What will be the amount of maternity leave in 2020? Are employers required to recalculate maternity benefits and pay extra? What are the new minimum and maximum sizes? Let's talk about it.

Maternity benefits (maternity benefits) will increase from January 1, 2020, since the new maximum average daily earnings must be taken into account when calculating benefits.

Let us remind you that maternity benefits are paid in a lump sum and in total for the entire period of maternity leave, which is (Part 1, Article 10 of Law No. 255-FZ):

- 140 days (in general);

- 194 days (with multiple pregnancies);

- 156 days (for complicated births).

Minimum and maximum amounts of maternity payments

The amount of payments is influenced by several factors: the length of leave, which depends on the woman’s health and region of residence, as well as the amount of salary in recent years. The minimum and maximum payout amounts are as follows:

| Payment type | Maximum | Minimum |

| B&R manual |

| 370.85 rubles per day |

| Allowance for registration | 655.49 rubles | 4,512 rubles |

| Lump sum payment at birth | 17,479.73 rubles | |

| Care benefit | 26,152.27 rubles |

|

Maternity benefit

The right to maternity benefits for pregnancy and childbirth in 2020 is granted to:

- expectant mothers who are officially employed or temporarily unemployed;

- women military personnel;

- dismissed (in case of liquidation of the enterprise);

- students.

The amount of this type of payment depends on the duration of the vacation, which can be:

| Who do they give it to? | Prenatal period | Postpartum period | Total |

| Normal uncomplicated pregnancy | 70 days | 70 days | 140 days |

| Complicated pregnancy or difficult childbirth | According to condition | According to condition | 156 days |

| Living in contaminated areas | 90 days | 70 days | 160 days |

| Twins or triplets | 84 days | 110 days | 194 days |

| Adoption of 1 baby | – | – | 70 days |

| Adoption of 2 children or more | – | – | 110 days |

The amount of the payment depends on the salary of the expectant mother for the previous 2 years.

- if the average income for the reporting period exceeded the minimum wage, the mother will receive 100% of the average monthly earnings.

- if the average monthly income is less than the minimum wage, then in 2020 the payment will be 11,163 rubles, and from 01/01/19 – 11,280 rubles.

Also, the unemployed and full-time students will receive a minimum payment.

Thus, in the second half of 2020, the amount of maternity benefits for pregnancy and childbirth (minimum and maximum) will be:

| Maternity leave | Minimum benefit | Maximum benefit |

| 140 days | RUB 51,380 | RUB 282,493 |

| 156 days | RUB 57,619 | RUB 314,778 |

| 194 days | RUB 71,198 | RUB 391,454 |

From January 1, 2020, the amount of maternity payments will increase slightly:

| Maternity leave | Minimum benefit | Maximum benefit |

| 140 days | RUB 51,919 | RUB 301,000 |

| 156 days | RUB 57,852.6 | RUB 335,507.64 |

| 194 days | RUB 71,944.9 | RUB 417,233.86 |

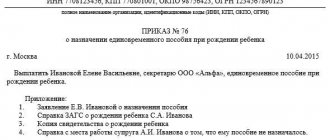

One-time benefit for the birth of a child

This type of payment is provided to one of the parents. When 2 or more children are born, benefits are paid for each of them.

After indexation on February 1, 2020, you can receive a benefit in the amount of 17,479 rubles at your place of work or from the Social Insurance Fund. To obtain it, you need to collect a package of documents:

- application for benefits;

- child's birth certificate;

- a certificate from the other parent’s place of work stating that he does not receive this benefit;

- a certified extract from the work book or other document about the last place of work (if the benefit is paid by social security authorities);

- certificate of divorce (if such a fact exists).

This list of documents must be submitted within 6 months from the date of birth of the child.

Read also…. Is it possible to drink coffee during pregnancy?

Child care allowance

According to current legislation, both the mother and the father of the baby can go on parental leave, and therefore qualify for appropriate payments. Non-working parents will also be able to receive monthly assistance, but in a minimal amount.

