Finding the answer

A fee is also established for combining two positions.

In order to correctly and quickly register an employee for the position of acting chief accountant, the HR department employee will need the employee’s documents, documents and the seal of the organization in which he works, as well as forms of all the documents necessary for registration.

So, how to appoint a chief accountant correctly and quickly? To do this, follow the instructions:

Typically, a leading accountant is appointed to the position of chief accountant. When concluding an additional agreement with this employee, write down all his responsibilities in the new position and new rights. The employee will have to perform the duties of the chief accountant along with his regular duties. It is important to indicate the amount of additional payment for additional functions. The reward for performing the duties of the chief accountant may be a percentage of the salary of the chief accountant or a percentage of the salary of that position. Which is usually occupied by an employee.

It is important to indicate the period for which the employee is appointed as acting chief accountant. It is also necessary to establish the right of his signature on financial documents that must be signed by the chief accountant.

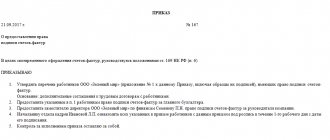

Before concluding an employment contract, all working conditions must be discussed and agreed upon with the employee. The agreement must be certified by the director of the organization and the seal of this organization. The contract must also be signed by the employee appointed to the new position.

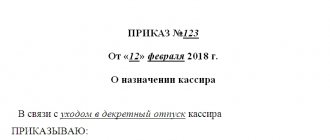

Drawing up an order for the appointment of an employee to the position of chief accountant.

The header of the document indicates the full and abbreviated name of the organization. If the organizational and legal form of the enterprise is a private entrepreneur, you should indicate his last name, first name and patronymic.

Next, indicate the number and date of the order, as well as the city in which the organization is located. The topic of the document in this case will be the appointment of an employee as acting chief accountant. The reason for drawing up the order is the need to replace the chief accountant during his absence.

The period for which the employee must perform the duties of chief accountant must be indicated. If an employee has to serve as chief accountant for more than a month, then combining two positions is unacceptable. In this case, it is necessary to formalize a transfer to a new position. In any case, the order further indicates the amount of remuneration for performing additional duties and establishes the right of signature of the acting chief accountant.

© Author: Davydchenko Anna

Comments

Correct registration of a “temporary” chief accountant

Most often, in practice, the performance of the duties of a vacationing chief accountant by another employee is formalized as follows. Here is a sample order for replacing the chief accountant during vacation.

There are two main ways to formalize an acting position:

The latter is formalized by order using the unified form T-5, approved by Resolution of the State Statistics Committee of the Russian Federation of January 5, 2004 No. 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment,” and, in general, does not cause difficulties. A temporary transfer implies the complete release of the employee from his main duties for the duration of the replacement of the chief accountant, and this is not entirely convenient, since he will have to look for another person to perform the work of the replacement employee. When performing the duties of the chief accountant, the replacement employee receives his salary for the period of replacement.

But I would like to dwell on the combination in a little more detail, since this is how the replacement of the chief accountant is most often formalized. Firstly, we must not forget that, according to Art. 60.2 of the Labor Code of the Russian Federation, such combinations during vacation must be paid (in the amount and manner agreed upon by the parties in advance). In the order for part-time work during vacation, it is necessary to indicate the content of the additional work, the period for performing the duties, and also, of course, the amount of additional payment for their performance as additional to the part-time employee’s own job responsibilities.

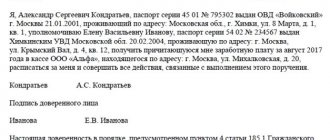

Finally, it is highly desirable that the transfer of the right to sign during the vacation of the chief accountant in funds, tax authorities, etc. be separately spelled out, and this right is confirmed by the appropriate power of attorney issued according to the rules of Article 185 of the Civil Code of the Russian Federation.

Some employers prefer to enter into an additional agreement to the employee’s employment contract for the period of replacement, and then the basis for issuing the order is not the decision of the general director, but the number and date of the additional agreement with the employee. Such an additional agreement may look like this:

It is also important to remember that the replacement employee has the right to refuse additional workload before the expiration of the workload (for example, if he cannot cope with the work), just as the manager can cancel the workload ahead of schedule. But the parties are obliged to notify about this in writing no later than 3 working days.

The additional payment for combined work is part of the salary, is taken into account in labor costs and is subject to personal income tax and all contributions.

Articles on the topic

The designation “and about” is sometimes found in job titles. What it means and how to write it correctly in official documents will be discussed in the article.

How to formalize the temporary performance of duties of the General Director

The head of the company is required in cases when he is absent for some reason (sick, on a business trip, vacation, etc.). As a rule, the temporary performance of duties of the general director is assigned to his deputy. If the director does not have a deputy whose job responsibilities would include temporarily performing the functions of a manager, then the general director assigns these responsibilities to another employee. In this case, he must issue an order to temporarily assign the duties of the head of the company to this employee.

It is recommended that the procedure for temporarily replacing a manager be specified in the company’s CHARTERS and in employment contracts with the general director and his deputy.

Which is correct: “accounting” or “accounting”

Derivations from the word "accountant" follow the same writing rules as the original. That’s why in a word like “accounting” the letter “x” is always written.

Example sentences

- My colleague and I ran into the accounting department to quickly submit the report and go to the break room.

- Accounting was the busiest department in the company, and the stupidest mistake you could make was to interfere with their fast pace of data processing.

- The aroma of tea could be felt from the corridor, which signaled the beginning of a break in the accounting department.

(To whom?) Acting director? And about. to the director? How to write correctly in an application?

If the charter spells out the entire procedure in detail, then issuing a separate order is not required.

Is it necessary to conclude with an employee who is not a full-time deputy general director an additional agreement to the employment contract on the temporary performance of his duties?

Everything will depend on how exactly the temporary performance of duties is formalized. If at the same time the employee is not released from his main job, then the performance of duties can be entrusted to him with his written consent (Article 60.2 of the Labor Code of the Russian Federation). In this case, it is recommended to conclude an additional agreement with the employee to the employment contract, in which all responsibilities for the position being filled are specified, the replacement period is set, and the amount of additional payment is determined. But there is another option for formalizing such relationships - through a temporary transfer to another job to replace a temporarily absent employee (Article 72.2 of the Labor Code of the Russian Federation). In this case, it is also necessary to draw up an additional agreement to the employment contract with the employee, since such a transfer occurs by agreement of the parties. Indicate in the agreement as the deadline for the transfer: “Before the general director goes to work” (Article 72.2 of the Labor Code of the Russian Federation) There is no need to make an entry in the work book in either case.

The acting CEO must sign documents on his own behalf, since this authority has been officially delegated to him. A situation often occurs when the position and surname of the general director is entered into a standard form (for example, in unified forms for accounting for labor and its remuneration), and the acting director writes by hand before the name of the position. O." and puts his signature. It turns out that the signature and the transcript of the signature do not match. At the same time, the “signature” requisite must include the job title of the person who signed the document, his personal signature, and a transcript of the signature (initials, surname). Such requirements are provided for in paragraph 3.22 of GOST R 6-30/2003. Please note that there is no such position as “acting officer”. Therefore, the acting person must indicate in the documents the position that he occupies according to the company’s staffing table.

