Employee bonuses are awarded as follows: types and sources

The reason for paying an employee an incentive such as a bonus may be:

- achievements of a labor nature, accomplished both by the work collective as a whole and by a specific employee personally;

- events that are not directly related to work activity, but caused by the intention to further reward the employee (for example, in connection with an anniversary or holiday).

For the reasons of the first group, the employer has the unconditional right to include bonuses in the salary structure (Article 129 of the Labor Code of the Russian Federation), and therefore take them into account as part of the payment for labor, i.e., attributing the accrued amounts of bonuses to the corresponding analytical expenses, which will reduce profit base.

It is quite difficult to include bonuses accrued on the grounds of the second group in your salary. The Ministry of Finance of Russia (letters dated 07/09/2014 No. 03-03-06/1/33167, dated 04/24/2013 No. 03-03-06/1/14283) insists on accounting for expenses on them at the expense of net profit.

Depending on the nature of the payments, bonuses can be:

- systematic (regular), the accrual and payment of which is carried out in compliance with the established frequency (once a month, quarter, year or other period of time);

- one-time (irregular), accrued and paid from time to time when an appropriate reason for payment arises.

Bonuses included in the salary structure may have both frequency patterns. But among them, as a rule, systematically paid incentives predominate. Bonuses not related to work achievements are usually one-time.

ConsultantPlus experts have prepared step-by-step instructions for assigning and processing bonuses to employees:

If you do not have access to the K+ system, get a trial online access for free.

Despite the presence of different sources for paying bonuses, bonuses will in any case constitute the employee’s income. And this income will need to be subject to personal income tax in the usual manner (clause 1 of article 210 of the Tax Code of the Russian Federation) and insurance contributions (clause 1 of article 420 of the Tax Code of the Russian Federation, clause 1 of article 20.1 of the law “On compulsory social insurance against accidents...” dated July 24, 1998 No. 125-FZ). Moreover, expenses for the purpose of calculating income tax can include not only those contributions that are accrued for bonuses included in the salary structure, but also those related to bonuses not related to work activities (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated April 2, 2010 No. 03-03-06/1/220).

Read more about the taxation of bonuses in the material “What taxes and contributions are employee bonuses subject to?”

According to which document is the bonus procedure determined?

The employer must develop all aspects of the bonus system used by him himself, establishing them in an internal regulatory act (Article 135 of the Labor Code of the Russian Federation). This act can be created in the form of a separate document devoted only to bonus issues (provisions on bonuses, incentives, incentive payments). But it is also permissible to include the rules for calculating bonuses as an integral part in the texts of other internal documents devoted to issues of labor law:

- wage regulations;

- collective agreement;

- labor agreement.

A specially developed separate document (or part of a document devoted to issues of labor law) is convenient for reflecting the bonus payment procedure applied to the majority of members of the workforce. Its presence makes it possible not to specify in detail the rules for calculating bonuses in the employment agreement with each of the employees, but to provide in this agreement only a reference to the details of the corresponding document on the bonus procedure. Thus, the development of a normative act on bonuses makes it possible to include detailed rules for calculating this incentive in employment contracts only with those persons whose bonuses are paid on an individual basis.

The presence of an internal document on bonuses is mandatory:

- to include bonuses in the salary structure (Article 135 of the Labor Code of the Russian Federation);

- taking into account bonuses when calculating average earnings (Article 139 of the Labor Code of the Russian Federation).

The inclusion of bonuses in the salary structure makes them mandatory for payment when the conditions under which the remuneration should be accrued are met. At the same time, it is allowed to reflect in the bonus document the rules for paying bonuses that are not related to labor achievements.

The regulations on bonuses should cover issues related to:

- all types of remuneration applied by the employer;

- the conditions under which each type of bonus is accrued;

- frequency of accrual of incentive payments;

- the circle of persons entitled to each type of bonus;

- indicators by which the right of a particular employee to the corresponding type of remuneration is assessed;

- grounds that make it impossible to receive a bonus;

- systems for assessing indicators reflecting the right to receive an incentive payment, which makes it possible to convert the assessment of these indicators into ruble equivalent;

- the process of reviewing the results of assessing the labor contribution made by each employee;

- a procedure that allows you to challenge the results of the distribution of the bonus.

