Formula for calculating the labor participation rate

To calculate the CTU, you need to use a system of established parameters, each of which is assigned its own “score”. The employee is assessed for each parameter, receiving a certain number of points for each in turn. The number of points is summed up.

To apply the formula, you also need to know the exact number of employees into whom the total participation will be divided. The calculation can be done like this:

KTU = (O / O1 + O2 +…+ Оn) x N

- KTU – labor participation coefficient;

- O – rating assigned to the employee whose participation rate is being calculated;

- О1 + О2 +…+ Оn – sum of points of all employees;

- N – number of team members.

https://youtu.be/Kf5vYMxIGaw

KTU at established tariffs

The labor participation coefficient is taken into account not only when organizing the payment of labor remuneration without tariffs. Another area of application of the CTU is the distribution of part of the labor remuneration fund, which is not included in the established tariffs.

Attention

The algorithm can be anything, the main thing is that it does not contradict the current provisions of the Labor Code and other legislative acts. IMPORTANT INFORMATION! No matter how the earnings are distributed, the amount received by each member of the team cannot be less than what is required according to the tariffs for such work performed within a specified period of time.

An example of remuneration calculation according to KTU

Let our conditional team have five workers engaged in making stools for a set time period. For the implementation of the plan, their team is entitled to payment of 1000 monetary units (let’s take a conditional value for calculations).

The first employee fully fulfilled the plan, complied with all standards, working the required number of working hours, that is, his KTU is equal to 1.

The second employee exceeded the norm by a quarter, the rest of the indicators are the same as the first. KTU will be 1.25.

The third employee fulfilled the quota, but due to his fault (failure to comply with the rules for working with equipment), the woodworking machine was broken, which forced the suspension of work. In addition, he was late for the start of the work day several times. Therefore, several points were deducted from him, and his CTU was 0.5.

The fourth employee fixed a breakdown in a woodworking machine; his qualifications allowed him to do this. He was given points for equipment maintenance; in addition, management noted the quality of his work, and his KTU turned out to be 1.6.

The fifth employee asked for time off on his last day of work. His work did not cause any complaints, but in fact he worked somewhat less than the others, so the KTU decreased to 0.65.

Now let’s calculate the share of each employee that he will receive with a non-tariff payment method, or the additional remuneration due as extra income, with an established “fixed” tariff.

The sum of all KTUs: 1 + 1.25 + 0.5 + 1.6 + 0.65 = 5.

With tariff-free payment, the total amount will be distributed as follows: 1000 / 5 = 200 (average share corresponding to a KTU unit). Then employees are entitled to:

- The 1st employee will receive 200 (account units);

- 2nd – 200 x 1.25 = 250;

- 3rd – 200 x 0.5 = total 100;

- 4th – 200 x 1.6 = 320;

- 5th – 200 x 0.65 = 130.

Thus, thanks to KTU, earnings were distributed unevenly, with some employees receiving significantly more than others. However, this is due to objective factors, and therefore will not cause a feeling of injustice and discontent in the team.

Calculation of the KTU value using the standard formula

Legislation allows the employer to develop its own system for calculating the labor costs, taking into account the specifics of the work of the entire organization. The most common formula by which the value of this multiplier is calculated is the following: final KTU = its base value (1) + increasing or decreasing indicators.

Thus, if there is no need to use evaluation criteria, then the employee is paid taking into account the basic value of the KTU. In other cases, if necessary, points are deducted when applying the reducing criterion. Conversely, points are added if an increasing criterion is used.

Example 1. Calculation of the amount of remuneration according to the KTU for construction team workers (tariff-free payment system)

The construction team consists of 6 people: A.V. Grigoriev, K.N. Linnik, V.V. Serpukh, A.N. Druzhin, L.M. Petrov, D.I. Kolosiev. All workers work at a construction site. Based on the results of the month’s work, the team was paid 30,000 rubles. (the amount taken for calculation is conditional). Based on the results, the degree of contribution of each worker was assessed through the CTU as follows:

- A.V. Grigoriev: 1 (completed and worked out everything).

- K. N. Linnik: 1, 5 (fulfilled the standards, did not violate anything and at the same time exceeded the norm by half).

- V.V. Serpukh: 0.5 (completed everything, but was late several times, therefore points were deducted from him).

- A. N. Druzhin: 1 (completed everything).

- L. M. Petrov: 0.5 (worked less than everyone else, asked for time off, but there are no complaints about his work).

- D.I. Kolosev: 1.5 (exceeded the norm by half).

