Explanations from the Russian Ministry of Labor and Rostrud on the application of labor legislation. Part 2

About wages

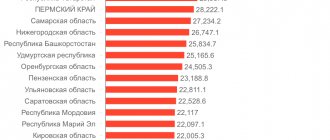

In letter dated June 5, 2020 N 14-0/10/B-4085, specialists from the Russian Ministry of Labor came to the conclusion that when working part-time under a time-based (time-based bonus) wage system, wages are accrued to the employee in proportion to the time worked , but not lower than the minimum wage in terms of the full monthly rate. In the same letter, officials assessed the legality of the employer’s actions in a situation where during the year the employee is paid wages in an amount less than the minimum wage, and in the future the accumulated difference is compensated by the payment of an annual bonus. It is clarified that the employee’s salary in each month must be at least the minimum wage, while the annual bonus will be taken into account only in the month in which it is accrued.

In letter dated March 14, 2020 N 14-1/OOG-1874, specialists from the Russian Ministry of Labor answered several questions about bonuses for employees.

Firstly, in response to the question about the payment of bonuses upon dismissal of an employee, the department indicated that if a bonus was awarded to an employee in accordance with the bonus order adopted before his dismissal, then it must be paid. If the order on bonuses for employees of the enterprise was issued after the dismissal of this employee, then there are no grounds for including him in the order, since at the time of issuance of the order he is not in labor relations with the organization.

Secondly, the department’s specialists spoke on the issue of the possibility of depriving an employee of a bonus if he is brought to disciplinary liability. In their opinion, in the provision on bonus payments to employees, the presence of a disciplinary penalty can be determined as a basis for deprivation or reduction of a bonus. It is also noted that the labor legislation does not establish the procedure for formalizing the deprivation or reduction of bonuses. Since the bonus system itself is regulated at the level of local regulations, the deprivation or reduction of a bonus should also be based on the provisions of the relevant local acts, therefore, the bonus order does not need to indicate data on the basis on which a particular employee was not awarded a bonus or its amount was reduced.

Rostrud also spoke about the rights and responsibilities of employers in the field of bonuses. In information dated December 10, 2020, department specialists recalled that establishing the procedure and amount of payment of bonuses, as well as the conditions for deprivation or reduction of bonus payments is the exclusive prerogative of the employer. However, the law does not oblige the employer to pay bonuses to employees. At the same time, officials noted that if the employer nevertheless fixed bonuses in the wage system, he must fulfill his obligations. Violation of the provisions of local regulations establishing the obligation to pay bonuses may result in administrative liability under Art. 5.27 Code of Administrative Offenses of the Russian Federation. In this case, the employer may establish conditions for the complete deprivation of the bonus or its reduction, for example, depending on the presence of a disciplinary offense.

The Ministry of Labor of Russia, in letter dated May 24, 2020 N 14-1/OOG-4375, answered the question of how to pay for downtime caused by repairs in an organization. As follows from the department’s explanations, this ground for suspending work in itself does not allow us to determine who is responsible for the downtime, and therefore to choose the proper method of payment. The employer should proceed from the reasons that caused the need for repairs. If repairs were required due to violations committed by the employee, then the blame for the downtime lies with him, which means payment for him in accordance with part three of Art. 157 of the Labor Code of the Russian Federation is not subject to downtime. If the repair is planned, then the time it is carried out can be classified as downtime due to the fault of the employer and paid in the amount of at least two-thirds of the employee’s average salary (part one of Article 157 of the Labor Code of the Russian Federation). If there is an emergency situation in the organization, then this, according to officials, should be qualified as downtime for reasons beyond the control of the parties, which is paid in the amount of two-thirds of the tariff rate, salary (part two of Article 157 of the Labor Code of the Russian Federation).

In letter dated September 4, 2020 N 14-1/OOG-7353, specialists from the Russian Ministry of Labor highlighted some issues regarding the procedure for paying overtime and work on weekends and holidays.

Firstly, the department recalled the resolution of the Constitutional Court of the Russian Federation of June 28, 2020 N 26-P, according to which payment for work on a weekend and (or) a non-working holiday must include all compensation and incentive payments provided for by the established for them wage system.

Secondly, the department indicated that if an employee worked less than the monthly standard of working time established by his employment contract in a calendar month, then payments are reduced proportionally. At the same time, if during the month an employee worked more than normal working hours, then payments should be increased.

Thirdly, the department noted that when working conditions deviate from normal conditions, increased wages are applied for each type of deviation from normal conditions. If an employee is required to work overtime and at night, such work must be paid both as overtime and as night work.

