Line 080, in accordance with its name, reflects the amount of tax not withheld by the tax agent.

Everything seems clear and understandable. But the debate around filling out this line is fueled by some accounting publications, which recommend that line 080 reflect the calculated personal income tax, which cannot be withheld until the end of the year.

Paragraph 4 of Article 226 of the Tax Code of the Russian Federation instructs tax agents to withhold the accrued amount of tax directly from the taxpayer’s income upon actual payment. Literally from this point it follows: if the income is not paid, then the tax could not be withheld. Therefore, in accordance with the name of the field, the amount of this tax must be reflected in line 080.

6-NDFL: how to check the correctness of the calculation for the first half of 2018

It is necessary to clarify that directly in the Tax Code of the Russian Federation and in the order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ-7-11 / [email protected] , which approved the form 6-NDFL and the procedure for filling it out, does not contain specific instructions on what exact amounts tax must be reflected in line 080 of the first section. There is only a line title.

Letters from the Ministry of Finance or the Federal Tax Service in this context can be regarded as documents of an explanatory and recommendatory nature, and not regulatory legal acts.

Often adherents of decisions on the possibility of tax withholding refer to the following letters:

But in letter 2, among the mistakes made when filling out form 6-NDFL, only non-compliance with the recommendations of paragraph 5 of letter 1 is indicated. And letter 1 does not indicate the exclusive requirement to reflect in column 080 only the amount of tax not withheld by the tax agent from income received by individuals in in kind and in the form of material benefits in the absence of payment of other income in cash, but it is said that these amounts should be reflected in line 080.

The question arises of what to do with the amounts of tax calculated on wages (and its components) when wages have not been paid.

It is assumed that the deadline for submitting the 6-NDFL report - a month after the end of the reporting quarter - provides sufficient time to pay wages and withhold personal income tax in accordance with the law.

In particular, in accordance with Part 6 of Art. 136 of the Labor Code of the Russian Federation, the timing of salary payments must be set in such a way that employees receive wages at least every half month. And the tax department, as you know, does not send out recommendations for circumventing violations of the law and preparing a report, provided that the deadlines for paying wages are violated.

We would like to remind accountants how ungrateful it can be to correct the value in this column based on the hypothetical expectation that tax will certainly be withheld because the salary will definitely be paid.

Not necessary. The contractors did not pay and the company has no money, the director bought a house in Miami and there was not enough to pay the employees. In the end, some employee himself can give up everything, go wherever he can and not give the employer the opportunity to pay him a salary.

Results

Line 090 in 6-NDFL is intended to include in the report information on tax refunds to individual payers on the grounds set out in Art. 231 Tax Code of the Russian Federation. The nuances of forming the line are determined by the filling procedure approved by the Federal Tax Service and certain aspects of Chapter 23 of the Tax Code of the Russian Federation.

On line 130 of the 6-NDFL calculation, indicate the generalized amount of income actually received by individuals on the date indicated on line 100. Indicate the income without deductions and taking into account personal income tax.

Page 080 of the 6-NDFL report is intended to reflect personal income tax, which the tax agent failed to withhold from the income of an individual. Such situations are possible when the “physicist” received a gift or other income in kind.

The algorithm for generating line 020 in 6-NDFL is determined by Order No. ММВ-7-11/ [email protected] and the requirements of the Tax Code of the Russian Federation. All other explanations by authorized persons and bodies must comply with the principles established by these regulations.

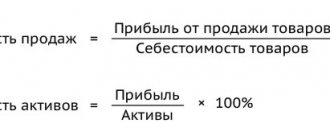

Reflection of the calculated personal income tax in the 6-NDFL report is a process that requires knowledge of the nuances of the legislation. At the same time, the existing basic formulas for calculating report indicators will help you independently check the correctness of your accounting data, without waiting for a request from the tax office.

The article “Attention! These are common mistakes in 6-NDFL.”