Next, to distribute the payment (30,000 rubles), you should sum up all KTU (1+1.5+0.5+1+0.5+1.5=6) and find out the average value of the multiplier (30,000/6=5,000 ). You can then calculate the amount paid to each employee.

Features of application

This indicator shows the overall qualitative and quantitative assessment of the work of employees, specialists and management in an overall positive result, that is, in the intensity and productivity of work.

In the basic value, KTU is expressed as one whole unit or 100%. This contributes to the calculation of the average assessment of employee performance and relates directly to those employees of the general team who fulfilled the production plan for the reporting period, had no recorded violations of labor protection rules, and were not involved in disciplinary punishments.

The basic labor participation rate has the ability to decrease and increase depending on the indicators that influence it. Indicators reflect the contribution of one employee to the overall collective result.

This coefficient can be calculated based on the results of a monthly period. Indicators that have an impact on the KTU are taken into account daily for a complete and high-quality calculation.

The tariff is calculated based on the salary and time actually worked by the team, despite the labor participation coefficient established for the employee.

The following are not collective income and, accordingly, are not distributed with the help of the CTU:

- Additional payments for night work, harmful and difficult working conditions, overtime and management of a team or unit.

- Allowances for qualifications and work experience.

- Rewards related to inventions.

- Disability benefits or any other type of individual benefits.

At established tariffs

The labor participation coefficient can be used not only in non-tariff wage rates, but also taking into account the tariff salary. KTU can be used to divide the wage fund into parts. Additional payments that may be included in the calculation of the indicator at established tariffs:

- bonus for exceeding the plan by the team;

- saving money related to the wage fund;

- one-time benefit when revaluing temporary standards.

Distribution of funds

Based on the way in which the form of remuneration, both individual and collective, is laid down in the enterprise’s Charter, as well as on the orders of the immediate supervisor, the use of the indicator of collective labor participation looks like this:

- Tariff-free earnings accrual system. In this case, the total amount earned by the entire team is distributed by calculating the average income for each employee, then the resulting result is adjusted using the labor participation indicator.

- Remuneration made in excess of established standards. Each of the employees of the team receives a salary depending on the tariff distribution rate, and the funds that are on the balance are transferred to the employees’ accounts taking into account the coefficient.

Where not to use

The indicator of distribution of funds from labor participation is applicable only in the case when labor activity is carried out collectively. According to the Regulations for the application of this coefficient, it is applied only in the area that is regulated. The participation fee does not include:

- Compensation to an employee for harmful working conditions.

- Cash surcharges above the norm.

- Additional payments for going to work on weekends and non-working holidays, at night and in the evening.

- Type of cash benefits.

Who installs

The Labor Code does not establish a procedure for calculating wages taking into account the participation rate; it is independently determined by the enterprise staff. The procedure for calculating such funds may differ depending on working conditions and the type of industry, but in no way should contradict the regulatory framework.

Earnings are distributed in a variety of ways, but it should be remembered that funds in the form of wages for each employee cannot be less than the established tariff rate (salary).

When KTU cannot be used

The qualification factor cannot be used in many forms of compensation, since it is an indicator of the personal effectiveness of a particular employee. The main condition for the use of CTU is the teamwork of labor. This means that all members of the work team perform identical work.

At the same time, this numerical factor is fundamentally unable to be used when calculating certain types of remuneration:

- compensation for work in dangerous and harmful production conditions;

- monetary compensation for overtime hours;

- payments for going out on the night shift;

- allowances for qualifications and length of service;

- additional payments for working on holidays and weekends;

- bonuses for professional discoveries and improvement proposals;

- benefits of all kinds.

https://youtu.be/Snri98CaCCg

Calculation of cash payments for all of the listed types is carried out according to general rules, and KTU in no way can influence this calculation procedure.

What is KTU and how is it determined

The concept of “labor participation rate” is not directly spelled out in labor legislation. Because of this, each organization calculates it differently, and this sometimes leads to violations by the employer. KTU is defined as the numerical coefficient of participation of a particular employee in the activities of the group, as well as the share of remuneration that this employee should receive. However, the final result depends on collective efforts, so the final salary depends not on one employee, but on the team.

The principle of calculation according to KTU is most often applied to various production specialties, as well as to construction teams

It is important to take this into account. that KTU can only be accrued as an incentive in addition to the basic salary specified in the contract

An employer has no right to reduce an employee's salary. unless there are special reasons for this, such as changes in working hours and the nature of the work performed.

This indicator applies to all kinds of incentive payments, bonuses and allowances with which the team is rewarded for the results achieved. The final salary cannot be less than the amount that was specified in the employment contract.

