Inventory of accounts in 1C 8.3, if it is discussed within the framework of accounting, implies a control procedure that makes it possible to identify the presence and general condition of assets and liabilities as of a certain date.

At the legislative level, the inventory procedure is regulated:

- Federal Law “On Accounting” dated December 6, 2011 N 402-FZ;

- Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 N 49 (as amended on November 8, 2010) “On approval of the Methodological Guidelines for the Inventory of Property and Financial Liabilities.”

Taking into account legal norms, in this article we will look at how to correctly document the results of an inventory of debt, inventories, fixed assets and work in progress in the 1C Enterprise 8.3 system using an accounting program.

If you have difficulty displaying your inventory, please contact our specialists. We will advise you and select the optimal price for 1C support.

In the system, none of the documents used to prepare inventory generate accounting entries, but on its basis documents can be created that directly adjust accounting data. Let's consider each type separately.

Carrying out an inventory in 1C of counterparties' debts

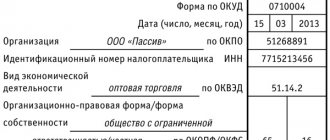

It is drawn up in the document “Settlements Inventory Act” (SIC). This inventory document has the task of reflecting the result, while the process of reconciliation with counterparties itself occurs using a reconciliation act. AIR does not contain detailed information on settlements with buyers and suppliers, but displays the total amount of debt for each counterparty as of the date. Based on the inventory report, you can print INV-17 (Act of Inventory of Payments) INV-22 (Order for Inventory).

The document is located in the sections “Purchases / Sales - Settlements with counterparties - Settlements Inventory Acts”.

Fig.1 Shopping

Fig.2 Sales

The document contains only 6 tabs: Accounts receivable, Accounts payable, Settlement accounts, Inventory and Inventory commission.

Fig.3 Tabs

Before filling in the data, you need to set up accounts on the “Settlement Accounts” tab for which balances will be displayed on the inventory date. By default, the program will automatically display a list of all accounts in which, according to RAS rules, debts from counterparties are accumulated and which are configured for a specific organization. The list can be edited if necessary.

Fig.4 Inventory of calculations in 1C 8.3

The next step involves specifying administrative information: the period and basis for conducting an inventory on the tab of the same name and the appointment of members of the inventory commission also on the corresponding tab. The data from the completed fields will appear on the printed form.

On the “Accounts Receivable” and “Accounts Payable” tabs, when you click the “Fill” button, the system will automatically fill in the balances of the configured accounts for each counterparty. By default, all balances in the system are considered confirmed. Unconfirmed amounts for the counterparty and amounts of debt for which the statute of limitations has expired must be filled in manually.

The inventory report itself does not generate transactions, and adjustments to the amount for counterparties must be carried out using the “Debt Adjustment” document.

Purpose of the INV-17 form

Before preparing financial statements, organizations need to take an inventory of their assets and liabilities. This facilitates not only the correct completion of the balance sheet, but also the timely identification of inconsistencies between accounting data and information available to counterparties.

To learn about what accounting data needs to be inventoried before starting to compile annual reporting, read the material “How to conduct an inventory before annual reporting.”

The need for an inventory also arises in the following cases:

- when changing materially responsible persons;

- theft at an enterprise and other unusual situations;

- liquidation of the organization.

The unified form INV-17 is used to document the results of the inventory of receivables and payables. It was put into effect by Decree of the State Statistics Committee of Russia “On approval of unified forms of primary accounting documentation for recording cash transactions and recording inventory results” dated August 18, 1998 No. 88. But it is not mandatory for use since 2013. It is possible to use a self-developed form of similar content instead. However, the INV-17 form contains fields for filling in all the information that must be reflected in such a form, and therefore continues to be actively used.

How to conduct an inventory in 1C? Let's talk about stocks

The inventory audit is documented in the “Goods Inventory” document, located in the “Warehouse-Inventory” section.

Fig.5 Sections of the “Warehouse”

Within the framework of this document, the operation can be carried out at the place of storage of inventories by selecting the appropriate warehouse, or at the materially responsible person (in this case, the warehouse field is not filled in).

