( 6 votes, average rating: 5.00 out of 5)

lawyer Documents

If it is necessary to correct information in the Unified State Register of Legal Entities, the enterprise applies to the registrar with an application (commercial enterprises - to the tax service, public organizations - to the Ministry of Justice and its territorial departments). Its form was adopted on January 25, 2012. The order on this under the number MMV-7-6 / [email protected] was published signed by the head of the federal tax service. The form is applicable from June 28, 2020. The deadline for submitting the application is no later than three working days from the date of the changes that occurred at the enterprise. Taking into account the fact that the period is very limited, instructions for filling out form p14001 in 2020 will allow you to accurately enter data into the application and not delay in submitting information to the registrar.

- General requirements

- Filling out P14001 when changing the director

- Filling out P14001 for participant exit

- Filling out P14001 for the purchase and sale of shares

The application form (sample) for filling out p14001 can be downloaded in PDF format from the link (taken from Consultant Plus).

In this article we will cover in detail the main points for filling out an application on form p14001 in three cases:

- When the director of the company changes;

- When one or more members of the company leave its membership;

- When a share in an enterprise is sold.

General requirements 2020

The application can be filled out either on a computer or manually. The requirements for filling out form p14001 when choosing a machine preparation method are as follows:

- Capital letters are used;

- Letters and other symbols are printed at 18 pt height;

- The font used on the computer is Courier New.

If the form is filled out manually, then a black pen will be required. Only capital letters must be entered into the fields on the application form.

If there are several adjustments, they can all be indicated in the same statement.

The p14001 form is printed using single-sided printing.

The document is quite voluminous - it includes 51 pages. But only the first page, sheet P, as well as the sections that reflect the updated information should be completed and sent to the registrar. The fourth page of the final sheet P must be completed by the notary.

On page 001 information identical to that available in the Unified State Register of Legal Entities is indicated:

- OGRN of the enterprise;

- His Taxpayer Identification Number;

- Full name of the organization in Russian indicating the form of ownership.

Don't forget to put the number 1 in the square of item 2 on the first page (Fig. 1).

picture 1

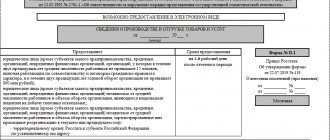

Sheet P is filled out as follows:

- Information about the applicant is entered on the first page. To do this, select the numerical value of the applicant’s category from the first point. After this, you again need to enter the company’s OGRN data, its INN and full name (again in Russian) (Fig. 2);

Figure 2

- The second page displays more detailed information about the applicant. They include his full name, TIN number, date of birth and place of birth indicated in the identity document, number, date of issue of the passport, issuing authority, department code;

- The third page indicates the address of residence and contact information;

In paragraph 5, page 4, the applicant personally fills out his full name (patronymic name - if only it is indicated in the passport) with a black pen. His handwritten signature on this page is certified by a notary.

The main sections are completed; we suggest moving on to the design of the pages depending on what adjustments are expected to be made in the state registration record.

Features of filling out an application

If you choose to fill out the document by hand, use black ink and enter only printed characters. Each character has a separate cell. In addition, the document can be filled out on a computer. Here it is recommended to use the Courier New 18 font. There are also other features of filling out the form:

- Filling and numbering

All sheets of the document have letter designations. In addition, they are additionally numbered. To indicate the number, there are three cells that must be filled in. Thus, for example, the fifth page is numbered not “5”, but “005”. It is worth noting that numbering is placed only on those pages in which changes will be indicated. For example, if the company’s manager changes, sheet “K” is filled out, which is designated by the number “002”.

- Front page

OGRN and TIN codes are entered here. In addition, the full name of the company must be indicated here. Do not forget to ensure that machine reading of information is successful, write the company name in capital letters. Here it is necessary to take into account that if the name of the organization consists of several words, one empty cell must be left between them. The absence of such a space is considered a serious error due to which the application will not be accepted. Long words that do not fit on one line can be wrapped. But at the same time, it is prohibited to place the transfer sign itself.

- Data correction

For these purposes, sheet “F” is used. At the top you will see three reasons why this page may be populated. In a specially designated cell you need to put a number corresponding to the reason. The first page of the sheet indicates data that is already available in the State Register. This is essentially incorrect information that needs to be corrected. The second page is for entering new data that is correct.

https://youtu.be/9ubnvEkUXwo

( Video : “How to fill out p13001 and p14001 to change your legal address?”)

