Home / News and changes

Back

Published: 05/28/2020

Reading time: 8 min

0

58

Form 21001 was first approved by Order of the Federal Tax Service of Russia MMV-7-6 / [email protected] in January 2012. It consists of 5 sheets of forms suitable for entering information about an individual registering as an individual entrepreneur. It later underwent a number of regulatory adjustments, with the latest revision taking place in June 2020.

- Required data to fill out form P21001

- Requirements for registration and filling

- Filling out the form

- Where to send form P21001

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

Over the course of 4 years, amendments were made to the form, which are invariably valid in 2020:

- Technical aspects of machine and manual writing , size, type and color of font are strictly regulated.

- Rules have appeared governing reductions, transfers, omissions.

- Barcodes have been added to form pages.

- Specifying the name of OKVED codes is no longer required.

- A field has appeared to indicate the preferred method of obtaining a certificate of registration.

In accordance with the latest amendments to Federal Law-129, which came into force in April 2020 on the basis of Federal Law-312, registration documents will be sent to citizens by e-mail in electronic format, and therefore filling out the field with an email address has become a mandatory condition for acceptance and consideration of the application (clause 3 of article 11 of Federal Law-129).

Who is an individual entrepreneur and how to become one

An individual entrepreneur is a representative of a small business. An individual receives this status only after state registration and registration with the tax service.

There are several key differences from an LLC:

- availability of authorized capital;

- direction of activity of the individual entrepreneur;

- another form of responsibility.

This primarily affects the rules for filling out a specific application.

Please note: when submitting an application, you must also pay attention to some other aspects, including the choice of the form of taxation and the type of activity itself.

Both a citizen of the Russian Federation and a citizen of any other country can become an individual entrepreneur. To start your activity, you must obtain the appropriate government permission. Doctors, private detectives and some other specialists are required to additionally obtain licenses or patents.

In addition to this, you also need to prepare documents such as:

- passport and photocopy;

- TIN;

- application for the use of a simplified or patent tax system;

- receipt of payment of state duty (800 rubles).

Any adult and capable citizen of the Russian Federation or another country who permanently lives in the territory of the Russian Federation can become an individual entrepreneur

What does form P21001 consist of?

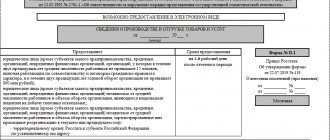

Having downloaded form P21001 from the official website of the tax service and scrolled through it, we will see that it includes three pages and 2 sheets - “A” and “B”. If you are a citizen of the Russian Federation, you can immediately remove the 3rd page of the application, because in our case it will remain empty (the 3rd page of the application is filled out by foreign citizens). On pages 1 and 2 you need to fill out information about the future individual entrepreneur (full name, place of residence, passport details, etc.). Sheet “A” contains information about those types of activities that will be of interest in the future activities of the future individual entrepreneur. Sheet “B” contains data on the order in which it is preferable to issue completed documents and the applicant’s contact information.

Important ! You can choose several types of activities, but only one can be the main one.

Application form

Despite the fact that registration is quite simple and straightforward, there are still certain requirements. You cannot simply write a statement by hand on a regular piece of paper. For this purpose, a special form p21001 is provided, which can be downloaded here. It was approved by order of the Federal Tax Service dated January 25, 2012.

There are two options for filling out the form:

- write all information by hand;

- type electronically and print.

The second option is no less popular than the first, because now it’s enough just to apply for opening an individual entrepreneur using form p21001 on your PC in Excel format and fill it out. For convenience, you can familiarize yourself with the proposed samples to avoid mistakes.

The application should be submitted to the local tax authority, where registration of new individual entrepreneurs is carried out. Moreover, documents should be sent to the place of actual residence, and not to the place of registration.

There are several options for the convenience of citizens:

- personally contact the tax authority and submit an application (or submit documents certified by a notary through third parties);

- send the completed form by mail;

- fill out the application and submit it electronically via the Internet.

Please note: when filling out manually, you should select a blank sheet and a black pen. Letters must be clearly printed. When filling out on a computer, you need to select the Courier New font with a size of 18 pt. One sheet must be filled out on one side only; double-sided applications will not be considered.

Requirements for filling

Since the p21001 form is intended to be read electronically with subsequent data processing by a computer, there are several requirements for its design:

- personally;

- through a proxy acting on the basis of a notarized power of attorney;

- by post.

