Pension Fund insurance premiums

Since 2020, the BCC for insurance premiums has become smaller. The point is that the BCC for fines and penalties on insurance premiums for additional tariffs has been changed. Now these BCCs do not depend on the special assessment (Order of the Ministry of Finance dated 06/08/2018 No. 132n). Here is a table with the changes.

| Payment Description | KBK 2018 | KBK 2019 |

| Penalty | ||

| Additional pension contributions according to tariff 1, if the tariff does not depend on the special assessment | 182 1 0210 160 | 182 1 0210 160 |

| Additional pension contributions according to tariff 1, if the tariff depends on a special assessment | 182 1 0200 160 | 182 1 0210 160 |

| Additional pension contributions according to tariff 2, if the tariff does not depend on the special assessment | 182 1 0210 160 | 182 1 0210 160 |

| Additional pension contributions at tariff 2, if the tariff depends on a special assessment | 182 1 0200 160 | 182 1 0210 160 |

| Fines | ||

| Additional pension contributions according to tariff 1, if the tariff does not depend on the special assessment | 182 1 0210 160 | 182 1 0210 160 |

| Additional pension contributions according to tariff 1, if the tariff depends on a special assessment | 182 1 0200 160 | 182 1 0210 160 |

| Additional pension contributions according to tariff 2, if the tariff does not depend on the special assessment | 182 1 0210 160 | 182 1 0210 160 |

| Additional pension contributions at tariff 2, if the tariff depends on a special assessment | 182 1 0200 160 | 182 1 0210 160 |

Main BCCs for taxes and contributions in 2019: list, explanation

The most used in 2020 are KBK, necessary for modern Russian individual entrepreneurs and business entities dealing with payment:

- Personal income tax for hired employees (KBK 18210102010011000110);

- income tax (regional KBK - 18210101012021000110, federal - 18210101011011000110);

For details, see the material “KBK when paying income tax in 2018-2019.”

See also “KBK for insurance premiums for 2018-2019 - table”.

What are the deadlines for paying personal income tax for employees in 2019?

As a general rule, personal income tax is paid no later than the day following the date of transfer of wages to employees. For example, the accountant closed the salary for January 2020 on January 31, 2019. The funds were paid to employees on 02/05/2019, which means that personal income tax must be withheld on 02/05/2019 and transferred to the budget before 02/06/2019.

When it comes to calculating vacation pay or various types of benefits (for temporary disability, caring for a sick child), different rules apply. The tax must be transferred to the budget system of the Russian Federation before the end (last day) of the month in which accrual and payment for vacation or sick leave were made.

Please note that you can use a special online calculator to calculate the income tax.

As a general rule, personal income tax must be paid in 2020 no later than the day following the day the employee (individual) was paid income. So, let’s say the employer paid the salary for January 2020 on February 8, 2020. The date of receipt of income will be January 31, 2020, the tax withholding date will be February 8, 2020.

Benefits and vacation pay

Personal income tax withheld from temporary disability benefits, benefits for caring for a sick child, as well as from vacation pay must be transferred no later than the last day of the month in which the income was paid. For example, an employee goes on vacation from March 6 to March 23, 2019. Vacation pay was paid to him on March 1.

In general, pay the withheld personal income tax in 2020 to the details of the Federal Tax Service with which the organization is registered (paragraph 1, clause 7, article 226 of the Tax Code of the Russian Federation). Individual entrepreneurs, in turn, pay personal income tax to the inspectorate at their place of residence. However, individual entrepreneurs conducting business on UTII or the patent taxation system transfer tax to the inspectorate at the place of registration in connection with the conduct of such activities.

After the budget receives personal income tax transferred by tax agents, these funds are distributed between the budget of the constituent entity of the Russian Federation and the budgets of municipalities (settlements, municipal districts, urban districts) according to the standards established by budget legislation.

Contributions of individual entrepreneurs to the FFOMS in 2020 (decoding KBK 18210202103081011160, 18210202103081013160)

When transferring fixed contributions to themselves intended for the FFOMS in 2020, entrepreneurs also need to use 2 BCC values depending on the period for which the payment is made. If the payment relates to periods before 01/01/2017, you need to use KBK 18210202103081011160, and if for periods after 01/01/2017, then KBK 18210202103081013160.

Penalties and fines will also be paid accordingly. For periods before 2020, you need to use for them, respectively, KBK 18210202103082011160 and 18210202103083011160. And when paying for periods from 01/01/2017, KBK 18210202103082013160 and 18210202103083 will be used 013160.

In 2020, individual entrepreneurs and legal entities with employees must still make contributions for them intended for the Federal Compulsory Compulsory Medical Insurance Fund. However, due to a change in the fee administrator, you will have to use a different BCC, choosing from its 2 values the corresponding to the period for which the payment is made.

When paying contributions for periods before 01/01/2017, KBK 18210202101081011160 is used, and when paying for periods after 01/01/2017, KBK 18210202101081013160 should be used.

Similarly, you also need to pay penalties and fines: for the period before 01/01/2017 - according to KBK 18210202101082011160 and 18210202101083011160, respectively, and for periods after 01/01/2017 - according to KBK 18210202101082013160 and 1821 0202101083013160.

SAMPLE PAYMENT ORDER FOR NDFL IN 2019

Below we provide a sample payment order for the transfer of personal income tax in 2020. The budget classification code for personal income tax is indicated in field 104 of the payment order. With this payment, the tax agent transfers personal income tax from employee salaries.

Let's look at how to correctly fill out a payment order for the transfer of income tax. Payment orders for the payment of fees and insurance premiums are drawn up in accordance with the rules approved by Appendix No. 2 to Order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013. In order for the payment to be generated correctly, you need to pay attention to the following aspects:

- in field 101 “Payer status” you need to indicate the value 02 - tax agent;

- in field 104 - KBK (for personal income tax in 2020 - 182 1 0100 110);

- OKTMO is entered in cell 105 (the correct value for a specific institution can be found on the official website of the Federal Tax Service);

- field 107 indicates the tax period for which payment is made;

- the basis for the payment, which determines its purpose, is entered in field 106.

It is also mandatory to register the details of the parties - TIN, KPP of the payer (fields 60, 102) and TIN, KPP of the recipient (cells 61, 103).

You can find out more about the rules for filling out a payment order in this material.

Kbk 182 1 0100 110 – penalties for non-payment of tax

Some companies that are faced with the fact that income taxes not paid on time resulted in fines and penalties are, of course, upset. And in order to pay off the debt, they now need to pay penalties using KBK 182 1 0100 110.

