In what cases is count 67 applied?

The account “Settlements for long-term loans and borrowings” is maintained by the organization receiving the credit (loan). In some cases, an enterprise needs to make expensive acquisitions, for example, equipment, but there is no free working capital at the moment. In such cases, it makes sense to take a long-term loan - that is, with a repayment period exceeding one tax period.

The account reflects information about counterparties (creditors) and loan agreements.

After the loan repayment period is reduced to 365 days, it can be transferred from 67 to 66 account “Short-term loans and borrowings”, or left on account 67. The chosen accounting method is fixed in the accounting policy of the organization.

Typical correspondence

Transferring a liability to a short-term liability

| Dt | CT | Operation description | Sum | Document |

| 67 | 66 | The amount was transferred to short-term | 680000 | Accounting information |

https://youtu.be/Bt_DGAWAkqY

Typical postings for account 67

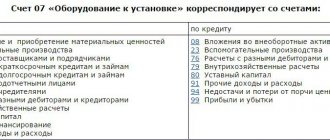

Correspondence 67 accounts and main entries for long-term loans and borrowings are presented in the table below:

| Dt | CT | Wiring Description |

| 50,51,52,55 | 67 | Receipt of long-term loans and credits Repayment – reverse postings |

| 07,10,11,41 | 67 | Received a commodity loan with material resources from an agricultural organization |

| 66 | 67 | Re-issuance of loans |

| 67 | 51,52,55 | Crediting a loan or borrowed funds to a bank account |

| 60 | 67 | Payment to the supplier/contractor through long-term loans or borrowings |

| 68 | 67 | The budget debt was paid through long-term loans |

| 76 | 67 | Paid debt to other creditors through credits or loans |

| 91 | 67 | Interest accrued on loans or credits received |

| 91 | 67 | Positive exchange rate differences in foreign currency are taken into account. Negative - reverse wiring. |

Getting a loan

Example

The organization Quadrum LLC received a loan from the bank in the amount of 1,578,000 rubles for a period of 3 years. Principal and interest are paid monthly in equal amounts.

Postings

| Dt | CT | Operation description | Sum | Document |

| 67 | Credit transferred to the organization's account | 1578000 | Bank statement | |

| 91.2 | 67 | Monthly interest accrued (payable) | 15122,50 | Accounting information |

| 67 | Monthly debt payment | 43833,33 | Payment order | |

| 67 | Monthly interest on loan | 15122,50 | Payment order |

General characteristics of accounting account 67

According to the Chart of Accounts for accounting financial and economic activities and the Instructions for its application (approved by order of the Ministry of Finance dated October 31, 2000 No. 94n), account 67 in accounting is an account for reflecting generalized information on the status of settlements on loans and borrowings taken out by an organization for a long period of time . That is, from 1 year.

The amounts of long-term loans and borrowings received are reflected in the credit of account 67 and the debit of accounts:

- 51 “Current accounts”;

- 52 “Currency accounts”;

- 55 “Special bank accounts”;

- 60 “Settlements with suppliers and contractors”, etc.

Also see “Short-term loans and borrowings: line item on the balance sheet.”

Obtaining a loan by issuing bonds

The bond determines the right of its owner to receive from the issuer (the one who issued this security) its nominal value within a specified period, as well as, in some cases, a fixed percentage of the nominal value or other property rights.

Expenses for the issue (issue) of bonds are included by the organization in non-operating expenses.

Bonds can be placed at par value, above par value or below par value. In the first case, accounting is carried out only on account 67, in the second case, the difference is taken into account on account 98 “Deferred income”. In the second case, the difference is reflected by entries Dt 91.2 - Kt 67 evenly over the write-off period.

Example of placement above par

Mercury LLC placed a bond on the secondary market worth 15,000 rubles, with a par value of 10,000 rubles. The repayment period is 24 months.

