Inheritance issues are always complex. And the point is not only that legally they are not entirely clear to people without the appropriate education. The loss of a loved one in itself is difficult for every family member. In addition, it is after the death of a relative that a huge number of standard conflicts arise regarding the division of property between heirs.

The division of property after the death of one of the spouses is no exception. In our article we will talk about how to formalize an inheritance after the death of a wife and on what principle, according to the law, the division of property will take place.

What property is inherited?

Cases involving the death of a husband or wife are legally considered on the basis of gender equality. That is, the lawyer’s consideration of inheritance issues will be conducted identically and impartially. However, before talking about inheritance shares, one cannot fail to mention such an important feature as jointly acquired property.

What is joint property?

After marriage, all acquired property will be jointly acquired. This applies not only to those purchases that are made in shared ownership, but also to many others. According to the law, jointly acquired property will be considered:

- Cash (salaries, benefits, pensions, scholarships, income from commercial activities);

- Real estate (land, houses, apartments or other objects);

- Property (cars, furniture, household appliances, etc.);

- Investments (bank deposits, securities, etc.).

Warning

After the death of the wife, all jointly acquired property is divided into two equal parts. Half becomes the property of the spouse, and the other half, which belonged to the deceased, is already inherited in order of priority (by law) or by will. That is, the spouse’s share cannot be distributed, since he had equal rights to this property.

Read about the mandatory spousal share in inheritance by law here.

Documents for entering into an inheritance without a will

According to the legislation of the Republic of Belarus, the rights of heirs are confirmed in the notary office at the place of residence of the deceased after 6 months from the date of death. To claim their rights, heirs must provide the following papers:

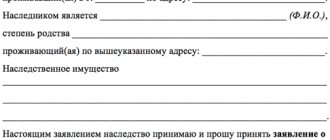

- Application for opening of inheritance;

- Applicant's identity card;

- Official documents confirming the degree of relationship;

- Stamp death certificate;

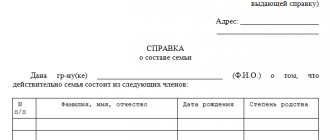

- A certificate confirming the residence of the deceased at the place of registration.

If the marriage between spouses has not been officially registered, rights to common property can only be obtained in court, where you will have to prove the fact of cohabitation and the acquisition of things that have become part of the inheritance.

In the case where the heirs live in another city or country, the inheritance can be opened remotely. To do this, you need to send a package of the above documents and a notarized statement. A trusted person, who acts as a ritual agent, will help resolve inheritance issues quickly and effectively. The bureau can not only order funeral arrangements, but also enter into an agreement to represent the interests of the heir in property matters and other legal matters.

What is the personal property of spouses?

Whether property is personal is determined by the time of its acquisition and the method of receipt. So, for example, all property that you acquired before marriage will be exclusively yours. After marriage, it will not be considered joint property.

However, you can receive personal property while you are married. This will be considered all that you:

- Receive as a gift, either officially by deed of gift (for property worth over ten thousand rubles) or without drawing up this document;

Read how to draw up a deed of gift for an apartment here.

- You will inherit.

Attention!

After the death of the wife, her personal property will be inherited by law, that is, according to the lines of inheritance or by will. In this case, there will be no division into two equal shares, and the spouse cannot claim half of this property.

Who has the right of inheritance?

Inheritance of the wife's property can be made:

- According to the will. In this case, she independently indicates the heirs, and the will is read out by a notary;

- According to the law. The law establishes certain shares that are inherited by the relatives of the deceased. Depending on the degree of relationship, the share of the inheritance is determined.

Inheritance queues and inheritable shares

There are eight lines of inheritance in total, which are divided according to the degree of relationship. First in line are:

- Spouse;

- Parents of the deceased;

- Children born in this marriage.

The property is distributed among the specified heirs in equal shares. It turns out that after the death of his wife, the spouse will both own half of the jointly acquired property and be the heir to the share of the property of the deceased spouse.

Information!

If there are no heirs of the first stage, or they have refused the inheritance, then the right passes to the next stage. The second priority is the brothers, sisters and grandparents of the deceased. We should also not forget the fact that the heir may be excluded from inheritance for various reasons.

Husband's rights to the deceased wife's inheritance

After the death of the wife, the concept of “joint property” with the husband is no longer used. There is a need to allocate shares. The deceased wife retains:

- Half of the jointly acquired property in a valid marriage, subject to the following conditions: the absence of other instructions in the marriage contract (if there is such a document);

- Property inherited by her separately at any stage of life;

- Personal property that she owned before the day of her marriage.

The property share of the wife (testator) becomes the property of the heirs by right of inheritance. The list of heirs can be determined in order of legal priority or in accordance with the will that was written before the death of the spouse. The husband's rights to inheritance, which is distributed after the death of his wife:

- The surviving spouse becomes the heir of the first (priority) line. However, this line also includes the parents of the deceased and her children. Therefore, if there are two or more owners, the inherited property will be divided equally between them;

- If the wife managed to draw up a will, and the husband’s name is not in it, then he has the right to claim only an obligatory share of the inheritance. It is at least 50% and is divided among all heirs claiming the obligatory share. These are people whose names are mentioned in the first place (children, father and mother, together with the spouse of the deceased), as well as disabled dependents. The second part of the inheritance in the amount of up to 50% will be transferred equally to those persons whose names appear in the will.

Regardless of whether the spouse’s name is on the will, he has two rights:

- The right to retain a share of the property that was acquired during marriage with the wife during her lifetime;

- The right to allocate your share of property without legal proceedings by obtaining a certificate of appropriate ownership of it.