Income tax payers know very well what the KBK codes mean. Constantly filling out payment orders when paying various contributions, taxes, duties, the taxpayer has to fill out payment orders, and it is there in field 104 that the BCC must be indicated.

Why do you need to indicate the BCC?

KBK is a special classifier developed by the Ministry of Finance, together with the Central Bank of Russia. A certain system of numbers that allows you to organize the flow of funds into the state treasury. Budget funds are spent in the same way.

https://youtu.be/s4m3Z-uW-xA

When the BCC is filled out in the payment slip, the treasury employee, based on these numbers, sends the funds to their destination. For example, all funds that were paid by a company for a certain type of tax can be divided into several groups:

- Income tax.

- Penalty on income tax,

- Income tax penalty.

Each of these groups has its own BCC, which is indicated by the payer in the payment document. For example, to find out what tax is in 2020 for KBK 18210101012022100110, you can use the following hint:

| Code | Purpose |

| 182 1 0100 110 | Income tax. |

| 182 1 0100 110 | Penalty on tax. |

| 182 1 0100 110 | Tax penalty. |

| 182 1 0100 110 | Interest. |

In addition to indicating the code in payment orders, BCC is indicated in reporting documents such as income tax returns, transport tax returns, and insurance premium reporting.

As you can see, KBK is an important classification code, and can even be considered a kind of organization account. By specifying the correct code, you can be sure that the amount will be sent to the regulatory authority, and the payer will be charged the penalty that was accrued.

Where is income tax paid?

Companies that are engaged in business or private entrepreneurs that do not use the simplified tax system or unified tax system pay income tax. They pay it into two budgets, and each has its own BCC. If you decipher KBK 182 1 0100110, it is relevant in 2020, you can find out where the amounts of money transferred by taxpayers go.

As is already known, the first three digits in this set of code refer to the government agency. And what set of numbers indicates which budget (federal or regional) the transfer goes to? In a twenty-digit code, these are the numbers (two) 12 and 13 in order. They are 01-Federal and 02-Regional. In our case, payments are made to the regional budget.

By deciphering KBK 18210101012022100110, you can understand what tax taxpayers will have to pay in 2017. If your company has received a notice to pay the specified BCC, then you can immediately say that this is a penalty for income tax. This means that the company either did not pay the tax on time, or an error was made when filling out the payment form and the money was not received on time.

When filling out a payment slip, you must check the KBK, since legislators often change not only laws, but also classification codes. For example, from 2020, all payments made for insurance contributions to the Pension Fund of the Russian Federation will be controlled by the FSS by the tax inspectorate, and the BCC will change accordingly.

When making payments for contributions, taxes, duties, the accountant must check the codes, otherwise the money will not be credited to the regulatory authority. Late payment of income tax will be fraught with consequences for the organization. This imposes not only a certain liability, but also fines, which will then need to be paid.

Source: https://saldovka.com/nalogi-yur-lits/kodi-kbk/18210101012022100110.html

Fixed payments for individual entrepreneurs “for themselves”

https://www.youtube.com/watch?v=b8oAsN9sc8w

If the tax agent made a mistake when transferring personal income tax, the payment can be clarified if three conditions are met:

- no more than three years have passed since the date of payment;

- clarification does not lead to the formation of arrears;

- despite the error, the money entered the budget system.

If the payment has not been received by the budget, then the payment cannot be clarified, and the tax agent’s obligation to transfer personal income tax is considered unfulfilled (for example, if the money has not been received by the budget system due to an error in the Federal Treasury account number). In this case, the tax agent must:

- transfer personal income tax again, filling out the payment order correctly;

- contact the inspectorate for a refund of incorrectly paid tax.

If the payment has been received to the budget, then there is no need to return the money and pay the tax again. You can clarify any details of the payment order, in particular:

- Federal Treasury account (field 17);

- Payer's TIN (field 60);

- Payer checkpoint (field 102);

- recipient's TIN (field 61);

- Recipient's checkpoint (field 103);

- “payer” detail (field 8);

- “recipient” detail (field 16);

- basis for payment (field 106);

- payer status (field 101);

- tax period indicator (field 107); KBK (field 104).

KBC for payment of penalties and VAT fines in 2019

According to Art. 75 of the Tax Code of the Russian Federation, a penalty is accrued and paid by the taxpayer if he is late in paying the tax. In this case, the organization can either calculate the penalty on its own or receive a request from the tax authority.

A tax fine is a sanction for offenses (Article 114 of the Tax Code of the Russian Federation), one of which is non-payment or incomplete payment of tax (Article 122 of the Tax Code of the Russian Federation).

Below are the BCCs for paying penalties and VAT fines in 2020. They remained the same as the previous year.

| Type of tax | VAT penalties | VAT fines |

| Value added tax on goods (work, services) sold in Russia | 182 1 0300 110 | 182 1 0300 110 |

| Value added tax on goods imported into Russia (from Belarus and Kazakhstan) | 182 1 0400 110 | 182 1 0400 110 |

| Value added tax on goods imported into Russia (payment administrator - Federal Customs Service of Russia) | 153 1 0400 110 | 153 1 0400 110 |

If the taxpayer made a mistake in indicating the KBK, Art. 78 and 79 of the Tax Code of the Russian Federation give the right either to return the amounts paid, or to offset them with other taxes if there is arrears on them. Also in paragraph 7 of Art. 45 of the Tax Code of the Russian Federation gives the opportunity to clarify the payment if an error was made in the BCC, but the money was received into the account of the Federal Treasury.

In 2020, the amount of penalties must be calculated according to new rules (they are in effect from 10/01/2017).

Find out more from the material “How to correctly calculate VAT penalties?”.

Having trouble calculating penalties? Use our auxiliary service “Fine Calculator”.

KBK NDFL 2020: what is important to know

We bring to your attention the current BCCs for paying personal income tax for employees and in other situations for legal entities and individual entrepreneurs. All codes are presented in convenient tables. Also see a sample of filling out a payment order for personal income tax payment.

in numbers 1 - 3 the code of the income administrator is encrypted (182 - tax service);

4 - 13 numbers contain the code of the type of income: group (100) and subgroup (101);

numbers 14 - 17 show the code of the income subtype;

numbers 18 - 20 contain the code for the classifier of operations of the general government sector (in terms of taxes, code 101).