Benefit up to 1.5 years

You can submit documents for accrual of this payment before the child reaches 1.5 years of age.

But, it is important to know that by applying for benefits before the expiration of 6 months. the family will receive the entire amount due from the moment of birth. When making payments after 6 months of age, accruals will be made only from the day the documents are submitted. When calculating the amount, many factors are taken into account:

- how many children were born in the family;

- are there any older children?

- whether the parents are employed and whether insurance premiums have been paid over the past years;

- bet size;

- regional coefficient;

- region of residence.

On average, the child care benefit for children under 1.5 years of age in the second half of 2020 will be:

| Parent status | 1st child | 2nd and subsequent |

| Officially employed | 40% from avg. earnings | 40% from avg. earnings |

| Unemployed | RUB 4,465.20 | RUB 6,284.65 |

In 2020, payments “for child care up to 1.5 years” will be increased following the increase in the minimum wage and will amount to:

| Parent status | 1st child | 2nd and subsequent |

| Officially employed | 40% from avg. earnings maximum 26,152.39 | 40% from avg. earnings maximum 26,152.39 |

| Unemployed | RUB 4,512 | will be known by 01.01.19 |

Benefit from 1.5 to 3 years

If, after the child reaches 18 months of age, he needs special care, parents are given the right to extend the state-provided parental leave. But payments during this period will be symbolic, only 50 rubles. per month.

The following can receive benefits:

- officially employed citizens of the Russian Federation;

- persons dismissed during the liquidation of the organization;

- individual entrepreneurs;

- students (full-time);

- guardians and adoptive parents;

The family has the right to complete documents within 6 months after the child reaches 1.5 years of age. If for any reason the documents are submitted late, but up to 6 months, the state will pay the entire amount that was due for the past period. If the child is 2 years old and the benefit has not been issued, the family automatically loses the right to this type of payment.

Families with twins and triplets, as well as some categories of beneficiaries and parents living in the resettlement area have the right to maintain benefits for up to 3 years in the same amount as up to 1.5 years of age.

Payments upon registration

Expectant mothers will receive their first maternity benefits in 2020 immediately after registration. This type of financial assistance is available to all women who visited a doctor after 12 weeks of pregnancy.

The state has set a fixed amount of 632.76 rubles.

Unfortunately, it was not possible to avoid bureaucracy when receiving even such an insignificant amount according to current economic realities. In order for the money to be transferred to the account, the recipient will have to provide a substantial package of documents to the place of work or to the social security authorities (in the absence of employment).

What is called "maternity leave"

All women insured by the Social Insurance Fund (SIF) can receive a maternity benefit determined by calculation. You can be insured there either compulsorily (if there is an employer who pays contributions to the Social Insurance Fund) or voluntarily (when there is no employer and insurance premiums are paid independently).

The volume of maternity payments from the Social Insurance Fund is the product of the number of days of maternity leave and the average daily earnings of a woman for the two years preceding the year of maternity leave (Clause 1, Article 14 of the Law “On Compulsory Social Insurance...” dated December 29, 2006 No. 255- Federal Law).

When assigning benefits, it is allowed:

- if there are several places of work, calculate it separately by each employer or one place at a time, taking into account income received in all places of employment;

- shift the calculation period for which data will be taken by 1-2 previous years, if there was another maternity leave or parental leave in the calculation period, in order to obtain a higher average earnings.

The income from which the calculation is made is limited to the minimum and maximum possible values. The role of the first (if real earnings in terms of full working time is insufficient or the woman is insured in the fund voluntarily) is performed by the federal minimum wage, in force on the start date of maternity leave (clauses 1.1, 2.1 of Art.

Both boundary indicators characterizing the income taken into account increase annually, and it is for this reason that the values of the maximum and minimum maternity leave increased in 2020.

