Form SZV-K: what is it for?

The SZV-K form is intended to reflect the work experience of an individual for periods before 2002. The SZV-K form is included in the personalized accounting information. It was approved by Resolution of the Pension Fund Board of January 11, 2017 No. 2n. That is, we can say that the reporting form is relatively new. The form looks like this:

current SZV-K form.

Some accountants are already familiar with the SZV-K form. The fact is that employers (organizations and individual entrepreneurs) previously reported using a similar form more than 10 years ago (in 2003-2004). Then it was also introduced to generalize information about work experience before 2002. However, in 2020, the SZV-K form was again required by the territorial bodies of the Pension Fund of Russia to collect information about the length of service. To determine the size of the insurance pension, you need to know the estimated pension capital. And this indicator summarizes the total amount of insurance contributions to the Pension Fund of the Russian Federation paid for the insured person, and pension rights acquired before January 1, 2002. Roughly speaking: the SZV-K form is needed by the Pension Fund to calculate pension points “earned” by a person.

However, there is an opinion that the SZV-K form is required by the Pension Fund of the Russian Federation to form a unified federal database on length of service, so that from January 1, 2018, the experiment of switching to electronic work books can begin.

Note that the legislation does not directly disclose the main purpose of the SZV-K form. In this regard, all that remains is to draw conclusions from the name of the form - “Information on the work experience of the insured person for the period before registration in the compulsory pension insurance system.”

It is worth saying that the SZV-K form is the only source of data on work experience and/or other activities before January 1, 2002. Neither the annual report of SZV-STAZH nor the monthly report of SZV-M contains such information. Also see “SZV-STAZH: new report for all employers.” Consequently, only from the SZV-K report can the Pension Fund of Russia bodies obtain information for periods up to December 31, 2001. At the same time, the first clarifications from representatives of one of the regional UPFRs recently appeared on the Internet. Here's what he explained:

Question: – Tell me, why did the Pension Fund of Russia divisions again need a report in the SZV-K form in 2020?

Answer: – Some insured persons with experience before 2002 do not have information on the personal accounts of the Pension Fund. The Pension Fund of Russia updates its databases every three years, the last one was in 2014. And in 2020 there is a new stage of updating.

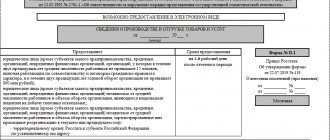

Sample form of the STD-PFR form.

At first glance, the extract form is very similar to SZV-TD. However, the last form is used to submit reports, and STD-PFR is used to provide the results of personnel movements.

The document contains the following information:

- Information about the registered individual;

- Information about choosing an electronic or paper work permit and submitting an application;

- Pension Fund number, as well as the name of the employer;

- Work activity data;

- Position, signature, as well as its transcript of the authorized official.

Download the STD-PFR form.

https://youtu.be/y_gqysFp2qc

Who should take the SZV-K

But who is required to submit reports in the SZV-K form? Which employees should be included in the report? Unfortunately, there are no clear answers to these questions in the legislation. In 2020, the practice developed in such a way that the territorial bodies of the Pension Fund of the Russian Federation began to send request letters to policyholders (organizations and individual entrepreneurs), which contain requirements to submit a SZV-K report for certain persons. Policyholders began to receive such requests both “on paper” and electronically. Moreover, some of these requests are marked “URGENT”. This surprised many accountants, to put it mildly.

Please note that the universal forms of such requests and the permissible cases of sending them to policyholders are not defined by the legislation of the Russian Federation. Therefore, PFR units, in practice, use an arbitrary form. However, most often, the fund’s requests indicate specific individuals whose data needs to be generated.

The practice in 2020 is that policyholders submit the SZV-K form at the request of the Pension Fund of Russia. The Fund, as a rule, requests information about those insured persons for whom it does not have information about their work experience before 2002. The policyholder provides the following information on persons (clause 1, article 8 of Federal Law No. 27-FZ of 04/01/1996):

- those working for him under an employment contract;

- who have concluded civil contracts with him, for which insurance premiums are calculated.

But what to do if the policyholder simply does not have information that could be included in SZV-K? This can happen when an employee, for example, does not have work experience for the period before 2002 or he has already quit at the time the request is received (his work book is missing). In such a case, in our opinion, it makes sense to send a letter to the PFR authorities indicating the reason why the policyholder does not have the opportunity to submit the SZV-K form.

Experience

The period of work under the STD is included in the length of service under the following conditions:

- period of work in the organization for at least two months;

- official employment;

- wages not lower than one minimum wage (minimum wage);

- transfer by the employer of funds from earnings to the Pension Fund of the Russian Federation.

The basis for confirming work experience is the work book. If the corresponding entry has not been made, you need to obtain a certificate from the accounting department to confirm it.

After transferring an employee to a permanent basis in the same organization, temporary work experience is included in continuous work experience, which affects sick leave payments.

Some aspects of a fixed-term employment contract are completely identical to the usual provisions. In certain cases, it is necessary to rely on the nuances established by law only for STD. An employee employed temporarily should not be subject to discredit by the employer and receive all required benefits and payments.

Filling out the SZV-K form: examples

The rules for filling out the SZV-K form and the corresponding instructions for accountants are defined in paragraphs 31 - 33 of Instruction No. 2p. The SZV-K report is filled out based on information from the work book and other documents, namely (clause 11 of the Rules approved by Decree of the Government of the Russian Federation of October 2, 2014 No. 1015).

- written employment contracts;

- labor records of collective farmers;

- certificates issued by employers or relevant state (municipal) bodies;

- extracts from orders;

- personal accounts and payroll statements.

One SZV-K form is filled out for only one individual. The information is filled out in the report in chronological order for the period from the start of the insured person’s employment until 01/01/2002 (clause 31 of Instruction No. 2p).