Fourthly, the letter touches on the issue of the relationship between the minimum wage and the totality of payments that form wages. According to officials, since overtime work is carried out outside normal working hours, its payment is not included in the minimum wage. A similar approach should be followed when taking into account other compensation payments. If work on weekends, non-working holidays, or at night was carried out within working hours, then the payment for it is taken into account as part of the minimum wage.

Letter of the Ministry of Labor of Russia dated November 2, 2020 N 14-1/B-872 states that workers’ work on weekends and non-working holidays should be paid taking into account compensation and incentive payments, even if this is not provided for by the collective agreement or local regulations of the employer .

In letter dated October 23, 2020 N 14-1/OOG-8448, specialists from the Russian Ministry of Labor considered the issue of an employee’s request to the employer to send part of his salary to repay the loan. As a response, the department cited Art. 137 of the Labor Code of the Russian Federation, which contains the grounds for deduction from an employee’s salary, among which deduction at the request of the employee is not indicated. From which we can conclude that officials do not consider such retention legal.

In letter dated October 23, 2020 No. 14-1/OOG-8459, specialists from the Russian Ministry of Labor noted that the responsibility for issuing pay slips rests with employers, including in the case of transferring wages to bank cards. This is due to the fact that the Labor Code of the Russian Federation (including Article 136 of the Labor Code of the Russian Federation) does not contain any exceptions regarding the presentation of pay slips to employees depending on the method of payment of wages.

In letter No. 14-3/B-718 dated September 3, 2020, representatives of the Russian Ministry of Labor came to the conclusion that deductions from the wages of those sentenced to correctional labor should be made from the full amount of wages. The letter notes that Art. 44 of the Penal Code of the Russian Federation does not contain a special clause stating that deductions must be calculated from the amount of wages remaining after deduction of personal income tax, as, for example, stipulated in Part 1 of Art. 99 of the Law on Enforcement Proceedings. A similar position was expressed in 2020 by specialists from the Ministry of Justice of Russia (letter dated 07/03/2018 N 04-88128/18) and the Federal Penitentiary Service of Russia (letter dated 06/09/2018 N og-19-21048).

In letter dated November 12, 2020 No. 14-1/OOG-8602, the Russian Ministry of Labor answered the question of whether an employer can pay wages earlier than the dates established for this. According to part six of Art. 136 of the Labor Code of the Russian Federation, wages are paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued. According to the Russian Ministry of Labor, this standard is protective for the employee and is aimed at reducing the gap between the performance of work and its payment. Thus, if the employer pays wages ahead of schedule, this does not worsen the employee's situation.

Methodological materials

| Letter of the Ministry of Labor of Russia dated April 11, 2020 N 18-0/10/B-2574 | 361 KB | 667 |

| Letter of the Ministry of Labor of Russia dated April 11, 2020 N 18-0/10/B-2574 | 72 KB | 680 |

On March 30, 2020, the Ministry of Labor and Social Protection of the Russian Federation held an instructional and methodological meeting with representatives of departments for the prevention of corruption and other offenses of government bodies and organizations on the topic “Analysis of information on income, expenses, property and property obligations, as well as verification their reliability” (hereinafter referred to as the meeting).

We forward the decisions agreed upon by the Office of the President of the Russian Federation on Anti-Corruption Issues, formulated based on the results of the meeting.

We ask you to bring these decisions to the attention of the responsible persons of the government body and organization and use them in practical anti-corruption activities.

Deputy Minister of Labor

and social protection of the Russian Federation

A.A. Cherkasov

Application

Ministry of Labor of Russia March 30, 2020, Moscow

Based on the results of an instructional and methodological meeting held at the Ministry of Labor and Social Protection of the Russian Federation with representatives of departments for the prevention of corruption and other offenses of federal government bodies, state bodies of the constituent entities of the Russian Federation for the prevention of corruption and other offenses, authorized structural units for the prevention of corruption and other offenses of organizations on the topic “Analysis of information on income, expenses, property and property obligations, as well as checking their reliability”:

1. Express gratitude to the federal government bodies, government bodies of the constituent entities of the Russian Federation for the prevention of corruption and other offenses, organizations for their active participation in its implementation and hope for further fruitful cooperation.

