Inheritance in Russia

Legal provisions affecting inheritance and the participation in it of such a figure as a notary are enshrined in the Civil Code of the Russian Federation. Section five of part three of the Code is devoted to this issue. Of course, there are also a number of other norms in force, but the foundations are laid precisely in the Civil Code of the Russian Federation.

Let us note that inheritance is not only the property of the deceased (apartment, car, land, etc.), but also property rights and obligations. Except for what is connected with the person himself, i.e., his personality - we are talking about alimony or compensation for harm.

According to the provisions of the law, you can become an heir: with a completed will, under an inheritance agreement or by law. The opening of the inheritance occurs on the day of death. If the court recognizes a person as deceased, the inheritance opens on the day the decision came into force.

Will

A will is an act certified in the prescribed manner and drawn up during life. It determines who gets what in the event of a person’s death. Moreover, the circle of persons here is not limited to family ties, it can be any people specified in the will.

All information cannot be disclosed until the opening of the inheritance. It must be drawn up in writing and certified by a notary or other persons provided for in regulations.

A notarized will must have a prescribed form and contain the necessary conditions. The notary will formalize the inheritance properly.

In law

The inheritance procedure by law begins when two other grounds (will or contract) are absent. The main feature of this form is the presence of queues of heirs established by the legislator.

First of all, the inheritance goes to children, spouses and parents. Secondly, siblings, half-brothers/sisters and grandparents inherit. They enter into inheritance if there is no one in the first place.

The rules also provide for a third line of inheritance if there is no one from the first and second. These are: full and half brothers and sisters of the parents of the deceased. Next come the heirs of the third, fourth and fifth degrees of kinship.

Mandatory share

The law protects the rights of a certain group of people. This applies to minors and heirs who are unable to work. They inherit in any case, whether there is a will or not, and the share that would be due to them upon entering into inheritance by law.

For example, a person bequeathed the transfer of his apartment into the ownership of a third party. However, the disabled and those under 18 years of age will still receive the portion determined by law. Moreover, we note that, in accordance with the Civil Code of the Russian Federation, the disabled also include citizens who have reached pre-retirement age. Let us remind you that for women this is the age of 55 years, for men - 60.

How to inherit an apartment that was jointly owned

The registration of inheritance is carried out by a notary. The case is opened at the request of the legal successor.

An application for acceptance of property is submitted at the place of registration of the copyright holder. In some cases, binding may occur to the location of real estate or the most significant property.

The deadline for submitting documents depends on the method of inheritance and the line of relationship with the deceased citizen (Article 1154 of the Civil Code of the Russian Federation).

An alternative way to enter into rights is to accept the inheritance after the fact. In this case, the applicant must take the necessary actions that confirm his intention to enter into the inheritance.

Procedure

To enter into inheritance, applicants must complete the following steps:

- Prepare a package of required documents.

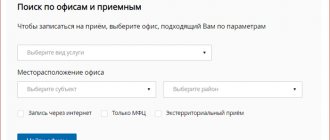

- Identify a notary office.

- Submit an application for acceptance of property.

- Conduct an assessment of the identified property.

- Pay the required fees.

- Obtain the appropriate certificate.

- Complete the transfer of ownership.

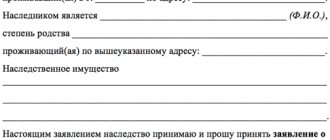

Statement

When registering an inheritance, the main document is the application of the successor. The form of the document is not fixed by law. However, the application must have several important sections. This includes:

- Name of the notary office.

- Personal data of the legal successor (full name, registration address).

- A brief description of the fact of the death of the testator.

- The essence of the appeal is acceptance of the inheritance.

- List of identified property.

- Mention of other applicants.

- Grounds for accepting inheritance (disposition/law).

- Date, signature.

If the heir is a co-owner of an object of inherited property, then he can indicate in the application a request for a share of this object.

Example. After the death of citizen M., the inherited property included ½ for an apartment, a car, and a land share. The heirs of citizen M. were his wife and daughter from his first marriage. The owner did not formalize the will. When submitting documents to a notary, the heiress assessed the property. The share in the apartment was 1,000,000 rubles, the car – 400,000 rubles, the land share – 800,000 rubles. The wife was a co-owner of the apartment. Therefore, she asked the notary to allocate the second share of the apartment as hereditary property. Since the second heiress owned the residential premises, and she did not object, the notary issued the widow a certificate for ½ share of the apartment and ¼ share of the land plot. The daughter received a car and ¾ of a plot of land. She paid her father's wife compensation in the amount of 200,000 rubles. and became the full owner of the land plot.

Sample application for issuance of a certificate of inheritance rights

Deadlines for accepting an inheritance

Primary heirs submit an application within 6 months . This includes applicants under the will and first-degree relatives (Article 1154 of the Civil Code of the Russian Federation).

Successors of the next stage submit documents six months after the death of the testator. They can claim their rights within 3–6 months.

A three-month period is given in case of non-acceptance of the inheritance by first-degree relatives. If the main applicants refuse or are removed from inheritance, the next legal successors are given six months.

Filing an application outside the established period is allowed in two cases - there is a court decision or the consent of the heirs to include another applicant in their composition (Article 1155 of the Civil Code of the Russian Federation). The first method is most often used.

Documentation

When submitting an application, the applicant must confirm his involvement in the property of the testator. The list of papers depends on the method of inheritance and the degree of relationship with the deceased citizen.

Minimum package of documents:

- civil passport of the recipient of the property;

- death certificate;

- certificate from the last place of registration of the property owner;

- document on deregistration;

- title deeds to real estate or other assets;

- report on the market value of the apartment;

- a will or documents confirming family ties;

- confirmation of payment of state duty.

