Risks when buying an apartment less than 3 years old

- Check the seller. First of all, avoid transactions made under a power of attorney, as its validity may terminate even before the registration of the purchase and sale agreement. Also try not to purchase real estate from visiting residents, as scammers often use such persons for their fraud. Before buying, ask the seller why he is selling the home - if it comes into question, treat such a transaction with the utmost caution.

- Check out the property. It is necessary to check both new buildings and secondary housing. Pay attention to the number of previous residents, the correspondence of the cost of the apartment and its condition, as well as the correctness of all the owner’s documents. Also at this stage, it is necessary to discuss with the seller all aspects of transferring funds, features of access to bank safe deposit boxes and other nuances.

- Check the sales procedure. You should be wary if the apartment is being sold urgently, or at a significant discount that exceeds 15% of the total cost. One should also be suspicious of cases when a property is sold not by the owner, but by his representative. If, under a vague pretext, you are presented with an incomplete package of documents, you can turn around and leave - this will be best for you.

- Sale using invalid documents. To do this, criminals use fake stamps, forms, “fraudulent specialists,” as well as an apartment that is rented from third parties for a short period of time (as a rule, the owners are not even aware of such tricks). The danger of this method is that it will be very difficult to find scammers and prove that you are right after the purchase.

- Applying to court to declare the transaction invalid. As a rule, after the sale, scammers file an application with the court to return the apartment back. This type is not so dangerous, since the money paid for housing is returned back to the buyer, but in a smaller amount due to the lower cost being stated in the claim. The difference goes into the pockets of the criminals, and the unfortunate buyer suffers losses and wastes his nerves and time.

- Sale of real estate to several individuals at the same time. A fairly common type of deception, in which the owner of the property makes several copies of documents for the apartment, then they are certified in different offices. After selling a property to several people, the owner usually disappears.

Step-by-step instructions: how to buy a home that has been owned for less than 3 years?

How to buy an apartment if it has been owned for less than three years? To carry out a transaction, you need to follow the specified algorithm step by step:

- Find an object.

- If it has been owned for less than three years, carefully check the documentation for the apartment and the owner’s passport.

- Identify the property of the seller and verify that he is of legal age.

- Make sure that the documentation required for the transaction is genuine.

- When inheriting, determine the circle of heirs. If the apartment is not sold jointly, then those who refuse the sale must submit official notarized refusals.

- After checking the documentation, draw up a preliminary agreement (at the discretion of the parties).

- Within the period specified in the PDCP, conclude the main purchase and sale agreement, draw up and sign the transfer deed.

- When concluding a bill of sale, check all provisions before signing it. Pay money when purchasing an apartment only in the amount specified in the contract.

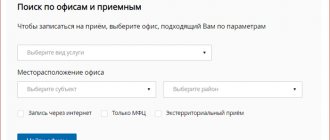

- Register the agreement by submitting it through the MFC or to a branch of Rosreestr (read more about registering a transaction through the MFC here).

- Receive a registered agreement and an extract from the Unified State Register of Real Estate, and begin to freely use the apartment for its intended purpose.

The buyer’s tasks at this stage are considered completed (we talked in detail about what the buyer should do after purchasing an apartment and how to resolve issues related to connecting housing and communal services, communications and much more here), but the seller will only have to pay personal income tax if the cost of the apartment is more than one million.

Owned for less than 3 years, what does it mean?

In the Housing Law , to the question what does it mean in advertisements for the sale of apartments that they write “owned for more than 3 years?” or less than 3 years? asked by the author Malinka - malinka the best answer is: If an apartment has been owned for less than three years, a citizen is obliged to pay income tax when selling the apartment; if for more than three years, he does not pay such tax.

It’s not so much a matter of taxation, because any competent lawyer (a realtor is often far from a lawyer, although he really likes to consider himself one) knows how to LEGALLY exempt income from the sale of an apartment from tax WITHOUT understating its value reflected in the transaction, even if the apartment is owned by the seller for 1 day, but the fact is that three years is the statute of limitations for disputes over the right to real estate.

