Reasons for receiving an advance

The reason for writing an application for an advance can be a variety of circumstances: a wedding or the birth of a child, the illness of a relative or loved one, the need for urgent loan repayment, renovations, a large purchase, etc. An advance is the best alternative to urgent loans, the interest on which, as we know, is incredibly high.

FILES

It should be noted that an application for an advance is written when the advance is not provided for in the employment contract between the employee and the employer or its term or amount differs from what is required.

Another, completely separate reason for an employee to receive an advance: a business trip or other corporate needs (purchase of office supplies, materials or equipment).

In this case, in the application for an advance, the future traveler or other employee of the enterprise must write the purpose of receiving the advance, as well as how exactly he intends to spend the funds received. Money is issued strictly on account and the balance must be returned back to the company's cash desk. If there is not enough money, then the accounting department is obliged to pay the employee the missing funds. At the same time, all actions must be documented.

How to make an application

There is no legally established form for applying for an advance. Therefore, it is compiled arbitrarily based on the rules of office work and based on established practice.

How to compose a document:

- For the application, you need to choose a blank white A4 sheet.

- The text can be entered using a printing device, computer programs, or written by hand.

- If the application is written by hand, choose blue, black or purple paste. Red, green, etc. writing is prohibited.

- The document must not contain strikethroughs, corrections, or significant blots.

- It is necessary that the text be written without gross errors. It is better to double-check it several times so that all names and positions are entered correctly.

Perhaps, when contacting the accounting department, the employee will be provided with a sample application or simply dictated to it. In this case, you need to focus on the established practice of a particular enterprise.

What information should be included in the application:

- Full company name.

- Full name of the manager to whom the applicant is applying; the name of his position.

- Full name of the employee; his position.

- Document's name.

- A request to provide a sum of money as an advance payment before the deadline specified by regulatory documents. It is necessary to indicate by what date the money must be provided.

- The requested amount in numbers and words.

- The reason why funds are needed ahead of schedule.

- List of documents attached to the application. This item is optional. But the employee can attach copies of documents that explain the reason.

- Date of application.

- Employee signature with transcript.

It is better to write the application in two copies. The first one is transferred to the responsible person. And you need to keep the second one for yourself. But first ask the employee who accepts the applications to sign and date your copy.

What to do to receive an advance

Issuing an advance (unless it concerns official needs) is the exclusive will of the employer. In other words, the initiator of the application is always an employee of the enterprise or organization, the final decision is made by the manager .

In order for the boss to put a positive resolution on the application, you must not only try to maintain good relations with him and conscientiously fulfill your work duties, but also prepare in advance a package of documents justifying the need to receive funds.

As a rule, employers rarely pay more than half of the average monthly salary in advance, so asking for a large amount is not practical, but getting 25-30% of your salary or salary is very possible.

It should be noted that the manager can leave the advance amount unchanged or adjust it depending on his ideas and the capabilities of the company.

The time period for consideration of such an application has not been established, but as practice shows, it usually takes from several hours to three days.

Sample application for increasing the amount of advance payment

The statement is quite simple. On a blank sheet of paper in the upper corner write the addressee's data {amp}amp;#8212; head of the organization (his full name, position), name of the organization. It is indicated from whom the appeal is being written.

In the center of the form is the name of the document.

The free-form text contains a request to the manager, for example: {amp}amp;#171;I request an advance in the amount of 5,000 (five thousand rubles) towards wages for August 2017{amp}amp;#187;.

Next, for greater persuasiveness, you can indicate why money is needed. For example, in connection with obligations to pay utilities, rent, loan repayment, treatment, etc.

The application must be signed, dated and handed over to its destination.

Design example

To the director of LLC {amp}amp;#171;Cook{amp}amp;#187;

Titov A.A.

from storekeeper A.A. Kotov

Statement

I ask you to give me an advance in the amount of 5,000 (five thousand) rubles towards wages for August 2020 in connection with the onset of obligations to pay a bank loan.

08/15/201Kotov A.A.

If the specific situation that occurs meets certain criteria of the employment contract, then proceed to write a memo.

You also need to attach a document certifying this fact.

For example, in the case of receiving benefits in connection with the replenishment of the family, this circumstance is registered, the date of birth of the child is indicated and a photocopy of the certificate is attached.

In case of illness, the diagnosis is indicated and a sick leave certificate or a certain certificate is attached.

To the General Director of Vympel LLC, A.I. Seleznev, from the chief accountant, S.A. Ivanova.

Office memo In accordance with clause 21 of the collective agreement, I ask you to provide one-time financial assistance to accountant N.E. Shmeleva.

