When applying the simplified tax system, the amount of state duty is included in the tax base

The Ministry of Finance of Russia in letter No. 03-11-06/2/29 dated 02/20/2012 in relation to organizations using the simplified tax system, which won the lawsuit and are returning the state duty they previously paid, indicates that the amount of the state duty increases the tax base.

According to the current tax legislation, it really turns out that the tax base must be increased by the amount of state duty reimbursement, since when applying the simplified tax system, a single tax is imposed on all income received by the organization (both from the sale of goods and services it produces, and from other sources). Exceptions to the general rule (non-taxable income) are specified in Art. 251 of the Tax Code of the Russian Federation, but state duty is not mentioned in this article.

The contradiction lies in the fact that state duty is similar in nature to taxes, since it is a fee levied in favor of the state. The procedure for collecting and the amount of state duty are established by Chapter 25.3 of the Tax Code of the Russian Federation. So what – the tax is taken from the tax?!

Let's consider this situation in more detail.

The fact is that in this case, the refund of the state duty is compensation received by the plaintiff organization that won the trial.

How to take into account state duty when taxing

Questions and answers on the topic

We are an OJSC using the simplified tax system for income minus expenses. I am interested in the recognition or non-recognition of state duties in income under the simplified tax system, and specifically: the state duty for registering changes in the constituent documents of a legal entity, the state duty for considering an appeal against a decision of the Arbitration Court, compensation for paid state duty by court decision.

From the text we can conclude that the question is whether the state duty can be included in expenses under the simplified tax system.

In this case, in each of the cases listed in the question, the state duty can be taken into account as part of the expenses.

If, according to a court decision, the costs of the state duty of the plaintiff organization are reimbursed by the defendant, take into account the amounts received in non-operating income (clause 1 of Article 346.15 of the Tax Code of the Russian Federation). The same rule applies to the return of state duties from the budget.

How to take into account the state duty

for

taxation

If an organization pays a single tax on the difference between income and expenses, then the amount of state duty paid can be taken into account in expenses (subclauses 22, 31, clause 1, article 346.16 of the Tax Code of the Russian Federation). Moreover, as an expense, the state duty must comply with the criteria of paragraph 1 of Article 252 of the Tax Code of the Russian Federation. That is, it must be economically justified. The same rule applies to the amount of compensation for legal costs by the defendant (subclause 31, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Include the amount of the state duty in expenses at the time of its payment to the budget (transfers to the plaintiff’s account as reimbursement of legal costs) (Clause 2 of Article 346.17 of the Tax Code of the Russian Federation).*

If, according to a court decision, the costs of the state duty of the plaintiff organization are reimbursed by the defendant, take into account the amounts received in non-operating income (clause 1 of Article 346.15 of the Tax Code of the Russian Federation). The same rule applies to the return of state duties from the budget. This conclusion can be drawn by paragraph 3 of Article 250 and paragraph 1 of Article 346.15 of the Tax Code of the Russian Federation.*

www.26-2.ru

Is state duty included in expenses under the simplified tax system?

Based on the fee paid at the beginning, the court made a decision, that is, it fulfilled its function. And the refund does not come from the state budget, but is collected from the defendant. In this case, it is obvious that the defendant pays the plaintiff a kind of fine, compensation for costs. And it is this operation that is taxed, and not the refund of the state duty as such.

Similarly, any penalty for violation of contractual obligations, which is payable by the debtor on the basis of a court decision, as well as the amount of compensation for losses or damages in accordance with clause 3 of Art. 250 Tax Code of the Russian Federation. Legally, the question is clear and does not require any other interpretation.

So, there is the Tax Code, explanations from the Ministry of Finance, comments from lawyers and financiers, and entrepreneurs again and again make the same mistake in this situation. The result is fines for errors in accounting and for underestimating the tax base.

This is just one point in current practice. And organizations that use the simplified tax system are faced with it. But the simplified taxation system was created to facilitate accounting. But in practice, it turns out that entrepreneurs stumble on such issues again and again.

Since 2013, organizations using the simplified tax system are required to keep accounting records in full. You will have to forget about keeping tax records on your own.

{module Article Suggestions}

Rebus Company

For example, a company submits an application to the tax authorities with a request to make changes to the Unified State Register of Legal Entities and is refused because the company itself made a mistake in the application form.