- Numeric values

There are pages in the document in which it is necessary to indicate values in numbers. For example, sheet “D” indicates the cost of the share. You need to remember that numbers are entered in such a way that they are as close as possible to the dividing mark. When entering integers, there is no need to put zeros after the period.

- Operations with shares

The form contains several sheets that are specifically designated for indicating data on transactions with shares. Former and new owners of the share are indicated in the appropriate columns. They are indicated using numerical values.

- Statements on OKVED

Tax legislation obliges organizations to use one main OKVED. Additional activities can be used as needed. Using this form, the organization has the right to enter an additional code or replace the main one. For these purposes, sheet “H” is used. You need to enter a new code in the corresponding column of its first page. The second page is intended to indicate the old OKVED code that you want to exclude from the State Register.

Filling out P14001 when changing the director

When there is a change in the head of the organization, then, in addition to page 001 and sheet P, you need to fill out a two-page sheet K, the latter in two copies: for the old and new leader separately.

Figure 3

When drawing up Sheet K for the outgoing director, on the first page in Section 1 the reason for making the changes is indicated - termination of powers, number 2 is selected (Fig. 3). In the second paragraph, you should indicate the full name and tax identification number of the resigning manager.

Next, copy the first page of sheet K and fill in information about the new manager. In the first section, select the value 1 (Fig. 4).

Figure 4

Next, in the third section, we enter reliable information about the new manager:

- FULL NAME;

- Job title;

- Date and place of birth;

- Identity document details;

- Information about place of residence;

- Contact phone number.

Similar data is reflected in sheet P, because the new director will act as the applicant.

Change (clarification) of LLC

Hello! Our LLC has a legal address registered more than 5 years ago: “Moscow, st. “The same address is written in the charter in the same format, down to the house. During the audit, the tax office noted that the address was invalid and asked to clarify how in the lease agreement, down to the room, the new address would be “Moscow, st., room. » Do changes need to be made on Form 14001 or 13001? Is it necessary to change the charter with such a change of address?

2. change of the legal address of the LLC in the Unified State Register of Legal Entities using form P14001 (if the address in the charter does not need to be changed). On September 1, 2014, changes to the Civil Code of the Russian Federation came into force, where the new version of Article 54 allows us to indicate in the organization’s charter its location, which is determined by the place of state registration on the territory of the Russian Federation by indicating the name of the locality (municipal entity). Thus, if your charter indicates a location, for example, the city of Moscow, instead of a full address, and you want to change the address within the city of Moscow, then in this case you will not have to change the charter and pay the state fee. This simplifies the procedure for changing the address before submitting for state registration only form P14001 of changes in the Unified State Register of Legal Entities, which must necessarily contain information about the address of the legal entity.

We recommend reading: Tax on the Sale of an Apartment Received by Inheritance in 2020 New Law

Filling out P14001 for participant exit

The next case when you need to fill out an application in form p14001 is when a participant leaves the company.

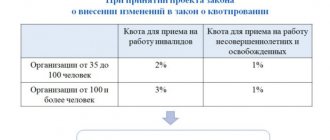

When distributing the share of a person who has left the ranks of the company's participants (a month is provided for this), you will need to fill out page 001, Z and R, as well as the following sheets, taking into account which participant is leaving the company:

- Sheet B, when a legal entity leaves the ranks of participants;

- Sheet D, if a foreign company;

- Sheet D, if a private person;

- Sheet E, if the government is at the federal, regional or municipal level.

Let us assume that an individual leaves the company. Then in the first section of sheet D, number 2 is selected and the full name and TIN of the participant are indicated (Fig. 5).

Figure 5

Next, sheets D are drawn up for other participants in the organization, but in the first section the number 3 is selected, and in section 4 the total amount of the authorized capital and the percentage of the share of a particular participant are indicated (Fig. 6).

Figure 6

On the sheet under the letter Z the reason for correcting the information is indicated:

- Purchase of a share by an organization;

- Distribution of the released share indicating the amount. The percentage is reflected in the next subsection (Fig. 7).

