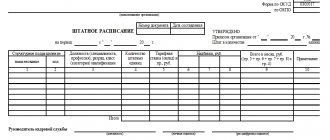

Staffing composition

The schedule lists:

- structural divisions of the company;

- positions - for knowledge workers, managers, specialists;

- professions - for manual workers, workers;

- number of staff units;

- salaries or tariff rates;

- the amount of incentive bonuses or bonuses, if any.

If the profession or position is without benefits and harmful working conditions, the employer can name the staffing unit himself, otherwise he will have to take the names from classifiers and regulations (OKPDTR, OKZ, ETKS).

The schedule does not list employees who hold positions or work in a specific profession. Freelance employees on GPC contracts also have no relation to the staffing table.

Enter the site

RSS Print

Category : Labor legislation Replies : 11

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev.1 Next → Last (2) »

| Legran |

| Please help me figure it out. Employee A (head of the sales department) went on maternity leave until she reached the age of 3 years. The employer wants to transfer employee B to the position of head of the sales department and conclude a contract with him (this is not a temporary transfer). It is planned to create a sales department, i.e. Employee A will return from maternity leave and will be transferred to the head of the sales department (with her consent). Question: does the employer have the right to do this? And how is this reflected in the staffing table? It turns out that there are 2 units of the head of the sales department in the staffing table. How to format this correctly? |

| I want to draw the moderator's attention to this message because: Notification is being sent... |

| Sergey [email protected] Belarus, Grodno Wrote 16546 messages Write a private message Reputation: 1771 | #2[361030] May 10, 2012, 4:11 pm |

Notification is being sent...

Pereat mundus et fiat justitia.| Legran [email hidden] Belarus, Brest Wrote 60 messages Write a private message Reputation: | #3[361044] May 10, 2012, 16:38 |

Notification is being sent...

| Sergey [email protected] Belarus, Grodno Wrote 16546 messages Write a private message Reputation: 1771 | #4[361046] May 10, 2012, 16:47 |

Notification is being sent...

Pereat mundus et fiat justitia.| Legran [email hidden] Belarus, Brest Wrote 60 messages Write a private message Reputation: | #5[361048] May 10, 2012, 5:08 pm |

Notification is being sent...

| Big_Repa" [email hidden] Belarus, Soligorsk Wrote 27803 messages Write a private message Reputation: 2222 | #6[361050] May 10, 2012, 5:23 pm |

Notification is being sent...

Silence is gold. And all the evil comes from him. Sex is also a form of movement.| Legran [email hidden] Belarus, Brest Wrote 60 messages Write a private message Reputation: | #7[361094] May 11, 2012, 9:03 |

Notification is being sent...

| Big_Repa" [email hidden] Belarus, Soligorsk Wrote 27803 messages Write a private message Reputation: 2222 | #8[361107] May 11, 2012, 9:56 am |

Notification is being sent...

Silence is gold. And all the evil comes from him. Sex is also a form of movement.| krolichek [email hidden] Belarus, Minsk Wrote 23 messages Write a private message Reputation: | #9[361125] May 11, 2012, 11:08 |

Notification is being sent...

| Big_Repa" [email hidden] Belarus, Soligorsk Wrote 27803 messages Write a private message Reputation: 2222 | #10[361137] May 11, 2012, 11:26 |

Notification is being sent...

Silence is gold. And all the evil comes from him. Sex is also a form of movement.« First ← Prev.1 Next → Last (2) »

In order to reply to this topic, you must log in or register.

Rules for filling out the staffing table

Enter the name of the company according to the constituent documents into Form T-3. Take the OKPO code for the form from the State Statistics Service information letter.

If you are creating a schedule for the first time, assign document No. 1, number subsequent schedules in order. Enter the current date. The day the schedule is created and the date it runs from may vary. In the “For period” line, enter the operating period of the schedule and the date it was entered.

Enter the details of the order that approves the staffing table into the approval stamp of the document. Below indicate the number of staff, departments, positions and salary. There are several columns for this:

- 1 “Name of structural unit”;

- 2 “Code” - use an order that will help you see the subordination in the organization and its structure;

- 3 “Position...” - indicate positions and professions in the nominative case, without abbreviation;

- 4 “Number of staff units” - indicate the number of full and part-time units;

- 5 “Tariff rate” - enter the salary amount, percentages or coefficients;

- 6, 7 and 8 “Bonuses” - fill out in accordance with the company’s system of remuneration and motivation;

- 9 “Total per month” - fill in if allowances and salary are stated in rubles;

- Column 10 is reserved for references to local regulations and other information related to staffing.

Maintain personnel, tax and accounting records in the online service Kontur.Accounting. Salary, reporting via the Internet, integration with banks, simple work with documents and support from specialists. For the first two weeks, all newcomers work in the service for free.

