Persons preparing reporting form 6-NDFL

The form is submitted by organizations or individual entrepreneurs that make payments to individuals and are responsible for calculating personal income tax and paying amounts to the budget. The calculation contains information about income accrued to employees, including taxable incentive payments. The form is submitted quarterly and at the end of the annual period. A number of indicators are formed on an accrual basis, the rest relate to payments made in the reporting quarter. The formation of incentive payments is carried out in stages:

- Creation of internal documents at the enterprise confirming the legality of the operation.

- Issuance of a bonus order.

- Calculation of the remuneration amount.

- Setting a payment deadline.

- Tax calculation.

- Transfer of the amount of the obligation.

Data on the amounts and timing of transactions are entered into the calculation. Each payment is first calculated separately by type of income, then summed up by date of receipt. When summing without identifying types, errors may be made when reflecting the dates in the reporting of tax calculation and payment. By consistently entering amounts into the statements, the likelihood of making an error is reduced.

Recipients of the information are the tax authorities that carry out accounting of the organization or individual entrepreneur or are located on the territory of the location of separate divisions with workplaces. Persons submit reports to the tax authority to which they transfer the tax.

“Zero” calculation of 6-NDFL

If an organization or individual entrepreneur did not accrue or pay income taxable to income tax to individuals, there is no need to submit a “zero” calculation of 6-NDFL. Also, if the company has no employees, then there is no obligation to submit payments. But it is recommended to inform the tax office that reports will not be sent and indicate the reason. If this is not done, the Federal Tax Service may suspend operations on the company’s accounts or fine you for failure to submit a report. If a “zero” 6-NDFL calculation is provided, the tax office will accept it in the prescribed manner.

Consultant Plus for accountants

Order the free collection ConsultantPlus “Changes in legislation for accountants 2020” and get access to all the most important news in accounting and personnel legislation. The collection contains up-to-date reference information, an accountant's calendar for 2020, reviews of changes in insurance premiums and much more.

Characteristics of awards for various purposes

The composition of remuneration, according to Art. 129 of the Labor Code of the Russian Federation, incentive payments are included. It is required to separate amounts that are of a production nature and one-time, paid in the form of incentives or by a certain date. Bonuses related to the performance of job duties are assigned when production targets are met. The procedure for assigning bonuses of a production nature is established in the organization by the regulations on bonuses.

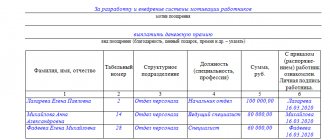

The decision on making payments is made by the manager, reflecting the data in the order. The order contains the names of recipients, amounts, and reasons for receipt.

Enterprises assign one-time bonuses regardless of performance indicators. The reasons for payment are holidays, company founding days, employee anniversaries and other non-production reasons. The amounts are not taken into account as part of the company's tax-reducing expenses. The source of security for the amounts is profit. One-time bonuses are assigned on the basis of an order from the head of the enterprise authorized by the meeting of founders or shareholders.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

How to enter data when paying bonuses along with salary

Bonus payments, depending on the performance of work, are most often made simultaneously with the basic salary. To understand how to correctly reflect them in accounting, let’s consider a specific case.

Example of recording awards

On August 14, 2017, the employees of the institution were given the basic salary for July in the amount of 401,000 rubles. The income tax on it amounted to 52,000 rubles. Exactly on the same date, employees were paid a systematic (in this case, monthly) bonus based on the results of their activities.

Premium payments were accrued for the 2nd quarter of 2020, as recommended in the order of the Ministry of Finance dated October 24, 2017. Their amount was 300,000 rubles, and personal income tax - 39,000 rubles.

Part of the 6-NDFL calculation with the designation of lines containing information about workers receiving remuneration will look like this:

- Page 100 - 07/31/2017;

- Page 130 - 401,000;

- Page 110 - 08/14/2017;

- Page 140 - 52,000;

- Page 120 - 08/15/2017;

- Page 100 - 08/14/2017;

- Page 130 - 300,000;

- Page 110 - 08/14/2017;

- Page 140 - 39,000;

- Page 120 - 08/15/2017;

Determining the timing of receiving incentive rewards

The day for receiving the amounts (personal income tax withholding) is set depending on the type of bonus, confirmed by accompanying documents. The legislation establishes deadlines:

- The last day of the month for bonuses based on labor performance.

- The day of actual receipt of the amount of a one-time bonus not related to the employee’s performance of duties.

