Administration of insurance premiums to the Federal Tax Service in 2019 - transfer

On January 15, 2020, the President approved Decree No. 13 “On Additional...” (hereinafter referred to as Decree No. 13), which contained instructions for the Government of the Russian Federation to submit to the State Duma, by May 1, 2020, a bill conferring powers on the Federal Tax Service to administer insurance premiums (hereinafter also referred to as – SV), paid to the Social Insurance Fund, Pension Fund and Compulsory Medical Insurance Fund.

We’ll talk further about what has changed over the last year and who is now authorized to control the payment of contributions by payers.

basic information

For a long time there were disputes over who should delegate administrative powers. Ultimately, the legislator decided to transfer the corresponding powers to the Federal Tax Service, because this body is distinguished by the high quality of its work.

The transfer of powers will allow:

- optimize the SV system;

- reduce administrative costs;

- simplify reporting.

Definitions

Administration is the execution by the body entrusted with the relevant powers of the following responsibilities:

- exercising control over the correctness of calculation, completeness and payment on time;

- accepting payments from payers for SV, starting with reporting for the 1st quarter of 2020 and beyond;

- collection of penalties and forfeits under SV, including those arising before 2020;

- refund of excess amounts paid by payers;

- provision of deferred (installment) payment.

Legislation

On January 1, 2020, in order to implement Decree No. 13, the following legislative documents were adopted:

The main changes in 2020 were introduced by Federal Law No. 243.

So, based on the text of Federal Law No. 243:

- a new Chapter 34 was added to the Tax Code of the Russian Federation;

- The FSS will continue to control the cost of insurance payments. monetary support for temporary inability to work and in connection with pregnancy (VNiM);

- analysis of insurance costs. monetary support for VNIM, based on information from the tax inspectorate, will be carried out by the FSS in the manner established by 125-FZ of July 24, 1998 “On Mandatory...” (hereinafter referred to as Federal Law No. 125);

- a new procedure for interdepartmental interaction between the Social Insurance Fund and the Federal Tax Service was approved regarding the income declared by the policyholder for VNIM.

Thus, in 2020, legislation vested the authority to administer insurance premiums to the Federal Tax Service in almost all aspects (except for the costs of paying insurance money for VNIM). VNiM now also controls the Federal Tax Service in terms of income.

Pros and cons of administering insurance premiums to the Federal Tax Service

According to the position of representatives of the social and economic sphere, the transfer of control over environmental protection from extra-budgetary funds to tax authorities has both its advantages and disadvantages.

Advantages:

- “paperwork” is reduced - instead of submitting reports to several control structures, you need to report to only one;

- the “transparency” of the tax history of individuals increases, since data on tax collections and SV are combined in one place;

- the total amount of payers' debt is reduced by improving the quality of administration;

- the number of inspections is being reduced due to the reduction of regulatory structures.

Minuses:

- reduction of the staff of the Social Insurance Fund, the Compulsory Medical Insurance Fund and the Pension Fund;

- the need to recruit and train new employees of the Federal Tax Service;

- a violation of the insurance premium payment system that has already been developed over the years - now payers will have to “get used to” the new rules.

Reasons for transferring functions

Features of administering insurance premiums to the Federal Tax Service (background):

- previously there was a single social tax, which was later replaced by mandatory insurance payments paid to various funds;

- in 2010, business representatives expressed their dissatisfaction with the abolition of the unified social tax - after all, with the introduction of amendments, they had to report to 4 places at once - the Pension Fund of the Russian Federation, the Compulsory Medical Insurance Fund, the Social Insurance Fund and the Federal Tax Service;

- in 2013, discussions began regarding the transfer of the functions of the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund to a single fiscal body in order to reduce the debt of payers and simplify the procedure for settlements and transfers of SV;

- businessmen turned to the Government of the Russian Federation with a request to consider the possibility of optimizing the existing system of insurance premiums;

- in 2013, the President instructed the Government to think about solving the problem, but for 3 years no special measures were taken.

Finally, in 2020, the problem reached its climax. The debt grew rapidly, a huge number of inspections were carried out, and the discontent of businessmen increased even more. The result was Decree No. 13 issued in 2020, and then the corresponding amendments to the Tax Code of the Russian Federation.