The established deadlines for advance payments, as well as other nuances, can be found using Article 136 of the Labor Code of the Russian Federation.

In order to properly draw up a document requesting an advance, it is advisable to write down the following points in the main part of the note:

- The exact coordinates of the workplace where the individual applying for the advance works.

- The exact amount required as an advance.

- How long has the employee been working at this enterprise?

- Circumstances as a result of which an employee needs early payment.

To the head of the State Unitary Enterprise of Moscow Trust “Mosotdelstroy No. 1” Sorokin Yu.P. from the head of the HR department B.A. Prigozhin

OFFICIAL NOTE I ask you to give permission for an advance payment for an employee performing work at the Elektrogorsk facility, Palace of Culture named after.

Lenin. The employee has been working since December 1, 2009.

Letter No. 1 Dear Victor Alekseevich, We are writing to you with a request to allocate additional funds for the purchase of 15 new computers for the computer science class. We also ask you to consider the possibility of additional financing for the installation of Internet access.

Hope for your understanding. Sincerely, Petr Ivanovich Letter No. 2 Dear Viktor Alekseevich, According to the previously signed agreement, in the third quarter of 2014, in order to launch a joint project, you must allocate us 100,000 rubles.

We promise to provide you with timely reports of all current expenses.

By Sergey Mashkov / 1st June, 2020 / Administrative law / No Comments

The note, as a rule, is intended for consideration by the head of the department where the employee is registered, and the decision as to whether to satisfy the employee’s request or not can be made not only by the immediate supervisor, but also by persons in charge of another department.

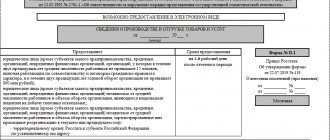

There is no finally approved sample note, so to this day they are guided by the standards adopted in the USSR. They also refer to the All-Russian Classification of Management Activities (OKUD), which is freely available to everyone.

OKUD was approved by state standard decree number 299, which came into force on November 30, 1993. You will find samples of memos for all occasions in this article. Not only a memo written on paper is allowed, but also an electronic form of this document.

Having received information about one of the schools in St. Petersburg, I compiled an example of a request letter to a sponsor with the following content: Dear First Name and Patronymic! Residents of our city are well aware of your activities in the field of charity, including education.

https://youtu.be/SvXAimKpX_I

In this regard, we appeal to you to support the modernization of the computer class of school No. 108 in the Vybrga district of the city.

St. Petersburg. A few words about the school. The educational institution was opened in 1937.

Attention

Currently, the school has 312 students from grades 1 to 11.

Over the past 50 years, the school has graduated 66 medalists, 19 of them with gold medals.

Six students were awarded diplomas from the Ministry of Education and Science of the Russian Federation.

These factors contribute to the high level of admission of school graduates to leading universities in the country.

Five former graduates returned to the school in a new capacity as teachers.

Decision to allocate funds for the purchase of literature: Corporate University / / An amount in the amount of I undertake to provide sales and cash receipts, as well as unspent funds within a period of up to 25 "" 200_g. //

Sales and cash receipts, as well as unspent funds in the amount of Select the mailings to which you want or do not want to be subscribed.

- Important Memo for receiving money on account

- Service memo for receiving money on account

- Sample memo for reimbursement of expenses

- Sample memo regarding compensation

At the same time, the terms within which wages must be paid are regulated by local acts of the enterprise or each specific employment contract.

If money is needed for any needs, an employee can take an advance from his future salary by first contacting the employer in writing with an application. In most cases, management responds adequately to such requests, especially if the employee asks for an advance for a good reason.

An appeal to superiors must be in writing, formatted as a statement and in a free form of presentation. When the application is reviewed by the manager, it may be approved, which will be confirmed by the appropriate visa.

To the Director of LLC "Povarenok"

Petrov P.P.

from baker V.V. Frolov

Statement

I ask you to issue an advance in the amount of 4,500 (four thousand five hundred rubles) towards the salary for September 2020 due to the need to pay the cost of utilities.

09/17/2016 Frolov V.V.

Sample application

First you need to understand what is meant by an advance, because there is no definition of this concept in the legislation:

- If this is the first part of the salary (and it is in this context that the word “advance” is traditionally used), then a shift in the timing of its payment is clearly unacceptable: neither earlier nor later than established by the employer’s local documents, any part of the salary cannot be issued (Article 136 Labor Code of the Russian Federation). And even if there is an employee’s application for early payment of the advance, the employer may be recognized as a violator and fined under Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Read more about what an advance is and how it is paid here.