KBK table for personal income tax on employee salaries in 2020

| Tax name | KBK |

| Personal income tax on income received from a tax agent: (salary, vacation dividends, etc.), except for those listed in Art. 227, 227.1 and Art. 228 Tax Code of the Russian Federation | |

| Tax | 182 1 0100 110 |

| Penalty | 182 1 0100 110 |

| Fine | 182 1 0100 110 |

| Personal income tax on income received by individual entrepreneurs, private notaries, and other persons engaged in private practice (Article 227 of the Tax Code of the Russian Federation) | |

| Tax | 182 1 0100 110 |

| Penalty | 182 1 0100 110 |

| Fine | 182 1 0100 110 |

| Personal income tax in accordance with Art. 228 Tax Code of the Russian Federation (certain types of income) | |

| Tax | 182 1 0100 110 |

| Penalty | 182 1 0100 110 |

| Fine | 182 1 0100 110 |

| Personal income tax on the income of non-residents employed by citizens on the basis of a patent (Article 227.1 of the Tax Code of the Russian Federation) | |

| Tax | 182 1 0100 110 |

| Penalty | 182 1 0100 110 |

| Fine | 182 1 0100 110 |

Firms and individual entrepreneurs are required to pay personal income tax for employees. It was their legislation that endowed them with the functions of a tax agent. The 2020 personal income tax for employees given in the KBK table should be applied when transferring payroll taxes, sick leave benefits, vacation pay, dividends, etc.

| Type of payment | Used KBK |

| Salary, sick leave, vacation pay, dividends, etc. | 182 1 0100 110 |

Individuals using the budget classification code 182 1 01 02030 01 1000 110 when paying personal income tax

If an individual just has to transfer income tax on his income, he submits a 3-NDFL declaration to the Federal Tax Service, which calculates the amount of personal income tax payable. In this case, in section 1 of the declaration, as well as in the payment document for the transfer of tax, KBK 182 1 0100 110 is indicated.

The list of income for the taxation of which an individual independently calculates and pays income tax is given in Art. 228 Tax Code of the Russian Federation. According to this norm, budget classification code 182 1 0100 110 is used by individuals who have received the following types of income:

- remuneration under employment contracts and civil partnership agreements (including hiring and rent) not from tax agents,

- income from the sale of property by its owners,

- income of a resident of the Russian Federation from a foreign source (except for persons performing military service abroad),

- income for which the tax agent did not withhold personal income tax, except for those about which the agent reported (with a 2-NDFL certificate with sign “2”) to the Federal Tax Service and the individual himself that they cannot be withheld during the tax period,

- winnings up to 15,000 rubles in the lottery, gambling conducted at a betting shop or in a bookmaker's office, as well as all winnings in other gambling games,

- remunerations received by the heirs and legal successors of the authors of works of literature, art, science, inventions, industrial designs,

- the cost of gifts from other individuals who are not relatives (except for real estate, stocks, shares, shares and means of transport),

- income in the form of the cash equivalent of real estate or securities transferred to a non-profit organization to replenish the target capital.

Such individuals pay penalties and fines using separate cash registers:

- 182 1 0100 110 – code for penalties,

- 182 1 0100 110 – code for fines.

KBK for simplified tax system in 2020

In simplified terms, BCCs depend on the applied object of taxation. Simplified people with a “income-expenditure” object should carefully consider the choice of the KBK when paying the minimum tax: since 2020, a single code has been used for both paying the single tax and the minimum one. If the minimum tax is paid for periods earlier than 2020, a separate BCC is used for it.

| KBK | Decoding |

| KBK simplified tax system 6% 2020 (“income”) | |

| 182 1 0500 110 | Single tax under the simplified tax system “income” |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| KBK simplified tax system “income minus expenses” 2020 | |

| 182 1 0500 110 | Single tax under the simplified tax system “income minus expenses” (incl., simplifiers transfer the minimum tax to this KBK simplified tax system in 2019) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Minimum tax under the simplified tax system (only for tax periods expired before January 1, 2020) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

Changes in the BCC for 2017-2018 - table with explanation

KBK for 2017-2018 (grouped in tables) will help you quickly select the current code for processing payment orders for the transfer of tax obligations to the budget. In our article we will also talk about changes to the BCC for 2017-2018.

How did the BCC change in 2017-2018 and were there any changes to the BCC for taxes?

Kbk in 2017-2018: table of insurance premiums

New BCCs for additional tariffs on insurance premiums from 04/23/2018

Budget classification codes for taxes for 2017-2018

Results

How did the BCC change in 2017-2018 and were there any changes to the BCC for taxes?

If you want to send a letter to someone by Russian Post, you must indicate the address of the destination and recipient. The budget classification code plays the role of the address for payment to the budget or declaration.

The payer indicates the BCC in 2017-2018 in the payment order, and the treasury sends the money to the budget of the appropriate level for a specific item and sub-item of income.

The same is with reporting: the KBK 2017-2018 contains information both about the tax itself and about the taxpayer.

IMPORTANT! In 2017-2018, KBC is used not only by legal entities and businessmen. Ordinary citizens also use them, paying, for example, property taxes based on notifications received from the tax office.

KBK codes 2017-2018 with decoding are given in the order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n. This is a voluminous document, which, in addition to the BCCs themselves for the current year, contains a classification of budget revenues and expenses. Changes to this document are made quite often, however, changes to the BCC (including changes to the BCC for 2017-2018) usually come into force from the beginning of the next year.

https://youtu.be/PAbbtYQWFSo

As for the BCC applied in 2017-2018, the most significant updates to them occurred in 2020 (KBK-2017) and were associated with the transfer of insurance premiums (except for contributions for injuries) under the control of the tax service. That is, the recipient of these funds was the budget, and not an extra-budgetary fund. Accordingly, changes were required in the main BCCs for such payments.

In addition, due to the presence of transitional type payments (accrued according to the old rules, but paid according to the new ones), new BCC-2017 were additionally introduced. The changes in the KBK-2017 codes regarding insurance premiums thus turned out to be double.

There are no fundamental updates in the BCK 2017-2018 regarding taxes and fees.

We draw your attention to the following:

- The only innovation of the KBK-2017 regarding taxes is the abolition of a separate KBK for paying the minimum tax under the simplified tax system. Since 2020, this payment is made to the KBK of the regular simplified tax system.