Nuances

In addition to the amendments introduced by Federal Law No. 243, there are also changes introduced by Federal Law No. 250, namely:

- Amendments were made to Federal Law 255-FZ of December 29, 2006, “On Mandatory...”, which retained the rights of the Social Insurance Fund to conduct desk audits of the correctness and validity of expenses for insurance payments. cash security for VNiM;

- Amendments were made to Federal Law No. 125 regarding the administration of social insurance against accidents at work by the tax inspectorate SV, in particular, new chapters were added - “Enforcement of... insurance premiums”, “Responsibility for committing violations...”, etc.

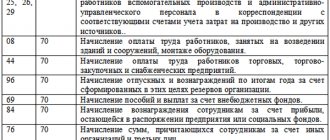

Accrual base

According to Part 1 of Art. 421 of the Tax Code of the Russian Federation, the basis for calculating SV for institutions and individual entrepreneurs is the amount of payments and other remunerations subject to compulsory social insurance (Part 1 of Article 420 of the Tax Code of the Russian Federation), accrued in relation to an individually determined citizen from the beginning of the billing period on an increasing basis.

Insurance premiums are not paid on earnings specified in Art. 422 of the Tax Code of the Russian Federation, for example:

- from government benefits (for example, unemployment benefits);

- from compensation payments (for example, related to compensation for harm, payment of the cost of the due allowance in kind, etc.).

Reporting

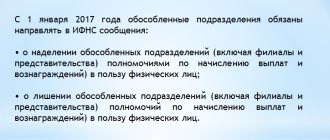

Based on Part 7 of Art. 431 of the Tax Code of the Russian Federation, SV payers paying remuneration to individuals are required to provide a single calculation no later than the 30th day of the month following the billing time period.

Judging by Part 1 of Art. 423 of the Tax Code of the Russian Federation, the calculated time interval is 1 calendar year.

The calculation is submitted to the tax office located at the location of the institution or its separate division.

Fixed payment

The fixed payment does not change due to the transfer of administration, that is:

- if the entrepreneur does not provide a declaration, then max. the payment amount will not be calculated;

- If an entrepreneur files a declaration but does not make payment, the tax authorities will independently calculate the amount of debt.

Budget classification codes

Insurance premiums can be paid either by the payer himself or by another person.

Changes in budget classification codes affected the payment of payments on account of a citizen’s temporary inability to work. When making contributions for “injuries,” the BCC did not change. In field 101 “Payer status” is now entered 01, instead of 08, as it was before.

Here is a list of BCCs for contributions paid from January 1, 2020:

| View SV | KBK |

| On OPS | 18210202010061010160 |

| VNiM | 18210202090071010160 |

| Compulsory medical insurance | 18210202101081013160 |

| On OPS “for yourself” (for the self-employed population) | 18210202103081013160 |

Additional contributions for employees who operate in conditions entitling them to early pension provision:

| View SV | KBK |

| For employees whose work is associated with hazardous conditions (additional tariff does not depend on the results of the special assessment) | 18210202131061010160 |

| For employees under harmful conditions (additional tariff depends on the results of a special assessment) | 18210202131061020160 |

| For employees operating in difficult conditions (the additional tariff does not depend on the results of a special assessment) | 18210202132061010160 |

| For workers employed under difficult conditions (additional tariff depends on the results of a special assessment) | 18210202132061020160 |

| For “injury” | 39310202050071000160 |

Accrual of penalties and fines

For non-payment of taxes or SV, a fine is established in the amount of 20% of the debt amount (if the base was underestimated or incorrectly calculated).

If they prove that non-payment was committed intentionally, the fine will be twice as large - 40% of the amount (Article 122 of the Tax Code of the Russian Federation).

Judging by Part 4 of Art. 75 of the Tax Code of the Russian Federation, from October 1. In 2020, the rules for calculating penalties have changed.