When preparing documents for signature by the acting general director, do not forget to change the job title and signature on the forms. A discrepancy between the title, signature and transcript will make the document legally invalid.

Office work: everything about and. O. and acting

When to use abbreviations

How the acting is written in the documents in abbreviated form: i. O. That's right, with dots between the letters. Temporary acting - acting. No dots. These abbreviations are appropriate in documents of various kinds, journalism and even colloquial speech. In official documents abbreviations and. o. and temporary are written exclusively in front of the person’s position.

How to correctly write acting director, deputy, head...

In short, the acting head of the department is reduced to acting. O. head of department (genitive case of position). In official documents abbreviations and. o. and vpio are written exclusively before the position of the person, not before the surname. This acronym does not allow any other options other than interim.

How is the acting person written in the documents?

Examples of difficult cases and answers to tricky questions:

- How to spell correctly in the plural: i. O. director or etc. O. directors? There are two options: i. O. directors (different acting directors of the same organization), etc. O. directors (various organizations).

- Acting with a capital or small letter? In case of abbreviation, all letters are small.

- If and. O. stands at the beginning of a sentence, you must write and. O. or I. o.? According to the rules of the Russian language, a capital letter is placed at the beginning of a sentence. This rule also applies in this case, we write with a capital.

- And about. said or said? As in the case of acting, depending on the gender of the person holding the position.

- Which is correct: acting director? And about. director.

In what cases is a power of attorney needed?

If neither the charter nor the employment contract with the manager provide for the possibility of transferring powers in the absence of the general director, then it is necessary to issue a civil power of attorney indicating the powers transferred to the trustee.

A power of attorney is a written authority issued by one person to another person for representation before third parties (Article 185 of the Civil Code of the Russian Federation). A power of attorney is a concept of civil, not labor law. It is designed to regulate the external relations of the company.

A power of attorney on behalf of the company is issued signed by its head or another person authorized to do so by the constituent documents, with the company seal attached. It is issued for a period of no more than three years, and if the period is not specified, it is valid only for one year from the date of issue.

The person who issued the power of attorney may revoke it at any time. And the person to whom the power of attorney was issued has the right to refuse it at any time (Part 1 of Article 188 of the Labor Code of the Russian Federation).

In what case can actions committed by the acting general director in his absence be considered illegal?

This can happen if the powers of the general director were transferred orally, without issuing a corresponding order, as well as if the powers to conclude agreements with counterparties were transferred without a power of attorney. Most likely, the arbitration court will decide that civil transactions concluded during this period were concluded by an improper person and will declare them invalid. And although arbitration practice recognizes transactions as legal, even if the powers of the head of the company were transferred to another person only by order, without issuing a power of attorney (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 24, 1998 No. 6813/97), the presence of a power of attorney will save you from the need to prove competence issuance of the order. The transfer of the powers of the general director by order should not contradict the charter of the company (it may stipulate, for example, that the powers of the general director are transferred only by power of attorney).

Accounting policy in 2013

A separate article is devoted to accounting policy in Law N 402-FZ. 8, according to which accounting policy is a set of ways for an economic entity (that is, an organization, institution) to maintain accounting records.

It is noted that an economic entity independently forms its accounting policy, guided by the legislation of the Russian Federation on accounting, federal and industry standards. By Order No. 160n dated November 25, 2011, the Ministry of Finance introduced International Financial Reporting Standards (IFRS) on January 1, 2012, and also provided their clarifications, which mainly apply to commercial organizations. It is possible that already during 2012 standards will appear that are also relevant for institutions in the public sector of the economy.

It is noteworthy that clause 6 of Art. 8 of Law N 402-FZ establishes new conditions for changing accounting policies, namely :

- changes in the requirements established by the legislation of the Russian Federation on accounting, federal and (or) industry standards;

- development or selection of a new method of accounting, the use of which leads to an increase in the quality of information about the object of accounting;

- a significant change in the operating conditions of an economic entity.

It is obvious that some orders of the Ministry of Finance, which are aimed at improving the quality of information on the activities of state (municipal) institutions, can be considered as a reason for changing accounting policies during the reporting period.

It is impossible not to note one very important point: according to Art. 5 of Law N 402-FZ, the accounting objects of an economic entity are:

- facts of economic life;

- assets;

- obligations;

- sources of financing its activities;

- income;

- expenses;

- other objects if this is established by federal standards.

And if assets, liabilities, sources, income and expenses have long been the object of accounting, then the “fact of economic life” is clearly a new object of accounting .

Note. A fact of economic life is a transaction, event, operation that has or is capable of influencing the financial position of an economic entity, the financial result of its activities and (or) cash flow.

It is obvious that the fact of economic life means business transactions, since Art. 9 of Law N 402-FZ states that every fact of economic life is subject to registration with a primary accounting document.

This thesis of Law N 402-FZ coincides with the norm set out in Art. 9 of Law N 129-FZ, which states that all business transactions carried out by an organization must be documented with supporting documents.

We note that in accordance with paragraph 3 of Art. 9 of Law N 402-FZ, the primary accounting document must be drawn up when a fact of economic life is committed , and if this is not possible, then immediately after its completion.

How to pay for temporary duties

Additional labor costs require additional wages. Article 151 of the Labor Code of the Russian Federation states that additional payments are due for performing the duties of a temporarily absent employee. The amount of these additional payments is established by agreement of the parties to the employment contract.

In the explanation of the State Committee for Labor of the USSR and the Secretariat of the All-Union Central Council of Trade Unions dated December 29, 1965 No. 820/39 “On the procedure for paying for temporary substitution” (it is valid to the extent that does not contradict the Labor Code of the Russian Federation) the following is said. The temporary worker is paid the difference between his actual salary (official, personal) and the official salary of the replaced employee (without personal allowance). Thus, the additional payment may be the difference in the salaries of the general director and the employee who temporarily replaces him.

Is it necessary to pay extra for the performance of the duties of the general director to his deputy, if replacing the director is the direct responsibility of this employee under the employment contract?

Need to. Until recently, paragraphs 3 and 4 of paragraph 1 of the explanation of the procedure for paying temporary substitution were in effect, which provided that the difference in salaries is not paid to a full-time deputy or assistant to an absent employee (in this case, the general director), as well as to the chief engineer who replaces the absent manager . However, the Supreme Court of the Russian Federation, by its ruling dated March 2003 No. CAS 03-25, abolished this clause as infringing on the rights of employees and contrary to Article 151 of the Labor Code of the Russian Federation. Thus, any employee, including a full-time deputy general director, needs to be paid extra for temporarily performing the duties of a manager. Download the HR program for employee accounting and automation of the HR department for HR officers “HR Department 2018”

Who does accounting report to in an enterprise?