Apartment according to will

It is definitely worthwhile to thoroughly study the issue and check the documents if the apartment has been owned for less than 3 years and the seller received it by will. The fact is that an inheritance document can be challenged within a certain period. If the heirs believe that the will was written under duress, then they can appeal to the court within a year. And if errors are discovered when drawing up the will or it turns out that the heir-seller is incompetent, then you can challenge it within three years.

What does it mean that less than 3 years of ownership

Another way to reduce the amount of tax is to deduct from your income the expenses incurred to purchase an apartment . This method is only suitable if the home was purchased and not received as a gift or inherited. In this case, personal income tax is paid only on the difference between the amounts from the sale and purchase , if this value is positive. For example, if an apartment was purchased in 2014 for 3.5 million rubles, and sold in 2015 for 4 million rubles, then the amount of tax payable will be:

Lyudmila, I answered you in the article about giving. It doesn’t matter that they lived together, what matters is the date they acquired (privatized) the apartment. If they purchased or privatized an apartment more than 3 years ago, then when your mother sells both her share and the share that she inherited from her husband, she does not need to file a declaration or pay tax. And if 3 years have not passed, then a declaration is filed and tax is calculated if it is sold for more than it was purchased. Those. The tenure period is counted from the date of purchase/privatization of the mother’s first share, and the date of receipt of the father’s share is no longer important.

We recommend reading: Sample Agreement of Donation of a Share of an Apartment to Minor Children Sample

How to sell an apartment less than 3 years old and not pay tax?

Methods for minimizing taxes when selling property owned for less than 3 years are the same as when owning an object for less than five, but more than three years. If you manage to avoid paying tax by owning an apartment for less than three years, you can do the same with an object you have owned for less than 5 years.

Method 1

The simplest and most obvious is the sale of an apartment worth no more than 1 million rubles. The amount of the tax benefit completely covers the transaction price:

1 million – 1 million = 0

The tax base itself disappears, turning into zero, and from zero no duties are paid.

Flaws:

- A very small percentage of transactions are in the price range of up to 1 million rubles;

- The tax benefit can only be used once a year. You will not be able to sell multiple apartments within one calendar year and apply the deduction each time.

Of course, the seller can artificially lower the contract amount, but there is a danger that the value of the property on paper will become less than the cadastral price multiplied by a reduction factor of 0.7. In this case, the law will not pay attention to the content of the contract and will simply calculate the volume of your obligation based on the cadastral price as described below.

The solution here may be to find out the cadastral value of the home as of January 1. The cadastral valuation may be noticeably lower than the market value, especially in the secondary housing segment.

In addition, you may find that your property, for some reason, does not have a cadastral valuation at all. Then it is impossible to rely on cadastre data and you can determine the sale price yourself.

Another reason why clarification of the cadastral valuation is useful is the prevention of possible penalties. An old property can indeed be sold inexpensively, cheaper than 70% of the cadastral valuation. In this situation, tax authorities will not only pay attention to this, but will also consider it an evasion of payment. For such offenses, a fine of 20% of the amount of tax lost by the budget is provided.

Method 2

This method is appropriate if the home was sold for the purpose of purchasing another apartment or house. You can deduct 13% of the cost of purchasing a new home from the tax you must pay.

Moreover, this method is interesting for its additional opportunities to reduce the tax base and the prospect of returning funds from the budget. Let me explain.

For example, during one calendar year you sold an apartment worth 2.5 million rubles and purchased another property worth 4 million rubles.

From the first transaction, you should calculate and pay your tax liability to the budget. To simplify the situation, let’s assume that you do not have any supporting documents about the acquisition of this object. Then you are left with the only acceptable calculation option - using a fixed tax deduction of 1 million rubles:

(2.5 million – 1 million) x 13% = 195 thousand rubles.

195 thousand rubles is the size of your tax liability.

However, during the same year you purchased an object worth 4 million rubles. This does not mean that you can claim a deduction from the entire purchase price, since the law limits the price of purchased housing for tax deduction purposes to two million rubles. Therefore, having made such a purchase, the amount of tax deduction will not exceed 260 thousand rubles (2 million rubles x 13% = 260 thousand rubles)

But even in this case, not only will you not have to spend money on payments to the treasury, but you will have the opportunity to receive the money owed to you from the state budget:

You owe the state - 195 thousand rubles.

The state owes you 260 thousand rubles.