2. Recommend to the units for the prevention of corruption and other offenses of federal government bodies, government bodies of the constituent entities of the Russian Federation for the prevention of corruption and other offenses, authorized structural units for the prevention of corruption and other offenses of organizations:

take a proactive position in the prevention of corruption and other offenses, guided in order to identify these offenses not only by information received from other government bodies and organizations, but also by using externally available information (open sources);

take measures to increase awareness of employees (employees) about the requirements of the legislation of the Russian Federation on combating corruption and the inevitability of punishment for their violation;

in their activities, pay special attention to situations of conflict of interest and compliance with the legislation of the Russian Federation on anti-corruption by persons holding positions associated with high corruption risks, the performance of duties for which involves, in particular, the implementation of organizational and administrative or administrative functions, control and supervisory functions activities, making decisions on the distribution of budgetary allocations, carrying out public procurement or issuing licenses and permits, storing and distributing material and technical resources.

3. Recommend that divisions for the prevention of corruption and other offenses of federal government bodies, state bodies of constituent entities of the Russian Federation for the prevention of corruption and other offenses, authorized structural units for the prevention of corruption and other offenses of organizations to submit information to the Ministry of Labor of Russia:

on measures taken to improve the efficiency of the analysis of information on income, expenses, property and liabilities of a property nature (hereinafter referred to as information on income) provided by employees (employees);

on the number of established facts of conflict of interest (affiliation), as well as non-compliance with other anti-corruption prohibitions, responsibilities and requirements when carrying out this analysis, as well as on measures taken based on the results of consideration of these situations;

on measures taken to improve the quality (effectiveness) of audits of the reliability and completeness of income information, control of expenses, the basis of which is the analysis of the submitted income information;

on the participation of anti-corruption units in monitoring the procurement of goods, works and services for the needs of these government bodies, organizations and structures subordinate to them for the possible commission of corruption offenses, conflicts of interest (affiliation) of officials.

Deadline: February 1, 2020.

4. Recommend that divisions for the prevention of corruption and other offenses of federal government bodies, state bodies of constituent entities of the Russian Federation for the prevention of corruption and other offenses, authorized structural units for the prevention of corruption and other offenses of organizations to submit proposals to the Ministry of Labor of Russia on improving the provisions of the legislation of the Russian Federation on combating corruption .

Deadline: May 31, 2020.

4. Recommend that divisions for the prevention of corruption and other offenses of federal government bodies, state bodies of constituent entities of the Russian Federation for the prevention of corruption and other offenses, authorized structural units for the prevention of corruption and other offenses of organizations to inform the Ministry of Labor of Russia about emerging problems when conducting checks on the accuracy and completeness of information about income, cost control.

5. Recommend that units for the prevention of corruption and other offenses of federal government bodies, government bodies of constituent entities of the Russian Federation for the prevention of corruption and other offenses, authorized structural units for the prevention of corruption and other offenses of organizations to inform the Ministry of Labor of Russia about the measures taken in order to:

establishing effective interdepartmental interaction with federal government bodies, the exchange of information with which is carried out as part of verification of the accuracy and completeness of information on income, control of expenses;

allocation of the necessary resources for the specified interaction.

Deadline: February 1, 2020.

6. Recommend that the Ministry of Internal Affairs of Russia, the Ministry of Emergency Situations of Russia, the Federal Tax Service of Russia, Rosreestr, Rosmorrechflot, Rosaviation, including their subordinate organizations, continue to work on the creation, development and uninterrupted functioning of services for providing information necessary for government bodies and organizations to conduct checks of the accuracy and completeness of information about income, control over expenses.

7. The Ministry of Labor of Russia, together with other federal government bodies, will continue to work on methodological support for the prevention of corruption and other offenses, including ensuring the preparation of methodological recommendations for conducting checks on the accuracy and completeness of income information.

LETTERS FROM ROSTRUD AND MINISTRY OF LABOR THAT CAN HELP IN CONTROVERSIAL SITUATIONS

Date: 09/04/2017

Rostrud and the Ministry of Labor of Russia have the right, like other departments, to accept various letters to clarify certain provisions of laws within their competence. However, it should be borne in mind that such letters are not normative acts and are of an advisory nature. They reflect the agency’s position on a specific issue, which courts often take into account when resolving controversial situations and substantiating the arguments of the parties in the process.

Here are some of these letters. 1. On the issue of deductions from an employee’s salary

Letter of the Ministry of Health and Social Development of Russia dated November 16, 2011 No. 22-2-4852: the employer calculates the amount of deductions from the amount that remains after taxes have been deducted. Letter of Rostrud dated October 1, 2012 No. 1286-6-1: a counting error is an error in arithmetic calculations. That is, an error when entering data into the accounting system is not an accounting error, and in this case, the overpaid money to the employee cannot be returned. A similar position is reflected in the Ruling of the Supreme Court of the Russian Federation dated January 20, 2012 No. 59-B11-17.

