The provisions of Article 30 of the Federal Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation” establish a certain method for calculating labor pensions. And the issue of experience plays a paramount role here.

The size of labor pensions should be calculated based on the total length of service of a citizen of the Russian Federation and his earnings before January 1, 2002. In addition, the amount of insurance premiums that were paid by the employer and recorded in the individual personal account of the policyholder after January 1, 2002 is taken into account.

The length of service that was worked after the above period is not taken into account when calculating and assigning a labor pension - this only applies to the amount of insurance contributions.

Thus, it can be argued that, according to the pension legislation of the Russian Federation, there are two main concepts - insurance length of service and total work experience.

Sick leave and calculation of length of service

Article 30 of Law No. 173-FZ of December 17, 2001 provides a fairly clear definition of length of service for assessing the pension rights of insured persons. Work experience is the total duration of not only labor, but also other socially useful activities until January 1, 2002. It is taken into account in calendar order, including the periods during which the employee should have been insured in the pension fund. In other words, he was obliged to pay contributions to the Pension Fund.

Now let’s look at the main question: is sick leave included in the length of service? If a citizen is on sick leave and at the same time is in an employment relationship with an organization, then this period can be counted towards the total length of service until 01/01/2002.

If during a given period a citizen was on sick leave, but was not in an employment relationship, then such a period is qualified as non-insurance and is not included in the total length of service.

It is worth noting that the insurance period represents the total duration of periods of work or other activities during which payments of insurance contributions to the Pension Fund of the Russian Federation were made. Other periods that are taken into account when calculating length of service are also important. So, in this case we are talking about the total duration of the employee’s work activity before 01/01/2002 and after 01/01/2002.

Since insurance contributions to the Pension Fund are not paid on days the employee is on vacation, sick leave is not included in the length of service.

Lots of documents

According to the “Rules for Confirming and Calculating Insurance Experience” (they are included in the third chapter of the Federal Law “On Labor Pensions in the Russian Federation”), insurance experience should include: the period of work under the employment contract; period of municipal, civil or public service; as well as the period of activity during which employees were subject to compulsory social insurance in case of illness.

In accordance with the above-mentioned Federal Law, the size of labor pensions is calculated taking into account the total length of service and the earnings received by the citizen (but only until January 1, 2002). The amount of insurance premiums paid by the employer and recorded on the citizen’s individual personal account after January 1, 2002 is also taken into account. Thus, length of service received after January 2002 is not included in the calculation of the labor pension; only the amount of insurance contributions is important.

What is this period and what happens?

Experience is a concept that applies to all working citizens.

- Work experience refers to the duration of a person’s work recorded in the work book .

You can confirm the years worked with other documents. This could be an agreement, a certificate, contributions to the Pension Fund. The unit of measurement for experience is years and months. It doesn’t matter where a person worked and how many jobs he changed. If work periods are reflected in established documents, they are all summed up. - Insurance experience is a concept introduced into legislation since 2002 .

This is the period during which the employer deducted contributions to the Social Insurance Fund (SIF) for this employee. It is from the Social Insurance Fund that sick leave is paid in case of temporary disability. It is very important to be sure that all contributions are transferred on time. The easiest way to check the fact of transfer is in the Pension Fund. The insurance period is a key indicator in calculating the size and calculation of a pension. - Preferential work experience for hazardous occupations is a period of work according to the lists of hazardous professions established by Decree of the Government of the Russian Federation No. 665 of July 16, 2014.

- Preferential seniority allows teachers and doctors to become pensioners after working in their specialty for 25 years. This is written in clause 19, part 1, art. 30 of Law No. 400-FZ of December 28, 2013 “On Insurance Pensions”.

Sick leave payment

Let's find out how sick leave benefits will be paid depending on the length of the insurance period:

- If your insurance period is less than six months, then the benefit is paid in an amount that cannot exceed the minimum wage;

- If the insurance period is more than six months, but less than 5 years, then you will receive 60% sick pay;

- With an experience of five to eight years, payment will be made in the amount of 80%;

- And if the insurance period is more than 8 years, then your sick leave will be paid in full.