Resolution of the Ministry of Labor of the Russian Federation dated August 21, 1998 No. 37).

In accordance with this regulatory act, the chief accountant organizes the work

on setting up and maintaining accounting records of an organization in order to obtain complete and reliable information about its financial and economic activities and financial position by interested internal and external users. The chief accountant also forms, in accordance with the legislation on accounting, an accounting policy based on the specifics of business conditions, structure, size, industry affiliation and other features of the organization’s activities, which allows timely receipt of information for planning, analysis, control, assessment of the financial position and results of the organization’s activities.

According to the provisions of the regulatory act under consideration, the chief accountant heads the work

:

1) on the preparation and approval of a working chart of accounts containing synthetic and analytical accounts, forms of primary accounting documents used for registration of business transactions, forms of internal accounting reporting;

2) to ensure the procedure for conducting an inventory and assessment of property and liabilities, documentary evidence of their availability, compilation and assessment;

3) on organizing a system of internal control over the correct execution of business transactions, compliance with the document flow procedure, technology for processing accounting information and its protection from unauthorized access.

The chief accountant also manages

formation of an information system for accounting and reporting in accordance with the requirements of accounting, tax, statistical and management accounting, ensures the provision of the necessary accounting information to internal and external users and accounting employees.

The chief accountant of the enterprise organizes the work

:

1) to improve the qualifications of accounting employees;

2) on setting up and maintaining accounting records of the organization;

3) on maintaining accounting registers based on the use of modern information technologies, progressive forms and methods of accounting and control, execution of cost estimates, accounting of property, liabilities, fixed assets, inventories, cash, financial, settlement and credit transactions, costs production and circulation, sales of products, performance of work (services), financial results of the organization.

The chief accountant of the enterprise provides

:

1) timely and accurate reflection in the accounting accounts of business transactions, movement of assets, generation of income and expenses, fulfillment of obligations;

2) control over compliance with the procedure for preparing primary accounting documents;

3) timely transfer of taxes and fees to the federal, regional and local budgets, insurance contributions to state extra-budgetary social funds, payments to credit organizations, funds to finance capital investments, repayment of loan arrears; control over the expenditure of the wage fund, the organization and correctness of calculations for the remuneration of employees, the conduct of inventories, the procedure for maintaining accounting records, reporting, as well as conducting documentary audits in the divisions of the organization;

4) drawing up a report on the execution of cash budgets and cost estimates, preparing the necessary accounting and statistical reports, submitting them in the prescribed manner to the relevant authorities;

5) safety of accounting documents and their delivery in the prescribed manner to the archive.

The chief accountant of an enterprise also provides methodological assistance to department heads and other employees of the organization on issues of accounting, control, reporting and analysis of business activities.

The knowledge requirements for the chief accountant of an enterprise are also contained in the Qualification Directory of positions for managers, specialists and other employees. Thus, according to the said regulatory act, the chief accountant must know

:

? accounting legislation;

? basics of civil law;

? financial, tax and economic legislation;

? regulatory and methodological documents on the organization of accounting and reporting, economic and financial activities of the organization;

? regulations and instructions for organizing accounting, rules for maintaining it;

? codes of ethics for professional accountants and corporate governance;

? profile, specialization and structure of the organization, strategy and prospects for its development;

? tax, statistical and management accounting;

? the procedure for processing accounting transactions and organizing document flow in accounting areas, writing off shortages, accounts receivable and other losses from accounting accounts, accepting, capitalizing, storing and spending money, inventory and other assets, conducting audits; forms and procedure for financial settlements;

? tax conditions for legal entities and individuals;

? rules for conducting inventories of funds and inventory, settlements with debtors and creditors, conducting inspections and documentary audits;

? procedure and deadlines for drawing up balance sheets and reporting;

? modern reference and information systems in the field of accounting and financial management;

? methods for analyzing the financial and economic activities of an organization;

? rules for storing accounting documents and protecting information;

? advanced domestic and foreign experience in organizing accounting;

? economics, organization of production, labor and management;

? basics of production technology;

? labor legislation;

? labor safety rules.

The chief accountant (an accountant in the absence of a chief accountant position on the staff) is appointed to the position and dismissed by the head of the organization. He reports directly to the head of the organization and is responsible for the formation of accounting policies, accounting, timely submission of complete and reliable financial statements (clauses 1, 2, article 7 of the Federal Law “On Accounting”).

According to paragraph 3 of Art. 7 of the Federal Law “On Accounting”, the chief accountant ensures compliance of ongoing business transactions with the legislation of the Russian Federation, control over the movement of property and the fulfillment of obligations.

The requirements of the chief accountant must be met by all employees of the organization. Cash and settlement documents, financial and credit obligations are considered valid from the moment they are signed by the chief accountant. In case of disagreements between the head of the organization and the chief accountant regarding the implementation of certain business transactions, documents on them can be accepted for execution with a written order from the head of the organization, who bears full responsibility for the consequences of such operations (clause 4 of article 7 of the Federal Law “On Accounting” ").

The responsibilities of the chief accountant are also formulated in the Qualification Directory of Positions of Managers, Specialists and Other Employees.

Enter the site

Acting acting director, acting director and director – how not to get lost?

The problem of the different attitude of labor legislation and legislation on legal entities to the sole executive body worries many. Indeed, according to labor legislation, the sole executive body is the same employee as everyone else, he just has the right to act on behalf of the organization without a power of attorney. In all other rights he is equal to an ordinary employee. He can go on sick leave, on vacation, on maternity leave, he can be demoted or promoted.

From the point of view of the legislation on legal entities, the director (general director) is a person entered in the Unified State Register of Legal Entities. What to do if he is entered into the Unified State Register of Legal Entities, but in fact no longer holds this position. Of course, he can be fired, but this is not the only option. This is the problem we would like to address in this material.

What are VRIO and IO?

Acting (temporarily acting) and IO (acting) are concepts that do not appear either in the Labor Code of the Russian Federation, or in the law on legal entities, or in the law on LLCs. However, the Explanation of the USSR State Committee for Labor of 1965, published back in Soviet times, is still in effect, in which an interim agent is understood as a person performing the duties of a temporarily absent employee. At the legislative level, there is no difference between virtual and independent organizations. However, in practice, an interim official is appointed for a certain period, that is, essentially, for the period of absence of a permanent employee, in this case no vacancies open. In turn, the executive officer is appointed for an indefinite period, until a new employee is hired for this position.

The EO may be a candidate for the position. The EO can be any employee of the company who is transferred part-time in accordance with the agreement. At the same time, after a permanent employee is hired, the agreement is terminated. If we are talking about an interim agreement, then there is no need to terminate the agreement, since the deadline is already specified in it. However, an agreement is not always required for IO. For example, some persons are required to be an EO by virtue of their official powers. For example, senior assistant, deputy, etc.