Line 070 in the 6-NDFL report is located in section 1 and is used to reflect the total amount of personal income tax withheld for the reporting period. This amount is calculated by summing the values that fell into line 140 of Section 2 for the entire reporting period, adjusting it for situations that arise at the border of periods (when payment of income and tax withholding fall into one period, and the deadline for paying personal income tax falls into another).

Benefits of line 080

There is such a concept in accounting, the amount of tax not withheld. This formulation is used to identify the non-countable part. Report 6-NDFL, line 080, filling out will sometimes be considered an error. It only needs to be filled out in the following cases:

- Income in kind, received not in cash equivalent, is determined and analyzed.

Previously, when the country's economy was experiencing a significant crisis, salaries were paid in goods and food to employees. A system of coupons and cards was used. The proximity to subsistence farming was obvious and frightening. Now this form of mutual settlements evokes more positive emotions. Prizes are given and bonuses are given in the form of goods and products. Taxes that were not deducted during the reporting period must be indicated in paragraph 080 of the first section of the form.

- Cash income is determined and analyzed, but the tax portion is not deducted.

This situation may arise when funds are partially transferred for work performed, in a situation where payment is delayed, or for other reasons. The tax amount has not been fully deducted. Thanks to the presence of paragraph 080 of form 6-NDFL, the Federal Tax Service will be able to see the figure in question.

- The employee owes the company some amount of money and did not return it at the time of submitting the report to the tax office.

- According to a court decision in which a deduction was not indicated, any amount is paid - in full, without tax withholding, detailed analysis, calculation in 6-NDFL.

Line 080 6-personal income tax: what amounts to include – Case

It is known that line 080 in the 6-NDFL declaration is not filled out very often, however, almost every tax agent is faced with entering data into it one way or another. To understand the specifics of filling it out, you will need to carefully focus on the rules stipulated by law. Otherwise, you will have to correct errors, which may result in real liability.

When information is entered into line 080 of the 6-NDFL declaration

Line 080 stores data on the amount of unwithheld tax. They are presented in the form of a cumulative total throughout the year.

However, many accountants cannot figure out what kind of unwithheld tax they are talking about. Therefore, in practice, the line records all tax not withheld from income received by individuals in the reporting quarter. And this is a fairly common misconception.

Line 080 records the tax that has not yet been deducted from the income received by the employee from the organization in kind, if the salary was not paid to him in cash.

The tax base in this case is considered to be the cost of goods or services at average prices prevailing on the market. Thus, an employee can take such material benefits from an LLC or individual entrepreneur as:

- salary based on manufactured products;

- payment for vacation;

- tuition fees, advanced training;

- payment of utility bills;

- souvenirs and gifts.

In addition, an individual has the opportunity to receive other benefits from working in a company:

- reduction in interest rates on borrowed funds;

- use of goods and services from partner organizations;

- purchasing securities at prices below market prices.

It is not possible to withhold taxes from this type of income, so the tax agent (LLC or individual entrepreneur) withholds them while the individual receives any cash payments. In this case, it is important to keep in mind that it is permissible to withhold an amount not exceeding 50% of cash income. But sometimes situations arise when the tax remains unwithheld:

- the amount of payments in cash equivalent is small, it is not enough to withhold personal income tax;

- the individual does not receive any cash payments from the organization.

It is for such cases that line 080 exists.

Line 080 of Form 6-NDFL records the entire amount of tax that was not withheld by the tax agent.

Entering data into line 080 of the 6-NDFL declaration

Line 080 includes the amount of unwithheld tax from cash payments received by employees for the entire reporting period.

Example of filling line 080

Rodeo LLC has five employees, their total income for the second quarter is 450,000 rubles. One person should receive a tax deduction of 1,400 rubles. per month. The amount for the quarter will be 4,200 rubles.

In addition, at the end of the quarter, the company made 2 gifts to those of its employees who are currently on well-deserved rest, at a price of 10,000 rubles. every. According to the law, the amount of tax-free gifts is 4,000 rubles, and tax must be paid on the remaining value.