How is it regulated?

At the same time, at the moment, the organizational structure of the staffing table has not been officially approved anywhere. Until 2013, the T-3 form was mandatory, approved by Decree of the State Statistics Committee No. 1 of 01/05/2004.

However, with the entry into force of the Federal Law “On Accounting”, enterprises are given the right to independently develop forms of primary documentation, unless they are specifically approved by the authorized body. There was no such approval regarding the staffing table - and therefore in organizations the form for it can be approved separately.

However, the T-3 form is still widely used. It is convenient for record keeping, contains all the necessary information, and personnel officers with experience have long been able to fill it out correctly. Therefore, in the future, it makes sense to first consider using this form.

Bad request

Info

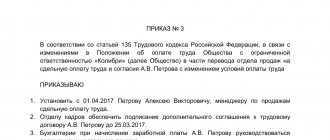

Thus, each company has the right to establish its own procedure for changing the staffing table, namely:

- frequency of adjustments (annually, quarterly, monthly);

- procedure for registering changes (order, addition in the form of attachments, publication of a new staffing table);

- mechanism for approving adjustments (the procedure for signing the amended document and the list of persons (positions) responsible for the development and approval of the document).

The mechanism for making changes to the staffing table used in a particular organization should be recorded in internal regulatory documents (for example, the Procedure for maintaining internal document flow).

Does the district coefficient apply to the combination surcharge?

November 8, 2013

Having considered the issue, we came to the following conclusion: When an employee performs additional work in order to combine professions (positions), the regional coefficient is applied to wages calculated taking into account the additional payment for the combination.

Rationale for the conclusion: Based on Art. Art. 315, 316 of the Labor Code of the Russian Federation, wages in the regions of the Far North and equivalent areas are carried out using regional coefficients to wages. From the above standards it follows that the regional coefficient is applied to the amount of wages. Wages in accordance with part one of Art. 129 of the Labor Code of the Russian Federation recognizes remuneration for labor depending on the qualifications of the employee, the complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions) conditions and in territories exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments). The need to calculate the regional coefficient on actual monthly earnings is also confirmed by the Ministry of Health and Social Development of Russia (letter dated February 16, 2009 N 169-13). In the case under consideration, the employee is paid additionally for additional work performed by the employee in order to combine professions (positions) (Article 60.2, Article 151 of the Labor Code of the Russian Federation). From Art. 149 of the Labor Code of the Russian Federation it follows that additional payment for combining positions is one of the types of payments for performing work in conditions deviating from normal ones. In other words, the specified additional payment for combining positions is a compensation payment accrued to the employee as part of his salary (Article 129 of the Labor Code of the Russian Federation). Accordingly, when combining positions, the employee is paid not two wages, but only one wage, which includes an additional payment for performing such additional work. Thus, when an employee performs additional work in order to combine professions (positions), the regional coefficient is applied to wages calculated taking into account the additional payment for combining them.

Answer prepared by: Expert of the Legal Consulting Service GARANT Chashina Tatyana

Response quality control: Reviewer of the Legal Consulting Service GARANT Kudryashov Maxim

Related posts:

- Calculation of insurance premiums for 2020 women on maternity leave. Is it necessary to include women on maternity leave in a single calculation of insurance premiums? Quote (Order of the Federal Tax Service of Russia dated 10.10.2016...

- Regional coefficient for the minimum wage Is the regional coefficient for the minimum wage calculated in 2020? Wages and minimum wages: legal basisDistrict…

- Deflator coefficient The Ministry of Economic Development, by order of November 3, 2016 No. 698, established deflator coefficients for 2020: the deflator coefficient required for the purposes of...

- Regional coefficient for vacation pay For certain regions where life is more expensive, so-called regional coefficients are provided that increase ...

Vote:

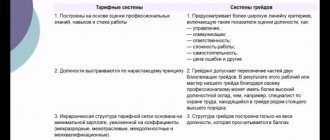

They violate both the norms of the current legislation and the rules for forming job titles in accordance with subordination. The following principles should be followed:

- The first is the correspondence of the name of the category to the staff hierarchy, which can be chosen arbitrarily, but taking into account the subordination.

- The second is the correspondence of the job title to the duties performed.

- The third is the application of the law.

Thus, the Decree of the Government of the Russian Federation No. 225 in paragraph 6 of the Instructions for filling out labor books states that the labor book is filled out only in the state language, which is Russian on the territory of the Russian Federation. Decree of the Government of the Russian Federation of April 16, 2003 N 225 Accordingly, it is prohibited to enter the names of positions in English and other languages.