- The last day of the month of issuing the order when making bonuses based on the results of the quarter or year.

Confirmation of the procedure for determining the period for payment of a systematic bonus is the provision of clause 2 of Art. 223 of the Labor Code of the Russian Federation, which establishes the date of receipt of income as the last day of the month in which the accrual was made. The procedure is applicable for incentive rewards calculated monthly.

One-time bonuses

Companies pay bonuses for anniversaries, professional holidays, etc. They are not related to work. In this case, the date of receipt of income is the day the money is issued. It does not matter in what month the director signed the bonus order. How to save on a holiday bonus.

In sections 1 and 2 of the 6-NDFL calculation, one-time bonuses must be shown in the same way as quarterly, semi-annual and annual bonuses. That is, include such premiums in section 1 of the 6-NDFL calculation in the payment period, and in section 2 - in the period in which the deadline for personal income tax payment fell.

Example of filling out 6-NDFL with a one-time bonus

On September 9, the director of the clinic issued a bonus to the doctors for the company’s birthday of 200,000 rubles. Personal income tax from it is 26,000 rubles. (RUB 200,000 x 13%). The company paid the bonus on September 12.

In section 2, the premium should be reflected as follows. In line 100, the accountant will write 09/13/2019, in line 110 - 09/12/2019, in line 120 - 09/13/2019. On line 130, the accountant will write out 200,000 rubles, on line 140 - 26,000 rubles.

Coding for reflecting amounts in reporting, established for various bonuses

For a more detailed reflection of data on the accrual of bonuses, a number of codes are provided in the reporting. New data was entered from December 26, 2016.

| Foundation of the award | Encoding | Deadline for receiving income |

| Monthly bonus as part of salary | 2 000 | Last day of the month |

| Bonus with monthly payments for production achievements | 2 000 | Likewise |

| Bonuses paid quarterly or annually for performance results | 2 002 | Last date of the month of issue of the order |

| One-time bonuses covered by profits | 2 003 | Day of actual receipt of incentive reward |

The legislator does not specify what amounts are made from profits. Performers are included in incentive payments from the profits remaining after taxation. The amounts are not related to the performance of duties and are one-time in nature. In the event that bonuses based on labor performance are paid simultaneously for several periods, the date of receipt of the amounts is considered to be the last day of the month of the payment transaction.

String value 120

The 6-NDFL report includes a title page and 2 sections:

- In the first, the cumulative total shows all information about tax accruals from the beginning of the year.

- The second contains data on income paid to individuals and tax withheld for a specific quarter. This is where the tax payment deadline is set.

Page 120 is closely related to pages 100 and 110. In the first, the date of actual receipt of income is written, and in the second, its deduction. The accuracy of filling out line 120 depends on the accuracy of this data.

The date of actual receipt of income is discussed in Art. 223 Tax Code of the Russian Federation. It means the day the income is paid to the recipient in any of the possible ways - crediting to a bank account, issuing cash or in physical form, etc. At the same time, paragraph 2 of the article contains important nuances:

- the date of the salary actually received is the last day of the month for which the accrual was made;

- when making payments to a dismissed employee, this date falls on the last day worked.

On page 110, reflecting the date of personal income tax withholding, you can also see the date of payment of wages, because these 2 dates coincide (clause 4 of article 226 of the Tax Code of the Russian Federation). Based on the data in this line, you can calculate the tax payment deadline for line 120 in 6-NDFL.

Payroll tax is paid within the period established by clause 6 of Art. 226 Tax Code of the Russian Federation. In general, it falls on the day following the actual issuance of funds to employees. If it coincides with a weekend or public holiday, then it must be postponed to the next day, which is a working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Lines for reflecting premiums in calculations

Section 2 of the calculation is completed for transactions performed during the reporting quarterly period. The section is intended for entering information about the dates of transactions for generating income and taxation.

| Line number | Date information for one-time awards | Date information for production bonuses |

| 100 | Information about the day the bonus was issued from the organization’s cash desk or by transfer to the employee’s personal account | Last day of the month |

| 110 | Tax withholding date for bonus payment | Date of actual payment |

| 120 | Personal income tax transfer date, defined as the next business day after the calculation is made | In accordance with the terms of payment of one-time bonuses |

How to fill out 6-NDFL when issuing a one-time bonus

Any bonus, regardless of its nature (production-related or not) and frequency of payment, is subject to income tax (clause 1 of Article 210 of the Tax Code of the Russian Federation). But the moment of its inclusion in the tax base for personal income tax, on the contrary, is determined by the indicated factors.