However, it is impossible to collect tax on the gift, and former employees no longer receive wages. In this case, section 1 of form 6-NDFL will look like this:

- line 020 - 470,000 rub. — reflects employee income for the second quarter and the cost of donated televisions (450,000 + 20,000);

- line 030 - 12,200 rub. — indicates the tax deduction for the quarter and the non-taxable part of the gift (4,000 + 4,000 + 4,200);

- line 040 - 59,514 rub. — here the accrued personal income tax from salary and gift is entered (470,000 – 12,200) * 13%;

- line 070 – 57,954 rub. — amount of personal income tax withheld (59,514 – 1,560);

- line 080 - 1,560 rub. - reflects the tax that the company cannot withhold (20,000 – 8,000) * 13%.

Lines left empty must be filled with zeros.

An example of filling out line 080 of form 6-NDFL with numbers in Rodeo LLC, correctly filling out the lines

When line 080 is empty

In some situations, line 080 of form 6-NDFL remains blank.

Table: allowed cases of empty line

After this, all lines from the hundredth to the one hundred and fortieth section of the second section must contain dashes.

Subsequent actions after filling out line 080 of the 6-NDFL declaration

After entering the data, the organization must notify the local authorities of the Federal Tax Service and explain for what reasons the withholding of personal income tax is impossible. At the same time, an individual who has received any type of income with tax not deducted from it is also notified. A special notification must be sent in the form of a 2-NDFL certificate indicating sign 2.

The period is determined by the tax period established by law (Article 216 of the Tax Code of the Russian Federation) - this is a calendar year. This means that tax that was not withheld in 2020 is reported until the end of January 2020.

If the time limits specified by law are violated, the enterprise is punished with a fine of 200 rubles. for each document not submitted on time (Article 126 of the Tax Code of the Russian Federation).

How to fix the error when filling out line 080

An error made in 6-NDFL can be corrected in two ways.

Table: error correction options

An updated calculation will be submitted as soon as possible after incorrect data is found. This document will require:

- When preparing the title page of the declaration, be sure to indicate the correction number;

- In the lines with previously indicated incorrect amounts, leave the correct indicators.

The entire procedure for entering data is not particularly difficult; the main thing is to clarify the calculation of taxes. Otherwise, incorrect amounts may appear.

It is important to carefully check the records and correct errors made when filling out form 6-NDFL

What is the liability for a mistake?

For submitting false information in the 6-NDFL declaration, tax officials have the right to fine the company in the amount of 500 rubles. (Article 126.1 of the Tax Code of the Russian Federation). The chance to avoid punishment can only arise if the error is quickly detected and corrected - before it catches the inspector’s eye.

: when filling out the eightieth line of the 6-NDFL calculation

Line 080 of section 1 of the 6-NDFL declaration most often raises questions when entering information into it. To understand the specifics of filling it out, the tax agent needs to understand exactly why it exists.

It should be remembered that the eightieth line should reflect the total amount of tax not withheld by the tax agent, cumulatively from the beginning of the tax period.

At the same time, there are very different situations in which tax cannot be withheld immediately.

Source:

Line 080 in 6-NDFL: when and how to fill out

A little more than a year has passed since the Federal Tax Service of the Russian Federation provided the new reporting form, but even now it is not clear to everyone what is used for and when to fill out line 080 6-NDFL - Amount of calculated tax.

Application of line 080

The purpose of this line is to indicate the amount and reason why the withholding agent was unable to collect from the individual. But do not think that with its help you can avoid the routine procedure for withholding personal income tax. In reality, every tax agent must remember his obligations, which means that he is obliged to carry out tax withholding without delay.

It is worth noting that taxes that are in limbo and transferred from other reporting quarters cannot be entered into this line.

In situations where an individual receives income presented in kind or material, the first may be the cost of goods or work transferred to the individual by a tax agent.

For example, this could be payment for education or vacation for an individual, or a gift. Under the guise of material benefit, it appears to be receiving profit from the acquisition of securities at a significantly reduced cost, saving money on paying interest for the use of borrowed funds of the company.

