What does a healthcare worker's salary consist of?

The system of accruals and payments to medical workers, including remuneration of medical workers working in educational institutions, has changed significantly.

Now wages are calculated according to the rules of contractual payment. The order of operation of the system is determined by uniform recommendations for the establishment of remuneration systems for state and municipal employees, approved by the decision of the Russian Tripartite Commission (Minutes No. 11 of December 22, 2017). The basis of the new system is the conclusion of effective contracts with health workers. They specify what working conditions are determined for the employee, what duties are assigned to the employee, how the salaries of health workers are calculated taking into account the assessment of the effectiveness of their work (Order of the Ministry of Labor No. 167n dated April 26, 2013). The standard form of an effective contract and the procedure for registering labor relations are given in the recommendations of the Ministry of Labor.

What other additional payments may there be, besides incentives?

https://www.youtube.com/watch?v=ytadvertiseru

Types of surcharges:

- payment according to the “road map” for health workers. As part of this state program, a constant increase in wages for doctors, mid-level and junior staff is planned. As a result, the salary should be from 100 to 200% of the average income in the region;

- payment for medical examinations for health workers (2019). Specialists receive additional payment for additional medical examination of public sector employees who work in schools, medical organizations, sports and research institutions. The rule does not apply to family doctors, local therapists and nurses working with them;

- payments under the Zemsky Doctor program. For doctors performing their duties in the village, compensation of 1 million rubles is provided. Conditions: age - not older than 50 years, higher education and completed internship in the field, as well as readiness to work in one locality for five years.

Tags: point, payment, legal, quantity, basis, stimulate

« Previous entry

Areas of training for nurses of the highest category

Currently, the only way to obtain the highest category of nursing qualifications is through special courses offered by nursing education. At the same time, as a rule, distance learning is practiced, with a break from work during classes.

The courses offer training in two stages:

- the first cycle studies lasted 3 weeks and ended with obtaining a certificate on the theoretical basis of nursing with the possibility of continuing education;

- in the 2nd stage, practical classes are conducted, after which they receive documents confirming the assignment of a category in the field of nursing.

The courses include additional classes in anatomy, physiology, pharmacology, pedagogy, sociology, basic nursing, health promotion, neurology, palliative care, emergency medicine, surgical nursing, geriatric nursing and others.

After graduation and receipt of documents confirming the assignment of the category, you receive the right to continue working. In the case of junior nurses who have graduated from medical institutions and are already working, separation from the work process is often the main reason not to improve their skills with additional courses and seminars.

Therefore, many nurses remain in their previous position, which undoubtedly interferes with their career ladder and reduces the chances of high earnings. And in our realities, this plays a very important role. A monthly internship requires both additional financial and time costs. In prestigious Moscow medical research institutions, on the basis of a limited right to practice issued by the regional council of nurses and midwives, many people can practice at the same time, which reduces the effectiveness of training.

To expand their professional qualifications, nurses have the opportunity to undergo special training in the following areas:

- nursing anesthesia and intensive care;

- surgical care;

- diabetes;

- epidemiological care;

- geriatric care;

- cardiology;

- neurological care with dialysis;

- neonatal care;

- neurological care;

- oncology care;

- operational care for the elderly;

- palliative care;

- pediatric care;

- psychiatric care;

- urgent Care;

- family care;

- teaching and education;

- health care;

- conservative care;

- health promotion and health education;

- organization and management.

For the above specialization trainings, a nurse who meets the following requirements can join:

- has practice in government agencies;

- has at least two years of experience in the profession;

- was admitted to specialization by the qualification commission.

Specialization training ends with passing an exam, which takes the form of a test consisting of 180 questions. The test lasts three hours. Having received a positive result, the nurse receives the title of the highest category in this field. In addition, nurses can also attend specialized, training and qualification courses.

Tariff salary (rate) by wage category for employees of medical institutions

Healthcare institutions that are financed from the budget independently, within the allocated budgetary allocations, determine the types and amounts of bonuses, additional payments and other incentive payments, taking into account the fact that the qualifications of employees and the complexity of the work they perform are taken into account in the amounts of salaries (rates) that are determined based on the Unified Tariff Schedule.

In the case of attracting employees of other institutions (divisions) for consultations, examinations, provision of medical care and other work to the institutions (divisions) specified in Appendix No. 2 to Order of the Ministry of Health No. 377, payment for their labor is made for the time actually worked, taking into account the increase for work in special conditions.

We recommend reading: Sample application for personal income tax refund 2020 for treatment

How much is required and what does the premium depend on?

The amount of the bonus for the qualification category directly depends on the position of the medical employee and is calculated from the established salary. Affects the size of payments and the amount of funding allocated to the institution for the reporting period.

Each medical organization has the opportunity to independently determine interest rates and the amount of payments for the category, adhering to the recommendations of higher ministries and departments. All compensation and incentive bonuses for health workers, their amount, the procedure for calculation and payment are prescribed in the local standards of each healthcare organization - the collective agreement and regulations on remuneration. The same information for each employee is enshrined in employment agreements or effective contracts.