The paid state duty will not be returned to the taxpayer, but the fee cannot be included in expenses, because no practical result is obtained from its payment. Please note that if the state duty is reimbursed to a legal entity by court decision, the amount must be included in the company’s income.

This opinion is shared by the Ministry of Finance of the Russian Federation in its letter dated May 17, 2013 No. 03-11-06/2/17357. Acceptance of state duty as a cost under the simplified tax system depends on the purposes of paying this state fee.

USN: expenses for business correspondence

The Department of Tax and Customs Tariff Policy <…> reports the following on the procedure for accounting for expenses by an organization applying a simplified taxation system.

According to subparagraph 18 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), when determining the object of taxation, a taxpayer applying a simplified taxation system with the object of taxation in the form of income reduced by the amount of expenses, has the right to reduce the income received by the amount of postal, telephone, telegraph and other similar services, as well as expenses for payment for communication services.

In accordance with paragraph 32 of Article 2 of the Federal Law of July 7, 2003 N 126-FZ “On Communications,” a communication service is understood as the activity of receiving, processing, storing, transmitting, and delivering telecommunication messages or postal items.

Thus, justified and documented expenses of an organization for payment of postal expenses, namely business correspondence, can be taken into account by an organization applying a simplified taxation system with the object of taxation in the form of income reduced by the amount of expenses.

In accordance with subparagraph 22 of paragraph 1 of Article 346.16 of the Code, the amounts of taxes and fees paid in accordance with the legislation of the Russian Federation on taxes and fees are taken into account as part of the expenses of an organization applying the simplified taxation system.

According to paragraph 10 of Article 13 of the Code, the state duty is a federal fee.

In connection with the above, the amounts of state duty are taken into account when determining the tax base for the tax paid in connection with the application of the simplified taxation system.

In accordance with paragraph 20 of the Rules for maintaining the Unified State Register of Legal Entities and providing the information contained therein, approved by Decree of the Government of the Russian Federation dated June 19, 2002 No. 438, information about a specific legal entity contained in the state register is provided upon request, drawn up in any form, indicating the necessary information.

According to paragraph 23 of this resolution, copies (extracts) of documents are provided for a fee of 200 rubles for each such document. The fee for urgent provision of information increases to 400 rubles for each document.

Since this fee is not a state duty, a taxpayer using a simplified taxation system does not have the right to take it into account in expenses

.

Deputy Director of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of the Russian Federation S.V. Razgulin

Expert commentary

Legal side of the issue

An exhaustive list of costs that are taken into account in the tax base for a single simplified tax is set out in Article 346.16 of the Tax Code of the Russian Federation. Subclause 31 of clause 1 of this article of the Code states that the state duty under the simplified tax system with the object “income minus expenses” is taken into account when reducing the base for the single tax of the simplified tax system. However, paragraph 2 of Article 346.16 of the Tax Code of the Russian Federation states that costs must meet the requirements listed in paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

Mainly, this paragraph requires the economic justification of the costs incurred in order to include them in the base for reducing the simplified tax system tax.

This means that by paying the state fee, the company must receive some significant result from this action, otherwise the fee cannot be classified as an expense.

Situations when the state duty cannot be included in expenses may be different. For example, a company submits an application to the tax authorities with a request to make changes to the Unified State Register of Legal Entities and is refused because the company itself made a mistake in the application form. The paid state duty will not be returned to the taxpayer, but the fee cannot be included in expenses, because no practical result is obtained from its payment.

State duty as an expense in the usn

Despite this

These types of expenses often cause distrust among tax authorities, and taxpayers have to defend the legality of their implementation.

As usual, the main arguments here are: the validity of postal expenses, documentary evidence and focus on business activities.

Regarding the second question about the possibility of taking into account the amount of state duty for urgent issuance of an extract when taxing, we note the following. Taxpayers using the simplified tax system have the right to reflect the amounts that went towards paying the state duty in expenses during the period of payment (letter of the Ministry of Finance of Russia dated 02/09/2011 No. 03-11-06/2/16*, Federal Tax Service for Moscow dated 18.07. 2011 No. 16-15/070485).

However, this provision does not apply to fees for early provision of information from the Unified State Register of Legal Entities. The “simplifiers” cannot reflect the amount of such payment as part of the costs, since the “early payment” fee is not a state duty.

* The document and commentary to it were published in “NA”

№ 6, 2011.

Tax consultant D.G. Nikolaev

Court fee

By virtue of subparagraph 31 of paragraph 1 of Article 346.16 of the Tax Code, simplifiers with the object “income minus expenses” can take into account the costs of:

- Court expenses.