Group (collective) wages

Group wage systems, reflecting the concerted efforts of a group of a work team, a structural unit, or an organization as a whole, rather than an individual worker. The most commonly used are mixed salary systems, where one part of the employee’s remuneration, usually a permanent salary, depends on his individual characteristics, and the other, usually a variable one, depends on the results of the group’s work. With direct team piecework wages, wages are paid not to an individual performer of the work, but to the team at a single piece rate for the entire volume of high-quality work performed, and then earnings are distributed among team members in proportion to the level of the tariff rate and the actual time worked by each team member. Collective team piecework wages are used for assembly, repair and installation of large units, operation of railway rolling stock, in the mining industries, etc. Team piecework wages can be used in cases where the labor of workers is functionally divided, i.e. Time production standards in this case, groups of workers are established not for each worker, but for the entire team.

This is important to know: Labor accounting and payment

The piecework wage system is used when it is possible to take into account quantitative indicators of the result of labor and normalize it by establishing production standards, time standards, and standardized production tasks. Labor standards - production standards, time, service, number - are established for workers in accordance with the achieved level of equipment, technology, organization of production and labor. Under the piecework system, workers are paid at piecework rates in accordance with the quantity of products produced, work performed and services rendered. According to the article of the Labor Code of the Russian Federation, when an employee with piecework wages performs work of various qualifications, his work is paid according to the rates of the work he performs. With piecework wages, prices are determined based on established grades of work, salary rates and time standards.

Direct piecework and indirect piecework payment systems

With a non-tariff wage system, wages are determined as the employee’s share in the payroll fund. In modern conditions, three forms of remuneration can be distinguished: piecework, time-based and mixed. Piecework wages - payment in accordance with the quantity of products produced. Its types:. Under the direct piece-rate wage system, labor is paid at rates per unit of output. Under an indirect piecework system, the size of a worker’s earnings is directly dependent on the results of the labor of the workers he serves. Rk-sd - indirect piece rate rate of the serviced worker, paid according to the indirect piece rate system, rub.

WATCH THE VIDEO ON THE TOPIC: Time-based form of remuneration - Payroll calculation

PIECE WAGE SYSTEMS

In modern production, collective forms of organization and remuneration are often used, which is determined both by the technological maintenance of large units, automated lines or the organizational need for a group of workers to jointly perform a complete set of interrelated works, as well as by the desire to materially interest workers in the results of collective activity. In domestic practice, the most common form of collective group organization of labor is production teams. In this regard, the concepts of collective and team payment are often used interchangeably. The most widespread is the collective brigade piecework wage system. Its use requires compliance with the following conditions:. With this payment system, the total piecework earnings of the team of the ZBR brigade is determined as the sum of the products of the brigade prices P i for individual types of production work by the volume of work performed by the brigade, the quantity of manufactured products in the accepted planning accounting units O i:. Methods for determining brigade prices depend on the content and nature of the work performed, methods of their rationing and accounting. When performing assembly, installation, and repair work, consisting of operations of varying complexity, the brigade piece rate per unit of work can be calculated using the formula: If the production of final products involves the performance of a number of works for which independent prices are established, the complex team price per unit of final product is calculated as follows:

Payroll accounting in construction

Electronic signature in 1 hour for: trading. A simple piece-rate system involves payment for the quantity of products produced and the volume of work or services performed based on the piece-rate rates accepted by the company. Such prices are determined per unit of product of one type or another. The piece rate is RUB. The company's worker Ivanov produced finished products in the following quantities: Piece prices may vary and increase or decrease depending on the quality of the products produced.

When servicing the unit by a group of workers with different placement qualifications, a comprehensive piece rate is determined by the formula. N exp is the production rate per unit for the same period for which the vehicle is taken into account.

Features of calculating KTU

Let’s imagine a team for which the following parameters for assessing its work have been developed:

- complexity of the work (on a three-point scale: the most difficult work - 3 points, average - 2 points, easy - 1 point);

- time load (maximum – 3 points, average – 2 points, minimum – 1 point);

- work on equipment (1 point for each type);

- equipment maintenance (2 points for each case);

- quality (1 point for compliance and 1 point for control);

- responsibility for results (up to 3 points, may be deducted for violations).

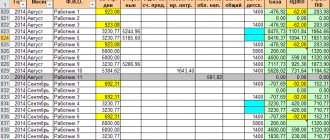

The Excel computer program is convenient for calculating KTU, where all indicators are visible in tabular form, and the last column displays the total for each employee.

How is KTU calculated? basic principles

- Compliance with labor discipline standards. If an employee is late for work and other violations, the KTU for him is reduced, and this will lead to a decrease in the final salary.