Source: https://imdbmedia.info/obrazets-zayavleniya-uvelichenie-razmera-avansa/

Does an employer have the right to refuse an advance?

An employer has the right to refuse an advance payment to an employee, but not always. Let's start with the fact that, by law, enterprises and organizations must pay their employees salaries at least twice a month (most often this is the middle and end of the month). If the employer pays wages once a month, then he violates the law, so his refusal to pay an advance automatically becomes illegal - in this case, the employee can safely contact the labor inspectorate to protect his rights.

In situations where the requirement to pay wages in two stages is met, the employer has every right to refuse to pay the advance.

As for advances for work purposes, the employer does not have the right to refuse (although he can change the amount of the advance payment), since if the answer is negative, the implementation of the task will be problematic.

Unscheduled advance

Organizations in their local regulations provide for the possibility of paying an unscheduled advance at the request of an employee. But the operation of issuing an unscheduled advance is not regulated by the norms of the Labor Code of the Russian Federation, due to which its qualification as an employee’s remuneration is ambiguous.

First of all, I would like to remind you that in accordance with Art. 129 of the Labor Code of the Russian Federation, remuneration for work is wages. The Labor Code of the Russian Federation does not define the concept of “advance payment”. However, Art. 136 of the Labor Code of the Russian Federation establishes that wages are paid at least every half month, on the day established by the internal labor regulations of the organization, the collective agreement, and the employment contract. At the same time, the letter of Rostrud dated 09/08/2006 No. 1557-6 states that organizations have the right to independently establish specific calendar dates of the month on which wages are paid in the internal labor regulations, collective agreement, and employment contract. But in accordance with Art. 136 of the Labor Code of the Russian Federation, federal law may establish other terms for payment of wages for certain categories of employees. For example, wages to a dismissed employee are paid within the time limits established by Art. 140 Labor Code of the Russian Federation. In addition, the letter of the Ministry of Labor of Russia dated November 28, 2013 No. 14-2-242 states that the Labor Code of the Russian Federation establishes the requirement that the interval between payments should not exceed half a month, while there is no connection to the calendar month, and the ability to pay all employees is not limited wages more often than the corresponding period.

Let's consider a situation in which an employee, at his request, is paid an unscheduled advance, that is, an advance for unworked time, which is not prohibited by labor legislation (Articles 136, 137 of the Labor Code of the Russian Federation). Most likely, on the date of receipt of such an unscheduled payment, the employee will not have a sufficient amount earned by him for the time actually worked. For example, a newly hired employee applies for extradition. Or suppose that an employee asks for an unscheduled advance on the 5th day of the month (that is, the payment occurs without taking into account the actual time worked).

GOOD TO KNOW

The norms of the Labor Code of the Russian Federation do not limit the possibility of paying employees wages more often than twice a month.

In this situation, regulatory authorities may qualify an unscheduled payment in their own way - not as wages, but as an interest-free loan (Resolution of the Federal Antimonopoly Service of the East Siberian District dated March 27, 2013 No. A58/4544/212).

However, in accordance with Art. 807 of the Civil Code of the Russian Federation, under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of other things received by him of the same kind and quality. In this case, the borrower is obliged to return the received loan amount to the lender on time and in the manner provided for in the loan agreement.

GOOD TO KNOW

The tax authorities may also regard the amount received by the employee as the company’s intention to reward the employee by including the amounts in his taxable income.

Unlike a loan, wages are the employee’s remuneration for work. Therefore, payment of wages in the form of an unscheduled advance (for a period of time that the employee will have to work in the future) does not create a monetary obligation for the employee to the employer. The employee will only have to fulfill his labor duties, paid in advance, and the fulfillment of these duties is established by the employment contract.

From all of the above, we can conclude that the issuance of an advance on wages is carried out within the framework of labor relations regulated by labor legislation, therefore, cannot be recognized as a loan that is provided within the framework of civil law relations. Most importantly, in order to avoid conflicts with regulatory authorities, it is necessary to document the issuance of an advance so that it can be clearly determined that the corresponding amount of money is paid specifically for wages, and not as borrowed funds on a repayable basis. It turns out that in order to reduce the risk, it is necessary to exclude the condition for the return of an unscheduled advance.

IMPORTANT IN WORK

Reclassification of the relationship in question into a relationship under an interest-free loan agreement leads to the emergence of material benefits for the employee due to savings on interest for the use of borrowed funds in accordance with clause 2 of Art. 212 of the Tax Code of the Russian Federation.

