The legislation defines specific deadlines for providing an employee with disability benefits, its calculation, payment, withholding and transfer of personal income tax. The Tax Code requires personal income tax to be calculated as of the date of payment, but the exact date of this event is unknown. The accountant is forced to calculate income and tax as of the expected date of payment, and if the expected and actual dates do not correspond, he must clarify the calculation. 1C experts, using the example of the 1C: Salaries and Personnel Management 8 program, edition 3, talk about the features of calculating temporary disability benefits, as well as withholding personal income tax from sick leave and reflecting them in 6-personal income tax reports.

The conflict between calculating personal income tax when calculating temporary disability benefits and clarifying the tax when withholding it creates difficulties for accountants in understanding the results of calculating personal income tax and generating 6-personal income tax reports. It becomes even more difficult if there are grounds for recalculating sick leave.

Deadline for accruing sick leave and calculating personal income tax

Chapter 4 of Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity” regulates the procedure for assigning, calculating and paying benefits for temporary disability.

The employer assigns the specified benefit to the employee if the employee submitted sick leave to the employer within 6 months after restoration of working capacity (Clause 1, Article 12 of Law No. 255-FZ). In cases where the six-month period has expired, the decision to assign benefits is made by the territorial body of the Social Insurance Fund if there are good reasons.

The benefit must be assigned (calculated) in accordance with paragraph 1 of Article 15 of Law No. 255-FZ within 10 calendar days from the date the employee submits sick leave. When assigning benefits, the amount that should be paid to the employee on sick leave is calculated. When paying benefits for temporary disability (as well as other income), personal income tax should be withheld (clause 6 of Article 226 of the Tax Code of the Russian Federation).

It turns out that within 10 days it is necessary to accrue the benefit amount in accordance with the procedure specified in Article 13 of Law No. 255-FZ and calculate personal income tax.

The tax is calculated on the date of actual receipt of income. Based on paragraph 1 of Article 223 of the Tax Code of the Russian Federation, the date of actual receipt of income for disability benefits is defined as the date of actual payment or transfer of income to the employee. When calculating personal income tax, it is necessary to take into account the tax status of the employee, his right to deductions, the availability of income certificates from other employers, etc. These conditions may change and affect the amount of tax. Therefore, when assigning benefits to an employee, personal income tax is calculated as of the expected date of payment.

https://youtu.be/7AXjt4XXO1E

In what situations is it necessary to show the BC in the certificate?

The 6-NDFL certificate includes all cases of payment of funds on sick leave when income tax is charged on them. It is not charged only for maternity benefits.

At the same time, the reflection of benefit payments in the report has fundamental differences with the calculation of wages. They are expressed in determining the date of receipt of income and the day of payment of tax on it. The day of receipt of income is determined according to the following principle:

- For salaries, this is the last day of the month in which they are calculated.

- For disability benefits , this is the actual date of receipt.

Therefore, the timing of tax transfers to the budget also becomes different (clause 6 of Article 226 of the Tax Code of the Russian Federation):

- Funds from salary

- The sick leave tax is transferred on the last day of the month the employee actually receives the money.

Sick leave payment period

Temporary disability benefits are paid by the employer or directly by the social insurance fund in the regions participating in the Social Insurance Fund pilot project. However, even in those regions where direct payments are made, the employer independently pays for the first 3 days of illness.

For the payment of accrued benefits, paragraph 1 of Article 15 of Law No. 255-FZ establishes a certain period - the day closest to the date of payment of wages after the assignment of benefits.

The benefit may be paid in installments. Each of these parts has its own payment date.

In general, payments of parts of one benefit may occur in different months or quarters, and the conditions for calculating personal income tax may differ. The date of actual receipt of income in the form of temporary disability benefits is determined as the date of payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Consequently, if benefits for one sick leave are paid in several parts, then each of these parts corresponds to its own payment date and the date of actual receipt of income.

Zero personal income tax in 2020

Many people are wondering whether it is necessary to submit zero personal income tax in 2020, including for sick leave. This is usually possible when the employee is on maternity leave. According to the law, personal income tax is not charged on benefits paid for pregnancy and childbirth, as well as for child care. That is, in fact, the specialist will be listed in the company. However, in fact, he will not perform any actions, so he will not receive a salary.