As in the case of the first document (with the act), filling out should begin with administrative information, on the “Inventory” “Inventory Commission” tabs.

When selecting a warehouse, the system automatically fills in data on item items and their actual quantity, price and amount. These amounts can be manually edited after the actual inventory count has been completed. Data on the recorded data is filled in when you click the “Fill-Refill accounting quantities and amounts” button. The system calculates the difference between actual and accounting data automatically.

After posting the document in the system, based on it, you can make write-offs and capitalization of goods and a report on retail sales, which already generate the corresponding accounting entries based on the inventory results.

For all questions related to warehouse accounting, please contact the 1C consultation line in Moscow, and also leave applications on our website. Our specialists will contact you as soon as possible.

Write-off of goods in 1C from the warehouse

In order to write off goods based on inventory, you need to create a new write-off document.

In “Inventory”, click the “Create based on” - “Write-off of goods” button:

The 1C Accounting 8.3 program will automatically generate a write-off for items that had a shortage:

If everything is correct, just click the “Pass” button. Let's check the write-off transactions:

Inventory of non-current assets

The inventory of non-current assets is drawn up in the document “Inventory of fixed assets”, located in the section “Fixed assets and intangible assets-Accounting for fixed assets”.

Fig.6 Sections “OS and intangible assets”

Similar to inventories, an inventory of fixed assets can be carried out either by division or by the financially responsible person. When conducting one division at a time, you must indicate the location of the OS. If you plan to conduct it at several storage locations, then it is enough to indicate the responsible person (leave the “Division” field empty).

Similar to the first two documents, first fill in information about the period and basis of the inventory on the “Inventory Conduct” tab and indicate the composition of the inventory commission.

The main task of conducting an inventory of fixed assets is to ensure their availability, therefore, when filling out the “Fixed Assets” tab, there is no data on the quantity, and the check is carried out based on the inventory number. After the actual inspection, the marks in the document must be removed (if the asset is not found). The difference will be calculated automatically.

Fig.7 Undetected assets

After posting the document in the system, based on it, you can create write-offs, acceptance for accounting, or transfer of fixed assets. And these documents, in turn, already form postings in the system.

General points

In all cases, the header of the document, where data on the inventory order is entered, is required to be filled out.

— but “type of operation” can be left empty.

INV-1 allows you to enter more than 22 positions. To do this, you just need to print the required number of copies of page No. 2. Please note that the total values are calculated both for the current page and for the document as a whole.

If, as in our example, discrepancies were found between the physical presence of fixed assets and their accounting in accounting, you should proceed to filling out a matching statement.

Inventory of work in progress

The 1C accounting program supports accounting for work in progress. Section “Production-Product Release”.

Fig.8 Production

The document reflects only the results of inventory by cost centers by types of products (product groups). Unlike other types of inventory, WIP should be registered in the program in only 2 cases:

- If during the period the organization produced products, and at the end of the reporting period there are balances (after the routine closure procedure);

- If there is no production, but according to the accounting policy, the balances of work in progress include the amounts of direct expenses (in this case, the accounting policy itself establishes the method “Using the document “WIP Inventory”).

The document records the results by department and type of product (product group). Data on the amount of accounting and tax accounting are filled in manually.

Although the price of 1C:Accounting is one of the lowest in the 1C product line, as we have seen, this product is not only a regulated accounting tool, but also a multifunctional assistant in warehouse, production and management accounting.

Formation of the initial cost of fixed assets

In accordance with Instruction No. 26, the cost of fixed assets is distinguished:

initial , which is defined as the amount of actual costs for the acquisition of an object and is established during the initial placement of the asset on the balance sheet. The initial cost is transformed into

revalued , arising when an organization revaluates objects (as a rule, on January 1 in accordance with the current legislation of the Republic of Belarus),

or current (market) , determined in cases established by law (non-monetary contribution to the authorized capital, gratuitously received fixed assets with “zero” residual value, etc.),

as well as the cost of impairment. Impairment is carried out at the request of the organization, based on established criteria (clause 16 of Instruction No. 26) and based on economic feasibility.