Based on all this, we can calculate the accrual of length of service and sick leave pay - useful information, right?

Well, now we know whether sick leave is included in the length of service: yes, it is. Moreover, we can calculate for ourselves how our sick leave will be paid if we suddenly get sick. But you still don’t need to get sick, especially if your insurance coverage is short. Therefore, be healthy!

What should women who are raising children do?

Employees who are on vacation and receive child benefits can also apply for the assignment of length of service to the insurance period based on the duration of work.

A temporarily disabled citizen has the right to apply for a period of insurance coverage while he was on the list of people looking for work through the employment center. This also applies to the following categories:

- Military personnel and employees of the Ministry of Internal Affairs, departmental enterprises. They receive contributions from the pension fund for agreeing to be useful to the country. If an injury was sustained in the service, the state will not just leave it like that. There is no need to worry about whether sick leave is included in the length of service for a pension in the Ministry of Internal Affairs.

- Army men receive all the benefits and payments that are due for agreeing to give the required years to their homeland. It doesn’t matter whether a citizen studies or works, he receives everything that is due in insurance cases in the same pension contributions.

- Preferential conditions are available to everyone who falls under the legislation.

It cannot be said that the innovations had a negative impact on citizens, but it is quite difficult for young specialists.

What is included in the insurance period?

To begin with, it is worth deciding on the concept of insurance experience itself. And this, in simple words, is all those periods, in their total value, for which you paid insurance contributions to the country’s Pension Fund; they are also taken into account when applying for a labor pension. It is possible to have and include other periods that are part of the insurance period.

According to the legislative norms of our country, the following time intervals can be included in the insurance period:

- When you worked or were engaged in any type of activity on the territory of our country and were insured under the compulsory pension insurance program (insured persons - hereinafter).

- When you worked or were engaged in any type of activity outside the territory of our country, you were also insured under the compulsory pension insurance program, both according to our legislation and worldwide; and also subject to independent payment of mandatory insurance payments for this type of insurance.

- When you completed military service or other activities that are equivalent to it, according to the legislation of the Russian Federation.

- When you received benefits from the state social insurance fund for temporary disability.

- When you received benefits from the state social insurance fund for child care until the child was 18 months old, but not more than 36 months in total.

- When did you receive benefits from the employment center?

- When you participated in paid public works assigned by the employment center.

- When you moved to another city or any other locality for a job to which the employment center sent you.

- When you were in prison due to unfounded decisions in criminal cases, regression, rehabilitation and exile plans.

- When you cared for a disabled person of the first group, a disabled child or a person over 80 years of age.

- When you lived with your spouse, a military man, while he/she was performing military service under a contract, where there was no possibility of your employment (this period cannot exceed five years in total).

- When you lived outside the country, provided that your spouse is an employee of a diplomatic or consular mission, according to the list approved by the government (this period cannot exceed five years in total).

Is sick leave included in length of service - advice for employees

Info

It includes the following list of points: What periods of work are included in the employee’s insurance period Article 11 Additional conditions for enrolling periods of work in the work experience Article 12 In what order are the accrual of length of service indicators carried out Article 13 What are the rules for calculating and confirming periods of work Article 14 Special aspects of length of service include the Law of the Russian Federation No. 4468-1 “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, the Federal Service of the National Guard of the Russian Federation " For military personnel, all periods of service are recorded.

Insurance experience and work experience, what is the difference?

To begin with, let's define the concept of length of service - this is a period established by law\periods in total value, which give the right to calculations and payments for vacations, sick leave, assignment and payment of pensions and similar benefits.

There are two main differences between insurance and work experience:

- Legislative assignment of length of service when receiving any social security:

- If you have an insurance period, then you have the full right to calculate and pay a pension.

- If there is a general insurance period, then it will need a legislative assessment of the length of service as such and clarification of the amount of insurance payments.

- Carrying out calculations and calculations based on length of service:

- The insurance period will include all periods both before and after the approval of the law of December 17, 2001.

- The length of service will include periods available as of December 31, 2001, and will not include periods included in the insurance period.

- Both types of length of service will include periods when you were at the labor exchange and received unemployment benefits.

- The insurance period includes all your activities as an individual entrepreneur, a member of a farm, etc.

