For the effective operation of an enterprise, it is important to control the level of income and expenses. This is possible when calculating capital investments made to develop the production cycle.

Expenses for the purchase of equipment are paramount. They form the basis of production means.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

When making calculations, the capital intensity ratio must be taken into account. It is necessary to assess the rational use of funds that are basic in the production cycle.

The essence of the concept

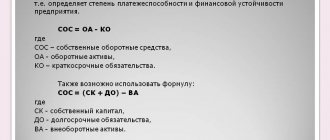

Capital intensity is a value that is calculated based on the cost of production assets when converting them into the ruble equivalent of finished products. The capital intensity ratio can be calculated using a special formula. The cost of fixed assets (Co) must be divided by the volume of products produced during the activity (P).

The value changes when the company's process optimization decreases or increases. The more efficiently equipment and fixed assets are used, the greater the amount of output that can be obtained. Then the capital intensity indicator may decrease.

As the ratio increases, the cost of goods decreases. As a result, the enterprise receives greater profits and economic efficiency of the production process. At the same time, the funds invested in production will be repaid in full.

To calculate capital intensity, the basic formula given above is used. But it has some disadvantages. Among them is the lack of accounting for the depreciation of production assets, which leads to the constancy of their prices. Also, when calculating, all manufactured products are taken into account. However, some part cannot be sold.

According to this formula, it is possible to evaluate the production and technological process, reflecting its dynamics. To assess the production efficiency and payback of goods, you need to use another formula: Fe = ½(Co1+Co2)/Pr. In it, the value of Co1 is taken to be the cost of means of production at the beginning of the billing period, and Co2 - at the end date. Etc. is a value reflecting the quantity of goods sold.

Data for the calculation can be taken from the balance sheet for a specific period and documents reflecting production, price and sales of products. It is also important to calculate the restoration amount. It will be needed to increase production output. In this case, you need to focus on the formula Fe = Ss.g./Pg.

In it under Ss.g. refers to the cost of means of production obtained on the basis of average annual calculations. Pg reflects the quantity of products that should be produced within 12 months according to the plan. Each indicator is prescribed in the business plan of the enterprise.

When determining the cost of equipment involved in the technological process, the full value is taken. Depreciation funds on the balance sheet are not taken into account.

Industry factor

The capital productivity/capital intensity of products of one economic, industrial or transport sector differ significantly from the values determined for another. In this regard, when analyzing dynamics by industry, region, or country, the corresponding changes in the structure of goods and assets are taken into account. The dynamics are influenced by:

- Volume of production of products in physical terms and their price.

- Structure and composition of the OS (specific gravity, age characteristics of the active part).

- Price, productivity and other characteristics of equipment and machines, their degree of wear.

- Proportion of unused assets, load level, capacity and area operating factors.

https://youtu.be/l3Pyy1mYEHs

Dependence on industries

The capital intensity ratio is required to optimize production processes and evaluate the efficiency of the enterprise. Normative meaning also helps to analyze all industries as a whole. According to such data, the ratio of production assets to gross product is calculated.

Among the types of capital intensity, direct and full are distinguished. When calculating the direct indicator, the degree to which results are obtained by the funds that were involved in the production process when creating products is assessed.

If it is necessary to estimate the total capital intensity, then those funds that were used indirectly in the creation of products are also taken into account. Capital ratio is an important indicator. But it is still considered auxiliary, since paramount importance is given to capital productivity.

Comprehensive analysis

To implement it, it is necessary to consider the company’s activities from different angles. That is why in economic analysis, capital productivity and capital intensity are taken into account primarily. The formulas given above are used to assess the efficiency of asset turnover and the amount of resources that need to be spent on their acquisition. Based on the results of the analysis, a set of measures is being developed aimed at increasing the profitability of asset turnover. Among them, in particular, may be provided:

- Increasing the share of equipment.

- Replacement of outdated models with new ones.

- Increasing production efficiency by increasing productivity, eliminating auxiliary unnecessary fixed assets.

- Selling a piece of equipment that is not used or is used extremely rarely.

- Transition to the production of products with higher added value.

- Increasing the number of shifts, eliminating downtime. This will lead to an increase in the coefficient of computer time use.

Formulas of the main components

When using fixed assets, three important indicators are determined:

- recoil;

- capacity;

- armament.

Capital intensity is based on the number of production assets used to produce products. The size is determined in relation to one ruble of the cost of the product.

Capital productivity shows the amount of output obtained from each ruble invested in fixed assets. On its basis, economic efficiency is determined.

Capital intensity and capital productivity are reciprocal quantities. With efficient and improved use of production means, increased output and reduced capacity are produced.

To calculate capital productivity, the allocation of working machines and equipment that make up the active part of the funds is made. To compare the growth rate and the implementation of the plan, it is necessary to take into account the value of the basics of industrial production per 1 ruble and the cost of equipment for the same amount.

The second indicator is ahead of the first if there is an increase in the share of the active part of fixed assets.

Recoil

Capital productivity shows the use of the enterprise's fixed capital in economic and industry assessment. To calculate it, it is important to know the amount of output and the cost of production assets.