2. Regarding the payment of daily allowances

Letter of the Ministry of Labor of Russia dated 09/05/2013 No. 14-2/3044898-4414: the employer is obliged to pay the employee daily allowance for each day of a business trip, including weekends, holidays and days en route.

3. Regarding payment of compensation for vacation

Letter of Rostrud dated October 31, 2008 No. 5921-TZ: this letter talks about proportional compensation for vacation. This principle applies if the employee worked for less than a full year and quit. For each month in this case, the employee is entitled to 2.33 days of rest. This amount is obtained by dividing 28 days of vacation by 12 months. Letters of Rostrud dated 08/09/2011 No. 2368-6-1 and dated 03/04/2013 No. 164-6-1: an employee who has worked in the company from 5.5 to 11 months receives full compensation for unused vacation in the event if dismissal occurs due to the liquidation of an enterprise, reduction in numbers or staff, reorganization, entry into active military service, etc. (Clause 28 of the “Rules on regular and additional leaves”, approved by the People's Commissariat of the USSR dated April 30, 1930). Letter of Rostrud dated December 24, 2007 No. 5277-6-1: the employer is not obliged to extend leave for an employee who fell ill during leave with subsequent dismissal. This position is also confirmed by Art. Art. 124, 127 of the Labor Code of the Russian Federation and the ruling of the Constitutional Court of the Russian Federation dated January 25, 2007 No. 131-O-O. However, it should be remembered that during illness during the vacation period followed by dismissal, the employee is paid temporary disability benefits.

4. On the issue of financial liability

In accordance with Part 2 of Article 244 of the Labor Code of the Russian Federation, agreements on full financial liability can be concluded with employees from a special list. This list was approved by Decree of the Ministry of Labor of Russia dated December 31, 2002 No. 85 (letter of Rostrud dated October 19, 2006 No. 1746-6-1). If the position is not on the list or the work on the list is not included in the employee’s job function, then the contract is considered unlawful.

5. On the issue of calculating benefits in case of temporary disability and in connection with maternity

Letter of the Ministry of Labor of Russia dated 08/03/2015 No. 17-1 / OOG-1105: replacement of calendar years, which are used to calculate average earnings for calculating benefits, can be carried out not for any previous years (year), but for those immediately preceding the onset of the insurance period case. That is, if in 2013-2014. the applicant was on maternity or child care leave, and a new insured event occurred in 2020, then 2013 and (or) 2014 can only be replaced by 2012 and (or) 2011, and not by any years prior to 2013 and/or 2014.

6. On the issue of calculating vacation pay

Letter of the Ministry of Labor of Russia dated April 15, 2016 No. 14-1/B-351: non-working holidays must be taken into account when calculating the average salary, and, accordingly, the duration of vacation increases only due to non-working holidays that fall during the vacation period. During the vacation period, the employee retains his average earnings, the calculation procedure for which is established by Article 139 of the Labor Code of the Russian Federation and the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922. In accordance with paragraph 5 of the Regulations when calculating the average Earnings from the calculation period exclude time, as well as amounts accrued during this time, including if the employee maintained average earnings, with the exception of breaks for feeding a child provided for by labor legislation. Thus, vacation days when the employee retained the average salary, and not a non-working holiday, are excluded from the calculation period.

7. Regarding the preliminary medical examination

Letter of the Ministry of Labor of Russia dated April 28, 2017 No. 15-2/OOG-1224: if an employee was fired (with termination of the employment contract) and then hired for the same job, he is subject to all the requirements of labor legislation, including including in terms of undergoing a mandatory preliminary medical examination (Article 69, Article 213 of the Labor Code of the Russian Federation). This situation may arise, for example, when a fixed-term employment contract is renewed. Therefore, before signing a new employment contract, the employer must send the employee for a preliminary medical examination, which is carried out at the employer’s expense.

8. On the issue of salary payment taking into account compensation payments

Letter of the Ministry of Labor of Russia dated April 18, 2017 No. 11-4/ОOG-718: compensation for overtime, night work, on weekends and holidays, as well as for combining (professions) positions is part of the salary, so it must be accrued every half month (Article 129 of the Labor Code of the Russian Federation). Specific dates are set in the PVTR, collective or labor agreement. For example, the PVTR states that salaries are calculated on the 5th and 20th, then the employee must be paid for overtime work for August 7th and 8th on August 20th. Also in this letter, the Ministry of Labor reminded that regional coefficients and percentage bonuses are calculated on the employee’s actual monthly earnings. It includes: salary, allowances and additional payments to tariff rates, compensation related to working hours and working conditions, bonuses and rewards, and other payments established by the organization’s remuneration system.

