Article 1153 of the Civil Code of the Russian Federation fixed two options for registering an inheritance in another city without traveling there. This is possible, but quite difficult. And this situation often occurs when the testator is in one city, and the legal successor is in another. According to Article 1115 of the civil law, the location for entry into an inheritance case is the extreme location of residence of the deceased owner.

Which is not entirely convenient for applicants living in a remote locality or region in terms of re-registration of the property estate. However, with the right approach and compliance with all the necessary requirements, it is possible to carry out re-registration without visiting another city.

Legislative regulation of the issue

According to the provisions of Art. 1153 of the Civil Code of the Russian Federation there are two methods of re-registration without the need to visit another city:

- Send the document to the notary office dealing with inheritance matters using postal services. The successor has the right to contact any notary at the actual location with a request to certify the application. The paper is sent by registered mail with acknowledgment of receipt.

- Entrusting the conduct of business to the principal through the execution of powers under a power of attorney. The document is drawn up in writing and certified by an authorized person. It can provide not only the prerogative of a representative to enter into inheritance, but also a preference for re-registration of property rights.

ATTENTION !!! Of the listed options, the second is considered more rational, since the process can be delayed, disagreements often arise between relatives, and sometimes it becomes clear that third parties have claims on the property of the deceased (for example, a banking institution claims a pledged car).

The representative may have to attend to the following tasks on site:

- find out the legality of claims of strangers to the inheritance mass of the deceased;

- start searching for material assets mentioned in the last expression of the individual’s will, but not present;

- make payments on debt obligations after receiving a document on property preference.

The presence of one of these situations requires the personal presence of the successor or his representative. In addition, if you decide to immediately sell the received property, you cannot do without a principal. You can ask a good friend who wants to help to follow the steps, or it is better to contact a lawyer experienced in family and inheritance matters. Because a specialist has a better understanding of the intricacies of the inheritance procedure and subsequent re-registration.

How to register an inheritance in another city without going there - affordable methods

Registration of an inheritance, the opening of which does not take place in the territory of residence of the inheritors, causes difficulties for the latter due to the need to travel. Especially if the distances between cities are quite significant. Let's figure out what the heir should do in such a situation, how to enter into an inheritance if the inheritance is in another city?

If we consider the process of obtaining an inheritance located or opened in another city, from the point of view of an ordinary person who is ignorant of legal issues, and in particular, inheritance law, then it seems quite complicated. Meanwhile, for professional lawyers this is a completely solvable and even commonplace matter.

The article gives two options for solving this issue:

When deciding how to apply for an inheritance in another city, you should take into account not only procedural issues related to deadlines, but also issues of a purely formal nature, which are also of no small importance

Today, options for submitting such documents electronically are allowed, but the physical equivalent has not lost its significance.

The current option for processing this kind of postal correspondence is registered mail. The algorithm of the heir’s actions itself is as follows: The following arguments can be given in favor of this option for resolving hereditary issues: Any close relative can act as a representative, for whom the heir issues an appropriate notarized power of attorney. But, more often than not, people tend to trust qualified lawyers and inheritance lawyers to resolve such issues.

Compliance with all procedural and formal procedures allows you to avoid wasting time and sometimes money. When entering into an inheritance remotely and not only, you should understand that six months are given for the entire process of opening and entering into an inheritance, which means that the procedure must begin not after this period, but during its course

Thus, it is important for the heir to meet the deadline within 6 months after the death of a relative, or the date recognized as the day of his death

Otherwise, the question of extending this period will arise, which is associated with legal proceedings. Information on how to enter into inheritance rights after 6 months is right here. Accordingly, the rights of the heir should be declared within the period from the moment of receipt of the news of the death of the testator and the departure of all funeral procedures.

According to the Civil Code of the Russian Federation, this moment is called the opening of an inheritance. Entering into inheritance rights involves filing an application. It must be in written form and contain:. If we are talking about a representative, then the completed application can be transferred to the notary, who opens and conducts the inheritance case through him. What is an inheritance matter, find out here.