- It does not take into account how length of service is earned; what is more important is the payment of insurance premiums. Therefore, it is important to control and pay insurance premiums. They are all your social guarantees to the extent required by law.

Calculation of length of service for sick leave

The insurance period as a result of calculating sick leave is considered the period during which the patient was insured as a result of temporary disability. It may include criteria such as:

- Labor productivity under the contract;

- Municipal and public service;

- Other time frames. For example, work may be related to the activities of an individual entrepreneur, a State Duma deputy, a member of a collective farm or a priest;

- Temporary periods of service, including work in the traffic police, as well as insurance experience in the form of sick leave calculation.

Calculation of length of service for sick leave in 2020

There is special software for calculating length of service intended for a temporary disability document. But, first of all, you need to understand that it is calculated in full days, months and years. This is stated in the Rules for calculating the insurance period, which were approved by order of the Ministry of Health and Social Development of the Russian Federation.

One full month is 30 days, and a year is 12 months. Now you can count the number of complete months and years. Convert the remaining days into months, and throw the rest aside. The number of months must be converted to full years. Now you can calculate the number of complete years and the number of months. They constitute the main length of service of an employee.

In this case, you won’t need an online calculator.

Calculation of sick leave without work experience

The procedure for calculating and paying for disability documents in 2018 is divided into several steps:

- To begin with, the average salary for the given time frame is determined.

- The daily wage is then calculated;

- Then the number of payments in the form of benefits is calculated;

- A fixed benefit amount is established for subsequent payment.

First you need to understand what your wages were for the previous full 24 months. Has the employee recently joined the organization? Provide a certificate of the amount of wages and other payments from previous jobs.

Every employer is required to provide such a certificate when dismissing an employee. You can then calculate your average daily income. The total amount is divided by 730. Then you can calculate the daily allowance for temporary disability.

The number of years the employee has worked must be taken into account. If he works for no more than six months, then for the next month of illness he is entitled to no more than one minimum wage.

That is, no more than 7 and a half thousand rubles from the first of July last year.

Let’s summarize the calculations and get the final amount when providing sick leave. The total number is multiplied by the number of days worked.

Is sick leave included in the length of service for calculating vacation pay?

A temporary disability document is issued quite often today. It is not beneficial for an employee to be on temporary disability leave. If he has worked in this or other organizations for 8 years, then his salary remains 100 percent.

From 5 to 8 - the salary is 80 percent. Up to 5 years - 60 percent. It should be noted that the total amount for sick leave payment is not calculated in the employee’s total income, from which vacation pay is formed. If an employee falls ill during the vacation period, this is also not included in the calculation.

Bottom line: the calculation of vacation pay has nothing to do with sick leave.

Is sick leave included in the length of service when calculating a pension?

The number of years worked (experience) is the sum of the length of days in socially useful work. This also includes periods of activity in accordance with the legislation of the Russian Federation. Based on the total number of years worked, the size is determined:

- Old age pensions;

- Due to disability.

However, two factors must be taken into account to include them in the length of service:

- The citizen must work on the territory of the Russian Federation;

- Contributions must be made to the Pension Fund with government support.

The period of work abroad may also be included in the total length of service. This clause is necessarily prescribed in an international treaty, and pension contributions were transferred to the Pension Fund of the Russian Federation. Does sick leave affect pension calculation? Most likely not, since it is not taken into account in the total number of years.

Maternity leave and sick leave for retirement

Maternity leave is considered paid leave. It is provided to a woman for the successful completion of pregnancy and subsequent childbirth. The duration is usually 140 days. Sometimes it's 156 days. The degree of complications of pregnancy and childbirth is taken into account.

If twins or more children are born, maternity leave is extended to 194 days. When calculating for a pension, maternity and sick leave are not included in the length of service, and therefore not in the pension. During this time, no contributions to the Russian Pension Fund are made.

As a rule, maternity leave consists of two types:

- Leave during pregnancy and childbirth;

- Baby care.

A woman must first get an appointment with her doctor. He will write out a document - a sick leave certificate. Based on the data provided, the employer issues mandatory leave. Regardless of the number of years the employee has worked, he is paid 100%. This is stated in Federal Law No. 255 on Compulsory Social Insurance.