The employee must be obligated to return the advance received only if he fails to repay the advance. For example, upon dismissal, that is, upon termination of an employment contract. In this case, the employer has the right to withhold from the employee’s salary the previously issued unearned advance to pay off the debt.

GOOD TO KNOW

An unpaid advance can be withheld no later than one month from the date of expiration of the period established for its return. For example, if an advance was received in February 2020, then the deadline for repayment of the advance is March 31, 2020, and the employer has the right to withhold the specified advance no later than April 30, 2020.

Moreover, the advance can be withheld only on the condition that the employee does not dispute the grounds and amount of deductions. To do this, it is necessary to obtain written consent from the employee, and only after this can an order or instruction (in any form) be issued to deduct from his salary the unearned advance issued on account of wages. A similar position was expressed in the letter of Rostrud dated 08/09/2007 No. 3044-6-0. If the employee does not agree to withhold the unearned advance payment, the organization does not have the right to issue a corresponding order. In this case, the issue of collecting the unpaid advance can only be resolved in court.

The procedure for paying personal income tax on the payment of an unscheduled advance

Let us recall that on the basis of clause 2 of Art. 223 of the Tax Code of the Russian Federation, the date of actual receipt of income of an individual (employee) in the form of wages is recognized as the last day of the month for which he was accrued income for work duties performed. As a general rule, in accordance with paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, the organization as a tax agent must transfer the withheld amount of personal income tax to the budget no later than the day of actual payment of wages. In letter No. 03-04-05/25494 of the Ministry of Finance of Russia dated July 3, 2013, it is explained that the organization transfers personal income tax to the budget from employees’ salaries once a month - with the final calculation of the employee’s income based on the results of each month. That is, until the last day of the month (until the 31st (until the 30th)), personal income tax is not withheld from the salary paid and is not transferred to the budget, even if for a given month part of the salary (advance) was paid during that month. For example, when paying wages for the current month on the 15th of the same month and the 1st of the next month, the entire personal income tax amount is calculated on the 31st (30th) day and transferred to the budget on the 1st. A similar position was expressed in the letter of the Ministry of Finance of Russia dated 08/09/2012 No. 03-04-06/8-232.

Another situation is also possible: wages for the current month are paid in the next month. For example, the first part is on the 10th, and the second part is on the 25th. In this case, personal income tax is calculated on the 31st (30th) day, and is transferred to the budget on each date of distribution of funds to employees, that is, on the 10th and 25th.

As for an unscheduled advance, in order to classify such a payment as income in the form of wages, the date of receipt of which is defined as the last day of the month (clause 2 of Article 223 of the Tax Code of the Russian Federation), the employer needs to make sure that the employee has actually worked the amount paid to him according to the application. Since an advance usually means wages for the first half of the month, in this case the advance is paid for the time actually worked (letter of Rostrud dated 09/08/2006 No. 1557-6). This will happen if an employee applies for an unscheduled advance payment, for example, after the 15th day of the month, that is, the advance payment on the application is paid taking into account the time actually worked, or the amount of the advance corresponds to the amount due for the time actually worked.

If an unscheduled advance is issued to an employee, for example, on the 3rd day of the month, then such payment is an advance for a period not yet worked in the current month.

Please note: payment of an unscheduled advance does not cancel the payment of wages on time at least every half month. Therefore, if the amount of the advance is equal to the amount of wages and there is nothing more to pay the employee, it must be returned to the employer. Considering the employee’s lack of economic benefit, personal income tax is not charged on it either when issuing an advance or when returning it. Let us remind you that Art. 41 of the Tax Code of the Russian Federation establishes that income is recognized as economic benefit in monetary or in-kind form, taken into account if it is possible to evaluate it and to the extent that such benefit can be assessed, and determined in accordance with Chapter. 23, 25 Tax Code of the Russian Federation.

Therefore, wages accrued at the end of the month will be paid and personal income tax will be transferred to the budget in the generally established manner (for example, on the 10th and 25th of the next month).

If an unscheduled advance is issued on the 30th (31st) day and its amount does not exceed the amount of monthly wages, then such payment will be wages for time already worked in the current month. Consequently, the provisions on the date of actual receipt of income in the form of wages as the last day of the month are applicable to it (clause 2 of Article 223 of the Tax Code of the Russian Federation). In this case, personal income tax on the specified amount will be subject to transfer no later than the day the salary is transferred to the employee’s account (30 (31) day of the month) or no later than the day of actual receipt of cash from the bank for payment of wages from the cash register (for example, 25 the 1st day of the next month).