One can also note the special role of letters from the Russian Ministry of Labor, which invite employers to join the Industry Tariff Agreement (STA). Let us remind you that these letters are published without fail in Rossiyskaya Gazeta and the employer must send a written reasoned refusal to join the UTS to the Ministry of Labor of Russia within 30 days. If no refusal is received, then the OTS applies to employers automatically.

Legislative framework of the Russian Federation

The Legal Department of the Federal Service for Labor and Employment reviewed letter No. 56 dated September 20, 2006. We report the following.

In accordance with Article 233 of the Labor Code of the Russian Federation, the financial liability of a party to an employment contract arises for damage caused by it to the other party to this contract as a result of its culpable unlawful behavior (actions or inaction), unless otherwise provided by the Code or other federal laws.

Financial liability occurs in the simultaneous presence of the following conditions: unlawful behavior (actions or inaction) of the causer; causal connection between the unlawful act and material damage; guilt in committing an unlawful act (inaction).

According to Article 238 of the Code, the employee is obliged to compensate the employer for direct actual damage caused to him, which is understood as a real decrease or deterioration of the employer’s existing property, as well as the need for him to make expenses or excessive payments for the acquisition, restoration of property or for compensation for damage caused by the employee to third parties.

Direct actual damage may include, for example, a shortage of monetary or property assets, damage to materials and equipment, costs of repairing damaged property, payments for forced absence or downtime, and the amount of a fine paid.

The Labor Code of the Russian Federation provides for two types of financial liability of an employee for damage caused to the employer: limited and full financial liability.

Limited financial liability consists of the employee’s obligation to compensate for direct actual damage caused to the employer, but not in excess of the maximum limit established by law, determined in relation to the amount of wages he receives.

In accordance with Article 241 of the Code, this maximum limit is the employee’s average monthly earnings.

Financial liability in the full amount of damage caused to the employer can be assigned to the employee only in cases expressly determined by the Labor Code of the Russian Federation or other federal laws.

The list of cases of full financial liability of employees is established by Article 243 of the Code.

Agreements on full financial liability are concluded according to the rules established by Article 244 of the Labor Code of the Russian Federation.

Currently, written agreements on full financial responsibility can be concluded only with those employees and for the performance of those types of work that are provided for in the List of Positions and Works replaced or performed by employees with whom the employer can conclude written agreements on full individual financial responsibility for shortages of entrusted property , approved by Resolution of the Ministry of Labor of Russia dated December 31, 2002 N 85. The above list of positions and works is exhaustive and is not subject to broad interpretation.