If you have questions, consult a lawyer. You can ask your question in the form below, in the online consultant window at the bottom right of the screen, or call the numbers (24 hours a day, 7 days a week): ( 2 4.00 out of 5) Loading…

Source: https://russiansu.ru/bolnichnyj-list/raschet-trudovogo-stazha-dlya-bolnichnogo-lista.html

The importance of the insurance period when calculating sick leave benefits

When calculating sick leave benefits, your entire insurance record is taken as a basis. And the amount of payment is directly proportional to its total duration. You can divide sick pay by periods:

- Provided that the insurance period is five years, sick leave payment will be equal to 60% of the average monthly salary.

- Provided that the insurance period is between five and eight years - 80%.

- Provided that the insurance period is more than eight years - 100%.

- Provided that the insurance period is less than six months, the payment will be equal to one minimum monthly salary with the influence of the regional coefficient.

Important! The insurance period for sick leave is calculated based on the date of occurrence of the insured event and has a calendar calculation. We remember that calculations are made on the basis of full calendar periods, and this can make dramatic changes in the amount of payment.

When does the insurance period cease to be so?

Non-insurance temporary situations are those when a person is registered with an enterprise, but does not fulfill his official obligations. But you can have no doubt about whether sick leave is included in the length of service for vacation. Definitely, the answer is yes. These include:

- military service;

- sick leave for social benefits;

- leave during pregnancy, as well as for child care (up to 6 years);

- leave to care for a disabled person;

- forced sick leave to care for the elderly under the age of 80;

- if the person was registered at the labor exchange as a disabled citizen;

- when you were on a business trip (if you spent more than 24 hours on the road without starting work);

- being in prison or custody.

Such periods can be considered non-insurance if people are considered insured and the company makes contributions to the funds according to equal periods.

Is sick leave included in harmful work experience? According to list No. 2, this applies only to those who work in enterprises in life-threatening conditions. According to list No. 1: these are hazardous enterprises that pose a threat to human health, not human life.

Counting the period of military and army service into the insurance period

On January 1, 2010, by order of the Ministry of Health and Social Policy, it was approved that the calculation of payments for sick leave during the period of general insurance coverage includes the time when you served in military and army service. However, only after January 1, 2007. Until this moment, no records are kept of this activity.

Important! Provided that this requirement had a significant impact on the amount of payment. It will be produced additionally from government funds.

Starting from January 1, 2010, all time spent in military and army service is included in the insurance period.

News about the exclusion of sick leave

Initially, conversations started last year. The main reason is that employers do not pay insurance premiums on sick leave, which raises the question: is it necessary to take this time into account at all?

It was precisely on the basis of such conclusions that the government came to the conclusion that unearned time should be excluded.

How long does sick leave include? Watch the video:

First of all, the situation concerns citizens who work officially and whose employers make timely insurance contributions.

What length of service is taken into account when calculating benefits in 2020 and how to calculate it

It is very important to correctly calculate the length of service to calculate disability benefits, since an error of even 1 day will give the Social Insurance Fund inspectors reason to recalculate the entire amount of sick leave.

For sick leave, the SS is taken into account, including all non-insurance periods. SS calculation is carried out in calendar order. All partial work periods are converted to full months and years in the following order: 30 days are counted as a full month, and 12 months are converted to a full year. Moreover, if a person worked in different organizations at the same time, then one of the periods of the employee’s choice is taken into account. This choice must be supported by a statement from the employee.

ATTENTION! When calculating length of service for sick leave, all insurance periods are taken into account, regardless of work interruptions.

To correctly calculate an employee’s insurance period for calculating sick leave, you can use free software by downloading it from the Internet.

Let's consider the algorithm for calculating the CC using an example.

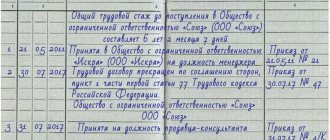

Efimova A. Yu. 02/20/2017 provided the accounting department of Versailles LLC with a sick leave certificate for 14 days of incapacity for work (from 02/06/2017 to 02/19/2017). The period of work in this company is from 06/01/2015, that is, 1 year 8 months. and 5 days (calculation from 06/01/2015 to 05/31/2016 - 1 year, from 06/01/2016 to 02/05/2017 - 8 months and 5 days).