- New codes have been introduced since 2020:

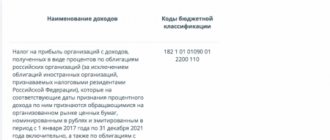

- for income tax on income received in the form of interest on bonds of Russian organizations in rubles issued during the period from January 1, 2020 to December 31, 2021 (Order of the Ministry of Finance dated June 9, 2017 No. 87n):

| Tax | 182 1 0100 110 |

| Penalty | 182 1 0100 110 |

| Fine | 182 1 0100 110 |

- for the transfer of excise taxes (order of the Ministry of Finance of Russia dated 06.06.2017 No. 84n):

| Excise taxes on electronic nicotine delivery systems produced in the Russian Federation | 182 1 0300 110 |

| Excise taxes on nicotine-containing liquids produced in the Russian Federation | 182 1 0300 110 |

| Excise taxes on tobacco (tobacco products) intended for consumption by heating, produced on the territory of the Russian Federation | 182 1 0300 110 |

- Since 2020, a new KBK has been introduced for paying the resort fee (the fee can be introduced from 05/01/2018 in certain territories in the Crimea, Krasnodar, Stavropol and Altai territories) - KBK 000 1 1500 140.

You will find the decoding of the KBK in the material “Deciphering the KBK in 2017-2018 - 18210102010011000110 and others.”

Kbk in 2017-2018: table of insurance premiums

Our KBK table in 2017-2018 reflects information regarding insurance premium codes that are most in demand among payers.

KBK for insurance premiums for employees

| Payment type | KBK | ||

| Contributions accrued for periods before 2020, paid after 01/01/2017 | Contributions for 2017-2018 | ||

| Contributions to compulsory pension insurance | contributions | 182 1 0200 160 | 182 1 0210 160 |

| penalties | 182 1 0200 160 | 182 1 0210 160 | |

| fine | 182 1 0200 160 | 182 1 0210 160 | |

| Contributions to compulsory social insurance | contributions | 182 1 0200 160 | 182 1 0210 160 |

| penalties | 182 1 0200 160 | 182 1 0210 160 | |

| fine | 182 1 0200 160 | 182 1 0210 160 | |

| Contributions for compulsory health insurance | contributions | 182 1 0211 160 | 182 1 0213 160 |

| penalties | 182 1 0211 160 | 182 1 0213 160 | |

| fine | 182 1 0211 160 | 182 1 0213 160 | |

| Contributions for injuries | contributions | 393 1 0200 160 | |

| penalties | 393 1 0200 160 | ||

| fine | 393 1 0200 160 |

KBK for insurance premiums of individual entrepreneurs

| Payment type | KBK | ||

| Contributions accrued for periods before 2020, paid after 01/01/2017 | Contributions for 2017-2018 | ||

| Fixed contributions to the Pension Fund | contributions | 182 1 0200 160 | 182 1 0210 160 |

| Contributions to the Pension Fund of the Russian Federation 1% on income over 300,000 rubles. | contributions | 182 1 0200 160 | 182 1 0210 160 |

| penalties | 182 1 0200 160 | 182 1 0210 160 | |

| fine | 182 1 0200 160 | 182 1 0210 160 | |

| Contributions for compulsory health insurance | contributions | 182 1 0211 160 | 182 1 0213 160 |

| penalties | 182 1 0211 160 | 182 1 0213 160 | |

| fine | 182 1 0211 160 | 182 1 0213 160 |

For current forms of reporting on insurance premiums, read the material “New reporting on insurance premiums in 2017-2018 - form”.

New BCCs for additional tariffs on insurance premiums from 04/23/2018

Source: https://nalog-nalog.ru/uplata_nalogov/izmeneniya_v_kbk_-_tablica_s_rasshifrovkoj/

KBK NDFL 2020 for legal entities on fines

| Type of payment | Used KBK |

| Fines of the employer company | 182 1 0100 110 |

| Individual entrepreneur fines | 182 1 0100 110 |

| Individual fines | 182 1 0100 110 |

| Personal income tax payer | KBC when paying penalties | KBC upon payment of a fine |

| Tax agent | 182 1 0100 110 | 182 1 0100 110 |

| IP | 182 1 0100 110 | 182 1 0100 110 |

| Individual (not individual entrepreneur) | 182 1 0100 110 | 182 1 0100 110 |

KBK: patent tax system 2019

The patent is paid by entrepreneurs, choosing the BCC that corresponds to the type of budget.

| KBK | Decoding |

| 182 1 0500 110 | Patent tax credited to the budgets of city districts |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Patent tax credited to the budgets of municipal districts |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Patent tax credited to the budgets of federal cities of Moscow and St. Petersburg |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

BCC of property tax for legal entities in 2019

| KBK | Decoding |

| 182 1 0600 110 | Tax on property not included in the Unified Gas Supply System |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Tax on property included in the Unified Gas Supply System |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| Purpose of payment | Mandatory payment | Penalty | Fine |

| for property not included in the Unified Gas Supply System | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| for property included in the Unified Gas Supply System | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

KBK – transport tax 2020 for individuals and legal entities

| Purpose of payment | Mandatory payment | Penalty | Fine |

| from organizations | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| from individuals | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

KBK on simplified tax system – 2020 (income)

| Purpose of payment | KBK |

| Advances and tax for the object “income” | 182 1 0500 110 |

| Penalties for the object “income” | 182 1 0500 110 |

| Fines for the object “income” | 182 1 0500 110 |

KBK on the simplified tax system - 2020 (income minus expenses)

| Purpose of payment | KBK |

| Advances, tax and minimum tax for the object “income minus expenses” | 182 1 0500 110 |

| Penalties for the object “income minus expenses” | 182 1 0500 110 |

| Fines for the object “income minus expenses” | 182 1 0500 110 |

KBK on UTII (single tax on imputed income) 2019

| Tax | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fines | 182 1 0500 110 |

KBK for 2020 for individual entrepreneurs (patent)

| Purpose of payment | Mandatory payment | Penalty | Fine |

| tax to the budgets of city districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| tax to the budgets of municipal districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| tax to the budgets of Moscow, St. Petersburg and Sevastopol | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| tax to the budgets of urban districts with intracity division | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| to the budgets of intracity districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

BCC for Unified Agricultural Tax for 2020

| Tax | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fines | 182 1 0500 110 |

KBK for water tax for 2020

| Tax | 182 1 0700 110 |

| Penalty | 182 1 0700 110 |

| Fines | 182 1 0700 110 |

BCC for land tax

| Payment Description | KBK tax | KBK penalties | KBC fines |

| For plots within the boundaries of intra-city municipalities of Moscow and St. Petersburg | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of urban districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of inter-settlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of rural settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of urban settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of urban districts with intra-city division | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of intracity districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