Registration of IO is possible in two ways. The first method is an order for the organization if there is no vacancy. Essentially, in this case, the EIO appoints an IO to himself. If you are planning such a situation, then it is better to write it down in the Charter. The second method is a decision or minutes of the General Meeting or the Board of Directors, if there is a vacant position. In this case, within a month a decision must be made on the appointment of this candidacy to the post of director or on rejection. It should be noted that tax authorities are very willing to meet the organization halfway and make an entry in the Unified State Register of Legal Entities about the sole proprietor, since they understand that the organization cannot exist for a long time without a director. The notary must submit an application in form P14001, with the name of the acting director or the acting director, an order for the acting director or a protocol for the acting director and constituent documents. Note that the procedure itself is identical to the procedure for changing the director. The applicant must be the IO himself. The Federal Tax Service is provided with form P14001 and, when submitting documents through a representative, a power of attorney. As a result, you receive a record sheet in which the Acting Actor or Individual Entrepreneur is indicated and an extract from the Unified State Register of Legal Entities, in which the Acting Acting Entity or Individual Entrepreneur is also indicated. By the way, don’t forget about the bank. You will need to change your card at the bank.

A little about embarrassment

The organization has appointed an acting acting director or executive director, all the documents have been drawn up, and suddenly the director, whom no one fired, returns to work.

And how to write correctly about the chief accountant

Before appointing an acting chief accountant, it is necessary to formalize the combination of professions. For this procedure, an additional labor agreement is drawn up, as well as an order for the temporary appointment of an employee as acting chief accountant.

Finding the answer

A fee is also established for combining two positions.

In order to correctly and quickly register an employee for the position of acting chief accountant, the HR department employee will need the employee’s documents, documents and the seal of the organization in which he works, as well as forms of all the documents necessary for registration.

So, how to appoint a chief accountant correctly and quickly? To do this, follow the instructions:

Typically, a leading accountant is appointed to the position of chief accountant. When concluding an additional agreement with this employee, write down all his responsibilities in the new position and new rights. The employee will have to perform the duties of the chief accountant along with his regular duties. It is important to indicate the amount of additional payment for additional functions. The reward for performing the duties of the chief accountant may be a percentage of the salary of the chief accountant or a percentage of the salary of that position. Which is usually occupied by an employee.

It is important to indicate the period for which the employee is appointed as acting chief accountant. It is also necessary to establish the right of his signature on financial documents that must be signed by the chief accountant.

Before concluding an employment contract, all working conditions must be discussed and agreed upon with the employee. The agreement must be certified by the director of the organization and the seal of this organization. The contract must also be signed by the employee appointed to the new position.

Drawing up an order for the appointment of an employee to the position of chief accountant.

The header of the document indicates the full and abbreviated name of the organization. If the organizational and legal form of the enterprise is a private entrepreneur, you should indicate his last name, first name and patronymic.

Next, indicate the number and date of the order, as well as the city in which the organization is located. The topic of the document in this case will be the appointment of an employee as acting chief accountant. The reason for drawing up the order is the need to replace the chief accountant during his absence.

The period for which the employee must perform the duties of chief accountant must be indicated. If an employee has to serve as chief accountant for more than a month, then combining two positions is unacceptable. In this case, it is necessary to formalize a transfer to a new position. In any case, the order further indicates the amount of remuneration for performing additional duties and establishes the right of signature of the acting chief accountant.

© Author: Davydchenko Anna

Comments

Add a comment

Fields marked *

required.

How to formalize the temporary performance of duties of the General Director

The head of the company is required in cases when he is absent for some reason (sick, on a business trip, vacation, etc.). As a rule, the temporary performance of duties of the general director is assigned to his deputy. If the director does not have a deputy whose job responsibilities would include temporarily performing the functions of a manager, then the general director assigns these responsibilities to another employee. In this case, he must issue an order to temporarily assign the duties of the head of the company to this employee.

It is recommended that the procedure for temporarily replacing a manager be specified in the company’s CHARTERS and in employment contracts with the general director and his deputy.

(To whom?) Acting director? And about. to the director? How to write correctly in an application?

If the charter spells out the entire procedure in detail, then issuing a separate order is not required.

Is it necessary to conclude with an employee who is not a full-time deputy general director an additional agreement to the employment contract on the temporary performance of his duties?

Everything will depend on how exactly the temporary performance of duties is formalized. If at the same time the employee is not released from his main job, then the performance of duties can be entrusted to him with his written consent (Article 60.2 of the Labor Code of the Russian Federation). In this case, it is recommended to conclude an additional agreement with the employee to the employment contract, in which all responsibilities for the position being filled are specified, the replacement period is set, and the amount of additional payment is determined. But there is another option for formalizing such relationships - through a temporary transfer to another job to replace a temporarily absent employee (Article 72.2 of the Labor Code of the Russian Federation). In this case, it is also necessary to draw up an additional agreement to the employment contract with the employee, since such a transfer occurs by agreement of the parties. Indicate in the agreement as the deadline for the transfer: “Before the general director goes to work” (Article 72.2 of the Labor Code of the Russian Federation) There is no need to make an entry in the work book in either case.

The acting CEO must sign documents on his own behalf, since this authority has been officially delegated to him. A situation often occurs when the position and surname of the general director is entered into a standard form (for example, in unified forms for accounting for labor and its remuneration), and the acting director writes by hand before the name of the position. O." and puts his signature. It turns out that the signature and the transcript of the signature do not match. At the same time, the “signature” requisite must include the job title of the person who signed the document, his personal signature, and a transcript of the signature (initials, surname). Such requirements are provided for in paragraph 3.22 of GOST R 6-30/2003. Please note that there is no such position as “acting officer”. Therefore, the acting person must indicate in the documents the position that he occupies according to the company’s staffing table.

When preparing documents for signature by the acting general director, do not forget to change the job title and signature on the forms. A discrepancy between the title, signature and transcript will make the document legally invalid.

In what cases is a power of attorney needed?

If neither the charter nor the employment contract with the manager provide for the possibility of transferring powers in the absence of the general director, then it is necessary to issue a civil power of attorney indicating the powers transferred to the trustee.

A power of attorney is a written authority issued by one person to another person for representation before third parties (Article 185 of the Civil Code of the Russian Federation). A power of attorney is a concept of civil, not labor law. It is designed to regulate the external relations of the company.

A power of attorney on behalf of the company is issued signed by its head or another person authorized to do so by the constituent documents, with the company seal attached. It is issued for a period of no more than three years, and if the period is not specified, it is valid only for one year from the date of issue.

The person who issued the power of attorney may revoke it at any time. And the person to whom the power of attorney was issued has the right to refuse it at any time (Part 1 of Article 188 of the Labor Code of the Russian Federation).

In what case can actions committed by the acting general director in his absence be considered illegal?

