Payslip: concept and requirements for its preparation

A payslip is a document that is drawn up by the employer to inform the worker about the accruals that are due to him. The obligation to draw up payment sheets follows from the provisions of Art. 136 of the Labor Code of the Russian Federation, according to which the employer is obliged to inform workers in writing on a monthly basis:

p, blockquote 2,0,1,0,0 –>

- information about the composition of salaries;

- information about other payments;

- information about withheld funds, in particular, tax deductions;

- information about the amount that will be paid to the employee for the pay period.

Important! The law does not contain mandatory requirements for the content of the payslip and the procedure for its execution. Each employer has the right to independently develop a form for this document and approve it by local act.

Based on the interpretation of the requirements of Art. 136 of the Labor Code of the Russian Federation, set out above, the following information must be reflected in the payslip:

p, blockquote 4,0,0,0,0 –>

- about funds accrued to the worker;

- about retained funds;

- about the amount to be paid.

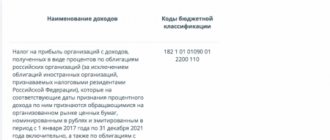

Types of codes that are used when filling out the 3-NDFL certificate

When filling out the 3-NDFL certificate, other income codes are used. They are enshrined in Appendix No. 4 to the Order of the Federal Tax Service of Russia dated December 24, 2014 N ММВ-7-11/ [email protected] 10 codes are used:

p, blockquote 10,0,0,0,0 –>

| Code | Type of income |

| 01 | Income received from the sale of real estate |

| 02 | Income received as a result of alienation of other property |

| 03 | Income received from the sale of securities |

| 04 | Profit from the transfer of property for rent |

| 05 | Income received free of charge, based on donation |

| 06 | Income from employment, if taxes were paid by the employer |

| 07 | Income from employment if tax was not paid by the employer |

| 08 | Dividend income |

| 09 | Sale of property at cadastral value |

| 10 | Other income |

p, blockquote 11,0,0,0,1 –>

Thanks to the above decoding, you can determine the composition of the amounts of money received from the employer, as well as correctly fill out the declaration in Form 3-NDFL.

https://youtu.be/y7hubjGaty4

Period from 1991 to 1995

For codes 530 a), b), 531 a), b) column 13. The cost of vouchers for sanatorium treatment of employees, summer holidays for children (the cost of vouchers to children's health camps) is not subject to income tax for individuals in cases where personalized confirmation is provided documents. 45. To code 531 e) columns 7, 8, 9 and 17.

Payment of additional (personal) contributions to the non-state pension fund “Blagosostoyanie” under agreements concluded by a division of JSC Russian Railways is accepted for the purpose of calculating income tax in cases where the specified payment is specified in the employee’s employment contract and subject to personalized accounting.

In the absence of personification and terms of payment under the specified agreement in the employment contract, these expenses are not taken into account in income tax expenses and are not subject to the unified social tax. In accordance with subparagraph 5 of paragraph 1 of Article 9 of the Law of July 24, 2009 No. 212-FZ additional (personal) contributions to the non-state pension fund “Blagosostoyanie” under agreements concluded by a division of JSC Russian Railways, from 01/01/2010.

are not subject to insurance premiums. 46. To code 505, columns 7, 8, 9. According to Article 7 of the Law of July 24, 2009 No. 212-FZ, the object of taxation with insurance contributions is payments and other remuneration accrued by organizations in favor of individuals under employment contracts and civil law contracts , the subject of which is the performance of work, the provision of services.

https://youtu.be/MbaA6lce8lA

Payroll sheet

Two friends meet:

-What are you working for?

- Get a big salary!

People work, first of all, to provide for their personal material needs and the well-being of their family. In Russia, the law stipulates that entrepreneurs and the state must pay wages to employees twice a month in the form of an advance and wages.