- Arbitration fees.

Thus, the costs of state fees to the court can always be taken into account on the simplified tax system. Moreover, simplifiers do this on the date of payment, and not on the date of entry into force of the court decision (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

To be more precise, the obligation to pay court fees arises due to the filing of a claim. Accordingly, such a state fee can be included in the expenses of the simplified tax system on the day the court issues a ruling to accept the application for proceedings.

It also happens that at first the simplifier attributed the state duty to the expenses of the simplified tax system, which he paid under a civil law agreement. However, a court decision was subsequently issued, which, among other things, returned the paid state duty to him. What should I do? It must be included in income. Letters of the Ministry of Finance of Russia dated March 20, 2014 No. 03-11-11/12250 and dated May 17, 2013 No. 03-11-06/2/17357 insist on this. Moreover, on the date of actual receipt of money from the other (losing) party. Also see “Bank services under the simplified tax system “income minus expenses”.

If you find an error, please select a piece of text and press Ctrl+Enter.

State duty: accounting and tax accounting, recognition as an expense

State duty is a payment for the performance of certain tasks by state institutions, and its reflection in accounting and tax accounting directly depends on what actions were paid. Let's consider the difficulties that arise when classifying state duties as bank expenses, taking into account that the total amounts paid by a credit institution can be quite significant.

The concept of state duty, its size, features and terms of payment, as well as payers are defined in Chapter. 25.3 parts of the second Tax Code of the Russian Federation.

In accordance with paragraph 1 of Art. 333.16 of the Tax Code of the Russian Federation, state duty is a fee levied on the persons specified in Art. 333.17 of the Tax Code of the Russian Federation, when they apply to state bodies, local self-government bodies, other bodies and (or) officials who are authorized in accordance with the legislative acts of the Russian Federation and constituent entities of the Russian Federation and regulatory legal acts of local government bodies, for committing in relation to these persons legally significant actions provided for in Chapter. 25.3 of the Tax Code of the Russian Federation, with the exception of actions performed by consular offices of the Russian Federation. It has been established that the issuance of documents (their duplicates) is equivalent to legally significant actions.

Article 333.17 of the Tax Code of the Russian Federation determines that organizations and individuals are recognized as state duty payers if they:

- apply for the performance of legally significant actions provided for in this chapter;

- act as defendants in courts of general jurisdiction, arbitration courts, or in cases considered by magistrates, if the court decision is not made in their favor, and the plaintiff is exempt from paying state fees.

Credit institutions pay state fees for various actions by government agencies. These payments can be divided into two groups: 1) state duty for registration actions of various government bodies; 2) state duty paid when filing claims in court. Accounting and tax accounting of each of them has its own characteristics.

Reimbursement of legal expenses for state fees in case of registration expenses minus income

USNO: how to take into account the payment of utilities by tenants, No. 14

- USNO: calculating the cost of goods sold, No. 12

- We return advances to the simplified tax system and reduce income, No. 12

- Answers to “special regime” riddles, No. 11

- An Uneasy Partnership of Simplists, No. 5

- Simplified accounting: simple recipes, No. 4

- Refund of last year's advance: reducing income under the simplified tax system, No. 4

- Simplified: about painful issues..., No. 3

- The simplifier transfers the building to the only participant - what is more profitable?, No. 3

- Simplification was wrongfully used: is it possible to avoid additional charges and fines?, No. 3

- From the new year - a new Book for simplifiers, No. 2

- “Simplified” tax for 2012, No. 2

- Is a simplifier entitled to deduct VAT on exports for the “general regime” period, No. 1

- 2012

Important: Simplified people have to deal with the provision of public services everywhere. Code, the state fee is attributed specifically to fees when applying to:

- Government structures.

- Local authorities.

- Other bodies and/or officials who are legally authorized to perform legally significant actions.

There should be no controversy as to whether state duty is taken into account in expenses under the simplified tax system when a document or a duplicate of it is issued to a simplifier for a fee. Yes, this is equated by law to legally significant actions. As follows from the meaning of subsection. 22 clause 1 art. 346.16 of the Tax Code of the Russian Federation, state duty is accepted as expenses under the simplified tax system in any amount upon its transfer to the treasury to the appropriate account. Taxation in industries: The judges came to the conclusion that the HOA is an economic entity that does not act in its own interests, but exclusively in the interests of the members of the partnership, including when it defends the rights of the owners of premises in the courts.