Exception! All non-taxable types of bonuses are listed in clause 7 of Article 217 of the Tax Code of the Russian Federation. In particular, these are payments for outstanding achievements in various fields (science and technology, education, culture, etc.) according to the list approved by Decree of the Government of the Russian Federation dated February 6, 2001 No. 89.

Let's consider one interesting letter from the Federal Tax Service of Russia dated April 11, 2017 No. BS-4-11/ [email protected] In it, tax officials referred to the opinion of the Ministry of Finance on the issue of determining the date of actual receipt of income in the form of a bonus. Thus, financiers believe (taking into account the position of the Supreme Court, set out in) that for bonuses related to wages (1) and not related to it (2), this date will be different.

For bonus payments of the 1st type, the date of actual receipt of income is determined according to the “salary” rules established by clause 2 of Article 223 of the Tax Code of the Russian Federation. That is, in the personal income tax base, such income is recognized on the last day of the month for which it is accrued. But there is one BUT here! For monthly bonuses this procedure is absolutely applicable. But what if the bonus is issued for a quarter or a longer period of time (for example, a year)?

Previously, the Federal Tax Service of Russia believed that in this case it is necessary to focus on the date of signing the order for the payment of the quarterly (annual) bonus (letter dated January 24, 2017 No. BS-4-11/1139). That is, on the last day of the month to which the order is dated, income must be recognized.

However, most recently, the Russian Ministry of Finance expressed its disagreement with this opinion in a letter dated September 29, 2017 No. 03-04-07/63400. As explained by the Department, the date of actual receipt of income in the form of a bonus paid based on the results of work for the year (including for the quarter) or a lump sum for achieved production results is determined by the date of payment, incl.

transfers to the employee’s bank account (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). And apparently, this position is supported by tax authorities (letter of the Federal Tax Service of Russia dated October 5, 2017 No. GD-4-11 / [email protected] ). That is, for the purpose of calculating personal income tax, a “labor” bonus, one-time, for a quarter or for a year, will become the employee’s income on the day of its payment.

For bonus payments of the 2nd type, the date of actual receipt of income is determined according to the general rules of paragraph 1, paragraph 1, Article 223 of the Tax Code of the Russian Federation, as the day of payment of such income (letter of the Federal Tax Service of Russia dated April 11, 2017 No. BS-4-11/ [ email protected] ). In other words, when the bonus is transferred to the employee’s bank account or issued to him from the organization’s cash desk, then income should be recognized.

In accordance with paragraph 1, paragraph 3, Article 226 of the Tax Code of the Russian Federation, income tax on “premium” income is calculated on the date of its actual receipt, i.e.:

- for a bonus that is part of the salary, this is either the last day of the month for which it is accrued or the day it is paid to the employee;

- for a bonus that is not part of the salary, this is the day it is paid to the employee.

Personal income tax calculated on income in the form of a bonus is withheld on the date of its actual payment (paragraph 1, clause 4, article 226 of the Tax Code of the Russian Federation).

The deadline for paying tax withheld from income in the form of a bonus is the working day following the day of payment of income (paragraph 1, paragraph 6, article 226 of the Tax Code of the Russian Federation, paragraph 7, article 6.1 of the Tax Code of the Russian Federation).

Now let's move on to the issue of filling out personal income tax reporting. Let's start with calculating 6-personal income tax.

As follows from the letters of the Federal Tax Service of Russia dated 03.18.16 No. BS-4-11/ [email protected] and dated 01.16.17 No. BS-4-11/499, the calculation in form 6-NDFL is filled out on the reporting date, that is, on 31 March, June 30, September 30, December 31 of the corresponding tax period. At the same time, Section 2 for the corresponding reporting period reflects those transactions that were carried out over the last three months of this period.

Line 100 “Date of actual receipt of income” is filled out taking into account the provisions of Article 223 of the Tax Code of the Russian Federation; line 110 “Tax withholding date” - taking into account the provisions of paragraph 4 of Article 226 and paragraph 7 of Article 226.1 of the Tax Code of the Russian Federation, and line 120 “Tax payment deadline” - taking into account the provisions of paragraph 6 of Article 226 and paragraph 9 of Article 226.1 of the Tax Code of the Russian Federation.