KBC for mineral extraction tax 2019

| Payment Description | KBK tax | KBK penalties | KBC fines |

| Oil | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Combustible natural gas from all types of hydrocarbon deposits | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Gas condensate from all types of hydrocarbon deposits | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Extraction tax for common minerals | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Tax on the extraction of other minerals (except for minerals in the form of natural diamonds) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Mineral extraction tax on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation, when extracting minerals from the subsoil outside the territory of the Russian Federation | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Mineral extraction tax in the form of natural diamonds | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Mineral extraction tax in the form of coal | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

Payments for subsoil use 2019

| Payment Description | KBK |

| Regular payments for the use of subsoil for the use of subsoil (rentals) on the territory of the Russian Federation | 182 1 1200 120 |

| Regular payments for the use of subsoil (rentals) for the use of subsoil on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation and outside the Russian Federation in territories under the jurisdiction of the Russian Federation | 182 1 1200 120 |

Payments for the use of natural resources 2019

| Payment Description | KBK for payment |

| Payment for negative impact on the environment Payment for emissions of pollutants into the air by stationary facilities | 048 1 1200 120 |

| Payment for emissions of pollutants into the atmospheric air by mobile objects | 048 1 1200 120 |

| Payment for discharges of pollutants into water bodies | 048 1 1200 120 |

| Payment for disposal of production and consumption waste | 048 1 1200 120 |

| Payment for other types of negative impact on the environment | 048 1 1200 120 |

| Payment for the use of aquatic biological resources under intergovernmental agreements | 076 1 1200 120 |

| Payment for the use of federally owned water bodies | 052 1 1200 120 |

| Income in the form of payment for the provision of a fishing area, received from the winner of the competition for the right to conclude an agreement on the provision of a fishing area | 076 1 1200 120 |

| Income received from the sale at auction of the right to conclude an agreement on fixing shares of quotas for the production (catch) of aquatic biological resources or an agreement for the use of aquatic biological resources that are in federal ownership | 076 1 1200 120 |

KBK for fees for the use of wildlife objects 2019

| KBK for fees | BCC for penalties | KBC for fines |

| 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

BCC 2020 for fees for the use of aquatic biological resources

| Payment Description | Codes | ||

| Tax | Penalty | Fines | |

| Fee for the use of aquatic biological resources (excluding inland water bodies) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Fee for the use of objects of aquatic biological resources (for inland water bodies) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

KBK 2020 for trading fee

| Payment Description | KBK for payment |

| Trade tax in federal cities | 182 1 0500 110 |

| Penalty trading fee | 182 1 0500 110 |

| Interest trading fee | 182 1 0500 110 |

| Fines trade fee | 182 1 0500 110 |

KBK 2020 tax on gambling business

| BCC for tax | BCC for penalties | KBC for fines |

| 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

State duty: BCC for 2020

| Payment Description | KBK |

| State duty on cases considered in arbitration courts | 182 1 0800 110 |

| State duty on cases considered by the Constitutional Court of the Russian Federation | 182 1 0800 110 |

| State duty on cases considered by constitutional (statutory) courts of constituent entities of the Russian Federation | 182 1 0800 110 |

| State duty on cases considered by the Supreme Court of the Russian Federation | 182 1 0800 110 |

| State duty for state registration: – organizations; – individuals as entrepreneurs; – changes made to the constituent documents of the organization; – liquidation of the organization and other legally significant actions | 182 1 0800 110 |

| State duty for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of legal entities | 182 1 0800 110 |

| State duty for carrying out actions related to licensing, with certification in cases where such certification is provided for by the legislation of the Russian Federation, credited to the federal budget | 182 1 0800 110 |

| Other state fees for state registration, as well as performance of other legally significant actions | 182 1 0839 110 |

| State duty for re-issuance of a certificate of registration with the tax authority | 182 1 0800 110 |

Income from the provision of paid services and compensation of state costs: KBK 2019

| Payment Description | KBK for payment |

| Fee for providing information contained in the Unified State Register of Taxpayers | 182 1 1300 130 |

| Fee for providing information and documents contained in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs | 182 1 1300 130 |

| Fee for providing information from the register of disqualified persons | 182 1 1300 130 |

KBC 2020: fines, sanctions, damages

| Payment Description | KBK for payment |

| Monetary penalties (fines) for violation of legislation on taxes and fees, provided for in Art. 116, 118, paragraph 2 of Art. 119, art. 119.1, paragraphs 1 and 2 of Art. 120, art. 125, 126, 128, 129, 129.1, art. 129.4, 132, 133, 134, 135, 135.1 | 182 1 1600 140 |

| Monetary penalties (fines) for violation of legislation on taxes and fees provided for in Article 129.2 of the Tax Code of the Russian Federation | 182 1 1600 140 |

| Monetary penalties (fines) for administrative offenses in the field of taxes and fees provided for by the Code of Administrative Offenses of the Russian Federation | 182 1 1600 140 |

| Monetary penalties (fines) for violation of legislation on the use of cash register equipment when making cash payments and (or) payments using payment cards | 182 1 1600 140 |

| Monetary penalties (fines) for violation of the procedure for handling cash, conducting cash transactions and failure to fulfill obligations to monitor compliance with the rules for conducting cash transactions | 182 1 1600 140 |

New BCCs for 2020.

| KBK in 2020 | KBK in 2020 | Account | ||

| Name | KBK | Name | KBK | |

| Corporate income tax (except for consolidated groups of taxpayers), credited to the federal budget | 182 1 0100 110 | Corporate income tax (except for consolidated groups of taxpayers), credited to the federal budget | 182 1 0100 110 | 68.04.1 |

| Corporate income tax (except for consolidated groups of taxpayers), credited to the budgets of the constituent entities of the Russian Federation | 182 1 0100 110 | Corporate income tax (except for consolidated groups of taxpayers), credited to the budgets of the constituent entities of the Russian Federation | 182 1 0100 110 | 68.04.1 |

| Profit tax of organizations of consolidated groups of taxpayers, credited to the federal budget | 182 1 0100 110 | Profit tax of organizations of consolidated groups of taxpayers, credited to the federal budget | 182 1 0100 110 | 68.04.1 |

| Profit tax of organizations of consolidated groups of taxpayers, credited to the budgets of the constituent entities of the Russian Federation | 182 1 0100 110 | Profit tax of organizations of consolidated groups of taxpayers, credited to the budgets of the constituent entities of the Russian Federation | 182 1 0100 110 | 68.04.1 |

| Corporate income tax on income received in the form of dividends from Russian organizations by Russian organizations | 182 1 0100 110 | Corporate income tax on income received in the form of dividends from Russian organizations by Russian organizations | 182 1 0100 110 | 68.44 |

