubtful debts (if any). It is not shown separately in the balance sheet, and interested users (owners, investors, regulatory authorities) need additional explanations in this regard.

For information about the preparation of explanations given in relation to debts, read the article “Deciphering accounts receivable and payable - sample.”

All organizations must formulate explanations, with the exception of:

- small enterprises entitled to simplified accounting and reporting;

- public organizations that do not conduct business activities and have no sales.

Moreover, explaining the balance is in the interests of everyone who cares about their reputation. The more fully the figures from the report are disclosed, the more transparent the company’s activities will appear. Such reporting will help not only strengthen your credibility, but also attract new investors. Explanations on the balance sheet will also help avoid unnecessary questions from regulatory authorities.

Read about the requirements for accounting in the material “What requirements must accounting satisfy?” .

NOTE! Clause 39 of PBU 4/99 (approved by order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n) stipulates that companies have the right to provide additional information along with reports if it is useful for external users of the reports. At the same time, the Ministry of Finance believes that companies are obliged to disclose information related to accounting reporting (information of the Ministry of Finance dated December 4, 2012 No. PZ-10/2012).

Have time to find a good accountant

Reporting ahead. All conscientious accountants will be busy with their clients. To reduce taxes and successfully report, it is important to understand the transactions and put the documents in order before reporting. If you doubt your accountant, now is the time to change him.

Why change accountant?

About 100 clients come to Knopka every month. When we connect a new company, we carefully check who did the accounting before us and how. Over 3 years of working with accounting, we have collected critical errors due to which entrepreneurs pay extra taxes and risk fines and account blocking.

We have already written about common accounting errors. Now we are talking about current figures and updating data that will help you choose a good accountant.

• Every tenth client has at least 1 report using the old form. Every year new reports appear, forms and deadlines for submission change. You need to keep track of changes, because submitting a report using the old form is the same as not submitting it at all. This is punishable by fines of up to 150 thousand rubles.

• 20% of new clients previously filed returns using an incorrect tax system. This is a serious mistake; the tax office even blocks the account for this.

• 89% of clients did not pay additional taxes to the budget. Often these are ridiculous amounts, but they can also block the account. It is known that from December to February the tax office implements the blocking plan.

• 52% of clients come to Button without an accounting database or with data in an incomprehensible format. The previous accountant does not want to give up the database, did not keep records at all, or simply disappeared. In case of tax claims, the entrepreneur will be to blame. In such a situation, you have to restore all accounting from scratch - this is very expensive. Well, or put up with his absence, and this is risky.

• We restore accounting records from scratch for approximately a third of new clients. All companies, except simplified individual entrepreneurs, are required to maintain tax records and accounting. And incoming accountants and outsourcers often only keep tax records, calculate taxes based on statements and draw up a balance sheet by eye. A fine is imposed for accounting violations. And if you violate it for several years in a row and underestimate taxes by more than 2 million, it’s a crime. Restoring accounting records is a difficult matter and is not cheap, on average 50-70 thousand rubles, so it is better to keep the records correctly right away.

• A mess in documents occurs in about half of new clients. Even if you are an individual entrepreneur using the simplified tax system and only keep tax records, all financial transactions need to be supported by documents: collect acts, invoices, fiscal checks, strict reporting forms. Documents are needed to confirm income and expenses during a tax audit.

• 30% of clients did not receive VAT refunds. You can reduce your tax bill if your suppliers issue VAT invoices. It happens that incoming accountants and outsourcers roll out VAT refunds with a separate price tag. The entrepreneur does not want to overpay and refuses the additional service, although he could potentially save more.

• For 50% of clients, we find several employees for whom we can reimburse money from the Social Insurance Fund. Outsourcers and incoming accountants often save time on personnel matters. And employees need to be properly employed, fired, paid maternity and sick leave, and taxes on these payments calculated. Often, when calculating sick leave, the accountant does not take into account bonuses paid in the current period. Because of this, the employee receives less money, and the entrepreneur receives fines from the labor inspectorate. Sick leave and maternity leave can be reimbursed from Social Insurance - the employee will be happy, and you will not lose anything.

What's the result?

89% of Knopka's new clients have accounting errors from previous years, so they are dissatisfied with their previous accountant. Are you confident in your accountant?

There are a thousand ways to save on accounting services: find a freelancer or an inexpensive outsourcer for a couple of thousand a month, entrust the accounting to your wife or a neighbor’s daughter from the economics department. But if you have a serious business, the tax savings will quickly pay for the money you pay to a reliable and experienced contractor.

Be attentive to the documents, love your business and, if you are not confident in your accountant, have time to change it before the end of the year.

—

We announce all articles on Telegram. You will also find news, tips and life hacks for entrepreneurs there. Join us

What information does the balance sheet note contain?