In addition, in accordance with the Instructions on the procedure for calculating depreciation of fixed assets and intangible assets, approved by Resolution of the Ministry of Economy, the Ministry of Finance and the Ministry of Architecture and Construction dated February 27, 2009 No. 37/18/6 (hereinafter referred to as Instruction No. 37), according to The depreciable liquidation of fixed assets can be calculated .

| NOTE! The procedure for changing the initial cost of fixed assets, the methods and methods used should be specified in the order on accounting policies. In addition, these issues fall within the competence of the permanent depreciation commission, therefore, the order (instruction) of the organization on the procedure for its work should include the corresponding responsibilities. |

The initial cost of fixed assets acquired for a fee is recognized as the amount of the organization's actual costs for acquisition, construction and production. The actual costs for the acquisition, construction and production of fixed assets are:

— the cost of the object according to the agreement (contract).

In the case of construction of an object with the involvement of a contractor, the costs of paying for the services of third-party organizations engaged to carry out construction and installation work and other similar types of work related to the acquisition, construction and production of fixed assets are accumulated in account 08 “Investments in non-current assets”, subaccount “ Acquisition of fixed assets” upon the readiness of the object, which must be confirmed by the commission upon acceptance of the object. The commission should include not only representatives of the customer and contractor, but also of the urban planning service and/or technical supervision;

— customs fees and duties.

If the organization purchasing fixed assets from suppliers is a VAT payer, then this tax paid on the acquisition of fixed assets is recorded as the debit of account 18 “Value added tax on acquired assets” and the credit of accounts 60 “Settlements with suppliers and contractors”, 76 "Settlements with various debtors and creditors." At the time of registration of fixed assets, VAT amounts subject to reimbursement in accordance with the procedure established by the legislation of the Republic of Belarus are written off from the credit of account 18, to the debit of account 68 “Tax calculations”.

If an organization is not a VAT payer, this tax must be included in the cost of acquired fixed assets.

If an asset is purchased using targeted budget funds, the tax amount is attributed to the source of financing and written off against 91 “Other income and expenses.”

This type of cost also includes registration fees, state duties and other similar payments made in connection with the acquisition (receipt) of rights to an object of fixed assets .

For example, to register a car with the traffic police, obtain a registration certificate for a property, enter a land plot into the cadastral register, etc.;

— costs of cargo insurance upon delivery to the place of operation;

— services of other organizations related to bringing the facility to a state of readiness.

Acquired fixed assets that do not require installation are written off in the amount of actual acquisition costs from account 08 “Investments in non-current assets” to account 01 “Fixed assets”.

| NOTE! Paragraph 34 of Instruction No. 37/18/6 on depreciation contains a rule according to which depreciation for acquired fixed assets is calculated from the moment of actual operation. For example, an organization purchased equipment that does not require installation for use in the production of products. However, its direct use can begin only after completion of repairs in the premises where production activities will be carried out. In accordance with accounting approaches, an object is taken into account as an item of fixed assets (account 01) at the time of acquisition and from that moment it is considered to be put into operation. However, there is no actual use of this object. Consequently, depreciation on such equipment will begin only after the necessary conditions have been created and its direct operation has begun in accordance with the goals of the organization. |

— other costs directly related to the acquisition, construction and production of fixed assets. In particular, these include:

1) remuneration paid to the intermediary organization through which the fixed asset was acquired.

These costs may arise for the organization if the intermediary organization was directly involved in the transaction between the supplier and the buyer of fixed assets;

2) amounts paid to organizations for information and consulting services related to the acquisition of fixed assets.

If, when purchasing fixed assets, the services of relevant organizations were necessary to obtain information about where one can purchase the fixed assets required for production or management, as well as consulting services related to the efficiency of their acquisition and use, then they (these services) are included in cost of acquired fixed assets.

But at the same time, operations carried out by the organization must be documented with supporting documents.

| NOTE! Organizations need to take into account that if amounts related to payments to suppliers, organizations for the implementation of work under construction contracts and other contracts, for information and consulting services can be written off against the cost of acquired fixed assets as they are recognized, then registration fees, state duties , other similar payments related to the acquisition (receipt) of rights to an object of fixed assets, customs duties, non-refundable taxes in connection with the acquisition of fixed assets are written off only when paid to the relevant organizations. |

3) interest on borrowed funds accrued before the fixed asset item was accepted for accounting if it was raised for the acquisition, construction or manufacture of this item.