You also need to remember that if a tax agent performs an operation in one submission period and completes it in another period, then this operation is reflected in section 2 of the 6-NDFL calculation in the submission period in which it was completed. In this case, the operation is considered completed in the submission period, in which the deadline for tax transfer occurs in accordance with paragraph 6 of Article 226 of the Tax Code of the Russian Federation, regardless of the date of actual tax transfer (see letters of the Federal Tax Service of Russia dated March 13, 2017 No. BS-4-11 / [email protected] and dated 12/15/16 No. BS-4-11/ [email protected] ).

Applying these explanations to bonus payments, we obtain the following algorithm of actions. Monthly production bonuses are reflected in the calculation of 6-NDFL in the same way as wages. This means that they fall into section 1 (except for line 070) in the presentation period when the premium was accrued (as of the last day of the month for which the premium is paid).

In section 2 and line 070 of section 1, premiums and personal income tax are reflected in the presentation period when the money was actually paid and the date of transfer of personal income tax to the budget arrived (remember that this date is the working day following the withholding of personal income tax, clause 6 of Art. 226 and clause 7 of article 6.1 of the Tax Code of the Russian Federation). In this case, line 100 indicates the last day of the month for which the bonus was accrued.

All other bonuses are reflected in both sections of the 6-NDFL calculation in the period of actual payment of money. The only exception is when the bonus is paid on the last working day of the quarter. In this case, the deadline for transferring personal income tax to the budget, taking into account the provisions of paragraph 7 of Article 6.1 of the Tax Code of the Russian Federation, will be postponed to the first working day of the next quarter. This means that the operation will fall into section 2 of the 6-NDFL calculation for the next submission period.

Note that if the premium is paid in several “tranches”, then in section 2 of the 6-NDFL calculation it will be necessary to reflect each payment separately (last paragraph of clause 4.2 of the Procedure for filling out 6-NDFL, approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. MMV- 7-11/ [email protected] ). In this case, tax must also be withheld from each payment in proportion to the amount paid (letter of the Ministry of Finance of Russia dated March 13, 1997 No. 04-04-06).

When reflecting bonus payments in the 2-NDFL certificate, you need to take into account rules that are essentially similar to those that apply when filling out the 6-NDFL calculation. As follows from paragraph 5 of Section V of the Procedure for filling out 2-NDFL (approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/ [email protected] ), income is reflected in the month when it is considered actually received according to the rules of Article 223 Tax Code of the Russian Federation.

Therefore, monthly bonuses in section 3 of the 2-NDFL certificate must be reflected in the month of accrual, and all others - in the month of actual payment.

We will separately consider the issue of coding such income. Let us recall that paragraph 1 of Article 230 of the Tax Code of the Russian Federation obliges tax agents to keep records of income received from them by individuals during the tax period in tax registers using special coding. The codes themselves were approved by order of the Federal Tax Service of Russia dated September 10.

Order No. ММВ-7-11/ [email protected] contains code 2002, corresponding to income in the form of bonuses paid for production results and other similar indicators provided for by law, labor or collective agreements, provided that the payment is not made at the expense of special funds purpose, target revenue, or profit of the organization.

Accordingly, according to code 2002, bonuses that simultaneously satisfy the following conditions are reflected:

- The payment is not made from profits, earmarked proceeds or special purpose funds;

- The payment is provided for by law, labor or collective agreements;

- The basis for payment is certain production results or other similar indicators (i.e. indicators related to the employee’s performance of his or her job duties), which is confirmed by an order for the payment of a bonus.

Entering into reporting data on bonuses that differ in the period of receipt

Organizations make incentive payments for various reasons. In one billing period, more than one type of bonus may be assigned and paid. Each amount is reflected in a separate block on lines 100-140 of the calculation.

Example 1. The company Sokol LLC produces annual bonuses by the day of company registration on July 21. The remuneration amount was 35,700 rubles. The monthly bonus for production indicators amounted to 68,000 rubles for July. The order and disbursement of funds were made on July 31. The reporting of Sokol LLC reflects indicators for individual blocks.

| Calculation line | Lump sum indicators | Monthly payment indicators |

| 100 | 21.07.2017 | 31.07.2017 |

| 110 | 21.07.2017 | 31.07.2017 |

| 120 | 07/24/2017 (first working day after the calculation) | 01.08.2017 |

| 130 | 35 700 | 68 000 |

| 140 | 4 641 | 8 840 |

When paying lump sums and wages, there is a discrepancy between the dates the employee receives remuneration. The day of receipt of one-time amounts is the date of payment; when paying for labor, the receipt of income is considered to be the last day of the month.