Thus, there are only three situations when filling out line 080 in 6-NDFL is a necessary procedure:

- A small amount of income that does not allow full personal income tax withholding.

- During the indicated period, the employee did not actually receive any income from the tax agent.

- The individual received payment in kind, for example, in the form of a gift.

Procedure for filling a line

Line 80 is filled in with the amount not subject to withholding by the tax agent. The filling procedure occurs with a cumulative total, which occurs at the beginning of the year.

https://youtu.be/aC2tKzbc2mQ

It is worth noting the fact that when filling it out, you cannot indicate a tax that was not withheld from the individual’s income paid in the reporting quarter. This also applies to other types of taxes transferred from quarters.

For example, if wages were accrued in September, but the procedure for withholding tax on this amount was carried out in October, the tax is reflected in line 020.

The calculation of personal income tax from this amount is entered in line 040. In this situation, it turns out that these types of amounts are not required to be entered in line 080. It should record amounts only for income received in non-tax deductible form.

Delay in information may result in a fine

It is necessary not only to fill out documents on time, but also to inform both the individual and the Federal Tax Service inspection about the impossibility of withholding tax. Information about problems with tax withholding should be submitted to the Federal Tax Service before the beginning of March of the following year. This information is provided in Certificate 2-NDFL.

This document indicates feature 2. If this certificate is submitted after the deadline allocated for this, the tax agent faces a fine of 200 rubles.

This penalty is also provided for any other certificate that was provided late.

What to do if there is an error in line 080

If you find incorrect data in a line regarding unwithheld personal income tax or the reflection of its amount, you must provide an updated calculation as soon as possible, adhering to certain rules. When filling out the 6-NDFL title page, you must enter an adjustment number. And in those lines where amounts with errors were previously indicated, you need to enter the correct amounts.

Despite the fact that line 080 is rarely filled out, almost every tax agent has to deal with filling it out. And although the filling out procedure itself is not difficult, nuances in tax calculations can provoke the appearance of amounts with errors, which means incorrect filling out of the line itself.

Source:

Line 080 in form 6-NDFL - when is it filled out in 2020 (2020)?

- Application of line 080 in 6-NDFL in 2020 - 2020

- Line 080 in 6-NDFL: what does it include?

- What to indicate in line 080 for a rolling salary?

- Examples of filling out line 080 in section 1 of form 6-NDFL

What does the information from column 080 tell you?

The eightieth column was included in the form to inform the inspectorate about the fact that it was impossible to withhold part of the taxes and reflect the amount in question. The total amount of unwithheld tax for the selected period is indicated. Only for this you need column 080.

Tax inspectors will be able to operate with this data when compiling statistics and internal reports of their department. If the amount will increase in the future and this is known in advance, you must still indicate the figure corresponding to the state of affairs at the time of submitting the form. Whether the situation will remain as predicted, one can only guess. The new figure, taking into account changes, growth or decrease, is indicated in the next reporting period. In this case, 6 personal income taxes will be accepted; filling out line 080 will not end with adjusting the entire document.

Having studied the meaning of each line of 6-NDFL

In plain sight in 6-NDFL, section 1, line 080. A person who independently fills out the report, if the tax inspectors have not provided a comment on the inaccuracies, will only be able to detect an error in it after some time. It is advisable to study the form before receiving a notification from the Federal Tax Service about the need for clarification. Figure out what line 080 in 6 personal income tax means, other points, whether they raise a question or not. There are certain deadlines for providing clarification. They must be respected. For some, this time may not be enough; the help of a specialist will be useful.

Information about some columns may seem superfluous. Even if this is true, it is worth spending time on them and analyzing their meaning. This will help you fill out the form faster in the future, without errors.

Is it necessary to submit a zero report 6-NDFL

The preparation of a zero 6-NDFL report is provided for at the legislative level.

The instructions for filling out the form state that such a report should include the following pages:

- A page with a title page, which is filled out in accordance with current requirements.

- The sheet on which Section 1 is located, where zeros are entered in the columns.

- A sheet containing Section 2, where the columns reflect zero indicators.