Postings

| Dt | CT | Operation description | Sum | Document |

| 67 | The amount of the bond's par value is reflected | 10000 | Bank statement | |

| 98 | DS received above the nominal value are reflected | 5000 | Bank statement | |

| 98 | 91.1 | Monthly: 5000/24 | 208,33 | Accounting information |

Below par placement example

Saturn LLC placed bonds at a price of 8,000 rubles with a par value of 10,000 rubles. The repayment period is 18 months.

Postings

| Dt | CT | Operation description | Sum | Document |

| 67 | Reflects the amount of funds received from the placement of bonds | 8000 | Bank statement | |

| 91.2 | 67 | Monthly: 2000/18 - price deviation from nominal | 111, | Accounting information |

Work 67 positions in accounting

Any company at some point comes to the point that it needs additional resources when it comes to the need, for example, to update production equipment or implement some large project. Then long-term loans and borrowings from national or international financial and credit institutions are attracted.

Before we talk about accounting records, it should be said that according to current regulatory documents, there are two ways to legitimately formalize transactions for borrowed resources received. In this case, we can talk about a credit agreement or a loan agreement. Such a transaction involves a lender and a borrower. In accordance with the terms of the concluded transaction, the lender or creditor transfers to the borrower a certain amount of financial resources for an agreed period. After the specified period is completed, the borrower must return the received resources and pay interest on their use.

Companies can also obtain a long-term loan by placing bonds. In this situation, subaccount 67.6 is used. These bonds can be sold at a price either less or more than their face value.

If securities are sold at a discount, then during the entire period of their placement the accounting department writes off losses from other income. In this situation, the company's interest paid on the bonds is recorded in a separate sub-account. These amounts are part of the operating expenses incurred.

If we talk about account 67, then it summarizes data on long-term loans and credits attracted by the company. Borrowed funds received and interest accrued on them are reflected on the credit side of the designated position. The debit part shows the repaid obligations. Thus, the nature of this position is passive.

Analytics on it is carried out by types of funds raised and creditors.

What is a bank account?

The bank opens a credit account for its client (both citizen and legal entity) in order to ensure the technical ability to both issue a loan and receive back the borrowed funds from the client. The latter, as they return, will deposit them into such a separate account.

The purpose of a credit account in a bank is to reflect in the balance sheet of the bank itself transactions aimed at the formation and repayment of loan debt in accordance with the provisions of loan agreements (see question 1 from the information letter of the Central Bank of the Russian Federation dated August 29, 2003 No. 4).

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Another common name for such an account is a loan account.

Taking into account the form of issuing a loan and the method of managing the account, the following types of credit bank accounts can be distinguished:

- Simple. The amount issued as a one-time loan is placed on it, and funds are deposited into it to repay this loan.

- Line of credit - a loan to a bank account is transferred in installments within the established limit as needed.

- Overdraft. A special cash reserve is linked to the client’s account (current or settlement), which the client can use in situations where there are not enough own funds to carry out a transaction on the account.

Accounting for short-term and long-term loans and borrowings (account 66 and 67)

The accounting (discount) operation of bills and other debt obligations is closed on the basis of a notification from the credit institution about payment by reflecting the amount of the bill in the debit of account 66 “Settlements on short-term loans and borrowings” and the credit of the corresponding accounts receivable. When an organization that is a bill holder returns funds received from a credit institution as a result of discounting (discounting) bills or other debt obligations, due to the failure of the drawer or other payer of the bill to fulfill their payment obligations on time, an entry is made in the debit of account 66 “Settlements for short-term loans and borrowings" in correspondence with cash accounts.

