The procedure for taking inventory of cash at the cash desk

The procedure for auditing cash at the cash desk consists of the following steps:

- Approval of the composition of the commission in an order using the unified form INV-22 (or similar to it, developed independently)

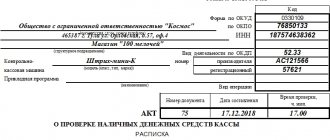

- Receiving a receipt from the cashier confirming the absence of unpaid cash and unaccounted for cash documents. The cashier also provides the commission with the latest cash report.

- Recalculation of funds and documents, comparison of the result with accounting, verification of the availability and movement of strict accounting forms with the information reflected in their registration log.

- Registration of inventory results in the INV-15 form.

Cash inventory in the INV-15 form can be found on our website.

Who conducts cash register inventory in 2020

Regardless of whether it is a planned inspection or not, the head of the organization must issue an appropriate order. With his help, he appoints members of the commission that will deal with the inventory. Usually a permanent commission is created. However, there are situations when an organization needs to perform a large amount of inventory work. In this case, you can additionally create working commissions. Typically, the audit team includes:

- accounting workers;

- representatives of the company's management;

- internal audit employees and employees of independent audit organizations;

- managers;

- economists;

- company security officers.

Each participant is personally approved by the director. All members of the inspection team must be present during the inspection. If one of them is missing, the check will be considered invalid. If there have been no personnel changes in the company, the manager has the right to use the same order on the composition of the inspection team that was issued last time.

The procedure for taking inventory of cash at the cash desk

As already mentioned, this procedure begins with the issuance of an appropriate order by the manager.

Before the inspection team begins to fulfill its obligations, all operations carried out by this cash register are stopped. The cashier or other financially responsible person must give a receipt stating that there is no unaccounted money or cash in the cash register that has not been capitalized. In this case, the commission is presented with all expenditure and receipt documents. After this, the inspection team begins the actual inspection. To do this, all funds currently available in the cash register are recalculated. This procedure is carried out in the presence of all members of the commission and under the strict supervision of the responsible employee. The amount obtained during the calculation is compared with the amount indicated in the documents. As you can assume, the result of the check can be one of three options:

- excess cash has been identified;

- shortage detected;

- actual availability corresponds to the information specified in the documents.

The final stage of the inventory is the registration of its results. To do this, fill out the corresponding act. The number of its copies depends on the specific situation. Usually two copies are made: one is intended for accounting, the second is given to the responsible employee. If the inspection was carried out due to a change in the financially responsible person, the document is made in triplicate. After entering all the necessary information in the document, each member of the inspection team must sign their autograph.

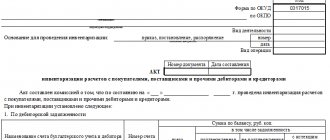

Procedure and sample for filling out the act f. INV-15 when taking inventory of the cash register

The inventory report is filled out on a computer or manually. No corrections or erasures are allowed.

The following sections are included in the relevant sections of the act:

- Name of the organization;

- name of the division (when conducting a cash audit in a separate division);

- document - the basis for conducting a check of the cash register, its number and date;

- number and date of the act, as well as the date of the inventory;

- cashier's signature on the receipt;

- the actual amount of cash, securities and other monetary documents;

- monetary asset records;

- audit results data;

- explanation of identified surpluses/shortages;

- signatures of commission members and financially responsible persons.

For more information about the procedure that should be followed when conducting cash transactions, read this article .

Cash inventory report sample filling

So, the results of the audit are summarized, for which an inventory report of cash in the cash register is drawn up. If deviations from the accounting data are identified, the reverse side of the report must be filled out, where the identified violations are listed, the cashier’s explanation is given, and management makes a decision on eliminating the discrepancies.

As a rule, if during a cash register audit a surplus is identified, then after receiving written explanations from the cashier, they are received at the cash desk on the day of the audit. Deficiencies are subject to recovery from the guilty person.

You can fill out the cash inventory report at the cash desk on a computer or by hand in blue or black ink, avoiding mistakes and blots. An act is drawn up in 2 copies, signed by the members of the commission, and the cashier signs that he is responsible for all the counted values.

Results

Periodic inventory of the cash register in the interests of any legal entity and individual entrepreneur working with cash. This helps to identify any shortages in a timely manner, stop abuses and discipline cashiers. The results of the inventory are documented using an act of form INV-15 or similar.