| Corporate income tax on income received in the form of dividends from Russian organizations by foreign organizations | 182 1 0100 110 | Corporate income tax on income received in the form of dividends from Russian organizations by foreign organizations | 182 1 0100 110 | 68.44 |

| Corporate income tax on income received in the form of dividends from foreign organizations by Russian organizations | 182 1 0100 110 | Corporate income tax on income received in the form of dividends from foreign organizations by Russian organizations | 182 1 0100 110 | 68.44 |

| Personal income tax on income the source of which is a tax agent, with the exception of income in respect of which tax is calculated and paid in accordance with Articles 227, 227.1 and 228 of the Tax Code of the Russian Federation | 182 1 0100 110 | Personal income tax on income the source of which is a tax agent, with the exception of income in respect of which tax is calculated and paid in accordance with Articles 227, 227.1 and 228 of the Tax Code of the Russian Federation | 182 1 0100 110 | 68.01 |

| Tax on income of individuals received from activities carried out by individuals registered as individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices, and other persons engaged in private practice in accordance with Article 227 of the Tax Code of the Russian Federation | 182 1 0100 110 | Tax on income of individuals received from the activities of individuals registered as individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices, and other persons engaged in private practice in accordance with Article 227 of the Tax Code of the Russian Federation | 182 1 0100 110 | 68.21 |

| Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity | 393 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity | 393 1 0200 160 | 69.01 |

| Insurance contributions for compulsory social insurance against industrial accidents and occupational diseases | 393 1 0200 160 | Insurance contributions for compulsory social insurance against industrial accidents and occupational diseases | 393 1 0200 160 | 69.11 |

| Insurance contributions for compulsory pension insurance in the Russian Federation | 392 1 0200 160 | Insurance contributions for compulsory pension insurance in the Russian Federation | 392 1 0200 160 | 69.02.7 |

| Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraph 1 of part 1 of Article 30 of the Federal Law of December 28, 2013 “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension | 392 1 0200 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraph 1 of part 1 of Article 30 of the Federal Law of December 28, 2013 “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension | 392 1 0200 160 | 69.02.5 |

| Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 2-18 of part 1 of Article 30 of the Federal Law of December 28, 2013 “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension | 392 1 0200 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 2-18 of part 1 of Article 30 of the Federal Law of December 28, 2013 “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension | 392 1 0200 160 | 69.02.6 |

| Employer contributions in favor of insured persons paying additional insurance contributions for the funded part of the labor pension, credited to the Pension Fund of the Russian Federation | 392 1 0200 160 | Employer contributions in favor of insured persons paying additional insurance contributions for the funded part of the labor pension, credited to the Pension Fund of the Russian Federation | 392 1 0200 160 | 69.05.1 |

| Additional insurance contributions for the funded part of the labor pension, credited to the Pension Fund of the Russian Federation | 392 1 0200 160 | Additional insurance contributions for the funded part of the labor pension, credited to the Pension Fund of the Russian Federation | 392 1 0200 160 | 69.05.2 |

| Contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund of the Russian Federation for the payment of additional payments to pensions | 392 1 0200 160 | Contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund of the Russian Federation for the payment of additional payments to pensions | 392 1 0200 160 | 69.02.3 |

| Contributions paid by coal industry organizations to the budget of the Pension Fund of the Russian Federation for the payment of additional payments to pensions | 392 1 0200 160 | Contributions paid by coal industry organizations to the budget of the Pension Fund of the Russian Federation for the payment of additional payments to pensions | 392 1 0200 160 | 69.02.4 |

| Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation | 392 1 0200 160 | 69.06.5 | ||

| Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of an insurance pension (calculated from the amount of the payer’s income, not exceeding the income limit established by Article 14 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund") | 392 1 0200 160 | 69.06.5, subconto 1 “Tax (contributions): accrued/paid” | ||

| Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of an insurance pension (calculated from the amount of the payer’s income received in excess of the income limit established by Article 14 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund") | 392 1 0200 160 | 69.06.5, subconto 1 “Contributions from income above the limit” | ||

| Insurance premiums for compulsory health insurance of the working population, credited to the budget of the Federal Compulsory Health Insurance Fund | 392 1 0211 160 | Insurance premiums for compulsory health insurance of the working population, credited to the budget of the Federal Compulsory Health Insurance Fund | 392 1 0211 160 | 69.03.1 |

| Insurance premiums for compulsory health insurance of the working population in a fixed amount, credited to the budget of the Federal Compulsory Health Insurance Fund | 392 1 0211 160 | 69.06.3 | ||

| Value added tax for goods (work, services) sold on the territory of the Russian Federation | 182 1 0300 110 | Value added tax for goods (work, services) sold on the territory of the Russian Federation | 182 1 0300 110 | 68.02 (for taxpayer) 68.32 (for tax agent) |

| Value added tax for goods imported into the territory of the Russian Federation (when importing goods from member countries of the Customs Union) | 182 1 0400 110 | Value added tax for goods imported into the territory of the Russian Federation (when importing goods from member countries of the Customs Union) | 182 1 0400 110 | 68.42 |