Interest payable on received loans and borrowings is reflected in the credit of account 66 “Settlements on short-term loans and borrowings” or account 67 “Settlements on long-term loans and borrowings” in correspondence with the debit of account 08 “Investments in non-current assets” on a monthly basis, which corresponds to the Instructions on the application of the Standard Chart of Accounts for Accounting, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated 00.29.2011 No. 50 (hereinafter referred to as the Instructions for the Chart of Accounts) and the Instructions for Accounting of Income and Expenses, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated 30.09.2011 No. 102 ( further – Instruction No. 102).

| NOTE! Instruction No. 26 and other regulatory legal acts on accounting do not provide for the inclusion of interest on loans and borrowings received for the acquisition and construction of fixed assets in their cost after commissioning. This must be determined in accordance with the resolution of the Ministry of Finance No. 16 of March 11, 2013 and must be enshrined in the order on accounting policies. The opportunity to apply this procedure for accounting for interest was provided to organizations until December 31, 2014 inclusive. Moreover, if borrowed funds are denominated in foreign currency , then in accordance with Decree of the President of the Republic of Belarus dated February 27, 2015 No. 103, from January 1, 2020, organizations can include in the value of assets recognized as fixed assets, both before commissioning and after registration as part of account 01 “Fixed assets” can increase (decrease) by: — the amount of exchange rate differences attributable to liabilities and loans expressed in foreign currency; — the amounts of exchange rate differences attributable to accrued and paid interest on loans and borrowings must be written off as established by the resolution of the Ministry of Finance No. 69 of October 29, 2014, to account 91 “Other income and expenses” as part of income and expenses for financial activities. At the same time, an additional entry is made into the accounting policy order that exchange rate differences attributable to accounts payable and credits and borrowings denominated in foreign currency are accumulated in account 08 (a separate sub-account) and at the end of the year are written off to the cost of the existing fixed asset . It should also be noted that the provisions of this Decree are valid until December 31, 2020 inclusive. |

How is the cost of fixed assets determined? To do this, let's look at an example.

Example. The supply of fixed assets from the manufacturing plant was carried out according to an agreement worth 20,000,000 rubles, and payment was made using borrowed funds.

The supplier charged a value added tax of 20% on the amount of RUB 4,000,000.

Paid expenses for the delivery of fixed assets by transport to a third party in the amount of RUB 5,000,000. and VAT in the amount of RUB 1,000,000.

Accrued expenses for payments to third parties for services related to the acquisition of fixed assets in the amount of RUB 7,000,000. and VAT in the amount of RUB 1,400,000.

Insurance payments in the amount of RUB 1,000,000 were paid to the insurance organization.

Paid for the services of the intermediary organization through which the fixed asset was purchased in the amount of 200,000 rubles. and VAT in the amount of 40,000 rubles.

Interest was accrued on borrowed funds taken to pay the supplier for the supply of fixed assets and other expenses associated with the acquisition of fixed assets in the amount of RUB 300,000.

Accrued other expenses associated with the delivery and installation of fixed assets (materials in the amount of 50,000 rubles; wages of workers for delivery and installation - 2,000,000 rubles; accrual of contributions to the Social Security Fund - 680,000 rubles and other expenses such as services of auxiliary workshops for the amount of RUB 1,500,000).

In accounting, these transactions should be reflected as follows:

a) capitalization of received fixed assets from the manufacturing plant

D-08 “Investments in non-current assets”, sub-account “Acquisition of fixed assets”

Kit 60 “Settlements with suppliers and contractors” - in the amount of 20,000,000 rubles;

b) payment of received fixed assets using a loan taken out

Dt 60 “Settlements with suppliers and contractors”

Kit 51 “Current accounts” - in the amount of 20,000,000 rubles;

c) payment of expenses for the delivery of fixed assets by transport of a third party

D-08 “Investments in non-current assets”, sub-account “Acquisition of fixed assets”,

Kit 76 “Settlements with various debtors and creditors”

And

Dt 76 “Settlements with various debtors and creditors”