In practice, Sections 1 and 2 are placed on the same page.

The procedure for filling out 6-NDFL takes into account situations where you don’t even need to submit a zero report, these include:

- If the activity was not carried out in a company or individual entrepreneur.

- In the absence of accruals and payments from employees for the reporting period, even in cases of their official employment.

- If the company does not have hired personnel.

These points have been discussed more than once in explanatory letters issued by tax authorities. Even if the company does not submit a zero report to the Federal Tax Service, it is recommended to draw up and submit letters to the inspector explaining the reasons why the 6-NDFL form is not drawn up and submitted for the period of time in question. In the absence of this letter, the tax office will be able to impose penalties on the business entity.

It must also be remembered that the instructions for filling out 6-NDFL include the need to fill out and submit this report when the only employee is the head of the company. In this case, information is entered only in relation to him.

Attention: if you ignore this obligation, the company may be fined for failure to submit a report. An exemption from submitting a report can be obtained if the company's management does not receive any remuneration during the reporting period.

When you can’t do without a clarifying report

Employees of an enterprise rarely receive a salary at the end of the month they work. At the beginning or middle, in the third decade - a classic case. The tax is carried forward to the next month. It is easy to assume that line 080 reflects it. But this is a mistake, which is confirmed by letter of the Federal Tax Service No. BS-4-11/9194 dated 05.24.16. Indeed, the deduction is deferred in time, postponed to the next month, but this does not mean that this information must be indicated on line 080. There is item 020 for income, 040 for providing information about the tax that needs to be withheld in personal income tax. Line 080 in 6-NDFL remains blank.

Annual and quarterly reports are filled out according to the same rules. The number in 070 may not coincide with the one in 040. Line 080 in 6 personal income tax, when filled out in 2020, will contain information for 2018.

Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/450 dated October 14, 2020 helps to understand the meaning of line 080 of form 6-NDFL and all other lines. From this document it follows that it would be a mistake to enter information about different employees individually, indicating several numbers simultaneously. One overall figure is always reflected. In addition to the fact that it is necessary to send a clarifying form to the Federal Tax Service, if the information is indicated in the wrong column or there is another inaccuracy, it is mandatory to send a message about the impossibility of withholding tax to all interested parties (Tax Code of the Russian Federation, Article 226, clause 5).

Actions of the tax agent after registration of 6-NDFL with completed column 080

To fill out line 080, you must correctly determine the relevance of a specific amount. However, the reporting process does not end with the preparation of the 6-NDFL report with filling out the column in question. The employer must prepare and send to the fiscal structure a notice of the impossibility of withholding the amount of personal income tax. Such an obligation is fixed in Art. 226 Tax Code of the Russian Federation. Such notices are intended for fiscal representatives and all individuals to whom income was paid throughout the year, but personal income tax was not withheld.

Within the framework of this procedure, there are the following nuances:

- for this notification, you should use a unified form - you should issue a certificate in form 2-NDFL, which was approved by Order of the Federal Tax Service of the Russian Federation No. ММВ [email protected] dated 10/02/2018;

- in certificate 2-NDFL, indicate item 2, and in the fifth section, fill out the column reserved for recording unwithheld income tax;

- the notice in question should be sent to the fiscal structure on time - no later than March 1 of the year following the reporting year. That is, for 2020, such documentation must be submitted no later than 03/01/2020. This period is also established by Art. 226 Tax Code of the Russian Federation.

If the 2-NDFL certificate is not provided to tax officers on time, they have the right to impose the following sanctions on the company:

- for a manager, the fine will be from 300 to 500 rubles. on the basis of Art. 15.6 Code of Administrative Offenses of the Russian Federation;

- for an enterprise the fine will be 200 rubles. for each notification provided untimely, on the basis of Art. 126 of the Tax Code of the Russian Federation.

Sending a message about the impossibility of withholding tax

If there is a tax portion that is not withheld, employees of the Federal Tax Service and individuals whose profits are reflected in the completed report must be informed about this. Whether it is necessary to send an additional letter from the Federal Tax Service or whether the sent reports are automatically included in the notification - another unclear point.