Starting from 2020, it is allowed not to develop internal acts devoted to issues of labor law and micro-enterprises (Article 309.2 of the Labor Code of the Russian Federation). However, in such a situation, the employer will have to spell out in detail all the bonus rules in each of the employment agreements, and the employment agreements themselves will have to be drawn up in a certain form. The form that must be used for these purposes is approved by Decree of the Government of the Russian Federation dated August 27, 2016 No. 858.

To learn how information about the accrued bonus can be included in an employment agreement, read the article “How to write a bonus in an employment contract - an example.”

What can be used to calculate bonuses for employees when calculating salaries?

The process of calculating the bonus amount depends on:

- from the base taken as the basis of calculation;

- from the algorithm that determines the sequence of calculation of the base itself or its constituent parts;

- from the restrictions set for taking into account.

The calculation can be based on:

- fixed amount of remuneration;

- salary;

- actual accrued earnings;

- the sum of bonus indicators expressed in ruble equivalent, used to assess the employee’s contribution to the labor process.

All conditions affecting the calculation must be stipulated in the regulatory act on bonuses.

The accrual of a bonus in a fixed amount can occur in different ways depending on the conditions for recording the time of actual work in the bonus period, fixed in the procedure for calculating the bonus from the accrual base:

- The amount of bonuses does not depend in any way on the actual time worked, i.e., remuneration will always be accrued, even if the employee did not work at all in the period under review.

- When calculating the payment amount, the time of actual work in any of the ways established by the regulatory document is taken into account. For example, this amount is calculated:

- in proportion to the number of days (calendar or working) actually worked in the period;

- without accruing it for that month of the period that turned out to be not fully worked (for a quarterly bonus, for example, in such a situation you will need to apply one of the following coefficients: 1/3 or 2/3).

By setting salary or actual earnings as the calculation base, they immediately determine, expressed as a percentage, the amount of the share that will be the bonus accrued from the corresponding base.

A salary-based remuneration is essentially similar to a fixed-amount bonus and may or may not be dependent in the same way on the amount of time actually worked during the bonus period. It differs from a premium accrued in a fixed amount:

- mandatory application of the regional coefficient to the accrued amount if it occurs in the region of work;

- the need to choose a method for calculating bonuses for periods of salary changes, which could be, for example, establishing the obligation to take into account when calculating bonuses the updated salary amount: from the beginning of the period for which the calculation is made;

- from the period following the salary change;

- in the period of change, taking into account the proportion of the number of days (calendar or working) attributable to each salary.

For more information about the features of a bonus calculated from salary, read the material “How to calculate an employee’s bonus based on salary?”

For a bonus determined as a share of actual earnings, the issue of accounting or not accounting for time actually worked in the period is unimportant, since this time is already taken into account at the time of salary calculation. But the bonus rules will have to reflect the choice of the algorithm used for calculating actual earnings. You can calculate it, for example:

- summing up all actual wages accrued for the period, regardless of which component of the payment for labor it relates to;

- by determining (for a bonus period exceeding a month) the average monthly actual salary, including in its calculation all payments accrued for the period, regardless of their relationship to one or another component of payment for labor, and dividing the amount of these payments by the number of months in bonus period.

For the bonus base, established as the sum of bonus indicators expressed in ruble equivalent, which serve to assess the employee’s contribution to the labor process, the algorithm for calculating this base is itself simple and is determined as the sum of the ruble values of the corresponding indicators. But the calculation of the value corresponding to each of the indicators will depend on the evaluation system for this particular indicator and on the specific formula used to calculate its ruble value. Since both evaluation systems and formulas may turn out to be different, including those involving the use of a system of increasing (or decreasing) coefficients, the calculation of such a base will ultimately turn out to be difficult, although it will most realistically reflect the employee’s contribution to the results of the work of the entire team for the period.