Usually, no explanations are provided separately for the balance sheet alone. Since it is not compiled alone, but as part of the reporting, an explanation is given immediately for all submitted reports.

Read about the reporting features of companies using the simplified tax system in the material “How to fill out a balance sheet using the simplified tax system?”.

It should be noted that all traditional reports decipher some lines of the balance sheet, that is, they are also its explanations.

So, from the financial results report we learn about the amount of net profit for the period, and it is an integral part of the line “Retained earnings (uncovered loss)” of the balance sheet.

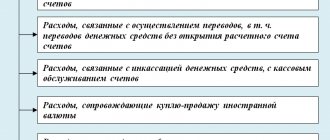

The cash flow statement provides information on how the “Cash and Cash Equivalents” line indicator is generated (broken down by line of business).

The statement of changes in capital deciphers the information reflected in section 3 of the balance sheet.

The remaining lines also require decoding and explanation. They are usually presented in the form of tables - they are convenient and visual. You can develop their form yourself, or you can use ready-made samples - they are in Appendix 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

NOTE! Order No. 66n contains an example of preparing explanations for balance sheet information about intangible assets, R&D, fixed assets, financial investments, inventories, debts of debtors and creditors, estimated liabilities, and state aid.

What could possibly happen? Two real cases

Wall Street System Administrator

Our co-founder’s wife is an experienced accountant, and last month a large restaurant chain in Moscow turned to her for help.

The restaurant kept all the databases on its server, which were managed by a permanent system administrator from the restaurant team. Right while the accountant was working, the system administrator went to an online casino and picked up a virus that destroyed the entire database. Who did they blame everything on? That's right, the accountant who just arrived.

The heroine is very lucky that her husband is the managing partner of the hosting and understands such things. After much arguing over the phone (our colleague was already ready to go out and clean up the admin’s face on his own), evidence was found and the culprit was punished. But the database was lost, that is, there was no happy ending for the system administrator.

Laptop stuck in someone else's apartment

This is an old story from other people we know.

An experienced 64-year-old woman regularly kept accounting records for an online store of Chinese gadgets using 1C. The client and database were stored on a laptop that was given to her at work. It was convenient: it’s easy to print from office printers, the base is small and fits on a netbook, you can take it with you to the country or home.

Then tragedy struck: on Friday evening she was taken away in an ambulance with a stroke. The netbook stayed at home because the accountant was responsible and took work on the weekend.

The laptop, of course, was rescued, the accountant recovered, but if we transfer this situation to current days and replace the stroke with a coronavirus, then the operation of rescuing a computer from a closed apartment takes on completely different proportions.

Can two cats and a Labrador open the door for you? Even if your neighbor waters the flowers and feeds the cats, will she give you the computer?

But let’s move on to 1C in the cloud - what are the options for deployment and operation in the cloud.

What does a sample explanatory note to the balance sheet look like?

There is no single sample of explanations for the balance sheet. Everyone explains what they consider necessary and useful for reporting users.

We'll show you what an explanation of a balance sheet might look like using an example.

| Explanations to the balance sheet JSC "Symphony" for 2020 1. General information Joint Stock Company (JSC) "Symphony" was registered by the Federal Tax Service No. 6 for Moscow on October 29, 2009. (The following information can be provided: OGRN, INN, KPP, details of the state registration certificate, address.) The balance sheet has been compiled in accordance with the accounting and reporting rules in force in the Russian Federation (if the balance sheet is prepared according to IFRS, this must be indicated). Authorized capital: 1,000,000 (one million) rubles. Number of shares: 1,000 pieces with a par value of 1,000 (one thousand) rubles. Main activity: milk processing and cheese production (OKVED 10.51). Composition of affiliates: Steklov Andrey Anatolyevich - member of the board of directors; Zavarzin Stepan Nikolaevich - member of the board of directors. 2. Basic accounting policies The accounting policy was approved by order of the director dated December 25, 2018 No. 156 (the following is a brief summary of its main provisions: depreciation methods, methods of assessing assets and liabilities, etc.). 3. Balance sheet structure (each line is shown as a percentage of the balance sheet currency, changes for the period are calculated). 4. Assessment of the value of net assets (the value of net assets is correlated with the authorized capital). 5. Analysis of the main financial indicators (financial ratios are indicated: liquidity, reserve coverage, autonomy, return on assets, etc.; this section also analyzes the degree of dependence on creditors, position on the securities market, etc.). 6. Composition of fixed assets (rub.): Name | Initial cost | Depreciation | Book value as of 12/31/2019 |

| Land | 1 270 000 | 1 270 000 | |

| Buildings, structures | 58 321 000 | 6 987 000 | 1 334 000 |

| Vehicles | 1 256 000 | 342 000 | 914 000 |

| Equipment | 32 598 000 | 4 984 000 | 27 614 000 |

| Inventory | 352 000 | 78 000 | 274 000 |

7. Estimated liabilities and provisions

As of 12/31/2019, an estimated liability for payment of regular vacations was formed in the amount of RUB 1,426,000, the number of unpaid vacation days is 67, the due date is 2020.