Figure 7

In the case when the share belonging to the retired participant is not distributed, you will have to submit an application to the tax office twice: with a message about the participant’s withdrawal (with completed page 001, sheets C, D, E or E, as well as Z. Then an application for distribution of the released participant is prepared shares.

Form form P14001

The application in form P14001 was approved by Order of the Federal Tax Service dated January 25, 2012 No. ММВ-7-6/ [email protected] After the new OKVED-2 classifier came into force, changes were made to the form (Order of the Federal Tax Service ММВ-7-14 / [email protected] dated 05/25/2016). In 2020, this form continues to remain relevant, although the tax service has been planning to significantly change it for several years.

Application form P14001 (form to fill out in pdf format)

The full application form includes 51 pages, but only some of them are filled out - separately for different information. Blank pages are not printed and not submitted to the Federal Tax Service.

Filling out P14001 for the purchase and sale of shares

When it is necessary to make changes to the Unified State Register of Legal Entities in connection with the purchase and sale of a share, the following sections must be completed in the application form P14001:

- Page 001;

- Sheet B, D, D or E, depending on which founder terminates his participation in the company. This can be a legal entity, a private person, a foreign enterprise, or a government body at any level.

- Leaf R.

To begin with, information about the founder who is selling his share is entered into sheet B, D, D or E:

- Full name of the company, if it is an enterprise;

- Full last name, first name and patronymic, TIN if this is a private person.

Figure 8

In the first section you need to set the value 2. And information about the retiring founder is indicated in the second section (Figure 8).

After this, we fill out similar sheets for the new participant. Here, already in the first section, you need to select the value 1 and fill out the third and fourth sections, that is, provide complete information about the participants of the company (Fig. 9).

Figure 9

From January 1, 2020, the purchase and sale of a share in an organization must be notarized. It does not matter which person is the second party to the economic transaction. This may be one of the participants of the company (legal entity or citizen), or a third party (third-party enterprise).

The notary not only confirms the authenticity of the applicant's signature on Form P, but also certifies the prepared purchase and sale agreement, and also personally sends the package of documents to the registrar. Only in this case can the transaction be carried out smoothly and the necessary changes be made to the record of the legal entity.

Thus, the tax office, with one order, brought all the changes that accompany an enterprise along its life path under a single standard of registration. If you have time and experience, you can understand the document, and samples for filling out form P14001 will allow you to quickly navigate the intricacies of preparing official documents.

Project of a new form P14001

For several years now, the Federal Tax Service has been developing new registration application forms. Judging by the draft Order, the new form P14001 will be one and a half times larger - 74 pages instead of the current 51. The application, which includes requirements for filling out registration forms, is also impressive in its volume - 72 pages.

Discussions on new application forms have been ongoing for three years. Perhaps the Federal Tax Service will nevertheless reduce the number of pages in the forms and simplify the requirements for filling them out. In the meantime, you can get acquainted with what the new form P14001 will look like by downloading it from the link below.

Application on form P14001 (draft new form)

Application methods

The form can be submitted to the tax authority at the location and registration of the legal entity in the following ways:

- through “My Documents” (Multifunctional centers for the provision of state and municipal services);

- directly to the tax authority in person;

- by registered mail.

Submitting the form electronically for 2020 is not yet available , even through the personal account of a legal entity on the official website of the Federal Tax Service.

Attention! The applicant must submit the application personally or his authorized person on the basis of a power of attorney. The form can be filled out either in advance or directly when contacting “My Documents” or the Federal Tax Service. Department employees are not required to independently fill out the form for the applicant.

Filling out the form when entering a new or changing OKVED

An application on Form 14001 must be submitted only if the addition or change of OKVED codes does not require a change to the company's Charter. (Otherwise, complete Form 13001).

Registration procedure:

- In paragraph 2 of the title page, the number “1” is entered (changes in information about the legal entity).

- On the first page “N” new codes are written for entering into the Unified State Register of Legal Entities.

- On the second page “N” codes are written that are excluded from the Unified State Register of Legal Entities.

If the main sheet H is not enough to fill in all the codes (both new and excluded), you are allowed to take additional pages.

The OKVED codes themselves must be at least four digits. They are written line by line, not in columns.

Sample of filling out form P14001 when changing OKVED (adding new ones):

When excluding old OKVEDs:

When changing the main OKVED:

https://youtu.be/EEEZ6JHIrnA