Financial results

Subaccounts 90 and 91 accounts

It's time to once again deepen our knowledge of booze. accounts. Nothing global, just keep in mind that accounting accounts can be detailed more deeply. For this purpose, lower level accounts, so-called sub-accounts, are opened. It looks like this:

Account 90 – Sales, includes:

Subaccount 90.01 – Revenue

Subaccount 90.02 – Cost of sales

Subaccount 90.09 - Profit / loss from sales

Accordingly, when selling, we do not make a generalized entry D 62 - K 90, but immediately use subaccounts that are suitable for the situation:

D 62 “Settlements with buyers and customers” – K 90.01 “Revenue”

We write off the cost price not D 90 - K 41, but assign it to the subaccount allocated for this matter:

D 90.02 “Cost of sales” - K 41

In fact, 62 and 41 accounts also have their own sub-accounts, which may differ slightly from one accounting program to another. The mandatory Chart of Accounts is advisory in nature in relation to subaccounts and the company must approve them in its accounting policies. Let’s not delve into this topic for now; all this is actually not that critical. Understanding the essence of reflecting a particular operation, it will not be difficult to understand the details.

By the end of the month, on account 90 we will have something like this:

That is, the credit of subaccount 90.01 will collect revenue, the debit of subaccount 90.02 will collect cost, and so on. We compare the turnover for the entire account as a whole and make a posting to subaccount 90.09 to equalize the total turnover:

D 90.09 “Profit / loss from sales” - K 99 “Profits and losses”, if revenue is greater than expenses.

D 99 “Profits and losses” - K 90.09 “Profit / loss from sales”, if expenses are greater than income.

Thus, we determine the financial result at the end of each month.

The same thing with 91 accounts, which record income and expenses not related to the main activities of the company. Usually these are bank commissions, interest on loans issued, rent, if these types of activities are not basic for the company.

Subaccount 91.01 – Other income

Subaccount 91.02 – Other expenses

Subaccount 91.09 - Balance of other income and expenses

Well, the postings at the end of each month:

D 91.09 “Balance of other income and expenses” - K 99 “Profits and losses”, received income from auxiliary activities.

D 99 “Profits and Losses” - By 91.09 “Balance of other income and expenses”, a much more common situation, various types of bank commissions have diminished our overall profit.

Before determining net profit, it is necessary to calculate income tax using the general taxation system or a single tax under a simplified system:

D 99 “Profits and losses” - K 68 “Calculations for taxes and fees”, posting is done once a month or once a quarter, depending on your program and taxation system.

That’s it, now account 99 will contain the final result of the company’s activities.

Balance Reformation

At the end of the year, the so-called “balance sheet reformation” occurs, the amounts on subaccounts 90 and 91 are “closed” on subaccounts 90.09 and 91.09, no balances on accounts 90/91 are transferred to the next year. It's easier to show with an example:

By the end of the year, the loan in subaccount 90.01 “Revenue” accumulated an amount of 15 million rubles. On the debit of subaccount 90.02 “Cost of sales” the amount is 10 million. Since we equalized monthly turnover on the 90th account, at the end of the year on subaccount 90.09 “Profit / loss from sales” there will be a debit amount of 5 million.

Now we close all subaccounts 90.01 and 90.02 to subaccount 90.09:

D 90.01 “Revenue” – K 90.09 “Profit / loss from sales”, 15 million, closed the sub-account for revenue accounting.

D 90.09 “Profit / loss from sales” - By 90.02 “Cost of sales”, 10 million, the cost accumulated for the year was written off.

Both the debit and credit of subaccount 90.09 will be exactly 15 million rubles, so there will be no balances on any of the subaccounts of account 90 at the end of the year.

Net profit and dividends

We write off the net profit or loss from activities on December 31 from account 99:

D 99 “Profits and losses” - K 84 “Retained earnings (uncovered loss)”, if at the end of the year they reached a profit.

D 84 “Retained earnings (uncovered loss)” - K 99 “Profits and losses”, if a loss has occurred.

Generally speaking, these two entries also relate to “balance sheet reform,” but it seems to me that it is easier to understand by separating them into a separate section.

In case of positive results, the owners of the company can decide to pay dividends:

D 84 “Retained earnings (uncovered loss)” - D 75 “Settlements with founders”, if the owners of the LLC are legal entities or individuals who do not work in their own - D 70 “Settlements with personnel for wages”, if the owner of the LLC is employed in the company.