Now, for debt arising after October 1, 2020, the amount of the penalty will depend on the time period of delay:

- If up to 30 days inclusive:

- If more than 31 days, then penalties for days 1-30 are calculated as follows:

Starting from day 31, according to the formula below:

What can't be changed

The changes that came into force on January 1, 2020 did not affect:

- taxable asset;

- categories of payers;

- tariffs for compulsory medical insurance;

- fixed payment for individual entrepreneurs;

- due date for payment of the fee;

- limiting base for calculus.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Source: https://autoexpertnost.ru/peredacha-administrirovanija-strahovyh-vznosov-v-fns/

Penalties and fines

Refunds of overpaid or collected amounts of contributions, penalties and fines accrued in previous periods before January 1, 2020 will be carried out according to an application written by the policyholder to extra-budgetary funds for the return of the overpayment (Part 1 of Article 21 of Law No. 250-FZ). If, after the policyholder submits an application, the Pension Fund or the Social Insurance Fund makes a positive decision on it, this data will be forwarded to the tax office, and the tax authority will have to make a direct refund to the policyholder.

Information on the amounts of arrears, penalties and fines on contributions generated for the reporting periods before January 1, 2020 will be transmitted to the tax authorities by the Pension Fund of the Russian Federation and the Social Insurance Fund of the Russian Federation. If the debt cannot be collected for any reason, it will be written off from the payer of insurance premiums (Parts 2, 3, Article 4 of Law No. 243-FZ).

Arrears, penalties, and fines on contributions are subject to write-off (that is, they cannot be collected from the policyholder) (Part 3 of Article 19 of Law No. 250-FZ):

- which cannot be recovered on the grounds listed in Art. 23 of Law No. 212-FZ, and which arose before 01/01/2017;

- the period for collection of which by the fund authorities will expire as of 01/01/2017.

The bodies of the Federal Social Insurance Fund of the Russian Federation retain the functions of verifying expenses incurred by payers (who are not participants in the pilot project) for the purposes of social insurance in connection with temporary disability and reimbursement of the excess of expenses incurred over accruals.

The PFR bodies retain the functions of maintaining personalized records and monitoring the payment of insurance premiums for voluntary pension insurance.

Administration of insurance premiums

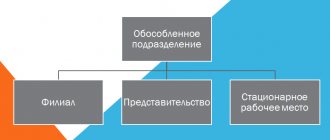

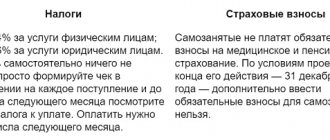

In this article we will look at the administration of insurance premiums. The administration of contributions can be carried out by two bodies, the Social Insurance Fund and the Pension Fund of the Russian Federation (previously, this function was still performed by the Federal Compulsory Medical Insurance Fund). Below we describe the main changes that occurred in 2020.

January 2020 became the starting point in moving the administration of insurance premiums from extra-budgetary funds to the tax service. On the fifteenth of this month, the President of the Russian Federation signed decree No. 13, the task of which is to instruct the Ministry of Finance to develop the necessary regulatory framework for assigning responsibilities for the administration of insurance contributions to the Federal Tax Service.

The path to this decision was long. The social and economic bloc waged a long struggle regarding which body should be responsible for insurance premiums paid to the Social Insurance Fund, the Pension Fund and the Compulsory Medical Insurance Fund.

As a result, it was decided to carry out significant changes in relation to the administration of collections of insurance payments and transfer these functions to the tax authority. The main argument was the higher quality of work of the tax service, which will reduce administrative costs, optimize the system of insurance fees and simplify reporting.

Changes for 2020

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Decree No. 13 of Russian President Vladimir Putin determined the need to strengthen payment discipline in relation to insurance contributions and instructed the Ministry of Finance to prepare draft laws by May 1, 2020. These bills should determine the specifics of transferring the functions of administering insurance premiums to an authorized executive body and allow the creation of a single information resource with information about the population of the Russian Federation and the civil acts concluded by them.

The tax office is expected to be responsible for collecting contributions. At the same time, the Federal Tax Service will be entrusted with the function of administering not only taxes and insurance payments, but also customs duties. At the same time, it is necessary to carry out the reform in such a way that the Federal Tax Service with tax functions is preserved within a single mechanism.

To translate these projects into reality, it is necessary to amend the Tax and Budget Codes, as well as laws related to these legal acts.

According to the latest estimates, the implementation of such changes will require the dismissal of about 18,000 employees of the Pension Fund and about 8,000 employees of the Social Insurance Fund.