The table shows the recommended premium values.

| Category | Interest rates for health workers per category |

| Higher | 30 % |

| First | 20 % |

| Second | 15 % |

Employee Scorecard

Based on the fulfillment of the performance criteria defined above, incentive payments are distributed among the company's employees. To record the degree of their implementation, a score sheet is used. The form of the document itself is not regulated by any legislative acts, but is necessarily prescribed in local regulatory documentation, for example, in the Regulations on incentive payments.

As practice shows, it is convenient to design a Sheet in a tabular form. Here the serial number and name of the criterion itself, its description are recorded. The following indicates the rating scale that is used by the employee to evaluate his performance according to each of the criteria. The document is personally signed by the employee and his supervisor.

How to get a bonus

Payment for a category to health workers begins automatically after it is assigned. You just need to write a statement. The basis for assigning a category for all public sector employees is certification for assignment of a category, which can be sanctioned by the manager or the employee himself.

To obtain a qualification category, a medical worker must undergo various reporting procedures to demonstrate his professional knowledge, skills and abilities to members of the certification commission. The certification commission consists of independent regional experts in the field of healthcare. The certification category is assigned by a general decision of the commission members after completing professional tasks.

After receiving the decision to assign a category, the employee applies to the manager with an application to determine the appropriate incentive payment for him and attaches the title documents. Promotion is made starting from the second category, then the first and then the highest are assigned. For each promotion, you must undergo a new certification.

The category has a validity period, upon completion of which it must either be confirmed or upgraded. At the same time, medical specialists have the right to early promotion to the next level.

Incentive additional payment for the professional category is mandatory! They can't not pay.

The obligation to assign payments is prescribed in the collective agreement of the institution and in the labor agreement concluded between the employer and employee. If the employment documents do not indicate the clause on its accrual, then the employer is still obliged to pay the premium. Violation of the rule results in administrative liability and penalties. The employee also has the right to appeal the non-payment of incentive amounts in court.

Are there any exceptions

Cash incentives do not apply to the following categories of health workers:

- participants of the “Health” program providing obstetrics and newborn care services: pediatricians, local therapists and nurses;

- doctors providing high-tech care.

Payments can be canceled:

- if there is a disciplinary sanction during the reporting period;

- if the doctor received money from patients for medical care, which should be provided free of charge.

We suggest you familiarize yourself with How to change the owner in an electronic insurance policy

Special requirements are imposed on the heads of the institution: they are not entitled to incentives when fulfilling a government order below 90%, if violations of fire safety rules, etc. are revealed.

Internship in the EU

The qualifications of nurses who have graduated from medical schools or medical vocational schools are currently not recognized in the European Union, but only in Russia. However, they can obtain the right to practice in the EU by conducting research.

The nurses they have have a high school diploma and a nursing diploma from:

- 5-year medical school;

- 2-year medical vocational school;

- 2.5-year medical college;

- 3-year medical vocational school.

The duration of study at the Europe research centers depends on the year of primary school and the type of school completed and is formed as follows:

- for graduates of 5-year medical institutes who began their studies in the 1990/91 academic year or later, studies last for a minimum of three semesters or 1633 hours;

- for graduates of 5-year medical universities who began their studies before the 1990/91 academic year, study lasts a minimum of five semesters or 3000 hours;

- for graduates of 2-year medical vocational schools, study at research centers lasts at least three semesters or 2410 hours;

- for graduates of 2.5-year medical vocational schools, study lasts at least two semesters or 1,984 hours;

- For graduates of 3-year medical schools, studies last for at least two semesters.

Taxation of surcharge

Compensation, incentives, bonuses and one-time additional payments and allowances for medical workers are included in the organization’s expenses for remuneration (Article 255 of the Tax Code of the Russian Federation). Consequently, the categorical surcharge is taken into account as the taxpayer’s income and is subject to personal income tax according to the general rule (clause 1 of Article 210 of the Tax Code of the Russian Federation).

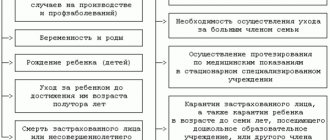

This rule also applies to insurance premiums, since the objects of social insurance are all payments accrued to payers of insurance premiums under labor and civil law agreements (clause 1 of Article 7 212-FZ).

Payment system and accounting for remuneration of medical workers

Incentive bonuses for employees of healthcare institutions, within the allocated budget allocations, can be established for the use of scientific achievements and advanced labor methods in their work, high achievements in work, performance of particularly important or urgent work (for the period of their implementation), as well as tension in work.

If an employee replaces a colleague who is sick or has gone on vacation, that is, performs other official (professional) duties, then the health worker is entitled to an additional payment. The amount of the additional payment must not only be specified in the collective agreement, but also agreed upon with health workers.