Sources:

- Code of Administrative Offenses of the Russian Federation

- Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49

- Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Cash inventory: goals and frequency

Cash inventory, as an effective control tool, is the main activity for checking the timeliness of cash transactions and acceptance for accounting, as well as compliance with legal requirements when registering them. A cash audit can be carried out as an independent audit, or be one of the sections of a comprehensive audit of the company’s production and financial activities. It takes place in two stages:

- inventory of cash and comparison of documented information with the actual availability of money;

- checking compliance with cash discipline.

The company’s internal auditors, as well as external auditors - the bodies of Rosfinnadzor and the Federal Tax Service - can monitor compliance with cash discipline.

As part of an internal audit, the frequency of inventory is established by the manager, and the procedure for conducting it is developed and fixed by local acts.

The cash register is usually checked:

- once a month, quarter or six months (in accordance with the adopted accounting policies), and always on the 1st day of the year following the financial one;

- when transferring the cashier's powers to another employee;

- during reorganization/liquidation of the company;

- in case of force majeure circumstances.

The attention of Rosfinnadzor authorities is drawn to companies that receive government investments, quotas and loans from the budget or extra-budgetary funds. They check the movement of funds through the cash register and in accounts, considering the intended purpose and legality of spending. Representatives of the tax authorities, when initiating an audit of the cash register, pay attention to the completeness of the receipt and accounting of revenue. As a rule, external inspectors ensure surprise inspections, which does not happen when control activities are planned within the company.

The obligation and procedure for conducting an inventory of the cash register, as well as all assets of the company, is regulated by the Methodological Instructions approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49.

Procedure for drawing up the act

The standard form consists of two pages. You can download the sample at the end of the article

Sample: form INV-15, first page.

Lines with the name of the organization, type or form of activity, and its hierarchical structure must be filled in.

It is necessary to reflect the number and date of the order to carry out the inventory and the creation of a commission to conduct it. The number of the act, as well as the date of its execution, are required to be filled out.

The person in charge (cashier) signs with a decoding of the name, surname and position under the receipt.

And then the commission fills in the lines that reflect the recorded results of the inspection, that is, the number:

- cash available in the cash register;

- valuable papers;

- marks that were counted by them.

Data is indicated in ruble equivalent.

It then states what their availability should be according to the cashier's report provided. The results of the comparative analysis are reflected respectively on the line “surplus” or “shortage”, indicating the specific amount.

On the same page of the form, fill out the numbers of the last incoming and outgoing cash orders. At the bottom of the page, all members of the commission sign with a description of their surname, initials, position, including the financially responsible person, that is, the cashier.

You can see an example of how to fill out the form, including its first page.

Filling out the second page of the form is carried out in the case when the actual availability of cash at the cash desk differs (up or down) from the provided cash accounting data.

Here, the person responsible for storing cash and other securities (cashier) explains the reasons for the shortage or surplus, if any.

Based on the results of the inventory, analysis of the reasons indicated in the explanation by the cashier, the head of the organization makes his decision on the existing surpluses or shortages, the procedure and timing for their elimination.

The manager certifies the document with a signature and seal and indicates the date.

An example of a completed INV-15 form, reverse side.

General provisions on inventory

The Ministry of Finance of the Russian Federation, by its Order No. 49 dated June 13, 1995, approved the Guidelines for the inventory of property and financial obligations. Clause 1.1 of this regulatory act places the obligation to conduct inspections exclusively on Russian legal entities. Domestic organizations must reconcile not only property, but also conduct an inventory of cash. Acts drawn up based on the results of such studies actually complete the verification.

Russian rule-making acts provide for several cases of reconciliation of actual assets and liabilities with accounting data:

- circumstances listed in clause 1.5 of the Guidelines;

- appointment of an audit at the initiative of the company’s management or in accordance with accounting policies.

The head of the enterprise, by order, orders an inspection and determines the members of the relevant commission, who, with their signatures, certify the INV-15 cash inventory act and other documents drawn up based on the results of the reconciliations.

The procedure for conducting cash checks was developed by the Ministry of Finance of the Russian Federation in paragraphs 3.39 - 3.43 of the Guidelines. According to existing rules, inventory is carried out in accordance with the Procedure for conducting cash transactions. However, the existing cash processing algorithm does not regulate the audit of money. The cash inventory form at the cash desk is the document that completes the check.

The procedure and timing of cash register inventory in 5 steps

- Before you start checking, draw up an order to conduct an inventory of cash in the cash register.

- Appoint a commission that will conduct the review.

- The cashier must provide the inspectors with the latest cash report.