This can happen if the powers of the general director were transferred orally, without issuing a corresponding order, as well as if the powers to conclude agreements with counterparties were transferred without a power of attorney. Most likely, the arbitration court will decide that civil transactions concluded during this period were concluded by an improper person and will declare them invalid. And although arbitration practice recognizes transactions as legal, even if the powers of the head of the company were transferred to another person only by order, without issuing a power of attorney (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 24, 1998 No. 6813/97), the presence of a power of attorney will save you from the need to prove competence issuance of the order. The transfer of the powers of the general director by order should not contradict the charter of the company (it may stipulate, for example, that the powers of the general director are transferred only by power of attorney).

How to pay for temporary duties

Additional labor costs require additional wages. Article 151 of the Labor Code of the Russian Federation states that additional payments are due for performing the duties of a temporarily absent employee. The amount of these additional payments is established by agreement of the parties to the employment contract.

In the explanation of the State Committee for Labor of the USSR and the Secretariat of the All-Union Central Council of Trade Unions dated December 29, 1965 No. 820/39 “On the procedure for paying for temporary substitution” (it is valid to the extent that does not contradict the Labor Code of the Russian Federation) the following is said. The temporary worker is paid the difference between his actual salary (official, personal) and the official salary of the replaced employee (without personal allowance). Thus, the additional payment may be the difference in the salaries of the general director and the employee who temporarily replaces him.

Is it necessary to pay extra for the performance of the duties of the general director to his deputy, if replacing the director is the direct responsibility of this employee under the employment contract?

Need to. Until recently, paragraphs 3 and 4 of paragraph 1 of the explanation of the procedure for paying temporary substitution were in effect, which provided that the difference in salaries is not paid to a full-time deputy or assistant to an absent employee (in this case, the general director), as well as to the chief engineer who replaces the absent manager . However, the Supreme Court of the Russian Federation, by its ruling dated March 2003 No. CAS 03-25, abolished this clause as infringing on the rights of employees and contrary to Article 151 of the Labor Code of the Russian Federation. Thus, any employee, including a full-time deputy general director, needs to be paid extra for temporarily performing the duties of a manager. Download the HR program for employee accounting and automation of the HR department for HR officers “HR Department 2018”

Download free programs for automating personnel accounting, calculating length of service, document flow, accounting for contracts and clients (CRM system)

Enter the site

Acting acting director, acting director and director – how not to get lost?

The problem of the different attitude of labor legislation and legislation on legal entities to the sole executive body worries many. Indeed, according to labor legislation, the sole executive body is the same employee as everyone else, he just has the right to act on behalf of the organization without a power of attorney. In all other rights he is equal to an ordinary employee. He can go on sick leave, on vacation, on maternity leave, he can be demoted or promoted.

From the point of view of the legislation on legal entities, the director (general director) is a person entered in the Unified State Register of Legal Entities. What to do if he is entered into the Unified State Register of Legal Entities, but in fact no longer holds this position. Of course, he can be fired, but this is not the only option. This is the problem we would like to address in this material.

What are VRIO and IO?

Acting (temporarily acting) and IO (acting) are concepts that do not appear either in the Labor Code of the Russian Federation, or in the law on legal entities, or in the law on LLCs. However, the Explanation of the USSR State Committee for Labor of 1965, published back in Soviet times, is still in effect, in which an interim agent is understood as a person performing the duties of a temporarily absent employee. At the legislative level, there is no difference between virtual and independent organizations. However, in practice, an interim official is appointed for a certain period, that is, essentially, for the period of absence of a permanent employee, in this case no vacancies open. In turn, the executive officer is appointed for an indefinite period, until a new employee is hired for this position.

The EO may be a candidate for the position. The EO can be any employee of the company who is transferred part-time in accordance with the agreement. At the same time, after a permanent employee is hired, the agreement is terminated. If we are talking about an interim agreement, then there is no need to terminate the agreement, since the deadline is already specified in it. However, an agreement is not always required for IO. For example, some persons are required to be an EO by virtue of their official powers. For example, senior assistant, deputy, etc.

Paperwork

Registration of IO is possible in two ways. The first method is an order for the organization if there is no vacancy. Essentially, in this case, the EIO appoints an IO to himself. If you are planning such a situation, then it is better to write it down in the Charter. The second method is a decision or minutes of the General Meeting or the Board of Directors, if there is a vacant position. In this case, within a month a decision must be made on the appointment of this candidacy to the post of director or on rejection. It should be noted that tax authorities are very willing to meet the organization halfway and make an entry in the Unified State Register of Legal Entities about the sole proprietor, since they understand that the organization cannot exist for a long time without a director. The notary must submit an application in form P14001, with the name of the acting director or the acting director, an order for the acting director or a protocol for the acting director and constituent documents. Note that the procedure itself is identical to the procedure for changing the director. The applicant must be the IO himself. The Federal Tax Service is provided with form P14001 and, when submitting documents through a representative, a power of attorney. As a result, you receive a record sheet in which the Acting Actor or Individual Entrepreneur is indicated and an extract from the Unified State Register of Legal Entities, in which the Acting Acting Entity or Individual Entrepreneur is also indicated. By the way, don’t forget about the bank. You will need to change your card at the bank.

A little about embarrassment

The organization has appointed an acting acting director or executive director, all the documents have been drawn up, and suddenly the director, whom no one fired, returns to work.

How to appoint a chief accountant and draw up an order

In this case, the entire procedure must be repeated - go to the notary with form P14001, then register the changes with the tax office and the bank. If, nevertheless, an interim acting director was appointed, then this is a plus for the company, since its activities will not be paralyzed when the director returns, because the employment contract with the director has not been terminated. However, a corporate conflict may arise here. The acting director is appointed by the director, but the director himself is elected by the General Meeting. To avoid such situations, it is advisable to stipulate in the Charter when the approval of an interim organization is required by the General Meeting and what number of votes is required for approval. Another embarrassing situation may be the absence of the director at the end of the powers of the executive director. However, even in this situation, tax officials meet the organization halfway. They calmly register any name of the individual executive organization, up to the deputy director. Banks are also calm about this.

From all of the above, we can conclude that if the director of the company is tired of work and went on vacation, there is no need to despair, you just need to appoint an acting director before his departure. Then there will be no need to involve the general meeting, and everyone will be happy.

printscanner.ru

How to appoint a chief accountant and draw up an order

In this case, the entire procedure must be repeated - go to the notary with form P14001, then register the changes with the tax office and the bank. If, nevertheless, an interim acting director was appointed, then this is a plus for the company, since its activities will not be paralyzed when the director returns, because the employment contract with the director has not been terminated. However, a corporate conflict may arise here. The acting director is appointed by the director, but the director himself is elected by the General Meeting. To avoid such situations, it is advisable to stipulate in the Charter when the approval of an interim organization is required by the General Meeting and what number of votes is required for approval. Another embarrassing situation may be the absence of the director at the end of the powers of the executive director. However, even in this situation, tax officials meet the organization halfway. They calmly register any name of the individual executive organization, up to the deputy director. Banks are also calm about this.

From all of the above, we can conclude that if the director of the company is tired of work and went on vacation, there is no need to despair, you just need to appoint an acting director before his departure. Then there will be no need to involve the general meeting, and everyone will be happy.