This is exactly the number of personnel involved in the collection of insurance premiums.

At the same time, the tax authority will need about 12,000 new specialists to implement the functions of administering insurance contributions.

The planned costs of implementing such changes are also significant. These costs will be covered by reducing the funding of funds and using the saved funds to carry out the reform.

The actual transfer of administration is scheduled for January 1, 2020, but it is possible that this date will be moved to mid-2020. It is planned to transfer the system for collecting insurance payments to the Federal Tax Service in the form in which it currently exists in extra-budgetary funds. There are no plans to replace insurance premiums with tax payments.

Administration of insurance contributions to the Federal Tax Service: advantages and disadvantages

According to representatives of the economic and social sector, transferring the administration of insurance payments from extra-budgetary funds to the tax office has both pros and cons. Below in the table we will reveal the administration of insurance premiums and highlight the pros and cons of this solution.

| Advantages | Flaws |

| Instead of four regulatory bodies, there remains one, as a result - a reduction in the burden on businessmen | The need to create a unified system that will unite the accounting of contribution and tax payers |

| Transparency of the tax history of individuals, since information on tax and insurance payments will be combined in one place | The need to reduce fund employees involved in the administration of insurance premiums and move them to the Federal Tax Service and conduct their retraining |

| Simplifying reporting for contributors | Significant expenses on personnel, application programs, software development |

| Reducing debt on insurance payments by improving the quality of administration | Violation of a well-functioning system for collecting insurance payments, which has become familiar to premium payers |

| Reduction in the number of inspections due to a significant reduction in regulatory authorities | Preservation of personalized reporting for individuals |

Administration of insurance premiums: why is transfer of functions necessary?

Since 2010, extra-budgetary funds have been assigned fiscal functions, which have performed them until today. Previously, there was a unified social tax, the collection of which was subordinate to the tax department.

Then the Unified Social Tax was abolished (read more about the Unified Social Tax in the article: “Unified Social Tax: Calculation, Declaration”), and it was replaced by mandatory insurance contributions paid to various funds depending on their content.

Already in 2013, conversations began about the need to transfer the powers of the Pension Fund, Mandatory Medical and Social Insurance Funds to a single fiscal body. It was assumed that these changes would improve the procedure for calculating and transferring contributions and would reduce the debt to the funds for insurance contributions.

The prerequisites for the innovations were the dissatisfaction of business representatives with the transfer of the administration of insurance premiums to funds since 2010. They considered this inappropriate and an unnecessary burden on economic entities - companies had to report and pay fees and taxes for one individual in four different places instead of one, as was the case under the Unified Social Tax.

The result was an appeal from businessmen to the Russian government with a proposal to create a single body that would combine the functions of administering insurance premiums and taxes.

In 2013, Vladimir Putin instructed the government to consider the possibility of returning to a unified administration of payments by the tax service.

However, it was not possible to form a clear opinion then, and until 2016, the functions of collecting insurance payments from the income of individuals were assigned to extra-budgetary funds.

There was an opinion that even if the administration of insurance premiums is transferred to the tax service, payers will still have the obligation to submit personalized reports to the funds, and therefore the point in combining all payments with the tax authority is lost.

In addition, the return of tax functions for the administration of contributions will entail significant monetary expenses, and will also require significant movements in personnel of both extra-budgetary funds and the tax office.

All these points temporarily suspended the reform in relation to administration; small and medium-sized businesses were in favor of transferring contributions under the jurisdiction of the Federal Tax Service; large businesses were categorically against it.

By 2020, this issue was raised by the State Duma.

The growth of arrears of insurance payments, a huge number of checks on small additional assessments of contributions, dissatisfaction with the economic sector forced us to reconsider the issue of transferring administration to the Federal Tax Service. The result was Vladimir Putin’s decision on the need to make changes to the administration system; this decision was formalized in the form of decree No. 13 of January 15, 2020.

According to the audits carried out, the quality of work of the Federal Tax Service is significantly higher than that of extra-budgetary funds due to the use of high-tech and modern techniques. It is believed that the creation of a unified mechanism for accounting for taxes and contributions will not only optimize the existing system in the Russian Federation, but will also increase Russia’s place in international rankings.