The capital productivity indicator determines the volume of production per unit of fixed assets. Based on this indicator, production efficiency is determined. The expression of quantity can be in kind or in money. The calculation is made in general for all funds, as well as for part.

The value is determined at various economic levels:

| If we take the enterprise level | The calculation is made based on the volume of products produced per year. |

| When determining the industry level | Gross value added or gross output is taken into account. |

| In the case of national scale calculations | GDP is taken as the basis. |

The coefficient can be calculated using the formula Fo = Vp/Sof, where:

| Fo | Capital productivity. |

| VP | Output. |

| Soph | Cost of fixed assets. |

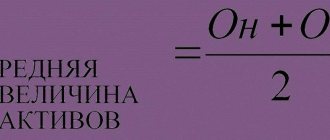

Fixed assets are calculated from the ratio of the average annual cost of capital. But in some cases it is important to take the cost of these funds for the initial and final billing period. Then the funds are added up and divided by 2.

Accounting for loans and borrowings is regulated by PBU 15/2008 “Accounting for expenses on loans and credits”. The methodology for analyzing financial solvency ratios can be found here.

Armament

Capital-labor ratio is an indicator that reflects the efficiency of using a company's production assets. It shows that employees have the means to carry out production.

Among them are:

- tools;

- machines;

- equipment;

- transport;

- building;

- buildings, etc.

The balance sheet must be used for the calculation.

The ruble coefficient can be calculated using the formula Kfond.v. = Sos (average annual) / Chp (average list), where Sos is the cost of fixed assets, and Chp is the number of personnel.

Changes in the capital-labor ratio are observed when personnel leave or equipment breaks down. Then the residual value of the funds is taken.

The value of the capital productivity indicator

The standard value of capital productivity is established for each industry, i.e. there is no standard. Thus, for industries with a large number of machinery and equipment, the coefficient will be lower than in less capital-intensive industries.

It is recommended to analyze this indicator over a number of years. An increase in the value of the capital productivity indicator over time will indicate an increase in the efficiency of using equipment and mechanisms.

To increase capital productivity, it is necessary either to increase production through more efficient use of equipment, or to sell/liquidate those assets that are little or inefficiently used. Increasing the efficiency of using existing equipment is achieved through:

- replacing equipment with more modern and high-performance ones;

- increasing the number of shifts;

- improving the professional training of equipment maintenance personnel.

How to calculate the capital ratio

To analyze the efficiency of using funds and the company's activities, certain values can be calculated. The main one is capital intensity. To carry out the calculation, it is necessary to know the balance sheet of the enterprise’s accounting department, taken for a specific period of time. A report showing profits and losses during the period under study is also important.

To calculate, you need to follow a certain sequence:

- You need to determine the cost of fixed assets that have an average annual expression. To do this, you need to add up the cost at the beginning and end of the period, recorded in line 120 of the balance sheet. The result obtained is divided by 2. When planning capital intensity, data from the business plan and program are used.

- Next, the cost of products that were produced over 12 months is calculated. You need to focus on the annual profit and loss report of the enterprise. When planning, you need to refer to the business plan or program.

- Capital intensity is calculated using the formula Fe=Co/B, where the first value is the average annual cost of fixed assets, and B is the cost of products produced over 12 months. The resulting value will be the capital intensity of the enterprise.

- If you need to calculate the capital intensity according to the plan, you need to refer to the business plan. You can also use planned and actual indicators for the past period. An analysis is made based on the data.

Improving OS efficiency

Today, enterprises pay quite a lot of attention to the issue of selling goods. In a fairly fierce competition, pricing occupies a key position in the process of generating demand. But constantly restraining prices and providing discounts to customers is extremely unprofitable. This could lead to a crisis because the income generated will not cover expenses. As a result, the company will become insolvent. A way out of the situation may be to reduce costs. According to many experts and managers of industrial enterprises, it is possible to reduce costs by reducing semi-fixed costs and constantly increasing output volume. The last task, as a rule, is solved by attracting new equipment (by leasing or credit) and only to a small extent by identifying and using internal reserves.

Undoubtedly, the attraction of new equipment will help increase output. But the expected economic effect will be received by those companies that increase their capacity to meet the increased demand for goods. It would be advisable for other enterprises to search for internal reserves and develop a program for their rational use.

Balance overview

The calculation is made on the basis of reporting data on financial indicators and the balance sheet. Income is reflected in the first document, and fixed capital in the second.

The capital intensity will be equal to COR = page 1150 BB (the value of fixed assets by BB)/page. 2110 OFR (reported income).

When calculating the capital intensity of products, you can rely on another formula: COR = page 1150 BB/page. 2200 OFR, where the last value is the company’s profit when selling products based on the financial result.

https://youtu.be/OKKqLkJk52c

Important point

Many managers do not clearly understand the need to determine return on capital. However, in practice, its value helps to make various management decisions. For example, knowing the capital productivity indicator, an entrepreneur purchases this or that equipment. If the subsequent profit is higher than the acquisition costs, then the investment can be considered effective. In this regard, we can say that the value of capital productivity serves as a means of insurance and planning for any enterprise.