Article 230 of the Tax Code of the Russian Federation states that tax agents (employers in this case) must provide Form 6-NDFL. If there were no accruals during the reporting period, then the company will not be a tax agent. Thus, there is no need to provide zero personal income tax to employees of the Federal Tax Service.

Control ratios for 6-NDFL

Important . If the company was a tax agent during the calendar year, then it will have to fill out form 6-NDFL. For example, a girl went on maternity leave and does not conduct economic activities, but she has her own individual entrepreneur/LLC, where she performs all functions independently. However, one month she had a profitable deal, for which she was able to make a profit or went on sick leave, from which she received income. In this case, she must submit a tax return to the Federal Tax Service in form 6-NDFL.

The declaration must be completed on an accrual basis. For example, if a company’s only accruals were for sick leave in May 2020, then it will not have to submit financial statements for the first quarter. However, you will need to provide papers for half a year, 9 months and an annual report.

Sample of filling out the zero form 6-NDFL

If, since July, the organization does not have the data to fill out Section 2, then this section must be provided to the Federal Tax Service, but it does not need to be filled out. Thus, dashes will be placed in empty cells in accordance with the requirements of 2020.

Important . If a company decides to submit a zero 6-NDFL report, the Federal Tax Service will accept it. However, failure to provide it will also not be a violation. The form must be filled in with summary data for the entire reporting period. In zero reports there will be a zero there.

Recalculation of sick leave

Article 15 of Law No. 255-FZ establishes the employer’s obligation to make calculations based on the documents that are available at the time of calculation, and to make recalculations if there are sufficient grounds for this.

For example, a condition for recalculating benefits may be a certificate received by the accounting department from a previous place of work confirming the citizen’s income or length of service, a certificate from the Pension Fund of the Russian Federation or the Social Insurance Fund about previous income, or other circumstances. Recalculation is carried out only for those sick leaves for which benefits were assigned no earlier than 3 years before the moment when the employee filed an application.

| 1C:ITS For more information on the assignment of temporary disability benefits, see the “Human Resources Officer’s Handbook” in the “Personnel and Remuneration” section. |

Form for calculating personal income tax

One of the reporting documents of organizations and individual entrepreneurs is form 6-NDFL. It is needed to calculate personal income tax regarding income for which the employer acts as a tax agent. The document is submitted after three months, six months, nine months and a year. The current version of the form is in the Order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected]

- tax rate (page 010);

- accrued income of employees (line 020);

- the amount of the calculated tax (p. 040);

- number of employees (page 060);

- the amount of tax withheld (page 070).

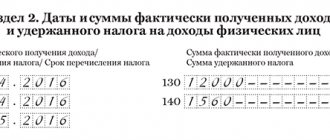

In section 1, reflect the information on a cumulative basis from the beginning of the year. In section 2, note the dates of receipt of income, withholding of personal income tax and the timing of its transfer to the budget (pp. 100-120). For each date, the corresponding payment amount and the portion withheld by the agent are indicated (pages 130-140).

Important! Payments of income, even of the same type, may relate to different dates or have different tax payment deadlines. Lines 100-140 are filled in for each such case separately.

A mandatory rule is to fill out all fields of the form. If you do not need to enter an amount in the field, enter zeros. The lines are filled starting from the leftmost cell. If there are extra digits in unfilled cells of the field, add dashes.

Personal income tax withholding period for sick leave

The date of personal income tax withholding in accordance with paragraph 6 of Article 226 of the Tax Code of the Russian Federation for sick leave is determined in the same way as for other income: this is the real date of payment of temporary disability benefits in full or for the first 3 days. As of this date, personal income tax should be calculated.

If, due to circumstances, the actual date of payment of income differs from the expected one or the income is paid in installments, then the personal income tax will have to be reviewed and clarified.

| 1C:ITS For information on personal income tax on temporary disability benefits, see the reference book “Income Tax for Individuals” in the “Personnel and Remuneration” section. |

An example of filling out 6-NDFL for the period in which there was sick leave

Here are a few examples and samples of filling out 6-NDFL with sick leave.