An employee can check the accuracy of salary calculations by looking at his payroll sheet. The employer is required to present this document with each payment of money earned by the employee. As a rule, such a sheet is prepared by the accounting department once a month. It must be generated in paper form, regardless of whether the company pays wages in non-cash form (by transfer to card accounts) or workers receive money at the cash desk. The procedure for issuing pay slips is determined by the organization independently, but failure to issue them can lead to penalties in the amount of one to five thousand rubles (the fine is imposed on the manager) or from thirty to fifty thousand rubles (for a legal entity). There is no standard form of pay slip. Each business entity develops it independently. However, there are certain requirements that must be met. The main thing is that the information on the sheet should be understandable.

What is the code in the payment slip when transferring salaries?

Consequently, it can be assumed that both the issuance of wages in cash and the transfer of it to the account of a non-resident are equivalent from the point of view of its legality and are determined only by the agreement reached on this issue by the employee and the employer.

If the employee wrote, the employer must transfer the money by bank transfer. When registering a payment order for salary transfer, in the “Purpose of payment” field before the text part, you must indicate the currency transaction code in curly brackets.

This means that from June 1, the bank formally has the right to refuse payment due to any error in the document (). The error can be corrected only if there is an internal instruction of the bank that allows you to request clarification from the client.

For late payment due to inaccuracies in the payment slip, counterparties will have to pay a penalty or legal interest, and the Federal Tax Service - a penalty. Because of this, you need to fill out not one personal income tax payment slip, but several. For example, on salary, vacation pay and sick leave. In a letter dated July 12, 2016 No. ZN-4-1/, the Federal Tax Service recalled that starting from 2020, new deadlines for paying personal income tax are in effect.

Namely, separate payment deadlines have now been established for personal income tax on wages, vacation pay and sick pay. Note: Look. Everything must be done the same as before!!!!!: “When issuing a payment order for transferring personal income tax to the budget from income in the form of an employee's salary, in detail 107 it is necessary to indicate the month and year for which the tax is transferred.

That is, which are not related to the budgetary system of the Russian Federation. Also see “.” How can an error in the checkpoint in a payment order result?

It is important to note that fields 102 and 103 of this document are filled out in strict compliance with the registration reason code assigned to the sender and recipient of the money.

Other information in these fields that does not reflect reality indicates erroneous data in the payment.

14 of the Procedure approved on December 18, 2013 No. 125n). Thus, the answer to the question about the mandatory checkpoint in the payment becomes clear.

The sender must indicate it if: transfers funds to the budget system (writes his reason code in field 103 of this payment order)

A mandatory attachment to the payment order for the transfer of salary amounts is a register indicating the payments due to each employee of the company.

: If the payment is drawn up for the transfer of an amount due to one employee, then it is filled out a little differently:

- the purpose of the payment is specific - in this field indicate the employee’s full name, a note about the nature of the payment (for example, “payment of wages for June 2020 to Alexander Mikhailovich Rebrov), his personal account number and amount;

- in the “Recipient's account” field indicate the employee’s account number at the bank institution.

- in the payee column reflect the full name of the employee;

An example of filling out a payment order to a Sberbank card when transferring money to an individual employee: You can transfer not only your salary to your employee’s card, but also all payments that he receives while performing his job duties.

Field 6 – amount in words.

There should be no other characters in this field.

The number must match the words in field 6, otherwise the payment will not be accepted. Field 8 – payer. Legal entities must indicate the abbreviated name and address, individuals - full name and registration address, those engaged in private practice, in addition to this data, the type of activity, individual entrepreneur - full name, legal status and address must be noted in brackets.

We suggest you read: Does the bank transfer salaries on Saturday?

The name (title) is separated from the address by the // symbol. Field 9 – account number. This refers to the payer's account number (20-digit combination).

Field 10 – payer bank. Full or abbreviated name of the bank and the city of its location.

226 of the Tax Code of the Russian Federation, enterprises paying income to individuals are required to calculate, withhold and transfer to the budget the amount of personal income tax in accordance with Art.

224 Tax Code of the Russian Federation. The tax agent must transfer the calculated and withheld personal income tax amounts no later than the day of actual receipt of cash from the bank or transfer of wages to plastic cards. If income is received in kind, then tax is paid to the budget no later than the day following the day of actual deduction of personal income tax.