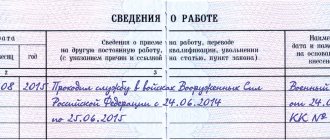

The work book contains the following entries:

07/17/2014 to 03/31/2015 - Garant LLC;

01/15/2013 to 07/16/2014 - Azimuth LLC.

Let's calculate the total SS.

Now we add up the obtained indicators: 1 year 6 months. + 8 months 15 days + 1 year 8 months. 5 days = 2 years 22 months. 20 days.

22 months convert to a full year, that is, 1 year 10 months.

2 years 20 days + 1 year 10 months. = 3 years 10 months 20 days.

20 days are less than 30 and are not counted as a full month, so the SS is not included in the calculation.

Thus, the SS is equal to 3 years 10 months.

How to determine the length of insurance for calculating sick leave?

Imagine that you incorrectly calculated an employee’s length of service. It turned out to be a little less than 8 years, but it should have been 8 years or more. If you make a slight mistake, the employee will receive less money than he should. In order not to offend employees and not violate the law, we will learn how to calculate the insurance period correctly.

Training

Remotely at Kontur.School. For accountants and personnel officers. Training document.

Select program

Calculation of the insurance period may be necessary in two cases:

- When calculating benefits for temporary disability or, as we used to call it, sick leave.

- To assign a labor pension.

In these cases, the calculation procedure, periods and other details may differ. In the article we will analyze only the calculation of the insurance period for assigning sick leave.

The amount of sick pay depends on length of service

The amount of temporary disability benefits depends on the employee’s insurance coverage:

- if the employee’s insurance period is from 6 months to 5 years, then he should be paid 60% of average earnings;

- from 5 to 8 years - 80% of average earnings;

- insurance experience more than 8 years - 100%.

Rules for calculating insurance experience

The insurance period is the period when the employee worked and the employer transferred insurance contributions for him to extra-budgetary funds.

Mandatory condition: you can include a certain period in the calculation of the insurance period only if insurance premiums were paid for the employee during this period.

The rules and procedure for calculating insurance experience are defined in the Rules for calculating and confirming insurance experience to determine the amount of benefits for temporary disability, pregnancy and childbirth, approved. by order of the Ministry of Health and Social Development of Russia dated 02/06/2007 No. 91 (hereinafter referred to as the Rules for calculating the insurance period).

Do not confuse insurance experience with work experience - these are different concepts

Work experience is the duration of exclusively labor activity, which is carried out on the basis of an employment contract.

For example, an employee who will be awarded temporary disability benefits was an individual entrepreneur in certain years. There was no employment contract, but during this period the individual entrepreneur paid insurance premiums for himself.

There is a discrepancy: there is no employment contract and, as a result, there is no entry in the work book either, but there are deductions for the period.

When assigning benefits to an employee, this period can be included in the insurance period, but on condition that the employee provides certain documents, for example, a certificate from the territorial office of the Federal Social Insurance Fund of the Russian Federation.

Documents confirming insurance experience

The main document confirming periods of work is a work book.

What if the information in the labor record is incorrect and inaccurate, or there are no records at all about individual periods of work? Then, to confirm the periods of work, the following are accepted:

- written employment contracts drawn up in accordance with labor legislation in force on the day the relevant legal relationship arose;

- certificates issued by employers or relevant state (municipal) bodies;

- extracts from orders;

- personal accounts and payroll statements.

If a work record book is not kept, periods of work under an employment contract are confirmed by a written employment contract drawn up in accordance with the labor legislation in force on the day the relevant legal relationship arose.

There are special cases - nannies, entrepreneurs, military personnel, etc.

The list of documents on the basis of which it is possible to confirm the length of service for various cases is given in section II of the Rules for calculating and confirming the insurance period (approved by order of the Ministry of Health and Social Development of Russia dated 02/06/2007 No. 91).