Accountant's Directory

In September 2013, an employee of an enterprise with a 5-day working week with a working day of 8 hours worked 4 hours overtime on one working day. The employee’s salary is determined based on the established hourly tariff rate of 10 rubles. 38 kop. The duration of normal working hours in September 2013 was 168 hours, which the employee fully worked.

3) to employees receiving a monthly salary - in the amount of no less than a single hourly or daily rate in excess of the salary, if work on a holiday was carried out within the monthly norm of working hours, and in the amount of at least double the hourly or daily rate in excess of the salary, if the work was carried out in excess of the monthly norm.

Interesting read: How to emigrate to Canada from Russia

How to calculate bonuses for additional pay and overtime

Additional payments and overtime are payments designed to compensate for the employee’s performance of labor functions under special working conditions. Their payment in all aspects is regulated by the provisions of the Labor Code of the Russian Federation. They are included in full in the salary, forming its compensation part (Article 129 of the Labor Code of the Russian Federation).

The question of calculating bonuses for additional payments and overtime can only arise if the basis for calculating the amount of bonuses is the actual earnings accrued for the period. Despite the fact that this earnings can, as already indicated above, be determined in different ways, it is calculated by taking into account all amounts accrued during the bonus period that form the salary, including additional payments and overtime.

If the bonus is set to be calculated from the salary, then additional payments and overtime will not be taken into account when calculating bonuses, since the calculation base here, by definition, forms only part of the accrued salary. When a bonus is awarded in a fixed amount or based on the sum of bonus indicators estimated in ruble equivalent, then it is not tied to salary at all and, accordingly, does not depend on it in any way.

To find out whether there are any restrictions on the amount of bonus paid, read the article “What can be the size of an employee’s bonus?”

If the Ural coefficient is not calculated

Not all employees decide about the Ural coefficient for their employer. Some due to not having full information, and many due to fear of losing their job. The employer is not always interested in additional personnel costs and often ignores its obligation to calculate such a coefficient. In addition, many citizens are convinced that this coefficient applies only to those employees who work in government organizations, and commercial organizations can charge it at their discretion. However, workers in the Ural District must not only know their rights, but also demand that they be respected.

Important! The Ural coefficient should be calculated not only on the salary, but on the employee’s bonus.

Often, the employer indicates in the labor contract with a note that the salary includes the Ural coefficient. An employment contract concluded with employees working in areas in which regional coefficients are established (including the Ural) must separately highlight the salary and the coefficient separately. This requirement is due to the fact that the coefficient is applied to employee bonuses and additional payments, and not just to salary. And in case of an entry that will contain a salary that includes a coefficient, its accrual, for example, for a bonus is not provided.

If an organization made such a mistake and introduced a clause on the amount of wages, which also includes Ural wages, then it is no longer possible to correct it retroactively. For all components of wages that were paid to employees, the regional coefficient must be calculated and paid.

Important! In the employment contract, the salary and the Ural coefficient must be indicated separately. Otherwise, the employee has the right to demand that a coefficient be calculated on the specified salary.

How to calculate a bonus taking into account the regional coefficient and northern bonuses

The regional coefficient and the northern bonus are additional payments of a compensatory nature, taking into account the fact of working in special climatic conditions. They also represent part of the salary that must be paid. The difference between them is that the regional coefficient is paid from the first day of work, and the right to receive the northern bonus and its increase depends on the length of work experience in the relevant area. The size of the coefficient and premium for each region is established by the Government of the Russian Federation, but at the regional level it is possible to increase these values (Articles 316, 317 of the Labor Code of the Russian Federation, Articles 10, 11 of the Law of the Russian Federation “On State Guarantees and Compensations...” dated 02/19/1993 No. 4520- 1).

It is necessary to increase the amount of the accrued bonus at the expense of the regional coefficient when bonuses are calculated from the salary and the corresponding coefficient is in force in the region. In all other cases, the issue of applying the coefficient remains unregulated by law. On the one hand, there is no need to charge a premium taking it into account, because:

- it is already taken into account in the earnings actually accrued for the period;

- the accrual of a bonus in a fixed amount or from the sum of bonus indicators estimated in ruble equivalent is not tied to the salary, which requires an increase by the corresponding coefficient.