Example

For clarity, let's give a practical example.

A certain company employs 5 people. A one-time bonus in the amount of 135,000 rubles was paid for the company’s birthday. The promotion was made on September 17 of this year. Personal income tax was calculated on the remuneration in the amount of 17,750 rubles.

| Line number in calculation | The indicator that is reflected |

| 100 | 17. 09 |

| 110 | 17. 09 |

| 120 | 18. 09 |

| 130 | 135 000 |

| 140 | 17,750 (personal income tax on a premium of 6 personal income taxes) |

Example. During the 1st half of 2020, Polygraph LLC made the following payments in favor of employee A. Yu. Ivanov (Standard personal income tax deductions were not provided to individuals.)

| Month of income accrual, rub. | Type of income | Amount of accrued income, rub. | Personal income tax (13%), rub. | Income payment date |

| January 2017 | Salary | 20 000 | 2 600 | 10.02.2017 |

| Monthly bonus | 10 000 | 1 300 | 10.02.2017 | |

| February 2017 | Salary | 23 000 | 2 990 | 10.03.2017 |

| Monthly bonus | 12 500 | 1 625 | 10.03.2017 | |

| March 2017 | Salary | 22 300 | 2 899 | 10.04.2017 |

| Monthly bonus | 11 700 | 1 521 | 10.04.2017 | |

| April 2017 | Salary | 25 000 | 3 250 | 10.05.2017 |

| Monthly bonus | 14 500 | 1 885 | 10.05.2017 | |

| May 2017 | Salary | 24 500 | 3 185 | 09.06.2017 |

| Monthly bonus | 14 000 | 1 820 | 09.06.2017 | |

| June 2017 | Salary | 28 000 | 3 640 | 10.07.2017 |

| Monthly bonus | 17 800 | 2 314 | 10.07.2017 | |

| TOTAL: | X | 223 300 | 29 029 | X |

In addition, the employee was paid:

- 04/05/2017 – bonus for 2020 in the amount of 30,000 rubles. (based on the order dated March 27, 2017);

- 05/22/2017 – 50th anniversary bonus in the amount of 10,000 rubles. (based on the order of May 19, 2017).

The Company did not make any other payments or remuneration in favor of individuals during the specified period.

The organization filled out the calculation on Form 6-NDFL for the first half of 2017 as follows.

Section 1 of 6-NDFL calculation

Filled with a cumulative total from the beginning of 2020 (in our example, until the end of June 2020).

line 010 – 13 / indicates the rate at which personal income tax is calculated and withheld from the income of individuals;

line 020 – 263,300 / indicates the total amount of income accrued to individuals for the period January – June 2020 (including bonuses);

line 030 – 0 / indicates the amount of tax deductions provided to individuals for the period January – June 2020;

line 040 – 34,229 / indicates personal income tax calculated on the income of individuals received for the period January – June 2020;

line 060 – 1 / indicates the number of individuals who received income at all tax rates for the period January – June 2017;

line 070 – 28,275 / indicates personal income tax withheld from the total amount of income paid to individuals at all tax rates for the period January – June 2020.

Section 2 of 6-NDFL calculation

Filled out only for the last 3 months of the reporting period (in our example, April – June 2020).

Information about the first payment.

Please note! The March salary will be included in the 6-NDFL form for the first half of 2020, but the June salary will not. The fact is that the corresponding operations are reflected in section 2 of the calculation in the period of their completion.

on line 100 – 03/31/2017 / the date of actual receipt of income is indicated; for salary / monthly bonus related to wages, this is the last day of the month for which it is accrued (paragraph 1, paragraph 2, article 223 of the Tax Code of the Russian Federation);

line 110 – 04/10/2017 / indicates the date of deduction of personal income tax from salary / monthly bonus; coincides with the date of their payment to individuals (paragraph 1, paragraph 4, article 226 of the Tax Code of the Russian Federation);

line 120 – 04/11/2017 / indicates the deadline for the transfer of personal income tax; for salary / monthly bonus - this is the day following the day of its payment (paragraph 1, paragraph 6, article 226 of the Tax Code of the Russian Federation);

Keep in mind! Line 120 of Section 2 of Form 6-NDFL indicates the deadline for tax payment established by the Tax Code of the Russian Federation, and not the date of its actual transfer to the budget by the tax agent.

line 130 – 34,000 / indicates the amount of wages and monthly bonus paid to individuals;

line 140 – 4,420 / indicates personal income tax withheld from wages and monthly bonuses paid to individuals.

