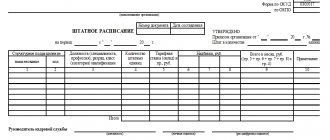

What kind of document is this, and what information should be included in it?

This document is drawn up as soon as the work of the enterprise begins.

The staffing table includes the following items:

- Name of production, institution or organization.

- The number of employees.

- Positions of employees of the entire department.

- Amount of payments for labor activity.

- Additional payments to employees.

- Monthly salary payment asset.

When filling out your schedule, freelancers should not be counted. According to Art. 11 of the Labor Code of the Russian Federation, labor laws do not apply to them (the rule applies to everyone working under civil contracts).

Attention! When hiring a new employee, it is worth indicating the position he occupies in the staffing table. A worker whose position is not valid according to the staffing table must not be allowed to work.

It is worth paying attention to the remuneration system when drawing up the staffing table. If there is a periodic salary in the document, it is required to indicate the salary in a specially designated column (No. 5). If the payment system is one-time or does not have tariffs, then a dash must be placed in this section. The results of the work performed are entered in a separate column (No. 10) “Note”.

When carrying out work performed in a certain season, information about this must be included in the staffing table. Also, when increasing the number of units of certain positions, it is worth noting the period for which they are included (according to Article 15, 57 of the Labor Code of the Russian Federation).

How to set piecework-bonus wages?

As stated in Part 2 of Art. 135 of the Labor Code, wage and bonus systems are established by a collective agreement, local regulations (for example, regulations on piecework wages, regulations on bonuses).

To regulate the rules of remuneration, internal documents are published that form the principles and describe the remuneration system established at the enterprise. Such internal regulations must comply with the norms of labor legislation and the collective agreement adopted at the enterprise (if there is one).

In addition, the terms of remuneration are significant and must be described in the employment contract with each employee (Article 57 of the Labor Code). This means that when signing an employment contract, the established conditions of the piecework-bonus payment system must be agreed upon and the parameters that affect the increase/decrease of wages depending on the quantity of products produced, its quality characteristics, resource savings, etc. must be indicated.

If the enterprise uses a piecework-bonus system, to calculate workers' wages it is necessary to sum up the piecework portion of earnings with the bonus. In this case, bonus additional payments are established, as a rule, for the quality indicators of the employee’s work. For example, for reducing the percentage of defects, increasing production standards or saving resources.

Official form T3 - staffing table. It displays the basic salary and additional payments. The organization has the right to use its own document form or ready-made T3.

Filling it out is the responsibility of the HR department employee. In a small organization, this function is assigned to an accountant or manager.

The document is used to approve the structure, staffing, and its number in accordance with the Charter of the enterprise.

The manager or his authorized person establishes the staffing table. The paper contains information:

- Existing positions in the organization.

- Amount of workers.

- Monthly wage fund.

- Amount of salaries and allowances.

- Structural divisions, their list.

When an employee's vacancy is entered into the schedule, it is registered without reduction. Entries are made in descending order, starting with the main position.

Changes to the document are possible in the following cases:

- Change of department of the enterprise or job title.

- Salary change.

- Reorganization of the company.

- Staff reduction.

- Employees affected by the changes must familiarize themselves with them and confirm this with their signature on the document.

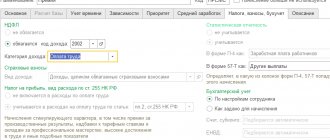

Restrictions when specifying wages

In the Labor Code of the Russian Federation there is a separate chapter on wages (Chapter 21). When displaying wages in the staffing table, there are the following restrictions:

- The salary amount is necessarily determined in accordance with the qualifications of the specialist and his position.

- The document must contain specific payment amounts and payment method. Referring to an employment agreement instead of specifying a clear salary amount is a violation of labor laws.

- In the staffing table, payment for work done by an employee must be indicated in rubles.

- The employer does not have the right to pay wages below the minimum established in accordance with the law of the Russian Federation.

- Payment for work of equal value should be the same. Those. if employees occupy the same positions, they are entitled to receive the same salary. Another question is if the responsibilities and scope of work of these officials are different. In this case, it is better to give different names to professions, or assign a specific rank.

- If there are any changes regarding payment, the employee must be notified in writing.

Important! If the employee does not agree with the employer’s conditions, the employment contract may be terminated in accordance with the legally established procedure.

Order to change wages, sample

In this section we offer you a sample order to change the payment of wages to employees:

This order does not have a set form. The employer can arrange it in any form.

The document should indicate:

- Full name and position of the employee affected by the changes;

- type of payment system;

- the number from which his salary will be calculated;

- the basis for innovation is the agreement to the employment contract.

Piece calculation

If earnings are piecework, then the amount of such payment will depend on the quality and result of the work. It follows from this that it is unacceptable to include a salary or piece rate payment in the staffing table. How to reflect piecework wages in the staffing table is shown in the example. In column No. 5 you need to put a dash, and in column No. 10 indicate that this payment is piecework and indicate its size. Also worth noting:

- what conditions does payment depend on;

- what is the price of the volume of work performed;

- whether there are additional payments or not;

- How often does the calculation occur?

Example: At the Parus LLC enterprise you can receive piecework wages. For one completed part, an employee can receive 20 rubles. If he makes 100 such parts in a month of work, he will be paid 2,000 rubles. Payment is made twice a month.

How to indicate piecework wages in an employment order

I would like to inform you that on February 19, 2020, from 6 to 14, there was downtime in the assembly shop due to a power outage.

The employee is granted an additional annual paid leave of [value] calendar days [indicate the basis for providing additional leave].