The total amount of tax is paid at the place of registration of the tax agent with the tax authority.

Pay slips - how to issue them correctly

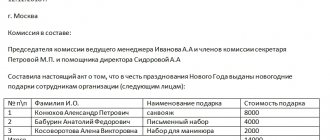

The purpose of the payslip (can be lower) is to explain information about the composition of wages and other accruals. The document is generated separately for each employee. The frequency of preparation is once a month for final payment; when issuing advances/vacation pay, there is no need to issue pay slips. The form is developed by the employer independently, taking into account the regulatory requirements of Art. 372 TK. The following data must be reflected:

- About the components of wages for the billing period, including salaries, bonuses, coefficients, bonuses, etc.

- About other accruals, including vacation pay, sick leave benefits, monetary compensation for delays in payment of earnings, payments upon dismissal, etc.

- About the deductions made - alimony, personal income tax, loan payments, advances, excessively withheld amounts, etc.

- About the total amounts to be issued “in hand”.

The responsible person of the employer must not only correctly reflect the transcript of the payroll slip, but also correctly issue the document to the employee, with mandatory confirmation of the fact of delivery. Experienced personnel officers advise keeping records in a special journal of pay slips or providing a tear-off part with a line for the individual to sign directly on the form itself.

Salary slip - decoding of indicators

When compiling payslips, it is necessary to separately reflect all amounts of accruals and deductions, and, if desired, encode the data. Combining payments for different purposes is not permitted. The legislation of the Russian Federation does not establish regulatory requirements for income codes. The company has the right to independently approve the coding. Then, instead of specific payments (salary, vacation pay, alimony, etc.), the pay slip form will contain only code numbers.

Note! If coding is used, all values must be notified to plant personnel. At the same time, for convenience, you are allowed to develop your own data or use codes from 2-NDFL certificates according to Order No. ММВ-7-11 / [email protected] dated 09/10/15. For example, individual income indicators are presented below.

Salary codes in the payslip:

- 2000 – salary for performing work duties.

- 1010 – income in the form of dividends.

- 2001 – remuneration paid to directors, members of the management body, board of directors, etc.

- 2012 – vacation payments.

- 2300 – amount of hospital benefits.

- 2010 – amounts paid for work under GPC contracts. except royalties.

- 2530 – earnings in kind.

- 2201-2209 – amounts of royalties.

- 2610 – the amount of material benefits from the use of loans received from the employer.

- 2720 – monetary value of gifts received.

Online magazine for accountants

Night time is considered to be the time from 22:00 to 6:00.

Overtime work is paid for the first two hours of work at time and a half, for subsequent hours - at double rate.

· piece workers – at double piece rates;

· employees whose work is paid at daily and hourly tariff rates - in the amount of double or hourly tariff rates;

· employees receiving a salary - in the amount of a single daily and hourly rate (part of the salary for a day or hour of work) in addition to the salary, if work on a day off or a non-working holiday was carried out within the monthly standard of working time, and in the amount of a double daily or hourly rate above the salary if the work was performed in excess of the monthly working hours.

· carried out along the route of railway rolling stock;

We suggest you read: An invalid marriage is really invalid

· has a traveling character;

· associated with individual trips within the areas they serve.

Expenses for employees with a mobile nature of work are also reimbursed.

During periods of particularly difficult meteorological conditions (frost, snowstorms, drifts and others) for work performed outdoors, piece rates or tariff rates (official salaries) for workers, specialists and employees may be increased by 10 percent.

Specific meteorological conditions, types of work and the list of employees for whom the provisions of this paragraph apply are determined by the head of the branch of JSC Russian Railways.

For employees of structural divisions of railways, structural divisions of branches of JSC Russian Railways that have problems with staffing, the head of the branch within the limits of the branch's wage fund may establish zonal allowances for special working conditions (higher pay zones). Zonal allowances are established for a certain period or the current calendar year, taking into account the volume of work performed and the level of tension in the formation of personnel (staffing shortages).

Regional compensation bonuses are established in order to regulate the wages of employees of JSC Russian Railways, taking into account the specifics of regional labor markets.

