Types of account transactions 50

Postings to the cash register (account 50) are of two types: incoming and outgoing.

Receipt cash transactions reflect the receipt of funds to the cash desk from various sources and are reflected in the debit of the account.

Expense cash transactions for account 50 are issued when money is issued from the organization's cash desk and are reflected on the credit of the account.

The most common sources of cash receipts are such forms of cash payments as proceeds from sales of goods, works, services and cash withdrawals from a current account. All of them are reflected in the score 50.

In addition, cash may come from employees of the enterprise, contractors, individuals and the activities of individual entrepreneurs.

Funds from the organization's cash desk can be issued for the following purposes:

- wage;

- payment of benefits, sick leave and other compensation;

- reporting on business and travel expenses;

- compensation for expenses incurred by an employee while traveling for business purposes;

- loans, financial assistance and cash gifts to employees.

Account 50 - cash register

The settlement account received contributions from the founders as a contribution to the authorized capital of the company 51 75 14 The settlement account received funds from third-party organizations and citizens 51 76 15 The settlement account received funds from branches, representative offices, departments and other separate divisions 51 79 16 On settlement account received funds from investors in the form of a contribution to a simple partnership 51 80 17 The settlement account received funds for targeted financing 51 86 18 The settlement account received proceeds from the sale of goods, works, services (when determining revenue “on payment”) 51 90 19 The current account received income related to sales and other disposals, non-operating income was received 51 91 20 The current account received funds received free of charge, as well as future income 51 98 How to calculate vacation pay correctly and have time to rest.

https://youtu.be/DOajxMQw-Ys

Account 50. Cash desk: accounting entries upon receipt of funds and documents

| 50.01 To 62.01 | payment received from customers for shipped products |

| D 50.01 K 62.02 | received an advance on the account from buyers |

| D 50.01 K 90.01 | retail revenue for the day was capitalized |

| D 50.01 K 76.02 | the amount was deposited into the account of claims made under the business agreement |

| D 50.21 K 52 | cash withdrawn from a foreign currency bank account |

| D 51.01 K 51 | received at the cash desk from a current account, posting from a ruble account |

| D 50.01 K 55 | receipt of cash at the cash desk from a special account |

| D 50.01 K 75.1 | contribution to the authorized capital of the organization by the founder in cash |

| D 50.01 K 50.02 | money arrived from the operating cash desk to the organization's cash desk |

| D 50.01 K 79.2 | receipt of cash to the cash desk from a separate division |

| D 50.01 K 70 | return to the cash desk of overpaid wages by the employee |

| D 50.01 K 71 | unspent accountable funds were returned by the employee |

| D 50.01 K 73.1 | return by the employee of a previously received loan |

| D 50.01 K 73.2 | contribution by the employee to repay the material damage caused |

| D 50.03 K 60.01 | vouchers for employees, gasoline coupons received |

| D 50.01 K 50.01 | Received partial payment for the trip from an employee |

Accounting upon receipt and withdrawal

Cash accounting involves making a posting to account 50 in correspondence with another account upon the completion of an incoming or outgoing cash transaction.

A receipt transaction refers to the receipt of cash at the cash desk. Receipt amounts are entered in the debit of account 50.

In this case, depending on the source of funds, the corresponding account can be:

- 51 – when withdrawing cash from a current account;

- 60 – if cash comes from suppliers;

- 62 – from buyers;

- 66, 67 – upon receipt of loan funds from the bank;

- 71 – from accountable persons;

- 73 – repayment of loans by employees, amounts of damage contributed by employees;

- 75 – from the founders:

- 76 – from other contractors.

The amounts of cash withdrawn from the cash register are entered into credit account 50. In this case, depending on the direction of issuing money, the corresponding account can be:

- 51 – depositing cash at the bank;

- 58 – financial investments;

- 62 – payment to the supplier, seller;

- 60 – refunds to customers;

- 66, 67 – repayment of loans in cash;

- 68, 69 – payment of taxes, contributions;

- 70 – staff remuneration;

- 71 – issuance of money for reporting;

- 75 – refunds to founders;

- 76 – to other counterparties.

The basis for recording the entry for cash withdrawal from the cash register is the cash receipt order.