Total: you can return 65 thousand rubles from the state budget. (260 thousand – 195 thousand = 65 thousand)

Please note, no distortions or abuses, only knowledge of the law.

Flaws:

- As noted above, the funds that you can deduct from your tax liability are no more than 260 thousand rubles;

- Both transactions - purchase and sale - must take place within one calendar year;

- You can use a tax deduction when buying a home once in your life. The size of the salary is not important.

Details of this method in the video:

The apartment has been owned for less than 3 years - what does this mean?

My daughters inherited a flat from their grandfather and sold it for 1600 rubles. Although the contract stated that each received 800 rubles, the tax office still obliged each to pay 13% of the amount of 600 rubles, i.e. the one that exceeds a million. Now each must pay 39 thousand rubles. We didn’t know about this, the lawyer during the transaction said that she would write in the contract that each girl would get half the amount and there would be no need to pay tax, but we were naive and believed and paid for it. If they knew, they would indicate less than a million or they would ask for a higher price per square meter to cover the tax. And so we reduced the price of the apartment, so now we also pay taxes. (Krasnodar)

I actually have a wow situation. there was an opportunity to invest money. I went straight to the seller. A guy with an 11 year old son has 2/3 shares of 1/3 each. they got the apartment in connection with the resettlement of the barracks. We got a full 2ku together with our aunt. The aunt in this 2nd apartment has her own small room and full ownership of 1/3 of the share. The guy decided to separate from his aunt because he didn’t need housing. Sells housing 2/3. with his 1/3 share there will be no problems, and no tax will be charged, since the amount is not higher than 1 ml. But with a child there are a lot of questions, you can, of course, wait until the child grows up. but it is not entirely clear at what age one can dispose of property. and now I’ve read a lot here and it’s absolutely BAD. that now you are afraid that the former owner will challenge you and will be shaking there for 3 years. or it must be supported by an agreement.

Ownership less than three years old, what does this mean?

If the apartment you are planning to sell has been owned by the seller for more than 3 years, then in this case there is no need to pay tax on the sale of the apartment. In this case, the amount of income does not matter. This provision is set out in paragraph 17.1 of Article 217 of the Tax Code of the Russian Federation.

These are the simplest ways that will save you from costs and unnecessary questions from government agencies. Let's be honest, this is not the highest interest rate yet. In some European countries, for example, France, the rate on income over 1 million euros per year is 70%. To be honest, this is pure robbery. But these are sacrifices of beauty and well-being of the population.

Owned for less than 5 years - what does it mean?

All other ways in which residential premises could become your property are subject to a period of 5 years. This could be equity participation, assignment of claims, obtaining a share in a building cooperative, etc. But the most common option for owning a house is to buy it. And above all, it is for this case that owning property for 5 years becomes a very important limitation and problem.

Selling a home before the expiration of the 5-year tenure also entails the seller’s obligation to calculate the amount of future payment to the treasury.

Under what conditions is it possible to donate an apartment that has been owned for less than 3 years?

- The disposal of property in shared ownership is carried out by agreement of all its participants.

- A participant in shared ownership has the right, at his own discretion, to sell, donate, bequeath, pledge his share or dispose of it in any other way, subject to the rules provided for in Article 250 of this Code during its alienation for compensation.

- Under an exchange agreement, each party undertakes to transfer one product into the ownership of the other party in exchange for another.

- The rules on purchase and sale (Chapter 30) are applied to the exchange agreement, if this does not contradict the rules of this chapter and the essence of the exchange. In this case, each party is recognized as the seller of the goods, which it undertakes to transfer, and the buyer of the goods, which it undertakes to accept in exchange.

How is car sales tax calculated?

- The car was sold for an amount exceeding 250,000 rubles . In this case, only the sales document is available. The tax here is formed without taking into account the price that you initially paid for the car, since it is impossible to document it, and is calculated using the standard formula: 250,000 tax deduction is subtracted from the sales price and 13 percent of the amount received is calculated. For example, you bought a car in 2014 for 451,000 rubles, and sold it in 2021 for 615,000, but you cannot document the purchase price. Then the tax is calculated as follows: (615,000-250,000)/100*13=47,450 rubles.

