Rules for drawing up a certificate of salary in the Pension Fund for granting a pension

To receive pension benefits, you need to prepare a package of documents, which are subsequently provided to an employee of the Pension Fund of the Russian Federation. It includes a certificate of the citizen’s salary, which is taken from the employer.

Attention! Typically, a salary certificate is Form 2-NDFL, but to submit it to the Pension Fund, it is not necessary to draw up the paper in accordance with all the rules. The document contains a list of information required to be reflected:

- Instead of a header, an imprint of the enterprise is placed, which reflects all the basic information about it. If there is no such stamp, the data is filled in in writing and a stamp is affixed below;

- Last name, first name, patronymic of the employee, as well as his date of birth. However, some businesses do not bother to record information about the age of the former employee;

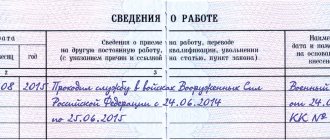

- How long does the employee work at the company? In this case, the exact periods and total service life are reflected;

- The amount of the employee's salary reflected by month. Annual income is also taken into account when drawing up the certificate;

- The currency in which the employee is paid. This is a requirement for all financial documents. It is enough just to write the final amount in words.

The certificate reflects the amounts that were accrued to the employee and not received by him. Thus, the deduction of 13% personal income tax is taken into account when filling out the document.

There are accruals that should not be taken into account when calculating your pension. These include:

- compensation issued to an employee in connection with unused vacation;

- payments due to the mother during the period of child care.

The note to the certificate reflects information on the calculation of temporary disability certificates.

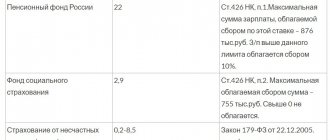

The certificate reflects information that the employer transferred the required contributions to the Pension Fund of the Russian Federation on behalf of the employee. Their exact size is indicated. In addition, copies of payment documents confirming the sending of contributions are additionally attached. Sometimes such papers are not provided.

The certificate is affixed with the seal of the organization, as well as the signature of the general director and chief accountant.

How to make a request to the Pension Fund archive for a pension

Good afternoon The husband applied to the Pension Fund for an old-age pension. Provided the necessary documents, including a work book. The fund told him that it was necessary to confirm all records because there were unclear stamps. Until 1996, he and his family lived in Kazakhstan. After moving to the Russian Federation, there were long ordeals in obtaining citizenship and settling in a new place of residence. It was not possible to get a job officially; the official work experience was only in Kazakhstan. They demand to bring certificates, and how and where to write requests, because now Kazakhstan is a different state, the organizations where my husband worked have not existed for a long time. Tell me, isn’t the Pension Fund involved in drawing up and sending out relevant requests? Why then are there such a bunch of clerks? An official government agency has more opportunities to obtain the necessary information through official channels than an ordinary person, especially an elderly person. Where can I get the necessary forms? contacts, addresses? At the time of the collapse of the USSR, my husband was 33 years old. In those days it was impossible not to work, all able-bodied people worked, there was an article for parasitism. Taking into account military service, most workers already had 8 years of work experience by this age.

- In this section you need to select the type of appeal. A statement confirming your work experience and salary is required.

- Fill in the form:

- indicate the applicant’s full name and organization name;

- correctly indicate the period of work in the form;

- indicate the location of the company;

- the position held by the applicant at that time.

Why do you need a certificate?

To receive a pension, a future pensioner must prepare a package of documents, which includes the following papers:

- passport;

- SNILS;

- military ID, if available;

- employment history.

The work book is the main document that makes it possible to determine the employee’s length of service. However, you will also need to obtain a salary certificate from your employer, because its size directly affects the amount of your future pension.

A work book is required to record work experience up to 2002. After this period, all deadlines are contained in the automated system of the Pension Fund of the Russian Federation.

Important! To calculate income for the period before 2002, the automated system takes the period from 2000 to 2001. However, if at this time a citizen received a small income, and in other periods his salary was higher, he may request a recalculation. Moreover, the average monthly salary is calculated based on the salary for any five years.

