Home / Labor Law / Payment and benefits / Maternity payments

Back

Published: 01/12/2018

Reading time: 12 min

0

3507

A newborn brings not only great joy to the family, but also additional financial expenses. After the birth of the baby, the mother does not work, spending all her time caring for the baby. During this period, financial assistance is very important. The state provides it through maternity payments, which the expectant mother receives during pregnancy and after the birth of the child.

Such payments to a woman are due for a period that usually includes 70 days before childbirth and can last the same amount after it.

The exact duration is determined by the doctor, which is recorded on the sick leave certificate.

Maternity benefits are calculated in accordance with Federal Law No. 81-FZ of May 19, 1995 “On State Benefits for Citizens with Children.”

The amount of payment, methods of payment and receipt are specified by Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity.”

- Categories of maternity leave recipients in 2020

- Indexation of maternity payments and minimum wage in 2020

- What does the amount of maternity leave depend on?

- Limit amount of maternity benefits

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

Does the amount of benefits depend on length of service?

Maternity leave is paid, its duration is about 4 months (two before and two after childbirth). During this period, it is the mother of the child who receives cash payments from the state; no other family member can be provided with this benefit.

In addition, it is important to know whether length of service is taken into account when calculating sick leave for pregnancy and childbirth. According to the law of the Russian Federation, the amount of payments varies depending on the length of the working period, but this applies to recently employed citizens with less than six months of experience.

According to the rules of the Labor Code, women who:

- work officially under an employment contract;

- serve in government agencies and local governments;

- are full-time students on a budget basis;

- serve in the armed forces of the Russian Federation;

- carry out entrepreneurial, legal and notarial activities;

- lost their job due to the closure of an organization or individual entrepreneur no more than a year ago and are registered with the employment center.

After 4 months, a second leave is granted - to care for a child, for the period of which accruals are also provided. They can be received by any family member caring for the child after submitting all the necessary documents.

If a woman works part-time for two years without changing employers, starting from 2020 she receives benefits from two organizations at once.

Terms of maternity payments

Every Russian citizen has the right to maternity leave, paid for by the state.

The duration of maternity leave for 2020 was 140 days: 70 days before and after the birth of the baby. If a woman was expecting two children at the same time, the period of maternity leave increased to 194 days: 84 days before and 110 days after childbirth. If the woman in labor had any health problems, the time frame for leave was also shifted, and the postpartum maternity leave was 86 days.

There is no standard amount of financial support for mothers, since each situation is considered individually. The only thing that can be said without additional calculations about the payment of maternity benefits in 2020 is that the payment terms will remain the same as they were in 2020. That is, the above-mentioned deadlines are also relevant this year.

It is also worth mentioning that other time frames will remain unchanged. Until the child turns one and a half years old, a young mother has the right to receive paid leave to care for her child. There is also the possibility of not going to work until the child is three years old, however, in such a situation, the woman will receive only symbolic financial assistance from the employer - 60 rubles per month.

How does it affect maternity leave?

If there is work experience, payments are calculated depending on the employee’s average earnings or her status, without taking into account length of service. Officially employed women and those serving in service receive benefits equal to their average earnings, no more and no less.

Female students receive compensation in the amount of their scholarship. And for those dismissed due to the liquidation of the employer, a benefit of 300 rubles is provided.

You can calculate charges for an employed woman, taking into account the following parameters:

- income for the last two years;

- number of working days;

- days of maternity leave.

The entire salary must be divided into working days.

If there are no days that can be excluded, then there will be 730 of them in two years (731 if one of the years is a leap year). Then multiply by the duration of maternity leave.

The latter indicator depends on how pregnancy and childbirth proceeds, and on the number of children in the womb (the minimum can be 140 days, the maximum can be 194). The working period for two years does not include days of temporary disability, maternity leave and child care.

What is maternity leave and who is entitled to it?

In 2020, regardless of whether the expectant mother is employed or not, she has the right to social benefits provided in connection with carrying a baby and bringing it into the world - the so-called “maternity benefits”.

Who receives maternity benefits:

- officially employed;

- military personnel;

- having unemployed status;

- who have adopted a child under 3 months of age;

- female students.

The right to leave and financial assistance is regulated by the Labor Code of the Russian Federation (Article 255). Each officially employed woman will have her own payment amounts.

The amount of payments depends on:

Articles on the topic (click to view)

- What is included in preferential medical experience?

- How much is the minimum old-age pension without work experience?

- How much work experience does a woman need to retire?

- How much work experience is needed for early retirement?

- How much is preferential teaching experience for retirement?

- How much municipal experience is needed for a municipal pension?

- How many minimum years of service does a woman need to qualify for a pension?

- work experience;

- income for two years before maternity leave (average daily income);

- number of days on the certificate of incapacity for work.

When calculating, they are guided primarily by the currently officially established minimum wage and the maximum permissible maximum payments taken into account.