- The cash inventory report is filled out step by step. To begin, please indicate:

- the name of the company and its legal form,

- OKVED code,

- number and date of the order on the basis of which the inventory is carried out.

The next part is filled out by the inventory commission.

- If there are securities, stamps, etc. in the cash register, the inspectors must also enter their quantity in the INV-15 act. See the sample filling - it shows how to correctly enter information about funds.

- In the same part of the form, you must enter the amount of cash according to accounting data - it must coincide with the one indicated by the commission.

- If there are discrepancies, they should be noted in the next part of the cash inventory report. There you also need to enter the last numbers of the PKO and RKO, which were registered before the start of the inspection.

- All members of the commission are required to sign Form INV-15. The financially responsible employee must also sign again.

- On the second side of the cash inventory report (INV-15 form), the employee must give an explanation of the shortage or surplus in the cash register. Based on his comments, a decision is made on how to deal with the discrepancy - it must be indicated on the form, stamped and signed by the manager.

Amounts must be indicated in numbers with a full written explanation.

If the commission finds discrepancies between the actual amounts and those recorded in accounting, you need to fill out the back of the form.

Step 1. First, an order from the manager is issued, which defines:

- timing;

- location;

- areas and objects that will be inspected;

- composition of the inventory commission.

The task of inventorying cash, as well as other valuables in the cash register of an enterprise, is to reconcile accounting data with the data in the cash book. In addition, the cash balance must correspond to:

- data from the cashier-operator's book;

- cash register data;

- indicators on the cash register tape.

Important! The absence of at least one member of the inventory commission is a reason to invalidate the results of the cash audit. It is also impossible to carry out an inventory without a cashier responsible for the valuables in respect of which the check is assigned (Appendix No. 2 of the Resolution of the Ministry of Labor of Russia dated December 31, 2002 No. 85, letter of the Ministry of Finance of Russia dated July 15, 2008 No. 07-05-12/16, clause 2.8 of Guidelines No. 49).

Before the start of the inspection, the financially responsible person submits the latest (current) cash documents to the inventory commission. In particular, these are incoming (Form No. KO-1) and outgoing cash orders (Form No. KO-2) or cash flow reports (for example, a certificate - report of the cashier of the operator, Form No. KM-6, Z-report, etc.) .

The responsible employee also confirms in writing that:

- all documents related to cash settlements have been submitted to the accounting department or handed over to the commission;

- the incoming assets are capitalized, and the disposed assets are written off as expenses.

Let's jump ahead a little and note that for this purpose, the cash inventory report in form No. INV-15 provides a special section “Receipt”.

https://www.youtube.com/watch?v=ytabout

The chairman of the commission endorses the received documents with the indication “before inventory on “(date).” This serves as the basis for accounting employees to determine the balances of monetary assets according to accounting data at the time the inventory begins.

Next, the verification itself is carried out.

Cash (paper bills and coins), as well as other valuables, are counted in the presence of all members of the commission. The actual balance is verified with the cash book data. If cash accounting is automated, then it is compared with program data.

Checking the actual availability of securities forms and strict reporting document forms is carried out according to (clause 3.41 of Methodological Instructions No. 49):

- types taking into account their starting and ending numbers;

- storage places;

- financially responsible persons.

When is a cash register inventory carried out?

According to Part 3 of Article 11 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as Law No. 402-FZ), the cases, timing and procedure for conducting an inventory are determined independently by an economic entity in a local regulatory act (hereinafter referred to as – LNA) taking into account the provisions of the Order of the Ministry of Finance of the Russian Federation dated June 13, 1995.

- change of financially responsible persons;

- preparation of annual financial statements;

- transfer of property for rent, redemption or sale;

- identification of facts of theft, abuse or damage to property;

- natural disasters, fire, accidents, etc.;

- reorganization/liquidation of the organization.

Current legislation also establishes other cases of mandatory inventory. For example, when selling an enterprise as a property complex (Article 561 of the Civil Code of the Russian Federation). In addition, the company management can supplement the legislative list. Let’s say that the LNA provides for a mandatory quarterly audit of the cash register. All of these cases are grounds for scheduled inspections.

An unscheduled (sudden) inventory is carried out unexpectedly for the financially responsible person (cashier) in order to control his activities. This check is carried out:

- by decision of the manager (in order to identify the cause of an error or to strengthen the internal control system);

- at the request of investigative and control authorities.

Since the timing of unscheduled audits is not defined at the legislative level, it means that the business entity must establish them.