The co-owner additionally provides evidence of his rights to a share in the objects of the inherited property. Such documents are not required from the spouse of the deceased, who allocated the marital share from the inherited property.

What about the actual method of inheritance? The successor will have to prepare a package of documents confirming the acceptance of the inheritance and its protection. Legally significant actions must be completed within a 6-month period .

Important! The residence of a co-owner in a residential premises in which the share belonged to the deceased owner is not considered actual acceptance of the inheritance.

Expenses

List of expenses when registering an inheritance

| Payment Description | Comments | Payment amount |

| State fee for a notary when entering into an inheritance | For spouses and close relatives | 0.3% of the amount of property received (no more than RUR 100,000) |

| For distant relatives and strangers | 0.6% of the amount of property received (no more than RUB 1,000,000) | |

| Technical work in a notary office | The list is established by methodological recommendations | The cost is set by the notary office. The maximum payment for the region is set by the Regional Notary Chamber. The cost of the service can be found on the website |

| Property valuation | Depends on the type of property | Real estate from 3000 rub. Car from 5000 rub. |

| State fee for registration of property rights | Depends on the type of property | Share in the apartment - 200 rubles. Apartment or house – 2000 rub. |

| Court expenses | Depends on the claims | State duty to court - from 300 rubles. Drawing up a claim - from 1500 rubles. Representation in court – from 10,000 rubles. |

Benefits when paying fees are granted to certain categories of heirs:

- disabled people of groups 1–2 (50% discount on the fee amount);

- citizens who lived with the testator on the day of his death;

- relatives of citizens who died in the performance of public duty;

- young children;

- incompetent citizens.

Deadlines for issuing a certificate of heir's rights

If the inheritance was accepted in a timely manner by applicants under a will or primary legal successors, then a certificate is issued to them after a 6-month period .

When registering an inheritance by second-degree relatives or as part of a transmission, the issuance of a certificate is shifted depending on the circumstances of the case.

Important! If the heirs can prove the fact that there are no other recipients of the property, then a certificate of the rights of the heirs can be issued earlier than the established period.

Inheritance of a share in joint property

Joint ownership is a common situation. A key feature of joint ownership and disposal of property is the consent of the other owners. That is, in order to dispose of the same apartment, for example, to bequeath it to someone, you need to obtain the consent of all other owners. If such consent is not obtained, but the apartment, for example, is sold by one of the owners, it will be a court case. By the way, joint property is considered to be property acquired by spouses during marriage (with some exceptions).

This legal regime does not always correspond to the aspirations and hopes of co-owners. Sometimes the situation even reaches a dead end, for example, in the event of the death of one of the spouses. In this case, the transfer of rights is shrouded in a veil of a whole host of legal norms, which are quite difficult to understand. The inheritance of an apartment that is joint property will help you formalize it properly, again, a notary.

Joint ownership - basic concepts

The essence of common property is revealed in Chapter 16 of the Civil Code of the Russian Federation. According to its provisions, this regime of ownership and disposal of property can be characterized as follows:

- Common property arises in the event of inheritance, receipt as a gift, privatization or purchase of one indivisible object by two or more persons.

- There are two types of common property - joint and shared. The first implies the presence of shares that are clearly designated and assigned to each co-owner. The second is the joint disposal and use of the object, without its distribution between the owners.

- The owner of a share of an apartment has the right to independently sell it or donate it. Also, after his death, the share passes unchanged to the heirs by law or by will.

- An apartment that is jointly owned cannot be sold, donated or inherited without the consent of the co-owners.

- Joint property can become shared property after an agreement on division is concluded between its owners or a corresponding decision is made by the court.

The living space belongs to all co-owners in equal shares, unless otherwise specified in the agreement governing its acquisition.

Common property of spouses

One of the main reasons for joint ownership of an apartment is acquisition during marriage.

According to Art. 256 of the Civil Code of the Russian Federation, all property acquired during marriage belongs to the spouses in equal shares if:

- a marriage contract was not drawn up between them, which establishes a different ratio or order of distribution;

- the object was not donated or inherited by one of the spouses;

- the right of joint ownership has been challenged (this is carried out in exceptional cases when there is a clear lack of the spouse’s feasible contribution to family assets).

The regime of common marital property applies to all property and to each property in particular. But the spouse may not always receive his half of the apartment. In some cases, by agreement or court decision, the living space may go entirely to one person, if the family’s material assets include more property, and one of the rights holders needs housing more.

Transfer of property under a gift agreement

The difference between a DD and a will is that the gift agreement is drawn up during the person’s lifetime. A deed of gift represents the transfer of rights to property to another person. Moreover, the gift agreement does not require mandatory notarization, plus, the agreement is quite simple to draw up. Another significant advantage of a deed of gift is that there is no need to pay tax when transferring property to family members. Other persons are required to pay 13%.

However, there are a number of nuances here, which we will discuss in more detail.

When can I apply?

To do this, you must have one of the following grounds :

- inseparable improvement;

- a previously concluded marriage agreement;

- proven maintenance (care) of the object by a spouse who is not an heir.

Important: The rarest reason is to reach an agreement with the heir-spouse. There are no other grounds for legal division.

Often, inheritance issues arise after the death of one of the spouses. Therefore, on our website you can read about:

- Do spouses have the right to inherit after the death of their husband?

- Does the wife have the right to a share and how to inherit?

- About the nuances of receiving an inheritance.

- Does a common-law wife have the right to inheritance?

- Who is the first priority heir?