Since the salary and monthly bonus have the same dates for receipt of income, withholding and transfer of tax, the corresponding payments are combined into a single block (pp. 100 – 140).

Information about the second payment.

on line 100 – 04/05/2017 / the date of actual receipt of income is indicated; for a bonus for a period exceeding one month, this is the day of its payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation);

line 110 – 04/05/2017 / indicates the date of deduction of personal income tax from the premium, which coincides with the date of its payment to individuals (paragraph 1, clause 4, article 226 of the Tax Code of the Russian Federation);

on line 120 - 04/06/2017 / the deadline for the transfer of personal income tax is indicated, for a bonus this is the day following the day of its payment (paragraph 1, clause 6, article 226 of the Tax Code of the Russian Federation);

line 130 – 30,000 / indicates the amount of the premium paid to individuals;

line 140 – 3,900 / indicates personal income tax withheld from the premium paid to individuals.

Information about the third payment (see the explanation of the lines above).

on line 100 – 04/30/2017;

on line 110 – 05/10/2017;

on line 120 – 05/11/2017;

on line 130 – 39,500;

on line 140 – 5 135.

Information about the fourth payment.

on line 100 – 05/22/2017 / the date of actual receipt of income is indicated; for a bonus not related to wages, this is the day of its payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation);

on line 110 – 05.22.2017 / the date of deduction of personal income tax from the premium is indicated, which coincides with the date of its payment to individuals (paragraph 1, clause 4, article 226 of the Tax Code of the Russian Federation);

on line 120 - 05.23.2017 / the deadline for the transfer of personal income tax is indicated, for a bonus this is the day following the day of its payment (paragraph 1, clause 6, article 226 of the Tax Code of the Russian Federation);

line 130 – 10,000 / indicates the amount of the premium paid to individuals;

line 140 – 1,300 / indicates personal income tax withheld from the premium paid to individuals.

Information about the fifth payment (see the explanation of the lines above).

on line 100 – 05/31/2017;

on line 110 – 06/09/2017;

on line 120 – 06/13/2017;

Keep in mind! If the deadline for transferring personal income tax falls on a weekend or a non-working holiday, then the expiration date is considered to be the next working day (clause 7, article 6.1 of the Tax Code of the Russian Federation).

on line 130 – 38,500;

on line 140 – 5,005.

See below for a completed sample calculation in form 6-NDFL of Polygraph LLC for 6 months of 2020 reflecting income in the form of a bonus.

Simultaneous receipt of basic, incentive and other income

Payments of wages and bonuses may coincide in one period. Thus, when an enterprise uses a salary-bonus system of remuneration, the amounts are divided by code, but are indicated simultaneously in section 2. For individual incentive amounts for production indicators, the dates coincide with the dates of remuneration. The time for receiving amounts is the last day of the month, regardless of whether the date falls on a non-working calendar day. No separate allocation of amounts is required.

Example 2. The company Sokol LLC makes payments for the successful fulfillment of duties based on production indicators once a month. An order based on the results of work in April was issued on May 10, 2017. The amount of the bonus was 75,600 rubles. The amount of accrued wages for May amounted to 185,300 rubles. In the calculation, Sokol LLC provides the following information:

| Line number | Index |

| 100 | 31.05.2017 |

| 110 | 31.05.2017 |

| 120 | 01.06.2017 |

| 130 | 260,900 rubles |

| 140 | 33,917 rubles |

Monthly bonus amounts in reporting are not allocated as a separate block from wages or other income related to wages when the dates of actual receipt of the amounts coincide.

Other amounts included in wages for which the terms do not coincide are reflected separately in the reporting. Thus, when paying employees vacation pay, taxable compensation amounts must be withheld upon payment. Agents must transfer the tax amounts before the end of the month of settlement.

We reflect the awards in section 1

Section 1 6-NDFL shows the total amount of accrued income, deductions, as well as the total amount of accrued and withheld tax.