Everything you need to know about staffing in 2020

Generally speaking, compiling documentation of this kind is the function and sacred duty of a labor economist from the department of organization and remuneration (Qualification reference book for positions of managers, specialists and other employees, Resolution of the Ministry of Labor of Russia No. 37 of 08/21/1998). This specialist must know how to develop a staffing schedule. However, in fact, the staffing table is prepared by accountants, personnel officers and lawyers, who have to figure out how to calculate the number of rates in the staffing table. The head of the company and the chief accountant are officially responsible for the document, since they sign it.

We recommend reading: Veterans In Samara From April 1, 2020

Who should draw up and maintain the staffing schedule and how?

The staffing table helps justify the dismissal of employees due to staff reduction when considering a case in court. Without this document, it is difficult for the employer to prove that the dismissal is justified. It will also be impossible to prove that at the time of dismissal there were no vacancies in the organization that could be offered to laid-off employees (the employer is obliged to offer other jobs during layoffs under Article 179 of the Labor Code of the Russian Federation; for this they must be in the staffing table).

Why was it necessary to introduce regional coefficients at all? Russia, as a state, has a very vast territory. Citizens of our country living in different regions sometimes find themselves in very different conditions. In some areas, for climatic reasons, the cost of living is much higher, while working and living conditions are much more complex and involve additional stress on people’s health. It would be unfair to evaluate labor equally given such differences in the original “rules of the game.” We need a certain state mechanism that would relatively equalize the rights of all workers of the Russian Federation. Its role in labor law is intended to be fulfilled by the district coefficient (RK).

Regional coefficient in the staffing table: to include or not to include

According to Resolution of the Ministry of Labor of the Russian Federation No. 3 of September 11, 1995, the employer is obliged to take into account any types of bonuses accrued on actual earnings (including for length of service), which include, among other things, regional coefficients.

Often, personnel specialists have a question about whether the regional coefficient is indicated in the staffing table. Such a question by default has no right to exist, since the answer to it was initially included in the standard form of staffing (form T-3, approved by Resolution of the State Statistics Committee of Russia No. 1 of 01/05/2004), recommended for use in all organizations.

The standardized form of the ShR (staffing table) has a dedicated section “Allowances”, represented by columns 6 – 8, in which the employer must indicate the type and amount of allowances provided for a specific position, accrued on the employee’s salary.

Employment contract with regional coefficient - sample

Read more about the regional coefficient here: According to Article 148 of the Labor Code of the Russian Federation, remuneration for work in areas with special climatic conditions is made in the manner and amounts not lower than those established by labor legislation and other regulatory legal acts containing labor law norms.

The legislation of the Russian Federation does not define a list of areas with special climatic conditions.

The employee bears full responsibility to the shareholders of the Company for the consequences of decisions made by him (or the employees of the Company subordinate to him), the safety and effective use of the Company’s property, as well as for the financial and economic results of the Company’s activities. 2.2. Responsibilities of the Employee Employee: 1.

This list was compiled on the basis of the letter of the Ministry of Health and Social Development of Russia dated February 16, 2009 No. 169-13, paragraph 1 of the explanations of the Ministry of Labor of Russia dated September 11, 1995 No. 3 “On the procedure for calculating percentage bonuses to wages for persons working in the regions of the Far North and equivalent areas, in the southern regions of Eastern Siberia, the Far East, and coefficients (regional, for work in high mountain areas, for work in desert and waterless areas)” approved by Resolution of the Ministry of Labor of Russia dated September 11, 1995 No. 49.

How to indicate the salary of “northerners” Since the regional coefficient is applied not only to the tariff rate, but also to other payments - components of the employee’s salary, the indication in the employment contract (hiring order) of a salary already increased by the regional coefficient will not correspond to the real one the procedure for calculating wages. Let's figure out which salary entry will be correct.

The issue of wages is always very relevant. Especially when it comes to mandatory requirements by law. Is it necessary to include an indication of the size of the regional coefficient and percentage bonus in the employment contract if the employee is hired to work in the Far North or equivalent areas?

And if necessary, how to register it? The main list of conditions that must be reflected in the employment contract is defined in Art. 57 Labor Code of the Russian Federation. Among those specified in Art. 57 of the Labor Code of the Russian Federation, the mandatory conditions are “the terms of remuneration (including the size of the tariff rate or salary (official salary) of the employee, additional payments, allowances and incentive payments)." Taking into account these requirements, the employment contract must necessarily indicate all types of payments that are established for the employee.

Employment contract Resolution of the Ministry of Labor of Russia dated July 23, 1998 No. 29 approved an approximate form of an employment contract with an employee who will work in the North. In accordance with Article 423 of the Labor Code, this normative act is applied to the extent that does not contradict the Labor Code of the Russian Federation. In paragraph 4.

1 of the sample form of the employment contract expressly stipulates that the official salary (tariff rate) is indicated separately from the size of the regional coefficient that is applied to the employee’s salary. It doesn’t matter whether you use a sample form of an employment contract or develop your own sample.