In addition, the authority to fill out this document can be delegated to him, which should be stated in the power of attorney issued to him. This document must contain a description of all functions and powers transferred by the heir to his representative. Thus, the law provides for remote resolution of issues of accepting an inheritance located not at the place of residence of the inheriting citizen.

To resolve this issue, the legislator defines two possible ways. At the same time, using the services of a representative by proxy is considered the most correct, reliable and profitable. Due to recent changes in legislation, the legal information in this article may be out of date!

How to submit an application to the notary authorities if you live in another city? Power of attorney and representative services Execution of documents and their contents. The method of entering into inheritance rights by means of postal correspondence is not reliable, since there may be malfunctions in the mail or other situations when the item does not arrive on time.

It is more correct to hire a qualified lawyer as a representative, especially in situations where the subject of inheritance is real estate or business, which rarely occurs without litigation. Inheritance documents can be sent by registered mail. Our lawyer will advise you free of charge. Comments 1.

Deadlines

Civil legislation has fixed a six-month period of time after the opening of an inheritance during which applicants have the right to enter into it. This long period was deliberately chosen so that all legal successors could learn about the existing prerogative and present their consent or refusal.

After this period, no new applications for consent will be accepted unless the period is extended by a court decision. It is possible to restore a missed deadline only through litigation, and then only if there are good reasons that contributed to the missed deadline.

Respectable factors include:

- Protracted illness.

- Stay in a correctional facility.

- Conducting compulsory service in the ranks of the Russian Armed Forces in remote areas.

- Receiving information about the opening of an inheritance with a long delay.

However, there is another way besides the judicial one. If all other successors do not make any claims, then an agreement is drawn up. The estate is divided among an increased number of successors, and new certificates of ownership are issued.

Customer Reviews

Review by Lobova E.I. Dear Lyubov Vladimirovna, I, Evgenia Ilyinichna Lobova, would like to express my deep gratitude to lawyer Yuri Vladimirovich Sukhovarov for the objective, complete, competent consultation on an issue that interests me. As theater begins with a hanger, I cannot help but note the exceptional politeness of the administrator Daria Vladimirovna Kutuzova.

I wish you great success! Lobova E.I.

Gratitude from Balitskaya A.S. I express my deep gratitude to Alexander Viktorovich Pavlyuchenko for his efficiency and professionalism in resolving controversial issues. The pre-trial settlement was completed as quickly as possible.

Balitskaya A.S., 05/15/2019

Thanks to Stepanov D.Yu. I express my deep gratitude to lawyer Denis Yuryevich Stepanov for his high professionalism and attentiveness to his case when considering the issue in word with a contractor who improperly completed the work of erecting a screw foundation. The cost of the work amounted to 178,300 rubles. And the court of the Vyborg district (Case No. 2-1432/2018) dated March 12, 2018) to collect, taking into account all fines, 504,800 rubles. Once again, I thank you and wish you success in your future work and only successful business conduct.

Grateful to you, your client. 05/18/18

Thanks to Pavlyuchenko A.V. from Astafieva A.S. I express my gratitude to the Legal Agency and in particular to lawyer Alexander Viktorovich Pavlyuchenko for the work done, high qualifications and high-quality approach. Thanks to Alexander Viktorovich, we managed to achieve a result in court in a case on the protection of consumer rights that I did not even expect. The amount recovered in court even exceeded my expectations. Thank you very much for your qualified work and professionalism.

Sincerely, Astafieva A.S., 03/01/2019

Gratitude from Potapova T.I. I express my gratitude to Denis Yuryevich Stepanov for the work done, high qualifications, as well as for very clear, accessible help in solving my problem (protection of consumer rights). Excellent, very competent lawyer. Thank you very much!

Sincerely, Potapova Tamara Ivanovna, 07/09/2019

Review by Rychnikova G.V. I express my gratitude to your employee Andrey Valerievich Ermakov for providing me with legal assistance.

I also express my gratitude to Diana Sumarokova for her polite and tactful customer service and the very pleasant atmosphere in your office.

Thanks to Mavrichev S.V. from Bars Dan A. I thank the wonderful Lawyer Sergei Vyacheslavovich Mavrichev for thorough, competent advice and human mutual assistance to all his clients who are in deep need of qualified and timely legal and psychological advice.