| Excise taxes on ethyl alcohol from food or non-food raw materials, including denatured ethyl alcohol, raw alcohol, wine, grape, fruit, cognac, calvados, whiskey distillates, produced on the territory of the Russian Federation | 182 1 0300 110 | Excise taxes on ethyl alcohol from food or non-food raw materials, including denatured ethyl alcohol, raw alcohol, wine, grape, fruit, cognac, calvados, whiskey distillates, produced on the territory of the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on ethyl alcohol from food raw materials (with the exception of distillates of wine, grape, fruit, cognac, Calvados, whiskey), produced on the territory of the Russian Federation | 182 1 0300 110 | Excise taxes on ethyl alcohol from food raw materials (with the exception of distillates of wine, grape, fruit, cognac, Calvados, whiskey), produced on the territory of the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on ethyl alcohol from non-food raw materials produced on the territory of the Russian Federation | 182 1 0300 110 | Excise taxes on ethyl alcohol from non-food raw materials produced on the territory of the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on ethyl alcohol from food raw materials (wine, grape, fruit, cognac, calvados, whiskey distillates) produced on the territory of the Russian Federation | 182 1 0300 110 | Excise taxes on ethyl alcohol from food raw materials (wine, grape, fruit, cognac, calvados, whiskey distillates) produced on the territory of the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on alcohol-containing products produced in the Russian Federation | 182 1 0300 110 | Excise taxes on alcohol-containing products produced in the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on tobacco products produced in the Russian Federation | 182 1 0300 110 | Excise taxes on tobacco products produced in the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on motor gasoline produced in the Russian Federation | 182 1 0300 110 | Excise taxes on motor gasoline produced in the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on straight-run gasoline produced in the Russian Federation | 182 1 0300 110 | Excise taxes on straight-run gasoline produced in the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on passenger cars and motorcycles produced in the Russian Federation | 182 1 0300 110 | Excise taxes on passenger cars and motorcycles produced in the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on diesel fuel produced in the Russian Federation | 182 1 0300 110 | Excise taxes on diesel fuel produced in the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on motor oils for diesel and (or) carburetor (injection) engines produced in the Russian Federation | 182 1 0300 110 | Excise taxes on motor oils for diesel and (or) carburetor (injection) engines produced in the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on wines, fruit wines, sparkling wines (champagnes), wine drinks made without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate produced in the Russian Federation | 182 1 0300 110 | Excise taxes on wines, fruit wines, sparkling wines (champagnes), wine drinks made without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate produced in the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on beer produced in the Russian Federation | 182 1 0300 110 | Excise taxes on beer produced in the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on cider, poire, mead produced on the territory of the Russian Federation | 182 1 0300 110 | Excise taxes on cider, poire, mead produced on the territory of the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol up to 9 percent inclusive (except for beer, wines, fruit wines, sparkling wines (champagne), wine drinks made without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate) produced on the territory of the Russian Federation | 182 1 0300 110 | Excise taxes on alcoholic products with a volume fraction of ethyl alcohol up to 9 percent inclusive (except for beer, wines, fruit wines, sparkling wines (champagne), wine drinks made without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate) produced on the territory of the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on benzene, paraxylene, orthoxylene produced in the Russian Federation | 182 1 0300 110 | Excise taxes on benzene, paraxylene, orthoxylene produced in the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on aviation kerosene produced on the territory of the Russian Federation | 182 1 0300 110 | Excise taxes on aviation kerosene produced on the territory of the Russian Federation | 182 1 0300 110 | 68.03 |

| Excise taxes on natural gas provided for by international treaties of the Russian Federation | 182 1 0300 110 | Excise taxes on natural gas provided for by international treaties of the Russian Federation | 182 1 0300 110 | 68.03 |

| Tax levied on taxpayers who have chosen income as an object of taxation (STS) | 182 1 0500 110 | Tax levied on taxpayers who have chosen income as an object of taxation (STS) | 182 1 0500 110 | 68.12 |

| A tax levied on taxpayers who have chosen income reduced by the amount of expenses (STS) as an object of taxation. | 182 1 0500 110 | A tax levied on taxpayers who have chosen income reduced by the amount of expenses (STS) as an object of taxation. | 182 1 0500 110 | 68.12 |

| Minimum tax credited to the budgets of constituent entities of the Russian Federation (STS) | 182 1 0500 110 | Minimum tax credited to the budgets of constituent entities of the Russian Federation (STS) | 182 1 0500 110 | 68.12 |

| Single tax on imputed income for certain types of activities | 182 1 0500 110 | Single tax on imputed income for certain types of activities | 182 1 0500 110 | 68.11 |

| Unified agricultural tax | 182 1 0500 110 | Unified agricultural tax | 182 1 0500 110 | 68.10 |

| Tax levied in connection with the application of the patent taxation system, credited to the budgets of urban districts | 182 1 0500 110 | Tax levied in connection with the application of the patent taxation system, credited to the budgets of urban districts | 182 1 0500 110 | 68.14 |

| Tax levied in connection with the application of the patent taxation system, credited to the budgets of municipal districts | 182 1 0500 110 | Tax levied in connection with the application of the patent taxation system, credited to the budgets of municipal districts | 182 1 0500 110 | 68.14 |

| Tax levied in connection with the use of the patent taxation system, credited to the budgets of federal cities | 182 1 0500 110 | Tax levied in connection with the use of the patent taxation system, credited to the budgets of federal cities | 182 1 0500 110 | 68.14 |

| Tax levied in connection with the use of the patent taxation system, credited to the budgets of urban districts with intra-city division | 182 1 0500 110 | Tax levied in connection with the use of the patent taxation system, credited to the budgets of urban districts with intra-city division | 182 1 0500 110 | 68.14 |

| Tax levied in connection with the application of the patent taxation system, credited to the budgets of intracity districts | 182 1 0500 110 | Tax levied in connection with the application of the patent taxation system, credited to the budgets of intracity districts | 182 1 0500 110 | 68.14 |

| Property tax of organizations on property not included in the Unified Gas Supply System | 182 1 0600 110 | Property tax of organizations on property not included in the Unified Gas Supply System | 182 1 0600 110 | 68.08 |

| Property tax of organizations on property included in the Unified Gas Supply System | 182 1 0600 110 | Property tax of organizations on property included in the Unified Gas Supply System | 182 1 0600 110 | 68.08 |

| Transport tax for organizations | 182 1 0600 110 | Transport tax for organizations | 182 1 0600 110 | 68.07 |

| Gambling tax | 182 1 0600 110 | Gambling tax | 182 1 0600 110 | 68.10 |

| Land tax from organizations owning a land plot located within the boundaries of intra-city municipalities of federal cities | 182 1 0600 110 | Land tax from organizations owning a land plot located within the boundaries of intra-city municipalities of federal cities | 182 1 0600 110 | 68.06 |

| Land tax on organizations owning a land plot located within the boundaries of urban districts | 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of urban districts | 182 1 0600 110 | 68.06 |

| Land tax on organizations owning a land plot located within the boundaries of urban districts with intra-city division | 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of urban districts with intra-city division | 182 1 0600 110 | 68.06 |

| Land tax on organizations owning a land plot located within the boundaries of intracity districts | 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of intracity districts | 182 1 0600 110 | 68.06 |

| Land tax on organizations owning a land plot located within the boundaries of inter-settlement territories | 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of inter-settlement territories | 182 1 0600 110 | 68.06 |

| Land tax on organizations owning a land plot located within the boundaries of rural settlements | 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of rural settlements | 182 1 0600 110 | 68.06 |

| Land tax on organizations owning a land plot located within the boundaries of urban settlements | 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of urban settlements | 182 1 0600 110 | 68.06 |

| Mineral extraction tax. Oil | 182 1 0700 110 | Mineral extraction tax. Oil | 182 1 0700 110 | 68.10 |

| Mineral extraction tax. Natural flammable gas from all types of hydrocarbon deposits | 182 1 0700 110 | Mineral extraction tax. Natural flammable gas from all types of hydrocarbon deposits | 182 1 0700 110 | 68.10 |