The number of days by which the amount of income related to the calculation period should be divided to obtain the average amount of earnings is equal to their real calendar number (730, 731 or 732, depending on which years fall within the calculation period). This amount is reduced by days corresponding to periods of payments not subject to insurance contributions (clause 3.1 of Article 14 of Law No. 255-FZ). The latter, in particular, includes time spent on sick leave, maternity leave and parental leave.

The coefficient taking into account the length of work experience is not applied to average earnings when calculating maternity benefits (clause 4 of Article 14 and clause 1 of Article 11 of Law No. 255-FZ).

To calculate the amount to be paid when applying for maternity leave in 2020, it is necessary to make rather complex calculations.

Before you begin calculations, you need to have the following information:

- the amount of the vacation worker’s salary for the previous two years (2017 and 2018);

- number of days in these two years (365,365=730);

- the presence and number of days that must be subtracted from the total (sick leave days, rest days without pay, during pregnancy);

- the amount of the minimum wage (minimum wage);

- rates of maximum social benefits;

- total work experience.

To calculate the amount, first calculate the average daily earnings, i.e. the total amount of income is divided by the number of days (for a total of 2 years minus those excluded).

The next step is to multiply the average daily amount by the number of vacation days indicated on the sick leave.

When calculating, there are the following nuances, which take into account not wages, but other initial data.

- If the amount received for the month is less than the minimum wage established as of the current date, then vacation pay increases to this indicator (9489 at the end of 2020).

- If the work experience is insignificant, calculations are not made, but the minimum wage rates are taken immediately.

- If salaries are high, they must be compared with the maximum indicators of social payments (in 2020 - 855 thousand per year) and vacation pay must be accrued within the specified limits.

The volume of payments and their list depends on the following parameters:

- Number of children in the family.

- Availability of benefits for parents.

- The administrative territory where the second child was born.

- Availability of employment for parents.

Payments may be one-time payments. That is, they are paid once. The following women are eligible:

- Women who are employed.

- Full-time students.

- Individual entrepreneurs who pay contributions to the Social Insurance Fund.

- Unemployed persons registered at the Employment Center.

Depending on which category the employee belongs to, the amount of the benefit is established. Payments are provided at the place of work or training, as well as in social centers. To receive benefits, a woman must contact her employer with the appropriate documents.

One-time payments are made at the birth of any child, regardless of how many other children the woman has.

The amount of the benefit for 2020 is 16,412 rubles.

Payments can also be monthly. They are issued if a woman contacts an employer before the child turns 1.5 years old. Let's look at the features of calculating monthly benefits:

- The accountant determines the average earnings for the last two years. 40% of this salary will be the amount of the benefit. This procedure is relevant only for employed women;

- 6,154 rubles will be a benefit for unemployed women, as well as employees whose insurance experience is less than 6 months. This is the minimum level. Payouts can be large.

The benefit can be received not only by the mother, but also by any person (related to the baby’s relatives) who actually cares for the child.

Amount of minimum maternity leave in 2020

When determining the amount of the minimum possible maternity benefits, one should be guided not only by Law No. 255-FZ, but also by the Regulations on the specifics of calculating benefits (approved by Decree of the Government of the Russian Federation dated June 15, 2007 No. 375). With regard to the calculation of the minimum wage for compulsorily insured persons, the Regulations prescribe:

- apply a regional coefficient to the amount of this minimum (clause 11(1));

- the minimum wage value corresponding to the start date of maternity leave should be spread over 24 months and divided by 730 days (clause 15(3));

- do not take into account the fact of working part-time (clause 16).

For those who are voluntarily insured, the calculation of the average daily benefit amount will be different (clause 15.4 of the Regulations):

- the regional coefficient for the minimum wage is not used here;

- The amount of daily benefits is determined by dividing the federal minimum wage by the number of calendar days in the month the maternity leave begins.

What will be the minimum amount of maternity payments in 2020? The minimum wage has been increased to 12,130 rubles from 01/01/2020. Calculation from it will give the following values of the minimum average daily benefit:

- for compulsorily insured persons - 12,130 × 24 / 730 = 398.79 rubles;

- for voluntarily insured persons (in relation to months with the largest number of calendar days in them) - 12,130 / 31 = 391.29 rubles.