On the other hand, the current legislation does not establish the procedure for applying the regional coefficient to bonuses. Therefore, the rules for bonuses can provide for their accrual using this coefficient in all situations for calculating incentive payments included in wages. The justification here is that the bonus is included in the salary.

The procedure for calculating northern bonuses is regulated by an instruction approved by Order of the Ministry of Labor of the RSFSR dated November 22, 1990 No. 2. It contains a ban on calculating bonuses for the following bonus payments (clause 19 of the instructions):

- one-time remuneration for length of service;

- remuneration based on the results of work for the year;

- incentives of a one-time nature and not provided for by the remuneration system.

At the same time, the instructions imply the possibility of calculating bonuses based on the results of work for a quarter, season or year, but with the condition that in order to calculate the monthly amount of the bonus, bonuses will be distributed over the months of the corresponding period in proportion to the time worked.

By the decision of the Supreme Court of the Russian Federation dated December 1, 2015 No. AKPI15-1253, the provisions of clause 19 of the instructions prohibiting the accrual of bonuses on remunerations paid for length of service and based on the results of work for the year were declared invalid as contrary to the current Labor Code of the Russian Federation. Thus, the northern bonus should be calculated on all bonus payments provided for in the remuneration system.

What you need to know ↑

Each employee should, if possible, analyze in as much detail as possible all the most important points relating to the calculation and payment of wages.

This will allow you to avoid conflict situations and many other troubles at work.

According to the Labor Code, when calculating wages for work in difficult climatic or other conditions, an increasing factor must be used.

Moreover, it is applied in some cases not only in relation to wages, but also to various bonuses received by the employee.

To understand the legislation governing this issue, you need to familiarize yourself with the following questions:

- basic concepts;

- types of bonuses;

- the legislative framework.

Basic Concepts

To simplify your understanding of the legislation in force regarding increasing coefficients, it is worth familiarizing yourself with the following basic concepts:

- bonus;

- multiplying factor;

- harmful/dangerous working conditions.

In labor legislation, a bonus is understood as some kind of monetary incentive for the successful completion of a complex and important task.

At the same time, a bonus can also act as a stimulating factor for a more responsible attitude to work.

There are many different types of bonuses, but not all require a special coefficient to be applied.

The term increasing coefficient refers to a certain amount of wages, below which the employer has no right to pay wages to his employee.

This point is regulated by Part 2 of Article No. 146 of the Labor Code of the Russian Federation, as well as Article No. 148 of the Labor Code of the Russian Federation. The designated sections of legislation provide the most accurate information regarding this term.

Increasing coefficients should be applied in cases where the working conditions of workers were found to be harmful.

At the same time, in order to understand which working conditions are unfavorable, you should refer to Government Decree No. 870 of November 20, 2008.

Another document that reveals this issue and has indisputable legal force is Order of the Ministry of Health and Social Development No. 46N dated February 16, 2009.

At the same time, the very fact of the presence of harmful conditions must be reflected in the employment contract.

Types of bonuses

Bonuses at any enterprise can be divided into the following main categories:

- regular bonuses;

- one-time bonuses;

- quarterly;

- at the end of the year.

Regular payments are understood as payments, the very fact of which is indicated in the previously concluded employment contract.

At the same time, the factors themselves influencing the possibility of making these payments must also be specified in the agreement between the employee and the employer.

Each case of payment of the premium itself is purely individual, which is why, in order to avoid the emergence of various controversial issues, it is necessary to thoroughly study the legislative framework.

Bonuses are often paid for particularly important tasks. Moreover, it can be anything, as long as it brings some serious benefit to the employer.

This is interesting: Review of Article 18 of the Law “On Protection of Consumer Rights” - return of goods

It is he who determines which task can be considered especially important. Moreover, in most cases, the very fact of payment of this incentive is agreed upon in advance.