If the unscheduled advance exceeds the amount earned, then when determining the date of receipt of income in the form of an unscheduled payment, the amount of which is calculated without taking into account the time actually worked by the employee, it is necessary to be guided by the provisions of Art. 223 Tax Code of the Russian Federation. Accordingly, personal income tax from the excess amount of the organization should be transferred to the budget no later than the day the unscheduled advance is transferred to the employee’s bank account or no later than the day following the day the employee receives it from the cash desk (Article 226 of the Tax Code of the Russian Federation).

Rules for writing and completing an application for an advance

Today, there is no mandatory, unified sample of this statement, so employees can write it in any form or according to a template developed and approved within the enterprise. Regardless of which option is chosen, the document must meet certain requirements. It must indicate the addressee :

- Company name,

- job title

- and full name of the manager,

as well as similar information about the applicant : his position and full name. In addition, the document itself must include the request for an advance , indicating its reasons.

The main text should be consistent and sufficiently succinct - usually the main idea fits into one - a maximum of three sentences.

If there are any circumstances in connection with which the employee wants to receive an advance and which he can document, this must also be reflected in this document in the form of a clause on attachments.

Finally, the application must be signed by the applicant (with a transcript of the signature) and dated on the day of submission.

The application is drawn up in two copies :

- one of which is endorsed by the secretary and subsequently remains in the hands of the employee,

- and the second is transferred to the organization.

After its consideration, depending on the decision made by the manager, a resolution is written on the application. If it is positive, based on this document, the accounting department calculates and issues the required amount. In any case, after the application loses its relevance, it is transferred for storage to the archive of the enterprise.

Is it necessary to submit an application for an advance payment ahead of time?

The need to receive an advance earlier than the planned date or in an increased amount can be caused by various reasons. It is important that they are truly significant:

- Wedding.

- Funeral.

- Birth of a child.

- A disease that requires expensive treatment, etc.

But even under difficult circumstances, issuing an extraordinary advance is not the employer’s responsibility, but only a personal expression of will. The employee must be prepared to provide documentary evidence that his reasons actually exist. For example, doctor’s prescriptions for medications and the price list for them.

If an advance is required ahead of schedule and/or in a larger volume, a written application for receipt is required. The law does not establish a time frame for its consideration. Usually the resolution is given within the day of filing. But not necessarily. It may take three days for the review.

Depending on the structure of the enterprise, you must submit an application to the accounting department or directly to the head of the department or the entire company. No matter who the document is submitted to, the addressee must indicate the head of the enterprise.

In some companies, the procedure for submitting applications is strictly regulated. For example, it requires contacting a special department and registering a document. In this case, you need to stick to it.

If the employer agrees to the payment, the payments planned by local standards must also be made.

For example, salaries at an enterprise are paid on the 15th and 30th. The employee asked for an advance on the 5th. If the decision is positive, the money should be provided to him on the 5th, 15th and 30th. Just not in the volumes that were originally planned.

If the deadlines established by the standards are not met, if this violation is discovered, the employer will be punished under Art. 5.27 Code of Administrative Offenses of the Russian Federation:

- The official will be fined from 1 thousand to 5 thousand rubles.

- Individual entrepreneurs will be charged an amount of 1 thousand to 5 thousand rubles as a fine.

- If a legal entity is recognized as the violator, the fine will range from 30 thousand to 50 thousand rubles.

When it turns out that a similar offense has already been committed previously and entailed an administrative penalty, the punishment will be harsher:

- The official will have to pay from 10 thousand to 20 thousand rubles as a fine. Plus, the violator can be disqualified for up to three years.

- Individual entrepreneurs will be fined in the amount of 10 to 20 thousand rubles.

- The organization will be fined from 50 thousand to 70 thousand rubles.

If the advance is paid but the work is not completed or the service is not provided

Situations where the employer paid an advance, but the subordinate did not complete his tasks, are not common, but still happen. In such a development of events, the employee is obliged to return the unused funds to the company’s cash desk. And this can be done in different ways:

- the employee can independently make a refund in cash or by bank transfer,

- the employer may withhold the amount paid from his salary until the debt is fully repaid.

In the second case, it is necessary to notify the employee in advance that part of the salary will be withheld to repay the advance.

If the employee quits and refuses to return the money, the former employer has the right to apply to the court to have the amount issued recognized as unjust enrichment.