- Kozhanova Evgenia | specialist in preschool educational institutions and personnel records management

Responsibility of the chief accountant to the employer

If the chief accountant does not perform his job duties properly, the Labor Code of the Russian Federation allows the manager to take certain measures of influence against the negligent employee.

Disciplinary responsibility

Like any other employee, the chief accountant may be punished for failure to perform or improper performance through his fault of the duties assigned to him by the employment contract. There are only three types of disciplinary sanctions: reprimand, reprimand, dismissal. When imposing a penalty, the severity of the offense committed must be taken into account.

If the chief accountant does not agree with the penalty, he can appeal it to the court. And it is often difficult for an employer to prove that he is right.

Firstly, a disciplinary sanction can be imposed only if the chief accountant has not fulfilled the obligation enshrined in his employment contract and job description. If the chief accountant did not fulfill (or did not fulfill on time) the director’s order, which is not part of his direct duties, then the court will not only cancel the disciplinary sanction, but will also oblige the organization to compensate for the moral damage caused to the chief accountant caused by the unreasonable penalty.

Secondly, it is necessary to prove not only the fact of the violation itself, but also that it occurred through the fault of the employee. If the employer fails to prove guilt, the court will declare the disciplinary sanction illegal. For example, the court overturned the reprimand given to the chief accountant for incorrectly calculating insurance premiums, since it turned out that the employer did not provide him with an accounting program, legal reference systems, or Internet access. Therefore, the chief accountant simply did not have the opportunity to learn about changes in legislation in a timely manner

Thirdly, you need to have time to punish the offending chief accountant within 6 months from the date of the offense. Thus, the court recognized that the employer has grounds to reprimand the chief accountant, who untimely submitted tax calculations for advance payments for land tax. But he canceled the penalty due to missing a 100-year deadline

The chief accountant can be punished not only for failure to perform or improper performance of his duties. He may be fired for making an unreasonable decision that entails a violation of the safety of property, its unlawful use or other damage to the property of the organization. Of course, if, according to the employment contract, the chief accountant is responsible only for accounting and reporting, then he does not make any decisions related to the property of the organization , and it is impossible to fire him on this basis.

Read more: How to write a sample reference from place of residence

If, despite the fact that your employment contract does not stipulate the obligation to make payments to suppliers, you still do this, then make sure that the supplier’s documents have a “Pay” director’s visa. So, once the chief accountant was fired because he, without the director’s permission, transferred money to pay an invoice issued by a counterparty for servicing accounting programs. And in another case, because he gave an order not to receive money to the cash desk, which resulted in their theft

Material liability

In addition to disciplinary action, the employer can punish the chief accountant with a ruble. If the employment contract with the chief accountant does not contain conditions on full financial responsibility, then from him, like from any other employee, damages can be recovered in an amount not exceeding his average monthly earnings

If the employment contract includes a provision on full financial liability, then the chief accountant is obliged to compensate the direct actual damage caused by him to the employer in full. We are talking about situations where the chief accountant did not fulfill his duties and it was as a result of this that the employer suffered damage. Moreover, damage can be recovered through the court even after the dismissal of the chief accountant (within 1 year from the date of discovery of the damage. For example, the court recovered from the former chief accountant the damage caused by him in the form of fines paid by the employer to the Pension Fund for late submission of information

to conclude a separate agreement on full financial liability with the chief accountant. Even if it is concluded, the court may relieve the employee of the obligation to compensate for the damage caused.

Let us emphasize that the condition of full financial responsibility in the employment contract works specifically for chief accountants. from a senior accountant the full amount of damage caused to the employer (for example, in the form of tax fines and penalties that the employer had to pay due to the senior accountant’s failure to fulfill his duties), despite the presence in the employment contract of a provision on full financial responsibility

If the chief accountant does not agree to compensate for the damage voluntarily, the employer can try to recover the money through the court. To do this, the employer must be prepared to prove to the court that:

- he suffered direct actual damage (the property has decreased or its condition has worsened);

- the damage was caused precisely as a result of the actions (inaction) of the chief accountant.

Judging by judicial practice, employers rarely manage to prove the existence of damage.

With the new Law on Accounting, chief accountants should feel more protected, because now they are no longer a priori responsible for everything in the world

For example, the Volgograd Regional Court did not support an employer who tried to recover from the chief accountant the amount of wages accrued and paid to employees for several years, due to the fact that the primary salary slip was not signed by the director. The court indicated that the chief accountant did not cause any damage to the employer, because the salary was accrued correctly

An employer from Moscow was also unlucky, who decided not to pay the former chief accountant a salary and compensation for unused vacation in retaliation for the fact that he improperly kept accounting and cash documentation and did not submit tax returns on time. In court, the employer explained his actions by saying that he had to pay a tax fine, spend money on the services of a consulting company, and also pay extra to the new chief accountant for correcting the mistakes of the old one. The court ordered the organization to pay off all debts to the former chief accountant and indicated that there were no grounds for collecting damages, since the accountant’s mistakes themselves do not entail a decrease in the employer’s property

It can be even more difficult to prove the guilt of the chief accountant. For example, in the Oryol region, the manager issued orders to award bonuses to employees, despite the lack of net profit. The property owner believed that the chief accountant was to blame for everything, since he knew about the organization’s lack of net profit, but did not point out this fact to the director. The court decided that the chief accountant was not to blame for the fact that the organization overpaid bonuses to employees, because he calculated and paid bonuses based on the orders of the manager

And in the Volgograd region, after the dismissal of the chief accountant, a shortage of raw materials and finished products was discovered at the warehouse. The organization considered that the cause of the shortage was the lack of reliable accounting and control over the movement of raw materials and finished products on the part of the chief accountant, and filed a lawsuit for recovery of the damage caused. The court pointed out: the lack of proper accounting in itself does not mean that the employer has suffered material damage. By the way, according to the new Law on Accounting, the object of accounting is not property, but assets, that is, abstract financial information (in other words, figures in reporting. Thus, for The chief accountant should not be responsible for the safety of property.

And sometimes it’s not even the employer who tries to place the blame on the chief accountant, but the former general director. Thus, the organization tried to recover more than 1 million rubles. material damage (tax fines and penalties accrued due to a one-day counterparty) from the former general director. In court, he tried to blame everything on the chief accountant, who accepted documents from a shell company for accounting. The appellate court rejected the argument of the former general director, pointing out that it was he, and not the chief accountant, who was responsible for compliance with the laws. However, the former general director got off with a slight fright: the cassation court decided that he, too, was not guilty of anything

Such a simple prop

In the usual way, there is absolutely nothing complicated in the design of the “Signature” requisite - the instructions in clause 3.22 of GOST R 6.30-2003 are very simple. The person who has the authority to sign this document:

- first indicates your position (from the left margin),

- puts a personal flourish,

- then - its decoding in the form of initials and surname.