Example 1. Sick leave accrued in February, paid in March, how to reflect it in 6-NDFL in 2019

This situation happens in organizations where salaries for the previous month are paid at the beginning of the next month.

At Ulybka LLC, salaries are paid on the 5th of every month. In February, sickness benefits were accrued in the amount of 7,000 rubles. (personal income tax 910 rub.), issued along with salary on March 5, 2020.

Line by line filling out sick leave in 6-NDFL for the 1st quarter will be as follows:

020 – 7,000 rub.; 040 – 910 rub.; 070 – 910 rub.

Attention! Since the date of transfer of personal income tax to the Federal Tax Service is the last day of the month of payment, in our example it falls on March 31 (Saturday). The payment date is moved to April 2, and this is a different billing period. That is, in section 2 of 6-NDFL, sick leave will only be reflected in the half-year report.

100 – 05.03.2019; 110 – 05.03.2019; 120 – 02.04.2019; 130 – 7000; 140 – 910.

Rolling sick leave in 6-NDFL from 2020, example of filling

Example 2. 6-NDFL with sick leave, example of filling out for the 1st quarter of 2019

Ulybka LLC has a practice of paying salaries on the 28th.

Total income for the 1st quarter amounted to 450,000 rubles. (150,000 every month);

Income 58,500 rub. (19,500 per month).

In February, one of the employees was sick, on February 12 he submitted sick leave to the accounting department, on February 19 he was awarded sick leave benefits - 5,500 rubles. (NDFL 715 rub.), which was paid in the February salary.

First of all, let's look at how to reflect the day of accrual or payment of sick leave in 6-NDFL. In our example, the accrual day is February 19, the payment day is February 28. And according to the procedure for filling out form 6-NDFL with sick leave, in line 100 we will indicate 02/28/2019.

110 – 28.02.2019; 120 – 28.02.2019

With this procedure for issuing wages, the dates of deduction and transfer of personal income tax from the certificate of incapacity for work coincide.

Important! The date of transfer of income from the February salary will be March 1, therefore it is impossible to combine the amount of salary and benefits, despite the fact that both amounts were transferred on the same day (see example below).

How to fill out 6-NDFL with sick leave for the 1st quarter of 2020, sample example

Reflection of personal income tax from sick leave in the 6-NDFL report

The difficulty in understanding the rules for filling out the 6-NDFL report arises when accruals for sick leave were made in one quarter, and payment in the next. Such sick leave will not be reflected in the 6-NDFL report (neither in Section 1 nor in Section 2) in the quarter in which it was accrued, but will appear in both Sections of the report in the quarter in which it is paid.

The procedure for filling out and submitting the calculation, approved. by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] and given in Appendix No. 2, provides for the indication in Section 1 of the amounts of accrued income, calculated and withheld tax, summarized for all individuals, on an accrual basis from the beginning of the tax period to the corresponding tax rate. However, the definition of the concept of “amounts of accrued income” indicated in line 020 of Section 1 is not given either in the Procedure or in the Tax Code of the Russian Federation.

Therefore, when filling out Section 1, you should take into account the control ratios (CR) for checking the report, brought to the attention of the Federal Tax Service of Russia letter dated March 10, 2016 No. BS-4-11 / [email protected] In this letter, the tax department explains how the report will be checked.

According to KS 1.3, accrued income, applied deductions and calculated tax must be consistent. In contrast to the term “accrued income,” the concept of “tax calculation date” is defined in accordance with Article 223 of the Tax Code of the Russian Federation. As noted earlier, for temporary disability benefits, the date of actual receipt of income is determined as the date of its payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

Since the payment date falls on the next quarter, the date of calculation and withholding of the tax falls on the quarter following the one in which the benefit was accrued. And indicating accrued benefit amounts in Section 1 before benefits are paid will violate the benchmark ratios.