FROM THE EDITOR

As an example, let us cite the resolution of the Fourth Arbitration Court of Appeal dated December 27, 2012 No. 04AP-5683/12. According to the society, its will and the will of the employees was aimed precisely at issuing an advance on wages, and not at issuing an interest-free loan. The company believed that, unlike a loan, wages (employee remuneration) is the employee’s remuneration for work (Article 129 of the Labor Code of the Russian Federation). Therefore, payment of wages in the form of a 100 percent (or more) advance (for the period of time that the employee will have to work in the future) does not create a monetary obligation for the employee to the employer. The employee will only have to fulfill his labor duties, paid in advance. Moreover, the fulfillment of these duties is established by the employment contract. Consequently, since the issuance of an advance on wages is carried out within the framework of labor relations regulated by labor legislation, it cannot be recognized as a loan. However, the court rejected these arguments, believing that the will was aimed at issuing a loan, based on the terms of the agreements concluded between the employee and the employer, namely, in all agreements there was a clause with the following content: “The employee has the right to return the amount specified in clause 1 of this agreement , before the return period established by this agreement." This condition, according to the judges, indicated that it was civil relations, and not labor relations, that developed between employees and society, since the issuance of an advance on wages does not imply the return of a sum of money to the employer by the employee from income received from other sources. The presence of this condition in the agreements indicated that the parties to the agreement had the will to create loan obligations. By Resolution of the Federal Antimonopoly Service of the East Siberian District dated March 27, 2013 No. F02-973/13, this conclusion was confirmed; the judges concluded that the company, as a tax agent that has entered into interest-free loan agreements with its employees, has an obligation to calculate, withhold and transfer personal income tax to the budget from material benefits received by employees from savings on interest for the use of borrowed (credit) funds.

- Back

- Forward

Results

Giving an employee a salary in advance - before he has earned it - is always a risk.

The letters from officials on this issue do not reveal a single position, however, the latest clarifications from the Ministry of Labor allow that the employer can meet the employee halfway. To do this, it is necessary to obtain a corresponding application from the employee, and also to establish the procedure for paying such funds in local regulations. The application is drawn up in free form, indicating the required amount and the reasons why it was urgently needed. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Main aspects

Salary is usually divided into two payments - an advance and the salary itself.

Sometimes an employee needs additional funds to solve his financial problems and the employer can provide him with the necessary assistance within reasonable limits.

But this is his right, not his obligation.

A request for an enhanced or extraordinary advance must be submitted in writing.

Only based on the results of consideration of the relevant application, the organization’s management can resolve this issue.

Important! It is necessary to distinguish the issuance of an advance for travel and other expenses associated with the execution of the employer’s instructions from an advance paid on wages.

Labor legislation

Labor legislation specifies that each employee must receive monetary remuneration for his work.

The Labor Code of the Russian Federation establishes the obligation of the employer to pay wages in at least two payments.

About half of the amount is usually an advance, and the rest is already the salary itself.

The amount of wages and the specific procedure for paying them to an employee are established in an individual or collective labor contract.

You should know that while establishing the obligation of an organization to make wage payments at least 2 times a month, the Labor Code of the Russian Federation does not limit it to more frequent issuance of funds.

Some companies resort to using “Western” payment technology and make them every week. But this is rather an exception to the rule.

Specific dates for the payment of advance payments and wages are fixed in the employment or collective agreement.

Important! If there are delays in the payment of wages or advance payments and it is impossible to resolve the situation with a violation of the contract through negotiations, you should not delay going to court.

You can file a claim for recovery of an advance or salary only within 1 year from the date on which the established amount must be paid to the employee.

What are the reasons for receiving

Various force majeure situations may occur in life and an employee may urgently need additional funds or simply find it necessary to receive an advance ahead of schedule.

In this case, the employer can meet halfway provided there is a written application from the employee.

Let's consider the reasons that may become the basis for receiving an advance ahead of the deadline established in the contract or in a larger amount:

| Serious health condition | the employee himself or his family members |

| Birth of a child | from an employee |

| Unexpected expenses | for example, for carrying out urgent repairs in an apartment, purchasing essential goods, etc. |

| Business trip | — |

Despite the fact that the head of the employing organization makes a decision at his own discretion and is not obliged in this situation to satisfy the employee’s request, there are practically no refusals on these requests.

Often it is much more profitable for company management to retain the loyalty of a permanent employee.

Comment. You should not abuse the opportunity to receive an advance ahead of schedule or in a larger amount than established by the contract.

Such actions are permissible only in the presence of truly compelling circumstances. You cannot abuse the trust of a leader.

Otherwise, the request will be denied even when the money is really needed very urgently.