The following documents help clarify the situation:

- letter of the Federal Tax Service of the Russian Federation dated November 16, 2016 No. BS-4-11/21695;

- order dated October 30, 2015 No. ММВ-7-11/485 on approval of the new 2-NDFL form.

The last part of reporting with the presence of income from which tax has not been withheld is completed by sending 2-NDFL with sign 1. It is recommended to do this before the first of April of the new year. This requirement is given in the letter of the Federal Tax Service No. BS-4-11/5443, 03/30/2016 and in the letter of the Ministry of Finance No. 03-04-06/61283, 12/01/2014. Failure to comply with the requirements may result in penalties in accordance with the Code of Administrative Offenses and the Tax Code.

Subsequent actions of the tax agent

Line 080 filled out in the annual report 6-NDFL will require one more action from the tax agent - prepare and send a message about the impossibility of withholding personal income tax (clause 5 of Article 226 of the Tax Code of the Russian Federation).

These messages are sent:

- tax authorities;

- to all individuals who were paid income during the year from which personal income tax was not withheld (letter of the Federal Tax Service of the Russian Federation dated November 16, 2016 No. BS-4-11 / [email protected] ).

When performing this duty, you must adhere to the following rules:

- for the message, use a special form - to do this, issue a certificate of income of an individual in form 2-NDFL (approved by order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11 / [email protected] );

- in the certificate of form 2-NDFL, enter the number 2 in the “Sign” field and in section 5, fill in the line intended to reflect unwithheld personal income tax;

- do not be late with the message - it must be sent to the specified addresses no later than March 1 after the end of the calendar year (clause 5 of Article 226 of the Tax Code of the Russian Federation).

2-NDFL with sign 2 for 2020 must be sent no later than 03/02/2020, because 03/01/2020 - Sunday. For a sample form, see here.

And do not forget that the Federal Tax Service and the Ministry of Finance recommend duplicating 2-NDFL certificates with sign 2, but with sign 1 at the same time - no later than March 1 of the next year.

Attention! Tax officials compare the indicators of forms 2-NDFL and 6-NDFL. Find out what the amount of line 080 should be in ConsultantPlus by getting trial access to the system for free.

How the deadlines for submitting 2-NDFL and 6-NDFL have changed can be found here.

If you fail to send messages on time, tax authorities may punish:

- manager - a fine of 300 to 500 rubles. (Article 15.6 of the Administrative Code);

- company - a fine of 200 rubles. for each overdue message (Article 126 of the Tax Code of the Russian Federation).

Item 080 is not filled in

Information about in what cases line 080 is filled out in 6-NDFL sometimes does not help clarify the situation. It’s easier to figure out what information should be reflected in this column by remembering the cases when its field remains empty.

Line 080 remains blank in strictly defined cases:

- all taxes are withheld;

- no payments were made from which in fact it is impossible to deduct tax;

- tax-free payments were made.

If we are talking about this kind of financial turnover, you can ignore field 080. There is no withholding tax.

If an error was made in 6-NDFL, line 080, what is included there could not be correctly determined or understood at another point, it is advisable to send a clarifying report as soon as possible to reflect reliable data.

Deliberate concealment of information and falsification must be punished by law. When an accident is to blame, one of the figures is distorted, an unwithheld tax deduction is included in the total amount, column 080 in 6-NDFL is filled out incorrectly, it is enough to eliminate the ambiguity and submit the correct information. This can be done on your own initiative. If the inspector accidentally accepted an incorrect report, the error will still be noticeable in the quarterly or annual report.

Subsequent actions after filling out line 080 of the 6 personal income tax declaration

If the calculation for the year is submitted with completed page 080 in 6 of the personal income tax, the employer is charged with one more obligation. In accordance with the law, the tax agent is required to report this fact to the Federal Tax Service of the Russian Federation at the place of reporting and to the individual from whom personal income tax cannot be withheld.