The application can be downloaded and printed, and then filled out handwritten with a black gel pen. You must send a registered letter to the tax office and then wait for the notification to be received. The letter itself must also include a description of the attachment (indicate the name of the document in the shipment, its type (original) and quantity - 1 piece).

Filling out an application for individual entrepreneur registration

A sample of filling out an application form for individual entrepreneur registration using form p21001 will help you clearly understand all the nuances of this procedure. The application itself consists of three sheets on which various information is placed. First of all, there is a title page intended for the applicant’s personal data.

It is necessary to clearly write in the appropriate lines:

- FULL NAME;

- Date and place of birth;

- actual residential address, contact telephone number;

- number and series of passport or details of another identification document;

- TIN (Taxpayer Identification Number).

There are usually no problems filling out the title page. You just need to carefully monitor all the data and avoid mistakes when filling out long TIN and passport numbers.

Next comes sheet “A”. It is dedicated directly to individual entrepreneurship itself, namely its key features and specialization. Here you fill in the economic activity codes, which are also collected in the All-Russian Classifier. First, you should carefully study these codes and compare them with your own idea. If during the registration process you enter the code incorrectly or do not enter it at all, then problems may arise with the tax service later.

Please note: we must not forget that the codes must exactly correspond to the designation adopted in OKVED - these are two-digit digital groups with dots between them.

If documents are submitted not in person, but through a representative or by mail, it is necessary that the signatures and copies on them be notarized

On one sheet “A” you can indicate no more than 10 types of activities for an individual entrepreneur. If there are more of them, you will have to fill out additional applications.

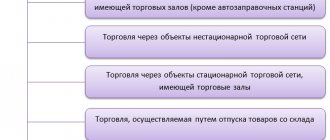

At the very top you should put codes for the main or priority activities, and then indicate related ones and those that may occur from time to time. All this directly depends on the business that is planned to be developed - trade, provision of services, production of certain products.

Approximate OKVED codes for an individual entrepreneur application:

- 49.32 – taxi activities and rental of cars with a driver (transportation and storage);

- 12/43/11 – execution of earthworks (construction sector);

- 85.41.9 – provision of additional education services for children and adults (sphere of education);

- 64.92.1 – provision of consumer loans (financial activity).

A new individual entrepreneur should describe his activities in a similar way. So, before doing this, there must be a clear idea of what the new business will be like.

Sheet “B” is also intended for personal data and to confirm authenticity. First, you need to indicate to whom the documents for inclusion in the Unified State Register need to be issued - directly to the applicant, the person representing him or sent by mail.

Next, indicate your contact phone number and E-mail. Such forms of communication are now used everywhere, and it is convenient to receive various notifications by email. After this you need to sign.

Please note: points 2 and 3 on sheet “B” are intended to confirm authenticity. Here the details of the official who accepted the application, as well as the notary who legally certifies the new document, are indicated.

Rules for filling out and submitting to the tax office

All applications submitted to the Federal Tax Service for state registration are filled out in accordance with Order No. ММВ-7–7/25 , therefore, if any questions arise when filling out, the answers to them can be found in this document (Appendix 20). It is allowed to enter information into the application both in printed form and by hand.

If the form is filled out manually, then entries can only be made in black ink and in large block letters . When entering on a computer, black capital font in Courier New format with a height of 18 is selected. Each sheet must be printed separately. Bilateral documents are not accepted.

Corrections and a mixture of printed and handwritten versions are also not allowed and are grounds for refusing to accept the application.

According to the amended rules, documents are not required to be stapled or otherwise secured. If you submit the papers yourself, you may be allowed to rewrite incorrectly completed sheets on the spot and thus accept the form. To make work easier on the website of the Federal Tax Service, you can download a special program created for generating registration documents.

The person filling out the documents has two tasks:

- Do not make mistakes when filling out your personal information so that it exactly duplicates your passport information.

- It’s good to think about what types of activities he is going to engage in, find out the necessary OKVED codes and write them down on the form.

Finding the right codes can take some time, and this is perhaps the most difficult part of filling out the entire form.

The primary information that is filled out by the future entrepreneur is distributed across several sections.

Sheet 1. Personal data

This section contains the following information:

- Full name, surname, patronymic.

- Taxpayer Identification Number, if available.

- Floor.

- Birth data: date, place of birth of the applicant, indicating the country, region and other necessary geographical information.

- Citizenship (number 1 for Russian, 2 for other countries, 3 for stateless).

- For foreigners, there is an additional field where the code of the country whose citizenship they have is filled in.

