Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

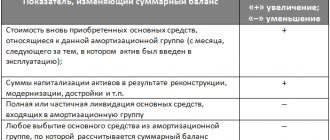

The division of direct and indirect costs is carried out to calculate the tax base and form the cost. This division is important for accounting and tax accounting. In organizations in different industries, expenses of the same type may be classified differently. In order to correctly distribute costs, you need to give them the correct definition.

Direct costs

Direct costs form the cost of only one type of product. In your accounting policy, you must independently determine the costs classified as direct.

Examples of direct costs:

- inventories, components and semi-finished products;

- wages of primary production workers and social benefits;

- depreciation of main production equipment.

The list of direct costs is presented in Art. 318 of the Tax Code of the Russian Federation, it is open and may include other expenses at your discretion. However, before including costs in the list of direct costs, please note: they must be directly related to the production and sale of goods, works and services.

For trade organizations there is a separate list of direct expenses, which is strictly regulated and cannot be changed. These include the cost of goods purchased and transportation costs.

What is more profitable for the organization?

From a monetary point of view, it is more practical for any manager to classify as many costs as possible as indirect: after all, then the income tax base in a particular period will decrease (clause 2 of Article 318 of the Tax Code). Tax authorities, naturally, support the opposite position.

A list of direct costs must be approved in the organization’s regulatory framework; it does not necessarily have to coincide with the recommendation, but there must certainly be a justification for this distribution. If chosen, management has the right to classify as indirect costs only those costs that cannot be considered direct.

NOTE! From the point of view of tax authorities, in controversial situations it is necessary to recognize the expense as a direct one - this list is open - rather than unreasonably expanding the number of indirect costs. A tax, usually recognized as indirect, can be considered direct, but the opposite is unacceptable.

Indirect costs

Using the cloud service Kontur.Accounting will help you correctly divide expenses into direct and indirect, as well as reflect them in a timely manner and in full. Get free access to the service for 14 days

Indirect costs form the cost of several types of products simultaneously. There is no way to directly determine which products they should be attributed to. These expenses support production processes and the operation of the organization as a whole. Examples of indirect costs:

- communal payments;

- salaries of support staff, administrative workers and managers;

- depreciation of auxiliary equipment;

- marketing campaigns for company advertising.

The Tax Code states that all costs that you did not classify as direct in your accounting policies are classified as indirect. Non-operating expenses should not be classified as indirect expenses, since they do not have a direct connection with the production and sale of goods, works and services. Distribute indirect costs proportionally across all types of products. Select a base for distribution. The base can be variable costs, for example, wages or the cost of materials.

Who distributes the costs

It is not always necessary to distribute expenses into direct and indirect. The diagram will help you understand in which case this needs to be done:

As you can see, non-trading organizations in which income and expenses are determined on a cash basis do not need to divide expenses into direct and indirect. The same applies to those who use simplified or imputation instead of the general regime, as well as entrepreneurs. The latter, even if they are in the general regime, do not pay income tax.

All this follows from the provisions of Articles 272, 318 and 320 of the Tax Code of the Russian Federation.

Combinations of different cost types

Using the cloud service Kontur.Accounting will help you correctly divide expenses into direct and indirect, as well as reflect them in a timely manner and in full. Get free access to the service for 14 days

Cost classification is based on different criteria, so combinations of them are possible. There are variable and fixed direct and indirect costs.

Direct costs are closely related to production, so most of them are variable. But there are exceptions: for example, the salary of a supervisor who controls the production process of a certain type of product. His salary does not depend on production volumes, which indicates the constant nature of the costs, and the relationship to a specific type of product makes them direct.

Indirect costs are also divided into fixed and variable costs. Fixed expenses include office rent, and variable expenses include the cost of tools, auxiliary materials, etc.

Expenses when there is no income

Situation: how to take into account direct and indirect expenses when calculating income tax using the accrual method if there is no income from sales in the reporting period. Is the organization not a newly created one?

If there is no income in the reporting period, the organization can only recognize indirect expenses.

The explanation is simple - you can recognize direct expenses only as goods, works or services are sold, the cost of which includes the costs. Direct expenses that relate to the balance of unsold products cannot be taken into account when calculating income tax.

As for indirect expenses, they are in no way tied to the revenue received. They can be taken into account in the current period. And expenses in tax accounting are recognized only as expenses that meet the following criteria:

- are aimed at generating income and are economically justified;

- documented.

These are the requirements of paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

Moreover, if a specific expense does not bring direct income to the organization, this does not mean that it is unreasonable. It is enough that it is necessary for the activity that will result in the income generated. Therefore, indirect expenses of an organization can be recognized even in the case when income has not yet been received in the reporting period. Such conclusions are expressed in letters of the Ministry of Finance of Russia dated August 25, 2010 No. 03-03-06/1/565, dated May 21, 2010 No. 03-03-06/1/341, dated December 8, 2006 No. 03 -03-04/1/821.

Direct and indirect costs in accounting

Of all the costs of manufacturing a product, its cost is added up. Account 20 contains almost all production costs that can be classified as direct. The main production account on debit corresponds with accounts 02, 10, 23, 25, 26, 60, 69, 70 on credit. To determine the cost of a product of a certain type, open analytical accounts for individual types of products and costs for account 20. This will simplify the procedure for generating cost by type.