Leopard Dana A. 09/18/2018

Gratitude from Ustinova T.M. I would like to express my deep gratitude to Sergei Vyacheslavovich for the legal services provided when I had a difficult relationship with Beauty Salon LLC and Alfa-Bank.

Ustinova T.M. November 10, 2018

Gratitude from Antonov Arkady I, Antonov Arkady Shanobich, turned to the Legal Agency of St. Petersburg for help due to the fact that when concluding an agreement for spinal treatment with Medstar, I was actually deceived in the cost of treatment and more. During the process of drawing up a treatment contract with me, no one explained to me that the treatment would be carried out using credit funds; the amount of treatment was constantly changing. My requests to be given longer time to familiarize myself with the procedures and consultations at their price list were refused. That is, there was actually pressure on the client. At home, when I carefully read the entire document, I realized that I had actually been deceived about money and treatment time. On October 30, 2018, I applied for legal assistance from the Legal Agency of St. Petersburg regarding the termination of the contract for treatment at Medstar and the termination of the loan agreement from Alfa-Bank. My case was handled by Denis Yurievich Stepanov, all issues were resolved very quickly and I was informed about all situations. I would like to thank Stepanov D.Yu. and all lawyers who work in this agency.

November 21, 2021

Gratitude from Plisetsky V.V. I would like to express my gratitude to Sergei Vyacheslavovich Mavrichev for his sensitive attitude and understanding towards clients. The issue was resolved within one day. I am very grateful to Sergei Vyacheslavovich.

Plisetsky V.V. October 19, 2018

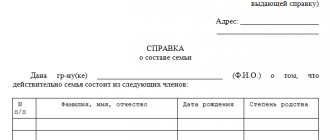

Required Documentation

Having set the goal of registering an inheritance estate without visiting the place of discovery, you should take care of preparing the necessary documents:

- documents of the legal successor, or representative documents;

- confirmation of family ties. They have the right to act as documents about birth, about marriage;

- testamentary disposition, if any;

- certified power of attorney.

IMPORTANT !!! Consent to accept the property mass is filled out directly from the notary according to the form he/she declares. The listed list of papers is not considered exhaustive.

For example, when extending the period for entering into an inheritance, you will need to provide evidence about the validity of the reason for absence (extracts from the patient’s medical record, a certificate from places of imprisonment, etc.).

How can I accept

Speaking about how to enter into an inheritance, it is worth noting that there are two ways in which this can be done:

- A method that is factual in nature. That is, no papers are drawn up. In this case, it is assumed that the successor will use the property assigned to him according to its purpose. In particular, caring for him, paying expenses associated with maintenance, etc.

- By completing the required documentation. This method involves the heir contacting the notary, who is in charge of the corresponding inheritance case. When contacting such a specialist, it is necessary to make a statement that the inheritance is open.

USEFUL INFORMATION: Actual acceptance of inheritance after death under the Civil Code of the Russian Federation

Both options by which inheritance is carried out are in accordance with the law, and the heir can make a choice regarding which option is more suitable for him. It should be remembered that no matter which method the assignee chooses, it will need to be applied within six months. This period begins to run from the date of death of the owner of the property.

In the first option, it is not subject to registration as such. In this case, the inheritance goes to the person who has the appropriate rights, according to laws and logic. A significant disadvantage of this method is the absence of a properly executed document that would confirm that the inheritance was accepted in accordance with the law. Therefore, it is recommended to register the receipt of property with the help of a notary. Otherwise, it is possible that one of the heirs will go to court to challenge such inheritance and will have to defend their rights.

When entering into an inheritance, you need to prepare documentation, which will require going through several stages:

- first you will need to visit a notary office in order to open an inheritance case;

- then you will need to write a statement reflecting your will to accept the inheritance (it must be properly certified);

- further activities are carried out aimed at collecting the required documentation;

- after which it is provided to the notary;

- successors will need to pay a state fee and provide a document;

- Lastly, a certificate is issued, which confirms that the heir has the corresponding right.