But the provision of such information is carried out according to certain rules:

- The information is reflected in the 2-NDFL certificate form.

- When filling out this form, you must enter code “2” in the “Attribute” column and fill out the field that reflects the corresponding amount.

- Completed copies of the document must be sent to the recipients no later than 01.03. year of provision of reporting information for the past period.

Due to the fact that in 2020 March 1st falls on a day off, information must be provided no later than the first working day of the specified month.

How to fix the error when filling out line 080

If an error was made in line 080 when preparing 6 personal income tax reports, or the information was reflected incorrectly, then you need to submit an updated calculation to the tax office. In this case, the serial number of the correction must be indicated on the title page (if there were no other clarifications, then the code “002” is entered accordingly). In the field in which incorrect data was entered, you must provide correct information.

Error correction options

In addition to submitting a clarification on line 080 in 6 personal income tax, the option of correcting an error in the half-year report is allowed if unwithheld tax was entered in the field from the salary carried over to the next month. In this case, it is enough to transfer the amount from column 080 to field 070 (withheld personal income tax).

What is the liability for a mistake?

If the tax agent managed to independently discover the error and submit an updated calculation, then he will be able to avoid liability measures. Otherwise, for providing reports containing incorrect information, including those under page 080, a fine of 500 rubles is imposed on the employer. If there is a repeated violation, the manager will face sanctions.

Application of line 080 in 6-NDFL in 2020 - 2020

The 6-NDFL calculation in its 1st section contains line 080. This line shows the amounts of personal income tax that the tax agent did not withhold from the individual.

It would seem that everything is elementary: the tax was not withheld and we indicate it in the above line. But in reality it turns out that not everything is so simple.

Firstly, for what reasons may personal income tax not be withheld? And which of these reasons oblige us to indicate the amount in line 080?

Thus, there are nuances that you need to be aware of when filling out line 080 in 6-NDFL.

The company is obliged to calculate and withhold personal income tax if an individual receives income from this organization. For example, salaries, gifts, payment for trainings and courses, reimbursement of fitness costs, as well as material benefits. An organization can withhold tax only when there is something to withhold.

Thus, it becomes clear that the amount of tax not withheld should be indicated in line 080 6-NDFL:

- due to the absence or insufficient amount of income of an individual to withhold tax from him;

- if it is impossible to maintain it throughout the reporting period.

Only when these two conditions are detected at the same time is line 080 filled.

IMPORTANT! When submitting the annual 6-NDFL with completed line 080, you must also provide information to the Federal Tax Service in form 2-NDFL with sign 2 for all individuals for whom tax was not withheld.

Null line 080 and padding errors

Line "080" should not contain any data in the following cases:

- If the tax agent managed to withhold income tax from all income of individuals.

- Throughout the year, no payments were made to individuals at all.

- When paying amounts not subject to personal income tax.

If the tax authorities have discovered an error in the indicators of line “080” of the 6-NDFL report (incorrect reflection of the amount or formatting of the line), it is necessary to provide an updated calculation of 6-NDFL, in which the error will be corrected. In this case, in the Title Page, in the “Adjustment Code” line, you will need to put the corresponding number.

https://youtu.be/aOUuS4yimpo

Line 080 in 6-NDFL: what does it include?

Let's figure out how line 080 6-NDFL is filled out and what is included there.

In practice, the following combinations of circumstances most often occur, forcing employers to fill out line 080 in Section 1 of Section 6-NDFL:

- income was issued in kind to an individual who has no income in the organization (or the income is insufficient to withhold personal income tax);

- a material benefit has arisen for an employee who has no income in the organization (or the income is insufficient to withhold personal income tax).

In accordance with Art. 131 of the Labor Code of the Russian Federation, wages to an employee can be paid up to 20% in kind. In most cases, these are gifts, payment for tuition, food, fitness, etc. Another type of income is considered to be material benefits that arise when employees use privileges provided by the employer. For example, loans on preferential terms or purchasing securities at a reduced cost. Such income is subject to personal income tax.