- The car was sold for an amount exceeding 250,000 rubles , plus the cost of its acquisition. We have documents confirming both transactions. In this case, you will need to pay a tax of 13% of the income received from the sale. For example, you purchased a vehicle in 2014 for 640,000 rubles and sold it in 2021 for 750,000. Tax calculation: (750,000-640,000)/100*13=14,300 rubles.

- The car was sold at a price exceeding 250,000 rubles , but the acquisition price was less than this amount. There are documents that confirm both transactions. Since the purchase amount was less than 250,000 rubles, the tax is calculated based on the sale price and tax deduction (this option is more profitable for the seller than calculating the amount of sale and purchase). For example, you purchased a vehicle in 2015 for 210,000 rubles and sold it in 2021 for 270,000. This means (270,000-250,000)/100*13=2600 rubles.

- The car was sold for less than RUB 250,000 . In this case, income tax cannot be withheld (Article 220 of the NKRF, clause 2.1). The presence or absence of a document of acquisition does not matter. For example, you purchased a vehicle in 2015 for 220,000 rubles and sold it in 2021 for 240,000 rubles. As you can see, the sale amount is 10,000 rubles less than the tax deduction. This means that, in accordance with the law, despite an income of 20,000 rubles, no tax is charged.

- The car was sold for more than 250,000 rubles , but less than the cost of the original purchase. There are documents about both the sale and purchase of a car. This situation also applies to those cases in which no tax is paid on the sale of the car. In this case, no tax is charged due to the lack of profitability.

We recommend reading: Inheritance under the Civil Code of the Russian Federation according to the law

What do deadlines affect?

The timing does not affect anything in this case if taxation is implied, because the donor does not receive anything from the transaction, it is free of charge.

The Tax Code (Article 217) speaks directly about tax restrictions when selling housing that the owner has owned for less than three years - you will have to pay a sales tax in the amount of 13% of the cadastral value of the home.

Moreover, the same rules apply to barter (Article 567 of the Civil Code). This rule applies to residents (Article 207 of the Tax Code), non-residents will have to share most of the income - 30%.

However, in this case we are talking about a gift. And if a person gives something, then what kind of income - and therefore deductions from it - can we talk about?

In this case, the income is most likely received by the one who was given the square meters. of taxes arises again . Is donated housing subject to tax if it has been owned for less than 3 years?

Here the influence will no longer be on how many years the previous owner owned the area, but on who the parties are related to each other.

This is exactly what many apartment sellers decide to play on, who officially formalize the transfer of housing as a gift - in order to save themselves from having to pay (read about what is better to formalize: donation or purchase and sale).

However, for such a case, you should hire an experienced lawyer so that the gift agreement itself does not raise any questions. The fact is that if an interested person becomes aware of something about the transfer being not free of charge, he can file a lawsuit and the transaction will be recognized as a sham (Article 170 of the Civil Code)!

Read about the cases in which you can challenge a deed of gift or invalidate a gift transaction on our website.

Ownership less than three years old, what does this mean?

Buying an apartment is a serious transaction, so it is important to be aware of the required package of documents when drawing up a contract. Most buyers think that all aspects of buying and selling can be left to a real estate agent. It must be remembered that he does not bear financial and legal responsibility for signing the deal. The real estate agent only provides information services.

But in cities with a high cost per square meter, which includes St. Petersburg, as a rule, it is still more profitable to reduce the tax base by the amount of costs incurred. Let's consider this example. A one-room apartment was purchased at the construction stage for 3 million rubles. After delivery of the house, its market price is 3.5 million rubles. Taking into account the tax deduction, the tax base will be 2.5 million rubles, and the tax will be 325 thousand rubles. Whereas the difference between income and expenses is only 500 thousand rubles, and the tax, accordingly, is 65 thousand rubles. The choice couldn't be easier.

Risks of buying an apartment less than 3 years old

- In some cases, the sale of an apartment is carried out according to a power of attorney. In such cases, the legitimacy of such a document may be called into question. If the power of attorney is declared illegal and has no legal force, then the transaction made under it will also be declared illegal.

- Selling an apartment received by inheritance is also a risky business. After all, as a rule, inherited property has more than one owner, who may not agree on actions among themselves, which becomes the cause of disputes.