Info

For shift workers working in the Far North and equivalent areas, the length of service includes:

- actual time (calendar days) of the shift in the regions of the Far North and areas equivalent to them;

- actual days of travel (provided for by the shift work schedule) from the gathering place (location of the organization organizing the work) to the place of work and back.

Such rules are established in Article 302 of the Labor Code of the Russian Federation. Accrual of bonuses Accrue bonuses from the date the employee becomes entitled to it. For part-time employees working in the organization, accrue percentage bonuses for length of service in the Far North regions in the same way as other employees (Part.

3 tbsp. 285 Labor Code of the Russian Federation). Calculate the bonus on the employee’s actual earnings (clause 1 of the clarification approved by Resolution of the Ministry of Labor of Russia dated September 11, 1995 No. 49).

Experience for the bonus Percentage bonuses depend not only on the region and age of the employee, but also on his work experience in a given region (Article 317 of the Labor Code of the Russian Federation). The length of service giving the right to receive bonuses is determined in calendar days of work in the relevant region on an accrual basis. In case of breaks in work, the length of service is maintained regardless of the timing of such breaks (clause

1 of the Decree of the Government of the Russian Federation of October 7, 1993 No. 1012). The duration of continuous work experience to receive a percentage increase is determined by the work book or by certificates issued by organizations (clause 33 of the Instructions approved by order of the Ministry of Labor of the RSFSR dated November 22, 1990 No. 2, clause 28 of the Instructions approved by order of the Ministry of Labor of the RSFSR dated November 22, 1990 . No. 3).

If you hire an employee to work in the Far North or equivalent area, in the text of the employment contract with him you must: - be sure to separately indicate the “net” tariff rate (salary); - it is advisable to indicate the specific size of the regional coefficient established for the area where the employee will actually work, or to make a reference to the normative act by which this regional coefficient is established.

Both options are acceptable. A sample of salary entries in an employment contract is given below. Sample Sample of entries in an employment contract on wages in the regions of the Far North Order for employment The unified form of order for employment (forms No. T-1 and T-1a), approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1, provides for the indication “ pure" size of the tariff rate (salary) without including any allowances.

The calculation of these payments does not depend on the location of the organization itself. For example, an organization located in Moscow and which has entered into an employment contract with a home worker from Murmansk (a region of the Far North) is obliged to provide such an employee with all the allowances established by law for work in the northern regions.

How and on what basis is the regional coefficient indicated in the “staff”

Despite the fact that the regional coefficient is provided for by federal regulations, its calculation to employees must be duplicated and provided for by internal regulatory documents (regulations on wages, collective agreement). It is on the basis of these documents that the employer calculates the coefficient for staff salaries.

In the “staff”, the regional coefficient is indicated in one of the columns of the “Allowances” section (columns 6 to 8). Its size is stated in percentage and ruble equivalent to earnings and is calculated taking into account all allowances established for this position.

How to indicate a department in the staffing table: sample

Not every organization has separate structural divisions. Especially if we are talking about a small business. When filling out the first and second columns, you must adhere to the following rules:

- If the company has separate divisions, indicate their names in the staffing table. Enter the names as they are defined in the documents on the creation of the unit. These can be departments, workshops, sites, branches, representative offices, etc. (clause 16 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2 “On the application by courts of the Labor Code of the Russian Federation”),

- The organization assigns codes to departments independently. The code may consist of numbers, letters and other symbols; this is not regulated by law,

- If the organization does not have divisions, you can choose one of the options:

- Place dashes in the appropriate columns,

- Develop your own staffing form without the “Division” column.

Step-by-step instructions for compiling

An act is drawn up according to the following steps:

- Enter the name of the organization. This item must be completed in accordance with the constituent documentation. If you have an abbreviated and full name, you have the right to choose any one.

- The date of acceptance and number are indicated. If the schedule does not come into force on the day it is drawn up, then the start date is indicated.

- The names of structural divisions are entered. Regarding state-owned enterprises, standards must be observed.

- Department codes are prescribed, depending on the hierarchy established in the company.

For organization

- Data is entered in the column regarding positions. The data in the column must match the employment contract and book.

- The number of staff units is indicated. You need to enter the number of workers that the organization requires, and not those that are employed.

- Information regarding tariff rates is entered. Specifying a value less than the minimum wage is not acceptable. The person filling out cannot indicate a monetary period, for example, from 5 to 7 thousand rubles. The amount must be fixed.

- The columns where the allowances are indicated are filled in. It is acceptable to indicate in percentage or rubles. This is influenced by legal norms, operating modes, and characteristics of the enterprise.

- The amount of the total salary is indicated. You need to enter the amount of salary and benefits.

- If available, indicate notes.

- Enter information regarding the necessary costs for the activities of the enterprise.