The full amount of the minimum maternity payment in 2020, as in previous years, depends on the duration of maternity leave, which in a standard situation is 140 calendar days. With it, the minimum maternity leave is equal to:

- for compulsorily insured persons - 398.79 × 140 = 55,830.60 rubles;

- for voluntarily insured persons - 391.29 × 140 = 54,780.60 rubles.

However, these amounts may be further reduced if the woman does not use maternity leave in full or is the adoptive parent of a newborn.

When is the minimum B&R benefit paid?

The minimum amount of the benefit will be if the employee worked for less than six months before going on sick leave according to the BiR (we are talking about the total length of service).

Benefits should also be calculated from the minimum wage in cases where the average daily earnings are lower than the minimum possible.

In other situations, the payment is assigned according to the average daily income, and its size does not depend on the length of service (as with the payment of regular sick leave), but is limited by the maximum limit (more information about the maximum benefit amount is here).

Firstborn benefit

In the new year, families who have given birth to their first child will be able to receive an increased benefit for up to one and a half years. Its amount depends on the regional cost of living. On average, it is just over 10 thousand rubles. As the minimum decreases, the size of payments decreases.

You can apply for an increased benefit provided that each family member has an income below the required minimum. Proving your low financial position will be required by providing a certificate of income for all family members. If after the calculation it turns out that it exceeds the established minimum, the payment will be refused. The family will be paid the standard benefit amount.

Amount of one-time payment in 2020

After the child is born and a birth certificate is issued for him, parents can apply for a one-time benefit. Both the mother and the father can do this, regardless of whether they have an official place of employment.

In 2020, the one-time payment amount will be 16,759 thousand rubles. To obtain this, one of the parents should contact work. Which of them will be involved in submitting the document does not matter. After receiving the application, the money should arrive in the parent’s account within ten days.

Regional benefits for the third child

Regional governments are introducing their own measures to support large families. One of them is allowance for the third child. It is issued immediately after the birth of a child, regardless of whether the woman is officially employed or not.

The amount of benefit for the third child is set at the regional level. As a rule, it is equal to one subsistence minimum. The payment is processed simultaneously with the federal benefit. At the same time, parents will receive it until the child turns 3 years old.

Large families are paid benefits for any child born after the status was assigned. So, having given birth to their fourth or fifth baby, parents will be able to apply for regional payments for him.

What maternity benefits can you expect?

According to domestic legislation, maternity leave means the time spent during the last 2-3 months of pregnancy, childbirth and caring for a baby up to 1.5 (sometimes 3 years). Labor law provides mothers with the following benefits:

- upon registration;

- for pregnancy and childbirth;

- at the birth of a child;

- when caring for a baby up to 1.5 years old;

- when caring for a child under 3 years of age.

The law establishes the following periods of maternity leave:

- 140 days (70 before birth and 70 after birth);

- 168 days (84 before and 84 after in case of multiple pregnancy);

- 194 days (84 before and 110 after in case of birth complications, as well as at the birth of 2 or more babies);

- 70 days (for adoption of one child);

- 110 days (for adoption of two or more children).

If no deviations in the course of pregnancy are noticed, maternity leave is prescribed from the 30th week after conception. Depending on the nature of the complications, the dates may be shifted to the 28th week, and some mothers are released from work as soon as the 6th month of pregnancy arrives (24th week).

Maternity payments in 2020: latest news

In the new year, it is planned to index all existing payments for newborn children, including benefits for BIR and child care until the child reaches the age of one and a half years. The rules and conditions for their registration will remain unchanged. At the same time, there are no plans to introduce new social measures to support young families.

- about the author

- Recent publications

Anna Vladimirovna

I am the editor-in-chief of our information portal, and I carefully review all the material from our experts before publishing them here. An economist by education, specialization in accounting, analysis and audit. Experience as an accountant for 10 years. I can work with long texts and legal documentation.