State fee for registration actions

For most credit institutions, the first group of such payments is less expensive than the second. It includes the state fee paid when undergoing a technical inspection of cars of a credit organization, fees for registering vehicles, registration of a lease agreement, registration of a mortgage agreement (real estate pledge), registration of changes to the constituent documents, registration of an additional agreement on termination of the pledge agreement and other similar actions. All these actions are united by a single procedure for accounting and tax accounting of paid state duties.

In accordance with the Regulation of the Bank of Russia dated March 26, 2007 N 302-P, expenses for the paid state duty for the above registration actions are reflected in the debit of account 60323 “Settlements with other debtors” and the credit of account 30102 “Correspondent account of the bank in OPERU ... Bank of Russia”. The payment made is credited to the expense accounts of the credit institution using the following posting:

- Dt 70606 “Expenses” (symbol 26411)

- Kt 60323 “Settlements with other debtors” - at the time of receipt of the relevant reporting documents.

Tax accounting of expenses for paid state duty is carried out on the basis of accounting data of the credit organization - the amounts reflected in expense accounts 70606 (symbol 26411). These invoices are reflected in the tax registers and are accepted without additional adjustments.

However, situations arise in which state duty expenses reflected in accounting on expense accounts 70606 (symbol 26411) are subject to adjustment and the amounts for them are not included in expenses that reduce the taxable base for income tax. For example , if:

- the state fee was paid by a foreign bank for issuing a work permit to an attracted foreign employee and this state fee is not reimbursed by them;

- the state fee has been paid for registering the lease agreement, but the premises are not used in banking activities;

- the state fee was paid for issuing a visa to foreign workers and is not reimbursed by them in the future; and etc.

A state fee may be paid for state registration of ownership of a real estate property owned by a credit institution. According to the Russian Ministry of Finance, this situation should be considered in accordance with the requirements of Art. 257 Tax Code of the Russian Federation. This article provides that the initial cost of a fixed asset is determined as the sum of expenses for its acquisition, construction, production, delivery and bringing it to a state in which it is suitable for use, with the exception of value added tax and excise taxes. In accordance with the clarifications of the Ministry of Finance of Russia dated March 4, 2010 N 03-03-06/1/113, the state duty paid for the state registration of ownership of a real estate property is included in the initial cost of the real estate property for profit tax purposes. Experts view this situation differently and have ambivalent views on the position of the financial department, so the credit institution must make its own decision. However, knowing the specifics of interaction with registration authorities, we can definitely say that there are often situations when a property is registered after it is put into operation. For such situations, the Ministry of Finance of Russia in Letter dated 02/11/2011 N 03-03-06/1/89 indicated that the initial cost of fixed assets is not subject to change in connection with the registration of rights to real estate and expenses for it. Consequently, in this case, the state duty is accepted for tax accounting purposes at a time.

Let us also consider situations when a credit institution acquires exclusive rights to an intangible asset or the creation of such an intangible asset (hereinafter referred to as intangible assets). Clause 1 of Art. 1249 of the Civil Code of the Russian Federation establishes that for the commission of legally significant actions related to a patent for an invention, with state registration of a computer program, a trademark and service mark and a number of other intangible assets, as well as with state registration of the transfer of exclusive rights to other persons and agreements on the disposal of these rights , patent and other fees are charged accordingly. Thus, credit institutions, when acquiring intangible assets (exclusive rights), in some cases pay a state duty in accordance with Art. 333.30 of the Tax Code of the Russian Federation, for example, for registration of an agreement on the alienation of the exclusive right to a registered computer program or database. In addition, when creating an intangible asset on its own, the credit institution also pays a state fee for its registration in accordance with paragraphs. 1 clause 1 art. 333.30 Tax Code of the Russian Federation.

What expenses for the simplified tax system include state duty?

Acceptance of state duty as a cost under the simplified tax system depends on the purposes of paying this state fee. When paying the state fee for filing a claim with the judicial authorities, for making changes to the Unified State Register of Legal Entities, for issuing copies of documents and other similar procedures, the state fee is included in expenses for the purpose of reducing the single tax of the simplified tax system, regulated by the norms of subparagraph 22 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation.