Let's take a closer look at how labor can be produced using summarized accounting of working time. Remuneration for summed-up accounting of working hours Remuneration for employees is made on the basis of hourly and (or) monthly tariff rates (salaries) determined in a collective agreement, agreement or by the employer (Art.

For family reasons and other valid reasons, the Employee, upon his written application, may be granted leave without pay, the duration of which is determined by agreement between the Employee and the Employer.

Let's take a closer look at how labor can be produced using summarized accounting of working time. Remuneration for summed-up accounting of working hours Remuneration for employees is made on the basis of hourly and (or) monthly tariff rates (salaries) determined in a collective agreement, agreement or by the employer (Art.

For example, the foreman of a construction team receives a percentage of the work done. How many cubes of masonry the masons lay in a month is how much the foreman will earn, as a percentage.

Salary

A fixed salary is a salary for performing work duties of varying degrees of complexity per month, not taking into account additional payments (according to Article 129 of the Labor Code of the Russian Federation).

In the fifth column of the staffing table, the amount of the monthly payment in rubles is entered. Salary depends on the payment system adopted at the enterprise in accordance with the law of the Russian Federation.

Reference! If the employee does not work full time, in column number 9 indicate the amount that sets a fixed amount, taking into account working hours.

Example: At the trading enterprise Argo LLC, an employee works at 0.5 rate. When registering a fixed payment amount in the staffing table, in column No. 4 you should indicate the number 0.5, and in column No. 5 income - 30,000 rubles. Then column No. 9 will display the amount that the employee will receive in the amount of 15,000 (30,000 rubles multiplied by 0.5). Accordingly, payment must be made according to the above calculation.

Additional payments

Additional payments that are adopted by the law of the Russian Federation or introduced at the request of the organization are entered into the schedule in columns No. 6, No. 7 and No. 8 (“Additional allowances”). If there is a different payment system at the enterprise, columns No. 5-No. 9 are filled out in accordance with the units of measurement.

Example: At the trading enterprise Argo LLC, the salary of a salesperson is 8,000 rubles when working one shift. After the employment contract was drawn up, the seller began working two shifts. For this he is entitled to a double bonus. In column No. 5 the seller’s main income is entered (8,000 rubles), and in columns No. 6-No. 8 there will be a figure of 16,000 rubles.

How to calculate and reflect the total amount?

To calculate the total amount of wages, the following documents are needed: a work agreement or an agreement between the employer and employee, a decree on hiring. These papers must contain: start date of work, salary, amount of additional payments.

You can calculate the payment amount as follows:

- First you need to calculate your salary before tax is deducted from it. This can be done by dividing income by the number of days worked, and then multiplying by the number of days worked.

- Tax must be subtracted from the resulting amount (in the Russian Federation, labor tax for 2020 is 13%).

- The end result is the total amount of salary that the employee will receive in person or on a bank card.

It is more difficult to calculate the amount of payment when the employee received additional money (bonuses, allowances, etc.). To do this, you need to add additional funds received to your basic income. Then do everything the same as in the first case.

Attention! A simpler way would be to calculate wages using special programs - calculators.

Example: An employee of the company Kristall LLC worked 15 days out of the prescribed 20 in December. His due payment is 6,000 rubles. Income for time worked is 4,500 rubles (6,000/20*15). Labor tax from salary will be 585 rubles (4500 * 13%). Accordingly, 4500 – 585 = 3915 rubles. The employee will receive this amount per month.

When calculating the total payment amount, a special form is filled out, which includes several items. It should contain the following information:

- Full name of the employee;

- payments from the beginning of the year;

- due revenue;

- days worked;

- income for working;

- accrued salary;

- deductions;

- personal income tax;

- the total amount intended to be paid to the employee.

Read more about how to reflect salary in the staffing table here.

How to specify wage conditions for piece workers in the TD and acceptance order?

The article will discuss the types and forms of primary documents on personnel records and wages, as well as the periods of their storage.

The simplest and most common option is a salary. Salary + bonus is also a very common type. Piecework payment is a little more rare, but it is also used quite actively in our country.

At the same time, employees must be familiarized with the specified local regulatory act against signature (part two of Article 22 of the Labor Code of the Russian Federation).

When registering a personnel order, you can check whether it corresponds to the current staffing schedule. Nevertheless, you can register an order, even if it does not currently correspond to the schedule. Any discrepancies that arise can be analyzed using the “Staffing Compliance” report.

In addition, if the employee will perform hard work or work under harmful or dangerous working conditions, indicate the appropriate compensation with a description of the working conditions at the workplace. Such rules are established by paragraphs and part 2 of Article 57 of the Labor Code of the Russian Federation. From the answer "" 3.

In practice, most organizations, when issuing an employment order, continue to use the unified forms T-1 (for registration of one employee) and T-1a (for registration of several employees) unchanged, since they are convenient and universal.

How to make adjustments when changing?

There are two ways to make salary changes to the staffing table:

- If there are significant changes in payments, the staffing table must also be completely changed. The new document is submitted for approval.

- Issue a decree “On making changes to the staffing table” or “On partial changes to the staffing table.” This method is suitable if the adjustments affected only part of the staff or individual employees.

The staffing table is one of the most important documents in an institution, enterprise or organization. It contains all the information regarding employees and their salaries.

Such documentation is compiled for the purpose of analyzing the personnel structure, as well as for drawing up reports that confirm the expenditure of funds to pay for labor activities during a tax or labor audit. This document can also help to justify reductions in production due to a reduction in staff (Letter of Rostrud dated January 21, 2014 No. PG/13229-6-1).