The table below shows the most common cash accounting entries.

| Operation | Debit | Credit |

| Withdrawing funds from a bank account | 50 | 51 |

| Receiving cash from foreign currency accounts | 50 | 52 |

| Receipts to the cash desk from special accounts (letters of credit, bills of exchange) | 50 | 55 |

| Cash refunds from sellers/suppliers | 50 | 60 |

| Receipt of funds from buyers | 50 | 62 |

| Receipt of short-term/long-term bank loan | 50 | 66 (67) |

| Refunds of unspent accountable money | 50 | 71 |

| Cash receipts from staff | 50 | 73 |

| Founder's contribution in cash | 50 | 75 |

| Operation | Debit | Credit |

| Transfer of proceeds to the bank | 51 | 50 |

| Delivery of foreign proceeds to the bank | 52 | 50 |

| Transfer of funds to special accounts | 55 | 50 |

| Making payments to suppliers | 60 | 50 |

| Refunds to customers | 62 | 50 |

| Repayment of loans | 66 (67) | 50 |

| Payment of tax amounts, insurance contributions | 68 (69) | 50 |

| Payment of wages | 70 | 50 |

| Issuance of accountable funds | 71 | 50 |

| Issuance of funds to employees for other transactions not related to wages | 73 | 50 |

| Payment of dividends by a company participant | 75 | 50 |

When carrying out business activities, organizations need to issue cash on account to employees for operational and business expenses, as well as for expenses associated with performing official tasks outside their place of permanent work. Employees who received money for these purposes are called accountable persons.

Cash issuance on account is made from the cash registers of enterprises. In this regard, the procedure for issuing funds on account is regulated by the Rules for conducting cash transactions and cash settlements in the Republic of Belarus. Money for these purposes can be received by enterprises only from banks and spent on the purposes for which they were received.

– for travel to the place of business trip and back to the place of permanent work in the amount of the cost of the submitted original travel documents. The posted employee is also reimbursed for the costs of booking tickets. In exceptional cases, in case of irregular transport services within one administrative district, with the permission of the employer, fares can be compensated without submitting travel documents at the minimum fare.

Expenses for travel by public transport (except taxis) to the station and pier, airport, if they are located outside the populated area, are also subject to reimbursement. Expenses for the use of bedding on trains are reimbursed to business travelers when traveling to and from their business trip.

– for the rental of residential premises (excluding travel time) in the amount of genuine paid invoices or receipts and other documents confirming the amount of expenses actually incurred (except for those cases when a posted worker is provided with free accommodation). Reimbursement of expenses for accommodation in luxury rooms is allowed in exceptional cases with the permission of the tenant. The posted worker, upon presentation of supporting documents, is also reimbursed for the costs of booking hotel rooms.

If a posted employee is provided with additional services that are not included in the room price (TV, refrigerator and other cultural and household items included in the hotel room equipment), these expenses are also subject to reimbursement based on supporting documents.

For living outside the place of permanent residence to cover additional personal expenses - daily allowance in the amounts established by the Ministry of Finance of the Republic of Belarus. Daily allowances for the time spent on the road are paid in the same amounts as for the time spent at the place of business trip.

To a posted employee, no later than the day before departure on a business trip, the employer is obliged to issue a cash advance within the limits of the amounts due to pay the cost of travel to and from the place of the business trip, expenses for renting living quarters and daily allowances.

Sending an employee on a business trip is formalized by an order and issuing a travel certificate to the employee. The time spent at the place of business trip is determined by the arrival and departure marks on the certificate. If an employee is sent to different localities, notes about the day of arrival and the day of departure are made at each point and certified by a seal (stamp) with the name of the organization to which the employee was sent.

Cash issuances on account for expenses associated with business trips of employees are made subject to a full account of the amounts previously received for these purposes. Cash issuances for expenses related to business trips can be made through the return of funds previously issued for these purposes and stored in the company's cash desk.

– no more than 3 working days – for expenses incurred at the location of the enterprise;

– no more than 10 working days – for expenses incurred outside the location of the enterprise;

– up to 30 working days – in an amount not exceeding one base amount.