If the fee is paid when registering a vehicle or during the registration procedure for real estate acquired by a company, then the state duty increases the amount of the cost of property subject to depreciation, and therefore reduces the tax base in accordance with the provisions of paragraph 3 of Article 346.16 of the Tax Code of the Russian Federation. It is important to note that this is legal for the state duty, which was paid before the depreciable object was put into operation. When paying a fee after putting this property into operation, the provisions of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation come into force, according to which the state duty should be included in one-time costs under the simplified tax system.

A convenient accounting program for the simplified tax system from Bukhsoft ensures competent maintenance and accounting of the warehouse, fixed assets, tangible and intangible inventories, as well as the company’s monetary assets in one place!

Is state duty included in expenses under the simplified tax system?

At the same time, the bank as a taxpayer must take into account that the initial cost of intangible assets for the purposes of calculating income tax is formed in accordance with the requirements of Art. 257 Tax Code of the Russian Federation.

The initial cost of intangible assets is determined as the sum of expenses for their acquisition (creation) and bringing them to a state in which they are suitable for use, with the exception of VAT and excise taxes, except for cases provided for by the Code (clause 3 of Article 257 of the Tax Code of the Russian Federation). In its clarifications dated August 12, 2011 N 03-03-06/1/481, the Russian Ministry of Finance indicated that the cost of intangible assets created by the organization itself is determined as the amount of actual expenses for their creation, production (including material expenses, expenses for wages, expenses for services of third-party organizations, patent fees associated with obtaining patents, certificates), with the exception of tax amounts taken into account as expenses in accordance with the Tax Code of the Russian Federation. Thus, the amounts of state, patent and other duties provided for by law are included in the initial cost of the intangible asset and written off as expenses through the depreciation mechanism. Thus, this type of state duty has a different procedure for attribution to expenses.

How the state duty is taken into account during simplification: postings

To reflect the operation of calculating state duty in accounting, it is necessary to remember that, according to Art. 333.40 of the Tax Code of the Russian Federation, in certain cases, the duty may be returned to the payer or, at his request, offset against other actions of government agencies. Therefore, until the expected legally significant action is completed (or a government agency refuses to perform it), the duty cannot be included as an expense either in accounting or tax accounting.

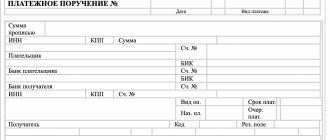

For mutual settlements with government agencies for payment of state duties, you should open a special sub-account to account 68. The postings will be as follows:

- Dt 68 Kt 51 (50) - payment of state duty;

- Dt 20, 23, 25, 26, 29, 44, 91 Kt 68 - charge of state duty;

- Dt 91 Kt 68 - payment of the state duty is attributed to non-operating expenses in connection with the refusal to perform a legally significant action;

- Dt 08 Kt 68 - the duty increased the initial cost of the property;

- Dt 51 Kt 68 - state tax is returned to the payer’s account.

The attribution of state duty to expenses during simplification depends on why such a duty was paid, as well as on whether this action was carried out or a refusal was received from government agencies.

nalog-nalog.ru

This is interesting:

- Order of the Ministry of Health of Russia dated 1512-2014 No. 834n on approval Order of the Ministry of Health of the Russian Federation dated December 15, 2014 No. 834n “On approval of unified forms of medical documentation used in medical organizations providing medical care in outpatient settings, and […]

- Order MZ 549n dated 07082013 Order of the Ministry of Health of the Russian Federation N 549n dated 08/07/13 MINISTRY OF HEALTH OF THE RUSSIAN FEDERATION ORDER dated August 07, 2013 N 549n ON APPROVAL OF REQUIREMENTS FOR COMPLETING MEDICINES AND MEDICAL DEVICES, STYLES AND […]

- Order 183 MH Order of the Ministry of Health of the Russian Federation dated April 22, 2014 N 183n “On approval of the list of medicines for medical use subject to subject-quantitative accounting” (with amendments and additions) Order […]

- Article 8 Law on Privatization Law “On the Privatization of Housing Stock in the Russian Federation” Information on changes: By the Law of the Russian Federation of December 23, 1992 N 4199-I, the title of this Law was amended by the Law of the Russian Federation of July 4, 1991 N 1541-I»O privatization […]

- Federal Law 48 on guardianship and trusteeship, as amended Federal Law of April 24, 2008 N 48-FZ “On Guardianship and Trusteeship” (with amendments and additions) Federal Law of April 24, 2008 N 48-FZ “On Guardianship and Trusteeship” With changes and additions dated: July 18, 2009, 1 […]

- Profsoyuznaya 58 notary Moscow notaries at the Profsoyuznaya metro station Below is a list of notaries in the selected category. To view detailed information on a specific notary, click on the notary's full name. Notary Aleshina Zoya […]

State fee for filing a claim in court

State fees in connection with filing claims in court are the most problematic group of payments for credit institutions.