Thus, after the death of his wife, the husband claims her inheritance in any case, unless he was divorced from her. But the share of the property inherited by him will depend on the number of heirs of the first priority, the contents of the will drawn up by the spouse during her lifetime, as well as on the presence of heirs claiming an obligatory share of the inheritance.

Rules of inheritance in the case of a joint will of spouses

On November 1, 2015, a law came into force according to which a married couple has the opportunity to draw up a will together

. In this case, spouses can only dispose of that part of the property that is jointly acquired. And all decisions regarding it must be made by mutual agreement.

A characteristic feature of a joint will is that one of the spouses can refuse it only while the second spouse is alive. This is due to the protection of the right of freedom of disposal of the testator, since the wife was a joint owner. The refusal of a joint will must be confirmed by a notary.

If the spouses have drawn up a joint will, then after the death of the wife, her property share passes legally to her husband, who survived her . But he loses the right to alienate the property that appeared in the will due to the imposition of a notarial prohibition.

When the husband also dies, the right of inheritance passes to the people whose names appear in the joint will.

Civil marriage and husband's rights to wife's inheritance

If a married couple actually had a marital relationship, but the marriage was not registered, then the rules for inheriting property change. A common-law husband has no rights to his wife’s inheritance after her death

, if he is able to work, and his name is not indicated in the will drawn up by the spouse during his lifetime, or if this will does not exist.

There are only two exceptions:

- The illegitimate spouse is disabled and has been dependent on the spouse for a year or more. In this case, the common-law husband has the right to claim an obligatory share of his wife’s inheritance if his name is not in the will;

- An illegitimate dependent spouse can receive the entire property if the eighth line of heirs has become a priority and there are no other dependents;

- The common-law husband has the right to his wife's inheritance if she indicated his name in the will . If there are heirs claiming an obligatory share, then he receives only part of the inherited property.

Thus, the inheritance received by the wife is not the property of the husband. Therefore, he has no rights to it and cannot dispose of it either. The only exception is the case of a large contribution of effort and resources to the wife’s inherited property. In this case, it becomes joint property.

And the order of inheritance by a husband from a deceased wife depends on the status of the marriage. If he is registered, then the husband becomes the priority heir. The common-law husband has limited rights of inheritance.

The husband's right to his wife's inheritance received during marriage is a matter of many legal disputes. Can a spouse claim inherited property? The answer to this question is determined taking into account the current civil law. Typically, this problem becomes relevant if the spouses are on the verge of divorce.

How is an inheritance processed?

Entering into inheritance is a fairly lengthy procedure that includes several stages. Initially, the inheritance is opened. The first day of opening the inheritance is the day of death of the testator, in this case the wife. Depending on the place of her residence, you will need to contact a notary who works in this area to accept the inheritance. If there is a will, the notary who certified this document handles the inheritance matter.

Basic documents for accepting an inheritance

After the death of the spouse, when the inheritance is open, it is necessary to collect the main package of documents to transfer them to the notary. You can provide them either in person, through a proxy, or even by mail, but all signatures and copies must be notarized. The personal presence of the heir is still most recommended.

The basic package of documents for opening an inheritance case includes:

- The heir's passport or other document proving his identity;

- Death certificate of the spouse or court decision declaring her dead;

- Documents that confirm the existence of relationship (for the spouse this is a marriage certificate, for children and parents of the wife - birth certificates);

- Papers that indicate the place of residence of the deceased (extract from the house register);

- Documents on the right of ownership of this or that property (documents for real estate, vehicles, etc.).

Information!

After the death of the wife, her husband must be issued a certificate of right to a share in the jointly acquired property. To correctly draw up this document, you will need papers indicating the dates of acquisition of real estate, vehicles or other property.

Additional documents for inheritance

To determine the shares of inherited property and confirm by what right the deceased owned it, additional documents are required. So, for example, they testify to the property right of the testator:

- Purchase and sale agreements;

- Court decisions on the appropriation of this or that property;

- Deeds of gift.

In addition, an assessment of the value of the entire inheritance is necessary. It is needed to determine the amount of state duty and fair division of the inheritance. In particular, an assessment will be needed if conflicts arise between relatives at the time of distribution.

Information!

The real market value is assessed with the help of specialized firms and government agencies. If the subject of valuation is located abroad of the Russian Federation, then the authorized bodies of the country where it is located should determine its price. After the assessment, these papers indicating the value of real estate, vehicles and other property are transferred to the notary.

The rights of a spouse to inheritance after the death of his wife

Does a spouse have a right to his wife's inheritance? If there is a will and if there is no will, the possibility of entry will differ.

By law, a spouse has the right to accept the property left behind after the death of the spouse on an equal basis with other primary beneficiaries. If the husband is the only heir and there are no other claimants, then the entire inheritance will go to him. If there are parents or children, the inheritance will be divided among all candidates in equal parts.

The spouse has the right to allocate 50% of the inheritance in his favor if the property left by the wife was acquired during the marriage. In this case, the husband has the right to receive a share in the remaining part of the estate.

If there is a will, the spouse's right can be changed. There are two possibilities for joining if you have this document:

- Become beneficiaries of a will.

- Use the right to a mandatory share.

If the spouse is written in the will, then the man will be able to receive everything that is intended for him. This may be an equal share on a par with other recipients or an assigned part of the property by the testator himself.

If the will is not in favor of the partner, then the property can only be obtained on the basis of the right to an obligatory share. Half of the legal share can be accepted if the spouse:

- Disabled or reached retirement age.

- Unable to work or incapacitated.

When registering a mandatory share, it is necessary to prepare documents that may indicate the special status of the recipient. For example, a statement of disability is suitable for a notary.