Section 1 must be filled out with a cumulative total for the first quarter, six months, nine months and a year (letter of the Federal Tax Service of Russia dated February 18, 2016 No. BS-3-11/650). In section 1, include income (deductions, tax amounts) for transactions performed during the reporting period. For example, in section 1 of the calculation for 9 months of 2020, indicators for the period from January 1 to September 30 inclusive should be reflected. So, in particular, in section 1 you need to show:

- on line 020 - all employee income on an accrual basis from the beginning of the year.

- on line 040 - the amount of calculated tax on an accrual basis from the beginning of the year.

Let us assume that in the period from January 1 to September 30, 2020, employees were paid wages in the amount of 985,000 rubles. This amount already includes bonuses paid for 9 months in the amount of 140,000 rubles. The entire amount of earnings, including bonuses, must be shown on line 020. And the tax calculated from this entire amount is transferred to line 040 of the calculation for 9 months of 2020. The tax amount is 128,050 rubles (985,000 × 13%).

Simply put, reflect bonuses in section 1 in the total amount of income and calculated tax. There is no longer any need to highlight bonuses separately in this section.

Annual and quarterly bonuses: a special approach

The letter of the Federal Tax Service dated January 24, 2017 No. BS-4-11/1139 contains very important clarifications from tax authorities on the issue of reflecting bonuses in the calculation of 6-NDFL. The meaning of these clarifications is that the method of determining the date of actual receipt of income in the form of a bonus for performing job duties depends on the results of the period for which the employee was awarded a bonus (based on the results of the month, quarter or year).

Reflection of unpaid amounts

Bonuses of a one-time nature are reflected in the reporting upon actual issue. Amounts assigned by order and not paid to persons are indicated in section 1 when calculating amounts and calculating tax. Due to the fact that the amounts were not paid on time, data is not presented in section 2 when preparing reports. Failure to pay the calculated tax when accrued but not paid will result in the imposition of a penalty.

Tax agents do not have the right to contribute to the budget an amount calculated ahead of schedule that is not withheld from the recipient. The Federal Tax Service has the right to establish the fact of non-payment of tax when transferring funds at the expense of the employer. In this case, the amount will need to be returned to the organization’s current account and the arrears must be paid again, additionally calculating penalties.

Filling out 6-NDFL for 2020

The calculation form remains the same. You must complete the title page and sections 1 and 2.

Section 1 indicates payments, deductions and tax on them from the beginning of the year. Moreover, if the income of individuals is taxed at different personal income tax rates, they are reflected separately - lines 010-050 are filled in for each rate. Data in lines 060-090 (“Total for all bets”) is entered only once on the first page.

It is worth paying attention to the correctness of the reflection of December payments in the first section. Whether to take into account wages for December depends on when the payments were made:

Lines 025 and 045 are filled out only by employers who paid dividends.

In line 060 enter the number of individuals whose income is reflected in 6-NDFL. Workers who did not have taxable income are not taken into account.

Section 2 contains information for the last quarter of the reporting year only on payments for which tax should have been transferred precisely in these three months. If the deadline for tax payment has not yet arrived, then this operation is not reflected in Section 2.

The dates of actual receipt of income and withholding of tax, as well as the deadline for transferring tax, are reflected as follows:

Important! The December wages paid on December 31, 2019, as well as the personal income tax on it, are not reflected in the second section, even if the tax was transferred on the same day. These amounts will need to be indicated in section 2 of the 6-NDFL calculation for the 1st quarter of the current year. The December bonus is reflected in the same way as salary.

Quarterly and annual bonuses in 6-NDFL

Whether to include information about bonuses for the quarter and year in the calculation depends on the date of their transfer.

Important! If a quarterly or annual bonus is paid to an employee before December 30 inclusive, one date is entered in lines 100 and 110 of section 2 - the date of transfer of the amount.

Sick leave and vacation pay in 6-NDFL

Sick leave benefits and vacation pay are reflected in 6-NDFL for the period in which they are paid. Accrued but unpaid amounts do not need to be included in the calculation.

Sections 1 and 2 of Section 6-NDFL for 2020 include information about sick leave and vacation pay paid in December. If sick leave was closed in December, and benefits were transferred in January of the current year, the data is not included in the calculation.

You can check the correctness of filling out the calculation using the updated control ratios. The average salary of an employee should be compared with the minimum wage, and the average salary for the organization - with a similar indicator in the industry in the region. If the amounts are not enough, tax authorities may suspect that the base is understated and conduct an audit.