If a document prepared on the letterhead of an organization is signed, then the position in the signature is indicated briefly (without repeating the name of the organization, which already appears at the top of the form) - see Example 1. If a document prepared in a different way is signed, then the name must be indicated in the position organizations - see Example 2.

Signing on the organization's letterhead

Signature not on the organization's letterhead

Responsibility of the chief accountant to the state

The chief accountant is responsible not only to the employer, but also to the state. Let's see what government agencies can hold accountable for.

Administrative responsibility

For failure to perform or improper performance of their duties, a company official may be brought to administrative liability.

If the employment contract entrusts the chief accountant with the duties of accounting and reporting, then he faces liability only for distortion of at least 10% of the amounts of accrued taxes or any article (line) of the financial statements form

The chief accountant, who, in accordance with the employment contract, also maintains tax records and cash transactions, may be held administratively liable for failure to submit or untimely submission of a declaration or calculation, violation of cash discipline. If your employment contract does not say anything about taxes and cash, then you are not may be prosecuted under these articles. If this does happen, the court will be on your side. The maximum fine for administrative articles is 3,000 rubles.

Just as in the case of other types of liability - disciplinary and material, the guilt of the chief accountant must be established and the deadlines for bringing him to justice must be met.

Read more: Application form for a new international passport 2018

It does not directly say which official should be held accountable - the manager or the chief accountant. Sometimes chief accountants and sometimes managers are fined. The latter often managed to avoid responsibility, since according to the old Law on Accounting the head of the department was responsible for everything.

Criminal liability

The chief accountant may be brought to criminal liability if the organization deliberately failed to pay large amounts of taxes to the budget for 3 years in a row:

- more than 2 million rubles, if the share of unpaid taxes exceeds 10% of taxes payable for this period;

- more than 6 million

However, it is almost impossible to bring the chief accountant to criminal liability. After all, for this it is necessary to prove that he intentionally acted with the aim of evading taxes (and not by mistake, not due to insufficient qualifications and As you understand, it is extremely difficult to prove intent.

The likelihood that the chief accountant will be held accountable for purely accounting violations (for example, unreliable reporting) is extremely low. True, the Ministry of Finance is going to supplement the legislation with provisions on the liability of “managers and other persons” for unreliable reporting, but for now this is only a plan

At the same time, if the employment contract with the chief accountant provides for obligations to settle all obligations to the budget (payment of taxes and contributions, submission of declarations), settlements with counterparties, and cash management, then for violations he may be subject to disciplinary, material and administrative liability.

This article describes in detail who the chief accountant reports to, and everything you need to know about it. Most likely, no one will argue with the fact that the chief accountant is shown to be one of the main positions in the organization. An employee who holds such a position is responsible not only for the correct, but also timely movement of the network, generation of reports, calculation and payment of taxes, and maintaining financial discipline. Since a certain time, the law says that the status of the chief accountant has changed slightly.

Adoption of mandatory measures for the use throughout the country of federal laws and other normative acts that determine the quality of legal coordination of labor of certain groups of workers. Nowadays, regarding the service of the chief accountant, such legislation is determined by the federal law “on accounting”.

Dear readers! Our articles talk about ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

In the previous law, the chief accountant was covered in Art. 7. In the legislation on accounting at the present time, the presented article does not exist, but the status according to the law of the chief accountant is shown in Art. 7. It is worth saying that the norms of the legislation shown, which are determined for the chief accountant, differ significantly.

Absolutely all new introductions that concern the chief accountant himself can be divided into the following aspects:

- Lack of rules on transfer to service, dismissal from a position, on exact subordination to the head of the company, obligations of the chief accountant's requirements for papers for all employees, as well as on his obligations.

- Submission of a single-level signature - only the head of the company; the signature of the chief accountant on the main accounting papers and accounting responsibility is not necessary.

- Distribution of responsibility between the head of the company and the chief accountant.

- Detailed problem solving process among the boss and chief accountant.

- The introduction of special qualification conditions for chief accountants of very significant organizations for the company, whose shares are quoted on the international market.

- Failure to obtain a certificate of a qualified accountant.

- The limitation in accounting is strictly for the head of the company.

What if the signatory is temporarily absent?

Here is what the methodological documents say regarding our topic - signing documents in the absence of an official:

In the absence of the official whose name is printed on the draft document, it can be signed by the person acting as manager or his deputy, who is duly entrusted with the management of the relevant area of activity.

It is not allowed to sign documents with the preposition “For” or with a slash before the job title. If the official whose signature is on the draft document is absent, the document is signed by the deputy manager, who has the right to sign documents for the manager, or another official who has the right to sign in accordance with the order on the distribution of duties, and the actual position of the person who signed the document is indicated , and his last name.

From the two fragments given above, the following conclusions can be drawn:

- the draft document

of the absent official have been duly “transferred” - even if the position and surname of the absent manager have already been entered into the project, the signer of the document must indicate his data

. Nothing is said about what to do with the project in this case, but it is obvious that it will have to be redone: neither strikethroughs nor empty props with a handwritten inscription will decorate the document; - Let us note that the prohibition on putting a slash or adding the preposition “For”

applies not only to federal executive authorities, but is also included in many sectoral instructions for office work, for example, in higher educational institutions, in the bailiff service, in the Federal Migration Service and others 1

Options for registering a replacement manager

It is rare that a director will leave the organization or division entrusted to him without leaving a deputy. But you can transfer powers to him in different ways. Moreover, in the absence of the main person, his functions can be distributed among several people.

The method of signing the understudy depends on the method of transfer of authority. Therefore, you need to understand what options are available and how they differ.

With regular replacement

contract

or job description

states that in the absence of the manager, it is he who will take over his duties. “Replacement on the field” occurs automatically: in the morning it turns out that the director had to urgently leave on a business trip, and all issues immediately become the responsibility of a full-time deputy.

To formalize a full-time replacement, clauses in an employment contract and/or job description are not enough. Order required

2, as well as

a power of attorney

issued to this employee by the director, listing the powers that are transferred to the deputy. For example, the director may allow the deputy to enter into transactions at a price only up to a certain amount or prohibit hiring people. All these nuances are prescribed in the power of attorney. Both the order and the power of attorney are issued once.

During the absence of the manager, a temporary transfer

to his position of another employee.

The transfer is made in accordance with Article 72.2 of the Labor Code of the Russian Federation. The parties enter into a written agreement

, and for a period of up to 1 year or until the day when the absent manager leaves, whose job is retained during his absence, the position is occupied by another employee.

In addition to the agreement, an order for temporary transfer and a power of attorney

.

From the point of view of labor law, this will be correct. But in the case of a temporary transfer specifically to the position of the sole executive body of the company (which is usually the general director), additional difficulties may arise. Firstly, the change of director (even short-term) is usually within the competence of the business owners (participants or shareholders) or the board of directors. Secondly, information about the change of manager must be submitted to the tax authority for inclusion in the Unified State Register of Legal Entities. Therefore, it is advisable not to arrange a temporary transfer, but to use other options.