Next, we will take a closer look at filling out each section of the SZV-K form.

Personal data of a person and his SNILS

At the very beginning of the SZV-K form, you need to indicate the personal data of the person in respect of whom the report is being filled out, namely:

- Last name, first name and patronymic (in the nominative case);

- date of birth;

- territorial conditions (there may be an empty field, code “RKS” or “ISS”, as well as the size of the regional coefficient).

Also, in the initial block of the SZV-K report, you need to indicate the insurance number of the individual personal account of the insured person (SNILS). It must be indicated without fail (clause 31 of the Instructions, approved by Resolution of the Pension Fund Board of January 11, 2017 No. 2n). Here's what filling the first block might look like using an example:

Form type

Also, at the top of the report submitted to the Pension Fund on the SZV-K form, you need to record the “Form Type” of the report. There can be three meanings: “original”, “corrective” and “cancelling” form. Mark the required type with an X:

The values of the SZV-K types are deciphered in the table below:

| Form type SZV-K | |

| Form type | When is it celebrated? |

| Original | If information about the length of service is submitted to an employee for the first time. The same type is noted if the corrected form SZV-K is submitted after the inspectors from the Pension Fund of the Russian Federation returned the report for revision due to errors. |

| Corrective | This is noted if the accountant independently identified an error in the already submitted SZV-K form, and now the erroneous information needs to be clarified or corrected. |

| Canceling | This type of form must be shown if you want to completely cancel previously submitted employee information. The “cancellation” form is submitted along with the “original” form. |

Section on periods of working activity

The section “Periods of labor or other socially useful activity” is, in fact, the most important and informative section of the new report. Include information:

- on the start and end dates of employment (clause 33 of Instruction No. 2p);

- on the periods giving the right to early assignment of a labor pension to certain categories of citizens (clause 33 of Instruction No. 2p).

How to enter information about work periods

Information about the work must be shown in SZV-K in chronological order. Simply put: the first line should be about the first place of work (period of experience). However, remember that information needs to be shown only about work experience before January 1, 2002. That is, the report form should end with a maximum date of 12/31/2001.

If, when filling out the report, the work periods “intersect”, then they will need to be “joined”. Let's give an example. Let's assume that a citizen was fired on July 11, 1998, and was hired into the next organization earlier - on July 9, 1998. Then indicate the first period up to July 11, 1998 inclusive, and the next period - from the next day, that is, from July 12, 1998.

Show the names of employers (or places of service) in the “Name of organizations” field in this section exactly as indicated in the work book (or military ID). That is, if, for example, the full name is indicated in the work book, then write down the full name in the report, if it’s an abbreviated one, enter the abbreviated name.

As for the field “Type of activity (code)”, form it in accordance with the codes specified in Appendix 1 to the Instructions, approved. By Resolution of the Board of the Pension Fund of January 11, 2017 No. 2n. We present their decoding in the table:

| Types of labor or other socially useful activities (for SZV-K forms) | |

| Code | Name |

| JOB | Job |

| RABSVPK | Work supported by testimony |

| RABZAGR | Work abroad |

| SERVICE | Military service and other equivalent service |

| SLPRIZ | Military service by conscription |

| SLAVES | Work during the Great Patriotic War |

| SLDAPBL | Service in military units, headquarters and institutions that are part of the active army, in partisan detachments and formations during hostilities |

| IZLVTR | Time spent in treatment in medical institutions due to military trauma |

| REBLOCK | Work in Leningrad during the blockade (from September 8, 1941 to January 27, 1944) |

| SLPROZH | Accommodation for wives (husbands) of military personnel serving under contract |

| SOCIAL FEAR | The period of temporary incapacity for work that began during the period of work and the period of being on disability of groups I and II |

| DO NOT WORK | A non-working mother caring for her child |

| CARE-CHILDREN | One parent caring for a child |

| CARE-INVD | Care provided for a disabled person of group I, a disabled child, an elderly person |

| TRUDLITSO | Care by an able-bodied person for a disabled person of group I, a disabled child or a person who has reached the age of 80 |

| CARE-HIV | Care of parents and other legal representatives for HIV-infected minor children |

| BEZR | Receiving unemployment benefits, participating in paid public works, moving in the direction of the employment service to another area |

| REHABILIT | Detention of persons unjustifiably prosecuted, unjustifiably repressed and subsequently rehabilitated, serving their sentences in prison and exile |

| PROFZAB | Being on disability of groups I and II resulting from a work-related injury or occupational disease |

| REVISION | Staying in places of detention beyond the period prescribed during the review of the case |

| DVSTO | Preparation for professional activity - training |

| PRZAGR | Residence abroad of wives (husbands) of employees of Soviet institutions and international organizations |

| PROVOV | Living in areas temporarily occupied by the enemy during the Great Patriotic War |

| PRBLOCK | Accommodation in Leningrad during its siege |

| PRONTS | Being in concentration camps |

| PROZHSUPR | The period of residence of spouses of military personnel serving under contract with their spouses in areas where they could not work due to lack of employment opportunities |

Method of submitting SZV-K

Policyholders can submit information in the SZV-K form “on paper” or electronically (clause 2 of article 8 of the Federal Law of 01.04.1996 No. 27-FZ). The format for submitting information in electronic form is established by Appendix 3 to Instruction No. 2p. In our opinion, it is more logical to submit the SZV-K report electronically. After all, then the information will quickly get to the individual personal account of the insured person.

Form SZV-K is submitted to the Pension Fund of the Russian Federation along with a list of documents according to form ADV-6-1 (clause 7 of Instruction No. 2p). See “ADV-6-1: form and sample filling”.