Kit 51 “Current accounts” - in the amount of 5,000,000 rubles;

d) accrual of expenses for services rendered related to the acquisition of fixed assets,

D-08 “Investments in non-current assets”, sub-account “Acquisition of fixed assets”,

Kit 76 “Settlements with various debtors and creditors” - in the amount of 7,000,000 rubles;

e) payment of insurance premiums

D-08 “Investments in non-current assets”, sub-account “Acquisition of fixed assets”,

K-t 76 “Settlements with various debtors and creditors”, subaccount “Settlements for property and personal insurance”,

And

D-76 “Settlements with various debtors and creditors”, subaccount “Settlements for property and personal insurance”,

Kit 51 “Current accounts” - in the amount of 1,000,000 rubles;

f) payment for the services of an intermediary organization through which fixed assets were purchased,

D-08 “Investments in non-current assets”, sub-account “Acquisition of fixed assets”,

Kit 76 “Settlements with various debtors and creditors”

And

Dt 76 “Settlements with various debtors and creditors”

Kit 51 “Current accounts” - in the amount of 200,000 rubles;

g) accrual of interest on borrowed funds

D-08 “Investments in non-current assets”, sub-account “Acquisition of fixed assets”,

K-t 66 “Settlements for short-term loans and borrowings” - in the amount of 300,000 rubles;

h) reflection of paid and accrued amounts of value added tax on transactions related to the acquisition of fixed assets:

— regarding payment to the manufacturer

D-18 “Value added tax on acquired assets”, subaccount “Value added tax on the acquisition of fixed assets”,

Kit 60 “Settlements with suppliers and contractors” - in the amount of 4,000,000 rubles;

Dt 60 “Settlements with suppliers and contractors”

Kit 51 “Current accounts” - in the amount of 4,000,000 rubles;

— regarding the delivery of vehicles

D-18, subaccount “Value added tax on the acquisition of fixed assets”,

K-t 76 “Settlements with various debtors and creditors” - in the amount of 1,000,000 rubles;

Dt 76 “Settlements with various debtors and creditors”

Kit 51 “Current accounts” - in the amount of 1,000,000 rubles;

— regarding payment for services of third parties

D-18, subaccount “Value added tax on acquired fixed assets”,

Kit 76 “Settlements with various debtors and creditors” - in the amount of 1,400,000 rubles;

— regarding payment for the services of an intermediary organization

D-18, subaccount “Value added tax on acquired fixed assets”,

Kit 76 “Settlements with various debtors and creditors” - in the amount of 40,000 rubles;

Dt 76 “Settlements with various debtors and creditors”

Kit 51 “Current accounts” - in the amount of 40,000 rubles;

i) accrual of other expenses for the delivery and installation of fixed assets:

— regarding written-off materials

D-08 “Investments in non-current assets”, sub-account “Acquisition of fixed assets”,

Kit 10 “Materials” - in the amount of 50,000 rubles;

— regarding contributions to the Social Security Fund

D-08 “Investments in non-current assets”, sub-account “Acquisition of fixed assets”,

Kit 69 “Calculations for social insurance and security” - in the amount of 680,000 rubles;

— regarding the calculation of the wage fund

D-08 “Investments in non-current assets”, sub-account “Acquisition of fixed assets”

Kit 70 “Settlements with personnel for wages” - in the amount of 2,000,000 rubles;

— regarding the services of auxiliary workshops

D-08 “Investments in non-current assets”, sub-account “Acquisition of fixed assets”

Kit 23 “Auxiliary production” - in the amount of 1,500,000 rubles;

j) reflects the cost of fixed assets put into operation

Dt 01 “Fixed assets”

K-t 08 “Investments in non-current assets”, sub-account “Purchase of fixed assets” - in the amount of 37,730,000 rubles;

k) paid value added tax on introduced fixed assets is written off for reimbursement (based on the VAT tax return) - in the amount of RUB 6,440,000.

The actual costs of acquisition, construction or production of fixed assets do not include general business and other similar expenses, except when they are directly related to the acquisition, construction or production of fixed assets.

Such expenses, for example , include the costs of maintaining the directorate of an enterprise under construction, start-up costs for trial production of products, personnel training, etc.