The reflection in Section 2 in this case does not raise any questions. The dates of actual receipt of income by individuals and withholding of tax, and the timing of tax remittance are indicated here. And it is clear that Section 2 can only be completed in the quarter when the benefit was paid.

| 1C:ITS For detailed information on preparing calculations using Form 6-NDFL in 1C programs, see the reference book “Reporting on personal income tax” in the “Reporting” section. |

Features of rolling sick leave: reflected in the 6-NDFL declaration

Differences in income recognition procedures result in:

- Salary data, as a rule, turns out to fall into different months, since it is accrued in one month and usually paid in another. At the border of the reporting periods, as a result, salary data for the last month of the reporting quarter will fall into section 1 (i.e., accruals), and in section 2 (by date of payment) will be shown only in the next period.

- Data on military goods most often turn out to be tied to one reporting period. This is due to the fact that the deadline for paying taxes is legally linked to the month of payment of income in the form of benefits.

However, for the terms of payment of sick leave tax, transitions to another month are also possible, including at the border of reporting periods. This occurs in cases where the last day of the month turns out to be a day off. Postponement to the next working day following the weekend (according to the rule established by clause 7 of Article 6.1 of the Tax Code of the Russian Federation) automatically means a shift in the payment deadline to another month, and if this month belongs to the next reporting period, then to another reporting period. This is due to the fact that the date of completion of the income payment transaction is considered to be the last of the dates related to it (letter of the Federal Tax Service of Russia dated July 21, 2017 No. BS-4-11 / [email protected] ).

Thus, if the deadline for tax payment is postponed, the data on personal income tax entered in lines 100–140 of section 2 will appear in the report relating to the next period. But in section 1 they should be shown in the period of actual payment by entering the corresponding figures in lines 020, 040 and 070 (letter of the Ministry of Finance dated March 13, 2017 No. BS-4-11 / [email protected] ).

S. N. Shalyaeva, 1st class State Civil Service Advisor, answered some of the taxpayers’ questions.

Get trial access to ConsultantPlus and find out the official’s answer to this question for free.

Example 2

A company employee was absent from work due to illness from June 17 to June 26, 20XX. He returned to work on June 27 and on the same day gave his sick leave to the accounting department.

On the same day, he was accrued benefits in the amount of 20,500 rubles. The payment was made on the day the salary advance was issued - 06/29/20XX.

The deadline for paying tax on benefits expires on 06/30/20XX. This day coincides with a holiday. Therefore, it is postponed to 07/01/20XX.

This operation will have to be reflected in 2 reports:

- For the first half of 20XX. There, data on military goods will appear only as part of the lines of section 1 in the following amounts:

| Line | Meaning |

| 020 | 20 500 |

| 040 | 2 665 |

| 070 | 2 665 |

- For 9 months of 20XX. Data on military goods in this report will be included only in the lines of section 2:

pp. 100 - 06/29/20XX;

pp. 110 - 06/29/20XX;

page 120 - 07/01/20XX;

pp. 130 – 20,500;

pp. 140 - 2,665.

For an example of reflecting “carryover” vacation pay, for which the same tax payment rules apply as for sick leave, see the article “How to correctly reflect vacation pay in Form 6-NDFL?”

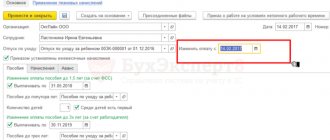

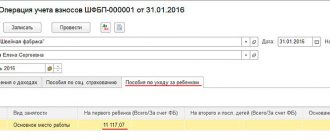

Personal income tax accounting in “1C: Salary and personnel management 8” (rev. 3)

We will consider the features of calculation and recalculation, accounting and reflection in personal income tax reports from sick leave in the 1C.Salary and Personnel Management 8 program, edition 3, using the following examples.

Example 1

| Worker S.S. On June 18, 2018, Gorbunkov submitted sick leave to the accounting department for the period from June 11, 2018 to June 16, 2018. The benefit on the same day was registered in the program with the document Sick Leave No. 1 and calculated. Payment of benefits is scheduled for June 29, 2018 during the interpayment period. However, the circumstances were such that the payment was made along with the salary on 07/03/2018. |

As a result of calculating benefits using the Sick Leave

5,979.45 rubles were accrued.