Situation : the employer demanded that the newly hired employee provide documents that can confirm that previous employers paid insurance premiums from payments made in favor of this employee. Should an employer really require such documents?

Decision : in paragraph 8 of the rules for calculating and confirming insurance experience, approved by order of the Ministry of Health and Social Development of Russia dated 06.02.

2007 No. 91, provides a list of documents that can be used to confirm insurance experience. There are no documents listed here that can confirm that previous employers paid insurance premiums for the employee.

Accordingly, it is not necessary to require these documents from a new employee.

Employer actions:

- Check the availability of documents that can be used to determine the periods included in the insurance period (work book, employment contracts, etc.).

- Now you can count your insurance period.

Periods of insurance coverage for sick leave

The insurance period includes:

- periods of work under an employment contract;

- periods of state civil or municipal service;

- periods of other activities during which a citizen was subject to compulsory social insurance in case of temporary disability and in connection with maternity.

Calculation of insurance period for sick leave

Calculation of periods of work (service, activity) is carried out in calendar order based on full months (30 days) and a full year (12 months). In this case, every 30 days of these periods are converted into full months, and every 12 months of these periods are converted into full years (clause 2, section III of the Rules for calculating and confirming the insurance period).

If the periods of work (service, activity) included in the insurance period coincide in time, one of such periods is taken into account at the choice of the insured person, confirmed by an application indicating the period selected for inclusion in the insurance period (clause 22 of the Rules for calculating the insurance period) .

An example of calculating insurance experience

Let's calculate the insurance period for employee Igor Plyushkin to calculate temporary disability benefits. The employee brought sick leave for the period from August 10 to August 15, 2020. Work book details:

- from January 1, 2012 to July 20, 2012, Plyushkin worked at Progress LLC;

- from July 22, 2012 to August 25, 2014 - at Vector LLC;

- from August 26, 2014 to August 29, 2014 - at Horizon LLC;

- from September 1, 2014 to the present time he works at Prima LLC.

Please note that the length of service should be calculated on the day preceding the day the illness occurred, that is, in our example, on August 9, 2020:

- period from 01/01/2012 to 07/20/2012 - 0 year 6 months. 20 days;

- period from 07/22/2012 to 08/25/2014 - 2 years 1 month. 4 days;

- period from 08/26/2014 to 08/29/2014 - 0 years 0 months. 4 days;

- period from 09/01/2014 to 08/09/2017 - 2 years 11 months. 9 days

- Total : 5 years 7 months. 7 days Igor Plyushkin’s insurance experience is 5 years 7 months 7 days; accordingly, when calculating benefits, the average daily earnings must be multiplied by 80%.

Advanced training courses for accountants and chief accountants on OSNO and USN. All requirements of the professional standard “Accountant” are taken into account.

Source: https://school.kontur.ru/publications/398

What documents are used to calculate length of service for the Social Insurance Fund?

The length of service for sick leave is calculated according to the employee’s work book. If a document is missing or contains incorrect information, the following are taken into account:

- labor agreements formalized by law;

- certificates issued by the employer;

- personal accounts;

- extracts from orders.

All documents must contain:

- number and date of issue;

- Full name of the employee;

- employee's date of birth;

- place of work;

- job title;

- work period.

The papers are transferred to the accounting department at the insured person’s place of work.

If an insured event occurs and the employee cannot provide the necessary documents to calculate the insurance period, then information about the employee’s salary and length of service should be requested from the Pension Fund of the Russian Federation.

Vacation and insurance days

A person can get a job while being a student and receive a salary. At the same time, he goes to the session or study and successfully graduates from the university without losing his job. As for sick leave, it will not be included in the insurance period, but in the work experience. Periods when a person takes vacation, legally paid by the enterprise, are considered insurance periods. Is sick leave included in the length of service when calculating a pension? No, it only shapes work activity.

Important! Employees who took sick leave before 2002 can consider their non-insurance periods as insurance periods, since they are included in the insurance and length of service. Everything that was issued after 2002 is not subject to accounting during the insurance period.

Formation of labor law

It is worth noting that everyone who formed their labor law before 2002 will receive a pension under the old law. In other words, a person goes to work officially according to the Labor Code of the Russian Federation, receives the right to work, which means he has the right to a pension and all deductions.