The legislative framework

The legislative framework that is mandatory for study and implementation includes the following:

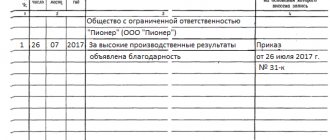

- Art. No. 191 of the Labor Code of the Russian Federation - incentives for work activity;

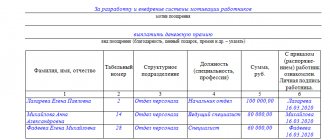

- Resolution of the State Statistics Committee No. 1 of 01/05/04 - the procedure for unified reporting, there is a sample order for employee bonuses;

- Federal Law No. 90-FZ of June 30, 2006;

- Law No. 4520-1 of 02/19/93 (as amended on 12/31/14) – on state guarantees for persons living and working in the Far North, as well as regions equivalent to it;

- Part 2 of Article No. 57 of the Labor Code of the Russian Federation;

- Part 2 of Article No. 135 of the Labor Code of the Russian Federation;

- Part 1, Article No. 8 of the Labor Code of the Russian Federation;

- Government Decree No. 216 of April 17, 2006

When forming a bonus, as well as its subsequent payment, it is imperative to be guided by the legal acts indicated above.

This will avoid the emergence of various types of conflicts with employees. It should be remembered that a bonus not specified in the employment contract is always paid only at the discretion and decision of the employer. This point is especially important to know.

The procedure for paying bonuses to employees according to current salary rules

After the changes made to the Labor Code of the Russian Federation, from October 3, 2016, the terms of payment of not only vacation pay (Article 136 of the Labor Code of the Russian Federation) and payment upon dismissal (Article 140 of the Labor Code of the Russian Federation), but also wages were legally limited.

The calculation of wages for the past month must now be carried out within 15 calendar days following this month (Article 136 of the Labor Code of the Russian Federation). Accordingly, taking into account the preservation of the wording in the Labor Code of the Russian Federation requiring payment of wages every half month, the timing of advance payments has also become more specific. Now it must be issued in the second half of the month for which it was accrued, maintaining a 2-week interval between the advance and salary.

However, questions remain regarding the payment of bonuses. Although the bonus provided by the wage system is a salary, it is not always calculated at the same frequency as wages. Therefore, the Ministry of Labor of Russia (information dated September 21, 2016, posted on the ministry’s website) recommended that the regulatory act on bonuses reflect an indication of both the month of bonus accrual and the month (or specific date) of bonus payment.

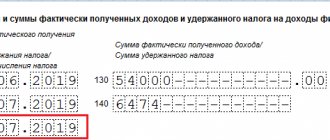

Specifying a payment month means that the premium must be paid no later than the 15th day of the corresponding month. If only the month of accrual is indicated, then the deadline for payment of bonuses will be the 15th day of the month following the month of their accrual (letter of the Ministry of Labor of Russia dated August 23, 2016 No. 14-1/B-800).

For more information about the procedure for paying bonuses under the Labor Code of the Russian Federation, read this article.

Payments based on average earnings

RK is a legally defined value for each region by which the employee’s monthly salary is multiplied.

Is the regional coefficient calculated for sick leave? Since the calculation of disability benefits is calculated on the basis of the actually paid salary, which already includes an increasing multiplier, the RK is not applied when paying for sick leave. However, there are a number of situations in which the RK can still be additionally accrued:

- The employee's insurance period at the time of provision of sick leave is no more than six months.

- The average monthly salary of an employee for the previous two years is less than the legally established minimum wage.

- The employee was not paid wages for two years (due to lack of work activity).

- A violation of the employee’s prescribed treatment regimen was discovered.

- The insured event occurred due to the employee’s drunken state.

Now you need to deal with the question of whether the regional coefficient is calculated on vacation pay. In the case of annual or educational leave, the situation is similar to the calculation of disability benefits. Since they are calculated based on average earnings, the preferential RK has already been accrued and included in the upcoming payment.

Accordingly, re-accrual of the regional indicator for vacation pay will lead to a violation of the law.

Results

The bonus calculation procedure is determined by many factors. First of all, these are bonus rules developed by the employer independently. Among these rules, the description of the features of the applied remuneration and the establishment of algorithms for calculating the base for calculating the amount of bonuses of each type are of primary importance. When calculating bonuses, regional coefficients established in the region and northern bonuses, if the employee is entitled to them, must be taken into account.

Sources: Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.