Video: salary payment procedure

Employer's liability in case of non-payment of advance payment

For late payment of advance wages, as well as for refusal to pay wages to employees in two installments, the employer may be held liable in the form of a fine. At the same time, the amounts of this punishment are established in the table below.

| Intruder | Amount of fine for a single violation | Amount of fine for repeated violation |

| Official (manager, payroll accountant) | From 10 to 20 thousand rubles | From 20 to 30 thousand rubles |

| Entity | From 30 to 50 thousand rubles | From 50 to 100 thousand rubles |

Obviously, if the violation is repeated, the punishment becomes more severe. However, these are still not all measures of liability for non-payment of advance wages. An official may be disqualified for a period of one to three years, as a result of which he will have to leave his position.

How to calculate the amount of a fixed advance

The fixed amount for the advance can be set:

- in total terms;

- in the amount of a certain percentage of the salary.

By paying an advance in a fixed amount, for example 10,000 rubles, the employer is at great risk. The risk is due to the fact that the employer is obliged to pay an advance in a constant amount, regardless of whether the employee was working or was, for example, on sick leave. Also, at the end of the month, the amount of the entire salary may be less than the advance paid. Therefore, employers rarely choose the first option for paying an advance.

The most common option is to determine the amount of the advance as a percentage of the salary. Since the Ministry of Health and Social Development indicates that the amount of the advance and salary should be approximately equal (letter dated February 25, 2009 No. 22-2-709), employers, as a rule, set the advance at 40–50% of the salary. But if the amount of the advance is set at ½ of the amount of earnings, then salaries for the first and second halves of the month will be very different. Let's look at an example.

Example 2

The employee's salary is set at 40,000 rubles. The personal income tax amount will be 5,200 rubles. (40,000 × 13%)

| Advance amount | Prepaid expense | Salary |

| 40% | 16 000 (40 000 × 40%) | 18 800 (40 000 – 5 200 – 16 000) |

| 50% | 20 000 (40 000 × 50%) | 14 800 (40 000 – 5 200 – 20 000) |

As can be seen from the example, the amount of monthly salary when paying an advance of 50% is significantly less than the amount of the advance itself.

The employer decides independently how to pay the advance in 2019-2020. We recommend setting the advance at 40-45% of the amount of earnings with a correlation to the time actually worked: by the date of payment of the advance, the accountant is provided with time sheets of the time worked by employees, and the salary amount for the 1st half of the month is adjusted to the number of days worked.

Let's consider the procedure for calculating such an advance using the example of manager L. E. Artemov.

Example 3

The employee's salary is 25,000 rubles. We will calculate the advance based on 40% of the salary and the correlation for the actual time worked.

The planned amount of the advance is 10,000 rubles. (25,000 × 40%).

But since the employee worked 7 days instead of 10, the amount of advance payment to be issued will be 7,000 rubles. (10,000 ÷ 10 × 7).

Is it possible to issue an advance before the due date?

Payment of an advance within the time limits strictly specified by local regulations of the employer is not always possible, since sometimes the dates for issuing an advance or salary fall on weekends or non-working days. And then the employer is obliged to pay wages the day before. For example, an organization has a salary payment date set for the 7th day of each month, and 09/07/2019 falls on a Saturday. How is the advance paid in this case? The employer is obliged to pay employees on Friday, 09/06/2019.

A situation is possible when the employer, of his own free will, decides to pay the advance in advance on a date not established for this event. The Labor Code does not contain restrictions on early payment of an advance or salary. But when checking, the labor inspectorate may consider this method a violation, since formally the period until the next salary payment will be more than half a month. Therefore, when issuing an advance, it is better to adhere to the established deadlines. Or, then issue the next part earlier in order to meet the 15 days (letter of the Ministry of Labor dated January 25, 2019 No. 14-1/OOG-461).

We wrote more about the position of officials on this issue here.

Is it possible to pay an advance ahead of schedule at the request of an employee? As noted above, the Labor Code does not contain a direct prohibition. But the answer to this question depends on the amount of the advance requested by the employee.

If an employee with a salary of 30,000 rubles. asks to give him 100,000 rubles. against future salaries, then, firstly, the employer bears high risks, because the employee may quit without paying the full amount. Secondly, the labor inspectorate can fine you for violating the requirement to pay wages every six months. And a dispute will most likely arise with the tax authorities about the timing and procedure for paying personal income tax.

When issuing an advance, as we have already found out, personal income tax is not withheld. And if at the end of the month there is no salary to be paid, then there will be nothing to withhold personal income tax from. Also, tax authorities may regard the advance payment as an interest-free loan and charge the employee personal income tax at a rate of 35% of the savings on interest. And organizations will be fined for failure to fulfill the duty of a tax agent.

How to correctly reflect early salary in 6-NDFL, read here.

Is it possible to “accelerate” the issuance of a salary advance by applying?