Each of the described steps involves performing certain actions. In particular, those relating to the collection of necessary papers and so on.

https://www.youtube.com/watch?v=OScudcXNK5A

Notice

Article 61 of the “Fundamentals of Legislation on Notaries” established the obligation for the authorized person to notify successors about the opening of a case. Generally, notification is carried out by registered mail with acknowledgment of receipt.

The employee informs only individuals known to him at the time of discovery. The successors have the right not to tell the employee about the presence of other legal heirs. However, the period for concealment of information may subsequently be reinstated for such persons.

The requirements are the same both when inheriting by testamentary disposition and by law. Such measures make it possible to ensure the attendance of all applicants with preference for succession.

Application for acceptance

To consent to inheritance, you must send an application to the notary's office indicating:

- Information from the successor's passport.

- Personal information of the testator.

- Places and dates of death of the property owner.

- Desires to accept the property mass.

- Evidence of family ties (in case of inheritance by law).

- Information about testamentary disposition.

- Information about other legal successors.

- Description of the property left by the deceased.

- Date the document was recorded.

- Applicant's painting.

It is allowed to write a consent at home using a sample or in the notary’s office itself, since before sending it to another city it is still subject to notarization.

Where to go to accept an inheritance in another city?

The opening of an inheritance occurs in the event of the death of the owner of the property or his recognition as deceased in court. The beneficiaries can be his relatives, and if there is a will, the persons specified in the document.

The primary issue before issuing a certificate of inheritance is the place of submission of documents.

In accordance with Art. 1115 of the Civil Code of the Russian Federation, the opening of an inheritance must be carried out at the last place of residence of the citizen. It could be:

- the place where the person permanently lived or spent the most time;

- place of residence of parents, guardians, legal representatives, if we are talking about a child under 14 years of age or a disabled citizen.

If it is unknown where a citizen lives, and his property is located outside the country, then succession is carried out at the location of the property. If there is real estate, the case is opened at its location, and if there is no real estate, where the most valuable part of the movable part of the inheritance is located.

Example. The real estate of citizen R. is located on the territory of the Russian Federation, and R. is registered in Ukraine. In Russia, the successor was refused to accept an application for the right to inheritance. On the advice of a lawyer, R. asked the notary for a written refusal to perform a notarial act and challenged it in court, guided by Art. 1115 of the Civil Code of the Russian Federation.

applications to the court to establish the place of opening of the inheritance.

Tax and state duty

Having begun the procedure of entering and re-registering the property in their own name, the successors will face some material costs. There is no inheritance tax, but you will have to pay a state fee. The so-called notary fee. The amount of his rate is determined by the degree of relationship with the deceased, as well as the value of the inherited part or the entire inheritance.

If the successor belongs to the category of close relatives, then the payment will be 0.3% of the final price of the received share, but not more than 100 thousand rubles. All other relatives will pay 0.6%.

Thus, if you do not have enough free time to register an inheritance in another city, it is better to seek help from a private attorney who understands the intricacies of this type of case. Contacting a lawyer is a modern and guaranteed way to resolve the situation. An agreement is signed between the representative and the represented, which spells out all the key points - what he has the right to, until what period the power of attorney is valid, sanctions in case of violation of the contract.

Price

Receipt of an inheritance involves the incurrence of certain costs by the successor. It is worth saying that there are not many payments that will need to be made.

The heirs will have to pay a state fee, which is charged for issuing a certificate confirming the rights to inheritance. Its size is regulated by law and depends on the rates:

- close relatives of the deceased will have to pay 0.3 percent, which is calculated on the value of the property passed on by inheritance;

- all other successors must pay 0.6 percent of the value of the inherited property.

In both cases, the legislator provided a limit; in the first case it is equal to 100 thousand rubles, and in the second – 1,000,000.

In addition to the above fees, the following may also be charged:

- the heir will have to pay for the work of a specialist whom he contacted for advice on receiving an inheritance;

- payment for notary actions that are of a technical nature (in particular, this may include typing the text of an application, etc.);

- paying a fee for helping the successor to collect and prepare the required papers;

- also, if the heir contacts a lawyer, lawyer or representative, this will also need to be paid;

- It is also possible to charge a fee for obtaining an extract, certificate, copy of paper, etc.

USEFUL INFORMATION: Job description: how to write, sample 2021