To determine the size of the allowances, indicators from the analysis of economic activity of the regions for the past calendar year are used.

· subsistence level of the working population of the region;

· average monthly wage in the region's industry;

· level of staff turnover in the divisions of JSC Russian Railways located in the region.

· the ratio of the average level of wages in the divisions of JSC Russian Railways located in the region to the level of wages in the industry of the region.

· the maximum allowable amount of the bonus cannot exceed 40% of the employee’s tariff rate (official salary).

· the bonus is paid monthly to employees of JSC Russian Railways whose permanent place of work is those regions for which such a bonus has been established by JSC Russian Railways.

Incentive payments.

In order to stimulate and improve professional skills for workers who consistently provide high quality work (manufactured products), who have mastered work in related operations and professions, bonuses for professional skills can be established, differentiated by qualification categories: III category - up to 20 percent, IV category - up to 16 percent, V category - up to 20 percent, VI category and higher categories - up to 24 percent of the corresponding tariff rate.

Employees of certain professions and positions of branches and structural divisions of JSC Russian Railways may be assigned class ranks and paid bonuses.

· 15 percent of the official salary – to doctors of sciences;

· 10 percent of the official salary – to candidates of sciences.

Managers, specialists and employees of branches of JSC Russian Railways may be given bonuses for a high level of qualifications, high achievements in work, and performance of particularly important work.

The bonus for performing particularly important work is established for the duration of specific work, but in all cases not more than for a calendar year.

Regional regulation is carried out in accordance with Articles 315, 316 and 317 of the Labor Code of the Russian Federation in the regions of the Far North and equivalent areas, as well as in areas where, in accordance with the legislation of the Russian Federation, regional coefficients for wages are established, wages are paid using percentage bonuses and regional coefficients in the manner and amounts established by the Government of the Russian Federation.

For codes 530 c), 531 c) columns 7, 8, 9, 17. In cases where the costs of travel to the place of work and back by public transport are provided for in employment contracts and upon provision of personalized supporting documents, these costs are accepted for the purpose of calculating income tax and are subject to insurance contributions (unified social tax until 01/01/2010).

How to decipher and understand a salary sheet?

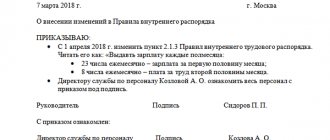

The labor law states that the form of the payslip is approved by the employer, taking into account the opinion of the representative body of employees, for example, using an order. May be issued in paper or electronic form - .

To keep track of issued documents, you can keep a register of pay slips or an accounting sheet.

Therefore, each organization may have its own form.

However, the salary sheet must contain the following sections:

- Accrued. All amounts accrued for the month are indicated here: salary, bonus, allowances, night time pay, additional payment for length of service, benefits, vacation pay, etc.

- Held. Information about deductions is reflected: personal income tax, writs of execution, orders for damages, etc.

- Paid or intersettlement payments. Typically, the advance payment is displayed here. But there may be other payments. For example, the payment of sick leave benefits was made before the payday, or the employer paid vacation pay.

- To be paid or in debt. The amount in this column is added up according to the formula: accrued - withheld - paid. If it turns out with a minus, then debt is indicated. This can happen if, for example, the advance payment for some reason turns out to be more than the accrued salary.

Art. 136 of the Labor Code of the Russian Federation obliges the employer to notify staff about accrued wages and withheld amounts.

For this purpose, employees receive payslips every month before payment of wages.

Not everyone can understand it and understand the numbers, codes, and ciphers contained in this document.

Therefore, we will look at each position of this document in detail.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 938-43-28 – Moscow – CALL

+7 – St. Petersburg – CALL

+7 – Other regions – CALL

It's fast and free!

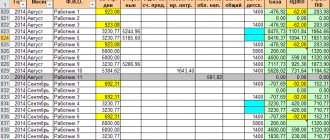

Codes by type of remuneration in the working time sheet

> > December 28, 2020 The code for the type of remuneration in the time sheet reflects information about what a particular amount was accrued for.

The main reason for using codes instead of standard letters is the need to automate calculation processes.