First you need to understand what is meant by an advance, because there is no definition of this concept in the legislation:

- If this is the first part of the salary (and it is in this context that the word “advance” is traditionally used), then a shift in the timing of its payment is clearly unacceptable: neither earlier nor later than established by the employer’s local documents, any part of the salary cannot be issued (Article 136 Labor Code of the Russian Federation). And even if there is an employee’s application for early payment of the advance, the employer may be recognized as a violator and fined under Art. Code of Administrative Offenses of the Russian Federation.

Read more about what an advance is and how it is paid here.

- The word “advance” is also used in another meaning - as payment of salary (or part of it) ahead of schedule on account of future earnings. The lack of money is familiar to many: for example, an employee has to spend money on a wedding or renovation, and he asks for a salary in advance - several weeks or even months in advance. According to the Ministry of Labor, the employer can satisfy this request, but he must prescribe the procedure for making such payments in his internal regulations (letter of the Ministry of Labor of the Russian Federation dated No. 14-1/OOG-3602).

IMPORTANT! Whatever the context in which the word “advance” is used, failure to meet the deadline for its issuance is fraught with risk. Despite the fact that today the Ministry of Labor formally authorized the issuance of money at the request of an employee against future earnings, there are also completely opposite explanations. For example, a letter from Rostrud of the Russian Federation dated No. PG/4067-6-1, in which the agency indicated that establishing deadlines for payment of wages not provided for by the Labor Code of the Russian Federation is not allowed, even if there is an application from the employee.

What to do when traveling on a business trip?

How to write an application for advance payment if you are sent on a business trip? Indeed, in this case, you need additional finances not for your own needs, but for the full implementation of the business trip assignment.

Advance payment

There are additional nuances when compiling:

Still have questions? Find out how to solve exactly your problem - call right now:

+7 (Moscow)

+7 (St. Petersburg)

8 For all regions!

It's fast and free!

- The header of the document is designed in the same way as in the previous case. Information is written in the upper right corner of the document.

- Clearly describe the task: where you are going on instructions from your superiors and for what purpose. If there is a relevant document, attach it or a copy to your application. The body of the application must indicate the reasons; they must be written out from the order that was drawn up in connection with the business trip.

- Calculate roughly all the expenses you will need to pay. Include travel, accommodation, meals and so on. All these calculations must be included in the application so that management can understand the validity of the declared amount.

The management does not refuse an application for an increased advance payment in connection with a business trip, since you are asking for money not to solve your own problems, but to complete the company’s assignment. In the life of everyone, even the most responsible employee, different situations may arise in which money is needed urgently and in larger quantities than is usually paid. In order to receive them correctly, draw up an application that must be submitted to management.

If possible, further explain the reason for such a statement in a personal conversation. This will increase your chances of getting your application approved. Most often, the manager satisfies such requests if the situation is truly significant. But, you shouldn’t abuse your superiors’ favor and ask for money often. Do this only in situations where it is really necessary and there is simply no other way out.

On payment of an advance in a fixed amount.

The issue of calculating a fixed amount for paying wages by the advance method to an employee of a public sector organization was considered by the Ministry of Finance in Letter No. 02-07-05/17670 dated March 29, 2016. Department officials indicated that such an issue is within the competence of the Ministry of Labor, and not the Ministry of Finance. At the same time, financiers recalled that, according to Art. 91 of the Labor Code of the Russian Federation, wages are calculated for the actual time worked, determined within the framework of accounting organized by the employer. At the same time, the procedure for paying wages (terms, amount and components), established by local acts of the institution, should not contradict the provisions of the Labor Code of the Russian Federation. As for the accounting of actually worked time, Order of the Ministry of Finance of the Russian Federation No. 52n approved the form of a timesheet for recording the use of working time, on the basis of which a fixed amount is calculated for the time actually worked for the first half of the month (including adjustment of the fixed amount), and methodological recommendations for its formation.

Taking into account these clarifications from the Ministry of Finance, the above position of the Ministry of Labor, as well as the risks associated with paying an advance in a fixed amount, we consider this method of paying salaries for the first half of the month unacceptable for public sector institutions.

In what cases is an advance required?

An employee may need an advance in case of urgent need, in situations that involve urgent or large expenses. This could be a wedding or the birth of a child, an employee’s illness, the need to pay off a loan, a major purchase, etc.

IMPORTANT! A separate reason for an employee to receive an advance is a business trip, which involves spending on housing and transportation. In this case, you can receive funds on account: actual expenses must be documented, the excess must be returned to the cash desk, and the deficiency must be reimbursed to the employee.