Perhaps the most common option now for registering a replacement is combining positions

in accordance with Art. 60.2 Labor Code of the Russian Federation. The deputy is entrusted, with his consent, along with the main work, to take on additional work in another position for a fee.

When combined, it can be issued as an order “On the assignment

duties” and the order

“On the performance

of duties”, which will significantly affect the execution of the “Signature” requisite.

The document is given legal force by the signature of an authorized person, and not by any employee of this organization. That’s why it’s important to properly empower the understudy. This is done using different documents.

Let us explain the purpose of each of them:

- An employment contract or other written agreement between an employee and an employer

reflects the composition of the employee’s responsibilities and rights. If he performs them poorly, then there is a basis for his responsibility for this. Often, the employment contract does not list in detail all the duties and powers, but refers to the job description. Documents regulating labor relations (between employee and employer) will need to be drawn up for full-time replacement and temporary transfer; - order:

- formalizes the delegation of specific powers/responsibilities to a specific person for a certain time and under certain conditions;

- this is an internal document that notifies employees of the home organization that a replacement has occurred.

An order is required for any method of transfer of powers; it specifies their composition. But it is better to reflect the terms of payment for replacement in a separate order, so as not to excite the imagination of its readers. Although the composition of the powers, if they are transferred to the backup in their entirety without adjustments, can not be listed in the order, but a link can be made to another document where they are, for example, to the “Regulations on the General Director of the Company”;

- a power of attorney

is needed to officially inform persons outside the organization about the composition and term of office of the backup. If he has such interaction (to sign contracts and other documents for distribution to the external environment, to represent the organization in relations with tax and judicial authorities, etc.), then a power of attorney is required! Without it, third parties will consider the understudy not authorized to represent the interests of the organization.

When signing an understudy on a document, be prepared to provide the recipient with copies of documents proving the competence of the signatory. In some cases, you can not wait for a request and immediately attach, for example, a power of attorney (this is often done when drawing up contracts).

Undoubtedly, of all the listed methods of replacing an absent manager, the best option is full-time replacement. There are cases in history where a director who suddenly ended up in the hospital was physically unable to appoint a deputy for several days, since he was first lying on the operating table and then in intensive care. In such rare but extremely unpleasant situations, a regular deputy is activated automatically. And if this is not so important for middle managers, then it is better for the “tops” to play it safe.

CHANGE 5. QUALIFICATION REQUIREMENTS

For the first time, special qualification requirements have been introduced at the legislative level for persons charged with maintaining accounting records in socially significant companies whose shares are quoted on the international market. The establishment of these requirements is an additional measure to protect the interests of potential investors of socially significant companies, including foreign ones, since the Accounting Law prioritizes the assessment of the financial condition of an economic entity.

According to Part 4 of Art. 7 of the Law on accounting in open joint-stock companies (except for credit organizations), insurance organizations and non-state pension funds, joint-stock investment funds, management companies of mutual investment funds, and other economic entities whose securities are admitted to trading on stock exchanges and (or ) other organizers of trading on the securities market (with the exception of credit organizations), in the management bodies of state extra-budgetary funds, in the management bodies of state territorial extra-budgetary funds, the chief accountant or other official entrusted with accounting must meet the following requirements:

- have higher professional education;

- have work experience related to accounting, preparation of accounting (financial) statements or auditing activities for at least three years out of the last five calendar years, and in the absence of higher professional education in the specialties of accounting and auditing - at least five years out of the last seven calendar years;

- not have an unexpunged or outstanding conviction for crimes in the economic sphere.

Individuals with whom the organization enters into an agreement for the provision of accounting services must also meet these requirements. Legal entities providing such services must have at least one employee who meets the established requirements (Part 6, Article 7 of the Accounting Law).

Additional requirements for the chief accountant or other official charged with maintaining accounting records may be established by other federal laws (Part 5 of Article 7 of the Accounting Law).

As you can see, the requirements for chief accountants established by the Accounting Law are quite simple. However, liability for their violation has not been established. This is due to the fact that liability is the subject of other branches of legislation and in this case it is necessary to turn to other laws. Just remember that all socially significant companies whose shares are quoted on the international market have supervisory authorities that monitor compliance with current legislation and have appropriate enforcement mechanisms for this.

The specified requirements must be taken into account by specialists of personnel services of socially significant companies when filling out the form for posting a vacancy and drawing up profiles of candidates (applicants) for the vacant position of chief accountant.

I work in the HR department of an insurance company. In accordance with the new Accounting Law, certain qualification requirements are imposed on persons who are entrusted with accounting in our organization. However, the chief accountant does not have the required work experience. Is this grounds for his dismissal?

The listed requirements do not apply to persons entrusted with maintaining accounting records on the day the Accounting Law came into force (January 1, 2013). This is indicated in Part 2 of Art. 30 of the Accounting Law. In fact, this norm enshrines the employee’s constitutional right to not have conditions worsen as a result of changes in the legislative framework. Consequently, previously concluded employment contracts (as well as contracts for the provision of accounting services) in case of non-compliance with the requirements of Parts 4 and 6 of Art. 7 of the Accounting Law cannot be terminated on this basis.?

Acting or acting - which is correct?

Until recently, all business correspondence was purely male: general director Ivanova, editor-in-chief Petrov. This unspoken rule was not described anywhere, but every self-respecting philologist refrained from using feminists.

However, in modern society, an increasing number of women are beginning to think about gender equality, so the words “director” or “editor” today may surprise few people.

However, the use of feminists still hurts the ear, so business documentation should adhere to established standards: if it is necessary to convey information about someone temporarily performing someone’s duties, then it is better to do this without reference to gender. For example, “to assign a bonus in the amount of two salaries to the acting chief accountant Maria Pavlovna Sidorova...”

On the other hand, approval by gender is not a violation, and if in the same order on awarding a bonus the employee writes: “acting chief accountant Maria Pavlovna Sidorova...” - this will not be considered an error and perhaps in a few years this form will even become a priority.

Origin and meaning of the word "accountant"

The word "accountant" comes from a direct combination of "Buch" and "Halter", which literally translates from German as "book" and "owner".

Therefore, if you read it literally, then in Russian you will get “book owner” or “book holder”. This simple origin of the word can be attributed to the equally unassuming work of this profession in the Middle Ages: an accountant was obliged to always keep the accounting book safe, keeping it from moisture and physical damage. The first “book owner” can be called Christoph Stecher, who was appointed to this position by the Holy Roman Emperor Maximilian the First. The direct responsibilities of the accountant were bookkeeping and maintaining a ledger to control expenses.

The origin of a word helps us write the word correctly if it was suddenly used in the text without the letter “x” (“accountant”) or with two letters “x” (“accountant”). Do not pay attention to pronunciation, as additional consonants that are difficult to speak are often omitted. In the word “accountant” it is either the letter “g” or “x”.

Acting and Acting - differences in spelling and meaning