Credit organizations that are actively developing in the retail lending segment often pursue risky policies when issuing loans to the population. Often it results in a large number of non-payments, and debts have to be collected from clients in court. Moreover, the more aggressive the bank’s policy, the more non-payments it experiences.

The amount of state duty paid by a credit institution directly depends on the size of the claim. The amount of the collected state duty is determined by clause 1 of Art. 333.19 Tax Code of the Russian Federation. They, in particular, determined that in cases considered in courts of general jurisdiction and by magistrates, the state fee is paid when filing a claim of a property nature, subject to assessment, at the price of the claim:

up to 20,000 rub. — 4% of the claim price, but not less than 400 rubles;

from 20,001 rub. up to 100,000 rub. — 800 rub. plus 3% of the amount exceeding RUB 20,000;

from 100,001 rub. up to 200,000 rub. — 3200 rub. plus 2% of the amount exceeding RUB 100,000;

from 200,001 rub. up to 1,000,000 rub. — 5200 rub. plus 1% of the amount exceeding RUB 200,000;

over 1,000,000 rub. — 13,200 rub. plus 0.5% of the amount exceeding RUB 1,000,000, but not more than RUB 60,000.

In large retail credit institutions, the number of claims filed for non-repayment of funds under loan agreements is in the thousands.

The paid state duty on filed statements of claim is reflected in the accounting records as the debit of account 60323 “Settlements with other debtors” and the credit of account 30102 “Correspondent account of the bank in OPERU... Bank of Russia”. These expenses are not transferred to expense accounting accounts 70606 “Expenses” at the time the court accepts the statement of claim. However, for tax accounting purposes in accordance with the requirements of Art. 272 of the Tax Code of the Russian Federation for organizations using the accrual method, expenses are accepted in the reporting (tax) period to which they relate, regardless of the time of actual payment of funds and (or) other form of payment.

In accordance with the requirements of paragraph 1 of Art. 333.18 of the Tax Code of the Russian Federation, when applying to the Constitutional Court of the Russian Federation, courts of general jurisdiction, arbitration courts or magistrates, the state fee is paid before filing a request, petition, application, statement of claim, complaint (including appeal, cassation or supervisory). An application, statement of claim, complaint, petition is accepted by the courts only after payment of the state fee. Thus, the acceptance of documents directly depends on the payment of the state duty, therefore, the date the credit institution accepts the costs of the paid state duty is the date of filing the documents (request, petition, application, statement of claim, complaint) to the court.

Article 101 of the Arbitration Procedural Code of the Russian Federation (hereinafter referred to as the Arbitration Procedure Code of the Russian Federation) provides that legal costs consist of state fees and legal costs associated with the consideration of the case by the arbitration court.

In accordance with paragraphs. 10 p. 1 art. 265 of the Tax Code of the Russian Federation, state duty expenses must be reflected in the tax accounting of a credit organization as part of non-operating expenses (legal expenses and arbitration fees). In such a situation, credit institutions are forced to keep an off-system record of the state duty paid, for which documents were submitted to the court. These non-operating expenses are reflected in the tax accounting of the credit organization based on data on the receipt of documents. In the future, credit institutions win or lose court proceedings. Depending on the decision made by the court, the bank reflects the data in its accounting records.

In cases where the court decides that the state duty is not subject to reimbursement by the defendant (client of the credit organization), the credit organization's accounting records reflect the costs of the previously paid state duty, which is not subject to reimbursement. These expenses are reflected in the following entries:

Dt 70606 “Expenses” (symbol 26407)

Kt 60323 “Settlements with other debtors” - based on the received decision (determination) of the judicial authority.

Thus, the expenses (account 70606) of the credit organization reflect the amount of previously paid state duty. As stated above, these expenses were reflected in tax accounting earlier - on the date of filing the documents. This means that in tax accounting there is a risk of reflecting the costs of the previously paid state duty a second time.