The reserve for doubtful debts was formed in the amount of RUB 1,678,000. due to the presence of overdue and unsecured debt of Quiet Dawns LLC.

A reserve for impairment of the value of inventories was not created due to the absence of signs of impairment of inventories.

8. Labor and wages

Payables for wages as of December 31, 2019 amounted to RUB 1,679,000. (for December 2020, payment deadline: 01/15/2020). Personnel turnover in the reporting period was 24.98%, the payroll number was 167 people. The average monthly salary is 20,675 rubles.

9. Issued and received security and payments (all their types are indicated).

10. Other information

(A list of extraordinary facts, their consequences, a description of significant facts that affected the balance sheet indicators, major transactions completed, events after the reporting date, adjustments made and other necessary information is provided.)

Director of JSC "Symphony" Devyatov Devyatov A. N. 03/20/2020

What questions are tests composed of?

During the interview, the applicant may be offered tests of various types. These can be psychological, motivational and professional issues, but tests related to the candidate’s professional activities

. The compilers of the examination program always give preference to practical tasks, so the test selection is dominated by questions that require knowledge of standards and drawing up entries.

For example, these could be short questions. As a rule, they are used in express testing:

- How to optimize profits?

- In what account are dividends recorded?

- What are the prerequisites for bankruptcy?

- How to calculate average earnings?

Also, the selection of questions may include thematic tasks, to which several answer options will be given:

Examples of test questions for a chief accountant

| Question | Answer options | Correct answer |

| 1. In 2020, the buyer was shipped a product that was accepted for accounting. In 2020, under the old contract, part of the goods was returned to the supplier. What VAT rate should be indicated in the documents: 18 or 20%? | A. 18% B.20% | The correct answer is 18%, since the invoice for returns within the same contract always indicates the original tax rate. |

| 2. Is it possible to pay dividends in cash received by the enterprise? | A. Possible B. Prohibited C. Possible, but not at the expense of revenue | Correct answer: yes, it is possible, but not at the expense of sales proceeds received at the cash desk. |

| 3.Can expenses for a corporate holiday be considered entertainment expenses? | A. Can B. Can't | Correct answer: impossible, since the Tax Code prohibits expenses for holidays and rest of employees from being classified as entertainment expenses. |

Test questions can be of varying degrees of complexity, and also have a thematic focus depending on the company’s field of activity. It is worth noting that when applying for the position of deputy chief accountant, similar questions are used.

All tests have a time limit: from 20 minutes to 3 hours. The presence of strict time frames makes it difficult to concentrate, provoking a stressful situation. Recruitment agency specialists recommend preliminary preparation not only for the oral interview, but also for the written test.

Results

Explanations for the balance sheet are allowed to be drawn up in any form. They may contain tables, graphs and charts. The detail of information in them can be very varied - it all depends on the company’s intention to disclose any important indicators in a certain way. The main thing is that the information contained in the explanations is reliable and useful for users.

Sources:

- Order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n

- Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Connecting to EDF services

Services for exchanging electronic documents are convenient, and universal remote work has made them simply necessary.

Client 1C: Enterprise integrates with them, but legally significant EDI requires the use of a qualified electronic signature. It can only be recorded on a flash drive or stored in a cloud service that has the appropriate certificates from domestic regulators.

It is impossible to upload an electronic signature to any medium or store it on a VPS, so usually an accountant works with electronic document management from a local computer by inserting a flash drive. A certified cryptographic information protection tool (the so-called cryptoprovider) and a public electronic signature certificate are installed on it. Its closed part is stored on a flash drive, which must be physically connected to the computer in order to sign documents in programs that support this function. To work with EDI via the web interface, you will need browser plugins.

So that a business-critical system does not have to be deployed on the personal computer of a specialist working remotely, a VPS is also useful, however, the option with a physical token will not work here.

It is difficult to say how a crypto provider will behave in a virtual environment, especially when trying to forward a USB port to a VPS via an RDP client. What remains is a cloud digital signature without a physical medium, but not all e-document flow services offer such a service. By the way, it costs about a thousand rubles a year, not counting the subscription fee for the document exchange service itself, which depends on the volume.

The good news is that almost all popular Russian services have long established mutual roaming of documents, so you can connect to anyone. There is also bad news: it will not be possible to completely get rid of paper, since among the counterparties there will certainly be those who do not use EDI.