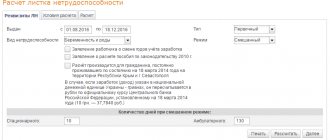

Payment calculation example

An employee with insurance experience is going on maternity leave from January 20, 2019.

Amount of income (100%) and calendar days (non-leap periods):

- 2017 - 390,000 rubles, number of days 365;

- 2018 - 410,000 rubles, number of days 365.

When calculating, accruals (390,000+410,000=800,000) and days (365+365=730) are summed up.

From the amounts received, the quotient is derived (800,000/730=1095.90) - the average daily earnings, i.e. coefficient that is multiplied by the number of vacation days:

- singleton pregnancy: 140*1095.90=153,426 rubles;

- multiple pregnancy : 194*1095.90=212,604 rub.

Who makes the payments

When the vacation in question is taken out, the finances must be provided by the company in which the mother is registered. The legislation specifies the time frame within which it is necessary to transfer money to a woman. This period should be 10 days. The countdown begins from the moment the complete package of documentation is provided.

In a situation where a citizen applies for money six months after the birth of the child, the amounts will be accrued and paid from the Social Insurance Fund. The reasons for departure from the established periods must be valid. If the mother does not have enough output, then payments to her will be provided from the budget of the Central Employment Center.

If your work experience is less than 6 months

There are cases when an employee works at an enterprise for no more than six months and leaves temporarily due to pregnancy and childbirth. Here we are talking about the smallest amount of payments. Maternity leave, if the length of service is less than 6 months, is calculated according to the average minimum wage.

In 2020 it is equal to 11,280 rubles. This indicator is also used when the employee’s average daily earnings are less than the lower limit established by law. The amount of the minimum wage may be higher in some constituent entities and regions of the Russian Federation.

There is also a maximum amount; it is limited by the size of the maximum base of insurance premiums. In case of repeated maternity leave, when the employee returns to perform her duties for a short period of time or without going to work at all, the benefit is provided a second time.

In this case, calculations will be made for the two working years that preceded the first vacation. To receive benefits, you must have a basis - a certificate of temporary incapacity for work. It is issued in district antenatal clinics for a period of pregnancy from 28 weeks.

Will maternity pay be paid if there is no experience?

If a woman does not work, she will not receive maternity benefits. But the situation changes if the expectant mother is officially recognized as unemployed: then she is legally guaranteed social benefits.

When documenting the status of unemployed, maternity benefits are calculated based on the established minimum amount of unemployment benefits - 1,500 rubles.

This is important to know: Is industrial practice included in work experience?

The following formulas are used for this:

- one-time payment amount: 1500 x 24: 730 x 140 = 6904.10 (rubles);

- monthly benefit amount: (850 x 24) / 730 x 30.04 x 0.4 = 335.78 (rubles).

Female students are also entitled to a payment (as those without work experience), its amount will be equal to the scholarship that the woman received before going on maternity leave.

In real terms, cash payments are so small that they do not stand up to scrutiny.

Who is eligible to receive the money?

The following categories of mothers can apply for this cash benefit from the state:

- Women who had a permanent job at the time of maternity leave. To process the payment, a woman must contact the social insurance department and notify the personnel department employees in her organization.

- Women registered as individual entrepreneurs. The amount of assistance will directly depend on the amounts that the woman transferred to the social insurance fund.

- Women who lost their permanent place of work, but managed to register with the employment center. To receive the payment, the lady must contact the social security department and provide a certificate from the antenatal clinic. Those categories of citizens who were at home and were not registered anywhere do not have the right to apply for maternity payments.

- Women who study as inpatients. In this case, the amount of the benefit will depend on the student's scholarship. Moreover, even if the girl studies on a contract basis, this will not affect the amount of payments. To obtain assistance, you must contact the dean’s office, providing a list of documents that will confirm your pregnancy.

How long do you need to work?

The fact that the expectant mother has insurance coverage does not in any way affect her eligibility to receive the benefits in question. This factor affects the amount of payment. This provision is connected by the fact that when calculating the amount, a couple of calendar years that preceded the decree are taken into account. Also of key importance is the size of a citizen’s salary.

Legislative acts define the rules in accordance with which benefits are calculated:

- when the time worked is a couple of years or more, the payment will be equal to forty percent of the employee’s average income;

- if the output is less than this value, then benefits are calculated based on the amount of payment for this time.

This is important to know: Accrual of pension points for Soviet service in 2020

Sometimes situations arise that the expectant mother has worked partly for the required period of time, and the output is less than a couple of years. In this situation, when calculating, it will be necessary to take into account what level of average wages occurred during the period worked.

When the output is less than six months, the calculations take into account the minimum wage established in the country. As of 2019, this figure is about 11.2 thousand. If the citizen was registered in the Central Taxpayer's Office, this indicates her authority to deduct the amounts in question. The accruals take into account the amount of benefits accrued by the specified service.