Special columns are provided for entering codes in unified timesheet forms. Find out what codes to use in your time sheet from our material. A time sheet is a supporting document on the basis of which employees’ salaries are calculated. A Russian organization has the right to independently develop a form for recording the working hours of its personnel or use forms approved by the State Statistics Committee in the form T-12 or T-13.

The timesheet records the daily amount of time worked by each employee, as well as the total number of hours of attendance (absenteeism) by type of paid labor.

Each type of labor corresponds to a specific code. Codes for types of remuneration in the T-12 form sheet are filled out only if the organization maintains the second part of the specified form.

Here, to reflect information about wages, a whole section is highlighted, which is called “Calculation with personnel for wages”. It indicates the type of remuneration not only in coded form, but also its name, for example salary (name) 2000 (code). In the form of the T-13 working time sheet, columns 7, 8 and 9 are intended to reflect information on the calculation of wages, which are duplicated twice in this form.

The code can be entered in two ways:

- In the case when there are different types of accrual in the timesheet, the code is entered in the corresponding cell, in column 7, opposite each employee.

- If the type and corresponding account for payroll is the same for all employees indicated in the timesheet, then the code is placed in the line “wage code”, which is located at the top and covers all columns from 7 to 9.

Up to 8 such codes can be used for one employee in this form of time sheet. List of wage codes that must be used

How to decipher and understand a salary sheet?

The labor law states that the form of the payslip is approved by the employer, taking into account the opinion of the representative body of employees, for example, using an order. It can be issued in paper or electronic form - read more about the procedure for issuing a sheet.

Therefore, each organization may have its own form.

However, the salary sheet must contain the following sections:

- Accrued. All amounts accrued for the month are indicated here: salary, bonus, allowances, night time pay, additional payment for length of service, benefits, vacation pay, etc.

- Held. Information about deductions is reflected: personal income tax, writs of execution, orders for damages, etc.

- Paid or intersettlement payments. Typically, the advance payment is displayed here. But there may be other payments. For example, the payment of sick leave benefits was made before the payday, or the employer paid vacation pay.

- To be paid or in debt. The amount in this column is added up according to the formula: accrued - withheld - paid. If it turns out with a minus, then debt is indicated. This can happen if, for example, the advance payment for some reason turns out to be more than the accrued salary.

Pay slip for June 2019

Personnel number 30672

Division Sales Department

| Total taxable income: 174,000 |

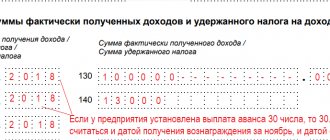

Salaries are paid to staff from the 1st to the 15th of the month following the reporting period. The item “debt owed by the enterprise at the beginning of the month” remains from the previous billing period (in the example, May).

In this example, wages for May are paid in June, which is reflected in the “transferred to the card” item.

The June salary will be paid in July; accordingly, this operation will be displayed on the payslip for July.

The amount from the column “payable for June” - 15230 will be reflected in the July payslip as “debt owed by the enterprise at the beginning of the month” and after its actual payment will appear in the paid column.

According to Art. 236 of the Labor Code of the Russian Federation, the employer is obliged, in case of untimely payment of wages, to immediately pay compensation for the delay. Then another item “compensation for delayed wages” will appear in the accrued column.

What is total taxable income?

The total taxable income on the payslip is the amount accrued to the employee from the beginning of the year, which is subject to personal income tax - 13%.

Not all employee income is subject to income tax.

Art. 217 of the Tax Code of the Russian Federation establishes restrictions in this regard.

Intersettlement payments

The concept of interpayments is not always used in payslips. These are advances or accruals that are issued in the period between the completion of main payments.

For example, this could be an advance or vacation payments. They are issued precisely during the inter-payment period.

Such payments can be made in one of the following ways:

- through the bank, transfer register;

- through the cash register, cash order or payroll.

How to deal with deductions for children?

Citizens with minor children or full-time students have the right to count on standard tax deductions for children.

They reduce the tax base.

To understand this benefit, you need to know what types of deductions are provided for by the Tax Code of the Russian Federation.