In our time, there is no need to provide a salary certificate to the Pension Fund. This rule was enshrined in a regulatory legal act that has lost legal force (Resolution of the Ministry of Labor of the Russian Federation No. 16 of 2002). However, when applying for a monthly state benefit, specialists of the Pension Fund of the Russian Federation do not pay attention to this fact and continue to request a certificate.

How to prepare documents in advance

Preparation of documents for receiving a pension

To prepare documents confirming information about the amount of wages, you must provide the following information:

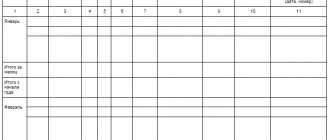

- Information on earnings for 60 months of work before 2002 or two years later (in the latter case, confirmed by personal records of the Pension Fund of Russia).

- If an application for pension payments is reviewed by a specialist at the Pension Fund of the Russian Federation, then the salary is set based on a coefficient of 1.4, and this is the maximum indicator. There is no need to provide any supporting evidence here. If earnings for 2000 and 2001 are less than expected, then a document indicating the amount of salary for 60 months before the start of 2002 is accordingly required.

After this time, the amount of wages does not affect the calculation of pension payments due to the fact that the calculations take into account the amount of insurance payments transferred from the enterprise to the Pension Fund of the Russian Federation. It is equally important to consider the salary and length of service.

Based on legislative and regulatory acts, it should be noted that citizens send a package of documents for pension accruals to the Pension Fund of the Russian Federation, located territorially. If according to the documents there is a difference between the citizen’s place of residence and registration, then it is possible to apply at the place of residence. If a person is convicted, then you can submit an application through the administration of the institution where he is located. There is no need to worry about deadlines for submitting documents, they are not limited.

Where can I get it

A certificate for the Pension Fund is obtained from the accounting department of the organization in which the future pensioner worked. In small firms, you need to verbally ask the chief accountant to draw up a document. In some organizations, the preparation of such paper is directly carried out by the manager.

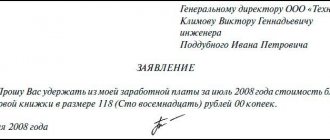

In large organizations, it is required to draw up a request application, which reflects the name of the document, the full name of the employee, as well as the purpose of the paper.

There is no single approved form. Each enterprise develops a document form independently. There is information that must be included. Professional accountants usually know this.

The finished document must be certified with a seal. Signatures of the chief accountant and manager are required.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Calculation of pensions for those born before 1967: procedure for registering accruals

People raising children alone can count on the insurance share. If the sole breadwinner had a certain period of work, then the insurance share is also calculated. To apply for any type of old-age benefits, you need to confirm that the breadwinner is absent or has died by providing a death certificate or a court decision declaring missing.

We recommend reading: Young specialist in rural areas program 2020 Chuvashia

After calculating the payment, the moment of its receipt is important. If all documents are completed correctly and submitted on time, the amount will be calculated and issued within the 10th day. If the pensioner submitted bank card or account details, then the payment is made to it on the 10th day, and there is no need to apply anywhere. When receiving money by mail, there may be a delay of 1-3 days for the postal service to process the new application. If the amount is less than the subsistence minimum (it is 10-11 thousand rubles), contact the Pension Fund.

Where can I get salary information if the company is liquidated?

If the enterprise where the future pensioner worked is liquidated, a citizen can apply for a certificate to the successor company, that is, an organization that was formed after the closure of the previously established company.

If there are no successors, you will need to contact the archive. All papers related to the existence of a previously closed enterprise are stored here.

The archive worker independently fills out the certificate in any form convenient for him. If he does not have any information, then the information does not have to be included in the document.

Watch the video. New salary certificate:

What does a pension consist of?

The insurance pension (formerly called labor pension) is calculated according to the formula:

number of points * cost of one point.