The transfer of cash issued on account to one person to other persons is prohibited.

– cash order form KO-1;

– receipt form KV-1;

– receipt form 20-fs;

– cash receipt with an attached copy of the sales receipt, other receipt documents approved in accordance with the legislation of the Republic of Belarus.

Persons who have received cash on account for expenses associated with business trips are required, no later than 3 working days after the expiration of the period for which they were issued, or from the date of return from a business trip, to submit an advance report on the amounts spent to the accounting department. Unused cash is returned to the cash desk, and personal funds used in the interests of the enterprise are subject to reimbursement.

– travel certificate with stamped notes on the day of arrival and day of departure from the place of travel;

– travel documents,

paid bills, receipts or other documents confirming the costs of renting residential premises and other expenses;

– report on the work done (at the request of the employer).

Unspent accountable amounts are returned to the cashier, overspent amounts are paid to the employee.

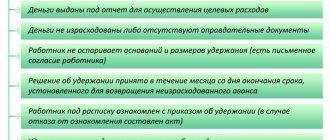

Accounting for funds issued for reporting is carried out on account 71 “Settlements with accountable persons”. For the amounts issued for reporting, account 71 is debited in correspondence with the credit of cash accounting accounts (50, 51, 52, 55). For the amounts spent by accountable persons, account 71 is credited in correspondence with the debit of accounts that record expenses (08, 20, 23, 25, 26, 29, 44) and acquired values (07, 10, 15, 16, 18, 41, etc. .) or other accounts, depending on the nature of the expenses incurred.

Accountable amounts not returned by employees on time are reflected in the credit of account 71 and the debit of account 94 “Shortages and losses from damage to valuables.” Subsequently, these amounts are written off from the credit of account 94 to the debit of account 70 “Settlements with personnel for wages” (if they can be deducted from the employee’s wages) or 73 “Settlements with personnel for other operations” (when they cannot be deducted from employee remuneration).

Account 50. Accounting for funds, transactions for issuing money from the cash register

| 51 K 50.01 | cash deposit to current account |

| D 70 K 50.01 | wages paid to employees |

| D 71 K 50.01 | amount reported |

| D 71 K 50.21 | travel allowances issued in foreign currency |

| D 58-1 K 50.01 | payment in cash for shares purchased |

| D 58-3 K 50.01 | a cash loan was issued to a counterparty |

| D 60.01 K 50.01 | payment to the supplier in cash for the supply of goods, work, services |

| D 62.01 K 50.01 | refund to the buyer when returning the goods |

| D 66 K 50.01 | repayment of the loan (debt) and interest on it from the cash register |

| D 69-1 K 50.03 | workers were issued vouchers paid for from the Social Insurance Fund |

| D 73.03 K 50.03 | employees were given purchased vouchers and gasoline coupons |

| D 91.02 K 50.03 | part of the trip paid by the employer was written off |

Accounting for cash on account 50 – “Cash desk”

Accounting account 50 is intended for accounting for cash flows, that is, for accounting for cash transactions. Debit 50 is intended to reflect cash inflows, credit 50 is intended to reflect cash outflows.

Documentation of cash transactions

All cash receipts and payments must be reflected in the statutory cash book; its maintenance is mandatory for every organization. All entries in the cash book are made on the basis of primary documents: incoming and outgoing cash orders. The entry of cash into the cash register is formalized by a cash receipt order, unified form KO-1, and the write-off of cash from the cash register is formalized by an expenditure cash order, form KO-2.

Analysis of account 50 shows that account 50 is active, intended to reflect assets (cash), its balance is always debit. An increase in an asset is reflected in a debit, a decrease in a credit.

Transactions with cash necessarily involve the use of cash registers, with the exception of some types of activities for which strict reporting forms can be used; read more about this in this article.

For each organization, a cash balance limit is established, that is, the amount of cash that can remain in the cash register at the end of the day; the amount in excess of the limit must be handed over to the bank at the end of each working day. When transferring cash to the bank, a forwarding slip is issued for the bag. The excess amount of cash can be left only to pay wages and benefits, but no more than five working days, including the day the bank issues the money.

The cash desk can store not only cash, but also monetary documents (paid tickets, vouchers).