- Meeting deadlines for completing assignments. If they are completed on time or ahead of schedule, the CTU increases.

- Quality of work performed. It is determined by indicators for each specific type of activity; the employer must develop clear criteria for the quality of work performed so that employees clearly understand what result needs to be achieved.

- Performing overtime tasks. If workers show increased zeal and perform tasks beyond the plan, this is also rewarded according to the KTU.

- The desire to improve qualifications and grow professional skills. The employer is directly interested in the professional growth of employees; their desire to improve their skills should be financially encouraged.

- Mentorship of young employees. participation in mentoring programs. Encouraging mentors improves the training of young staff, which is beneficial for any enterprise, so such work must be encouraged.

Passivity, failure to meet deadlines, a decrease in the quality and pace of work, and disinterest in achieving results by the team can lead to a decrease in the employee’s performance level. In practice, the coefficient is often reduced for lateness, unnecessary breaks, absenteeism and other violations; this is one of the effective disciplinary measures.

9.4. Remuneration in teams

I work in construction, the work of employees is paid taking into account the KTU labor participation coefficient, applied in accordance with the regulations on remuneration. The basis for calculating wages and bonuses is data from financial statements and operational accounting, that is, time sheets and orders. This earnings are formed from the tariff salaries of full-time employees. The basic level of the KTU is set for all workers to be the same, equal to one. The coefficient of labor participation in the current performance results of the division is used in a non-tariff wage system. On its basis, the assessment of the employee’s share in the overall results of the work of the organization or its division and, accordingly, in the wage fund is adjusted.

This is important to know: The law on new rules for paying wages on a card: what is changing

VIDEO ON THE TOPIC: Filin Sergey. Beware of piecework wages!

The team form of remuneration is used when both the team as a whole and each of its members in particular are interested in achieving the best final results of work. Work in teams can be paid using both intermittent and time-based forms of wages. The piece-rate form of remuneration is used in areas and types of work in which the workers themselves significantly influence the quantitative and qualitative results of labor. In this case, the following must be ensured: Bonuses are given to team members for fulfilling and exceeding established production targets, technically sound standards, improving product quality, saving raw materials, materials, etc. When paid on a time basis, team members are rewarded for completing standardized tasks, service standards, compliance with established quality indicators, etc. Total earnings The piecework wage team consists of the following parts:. In addition, the team’s total earnings are not included, but personal allowances are established for highly qualified workers engaged in particularly responsible work for high professionalism. The second option for calculating the collective piece rate is based on calculating the labor intensity of the work performed. In this case, the collective piece rate is determined by the formula:.

Criteria for increasing and decreasing the indicator

The indicator is established when the production tasks of the enterprise are fulfilled without violations of labor discipline and exactly on time by the manager.

There are several criteria for increasing and decreasing the coefficient.

Raising:

- The team takes the initiative to master advanced technologies and workplaces, which significantly reduces labor costs (+0.2 +0.4).

- Increasing the intensity and efficiency of the team to reduce the established deadlines for completing the task (+0.2 +0.4).

- An employee’s performance of complex procedures, initiative to combine several professions, or assistance in work activities to other employees of this team (+0.1 +0.3).

- Carrying out activities that do not correspond to the qualification level, but performing tasks that are an order of magnitude higher (+0.1 +.0.3).

Downgrades:

- The assigned task was not completed on time (-0.2 -0.4).

- Marriage in the process of work, which determines the possibility of high labor costs (-0.2 -0.4).

- Failure to complete the order (-0.1 -0.3).

- Violation of the rules of operation and operation of mechanized production and equipment (-0.2 -0.5).

- Damage or loss of working tools (-0.3 -0.5).

- Activities that do not comply with safety and health regulations (-0 -0.5).

- Disciplinary violations of the production regime (-0.2 -0.5).

- Missed workday (0).

- Disciplinary violation of the customer's rules (-0 -0.5).

How funds are distributed

The legislative framework does not have clear and transparent definitions of how payments under the CTU are established. Calculations are made by the enterprises themselves, in the most acceptable ways, but it is important to know that this point does not contradict the law.

For a certain category of qualified employees, there should not be a downward change in wages when using KTU. That is, the employee must at least receive his tariff.

KTU is also used:

- With the introduction of a tariff-free system. The payment amount is divided by the number of employees working together. In this case, the average coefficient is one, and is adjusted on the basic basis of the KTU.

- Distribution of the amount of wages over the tariff. Employees receive wages in excess of tariff accruals, and then distribute the remaining amount to all employees.