The cost changes annually and is approved by Government Decree. Those citizens who have earned at least thirty points during their working life have the right to pension provision. The total pension includes the insurance part and a fixed payment (previously the basic part). The size of the fixed payment is also approved at the state level.

That is, only points need to be calculated. And their number depends on the salary.

For what period is a certificate drawn up to assign a settlement?

Please note! According to the current Russian legislation, when calculating a pension, you can take two periods to calculate your average monthly earnings:

- wages for the period from 2000 to 2001;

- salary for any five consecutive years.

According to statistics, the best years for which the highest average monthly salary is calculated are 1976 - 1986.

It is not difficult to understand which option to choose. There is no need to select a five-year period if, from 2000 to 2001, the employee received:

- 2900 rubles for areas where the salary coefficient is 1.8, for example, the Republic of Sakha (Yakutia);

- 2600 rubles, where the coefficient is equal to or greater than 1.6, for example, Murmansk region;

- 2100 rubles, where the salary coefficient is equal to or less than 1.5, for example, the Republic of Udmurtia.

The size of the future pension directly depends on the previously received wages. That is why years are so important when calculating security when determining average monthly income.

Where can I get information about income for calculating pension payments?

Old-age pension for men begins at the age of 60 years, for women - 55 years. But some professions (preferential ones) imply retirement at an earlier age.

A certificate of the employee’s average salary for the purpose of an old-age pension is requested from the organization’s accounting department.

As a rule, an employee of pre-retirement age only asks for a certificate orally. This practice is used in small companies; in large enterprises, a corresponding application is also drawn up.

Each enterprise can develop the salary certificate form for the Pension Fund independently; it is also possible to fill it out using an existing document taken from another organization as a basis.

The completed certificate is signed by the head of the human resources department, chief accountant, and head of the enterprise.

If the organization has been liquidated, it is necessary to send a written request to the archive department that accepted the papers of the deregistered company, and issue an extract from the salary documents.

The form of the certificate for the Pension Fund is known to the archive workers; they help collect the necessary documents for assigning a pension.

It is not always possible for an archive employee to draw up a certificate in the approved form, but he has the right to fill out the document himself according to the information he has.

Additionally, on our website you can download samples of earnings certificates:

- for subsidies;

- for unemployment benefits from the employment center;

- for social security benefits.

Application processing time

The deadline for applying for a pension has not been established. The main thing is to start registration no earlier than retirement age.

The citizen’s documents and application are reviewed within ten days from the date of submission of the package of papers. Next, a decision is made on the assignment of a pension. The citizen will learn the date of its receipt from a written notification.

Sometimes a future pensioner, due to his carelessness, makes mistakes while collecting papers or filling out documentation. In this case, three months are given to correct errors.

The period for providing pension benefits also increases if the pension is issued at the place of residence and not at the place of registration.

Watch the video. Why do you need work experience, how to retire:

Dear readers of our site! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your specific problem, please contact the online consultant form on the right. It's fast and free! Or call us at :

+7-495-899-01-60

Moscow, Moscow region

+7-812-389-26-12

St. Petersburg, Leningrad region

8-800-511-83-47

Federal number for other regions of Russia

If your question is lengthy and it is better to ask it in writing, then at the end of the article there is a special form where you can write it and we will forward your question to a lawyer specializing specifically in your problem. Write! We will help solve your legal problem.

The main document for applying for a pension - where to apply

The state supports childhood, motherhood and old age in every possible way. Every year, programs come into force that allow these categories to receive financial support. One such program is a pension.

salary certificates to the Pension Fund for calculating pensions - where to get, how to apply?

» » » 08/28/2020 Every year, government programs come into force that allow certain categories of citizens to receive financial assistance. One of these areas is pensions. When a citizen approaches retirement age, he needs to prepare documents confirming his earnings and required for calculating monthly payments This form is a salary certificate. The article describes typical situations. To solve your problem - or call for free: - Moscow - - St. Petersburg - - Other regions - It's fast and free!

Old-age pension for men begins at the age of 60 years, for women - 55 years.