Even though these procedures take quite a lot of time and may require some financial expenses, this will ensure that your purchase is safe. This will also allow you not to get involved in dubious transactions, which could lead to even bigger problems in the future.

The apartment was received by will

If the apartment has been owned for less than three years and was received by will or inheritance, there is a serious possibility that the other heirs will not agree that one of them took the entire apartment into his own ownership and did not share it with them.

As a result, they may sue and declare the distribution of the inheritance incorrect/invalid. As a result, the seller loses ownership of the home and, logically, the purchase and sale transaction is also considered illegal.

The buyer is obliged to return the apartment and can demand money from the seller. The general principles here are similar to the situation described above. Simply put, you will have to return the apartment anyway, but demanding money will be problematic.

The problem can be solved by making sure that all other heirs also received the property of the deceased in proportion to the seller’s apartment and do not have any claims to it. It’s even better if the seller is the only heir.

It is necessary to take into account the fact that even after 3 years or more, the right to foreclose on an apartment can be restored if there are good reasons for this. For example, if one or more heirs did not know and could not know that they are now heirs.

Example: An apartment was received by will and immediately sold to a third party. Other heirs do not agree with the will and were able to get it canceled through the court for the reason that the testator at the time of drawing up this document was not aware of his actions. The buyer loses his home and will be forced, with a controversial result, to demand money from the seller-heir under the will.

Risks of purchasing an apartment that has been owned for less than 3 years

Of course, buying such an apartment will not necessarily be burdened with all these troubles. Undoubtedly, there are conscientious sellers who have valid and well-founded reasons for selling a property without causing any problems.

- Indication of the place and date of its compilation;

- Personal passport details of each participant in the transaction, including registration addresses that match the originals;

- Description of the characteristics of the apartment being purchased, the form of ownership, as well as an indication of the documents on the basis of which ownership rights were obtained from the seller;

- There is no guarantee that the apartment is not encumbered and there are no persons who have the legal right to live in it;

- The final cost of the property in full;

- Deadline for complete vacancy of the apartment by current residents.

Collegium of Advocates

With the entry into force of the Law “On Bankruptcy of Individuals,” the risks when purchasing apartments with reduced prices have increased many times over. An additional circumstance that may arise within 1-3 years from the date of a real estate transaction is the possible bankruptcy of the seller , which, coupled with insolvency, greatly increases the financial risks of the buyer.

If for some reason the transaction is declared invalid, the court will apply the consequences of invalidity of the transaction.. In this case, sq. will be returned to the Seller, and he will have to return that amount to you. will be indicated in the DCP. But this does not negate your opportunity, if such a situation arises, to return the remaining funds (in court in a separate claim), issued by a receipt (such a receipt must also be drawn up in compliance with certain points).

Less than Three Years of Ownership Means That

We found an apartment to buy, but it has been owned for less than 3 years, so we are offered to buy it under contract for 1 million, but in reality for 7, having written a receipt for the rest. How can you insure yourself in case of termination of the transaction? How can you increase the value in the contract? and if we ever want to sell it (if we buy it) for real value, then what: will we have to pay tax on the difference?

If, when selling, you can use the deduction of only 1 million, then you can indicate in the DCT a price no higher than 3 million so as not to pay anything. In general, the essence is this: when selling, you must pay 13% x (C-1 million). When purchasing, you are entitled to a return in the amount of 13% x 2 million (if the amount in the purchase agreement is specified at least 2 million).

Why 3 years

Where did this three year period come from? The fact is that real estate, which has been owned by the owner for less than three years, is sold and bought under certain conditions.

For example, one of the conditions is that the seller undertakes to pay personal income tax in the amount of 13% of the tax base. The tax base is the difference between the expenses for this apartment and the income from the sale of it. If the housing was received as a result of a gift agreement or by will, then the minimum amount that is not subject to taxation is 1 million rubles. 3 years after the owner of the property took ownership, he does not pay tax.

For some transactions in 2021, on January 1, the period was increased to 5 years. This applies to sales and investment agreements.

Tax-related inconveniences also exist for the buyer. When purchasing a first home that has been with the seller for less than three years, the buyer cannot apply to the Federal Tax Service and receive a tax deduction for it.