Responsibility when filing reports

For refusal to fulfill the duties of a tax agent in the form of providing information on the taxation of individuals, sanctions are imposed under Article 126 of the Tax Code of the Russian Federation. The fine is 1,000 rubles for each monthly period from the date of due submission of the calculation. Full and partial months of missing the deadline are taken into account.

Errors made during the generation of reporting data also entail the imposition of sanctions. If the deadlines for calculating taxes and transferring the amount to the budget are violated, penalties are imposed for each day of delay. The arrears identified in the calculation must be included in the budget. If erroneous information is discovered by the taxpayer himself and the updated calculation is submitted in a timely manner after payment of the arrears, no fine will be assessed.

Application of standard deductions when calculating bonuses

The bonus can be paid along with the advance payment, with the salary or during the interpayment period. Tax should be withheld simultaneously with the transfer of income to the employee. And in order to withhold tax, it is necessary to calculate the tax base. It is at this moment that the Tax Code of the Russian Federation provides for the provision of deductions (clause 1 of Article 218 of the Tax Code of the Russian Federation). But pre-payroll deductions may be unnecessary due to the fact that after payroll the employee's total income exceeds the deduction limit. Let us remind you that in 2020 the maximum tax base is 350,000 rubles.

The 1C: Salary and Personnel Management 8 program, edition 3, automatically processes such situations, and personal income tax is recalculated when payroll is calculated. Let's consider cases of additional personal income tax accrual and their reflection in the 6-NDFL report.

Case 1. A deduction was provided when calculating the bonus

Employee S.S. Gorbunkov has registered the right to social deduction with code 126 for the first child. After calculating wages for September, the tax base for determining the right to deduction amounted to 300,000 rubles. In mid-October, a decision was made to pay a bonus of 10,000 rubles.

In accordance with the bonus regulations adopted by the organization, the bonus with code 2002 has the category Other income from labor activities and is paid during the interpayment period. The payment date of the said premium is scheduled for 10/11/2017. When paying the premium, personal income tax must be withheld. Therefore, it is necessary to calculate the tax when it is calculated.

Since the calculation base as of October 11, 2017, taking into account the bonus, is 310,000 rubles, the social deduction for a child is 1,400 rubles. should be applied. Please note that at the time of accrual and payment of bonuses, the accountant cannot foresee how much the employee’s salary will be accrued, since unplanned events may occur (for example, unpaid leave, absenteeism, death, etc.). The calculated personal income tax is 1,118 rubles. ((RUB 10,000 - RUB 1,400) x 13%)). When transferring funds that must be paid to an employee, the tax is withheld and no later than the next day is transferred to the budget system of the Russian Federation.

Payroll period begins in early November. Employee S.S. Gobunkov worked regularly all month, and he receives his salary for October in full - 75,000 rubles. Taking into account the salary received, the tax base for calculating the right to deduction is 385,000 rubles. (RUB 300,000 + RUB 10,000 (bonus) + RUB 75,000 (salary)), which exceeds the limit of RUB 350,000. Thus, in October S.S. Gorbunkov loses the right to deduction. The deduction was excessively applied and must be reversed. When calculating wages, additional taxes are calculated.

The accrued personal income tax on salary is 9,750 rubles. (RUB 75,000 x 13%)).

Personal income tax on the premium is additionally charged in the amount of 182 rubles. (RUB 10,000 x 13% - RUB 1,118). The deduction applied to the premium is 1,400 rubles. now applies to all income for October (RUB 85,000). The deduction is distributed in proportion to income: 164.71 rubles. accounts for the premium and 1,239.29 rubles. - for payment according to salary.

Salaries are transferred to employee accounts on November 6, 2017. The payroll registers the amount of tax to be transferred separately by Type of income: Other income from labor activity - 182 rubles. and Salary - 9,750 rubles. Additional accrued 182 rubles. taxes must be transferred no later than the day following the day of payment of wages. This is exactly the picture that Section 2 of the annual report 6-NDFL displays (Fig. 2).

Rice. 2. Section 2 of form 6-NDFL for the year for Case 1

Lines 110 and 120 determine the period when tax in the amount indicated in line 140 is due to be transferred. That is, the additional accrued 182 rubles. must be transferred within the period 06.11.2017-07.11.2017. In this case, the value of line 130 of the block corresponding to additional tax calculation is equal to 0. Income in the amount of 10,000 rubles. and the tax withheld from him on October 11, 2017 in the amount of 1,118 rubles. are displayed as a separate block.