| Mineral extraction tax. Gas condensate from all types of hydrocarbon deposits | 182 1 0700 110 | Mineral extraction tax. Gas condensate from all types of hydrocarbon deposits | 182 1 0700 110 | 68.10 |

| Extraction tax for common minerals | 182 1 0700 110 | Extraction tax for common minerals | 182 1 0700 110 | 68.10 |

| Tax on the extraction of other minerals (except for minerals in the form of natural diamonds) | 182 1 0700 110 | Tax on the extraction of other minerals (except for minerals in the form of natural diamonds) | 182 1 0700 110 | 68.10 |

| Tax on the extraction of mineral resources on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation, when extracting mineral resources from the subsoil outside the territory of the Russian Federation | 182 1 0700 110 | Tax on the extraction of mineral resources on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation, when extracting mineral resources from the subsoil outside the territory of the Russian Federation | 182 1 0700 110 | 68.10 |

| Mining tax on natural diamonds | 182 1 0700 110 | Mining tax on natural diamonds | 182 1 0700 110 | 68.10 |

| Water tax | 182 1 0700 110 | Water tax | 182 1 0700 110 | 68.10 |

| Fee for the use of fauna objects | 182 1 0700 110 | Fee for the use of fauna objects | 182 1 0700 110 | 68.10 |

| Fee for the use of aquatic biological resources (excluding inland water bodies) | 182 1 0700 110 | Fee for the use of aquatic biological resources (excluding inland water bodies) | 182 1 0700 110 | 68.10 |

| Fee for the use of objects of aquatic biological resources (for inland water bodies) | 182 1 0700 110 | Fee for the use of objects of aquatic biological resources (for inland water bodies) | 182 1 0700 110 | 68.10 |

| Payment for emissions of pollutants into the atmospheric air by stationary facilities | 048 1 1200 120 | Payment for emissions of pollutants into the atmospheric air by stationary facilities | 048 1 1200 120 | 68.10 |

| Payment for emissions of pollutants into the atmospheric air by mobile objects | 048 1 1200 120 | Payment for emissions of pollutants into the atmospheric air by mobile objects | 048 1 1200 120 | 68.10 |

| Payment for discharges of pollutants into water bodies | 048 1 1200 120 | Payment for discharges of pollutants into water bodies | 048 1 1200 120 | 68.10 |

| Payment for disposal of production and consumption waste | 048 1 1200 120 | Payment for disposal of production and consumption waste | 048 1 1200 120 | 68.10 |

| Payment for other types of negative impact on the environment | 048 1 1200 120 | Payment for other types of negative impact on the environment | 048 1 1200 120 | 68.10 |

| Recycling fee (for wheeled vehicles imported into the Russian Federation) | 153 1 1200 120 | Recycling fee (for wheeled vehicles imported into the Russian Federation) | 153 1 1200 120 | 68.10 |

| Recycling fee (for wheeled vehicles manufactured in the Russian Federation) | 153 1 1200 120 | Recycling fee (for wheeled vehicles manufactured in the Russian Federation) | 153 1 1200 120 | 68.10 |

) in categories 14-17 from January 1 it is indicated: when paying tax 1000, when paying penalties on taxes - 2100, when paying interest - 2200, when paying fines: when paying penalties on contributions - 2000.

) subaccount 68.44 “Income tax when performing the duties of a tax agent” to account 68 “Calculations for taxes and fees” of the 1C: Accounting chart of accounts is opened in the “1C: Enterprise” mode.

KBK: land tax 2020 for legal entities

When paying land tax, companies choose BCC in accordance with the territorial location of the site. The choice of land tax penalties by the KBK, as well as “penalty” codes, also depends on the location of the site.

| KBK | Decoding |

| 182 1 0600 110 | Land tax from organizations if the site is located within the boundaries of intra-city municipalities of federal cities |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations if the site is located within the boundaries of urban districts |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations if the site is located within the boundaries of urban districts with intra-city division |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations whose land plots are located within the boundaries of intracity districts |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations whose land plots are located within the boundaries of inter-settlement territories |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations whose land plots are located within the boundaries of rural settlements |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations whose land plots are located within the boundaries of urban settlements |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

KBK: Recycling fee

The fee was introduced in the capital by Moscow Law No. 62 dated December 17, 2014; it is not collected in other regions.

| KBK | Decoding |

| 182 1 0500 110 | Trade tax paid in the territories of federal cities |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| KBK | Decoding |

| 048 1 1200 120 | Environmental fee |

| KBK | Decoding |

| 182 1 1500 140 | Fee for the use of resort infrastructure (resort fee) |

The list of codes is supplemented by two BCCs for penalties for non-payment of the recycling fee for self-propelled vehicles and trailers for them imported into the Russian Federation from Belarus and other countries (approved by order of the Ministry of Finance of the Russian Federation dated September 20, 2018 N 198n).

| KBK | Decoding |

| 153 1 1200 120 | Recycling fee for wheeled vehicles and trailers imported into the Russian Federation (except for those imported from the Republic of Belarus) |

| 153 1 1210 120 | penalties |

| 153 1 1200 120 | Recycling fee for wheeled vehicles and trailers imported into the Russian Federation from the Republic of Belarus |

| 1 1210 120 | penalties |

| 153 1 1200 120 | Recycling fee for wheeled vehicles and trailers for them produced and manufactured in the Russian Federation |

| 153 1 1200 120 | Recycling fee for self-propelled vehicles and trailers for them, produced or manufactured in the Russian Federation |

| 153 1 1200 120 | Recycling fee for self-propelled vehicles and trailers for them imported into the Russian Federation, except for self-propelled vehicles and trailers for them imported from the territory of the Republic of Belarus |

| 153 1 1220 120 | penalties |

| 153 1 1200 120 | Recycling fee for self-propelled vehicles and trailers for them imported into the Russian Federation from the territory of the Republic of Belarus |

| 153 1 1230 120 | penalties |

kbk 2018

KBK: State duties 2020

| KBK | Decoding |

| 153 1 0800 110 | State duty for the issuance of excise stamps with a two-dimensional bar code containing the identifier of the unified state automated information system for recording the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products (USAIS) for labeling alcoholic products |

| 160 1 0800 110 | State duty for the issuance of federal special stamps with a two-dimensional bar code containing the identifier of the unified state automated information system for recording the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products (USAIS) for labeling alcoholic products |

| 182 1 0800 110 | State duty for re-issuing a certificate of registration with the tax authority (when applying through multifunctional centers - MFC) |