Next, personal income tax is withheld from dividends from individuals or income tax from participants-legal entities:

D 70 / 75 – K 68 “Calculations for taxes and fees”

Well, and, in the end, the owners receive the long-awaited dividends:

D 70 / 75 – K 50 “Cashier” or K 51 “Cash Accounts”

General provisions

Credits and borrowings play an important role in the life of commercial organizations. Do not think that the presence of accounts payable for an organization is, of course, bad. The fact is that loans usually fit quite organically into the economic life of organizations. Of course, if an organization has enough of its own funds for certain operations, it can easily do without a loan. After all, a loan also means interest on it. But in some cases, for example, if there is a lack of money for current operations, with major updates of fixed assets, with the seasonal nature of work, when last year’s funds are coming to an end, and the next receipt of money is not expected soon, loans can seriously help the organization. In fact, a “healthy” balance sheet, from a financial analysis point of view, usually contains some amount of accounts payable.

Difference between loans and borrowings

Credits and borrowings are different concepts. Chapter is devoted to loans and borrowings. 42 of the Civil Code of the Russian Federation “Loan and Credit”. The main difference between a loan and a credit is that only special credit organizations can provide funds on credit - usually banks. And the loan can be issued by any organization.

Another important difference is that a loan provides for the payment of interest for its use, while a loan, in its original definition, is considered interest-free.

Also, a loan usually involves the issuance of funds, and a loan can well be made both in real and in monetary form.

So, in Art. 819 of the Civil Code of the Russian Federation states that under a loan agreement, a bank or other credit organization (lender) undertakes to provide funds (loan) to the borrower in the amount and on the terms stipulated by the agreement, and the borrower undertakes to return the amount of money received and pay interest on it.

At the same time, in Art. 807 of the Civil Code of the Russian Federation gives the following definition of a loan: under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal amount of other things received by him of the same kind and quality.

In practice, in order to be sure that the loan your organization received is interest-free, the agreement for this loan must directly indicate that it is interest-free.

The issuance of a loan or loan must be formalized in the form of an agreement.

There are such concepts as commercial credit (Article 823 of the Civil Code of the Russian Federation) and commodity credit (Article 822 of the Civil Code of the Russian Federation).

Trade credit provides for the transfer of things under the conditions specified in the trade loan agreement: the parties may enter into an agreement providing for the obligation of one party to provide the other party with things defined by generic characteristics.

A trade credit agreement is a consensual agreement, that is, an agreement for the conclusion of which the agreement of the parties is sufficient. Such an agreement is considered concluded from the moment it is signed by the parties.

At the same time, a loan agreement, for example, is a real agreement, that is, an agreement for which recognition as concluded requires the fulfillment of the provisions of the agreement - the transfer of things or funds.

A commercial loan is not a loan in the literal sense of the word, but the provision of an advance, advance payment for goods, deferment or installment payment for goods. In fact, using a commercial loan, an organization gets the opportunity for some time to manage other people's funds, which, in the normal state of affairs, should have been paid for goods or services. Let's assume that an organization has agreed with a supplier on a two-week deferred payment for materials supplied. It turns out that the organization received materials (say, worth 10,000 rubles), and the organization may not pay for these materials for 2 weeks, using funds at its own discretion. It is possible that by investing this money in some profitable business (say, by buying some scarce goods and selling them), the organization will be able to benefit from a deferred payment.

Of course, a commercial loan does not always mean receiving benefits from the turnover of funds that are not paid immediately after delivery or in the form of an advance payment. It is quite possible that an organization simply does not have the money at the moment to pay the supplier’s invoice, but, for example, it expects the receipt of money from the buyer, at the expense of which it will be able to pay the supplier.

Another commercial loan option is prepayment. That is, for example, our organization entered into an agreement with the supplier organization on prepayment of goods. The advance payment is transferred to the supplier, and the goods are expected to arrive only in a week. All this time, the supplier can use the funds transferred to him as an advance payment, and this will be a commercial loan.

In fact, any discrepancy in the timing of counter obligations under concluded contracts is a commercial loan. Often commercial loans are not processed in any special way. These are ordinary settlements with suppliers or buyers.

Let's consider the features of reflecting loans and borrowings in accounting accounts.

Reflection of loans and borrowings in accounting

From an accounting point of view, loans and borrowings can be short-term (up to 12 months) and long-term (over 12 months).

Accounting for short-term loans and borrowings is kept on account 66 “Settlements on short-term loans and borrowings”, long-term accounting is kept on account 67 “Settlements on long-term loans and borrowings”. These are accounts that are usually used as passive accounts. The credit balance on such an account means the presence of outstanding loans.

Features of accounting for expenses on loans and credits are regulated by the Accounting Regulations “Accounting for expenses on loans and credits” (PBU 15/2008). In particular, PBU 15/2008 is applicable for recording and reporting information on any loans and borrowings for all legal entities except credit organizations and budgetary institutions.

The principal amount of the loan or borrowing is reflected in accounting as accounts payable. In addition to accounts payable for the amount of the credit or loan, the organization has expenses associated with fulfilling its obligations. So, this is the interest due to be paid to the lender (creditor). As additional expenses, amounts paid for information and consulting services, amounts paid for the examination of a loan agreement (credit agreement), and others may appear here. Loan and credit expenses are accounted for separately from the principal amounts of loans and credits. This is usually done in various subaccounts of accounts 66 and 67.

Borrowing expenses are recognized as other expenses, excluding that part of them that is subject to inclusion in the cost of the investment asset. An investment asset is a property whose preparation for use requires a long time. For example, a facility under construction (industrial structure), which will be taken into account after completion of construction. A large part of PBU 15/2008 is devoted to investment assets.

In accordance with the Chart of Accounts and the Instructions for its use, loans received are taken into account in the credit of accounts 66 and 67. Typically, when receiving loans, an entry is made to the debit of cash accounting accounts and the credit of account 66 or 67.

In general, interest payable on loans and borrowings received is also reflected in the credit of accounts 66 and 67 in correspondence with the debit of account 91 “Other income and expenses.”

13.4. Examples of accounting for loans and credits

Let's consider an example of accounting for the receipt of a short-term interest-free loan in non-monetary form. For example, an organization has entered into a trade credit agreement, according to which another organization is obliged to supply it with materials worth 10,000 rubles (plus 18% VAT - 1,800 rubles). Our organization is also going to use materials to provide this trade credit.

When materials are received, the following entry is made:

D10 K66 10,000 rub. — materials received under the trade credit agreement

D19 K66 1800 rub. — VAT is reflected on received materials. This VAT can be accepted for deduction in compliance with the usual conditions for accepting VAT for deduction and only after the return of this trade credit by the organization.

The term of the trade loan has passed, the time has come for the organization to return it. This is documented with the following entries:

D66 K91-1 11800 rub. — the loan amount specified in the agreement is reflected in the organization’s other income

D91-2 K10 10,000 rub. — the cost of materials to be transferred to the lending organization is written off

D91-2 K68 1800 rub. — VAT is reflected on the transferred values

D68 K19 1800 rub. — input VAT has been accepted for offset on values previously accepted under the trade credit agreement.

Now let’s consider accounting for the same goods at the lending organization.

When issuing a loan, the following entries are made:

D58 K91 — 11,800 rub. — the value of the property specified in the loan agreement is reflected in account 58 “Financial investments”

D91 K68 1800 rub. — VAT on the transaction, subject to payment (the moment of implementation is the shipment of valuables)

D91 K10 10,000 rub. — the accounting value of materials transferred under the loan agreement.

Now the materials are returned to the lender:

D10 K91 10,000 rub. - materials returned

D19 K91 1800 rub. — VAT has been returned, which can be accepted for offset

D91 K58 11800 rub. — the cost of financial investments (loans) is written off for the organization’s expenses

D68 K19 1800 - accepted for crediting VAT related to returned materials.

Here it is necessary about - in addition to, in fact, financial investments, it is used to account for loans that the organization gives.

If the agreement provides for the payment of interest, for example, in cash, then we make the following entries with the borrower:

D91 K66 - for the amount of interest accrued for payment

D66 K51 - interest paid for using trade credit

We make the following entry at the recipient of the funds (lender):

D51 K76 - for the amount of interest received.

In accordance with subclause 15 of clause 3 of Art. 149 of the Tax Code of the Russian Federation, VAT is not assessed on transactions for the provision of loans in cash, as well as the provision of financial services for the provision of loans in cash.

If the interest were returned in the form of materials, the transactions for its receipt would be subject to VAT.

As you can see, here you can observe an interesting process: based on the results of the transactions, neither the borrower nor the lender actually pays VAT, but he participates in each of the transactions, and it is possible that the lender will pay an advance payment for VAT, including VAT in it transferred values, but if similar values are returned to him, he will be able to present the same amount of VAT for offset. A similar situation arises for the recipient of a trade loan - first, she takes into account the input VAT on account 19 and cannot accept it for offset until she returns the trade loan. When returning a trade loan, VAT is charged and must be paid to the budget (in our case, the amounts of input and output VAT are equal; in reality, when carrying out such an operation, everything may not look so smooth), after which the organization can offset the input VAT and, as a result, the amounts input VAT and VAT payable to the budget also cancel each other out.

Now let's look at an example of accounting for a long-term monetary loan that provides for the payment of interest on use. Suppose we took out a loan in the amount of 100,000 rubles for three years (36 months), and, in accordance with the loan agreement, in the first month we are obliged to repay the principal amount equal to 1000 rubles and the amount of interest equal to 3000 rubles. In the second month, the principal amount equal to 1,100 rubles and the amount of interest equal to 2,900 rubles are repaid; information on the amounts of interest and principal due for repayment in the following months is regulated by the loan agreement.

In the example given, we will use the following subaccounts to account 67:

· 67-1 Long-term loans

· 67-2 Interest accrued for using a loan

· 67-5 Amounts of overdue long-term loans

· 67-6 Amounts of overdue interest accrued for using a long-term loan

D51 K67-1 100,000 rub. — a long-term loan has been credited to the current account in accordance with the loan agreement.

D91 K67-2 3000 rub. — interest accrued for using the loan in the first month

D67-1 K51 1000 rub. — part of the principal debt intended for repayment in the first month was transferred to the credit institution

D67-2 K51 3000 rub. — interest for using the loan in the first month is transferred to the credit institution

In the second month, the organization again accrues interest:

D91 K67-2 2900 rub.

However, now the organization is not able to pay interest and principal, so both are transferred to the category of overdue loans:

D67-1 K67-5 99,000 rub. — the amount of the principal debt was transferred to the category of overdue loans

D67-2 K67-6 2900 rub. — the amount of accrued interest was transferred to the category of overdue loans.

Loans can be divided into non-targeted - that is, those the funds of which the borrowing organization can spend for any purpose, and targeted - those that are taken for a specific purpose. If the borrower used the loan received for purposes other than those specified in the agreement, he will be in trouble.

Please note that the receipt of loan funds is not income of the organization, and their disposal is not an expense. At the same time, interest on a loan is an expense.

Accounting records

We systematize information about the features of accounting for loans and credits. Table 13.1 shows accounting records for accounting for trade loans from the lender and borrower - commercial organizations.

| Table 13.1. Accounting entries for accounting for trade credits | |||

| Contents of a business transaction | Primary document | D | TO |

| Accounting for a trade loan from a borrower: obtaining a loan | |||

| Materials received under the trade credit agreement | Trade credit agreement, invoice | 10 | 66 |

| VAT is reflected on received materials | Invoice | 19 | 66 |

| Interest accrued for using a commercial loan | Agreement, accounting certificate | 91 | 66 |

| Interest paid from current account | Bank statement, payment documents | 66 | 51 |

| Repayment of the loan by the borrower | |||

| The loan amount specified in the agreement is reflected in other income of the organization | Trade credit agreement | 66 | 91-1 |

| The cost of materials to be transferred to the lending organization has been written off | Help for accounting calculations | 91-2 | 10 |

| VAT reflected on transferred values | Help for accounting calculations | 91-2 | 68 |

| Incoming VAT accepted for offset | Invoice | 68 | 19 |

| Accounting for a trade loan from a lender: issuing a loan | |||

| The value of the property specified in the loan agreement is reflected | Loan agreement | 58 | 91 |

| VAT payable reflected | Loan agreement | 91 | 68 |

| The accounting value of materials transferred under the loan agreement is reflected | Loan agreement, invoice | 91 | 10 |

| Returning the loan to the lender | |||

| Materials eligible for return under the trade credit agreement have been returned. | Trade credit agreement, confirming documents on receipt of materials | 10 | 91 |

| VAT included in the cost of materials | Invoice | 19 | 91 |

| The cost of financial investments (loans) is written off as expenses of the organization | Agreement, accounting certificate | 91 | 58 |

| “Input” VAT accepted for offset | Invoice | 68 | 19 |

| Interest received for using a loan on a current account | Bank statement, payment documents | 51 | 76 |

Table 13.2 shows records for accounting for cash loans from the borrowing organization.

| Table 13.2. Accounting for a cash loan from a borrower | |||

| Contents of a business transaction | Primary document | D | TO |

| A long-term loan was received into the current account | Loan agreement, bank statement | 51 | 67-1 |

| Interest accrued for using the loan | Loan agreement, accounting certificate | 91 | 67-2 |

| Funds were transferred to the credit institution to repay accrued interest | Bank statement | 67-2 | 51 |

| Funds were transferred to the credit institution to repay part of the principal debt as provided for in the loan agreement | Bank statement | 67-1 | 51 |

| The amount of the principal debt was transferred to the category of overdue | Debt inventory act | 67-1 | 67-5 |

| Accrued interest transferred to overdue category | Debt inventory act | 67-2 | 67-6 |

Important documents

· Loan agreements

· Loan agreements

· Documents on the receipt (disposal) of funds or other assets

· For targeted loans - reports on the targeted use of borrowed funds

Debit and credit

Accounting entries compiled from the debit entries of account 67 indicate a decrease in the amount of debt on loans with a long repayment period. This happens after:

- debt repayment;

- fulfillment of obligations by both parties to the loan agreement;

- transition of debt from the status of long-term to the status of debt with a short payment period;

- crediting an outstanding loan or loan to other profits;

- crediting to other profits an increase in the cost of goods or services associated with an increase in the rate of a loan or loan with a long period of payment in foreign currency.

The transfer of funds provided at interest for a long period (as well as the amount of interest) is expressed as a loan.

Postings to account 66 - settlements for short-term loans and borrowings

Trade credit transactions are reflected in a separate subaccount to account 66 “Settlements on short-term loans and borrowings.” Separately, on account 66 “Settlements for short-term loans and borrowings,” agricultural organizations take into account operations on loans, the payment of interest on which is subsidized from the budget.

Receipt of a loan from a commercial bank is reflected in the usual manner by the debit of the cash accounting accounts and the credit of account 66 “Settlements for short-term loans and borrowings.” Interest due on loans received is debited to account 91 “Other income and expenses” from the credit of account 66 “Settlements on short-term loans and borrowings” (in full). After repaying the debt on these loans and borrowings, subsidies are credited to the current account, account 51 “Current account” is debited and account 86 “Targeted financing” is credited.