IMPORTANT! Material benefits are taxed at a rate of 35%.

Tax on both material benefits and in-kind income is deducted from the individual’s immediate remuneration. And if there is no income and is not expected, then the amount of calculated but not withheld personal income tax is indicated in line 080 in 6-NDFL (letter of the Federal Tax Service of the Russian Federation dated July 19, 2016 No. BS-4-11/12975).

IMPORTANT! The amount of tax withheld in this way cannot be more than 50% of the monetary reward. But it is possible to deduct the tax in subsequent quarters.

It turns out that line 080 6-NDFL contains the tax:

- not withheld for objective reasons in the reporting period;

- calculated on an accrual basis;

- for all individuals whose tax was not withheld.

6-NDFL line 080: how to fill out in 1C

Form 6-NDFL entered our lives, receiving along the way a million curses from accountants and a million comments from tax authorities about the rules for filling it out. But passions and disputes do not subside. One of the points of constant doubt was line 080. We tell you how and why line 080 is filled out in “1C: Salary and Personnel Management 8” edition 3.

Line 080, in accordance with its name, reflects the amount of tax not withheld by the tax agent. Everything seems clear and understandable. But the debate around filling out this line is fueled by some accounting publications, which recommend that line 080 reflect the calculated personal income tax, which cannot be withheld until the end of the year.

At the same time, none of them takes upon themselves the responsibility to clarify which article of the Tax Code of the Russian Federation supports predictors. What can be included in the words “it will be impossible to hold it until the end of the year”? There are no proposals in the Tax Code to tell fortunes about what will happen by the end of the year.

Paragraph 4 of Article 226 of the Tax Code of the Russian Federation instructs tax agents to withhold the accrued amount of tax directly from the taxpayer’s income upon actual payment. Literally from this point it follows: if the income is not paid, then the tax could not be withheld. Therefore, in accordance with the name of the field, the amount of this tax must be reflected in line 080.

What to indicate on line 080 for a rolling salary

Often, a month's wages are paid only in the next month within the period specified in the collective agreement. And this is an absolutely normal situation. There should not be any confusion.

But accountants, afraid to provide false information to the Federal Tax Service, deliberately indicate in line 080 6-NDFL with the salary accrued in the last month of the quarter, which was paid to employees only in the next month. After all, at the end of the quarter, personal income tax was not withheld, since the moment of tax withholding is considered to be payment of wages.

But this is a trap. In this case, line 080 in 6-NDFL remains untouched. This is the opinion of the tax authorities (letter of the Federal Tax Service of the Russian Federation dated May 16, 2016 No. BS-4-11/8609).

This is explained by the fact that the organization’s obligation to withhold tax arises not in the month of salary accrual, but in the next month, with the direct payment of funds to employees.

If different reporting periods

As a general rule, the tax agent is obliged to transfer the tax amount no later than the day following the day the income is paid. An exception is made only for temporary disability benefits (including benefits for caring for a sick child) and vacation pay. Personal income tax withheld from these payments must be transferred no later than the last day of the month in which they were paid (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Therefore, if, for example, the salary for March 2020 is paid in April, accordingly, personal income tax will be withheld and transferred in April. In this regard, in Section 1, the amount of accrued income will be reflected in Form 6-NDFL for the first quarter, and in Section 2 this operation will be reflected only for direct payment of wages to employees, that is, in the Calculation in Form 6-NDFL for the first half of 2020 ( letter of the Federal Tax Service of Russia dated February 25, 2016 No. BS-4-11/ [email protected] ).

Let's look at what dates should be indicated in this case when filling out 6-NDFL with an example.

EXAMPLE 1. Wages for March were paid to employees on April 5, and personal income tax was transferred on April 6. The operation is reflected in Section 1 of the Calculation in Form 6-NDFL for the 1st quarter, while the tax agent does not reflect the operation in Section 2 for the 1st quarter of 2020. This operation will be reflected when directly paying wages to employees, that is, in the Calculation in Form 6- Personal income tax for the first half of 2020

Solution

Also see "