Sheet 2. Postal and passport data

- Information about place of residence or registration in the Russian Federation. To correctly fill out the address, it is recommended to use the KLADR directory.

- Passport details or details of another available document confirming the person.

We will talk about filling out sheet 3 a little below, since it only applies to foreign citizens.

Sheet A. OKVED codes

All necessary activity codes that must be entered into the application form can be found directly in Appendix A to Resolution No. 454-st of the State Committee of the Russian Federation for Standardization and Metrology, where they are grouped by type, or search on the Internet.

The codes are written on a line and must contain at least four digits. There are no restrictions on the number of filled-in codes. Therefore, in addition to the types of activities that you definitely plan to engage in, you can also write down those whose use is unlikely, but possible. If one sheet is not enough, you can use several. The only caveat is that the main OKVED is filled out only once on the first page.

Some activities entered on the form may require an additional certificate of no criminal record. This is activity in the fields of education, medical, social and others, including those where the interests of minors are affected.

Sheet B. Confirmation of the accuracy of the submitted information

- The method for issuing the finished certificate is indicated (number 1 - to the applicant himself, 2 - to the applicant or by proxy, 3 - send by mail).

- Contact details.

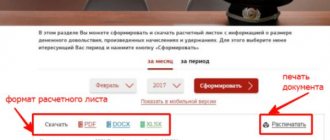

You can download the application form and sample here

Spaces are not used to indicate telephone numbers. Each number and sign is written in a separate cell. An email address is indicated only if the application is submitted online.

If you submit an application in person, it is signed only in the presence of a Federal Tax Service official authorized to accept documents. If sending occurs by mail or by proxy, then the applicant’s signature is notarized.

For detailed information about filling out the form electronically, see the following video:

Additional information and direct registration

One of the most important features is the choice of taxation form. You can switch to a simplified scheme no later than within 30 days from the date of registration, so you should think about this possibility in advance. The best option is to immediately write an application to switch to the simplified tax system and submit it along with documents for registering an individual entrepreneur. At the FN department, the applicant is given a receipt for documents and one copy of an application for transition to a simplified scheme.

If the application is filled out correctly and the necessary documents are attached, and the state fee is paid, then the registration procedure itself, as a rule, takes no more than five working days. In other words, becoming a new individual entrepreneur and starting your own business will not be difficult. If you receive the appropriate status, you can immediately start doing business in a particular industry.

Last changes

However, the last point of the above general requirements has lost its relevance due to recent changes. Federal Law No. 129 on the registration of legal entities and individual entrepreneurs was amended by Law No. 312 of October 30, 2017, which entered into force on April 29 of this year. The form for registering an individual entrepreneur in 2020 can also be submitted in paper form, however, the Federal Tax Service is obliged to issue all documents evidencing the registration (the Unified State Register of Entry and Entry into Entry and the Certificate of Registration) only in electronic form.

Thus, specifying an email becomes a necessary requisite. Originals are now issued only upon special request. This innovation is expected to significantly increase the efficiency of interaction and, for example, the result when submitting forms through the MFC will be obtained faster.

In this article:

- General requirements for filling out an application

- Filling out application P21001 step by step

Form P21001 - application for registration of an individual as an individual entrepreneur. To fill it out correctly, you need passport data, types of activities according to codes from OKVED, email address, and a valid phone number. The application must be filled out strictly according to the instructions, because Errors in form P21001 are a common reason for tax authorities refusing to register an individual entrepreneur.

What requirements must be met in order to fill out the application correctly?

- The application form can be filled out manually or on a computer.

- If text data is entered into applications, they are written in capital letters, but if the application is filled out on a computer, then the Courier New font is used.

- font size 18.

- Fill out the application from left to right.

- The application must be written in black; if filled out by hand, use a black pen; if printed from a computer, use black ink.

- Any symbol required by the filling logic and only one is entered into the space intended for filling, for example, only one letter, one number or one punctuation mark.

- If you need to enter several words, you should leave one space between them blank.

- When there is not enough space on a line to enter the required data, you can do the following:

– fill all the familiar places of the current line, the rest are written in a new line, starting from the first familiar place on the left, even if the word is broken, and the hyphen is not used;

– if the line is completely filled and the last space is filled with the last letter of the word, then starting from the new line, one cell is skipped, which will be a space between two separate words.

- If not all sheets of the application are completed, then empty ones are not included in form P21001 and are not provided to the tax office

- There should be no in the completed application form, ready for submission to the tax office !

- Form P21001 pages must be printed on one side of the sheet only.