The way out of this situation, along with other options, is to carry out, for tax purposes, an adjustment (reduction) of expenses reflected in account 70606, which reflects the amounts of state duty that are not subject to reimbursement. Having excluded the amounts of state duty expenses that are not subject to reimbursement, the credit organization must “close” them in tax accounting, reflecting them in the appropriate form of the tax register as a duty that is not subject to reimbursement. Of course, reflecting this data in tax accounting requires maintaining appropriate non-systemic records of all decisions (decisions) made (adopted), however, taking into account the cost of the issue for retail credit organizations and the conservative approach used by many, it is better to do this.

In situations where the court has decided to reimburse the client for the state duty previously paid by the credit institution, this decision is reflected in the accounting records using a different posting scheme:

Dt 60323 “Settlements with other debtors” (personal account for settlements with the debtor)

Kt 60323 “Settlements with other debtors.”

A comment. Yu.V. Nesterova, auditor UBA Consultancy Service

There is another point of view on the procedure for reflecting in accounting the paid state duty on filed claims: until the court decision is made, it is taken into account on the personal account of balance sheet account 60312 “Settlements with suppliers, contractors and buyers.” This position is set out in Letter No. 15-1-3-11/4353 of the Department of Banking Regulation and Supervision of the Bank of Russia dated 09/04/2008.

The procedure for recording transactions in accounting in the presence of a court decision made in favor of the bank deserves special attention. In this case, the fee paid by the bank is an element of the calculation base of the reserve for possible losses, since it represents a fee established by law, levied when applying to the judicial authorities (attributable to the bank’s expenses in the event of a court decision not in its favor). Until the court makes a decision, the state duty paid by the bank is not subject to reservation. If the decision is made in favor of the bank, the amount of the fee to be reimbursed by the defendant will represent an element of the calculation base for the formation of a reserve for possible losses in accordance with clause 6.1 of Bank of Russia Regulations dated March 20, 2006 N 283-P “On the procedure for the formation by credit institutions reserves for possible losses." The elements of the reserve calculation base include possible additional expenses, including those caused by the likelihood of claims being presented to the credit institution in connection with non-fulfillment or improper fulfillment of obligations arising from mandatory payments (including penalties, legal expenses, etc.). The amount of the reserve must correspond to the amount of the reserve formed for the borrower's loan debt.

In accordance with the calculations, the previously paid state duty is transferred, subject to reimbursement, by decision (determination) of the judicial authority.

Payment of state duty can be carried out in various ways.

Making a payment through the cash register will be processed using the following transaction:

Dt 20202 “Cash desk of credit institutions”

Kt 60323 “Settlements with other debtors.”

Payment of state duty by the client from his current account with a credit institution will be reflected by the following entries:

Dt 40817 “Individuals” or 40820 “Accounts of non-resident individuals”

Kt 60323 “Settlements with other debtors.”

Thus, as we see, the completed operation does not affect either the expense (70606) or income (70601) accounts of the credit organization, therefore, income in the form of reimbursed state duty cannot be taken into account in tax accounting based on the data of the income accounts of the credit organization.

One of the solutions in such a situation, as mentioned above, is to maintain off-system accounting for paid and recognized state duties. Data on decisions (rulings) of judicial authorities that have entered into legal force and the state duty subject to reimbursement are reflected in the appropriate forms of tax accounting registers on the date of entry into force of the decision (ruling) of the judicial authority. Thus, non-operating income and state duty expenses will be reflected in the tax accounting of the credit organization.

When reporting data on recognized state duties, credit institutions face difficulties associated with late receipt of court decisions and rulings. As in other cases, untimely receipt of these documents leads to untimely reflection of income in the tax accounting of the credit organization. This issue is especially acute when this happens at the junction of tax periods, and the credit institution must decide which period to choose to reflect them.

E.A. Khatskaya

Boss

operational office

in Tolyatti

LLC Commercial Bank

"Kama Horizon"

Question: Does an organization have the right to reduce the tax base for income tax by the amount of the state duty paid when filing a statement of claim, as well as by the amount of expenses for paying a lawyer when considering a case in an arbitration court?

Answer: According to clause 1 of Article 252 of the Tax Code, for the purposes of Chapter 25 of the Tax Code of the Russian Federation, the taxpayer reduces the income received by the amount of expenses incurred (except for the expenses specified in Article 270 of the Tax Code of the Russian Federation).

Classification of legal expenses

Legal expenses consist of state fees and legal costs associated with the consideration of the case by the arbitration court. This is stated in Article 101 of the Arbitration Procedure Code.