Indirect costs are contained in accounts 25 and 26. To prepare loan entries, the same correspondence is used as for direct costs. Do not forget that indirect costs cannot be attributed directly to the cost of one product. Select a reasonable allocation basis and note your choice in the accounting policy.

Why did the question arise?

The taxpayer’s question to the financial department arose in connection with the replacement of the unified social tax with insurance contributions in 2010. This innovation required the introduction of appropriate changes to Chapter. 25 Tax Code of the Russian Federation. In particular, Federal Law No. 213-FZ of July 24, 2009 “On amendments to certain legislative acts of the Russian Federation and invalidation of certain legislative acts (provisions of legislative acts) of the Russian Federation in connection with the adoption of the Federal Law “On insurance contributions to the Pension Fund” of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds" in the recommended list of direct expenses given in the Tax Code of the Russian Federation (clause 1 of Article 318), the unified social tax was replaced by expenses for compulsory social insurance in case of temporary disability and in connection with maternity, compulsory health insurance, compulsory social insurance against industrial accidents and occupational diseases. And later paragraphs were also adjusted. 1 clause 1 art. 264 of the Tax Code of the Russian Federation (clause 22 of article 2 of the Federal Law of July 27, 2010 N 229-FZ). And now organizations must take into account accrued mandatory insurance contributions to the Pension Fund of the Russian Federation, the Federal Social Insurance Fund of the Russian Federation, and the Federal Compulsory Medical Insurance Fund as part of other expenses associated with production and sales. The date of inclusion of insurance premiums in expenses is the date of their accrual (clause 1, clause 7, article 272 of the Tax Code of the Russian Federation). Clause 1 of Art. 318 of the Tax Code of the Russian Federation allows taxpayers to independently determine in their accounting policies the list of direct expenses associated with the production of goods (performance of work, provision of services). Guided by these standards, the organization that asked the question to the Russian Ministry of Finance classified this type of expense as indirect in its accounting policy for tax purposes (from January 1, 2010). In the income tax return, the amount of contributions is reflected in line 040 of Appendix No. 2 to sheet 02. But the taxpayer still had doubts: is it legal to apply this accounting procedure for income tax purposes or should this type of expense (insurance premiums) counted as direct expenses?

Direct and indirect expenses in tax accounting

Using the cloud service Kontur.Accounting will help you correctly divide expenses into direct and indirect, as well as reflect them in a timely manner and in full. Get free access to the service for 14 days

In tax accounting, expenses are also divided into direct and indirect, but for different purposes. The task of accounting is to formulate the cost per unit of production, and for tax accounting it is important at what point the costs are charged to the cost of production. The size of the tax base will vary depending on the amount of direct and indirect costs.

Direct expenses are charged to the current tax period only after the products to which they are charged have been sold.

Indirect expenses are in no way related to sales; they reduce the tax base in the same reporting period in which they arise.

If in your organization the volume of indirect costs exceeds direct ones, then the costs will be taken into account earlier and the amount of taxable profit will decrease. You need to carefully monitor the rationale behind your decisions to classify expenses as indirect. If you underestimate the amount of direct expenses or incorrectly account for them, the tax authorities may consider this a violation and hold you accountable.

DIRECT COSTS IN TRADE: IS THERE THE RIGHT TO CHOICE

Costs associated with the sale of goods are also divided into direct and indirect. But for trade, the Tax Code has established its own rules and its own list of direct expenses. So, direct expenses should include:

- the cost of goods sold in the reporting (tax) period;

- transportation costs for delivering goods to the company’s warehouse (if such costs are not included in the cost of purchasing goods).

The remaining expenses (except for non-operating expenses) can be classified as indirect.

Let's see if it is possible to classify transportation costs for delivering goods as indirect costs. To do this, you need to decide whether the right to “self-determination” with a list of direct expenses, enshrined in Art. 318 of the Tax Code of the Russian Federation, or not.

On the one hand, we can say that the general rule should also apply to trading activities. On the other hand, for trade expenses, the Tax Code took into account the specifics of the activity and established special rules. And this circumstance is more significant.

Therefore, if you do not include transportation costs for the delivery of goods as part of direct costs (either as independent costs or as part of the purchase price of goods), then claims from inspectors are possible. At the same time, all other transportation costs (for example, those associated with the delivery of goods to customers) can be safely taken into account in the list of indirect expenses for income tax.

Overhead Estimated Costs

This is a specific item that covers expenses not related to construction. This includes:

- personnel training and professional development;

- organization and management;

- business trips;

- communication services;

- maintenance of vehicles owned by the enterprise;

- payment for forced downtime;

- damage to property, etc.

The final list depends on the specifics of the enterprise and the specific case under consideration.

General running costs

- administrative costs;

- personnel costs;

- depreciation of general purpose fixed assets;

- rental of office premises;

- payment for information, audit and other services.

The following amounts are written off:

1) to account 20 and distributed among individual types of services;

2) to account 46 “Sales” as semi-fixed costs.

At the end of the reporting period, turnover for DT 20 reflects the direct, variable costs of manufacturing products and shows the actual cost. Balance – the amount of unfinished production.