READ MORE: How to apply for a disability insurance pension

Is sick leave included in the length of service for a preferential pension in such cases? Yes, this is the case if the employee designated his resources officially before 2002.

Are sick leave and vacation included in harmful work experience{q}

A certificate of incapacity for work is a document necessary to confirm the legality of an employee’s absence from work due to deteriorating health, accruing appropriate payments to him and taking into account his total length of service.

A number of regulatory documents of the Russian Federation are responsible for regulating issues in this area:

- Chapter 3 “Insurance pensions” of the Federal Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ.

- Law of the Russian Federation of February 12, 1993 No. 4468-I “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system , troops of the National Guard of the Russian Federation, and their families."

- Federal Law No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

https://www.youtube.com/watch{q}v=9YosHito79w

This article talks about typical ways to resolve the issue, but each case is unique. If you want to find out how to solve your particular problem, call:

- Moscow.

- Saint Petersburg.

Or on the website. It's fast and free!

The Social Insurance Fund of the Russian Federation is responsible for calculating temporary disability benefits.

This organization, based on the period during which the citizen transferred insurance contributions after January 1, 2002 and based on the years worked until December 31, 2011, calculates the amount of social benefits due for transfer.

If a citizen, during a period of illness, did not have a legal labor relationship with an organization or enterprise and did not make monthly contributions to the Fund, then he cannot, by law, count on sick leave payment and accounting for this period of total length of service.

The disability benefit depends on how long the citizen worked and how much social benefits he managed to deduct:

- not less than the minimum wage - if the working period is less than six months;

- 60% of monthly salary – five years;

- 80% of monthly salary – from five to eight years;

- 100% of monthly salary – more than eight years.

For the calculation of temporary disability benefits and labor pensions, the determining role is played by the total length of work or insurance experience.

Work experience is the period of labor and social activity of a citizen until January 1, 2002. After 2002, calculations are made only for payments to the Social Insurance Fund of the Russian Federation.

A work record book is considered a supporting document. It is necessary for assigning old-age or long-service pensions, vacation pay, and social benefits.

The insurance period is the period of labor and other activities of a citizen, during which funds were transferred to the Social Insurance Fund of the Russian Federation.

According to the Federal Law “On Insurance Pensions” dated December 28.

2013 N400-FZ, only those periods of a citizen’s incapacity for work will be included in the insurance period during which he was officially employed or engaged in another type of activity with deductions to the Social Insurance Fund. All other cases will be considered uninsurable and cannot be counted towards the number of days for calculation.

The length of service will include all days during which the employee was actively employed.

The insurance period, according to the Federal Law “On Insurance Pensions,” includes:

- period of child care up to the age of three years;

- military service;

- conducting other labor activities both within the country and abroad with the transfer of funds to the Social Insurance Fund;

- periods of temporary incapacity for work for health reasons with the provision of supporting documents from a medical institution, including the issuance of a certificate of incapacity for work to care for a relative in serious condition or a disabled child;

- registration at the Employment Center at the place of residence and performance of public works from the Center;

- unemployed period as a spouse of a diplomat abroad, as a spouse of a military man without the possibility of employment (no more than five months).

https://www.youtube.com/watch{q}v=O4pFYEVfonc

Before the adoption of the new pension reform in 2002, the pension was calculated based on the number of days worked, and an employee’s time on sick leave was included in the total length of service.

According to the new pension reform, which came into force in January 2002, the size of the pension depends on the insurance contributions transferred by the citizen. When granting temporary disability benefits, it is subject to personal income tax only.

Deductions from sick leave payments to the Pension Fund are not provided, therefore, when calculating pension payments, periods of absence from work due to illness must be removed from the total number of working days.

Thus, the length of service before January 2002 and insurance payments transferred by the employer or the citizen himself after the adoption of the new reform will be included in the calculation of length of service when calculating a pension.

Dear readers, each case is individual. If you want to find out how to solve your particular problem, call:

- Moscow.

- Saint Petersburg.

The employer pays monthly insurance premiums for each employee. The period for which mandatory insurance accruals were made is called the insurance period.