Deductions for children are provided in the following amounts:

- for one child – 1400 rubles;

- for the second offspring – 1400 rubles;

- for the third and subsequent children 3,000 rubles;

- for disabled children, parents - 12,000 rubles;

- foster parents for disabled children – 6,000 rubles.

Deductions for children are provided monthly until the total income exceeds 350 thousand rubles.

With the new year, the countdown begins anew. The required benefit amounts are reflected in the line “deduction for children” on the sheet.

For example, if an employee has 1 child and wrote an application to the accounting department for a benefit, the amount of 1400 will appear in this column on his payslip. This should be understood as the amount by which taxable income will be reduced.

Employees may also have the right to other types of deductions: social or property. Then a separate position on the payslip will indicate the amount of the benefit and its name.

Codes and ciphers

Organizations quite often use income codes on payslips; to decipher them, you need to know which ones are provided.

Basic codes to be reflected in the salary slip:

- 2000 – salary;

- 2012 – vacation pay;

- 2013 – compensation for unused vacation;

- 2014 – severance pay;

- 2300 – payment of sick leave;

- 2762 – payments in the form of financial assistance at birth, adoption, etc.

How should vacation pay be reported?

If the employee went on vacation, then a separate position in the accruals “vacation pay by calendar days” will appear on the payslip; it is reflected with the code “2012”.

No later than three days before going on vacation, the employer must pay vacation pay (Article 136 of the Labor Code).

When paid, the amount of accrued vacation pay minus personal income tax will appear in the “paid” column.

If there is a writ of execution, then the employee will receive even less money.

Example

The employee was accrued vacation pay for 28 days of 45,000 rubles.

According to the writ of execution, 20% is withheld from him monthly.

The amount will appear in the “paid” column: 45,000 - (45,000 - 45,000 * 13%) * 20% = 31,320 rubles.

In other words, from the accrued vacation pay, the accountant will first deduct personal income tax, then 20% according to the writ of execution, and give the difference to the employee.

How to read the line “total withheld”?

This section reflects all deductions from the employee's salary by law.

These could be the following positions:

- Tax on personal income. It is calculated as 13% of the accrued amount, minus the deduction (if any).

- Deductions according to executive documents. The maximum amount of such deductions cannot be more than 50%. In exceptional cases 70%.

- Deductions at the request of the employee. For example, voluntary transfers to a pension fund.

- Deductions based on orders for the enterprise: compensation for damage, accountable amounts, membership fees, etc.

All listed items, if they are present on the payslip, are deducted from the accrued salary and are reflected in total in the “total withheld” line.

Decoding salary codes

Content

Home » For an accountant » Payroll codes in 2020 Return to Payroll 2020 The wage type code in the time sheet reflects information about what a particular amount was charged for.

Special columns are provided for entering codes in unified timesheet forms. Find out what codes to use in your time sheet from our material. A time sheet is a supporting document on the basis of which employees’ salaries are calculated.

A Russian organization has the right to independently develop a form for recording the working hours of its personnel or use forms approved by the State Statistics Committee in the form T-12 or T-13. The timesheet records the daily amount of time worked by each employee, as well as the total number of hours of attendance (absenteeism) by type of paid labor.

Each type of labor corresponds to a specific code. Codes for types of remuneration in the T-12 form sheet are filled out only if the organization maintains the second part of the specified form. Here, to reflect information about wages, a whole section is highlighted, which is called “Calculation with personnel for wages”.

It indicates the type of remuneration not only in coded form, but also its name, for example salary (name) 2000 (code). In the form of the T-13 working time sheet, columns 7, 8 and 9 are intended to reflect information on the calculation of wages, which are duplicated twice in this form.

The code can be entered in two ways: • If the type and corresponding account for payroll is the same for all employees indicated in the timesheet, then the code is placed in the line “wage code”, which is located at the top and covers all columns from 7 to 9. • In the case when there are different types of accrual in the timesheet, the code is entered in the corresponding cell, in column 7, opposite each employee.

Up to 8 such codes can be used for one employee in this form of time sheet.