Conducting cash transactions is regulated by certain regulatory documents that must be studied for proper cash accounting and proper cash management.

Regulatory documents for cash transactions:

- The Regulation “On the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation”, approved by the Bank of Russia on October 12, 2011 No. 373P, is the main document regulating cash transactions.

- Regulations on the use of KKM No. 745 1993 (ed. 08.08.2003)

- Directive of the Bank of Russia dated June 20, 2007 No. 1843-U “On the maximum amount of cash settlements between legal entities.” At the moment, the maximum amount of cash payments between legal entities is limited to 100 thousand rubles.

|

Trade and reflection of retail revenue in NTT

The process of reflecting trade in 1C Accounting 8.3 for a manual point of sale can be reflected in the following sequence:

- movement (admission) to NTT;

- inventory;

- fixation of retail revenue with a cash receipt order;

- Creation of a retail sales report based on inventory.

Since the topic of the article is retail revenue, I will only consider 1C cash documents - “Cash receipt order” and “Retail sales report”.

The topic of retail trade is covered in more detail in our article - Retail sales in 1C 8.3 Accounting

Trading in NTT does not imply daily reflection of revenue and reflection of sales of goods. The organization independently determines the period when to register receipt of revenue and take inventory.

Important! When registering an operation to receive revenue from a manual point of sale, you must first create and post a cash receipt order, and then draw up a sales report.

Now I’ll explain why. Let's create a PCO with the type of operation “Retail Revenue”. As a warehouse, we will indicate a retail outlet with the type “NTT”:

Let's run the document and see what movements (in particular postings) it will generate:

As you can see, account 90.01.1 does not have a third subaccount. And there is nowhere for it to come from, since the PKO does not contain information about the goods sold.

Now let’s create a report on retail sales in NTT (the program itself will determine the type of operation based on the type of warehouse). We will assume that we have already carried out an inventory and created a document with a report based on it:

We post the document and look at the postings:

When posting, the posting created by the cash receipt order is reversed, and postings are created with the third subaccount filled in. This analytics is needed to correctly perform routine operations at the end of the month.

This is why it is important that a PCO is carried out first.

https://youtu.be/eopPbPIGWFE

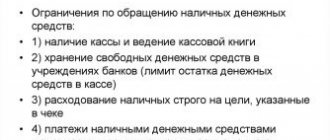

Regulation of cash transactions

Cash flow is typical for almost all enterprises and individual entrepreneurs. The specifics of conducting cash transactions are enshrined in the instruction of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014. The document regulates the registration and accounting of cash flows of economic entities.

Currently, there is still a need to independently determine the cash settlement limit each year. However, for small businesses and individual entrepreneurs the obligation to set a cash limit has been abolished. They no longer need to monitor their cash balance on a daily basis.

For more details, see the article “Cash discipline - cash balance limit for 2020.”

Common questions about 51 accounts

Question. How to reflect the receipt of revenue on the current account if the buyer paid for services with a bank card?

Answer. In this case, make the following entries

- Debit 62 / Credit 90.1 – revenue paid by bank card is reflected

- Debit 57 / Credit 62 - posting is done if the money does not immediately appear in the organization’s current account

- Debit 51 / Credit 57 – amount credited to the organization’s current account

- Debit 51 / Credit 62 - posting is done if the money is immediately credited to the organization’s current account

Responsibility for failure to comply with cash discipline

Business entities are responsible not only for the correct execution of cash documents, but also for the completeness of cash receipts. The statute of limitations for violations of cash transactions is short and is only 2 months. The tax office has the right to hold violators administratively liable if errors are discovered. According to paragraph 1 of Art. 15.1 of the Code of Administrative Offenses of the Russian Federation, the fine for organizations can reach 50,000 rubles. For individual entrepreneurs and managers under the same article, fine payments will amount to 4,000–5,000 rubles.

For more information about the level of responsibility, see the material “Are your cash discipline in order?”

Individual entrepreneurs are exempt from full-fledged cash transactions with the establishment of a cash limit and the use of strict unified forms of documents. But if entrepreneurs still work in the course of their activities with cash settlement and payment services, then they must be filled out in accordance with all the rules.