We suggest you read: How to find out where a traffic police offense was committed

What to do if you are sick and need sick leave{q}

After reading the article, you will find out whether sick leave was included in your work experience, how to calculate it, and what pension supplements you should expect.

According to Article 5 of the Federal Law “On Compulsory Social Insurance” No. 255 of December 29, 2006, the basis for obtaining a temporary disability certificate is:

- Illness, injury.

- Staying at a sanitary resort treatment as directed by a doctor.

- Illness of one of the family members who requires care or quarantine.

- Maternity leave.

To receive paid sick leave you must:

- Work officially.

- Every month, pay an insurance premium to the account of the social insurance fund (FSS).

If a worker quits his job no more than a month before the sick leave is issued and does not get a new job, then the former employer pays for the sick leave. Payments are made, among other things, from the Social Insurance Fund.

You need to calculate the following:

- The time periods for which insurance premiums were paid for the year.

- Number of complete months and years.

A full month is equal to 30 days. A full year is equal to 12 months.

The main document is the work book. In its absence, the following documents can be used:

- Employment contract.

- Documents confirming employment from previous work.

- Personal accounts, indicating the periods and amounts of insurance premiums.

- Salary accounts.

- Archival documentation.

Step by Step Actions

- Select all working periods.

For individual entrepreneurs, all dates with payment of insurance premiums are taken into account. Study time is not taken into account. If a person worked at several enterprises at the same time, only one period will be taken into account. - Count the number of complete years and months of the above periods.

Add up all the days. Consider every 30 days as a full month. Then add up all the years. The resulting number of full years and months will be the insurance period.

Examples of calculations

https://www.youtube.com/watch{q}v=CIFPedG_Hn8

Alexander Ivanov was sick from February 12 to February 20, 2020. From November 1, 2006, under an employment contract, he worked in Insurance premiums were paid for the entire period.

An employee works continuously for 11 years and 4 months - the benefit will be 100% of the salary.

Petrova Anna worked from May 3, 2013 to November 21, 2020, and from December 1, 2013. In June 2020 she went on maternity leave. Returned from maternity leave in May 2018. Sick leave December 18-27, 2020.

"Salyut" - a full 2 years 5 months.

“Economy” 2 years 3 years maternity leave – 5 years in total.

In total, the insurance period is 7 years 5 months - the benefit will be 80% of the salary.

For convenience and to independently determine the amount of payment, there are special services for calculating sick leave certificates. The programs are created in accordance with all legal requirements:

- Hypnotronic

- Assistant.

- Ayudarinfo

- Calcon

The working principle of work experience calculators is approximately the same.

To calculate you need:

- In the special column, enter the dates of hiring and dismissal. You can use the built-in calendar.

- Next, if necessary, enter your full name.

- Additional periods are introduced (in case of employment in several organizations), as well as whether there was military service. Calculators contain up to 15 lines, i.e. You can enter up to 15 work periods. If necessary, lines can be added by clicking on the “add” tab. When you enter the desired date, the number of full years and months of service as of the specified date appears in the table.

- After that, click the calculate button.

The higher the salary and the longer the period of insurance coverage, the higher the amount of sick leave payment. Calculated as follows:

- The minimum wage amount for a calendar month when working for less than six months.

- 60% of earnings - over 6 months and less than 5 years.

- 80% of earnings, more than 5 years, but less than 8 years.

- 100%, i.e. in full - over 8 years.

Thus, the more time an employee worked and paid insurance premiums, the more favorable the amount of sick leave payment for him.

For non-working pensioners with a long working insurance period, annual pension indexation is provided. The higher the length of service, the higher the bonus points. There is no indexation for working pensioners. When the pensioner retires, the pension amount will be indexed taking into account the length of service. The amount of payments depends on the region of residence of the pensioner.

The period of work experience is filled out by the employer in the second part of the sheet.

Note! Work experience is calculated on the day before the onset of disability.

You must specify the number of full years and months without zeros. For example, 7 years 5 months (07 years and 05 months would be incorrect).

If an employee has worked for exactly 7 years without months, then you must indicate 7_00.