The date of actual receipt of income corresponds to the expected payment date of 06/29/2018. The actual payment was made on 07/03/2018. Therefore, the date of actual receipt of income changes.

After payment of benefits on 07/03/2018, the date of actual receipt of income is 07/03/2018.

In Example 1, the estimated payment date and the actual payment date refer to different months of the tax period - 2020 - and to different reporting periods - the II and III quarters, respectively.

In Form 6-NDFL, this disability benefit is not reflected in the half-year report, but is displayed in Sections 1 and 2 of the 9-month report, which complies with legal requirements.

How to reflect sick leave in 6 personal income tax basic provisions

When completing this form, the following general requirements must be taken into account in all cases:

- The report is submitted quarterly, no later than certain deadlines: 05/04/2016; 08/01/2016; 10/31/2016; 04/01/2017.

- It is mandatory for organizations and individual entrepreneurs that pay income to individuals. Not only the monetary value is taken into account, but also the physical value.

- In section No. 1 of each report, data is entered on an accrual basis. In the second - indicate information for 3 reporting months.

- Filling out is carried out using standard requirements for reporting documentation. You must not make blots, correct them with a proofreader or other means, or mechanically damage paper media.

- For verification, special control formulas are used.

- If errors are found in the tax office, it is proposed to eliminate the shortcomings within 5 days, no more.

We would like to emphasize that failure to submit reports on time is punishable not only by fines, but also by account blocking. Therefore, it is better to reflect sick leave in 6 personal income tax and enter other data correctly. Otherwise, losses may occur that worsen the economic performance of business activities.

How is the annual bonus paid to employees?

In order to ensure that accounting employees of organizations do not make mistakes when submitting Form 6 of personal income tax with a completed column on annual bonuses to employees, the tax authorities issued the following clarifications:

- A written notification that provides an explanation of the procedure for preparing reporting documents when paying cash bonuses to employees for the previous year.

- Addition to the order dated October 27, 2020, which clarifies the procedure for determining the amount of income actually received by a citizen in the form of monetary compensation for the purpose of depositing funds for personal income tax.

There are several types of classification of the date of actual receipt by a citizen of material compensation:

- taking into account paragraph number two of Article 223 of the basic tax law, the day of actual receipt of money should be recognized as the last day of the month for which the citizen will receive the indicated income in accordance with the paragraphs of the concluded employment agreement with the employer;

- such a day may be recognized as the last day of the month during which the employee must receive the designated income;

- Also, the indicated date may be recognized as the last day of the month that appears in the date of the order of the head of the enterprise to accrue material compensation for work for the interval of a year or quarter.

It is worth noting that before written explanations of this problem appeared, the tax authorities considered this date to be the day when the bonus was paid to the person. In other words, on the day the funds arrive in the bank account at a banking institution.

This attitude of the tax authorities caused great confusion in the correct filling out of the second section of the reporting document, because the information in lines 100 did not match.

We recommend you study! Follow the link:

Does an individual entrepreneur pay personal income tax for himself and for his employees?

Procedure and deadline for personal income tax payment

Sick leave must be reflected in 6-NDFL upon payment. Thus, carryover sick leave, which is opened in one quarter and transferred to another, is reflected in the reporting period when they were actually compensated. Therefore, when filling out 6-NDFL, you should focus on the procedure for paying for sick leave.

After the employee has closed the ballot and gone to his workplace, the employer is obliged to:

- Within 10 days, calculate the due compensation for sick days.

- Calculate the amount of income tax to be withheld.

- Transfer the resulting difference to the recipient's current account on the next payment date. Ballots are not paid as they are calculated, but are issued taking into account the next day of payment of the advance or salary.

Please note that personal income tax is transferred for sick leave using a different method than for salary. When paying wages, the day of tax transfer is considered to be the working day following the payment. But when paying sick leave compensation, the tax transfer day is considered to be the last day of the month in which it was transferred to the account, regardless of when it was actually issued to the employee - at the beginning of the month or at the end.

In 6-NDFL, sick leave is shown in those quarters when payments are actually transferred to the employee, and not just calculated.