Head of the Legal Department

of the Federal Service for Labor and Employment I.I. SHKLOVETS \r\n

Letter of the Ministry of Labor dated March 24, 2020 N 14-2/B-293

MINISTRY OF LABOR AND SOCIAL PROTECTION OF THE RUSSIAN FEDERATION LETTER dated March 24, 2020 N 14-2/B-293

The Ministry of Labor and Social Protection of the Russian Federation has considered your appeal dated February 25, 2020 N NP-08-12/4089 regarding the need to provide information on labor activity in relation to the heads of organizations that are the only participants (founders) operating without concluding employment contracts , and reports. In accordance with the Regulations on the Ministry of Labor and Social Protection of the Russian Federation, approved by Decree of the Government of the Russian Federation of June 19, 2012 N 610, the Ministry of Labor of Russia provides clarifications on issues within the competence of the Ministry in cases provided for by the legislation of the Russian Federation. The opinion of the Russian Ministry of Labor on the issues contained in your letter is not an explanation or a regulatory legal act, but only contains the opinion of specialists. Labor legislation and other acts containing labor law norms regulate labor relations and other relations directly related to them. According to Article 15 of the Labor Code of the Russian Federation (hereinafter referred to as the Code), labor relations are relations based on an agreement between the employee and the employer on the personal performance by the employee for payment of a labor function (work according to the position in accordance with the staffing table, profession, specialty indicating qualifications; specific type of work entrusted to the employee), the employee’s subordination to internal labor regulations while the employer provides working conditions provided for by labor legislation and other regulatory legal acts containing labor law norms, a collective agreement, agreements, local regulations, and an employment contract. The parties to the labor relationship are the employee and the employer. An employee is an individual who has entered into an employment relationship with an employer. An employer is an individual or legal entity (organization) that has entered into an employment relationship with an employee. Chapter 43 of the Code establishes the specifics of regulating the labor of the head of an organization and members of the collegial executive body of organizations. At the same time, Part 2 of Article 273 of the Code directly defines cases when the actions of the said chapter do not apply to the relations arising between the manager and the management organization. In particular, the Code does not regulate these relations if the head of the organization is the only participant (founder), member of the organization, owner of its property. This norm is based on the impossibility of concluding an agreement with oneself, since the organization has no other participants (members, founders). The signing of an employment contract by the same person on behalf of the employee and the employer is not provided for by labor legislation. The sole participant of the company, by his decision, assumes the functions of the sole executive body - director, general director, president, etc. In this case, management activities are carried out without concluding any contract, including an employment contract. Labor legislation does not apply to the relations of the sole participant of the company with the company founded by him. Thus, the norms of labor legislation on wages, working hours, leave, maintaining a work record book, collective agreement and others do not apply to the head of the organization, who is the only participant (founder), member of the organization, owner of its property. In this case, one should be guided by the norms of the Federal Law of February 8, 1998 N 14-FZ “On Limited Liability Companies”, constituent documents. Considering that information on labor activity is generated for all registered persons with whom labor (service) relationships have been concluded or terminated, information on labor activity in relation to the only participants (founders) carrying out activities without concluding employment contracts is not submitted to the Pension information system Foundation of the Russian Federation.

Director of the Department of Remuneration, Labor Relations and Social Partnership M.S. MASLOVA

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Letter of the Ministry of Finance of the Russian Federation dated April 12, 2018 N 03-03-06/1/24220 Question: About accounting for income tax purposes of depreciable property...

- Letter of the Ministry of Finance of the Russian Federation dated January 30, 2012 N 03-03-06/1/40 ...

- Appeal ruling of the Omsk Regional Court dated May 30, 2019 in case No. 33-3120/2019 OMSK REGIONAL COURT APPEAL DECIDING dated May 30, 2020...

- Letter of the Ministry of Finance of the Russian Federation dated 06.06.2019 N 03-03-06/2/41359 ...

Letter from Rostrud of Russia dated September 16, 2012 No. PR/7156-6-1

Question: In accordance with Articles 2, 5 and 7 of the Law of May 2, 2006 No. 59-FZ “On the procedure for considering appeals from citizens of the Russian Federation,” please clarify the following question.

An individual entrepreneur hires employees under an employment agreement (contract). Accordingly, within the framework and on the terms of the concluded employment contract, they are accrued and paid a salary. According to written statements from some employees, part of their salary is not given to them, but is transferred to third parties. In particular, banks – for repayment of bank loans, insurance organizations – for medical insurance. Transfers are made in the amounts and according to the details that employees indicated in their applications.

According to a number of experts, any deductions from wages are possible only in the manner and under the conditions provided for by the Labor Code of the Russian Federation (for example, according to writs of execution, compensation for material damage, etc.). At the same time, the Labor Code of the Russian Federation does not provide for the possibility of deducting any amounts from employees’ salaries, even upon their written statements.

Are such deductions legal?

Is labor legislation violated if certain amounts are withheld from employees’ salaries based on their written applications and in the amounts indicated in these applications? 08.11.2012

Answer:

FEDERAL SERVICE FOR LABOR AND EMPLOYMENT

LETTER

dated September 16, 2012 No. PR/7156-6-1

The Legal Department of the Federal Service for Labor and Employment reviewed the request. We report the following.

The employer has the right to make monthly deductions from the employee’s salary only in the cases listed in Article 137 of the Labor Code of the Russian Federation (hereinafter referred to as the Code).

No other additional deductions from wages are allowed at the discretion of the employer.

According to Article 138 of the Code, the total amount of all deductions for each payment of wages cannot exceed 20 percent, and in cases provided for by federal laws, 50 percent of wages due to the employee.

These articles deal with deductions from wages, which are made regardless of the will of the employee in order to repay the employee’s debt to the employer or other persons.

In the situation set out in the request, we are not talking about withholding, but about the employee’s will to dispose of accrued wages.

From our point of view, an employee can dispose of his wages at his own discretion, including by repaying a loan, by submitting a corresponding application to the employer’s accounting department. However, the provisions of Article 138 of the Code do not apply in this case.

Head of Legal Department A.V. Anokhin

Post: