Order to cancel surcharges and allowances

If the payment is directly provided for in the employment contract or an additional agreement to it, it is not easy to cancel it. Such cancellation is equivalent to changing the terms of the employment contract.

An employment contract is a bilateral document. The parties can only change it together.

The name of this compensation indicates the fact of payments to employees on an individual basis. Employers often decide to individually reward an employee for achievements at work. In Part 2 of Art. 135 of the Labor Code of the Russian Federation specifies a list of elements that are included in the remuneration system: the size of tariff rates, salaries, additional payments and allowances of a compensatory and incentive nature.

Since in the case under consideration the payment of an allowance for professional excellence is provided for by a collective agreement, given that the employment contract concluded with the employee establishes that the allowance is part of his salary, non-payment of the allowance will be a violation of the employee’s rights if the circumstances in which this allowance exists may not be paid by the employer, absent.

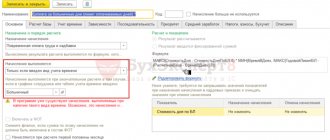

Contents: V. based on the results of the 2nd quarter for improper performance of his official duties. I entrust the execution of this order to the deputy director for organizational work P. Rogozhkin. Personal additional payment is rarely included in the remuneration section of an employment contract with an employee.

This is not some kind of violation of labor legislation, since such additional payment refers to incentive payments.

However, the employer must necessarily include the procedure and conditions for assigning such additional payments in the wage regulations or in the collective agreement.

Otherwise, his expenses for paying such additional earnings can be charged as expenses from profit and will not reduce the tax base.

But the presence of such provisions in the documents of the remuneration system does not oblige the administration to anything special.

The fact is that it is usually enough to write in the provision that the decision on such payment is made taking into account the economic situation at the enterprise or under some condition.

In the case when it is necessary to establish a personal additional payment for a specific employee, a motivated memo from the immediate superior addressed to the manager who has the right to make such a decision (director, HR director, financial director, chief accountant, etc.) is usually sufficient. The memo must indicate the reasons why such an additional payment is necessary, indicate its amount in rubles and the validity period of such an additional payment. It is recommended not to make such an allowance indefinite, but to set it for a certain period (for example, for six months or a quarter).

In the future, you can write a second request to extend the validity of such additional payment. After such a document has been endorsed by the manager, it must be transferred to a labor organization specialist or to the accounting sector (accountant).

This document will be the basis for them when preparing a draft order to establish a personal allowance for an employee.

The order to establish a personal surcharge is drawn up in any form.

https://youtu.be/oJb7xxEpGDs

Cancellation of incentive payments without violations of the Labor Code

Selections from magazines for an accountant Details Category: Selections from magazines for an accountant Published: 04/08/2015 00:00 Source: Glavbukh magazine Incentive payments are additional payments and allowances, bonuses and other incentive payments that are an integral part of wages (Article 129 of the Labor Code RF). Such payments include, for example, additional payments for performing additional duties, bonuses for completing a special task, bonuses for knowledge of a foreign language, team management, mentoring, saving on raw materials and consumables, and others. The procedure for canceling incentive payments assigned to company employees mirrors how they were established Documents on incentive payments Incentive payments can be established by an employment or collective agreement, as well as by order of the manager (Part.

2 tbsp. 135 of the Labor Code of the Russian Federation) (see diagram).

Please note that the Regulations on remuneration and bonuses may be approved by order of the manager or be part of a collective agreement. The diagram shows the latter option.

The cancellation of the incentive payment also depends on how it was established.

Payment in accordance with the employment contract If the payment is directly provided for by the employment contract or an additional agreement to it, it is not easy to cancel it.

Such cancellation is equivalent to changing the terms of the employment contract.

An employment contract is a bilateral document. The parties can only change it together. In order not to violate the procedure, the employer must: - notify the employee; — conclude an additional agreement with him to the employment contract; - issue an order. If the bonus is established by the employment contract, in order to cancel it, the employee must be notified in writing two months in advance (Part.

2 tbsp. 74 Labor Code of the Russian Federation). Agreement to the employment contract If the employee agrees to continue working under the proposed conditions, that is, without an additional bonus, an additional agreement must be concluded with him to amend the employment contract. Reasons for cancellation. The text of the agreement must indicate the reason for the changes being made, for example, write that the bonus has been canceled due to a change in organizational or technological working conditions, the amount of working time, the composition of the employee’s job responsibilities, or a structural reorganization of production.

The essence of the changes. It is more convenient to establish new conditions by writing down new wording of the amended clauses of the employment contract. The second option is to indicate which words of the previous formulations have been removed and which have been added to the text.

Order Based on an additional agreement to the employment contract, an order (instruction) is issued. It describes the changes themselves, the timing and procedure for their application by company employees. The order must be familiarized to the employee affected by the change.

If the employee does not agree to change the terms of the employment contract, offer other options. If an employee refuses to sign an additional agreement to the employment contract, the employer is obliged to

Additional leave for hazardous working conditions

Consequently, until transfer to another position or dismissal, this benefit remains with the employee. The employer cannot recall the “harmmaker” from vacation (Article 125 of the Labor Code of the Russian Federation). Therefore, a rational approach is to provide additional leave only for time actually worked in harmful and dangerous conditions.

- The HR specialist passes the calculation note to the accounting department.

- Within 3 days, the personnel officer familiarizes the employee with the order.

- Two weeks before the scheduled date, the employee submits an application to the manager.

- The HR specialist draws up an order for granting leave (on Form T-6).

- The employee receives vacation pay within 3 days.

- The order is signed by the Director or an official acting by proxy.

The employee must complete the application.

Notification of a change in working hours and cancellation of additional leave for an employee for irregular working hours

Limited Liability Company "Beta" LLC "Beta" N.I.

Krasnova, working as a salesperson On changing the work schedule and canceling additional leave for an employee for irregular working hours In case of your refusal of the offered work, the Contract will be terminated in accordance with clause 7, part 1, art. 77 of the Labor Code of the Russian Federation. We ask you to sign for receipt of this notice (employer's copy), put the date of its delivery and a mark of consent (disagreement) to change the work schedule and cancel additional leave for irregular working hours.

General Director _________________________ A.I. Petrov A received notification of a change in the work schedule and cancellation of additional leave for irregular working hours.

I refuse to continue working under the new conditions ____________________.

Agreement to work in new conditions ____________________.

· about the conditions and requirements of labor protection in the workplace; · about the existing risk of damage to health; · about the compensation and personal protective equipment due; · on the results of a special assessment of working conditions at his workplace (clause

5 tbsp. 15 of Law No. 426-FZ). EMPLOYEE'S WORKING CONDITIONS IMPROVED - BENEFITS ARE CANCELED Example 1.

Notifying the employee about changes to his employment contract in connection with the improvement of his working conditions · established reduced working hours - a 36-hour work week; · paid increased wages; · provided additional paid leave of 7 calendar days. · the procedure for granting and duration of additional paid leave; · provision of therapeutic and preventive nutrition; · mandatory medical examination, etc. DRAFTING AN ADDITIONAL AGREEMENT Example 2.

Order to cancel surcharge

Contents Allowances for employees can be compensatory or incentive in nature.

They can be one-time or regular. If these are regular allowances (for example, for the period of being on a business trip), then it may be necessary to cancel them. In this case, an order to cancel the allowance is created (a sample is at the end of the article). Additional payment may be assigned when an employee combines different positions.

If the duty to combine is cancelled, then the bonus is also cancelled. This means early cancellation. The procedure is carried out in accordance with this order:

- It is required to issue an order to terminate the duty and cancel the allowance.

- It is necessary to notify the other party (employer or employee) 3 days in advance about the cancellation of the combination of positions (or the cancellation of another duty for which an allowance is accrued).

FOR YOUR INFORMATION!

If the premium is established for a certain obligation that will automatically stop after a certain time has elapsed, then there is no need to draw up an order to cancel the payments.

The bonus will automatically cease to be paid once the duty is removed.

That is, the order is needed only in case of early cancellation of the allowance. The order is issued in free form. However, it must contain the following mandatory details:

- Position, qualifications of the employee.

- Company information.

- Information about the employee to whom the bonus was accrued.

When drafting the text of the order, you need to remember the main goal.

In particular, it is necessary to clearly formulate the reasons for canceling the allowances. on the cancellation of the allowance Due to the cessation of production necessity and on the basis of Article 60.2 of the Labor Code 1. Terminate Order No. 33-O dated September 1, 2021 on the assignment to sales manager Ivanov O.L.

additional work. 2. Early from November 25, 2021, stop paying the bonuses established on the basis of Order No. 33-O. 3. I reserve control over the execution of the order.

For harm, a medical worker is entitled to guarantees and compensation.

Harmful working conditions for medical workers: a list There is no unified list of unfavorable working conditions for medical workers, therefore, depending on what guarantees and compensation the employee is applying for, different lists are used, in particular, approved:

- orders of the Ministry of Health and Social Development of Russia dated 04/12/2011 No. 302n, dated 02/16/2009 No. 45n, dated 05/30/2003 No. 225;

- Decrees of the Government of the Russian Federation dated February 14, 2003 No. 101, dated June 6, 2013 No. 482.

Factors in the working environment can be recognized as harmful based on the results of a special assessment of working conditions (hereinafter referred to as SOUT). A bank’s refusal to carry out a transaction can be appealed. The Bank of Russia has developed requirements for an application that a bank client (organization, individual entrepreneur, individual) can send to an interdepartmental commission in the event that the bank refuses to make a payment or enter into a bank account (deposit) agreement.

The absence of harmful working conditions is the basis for signing an additional agreement with the employee, which is attached to the employment contract.

When additional payment for additional work is not established

Letter of Rostrud dated May 24, 2011 No. 1412-6-1 “On the peculiarities of performing work by combining professions (positions), as well as in cases of performing the duties of an absent employee»

Read more I paid through government services and the debt remains

. In practice, there may be cases when the job description of certain categories of employees stipulates that during the absence of another employee with a similar job function from the workplace, they perform the duties of the absent employee. The specified provisions of job descriptions, which are an integral part of employment contracts, do not imply additional payments, since in this case this work (performing the duties of a temporarily absent employee) is performed within the framework of the concluded employment contract.

Letter of the Ministry of Health and Social Development of Russia dated March 12, 2012 No. 22-2-897 “On the procedure for performing combined work”

. Job descriptions of certain categories of employees may provide for cases when, during the absence of another employee with a similar job function from the workplace, they perform the duties of the absent employee. The specified provisions of job descriptions, which are an integral part of employment contracts, do not imply additional payments, since in this case this work (performing the duties of a temporarily absent employee) is performed within the framework of the concluded employment contract.

How to cancel a previously established additional payment to employees?

Answer: The procedure for canceling an additional payment depends on how such an additional payment was established. The cancellation of an additional payment can be formalized by amending the employment contract or issuing a local regulation that cancels the additional payment. Rationale: Remuneration systems, including additional payments and allowances of a compensatory nature, including including for work in conditions deviating from normal conditions, systems of additional payments and bonuses of an incentive nature and bonus systems are established by collective agreements, agreements, local regulations (Art.

135 of the Labor Code of the Russian Federation). Conditions of remuneration (including the amount of the tariff rate or salary (official salary) of the employee, additional payments, allowances and incentive payments) are mandatory conditions for inclusion in the employment contract (Article 57 of the Labor Code of the Russian Federation). Cancellation of additional payments, established by the employment contract The employment contract specifies the terms of remuneration (including the amount of the tariff rate or salary (official salary) of the employee, additional payments, allowances and incentive payments) (Article 57 of the Labor Code of the Russian Federation). The additional payment due to the employee can be directly indicated in the labor contract agreement or it may contain a reference to the relevant local regulatory act or collective agreement providing for the grounds and conditions for their payment (Art.

Art. 57, 135 of the Labor Code of the Russian Federation).Changing the terms of an employment contract, including remuneration, determined by the parties, is allowed only by written agreement of the parties to the employment contract, with the exception of cases provided for by the Labor Code of the Russian Federation (Article 72 of the Labor Code of the Russian Federation).Changing the terms of an employment contract determined by the parties is also allowed at the initiative of the employer for reasons related to changes in organizational or technological working conditions, while the employer is obliged to comply with the procedure established in Art. 74 of the Labor Code of the Russian Federation. In particular, the employer is obliged to notify the employee in writing of the terms of the employment contract determined by the parties, as well as the reasons that necessitated such changes, no later than two months in advance, unless otherwise provided by the Labor Code of the Russian Federation (Part.

2 tbsp. 74 of the Labor Code of the Russian Federation). Thus, the additional payment established by the employment contract can be canceled only by making appropriate changes to it. At the same time, if the employee agrees to new working conditions, Art.

We recommend reading: Where to get a certificate of pension amount for a pensioner

Art. 57 and 72 of the Labor Code of the Russian Federation provide for the possibility of amending an employment contract by concluding in writing an additional agreement between the employee and the employer, which is an integral part of the employment contract. Cancellation of the additional payment established in the collective agreement Changes and additions to the collective agreement are made in the manner established by the Labor Code of the Russian Federation for its conclusion, or in the manner prescribed by the collective agreement (Art.

44 Labor Code of the Russian Federation). If the collective agreement does not contain a special procedure for making changes to it, they are made through collective negotiations, as when concluding a collective agreement (Article 47 of the Labor Code of the Russian Federation). To change the conditions provided for by the collective agreement,

Establishing additional payments to employees for increasing the volume of work

8408 Page content The employer has the right to assign additional work to an employee.

(hereinafter referred to as the “Contract Agreement”) the following changes. 2. State paragraph _____._____ in the following wording: 3.

An additional payment is established for it, and it must be formalized in accordance with regulations. Increasing the volume of work involves assigning an employee work in his own specialization. It is assumed that this work is not specified in the original employment contract. The procedure is regulated by Article 60.2 of the Labor Code of the Russian Federation.

Additional load is assigned if the following conditions are met:

- No separation from core activities.

- Performing duties within the standard working hours (based on Part 1 of Article 60.2 of the Labor Code of the Russian Federation).

Article 60.2 of the Labor Code of the Russian Federation stipulates additional conditions for increasing the scope of work:

- Carrying out activities in another or original position.

- Obtaining written consent from the employee.

- The manager is obliged to pay the employee extra for additional assignments.

An increase in the scope of work is introduced based on the worker’s application.

IMPORTANT! The employer needs to know what exactly is meant by an increase in the volume of work. As part of this procedure, the manager can assign an employee work performed within the boundaries of his position, the volume of which is greater than standard. If the worker is assigned another job, the design will be slightly different.

For example, in case of internal part-time work, the employer needs to draw up an additional employment contract. In order to correctly process the additional payment, you need to correctly document the increase in the scope of work.

Sample order for withdrawal of surcharge

An employment contract defines the main responsibilities of an employee related to production activities, but under certain conditions, the employee, by decision of the employer, may be assigned additional responsibilities that he must perform during the working day established by law.

There are many questions in this context.

Why, in fact, can previously assigned additional payments be withdrawn?

How should all legislative nuances be observed when removing them?

How should the Personnel Order be drawn up, and what mistakes can be made when completing it. Every able-bodied citizen should know about this.

Since the provision of additional work is initiated by the management of a legal entity and is achieved by concluding a mutual agreement between the employer and the employee, it can accordingly be terminated at the initiative of one of the parties. To do this, notifications are exchanged, and the procedure is formalized with a standard personnel document - an Order to stop additional work and remove additional payments for them.

By order of the enterprise, which regulates the appointment by the manager of additional labor functions and additional payment for their implementation, as well as their removal, the following work can be assigned:

- Combining single-profile professions or positions in one organization with limited staffing; At one enterprise, for objective reasons, service areas may be expanded and the volume of work performed may be increased; In the event of a long absence of one of the employees for good reasons - tariff, educational, maternity leave, sick leave or other reasons, another employee with similar professional skills and qualifications is offered to perform his duties without being relieved of the permanent duties stipulated by the employment contract.

Accordingly, in the case when the reasons for the expansion of professional duties are eliminated, an Order is issued to remove additional payments for work above the staff schedule.

That is, if there is no need to use combinations, the employee does not have the right to claim additional payment. The cancellation of its accrual and delivery to the employee follows the publication of the relevant Order. If the original document was urgent and its deadline has expired, formalize the removal of additional job responsibilities by some administrative act of management.

Contents of the article For an increase in the scope of job responsibilities, additional payment and the employee’s prior written consent are required.

No less strict adherence to the letter of the law requires the removal of such motivational additional payments. The main legislative acts regulating the assignment and withdrawal of additional payments: – assignment of additional payment; – regulations on the timing of additional labor functions; about incentive payments;

Additional work: expanding service areas and increasing the scope of work

Expanding service areas and increasing the volume of work means performing, along with one’s main work stipulated by an employment contract, an additional amount of work in the same profession or position, that is, performing homogeneous work (for a similar position, specialty, qualification).

At the same time, the concept of “expansion of service areas” for the purpose of applying Articles 60.2 and 151 of the Labor Code of the Russian Federation includes the assignment of additional work for the same position, the work for which is made dependent on zones or areas, and with an increase in the volume of work - on production standards. The clarifications of the State Labor Inspectorate in the Chelyabinsk Region dated November 21, 2017 indicate that the main difference between expanding service areas and increasing the volume of work is that expanding the service area is established when a position requires the presence of zones or areas (for example, a social worker, a doctor, a cleaner) .

We recommend reading: Agreement in editable format

And when the volume of work increases, in addition to the main work, the employee is entrusted with similar additional work, that is, the volume of previously performed work increases (for example, a mechanic for mechanical assembly work). For clarity, let’s summarize these differences in a table: The table shows that in other respects, the registration of additional work is the same both when expanding service areas and when increasing the volume of work: you need to enter into an agreement with the employee, adhere to the rule of equal pay for work of equal value, and record working hours There is no need to conduct separate work for additional work.

[…] Concept

How many days in advance must an employee be notified of the cancellation of a personal allowance?

Answer to the question: It is mandatory to specify all allowances and additional payments in the employment contract (Article 57 of the Labor Code of the Russian Federation). Terms of remuneration, including additional payments, allowances and incentive payments, are mandatory terms of the employment contract (para.

5 hours 2 tbsp. 57 Labor Code of the Russian Federation). Therefore, changes in such conditions, including the abolition of the bonus for length of service, must be formalized according to the rules for changing the terms of the employment contract, even if such a bonus is not specified separately in the employment contract itself, but a link is given to the local regulatory act in which the bonus is fixed.

As a general rule, the terms of an employment contract can be changed only by written agreement of the parties (Article 72 of the Labor Code of the Russian Federation). Therefore, if the employee agrees to cancel the bonus, then the bonus can be canceled by removing the corresponding clause from the employment contract with the employee at the current date.

No prior notice to the employee is required. If the employee does not agree to the cancellation of the bonus, then the employer can cancel the corresponding bonus unilaterally only if he justifies the need for its cancellation for reasons of a technological or organizational nature in accordance with Art.

74 Labor Code of the Russian Federation. When conditions change due to changes in organizational or technological working conditions (changes in equipment and production technology, structural reorganization of production, other reasons), the terms of the employment contract determined by the parties cannot be preserved; they can be changed at the initiative of the employer in accordance with Art. 74 of the Labor Code of the Russian Federation, with the exception of changes in the employee’s labor function.

Those. the corresponding procedure can be carried out only if there are reasons of an organizational or technological nature (part 1 of article 74 of the Labor Code of the Russian Federation). In this case, the employee must be notified of changes in the employment contract at least two months before such changes.

The organization must be prepared for the fact that in the event of a dispute, it will have to prove the need to reduce wages due to changes in organizational or technological working conditions (paragraph 21 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2, Determination of the Oryol Regional Court dated November 14, 2013 No. 33-2525). Therefore, already at the initial stage of innovation, it is necessary to justify the reason for canceling the allowance with documentation.

It is unlawful to justify the cancellation of an increase on facts that do not affect the conditions and mode of work of the employee or other terms of the employment contract. For example, a difficult economic situation in the country and on the market will not be a justified reason for canceling an employee’s bonus. This position is also confirmed by the courts (see, for example, Determination of the Moscow City Court dated August 10, 2010 No. 33-23831).

A justified reason for changing the conditions of remuneration may be recognized, for example, a transition to a new organizational structure, a change in the remuneration system as a whole for the organization (see, for example, the Appeal ruling of the Supreme Court of the Republic of Karelia dated 08/14/2014 in case No. 33-2788/2014 If you can justify the cancellation of the employee bonus on organizational or technological grounds (in accordance with Art.

74 Labor Code of the Russian Federation)

Notification of scheduled leave - sample

Due to the fact that they are now trying to save at least something))) it is better to go through the procedure of a collective meeting with keeping minutes of who is for and who is against, prepare notifications and obtain consent to change the terms of the TD or not. In general, in this order, which will avoid constant explanations on the questions asked. That is, it is better to prepare people in advance. We are also currently working to reduce vacations. But so far only in words. I want to draw the moderator's attention to this message because: A notification is being sent... I live in the present. I am confident in the future. Learned in the past.

The employer must prove that the change in the rate of the part-time worker was a consequence of changes in organizational or technological working conditions, for example, changes in equipment and production technology, improvement of jobs based on their certification, structural reorganization of production, and does not worsen the employee’s position compared to the terms of the collective agreement , agreements. In accordance with paragraph 21 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 N 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation,” if the employer does not provide relevant evidence, the employee may subsequently be reinstated at work. Details in the materials of the Personnel System: 1. Answer: How to make changes to the employment contract with an employee I.I.

If the terms of the employment contract determined by the parties are changed at the initiative of the employer, and the employees (or at least one employee) do not agree, then this change must be formalized in accordance with the provisions of Art. 74 of the Labor Code of the Russian Federation - in the case when, for reasons related to changes in organizational or technological working conditions, the terms of the employment contract determined by the parties cannot be maintained - they are allowed to change at the initiative of the employer. In this case, it is necessary to notify employees of changes in the terms of the employment contract determined by the parties no later than 2 months before their introduction. The form of the notification is not established at the legislative level; you can compose it in any form. However, in accordance with Article 74 of the Labor Code of the Russian Federation, the employer may, in certain cases, change the terms of the employment contract unilaterally. This is possible when organizational or technological working conditions change. This procedure involves the following steps:

- Notify the employee of the upcoming change in working conditions, including the cancellation of additional benefits. leave, and the reasons that necessitated the change in writing, no later than two months before the introduction of such a change.

- If the employee agrees to the upcoming change, an additional agreement to the employment contract is drawn up with him, in accordance with the above recommendations.

- Please note that when notifying an employee of an upcoming change in the terms of the employment contract, the employer must also indicate the reason for such change.

Is it necessary to issue an order to cancel additional payments?

Answer to the question: The employer establishes the procedure for bonuses and payment of other incentive payments and allowances at its own discretion. In this situation, the additional payment was established for a certain period - a year, and after this period there are no grounds for its payment.

Thus, no additional orders to cancel the additional payment for professionalism need to be issued, since this additional payment was initially established for a certain period, and this period has expired. Details in the System materials: 1. Journal: Salary, No. Payments to employees We are canceling incentive bonuses for I.A.

Tusheva, expert at Zarplata magazine When switching to austerity mode, companies first of all cancel incentive payments.

At the same time, it is important not to violate labor laws.

Otherwise, instead of saving money, there is a risk of getting bogged down in litigation with employees. Incentive payments are additional payments and allowances, bonuses and other incentive payments that are part of the salary ().* Such payments include, for example, additional payments for performing additional duties, bonuses for completing a special task, bonuses for knowledge of a foreign language, management team, mentoring, saving raw materials and consumables and others.

The procedure for canceling incentive payments assigned to company employees mirrors how they were established. What compensation cannot be canceled Incentive payments do not include compensation payments: - for work at night, on weekends and holidays; - in harmful and (or) dangerous working conditions, in the regions of the Far North or in areas equivalent to them.

The employer has no right to cancel them.

He only has the opportunity to change the terms of their payment if initially these conditions were more favorable compared to the requirements of labor legislation.

What documents can establish incentive bonuses? Incentive payments can be established by an employment or collective agreement, as well as by order of the manager () (see diagram). Please note that the Regulations on remuneration and bonuses may be approved by order of the manager or be part of a collective agreement.

The diagram shows the latter option. To begin the process of canceling the incentive payment, you need to find out how it was established. Scheme What document can establish a premium False Payment is made in accordance with the employment contract If the payment is directly provided for by the employment contract or an additional agreement to it, it is not easy to cancel it.

In order not to violate the procedure, the employer must:

- - issue an order.

- — conclude an additional agreement with him to the employment contract;

- — notify the employee;

We notify the employee of changes in the terms of the employment contract. If the bonus is established by the employment contract, in order to cancel it, the employee must be notified in writing two months in advance ().

Such cancellation is equivalent to changing the terms of the employment contract. An employment contract is a bilateral document. The parties can only change it together.

Order to cancel the allowance

1338 Allowances to employees may be compensatory or incentive in nature.

They can be one-time or regular. If these are regular allowances (for example, for the period of being on a business trip), then it may be necessary to cancel them. In this case, an order to cancel the allowance is created (a sample is at the end of the article). FILES Additional payment may be assigned when an employee combines different positions.

If the duty to combine is cancelled, then the bonus is also cancelled. This means early cancellation.

The procedure is carried out in accordance with this order:

- It is necessary to notify the other party (employer or employee) 3 days in advance about the cancellation of the combination of positions (or the cancellation of another duty for which an allowance is accrued).

- It is required to issue an order to terminate the duty and cancel the allowance.

FOR YOUR INFORMATION! If the premium is established for a certain obligation that will automatically stop after a certain time has elapsed, then there is no need to draw up an order to cancel the payments.

The bonus will automatically cease to be paid once the duty is removed.

That is, the order is needed only in case of early cancellation of the allowance.

The order is issued in free form.

However, it must contain the following mandatory details:

- Information about the employee to whom the bonus was accrued.

- Position, qualifications of the employee.

- Company information.

When drafting the text of the order, you need to remember the main goal. In particular, it is necessary to clearly formulate the reasons for canceling the allowances. LLC "Kvadrat" Order No. 67-R on the abolition of the city allowance.

Moscow November 22, 2021 Due to the cessation of production necessity and on the basis of Article 60.2 of the Labor Code, I ORDER: 1. Terminate Order No. 33-O dated September 1, 2021 on the assignment to sales manager O.L. Ivanov. additional work. 2. Early from November 25, 2021, stop paying the bonuses established on the basis of Order No. 33-O.

3. I reserve control over the execution of the order. General Director Kruzhkin O.O. (signature) The order has been reviewed by: Ivanov O.L.

(signature)

Notice of cancellation of additional work assignment

Types of additional work are:

- combination of professions (positions);

- expanding service areas, increasing the volume of work;

- performance of duties of a temporarily absent employee without release from current duties specified in the employment contract.

In accordance with Art. 60.2 of the Labor Code of the Russian Federation, the employer has the right to cancel the order to perform additional work ahead of schedule. To do this, the employer must notify the employee about this in writing - provide a corresponding notice, which the employee must be familiar with against signature.

Since the law does not establish a form for notification of cancellation of additional work, personnel specialists issue it arbitrarily.

A notice of cancellation of an order to perform additional work must contain:

- employee and employer data;

- characteristics of performed additional responsibilities;

- reasons for early cancellation of additional execution. responsibilities.

Notifications about cancellation of additional work are recorded in the notification log.

The storage period for the document in question that is not included in the personal files is five years.

Orders to cancel incentive payments

» Consumer law An employer can cancel part of the payments to an employee without violating the Labor Code.

In some cases, the employee may not even be warned about this. Incentive payments - additional payments and bonuses to wages of an incentive nature, bonuses and other incentive payments (Article 129 of the Labor Code of the Russian Federation). Additional payments and allowances can be established by collective agreements, agreements, local regulations and other legal acts containing labor law norms (Art.

135 Labor Code of the Russian Federation). As a rule, additional payments are established by an employment contract, collective agreement, local regulation or order of the manager. And the procedure for canceling them depends on how they were installed.

This document is two-sided, and the employer does not have the right to amend it independently, since this is considered a change in working conditions. Therefore, the employee must be notified in writing two months in advance about the upcoming transformation and the reasons, which is established in Art. 74 Labor Code of the Russian Federation. It also stipulates that if the employee does not agree to the new conditions, he may be offered another job.

If the employee does not agree to the new conditions or the proposed job, the employment contract is terminated. So, the employer notifies the employee in writing about changes in the terms of the employment contract, after which an additional agreement to the employment contract is concluded and a corresponding order is issued.

The manager also does not have the right to unilaterally change the conditions stipulated by the collective agreement. The terms of the collective agreement are changed in the manner established in the text of the document itself (Art.

44 Labor Code of the Russian Federation). A legal act containing labor law norms ceases to be valid due to the expiration of its validity period, the entry into force of another act of equal or higher legal force, or due to the cancellation of this act by an act of equal or higher legal force (Article 12 of the Labor Code of the Russian Federation). That is, in order to cancel a payment approved by a local act, the employer can issue a new document.

If the bonus was established by order of the manager and the document did not indicate the period during which the employee receives the bonus, then it is enough to simply issue an order to cancel the payments. This does not even require informing the employee.

It turns out that it is easier to establish some payments to an employee by order, since they will be easier to cancel. Deputy Chief Accountant of Stanko LLC Elena Topchiy: “Employment contracts and local regulations, as a rule, establish salaries and bonuses that the employer is guaranteed to be able or obliged to pay.

Bonuses, which remain at the discretion of the employer and depend on many factors, are easier to establish by order. Of course, if an employee’s salary is small and he is counting on a bonus, dissatisfaction if it is not awarded will be great.

However, there will be no violation, since incentive payments depend on many factors. For example, from the employee’s work, from the company’s revenue.

As for the bonuses established by law, the employer is obliged to pay them.

Order to cancel surcharge

0 We talked in ours about additional payments that can be accrued to employees in the form of compensation and incentive measures, and also provided a sample order for additional payment to employees.

In some cases, additional payments to employees are one-time in nature, and the order for their payment is the basis on which additional payments are accrued to employees. For example, an additional payment to the salary of an employee who was on sick leave or on a business trip. But in some cases, the surcharge order is valid for a certain period of time.

For example, when combining professions (positions), the employer’s order establishes both the fact of the combination and the amount of additional payment for the combination. The period during which the employee performs additional work and, accordingly, receives additional payment, is established by the employer with the written consent of the employee and is also reflected in this order (). At the same time, the employee has the right to refuse to perform additional work ahead of schedule, and the employer has the right to cancel the order to perform it ahead of schedule.

To do this, you just need to notify the other party in writing no later than 3 working days in advance. Accordingly, when the need for combination disappears, the employee will not be entitled to additional payment. The cancellation of the surcharge is usually formalized by order.

Such an order is drawn up if the combination is interrupted ahead of schedule. When the combination period specified in the initial order expires, there is no need to also draw up an order to remove the additional payment.

After all, the removal of additional responsibilities from an employee automatically entails the termination of additional payments. For an order to cancel the surcharge, we will provide a sample in our consultation. The employer decides for himself how to draw up an order to cancel the additional payment.

Usually it indicates the reason why the accrual of the surcharge is suspended, full name. and the position of employees for whom additional payments will no longer be made. When additional duties are removed from the employee, such an order simultaneously confirms that the combination is terminated and, accordingly, the additional payment is no longer accrued.

The order to withdraw additional payment from an employee must be familiarized to such employee against signature.

When canceling the additional payment for combining, the order (sample) may look like this:

Answer

As we understand from your question, we are talking about expanding service areas, increasing the volume of work determined by the employment contract, for which additional payment is provided (Article 60.2 of the Labor Code of the Russian Federation).

Accordingly, in this case, the employee must be notified in writing of the early termination of additional work no later than three working days in advance. If an employee wants to refuse to perform additional work early, he must also notify the employer in writing three working days in advance.

Further, early completion of additional work can be formalized by order ( see sample below

).

Details in the materials of the Personnel System:

An employee’s performance of work that is not part of his job duties can be documented in one of four ways:

The choice of option depends on the nature of the additional work and the frequency with which the employee must perform it. If an employee will have to engage in a new job for a certain time, then it is better to arrange an internal part-time job or a combination of professions (positions).

With an internal part-time job, the employee performs additional work in his free time from his main job (Article 60.1 and Part 1 of Article 282 of the Labor Code of the Russian Federation). To do this, the employer enters into a separate employment contract with the employee (Article 60.1 of the Labor Code of the Russian Federation).

Read more Sign a contract for military service in Ukraine

When combining professions, an employee does additional work during his regular working day. In this case, additional work is paid and is possible only with the written consent of the employee. Such rules are established in Part 1 of Article 60.2 of the Labor Code of the Russian Federation.

Expanding service areas and increasing the volume of work performed means performing, along with one’s main work stipulated by an employment contract, an additional volume of work in the same profession or position (Part 2 of Article 60.2 of the Labor Code of the Russian Federation).

In this case, the assignment of additional work to an employee for additional payment will be formalized by the employee and the employer signing an additional agreement to the employment contract, which will determine both the content and volume and duration of future work, as well as additional payment for its implementation (Articles 72, 151 of the Labor Code of the Russian Federation ).

Based on the additional agreement to the employment contract, issue an order (in any form) to assign the employee the appropriate work and establish additional payment. Submit a copy of the order to the accounting department for calculation and payment of additional payments to the employee.

It should also be remembered that information about combining professions, expanding service areas, increasing the volume of work, performing the duties of a temporarily absent employee without release from work specified in the employment contract is not entered into the employee’s work book and his personal card (Part 4 of Article 66 of the Labor Code RF, clause 4, 10 of the Rules approved by Decree of the Government of the Russian Federation dated April 16, 2003 No. 225, section 3 of the Instructions approved by Decree of the Ministry of Labor of Russia dated October 10, 2003 No. 69).

If the work is one-time and is not repeated for some time, and the employer is interested in the result, not the process, then it is better to conclude a civil contract. For more information about this agreement, see How to conclude a civil contract for the performance of work (provision of services) with a citizen.

Ivan Shklovets

, Deputy Head of the Federal Service for Labor and Employment

Early termination of combination

The employee has the right to refuse to perform additional work ahead of schedule, and the employer has the right to cancel the order to perform it ahead of schedule. The employee must be notified in writing of the early termination of work in a combination of professions (positions) no later than three working days in advance. If an employee wants to refuse to perform additional work early, he must also notify the employer in writing three working days in advance. This procedure is provided for in Part 4 of Article 60.2 of the Labor Code of the Russian Federation.

Ivan Shklovets

, Deputy Head of the Federal Service for Labor and Employment

Sample order form

Limited Liability Company "Alfa"

about cancellation of additional work

Moscow March 10, 2020

Due to production needs

- Cancel the order to manager V.V. ahead of schedule. Ivanov to perform additional work for the sales department manager on the terms of increasing the volume of work from March 11, 2020.

- The accounting department does not charge additional payment for increasing the volume of work V.V. Ivanov since 03/11/2015.

Reason: notification dated March 10, 2015

General Director V.A. Lviv

I have read the order:

Manager V.V. Ivanov

September 24, 2013

With respect and wishes for comfortable work, Svetlana Vartanova,

Order to cancel surcharges and allowances

Free consultation by phone: +7 (499) 495-49-41 / Customs law / Cancel personal bonus order Personal salary bonus - the justification for this payment must be reflected either in the employment contract or in the additional agreement to it.

It is also possible, although this option is rarely used for personal allowances, to include in the local acts of the enterprise a condition on the assignment of payment to a specific employee. We'll talk about how to properly justify the premium below. Personal bonuses to the basic salary How is a personal salary bonus calculated?

The procedure for organizing the payment of a personal allowance Memo for a personal allowance, sample Personal allowances to the basic official salary In Art.

129 of the Labor Code of the Russian Federation states that the salary system includes various types of allowances and additional payments, which in essence are compensatory or incentive payments. I order the Labor Code of the Russian Federation and paragraph 8 of the employment contract dated February 12, 2016 No. 189...”

- The clause states that the HR specialist must familiarize the employee with the order against signature.

- Instructing the responsible employee to organize work on payment of the bonus.

- The document is completed by affixing the signature of the head of the enterprise and the official seal.

- Determination of the person responsible for the execution of the provisions of the order.

- Next comes the point that a personal bonus is established to the official salary (indicating the amount of payment).

- The employee is familiarized with the order against his signature. Service memo for a personal allowance, sample Personal allowances can also be of a spontaneous nature, i.e., in fact, they are one-time bonuses. In this case, they are appointed at the will of management or on the basis of a memo from the worker’s immediate supervisor.

Contents Attention The motivation must show production or economic feasibility so that when audited by the tax service, such costs are legally charged to the cost price.

For example, you can write this: In order to stimulate the site personnel to fulfill the production program on time and reduce the number of defects in the 1st quarter of 2020, I ORDER:

- In case of violations of labor and production discipline by a site employee, personal additional payment in the month when the violation occurred shall not be paid.

- Control over the execution of the order is assigned to the chief accountant.

- Set the amount of personal additional payments to the site team for the 1st quarter of 2020 in accordance with Appendix 1.

How to cancel A personal allowance can also be removed at the request or memo of the immediate supervisor. The diagram shows the last option. The cancellation of the incentive payment also depends on how it was established. Payment in accordance with the employment contract If the payment is directly provided for by the employment contract or an additional agreement to it, it is not easy to cancel it. Important: Such cancellation is tantamount to changing the terms of the employment contract.